How can housing alerts help identify promising real estate investments in opportunity zones. What are the key strategies for setting up effective alerts to uncover hidden gem neighborhoods. How can investors leverage data and local knowledge to assess area potential.

Understanding Opportunity Zones and Real Estate Investment Potential

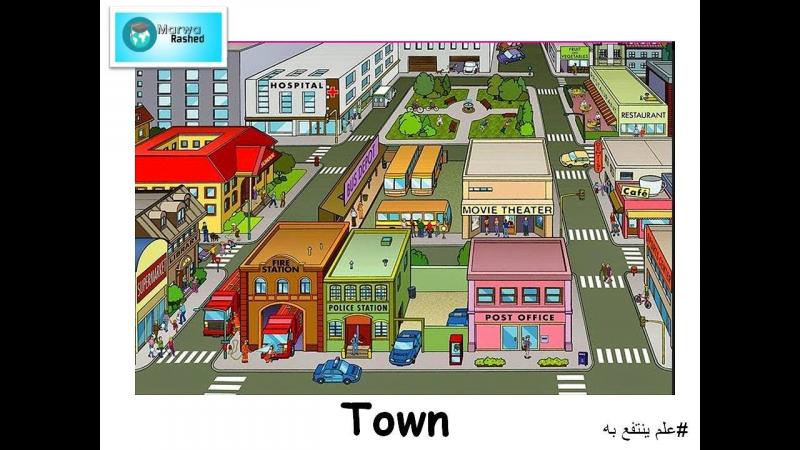

Real estate investing has become an increasingly attractive option for those looking to diversify their portfolio and capitalize on market trends. One particularly exciting avenue for investors is the emergence of opportunity zones – economically distressed areas designated by states where new investments may qualify for preferential tax treatment.

Opportunity zones offer a unique chance for investors to generate profits while contributing to community revitalization. But how can one identify the most promising neighborhoods poised for a rebound?

What are Opportunity Zones?

Opportunity zones are specific geographic areas that have been designated as economically distressed and in need of investment. These zones were created as part of the Tax Cuts and Jobs Act of 2017 to spur economic development and job creation in low-income communities.

Investors who put capital into opportunity zones can benefit from significant tax incentives, including deferral of capital gains taxes and potential elimination of taxes on new appreciation if the investment is held long-term.

Harnessing the Power of Housing Alerts for Investment Opportunities

One of the most effective tools for identifying promising real estate investments in opportunity zones is the use of housing alerts. But what exactly are housing alerts and how can they benefit investors?

Defining Housing Alerts

Housing alerts are automated notifications that inform investors about new real estate listings matching specific criteria. These alerts can be customized to focus on particular geographic areas, price ranges, property types, and other factors relevant to an investor’s strategy.

By setting up targeted housing alerts, investors can stay ahead of the curve and be among the first to know about potential opportunities in their chosen opportunity zones. This proactive approach can provide a significant competitive advantage in a fast-moving market.

Setting Up Effective Housing Alerts

To maximize the effectiveness of housing alerts for opportunity zone investments, consider the following strategies:

- Research and identify opportunity zones in your target area that show early signs of revitalization but remain affordable

- Conduct on-site visits to get a feel for the neighborhood and identify potential investment properties

- Use real estate platforms like Realtor.com or Zillow to set up customized alerts for each opportunity zone

- Specify criteria such as price range, property type, number of bedrooms and bathrooms, and other relevant factors

- Be prepared to act quickly when promising opportunities arise by having financing pre-approval in place

Leveraging Data Analytics to Assess Area Potential

While housing alerts can help identify potential investments, it’s crucial to supplement this information with thorough data analysis to evaluate an opportunity zone’s growth potential. What key metrics should investors consider?

Essential Real Estate Data Indicators

To gain a comprehensive understanding of an area’s investment potential, focus on the following data points:

- Home value forecasts: Analyze 12-24 month outlook for property values

- Sale-to-list price ratio: Determine if homes are selling above or below asking prices

- Inventory levels: Assess the balance between supply and demand

- Days on market: Evaluate how quickly properties are selling

- Rental occupancy rates: Gauge the strength of tenancy demand

Online tools like NeighborhoodScout can help compile and compare this data across different areas, allowing investors to identify zones with the most promising growth potential.

Tapping into Local Expertise for Insider Knowledge

While data analysis is crucial, there’s no substitute for on-the-ground insights from local real estate professionals. How can investors leverage this valuable resource?

Connecting with Local Real Estate Experts

To gain a deeper understanding of opportunity zone neighborhoods, consider the following approaches:

- Seek out realtors who specialize in the specific metro area you’re researching

- Consult with local agents about upcoming developments, city planning decisions, and overall community momentum

- Connect with contractors and architects working in the zones for firsthand knowledge of projects in the pipeline

- Attend local real estate investment meetups or join online forums to network with other investors in the area

These local connections can provide invaluable perspectives on which opportunity zones have the greatest potential for growth and investment returns.

Developing a Strategic Approach to Renovation and Redevelopment

Once promising opportunity zones have been identified, it’s essential to create a comprehensive plan for acquisition and redevelopment. How can investors ensure their projects are set up for success?

Key Elements of a Successful Redevelopment Plan

Consider the following steps when crafting your investment strategy:

- Create a list of potential property types for investment (e.g., vacant land, multifamily, retail)

- Research local zoning laws and permit requirements for your intended use

- Develop a detailed renovation budget and timeline for each potential project

- Identify and vet general contractors experienced in rehabilitation projects

- Forecast post-renovation pricing and rents to estimate potential ROI

It’s crucial to maintain conservative estimates throughout this process to ensure your investment numbers are realistic and achievable.

Maximizing Tax Benefits for Opportunity Zone Investments

One of the primary advantages of investing in opportunity zones is the potential for significant tax benefits. How can investors make the most of these incentives?

Understanding Opportunity Zone Tax Incentives

Work closely with your accountant or financial advisor to leverage programs such as:

- Temporary tax deferral on prior capital gains invested in an opportunity fund

- Basis step-up on capital gains invested over time, potentially reducing taxes owed

- Elimination of tax on new appreciation if the investment is held for a specified period

By strategically utilizing these tax incentives, investors can significantly enhance their overall returns on opportunity zone investments.

Navigating Challenges and Mitigating Risks in Opportunity Zone Investments

While opportunity zones offer exciting potential, they also come with unique challenges. How can investors effectively navigate these obstacles and mitigate risks?

Common Challenges in Opportunity Zone Investing

Be prepared to address the following potential hurdles:

- Higher renovation costs due to the distressed nature of many properties

- Longer timelines for project completion and area revitalization

- Potential resistance from existing community members to new development

- Navigating complex local regulations and zoning requirements

- Securing financing for projects in economically distressed areas

Risk Mitigation Strategies

To minimize potential pitfalls, consider implementing these risk management techniques:

- Conduct thorough due diligence on all potential investments

- Diversify your portfolio across multiple opportunity zones and property types

- Build strong relationships with local community leaders and organizations

- Work with experienced legal and financial advisors familiar with opportunity zone regulations

- Maintain a conservative financial approach, with adequate reserves for unexpected expenses

By proactively addressing these challenges and implementing robust risk management strategies, investors can position themselves for long-term success in opportunity zone investments.

Leveraging Technology for Opportunity Zone Investment Success

In today’s digital age, technology plays a crucial role in identifying and managing real estate investments. How can investors harness the power of technology to maximize their success in opportunity zones?

Essential Tech Tools for Opportunity Zone Investors

Consider incorporating the following technological solutions into your investment strategy:

- Property management software to streamline operations and track financial performance

- Virtual and augmented reality tools for remote property inspections and visualizations

- Big data analytics platforms to identify emerging trends and investment opportunities

- Blockchain technology for secure and transparent real estate transactions

- Crowdfunding platforms to raise capital for larger opportunity zone projects

By leveraging these technological advancements, investors can gain a competitive edge in identifying, acquiring, and managing opportunity zone investments.

Implementing a Data-Driven Investment Approach

To fully capitalize on the potential of opportunity zones, consider adopting a data-driven investment strategy:

- Utilize predictive analytics to forecast market trends and identify high-potential areas

- Implement machine learning algorithms to optimize property selection and investment timing

- Develop custom dashboards to monitor key performance indicators across your portfolio

- Leverage social media analytics to gauge community sentiment and market demand

- Employ geospatial analysis to identify patterns and opportunities within opportunity zones

By embracing a tech-forward, data-driven approach, investors can make more informed decisions and potentially achieve higher returns on their opportunity zone investments.

Building a Network of Opportunity Zone Investors and Professionals

Success in opportunity zone investing often relies on collaboration and shared knowledge. How can investors build and leverage a strong network to enhance their investment strategies?

Strategies for Networking in the Opportunity Zone Space

Consider the following approaches to expand your professional network:

- Join local and national real estate investment associations focused on opportunity zones

- Attend industry conferences and seminars dedicated to opportunity zone investing

- Participate in online forums and social media groups for opportunity zone investors

- Collaborate with other investors on joint ventures or syndicated deals

- Build relationships with local government officials and economic development agencies

By cultivating a diverse network of professionals in the opportunity zone space, investors can gain valuable insights, access to deals, and potential partnerships that can drive long-term success.

Leveraging Partnerships for Enhanced Investment Opportunities

Explore the following partnership opportunities to expand your investment reach:

- Form joint ventures with experienced developers to tackle larger projects

- Collaborate with local non-profits or community organizations on impact-driven investments

- Partner with institutional investors to access larger pools of capital

- Work with specialized opportunity zone funds to diversify your investment portfolio

- Engage with universities or research institutions on innovative development projects

By leveraging strategic partnerships, investors can amplify their impact and potentially achieve greater returns on their opportunity zone investments.

Measuring and Reporting on Opportunity Zone Investment Impact

As opportunity zone investments gain traction, there’s an increasing focus on measuring and reporting their social and economic impact. How can investors effectively track and communicate the positive changes their investments bring to communities?

Key Impact Metrics for Opportunity Zone Investments

Consider tracking the following metrics to gauge the impact of your investments:

- Job creation and retention within the opportunity zone

- Increase in median household income for local residents

- Improvements in local educational outcomes and opportunities

- Reduction in crime rates and increased public safety

- Environmental improvements and sustainability measures implemented

- Increase in property values and overall economic activity in the area

By consistently monitoring these metrics, investors can demonstrate the tangible benefits their projects bring to opportunity zone communities.

Developing Comprehensive Impact Reports

To effectively communicate the impact of your investments, consider the following steps:

- Establish baseline data for key metrics before beginning your investment

- Regularly collect and analyze data on impact indicators throughout the investment period

- Develop clear, visually appealing reports that highlight both quantitative and qualitative impacts

- Share impact reports with stakeholders, including investors, community members, and local government officials

- Use impact data to inform future investment decisions and strategies

By prioritizing impact measurement and reporting, investors can not only demonstrate the value of their opportunity zone investments but also contribute to the broader understanding of these programs’ effectiveness in driving community revitalization.

Introduction to real estate investing and identifying opportunity zones

So you’re thinking about diving into the world of real estate investing? I don’t blame you. With historically low mortgage rates and several tax incentives for investing in certain neighborhoods, now is an excellent time to explore this asset class. And if you’re savvy, you can find diamonds in the rough that will yield great returns down the road.

One of the most exciting opportunities right now is investing in qualified opportunity zones. These are economically distressed areas designated by each state where new investments may be eligible for preferential capital gains tax treatment. So you can do good while also generating profits! But how do you identify promising neighborhoods that are poised for a rebound?

What are housing alerts and how can they help?

Housing alerts are automated notifications you can set up to receive emails or texts when new real estate listings matching your customized criteria are posted. This makes it easy to stay on top of opportunities in your preferred locations without having to manually check real estate sites every day.

For investing in opportunity zones, alerts are invaluable. As soon as a fixer-upper or vacant lot hits the MLS in an area you’ve targeted, you’ll know about it. Being first in line as an investor gives you a competitive advantage.

Setting up alerts for under the radar areas

Here are some tips for setting up alerts to uncover hidden gem neighborhoods before they get hot:

- Research opportunity zones in your city and surrounding metro area. Make a list of zones that show early signs of revitalization but are still affordable.

- Drive through each area to get a feel for what properties are currently listed vs what might become available. Look for vacant lots, run down houses, and buildings in need of renovation.

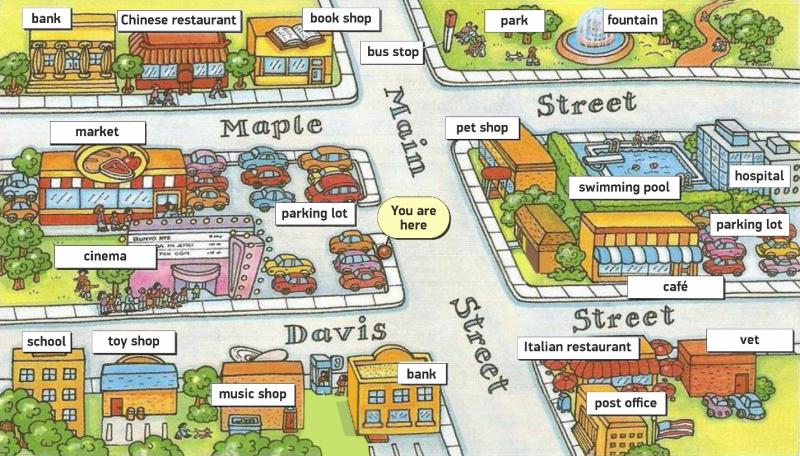

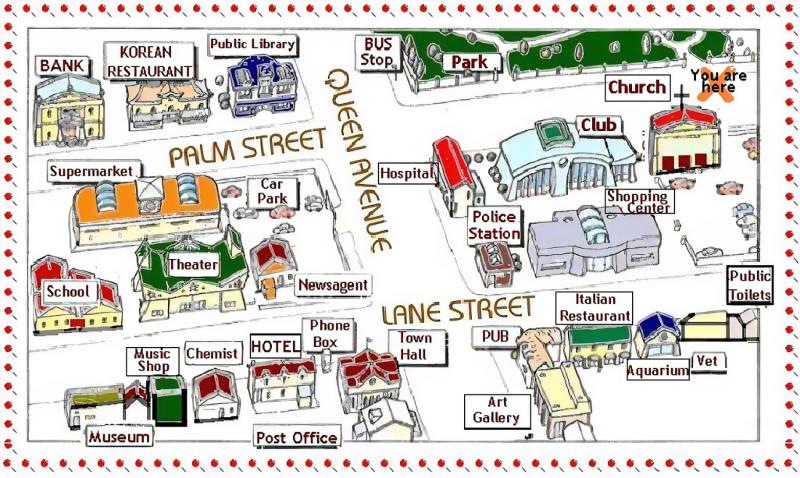

- On sites like Realtor.com or Zillow, set up alerts for each opportunity zone. Customize by geography, price range, property type,beds/baths, etc.

- As the alerts roll in, be prepared to act quickly on properties with potential. Having pre-approval for financing will help you close fast.

Digging into data to assess area potential

In addition to on-the-ground research, make sure to dive into key real estate data indicators to evaluate if an opportunity zone is primed for growth. Useful metrics to look at include:

- Home value forecasts – what is the 12-24 month outlook?

- Sale-to-list price ratio – are homes selling above or below asking?

- Inventory levels – are supply and demand balanced or tilted one way?

- Days on market – how quickly are homes selling?

- Rental occupancy rates – is there strong tenancy demand?

Online tools like NeighborhoodScout make it easy to compile and compare this data across different areas so you can zero in on ones poised to take off. Trends like increasing sale prices and shrinking inventory levels are positive signs.

Tapping into insider local knowledge

Even with thorough data analysis, there is no substitute for on-the-ground insights. Realtors and other real estate professionals familiar with opportunity zone neighborhoods can provide invaluable perspectives.

Look for agents who specialize in the specific metro area you are researching. Get their takes on upcoming developments, city planning decisions, and overall community momentum. They might point you to an opportunity zone with great potential before it pops up on the radar.

You can also connect with contractors and architects working in the zones. They may have firsthand knowledge of projects in the pipeline and identify streets and blocks that are likely hotspots for investment.

Creating a game plan for renovation and redevelopment

Once you pinpoint the most promising opportunity zone prospects, start crafting a business plan for acquisition and redevelopment:

- Make a list of property possibilities – vacant land, multifamily, retail, etc.

- Research permit and zoning requirements for your intended use.

- Create a renovation budget and timeline for each potential project.

- Identify general contractors experienced with rehabilitation projects.

- Forecast pricing and rents post-renovation to estimate ROI.

Conservative estimates are crucial to make sure your numbers pencil out. It’s better to be pleasantly surprised if renovated assets overperform.

Tapping into incentives for opportunity zone investing

One of the key benefits of investing in opportunity zones is preferential tax treatment. By working with your accountant or financial advisor, you can maximize programs like:

- Temporary tax deferral on prior capital gains invested in an opportunity fund.

- Basis step up on capital gains invested over time to minimize taxes owed.

- Elimination of tax on new appreciation if investment held for 10+ years.

Understanding timelines and qualifications for these incentives will be extremely useful as you pursue deals.

Keys to successful opportunity zone projects

Realizing the full benefits of investing in an opportunity zone rest on executing projects wisely. Here are some tips:

- Conduct meticulous due diligence before acquiring properties.

- Thoroughly vet your general contractor and architect.

- Get proposals from multiple subs to control rehab costs.

- Factor in contingency buffers into any budget.

- Monitor construction progress closely to avoid delays.

- Use competitive market data to set listing prices.

Staying on time, on budget, and aligned with demand will help your first OZ project be a success. This will set you up for larger scale investments as you expand your portfolio.

Ready to start leveraging opportunity zones? With the right property alerts, local connections, and incentives, you can build wealth while revitalizing a community. It’s a win-win scenario if executed strategically. The time to invest is now before others catch on – be poised to move fast as soon as the right deal pops up in your targeted zone.

What are housing alerts and how do they work?

In our data-driven world, real estate housing alerts are an invaluable tool for investors to get notified of opportunities in real time. But what exactly are they and how can you leverage them in your search for properties?

Housing alerts are automated notifications set up to inform you when new listings meeting your customized criteria enter the MLS. For example, you could get an email or text alert whenever a fixer-upper in the price range, location, and property type you desire is posted for sale.

Alerts are available on most major real estate sites like Realtor.com, Zillow, Trulia, and Redfin. You can tailor them to your specific investing goals – whether searching for single family flips, multifamily rentals, land parcels, commercial buildings, etc. Granular adjustments can be made for parameters like:

- Location – target a specific neighborhood, zip code, city, or radius from a point on a map.

- Price range – set a minimum or maximum price or price per square foot.

- Property type – single family, condo, townhome, land, multifamily, etc.

- Beds, baths, square footage.

- External features – pool, garage, waterfront.

- Keywords in listing description – fixer-upper, handiman’s special, as-is, etc.

The ability to fine tune housing alerts to this level helps you hone in on the exact type of properties you want to pursue. You’ll only get notifications about listings matching your ideal criteria instead of having to sift through irrelevant results.

When setting up alerts, think about the key attributes of your target properties. Focusing on opportunity zones? Look for vacant land or rundown houses needing extensive renovation. Wanting to acquire rental units? Alerts for 2-4 unit multifamily buildings could be perfect.

Pro tips for effective alerts:

- Set up email and push notifications on your phone – speed is essential to jump on deals.

- Create alerts on multiple sites for the widest net.

- Fine tune your parameters once you see the types of listings coming through.

- Prioritize alerts for hot zones primed for growth.

With the right housing alerts in place, you gain an invaluable edge to pounce as soon as an appealing new property hits the market. In competitive opportunity zones, acting quickly is key – alerts let you do that.

Signing up for housing alerts in your city

Are you ready to become a real estate investor, but not sure where to start? One great way to identify promising investment opportunities is by signing up for housing alerts in your city. This allows you to get notifications whenever a home goes on the market in an area you’re interested in.

In particular, setting alerts for neighborhoods that the city has designated as rehabilitation zones can clue you in on areas poised for gentrification. Buying a fixer-upper home while prices are still low, then renovating and either renting out or reselling once the neighborhood becomes hot, can be a savvy investment strategy.

So how do you go about signing up for alerts? Here are some tips:

Use real estate listing sites

Major real estate listing sites like Zillow, Redfin, and Realtor.com allow you to set up custom alerts for free. You can narrow down parameters like location, price range, number of bedrooms and bathrooms, square footage, etc. Anytime a home matching your criteria hits the market, you’ll get an email notification.

Take the time to really dial in on the neighborhoods you want to target. Look for areas the city has identified as revitalization zones, where they are offering incentives like tax breaks for redevelopment. Drive around and get a feel for the housing stock and local amenities.

Work with an agent

Connecting with a local real estate agent is another great way to stay on top of inventory in up-and-coming areas. Explain that you are looking for fixer-upper homes in redevelopment neighborhoods. The agent can set up custom MLS alerts on your behalf, based on your investment goals and criteria.

An experienced agent will also have insider knowledge on which neighborhoods are poised for growth. They can point you to under-the-radar opportunities that aren’t yet on the city’s revitalization radar.

Connect with contractors and tradespeople

Networking with general contractors, electricians, plumbers, and other tradespeople can provide valuable boots-on-the-ground intel. They work extensively in these emerging neighborhoods and may hear about homes coming up for sale through word-of-mouth before they hit the MLS.

Let them know the types of properties and locations you are looking to buy in. Ask them to keep you in mind if they hear of any leads. You can return the favor by offering them first crack at your renovation work.

Drive or walk around target neighborhoods

“Driving for dollars”, as investors call it, is tried-and-true way to find deals. Physically touring your target neighborhoods allows you to spot fixer-uppers with your own eyes. Look for signs of neglect like peeling paint, overgrown lawns, broken windows etc. Jot down addresses and ask your agent to pull up property details.

Walking around also lets you chat with residents and get unfiltered opinions on the area. They may share insights that aren’t immediately obvious as an outsider.

Check public property records

Your county or city likely makes property records available online. Search for things like code violations, tax delinquencies, or default notices. Distressed properties like these often represent a buying opportunity.

You can also look up properties that have recently sold for lower than market value. Reaching out to the sellers to ask if they have other homes in the neighborhood coming up for sale could uncover potential deals.

Follow local news and community pages

Stay plugged into what’s happening in your target areas by following neighborhood-specific news sources, Facebook groups, Nextdoor pages etc. This can clue you into new development projects, school improvements, increases in crime, or other trends that impact property values.

You may also come across posts by frustrated homeowners looking to offload their property. Reach out to see if they might be interested in selling to an investor.

Partner with other investors

Connecting with other real estate investors operating in your city can dramatically expand your access to potential deals. Most investors focus on certain niches or neighborhoods. By sharing leads and information, you give each other first dibs on properties that align with your respective buying criteria.

Plus, you may be able to partner on deals that are too big for any single investor. Team up to buy and renovate larger multifamily properties or apartment buildings in up-and-coming areas.

Signing up for housing alerts using the strategies above will help you stay one step ahead of the market when it comes to identifying and capitalizing on investment opportunities in your city’s next hot neighborhoods. Do your due diligence before buying to confirm positive indicators like increased development activity, new businesses and amenities coming in, and demographic shifts towards younger professionals. With the right property in the right location, you can realize some major returns down the road.

Customizing alerts for specific neighborhoods and property types

Setting up housing alerts is a great way to stay on top of the real estate market in neighborhoods you want to invest in. But simply getting alerts for every listing that hits the market can quickly become overwhelming. The key is customizing your alerts so you only get notified about properties that fit your specific buying criteria.

When signing up for alerts, here are some ways to dial in on the exact areas, property types, and price points you are targeting:

Look for existing overlay zones

Many cities have special zoning designations meant to encourage redevelopment in certain neighborhoods. For example, some areas may be designated as historic districts, arts districts, or economic opportunity zones. There are often tax breaks or other incentives offered to investors and developers in these areas.

Setting alerts for any listings within these overlay zones will bring potential deals in up-and-coming neighborhoods onto your radar.

Research recent rezoning petitions

Pay attention to neighborhoods where residents or developers have submitted requests to the city to change the zoning. Usually this is done with the intention of allowing different property uses, higher density projects, or new types of construction.

Rezoning approval can be a precursor to major growth and investment. Getting in early with alerts will let you identify opportunities as they pop up.

Look for patterns of disinvestment

Distressed neighborhoods that have experienced prolonged disinvestment often become prime targets for revitalization efforts. Warning signs include high rates of vacant or abandoned properties, population decline, low home values relative to the region, etc.

Once the city designates these zones for redevelopment, setting alerts will notify you as fixer-upper deals hit the market.

Target specific property types

Think about the types of properties that align best with your investing strategy in terms of renovation costs, potential resale value, and rental income if you plan to hold. Setting alerts for your preferred property types – like single family homes under 2,000 sqft, duplexes, 4-plex apartments etc – will filter out irrelevant listings.

Factor in proximity to amenities

Emerging neighborhoods located close to major employers, universities, parks and green space, retail and entertainment districts, and public transit hubs tend to gentrify first. Set your alerts to pick up listings within a walkable radius of these amenities.

Look at demographic trends

Neighborhoods attracting more young professionals and families tend to see increased development and housing demand. Pay attention to areas where the population skews younger and more educated, as they will likely appreciate faster thanks to their desirability.

Dig into transportation improvements

New public transit stops, bike sharing stations, highway extensions and other transportation upgrades make a neighborhood more attractive. Setting alerts along these corridors gives you early notice as investment ramps up.

Monitor city planning initiatives

Check your city’s website to see if they have published any kind of comprehensive plan, growth blueprint or economic development strategy. This will call out priority zones and neighborhoods the city intends to focus revitalization efforts and funding.

Drive around target neighborhoods

Simply driving around your target areas gives you valuable first-hand perspective. Look for visual cues about recent investments like new facades, building renovations, restaurants and businesses. Also note signs of disinvestment like vacant storefronts, neglected homes etc.

Talk to knowledgeable locals

Speaking with residents, business owners, agents and other locals is a great way to gauge neighborhood sentiment. Ask what they see as pros and cons, as well as any notable changes on the horizon. Their insights can help validate if your target area seems poised for growth.

Partner with sellers interested in owner financing

Connecting with sellers who are willing to finance deals with less stringent lending terms broadens your buying power. Many are motivated byrevitalizing their neighborhood. They may give you a chance even if you can’t qualify for traditional financing.

Setting highly customized alerts using strategies like these will feed you listings perfectly suited to your investment goals. Pay close attention to any patterns or commonalities between properties that catch your eye. This will help refine and improve your alerts over time.

With alerts tailored to your specific criteria, you’ll waste less time sifting through irrelevant listings. When the right deal pops up in an up-and-coming area, you’ll be ready to jump on it swiftly and confidently.

Using alerts to find undervalued properties in rehabilitation zones

One of the key strategies real estate investors use is setting up alerts to identify undervalued or distressed properties in areas seeing increased redevelopment investment. This allows you to buy low and potentially sell or rent for a major profit down the line.

Targeting neighborhood rehabilitation zones specifically is smart, since the city has already flagged these as areas primes for revitalization. Here are some ways to use alerts to uncover deals:

Look for signs of neglect

Drive or walk around your target zones to get a feel for the current housing stock. Make note of addresses for properties that show outward signs of neglect like peeling paint, overgrown landscaping, broken windows, etc. Set up alerts to notify you if any of these addresses hit the market.

Monitor code violations

Properties with multiple code violations have often fallen into serious disrepair. The owners may be motivated sellers if the cost of repairs exceeds the property’s value. Code records are public information, so set alerts on violators in rehabilitation neighborhoods.

Watch for tax sales

Homeowners who are behind on their property taxes and facing tax sale auction by the city are highly motivated to sell. Tax records can help you identify these distressed properties. Create alerts so you’re notified if they hit the market.

Note recent sales trends

Look for patterns of homes selling for well under regional market value in your zones. The new owners likely purchased with the intent to rehab and flip. Set alerts for comparable homes that may present a similar opportunity.

Scan eviction and foreclosure filings

Properties going into eviction or foreclosure are often sold off cheaply and quickly. Monitoring local filings in your target areas can help you jump on a deal before the bank lists it.

Track mortgage and lien releases

When an owner pays off the liens and loans on a property, it often signals their intent to sell or improve it. Freeing up equity makes funding repairs simpler. Set alerts on any lien releases in your zones to find newly motivated sellers.

Look for expired or abandoned permits

Expired building permits or abandoned renovations suggest a distressed seller. Construction costs exceeded their budget or capability to fix up the property. Alerts for any permits pulled in your zones will let you follow up.

Monitor housing vacancy rates

Neighbors will start pressuring the city to address growing vacancies once it passes a certain threshold. This motivates absentee owners to sell. Set vacancy alerts to find these neglected rentals.

Follow niche listing sites

Sites like Hubzu and Homes.com list bank-owned foreclosure properties. Owners sometimes list homes for sale by owner to avoid realtor fees. Driving around and noting “for sale by owner” signs is another way to find motivated sellers in your zones.

Talk to other investors

Connecting with other real estate investors operating in your zones gives you access to their insider knowledge. They may be willing to pass along leads that don’t fit their criteria but align with yours.

Offer owner financing

Sellers are often more flexible if you offer better terms than the bank. Providing owner financing with only a percentage down can get you in the door on deals with more potential upside.

Leveraging customized alerts using strategies like these will feed you off-market listings before most buyers ever see them. You’ll be clued into all the indicators of a motivated seller with a property ripe for renovation. Staying nimble and acting quickly will help you clinch the deal.

With the right approach, alerts can help you consistently find undervalued properties in rehabilitation zones that have major profit potential. Do your homework to confirm the neighborhood conditions support a strong return on investment before you buy. Then fix up and flip or rent the property to realize substantial gains as the area gentrifies.

Researching opportunity zone tax incentives for investors

Many cities are designating certain neighborhoods as opportunity zones to incentivize investment in redevelopment. These zones provide major tax benefits for real estate investors who understand how to maximize them.

If you’re setting up housing alerts to find deals in rehabilitation neighborhoods or areas the city wants to revitalize, be sure to also research if they overlap with opportunity zones. Here’s an overview of the main incentives:

Tax deferral on capital gains

When you sell an appreciated investment asset like stocks or real estate, you normally owe capital gains taxes on the profit. But gains reinvested into an opportunity zone can defer your tax payment until 2026. Plus, you get a 10% reduction in the gains if you hold the investment for 5 years and 15% after 7 years.

Tax-free appreciation

Any new capital gains earned from appreciating assets or rising property values within an opportunity zone are completely tax-free if you hold the investment for 10 years or more. This is huge for real estate investors who fix up and flip homes.

Tax-free investments

You can also start from scratch by making new equity investments in opportunity zone projects. Appreciation on this invested capital is tax-free after 10 years as well, even if you didn’t realize any capital gains to defer in the first place.

No limit on fund size

Normally capital gains deferrals are capped at reinvesting $1 million in gains. But for opportunity zone investing, there is no limit. You can defer any amount of gains by rolling them into an opportunity fund.

Lower investment threshold

Typically investors need to deploy millions in capital to access tax incentives like these. But the minimum for opportunity zone investing is just $10,000. This opens the door for smaller retail investors.

Here are some tips for researching and leveraging opportunity zones in your city:

Identify designated tracts

The U.S. Treasury has published a full list of population census tracts that local governments applied to designate as opportunity zones. Compare this list to any rehabilitation zones you plan to invest in.

Consider forming an opportunity fund

To activate the capital gains deferrals, you need to invest through a qualified Opportunity Fund within 180 days of realizing the gain. Either find an existing fund targeting your zones, or form one yourself focused on your properties.

Research local tax incentives

In addition to the federal tax benefits, many states and cities offer added incentives for investing in their opportunity zones like tax credits, grants, fee waivers, fast-tracked approvals etc. Be sure to tap into these.

Connect with government contacts

Reaching out to economic development officials in charge of the local opportunity zone program can provide insights on any zoning, planning or financial incentives being offered specifically for properties in these tracts.

Find a tax professional familiar with OZ investing

Consulting a qualified accountant or tax attorney with opportunity zone experience ensures you take full advantage of the tax benefits and avoid any compliance pitfalls.

Look for government RFPs

Cities may issue Requests for Proposals calling for development projects in certain tracts. Responding positions you for institutional investment, public-private partnerships, and other supports.

Research flexibility for existing assets

There are certain ways to get capital gains tax relief on appreciated real estate you already own by exchanging it into an opportunity fund at market value within 180 days.

Opportunity zones offer transformational tax savings for real estate investors who understand the intricacies. Setting alerts for deals in these areas gives you privileged access to properties with incredibly lucrative incentives.

Just be sure to do your due diligence upfront to factor the tax benefits into your overall return projections and maximize your advantage.

Tips for identifying neighborhood rehabilitation zones with potential

Not all neighborhood rehabilitation zones designated by cities offer equal opportunity. Doing thorough research beforehand allows you to identify areas truly primed for revitalization.

Here are some tips for analyzing zones and setting up alerts only in those with convincing signs of upside potential:

Look for economic growth indicators

Redevelopment plans often start with improving the local jobs base and expanding the tax base. Look for new office buildings, corporate relocations and expansions, entrepreneurial activity, and business investment as good signs.

Research planned amenities and infrastructure

New parks, transit extensions, bike lanes, school renovations and other public or private investment in amenities makes an area more desirable. Upcoming improvements are usually outlined in city planning documents.

Analyze demographic shifts

An influx of younger skilled workers seeking affordable housing near jobs is the perfect demographic change for redevelopment. Areas retaining more graduates from local universities also indicate promise.

Assess political will and funding

A zone is less likely to progress if the city counsellors and officials who approved it are no longer in office. Make sure there is still broad political support and budget allocated.

Look for anchor institution involvement

Major employers, universities, hospitals or large cultural centers focused on revitalization can give a zone builtin stability and resources. See if they have committed to projects.

Evaluate current owner occupancy rates

Neighbourhoods with high rental concentrations signal opportunity if the city wants to incentive more owner-occupiers. But very low occupancy also creates challenges.

Research permits and zoning changes

Increased permitting for renovations, new constructions, zoning variance applications etc. demonstrate early private investment. This builds momentum.

Look into distressed property auctions

If tax auctions and foreclosures are selling properties below assessed values, it indicates disinvestment that could spark a turnaround story as the market bottoms out.

Analyze plans from a racial equity lens

To sustain mixed-income diversity, plans should enable existing residents to stay and benefit. Make sure affordable housing, local hiring guarantees, tenant protections etc. are addressed.

Tour the neighborhood during different times

Visiting the area on evenings and weekends gives you a clearer sense of resident activity, community vibrancy, safety, walkability, and overall feel relative to other zones.

Have reasonable expectations on timeframe

Meaningful revitalization can take 5-10 years. Make sure your investment strategy aligns with realistic timing for property values to start appreciating.

The initial designation of a rehabilitation zone is only the first step. Setting alerts in the right zones with all the pieces in place for sustainable, equitable growth provides the best opportunity. Follow permitting patterns, policy shifts, and private investment indicators to see tangible progress.

With sound due diligence upfront, you can zero in on zones where market conditions and revitalization initiatives align to give you the highest probability of return on investment. Then utilize customized alerts to find the most promising deals as soon as they hit the market.

Evaluating property and neighborhood metrics using online tools

Online real estate platforms provide tons of data to help you objectively evaluate properties and neighborhoods when researching areas for your housing alerts. Here are some key metrics to analyze:

Price per square foot

Look at average price per square foot for recent sales to identify undervalued homes priced below the norm in a neighborhood. Low $/sqft indicates opportunity to add value through renovations.

Price appreciation

Review historical sales data and price appreciation over the last 5-10 years. Steady, moderate gains of 4-6% indicate stable growth potential versus erratic swings or stagnation.

Crime rates

Falling crime stats and new policing initiatives can support growth. But rising incidents may stem positive perception until the city addresses it.

School rankings

Top rated schools drive demand from families. Poorly performing schools can deter buyers unless there are turnaround plans in place.

Walkability scores

Areas with high walkability have amenities nearby and are sought after. Use tools like WalkScore to gauge pedestrian friendliness and access.

Transit access

Proximity to public transit hubs, commuter rail stations, and bus routes saves commuting costs. Check distance to these transportation options.

Employment data

Growing job centers nearby and decreasing unemployment signal a stronger rental and sales market for housing. Check labor statistics.

Business openings/closings

More small business openings than closings indicates economic health. Monitor new retail and commercial tenant activity.

Home value forecasts

Sites like Zillow provide home value forecasts. Ensure expected appreciation aligns with your investment timeline to profit.

Owner occupancy rates

Neighborhoods with higher owner-occupancy have more stability. Low rates can present an opportunity but also challenges.

Rental vacancy rates

If rentals in the neighborhood are in high demand with minimal vacancies, it demonstrates positive viability.

Renovation activity

Track permits issued for renovations, construction, and repairs. This early private investment builds momentum.

Taking time to analyze all the data for an objective snapshot of property and neighborhood dynamics helps remove guesswork when targeting your alerts. You can zero in on metrics that support focused revitalization while avoiding areas with red flags.

Online tools make it easy to research metrics across multiple zones anywhere in the country from your laptop. Utilize them to identify communities where market trends and fundamentals align for strong rehabilitation potential.

Connecting with local real estate agents knowledgeable about the area

One of the best resources for identifying up-and-coming neighborhood rehabilitation zones is a knowledgeable local real estate agent. Their insights and connections can provide invaluable boots-on-the-ground intel.

Here are some tips for connecting with the right agents to help you evaluate potential areas for your customized housing alerts:

Ask for referrals from investors in the market

Other real estate investors already active in the neighborhoods you’re researching likely have trusted agent partners. Ask for referrals to agents who helped them identify and close quality deals.

Look for agents active in real estate investor associations

Many agents build a specialty working with investors and rehabbers. Search for ones who are members of local REIA (Real Estate Investor Association) chapters or volunteer groups like REtipsters.

Search online reviews for agents knowledgeable about development

Look for buyer agent reviews that cite experience with investment properties, fixer-uppers, helping investors research up-and-coming areas, familiarity with rehab costs, etc.

Ask agents about their local involvement and connections

Look for agents deeply embedded in the community through volunteer work, school boards, local non-profits, and neighborhood groups. Their networks offer insights.

Verify their recent neighborhood activity and sales

Data aggregators like Trulia track agent activity statistics for each zip code. Verify they have several recent transactions in your target zones.

Drive around the neighborhood together

Tour the area together to get boots-on-the-ground perspectives. Note their insights on properties, observations about updates, areas to avoid, etc.

Research their professional certifications and designations

Designations like CRB (Certified Real Estate Broker) and CRS (Certified Residential Specialist) indicate deeper training in investment real estate analysis.

Ask about their relationships with lenders and contractors

The best agents already have a list of preferred lenders and contractors they can recommend to help you execute deals from start to finish.

Request their strategy for targeting motivated sellers

Find out what strategies they use to cultivate off-market listings like FSBOs, expired listings, pre-foreclosures etc. in the neighborhoods you want to invest in.

Taking time to find the right agent partner well-versed in each zone’s dynamics pays dividends over time. Leverage their insights and connections to hone in on the blocks poised for growth. Then utilize their alert capabilities to start finding hidden investment opportunities.

The most successful real estate investors build strong local teams starting with a real estate agent specialized in their target investment niches. Their advice can help you set alerts in the right zones and drill down quickly on the best deals.

Finding contractors and architects with rehabilitation experience

Successfully renovating and rehabbing investment properties requires finding the right contractors and architects experienced with restoration projects. Their expertise can make or break your return in rehabilitation zones.

Here are tips for partnering with the best team to execute your vision:

Ask for referrals from investors in your network

Leverage recommendations from other real estate investors who have completed successful projects in your target neighborhoods. They can vouch for teams they’ve worked with repeatedly.

Look for specialists that tout their rehab experience

Seek out providers that prominently promote their experience with restoration work on their website, online profiles and marketing materials as an area of focus.

Verify they have worked extensively in the neighborhoods you target

Local experience in your specific zones provides huge benefits in navigating permitting, inspection nuances, sourcing materials, and networking with tradespeople.

Review their online portfolio of rehabilitation projects

Evaluating examples of high-quality restoration work in their portfolio provides confidence in their capabilities and vision for sensitive renovations.

Ask about their historical registration experience

Contractors with experience navigating registers of historic places provide added value for properties requiring approval from historic commissions.

Look for proper licensing for the project type

Verify they have all required general contracting licenses. Specialty licenses in areas like lead paint removal or asbestos abatement are a plus.

Inquire about their subcontractor relationships

Established relationships with qualified subcontractors like electricians, plumbers and HVAC technicians ensure the team has all the right niche expertise.

Discuss their approach to integrating modern upgrades

The right balance of historic restoration and modernizing upgrades increases functionality. Make sure your visions align.

Ask about experience securing rehabilitation grants and tax credits

Contractors familiar with available government incentives can help maximize them to improve your return on investment.

Review sample bid and budget documents

The bids should demonstrate a clear understanding of rehabilitation costs and complexity to avoid surprises down the road.

Taking extra care to vet your team’s experience, portfolio and approach pays off exponentially. With the right partners, securing deals in promising zones is only half the battle—executing the transformation effectively is the other critical piece.

Creating a business plan and budget for acquiring and renovating properties

Successful real estate investment in neighborhood rehabilitation zones requires thoughtful planning and budgeting before buying your first property. A detailed business plan and projected budgets set you up for success.

Here are some tips for creating a strategic plan and financial model to guide your investment:

Define your investment thesis and criteria

Start by clearly laying out your strategy focused on rehabilitation zones, including target locations, property types, deal metrics, and projected returns.

Project acquisition costs

Factor in purchase price, closing costs, agent fees, and any initial financing costs to determine your total acquisition budget per property.

Estimate renovation budgets

Work with contractors to outline expected costs for materials and labor to meet your scope of work for upgrades and restoration.

Model projected revenues

Forecast income from rent or sale after repairs based on comps in improved zones. Remember to account for vacancies and seller concessions.

Understand permitting and zoning requirements

Consult resources like your city planning department to factor in costs and timelines for approvals, permits, inspections and any zoning challenges.

Account for financing costs

If utilizing funding sources like bank loans, factor in interest payments, points, fees and payback expectations relative to your projected timeline.

Model tax considerations

Include estimated property taxes, as well as tax implications of rentals vs. flipping like depreciation. Consult an accountant to maximize write-offs.

Build in buffers for surprises

It’s prudent to add 10-20% cushions on both your rehab budget and timeline projections to absorb unexpected overages.

Analyze your all-in costs vs. ROI

Compare your total budget to your projected sales or rental proceeds to make sure the return meets your investment hurdles after carrying costs.

Test different scenarios

Model worst, base and best case projections to stress test that the deal economics pencil even if your assumptions prove optimistic.

Approaching each rehabilitation zone investment as a detailed business plan forces rigor and accountability. Be sure to revisit your models often as you gain experience. Setting realistic budgets and return targets upfront will help ensure properties identified using your customized alerts offer profit potential.

Financing options for opportunity zone real estate investments

Real estate investments in opportunity zones can provide attractive tax benefits for investors, but actually capitalizing on those benefits requires navigating the specifics of opportunity zone regulations. One key consideration is financing – how you fund your investment can impact your ability to maximize tax advantages. What financing options make the most sense for opportunity zone deals?

Opportunity zones themselves are designed to spur investment in designated low-income census tracts through tax incentives – if you invest realized capital gains in an opportunity fund and hold your investment for at least 10 years, you can defer and reduce taxes on the original gain, and also eliminate taxes on any new gains from the opportunity zone investment. This can make opportunity zones very appealing for real estate investments in particular.

However, the devil is in the details. The regulations specify that to receive the full tax benefit, you must invest realized capital gains – this means you can’t use debt or borrowed money for your initial investment. So for real estate, you would need to make an all-cash purchase of the property first. Once the property is acquired, though, you have more flexibility in using debt or leverage as part of your ongoing investment strategy.

This raises a key question – where do you find the cash to make that initial purchase, especially if it’s a sizable commercial real estate investment? A few options to consider:

Reinvest capital gains from another transaction

If you’ve recently sold another property or investment at a gain, reinvesting that capital gain into an opportunity zone project allows you to both defer taxes and redeploy the proceeds into a new investment. This is one of the most straightforward ways to capitalize on opportunity zone benefits.

Team up with other investors through a fund

Pooling your money with other investors in an opportunity zone fund provides the ability to make larger investments that you couldn’t access on your own. It also simplifies the investment process. Just make sure you understand the fund’s investment strategy and projected timeline before investing, as you likely need to hold your interest for at least 10 years.

Take advantage of accelerated depreciation

While you can’t use leverage for the initial purchase, taking advantage of accelerated depreciation once you own the property allows you to conserve cash flow in the early years of the investment. This provides some of the cash flow benefits of debt financing without borrowing.

Structure a shareholder loan

Though you can’t directly finance the property purchase, structuring a shareholder loan into your opportunity zone business allows you to subsequently inject additional cash into the project in a tax-efficient way. The key is ensuring the shareholder loan comes after the initial cash investment.

Partner with a bank using a delayed financing structure

Some banks have developed specialized loan products for opportunity zones which allow you to purchase the property using 100% cash initially, but then subsequently refinance a portion of the investment with debt on a delayed basis. The bank essentially commits upfront to provide financing once the property is opportunity zone eligible.

Consider mezzanine debt structures

Mezzanine lending providers offer alternative debt products at higher interest rates and terms than conventional loans. This type of subordinated debt can provide financing for opportunity zone projects once the initial investment has been held for a certain period.

The bottom line is that financing and structuring for opportunity zone real estate investments requires planning and creativity. But various options exist, and taking time to understand the regulations opens up possibilities to make the most of available tax benefits.

If you’re ready to explore investing in an opportunity zone, the key is finding promising markets that are poised for growth and align with your investing strategy. Keep reading to learn how housing alerts for designated neighborhoods can help identify rehabilitation zones with strong investment potential.

Ready to Invest in Real Estate? Find Out How to: Get Housing Alerts for Neighborhood Rehabilitation Zones

Investing in real estate can be highly lucrative, but it also carries risk. Maximizing returns while minimizing risk requires deep knowledge of potential investment neighborhoods and areas poised for growth.

One strategy savvy investors use is targeting up and coming areas designated as opportunity zones or neighborhood rehabilitation zones. These are neighborhoods identified by local governments as needing investment and development. Investing early in these turnaround areas can deliver strong returns.

But how do you learn about neighborhood rehabilitation zones with promising investment potential? Signing up for housing alerts provides real-time notification when new opportunities arise.

Benefits of housing alerts

Housing alerts allow you to get timely information on opportunity zone neighborhoods and quickly act when the right deal comes along. Key benefits include:

- Early access to listings – Get real-time notifications when properties become available in designated zones before they hit the mass market.

- Focus on high-potential areas – Screen for housing alerts in specific neighborhoods identified as opportunity zones rather than sifting through irrelevant listings.

- Jump on time-sensitive deals – Be ready to move when deals or development incentives have tight timelines to maximize program benefits.

- Get pre-qualified – Being pre-approved for financing helps you act quickly when you find the right opportunity zone property.

Setting up alerts

Signing up for housing alerts is easy and free through many listing sites and real estate apps. Follow these steps:

- Search for opportunity zones or neighborhood rehabilitation areas in your city.

- Save these as favorite neighborhoods to monitor.

- Set up custom alerts for these zones to get notifications when new listings appear.

- Consider alerts for upcoming open houses so you can tour new rehabbed properties right away.

As new properties hit the market or open houses are scheduled in your targeted zones, you’ll get real-time alerts on your smartphone. This allows you to jump on promising listings before the competition.

Acting quickly on deals

Speed and decisiveness are critical when deals appear in up and coming areas. Follow these tips when your housing alerts notify you of a new opportunity:

- Research the listing and neighborhood to confirm it meets your criteria.

- Schedule a showing or attend the open house promptly.

- Pull together your offer documents and financial pre-approval letter.

- Submit your strongest offer as quickly as possible.

In many cases, being first through the door with an attractive offer gives you the edge in competitive opportunity zone areas. Your housing alerts will give you a jump start.

Invest in turnaround zones early

Housing alerts provide instant notifications when promising listings become available in rehabilitation zones and opportunity zones. Sign up for alerts on your target neighborhoods today, so you’re ready to invest when the right deal comes along.

Assessing rehab costs and setting realistic asking prices

Successfully flipping or rehabbing investment properties for profit requires accurately estimating your repair and upgrade costs and then setting an optimal asking price. Underestimating rehab costs or overpricing the property after fixes can quickly erode your returns. What key steps can help assess renovation costs and maximize sales proceeds?

Inspect the property thoroughly

There’s no substitute for an in-depth inspection when determining the scope and cost of needed renovations. Some tips for your inspection walk-through include:

- Take extensive photos of every room, defect, dated element, etc.

- Look beyond cosmetics to structural, electrical and plumbing systems.

- Assess any additions or renovations that may not be permitted.

- Identify potential environmental issues such as asbestos, lead paint or mold.

A comprehensive inspection, along with photos, allows you to fully catalog every item needing repair or replacement down the road.

Interview local contractors

Don’t try to guess rehab costs – talk to contractors and tradespeople in your area to get accurate estimates. Key questions to ask include:

- How much for specific items like drywall replacement or bathroom remodels?

- Estimated number of hours for defined work scopes?

- Hourly rates for different trades like electricians?

- Cost savings for doing work in bulk like all new flooring?

Local experts will know specific costs in your market and can translate your required renovations into dollars and cents estimates.

Factor in contingency costs

It’s practically guaranteed that some unforeseen issues will arise once work begins, so budget contingencies are a must. Allocate at least 10-20% beyond your base cost estimates for surprises like:

- Rotten subfloors or leaky pipes hidden until demolition.

- Outdated wiring or plumbing needing more replacement.

- Poor insulation or windows requiring additional upgrades.

- Change orders for any design changes during the project.

Adequate contingency funds help avoid going over budget mid-project.

Consider long term maintenance

To maximize future resale value, look beyond immediate repairs to upgrades that reduce long term costs. For example:

- Energy efficient HVAC systems can cut utility bills.

- Metal or composite roofing adds longevity vs. shingles.

- Quality exterior finishes reduce maintenance.

- Replacing dated plumbing fixtures prevent leaks.

These long-term investments pay off when it comes time to sell.

Research comparable asking prices

Once you have a complete handle on renovation costs, do market research to set your asking price. Some tips:

- Look at comparable homes sold nearby – target the upper end.

- Factor in additional value you’re adding through upgrades.

- Consider future neighborhood appreciation based on momentum.

- Talk to real estate agents for their assessment of market demand.

Setting the price too high can stall a sale; too low leaves money on the table. Shooting for top-end of comparables helps maximize profitable flips.

Test the market and adjust

Your initial asking price is just a starting point – be prepared to adjust based on buyer feedback and demand. Tactics include:

- Listing on the high end, leaving room to negotiate.

- Assessing initial open house traffic and feedback.

- Monitoring online views and favoriting of the listing.

- Being flexible to reduce or increase price accordingly.

Letting the market speak helps fine-tune your pricing for optimal sales velocity and return.

By following proven processes to calculate renovation costs, set asking prices, and adjust as needed, you can maximize success flipping and rehabbing real estate investments.

If you’re ready to explore investing in an opportunity zone, the key is finding promising markets that are poised for growth and align with your investing strategy. Keep reading to learn how housing alerts for designated neighborhoods can help identify rehabilitation zones with strong investment potential.

Ready to Invest in Real Estate? Find Out How to: Get Housing Alerts for Neighborhood Rehabilitation Zones

Investing in real estate can be highly lucrative, but it also carries risk. Maximizing returns while minimizing risk requires deep knowledge of potential investment neighborhoods and areas poised for growth.

One strategy savvy investors use is targeting up and coming areas designated as opportunity zones or neighborhood rehabilitation zones. These are neighborhoods identified by local governments as needing investment and development. Investing early in these turnaround areas can deliver strong returns.

But how do you learn about neighborhood rehabilitation zones with promising investment potential? Signing up for housing alerts provides real-time notification when new opportunities arise.

Benefits of housing alerts

Housing alerts allow you to get timely information on opportunity zone neighborhoods and quickly act when the right deal comes along. Key benefits include:

- Early access to listings – Get real-time notifications when properties become available in designated zones before they hit the mass market.

- Focus on high-potential areas – Screen for housing alerts in specific neighborhoods identified as opportunity zones rather than sifting through irrelevant listings.

- Jump on time-sensitive deals – Be ready to move when deals or development incentives have tight timelines to maximize program benefits.

- Get pre-qualified – Being pre-approved for financing helps you act quickly when you find the right opportunity zone property.

Setting up alerts

Signing up for housing alerts is easy and free through many listing sites and real estate apps. Follow these steps:

- Search for opportunity zones or neighborhood rehabilitation areas in your city.

- Save these as favorite neighborhoods to monitor.

- Set up custom alerts for these zones to get notifications when new listings appear.

- Consider alerts for upcoming open houses so you can tour new rehabbed properties right away.

As new properties hit the market or open houses are scheduled in your targeted zones, you’ll get real-time alerts on your smartphone. This allows you to jump on promising listings before the competition.

Acting quickly on deals

Speed and decisiveness are critical when deals appear in up and coming areas. Follow these tips when your housing alerts notify you of a new opportunity:

- Research the listing and neighborhood to confirm it meets your criteria.

- Schedule a showing or attend the open house promptly.

- Pull together your offer documents and financial pre-approval letter.

- Submit your strongest offer as quickly as possible.

In many cases, being first through the door with an attractive offer gives you the edge in competitive opportunity zone areas. Your housing alerts will give you a jump start.

Invest in turnaround zones early

Housing alerts provide instant notifications when promising listings become available in rehabilitation zones and opportunity zones. Sign up for alerts on your target neighborhoods today, so you’re ready to invest when the right deal comes along.

Marketing and selling rehabilitated properties for optimal returns

After investing time and money rehabbing an investment property, effectively marketing it and selling for top dollar is critical to maximize returns. What strategies help optimized sales of renovated properties?

Professional photography

Quality listing photos grab buyers’ attention and highlight renovations and upgrades. Tips for stellar pics include:

- Wide shots showcase the space and flow.

- Close ups highlight finishes like counters or flooring.

- Proper lighting shows the space at its best.

- minimal staging with neutral furnishings.

Hiring a real estate photographer provides photos buyers obsess over.

Compelling descriptions

Along with eye-catching photos, the listing descriptions must create excitement and interest in the renovated property. Some tips:

- Highlight unique style and any hand-crafted elements.

- Emphasize new higher-end appliances or systems.

- Note special features like custom built-ins or bonus spaces.

- Use energetic, descriptive language to paint a vision.

A stellar listing description gets buyers eager to see the property in person.

Strategic pricing

Set the list price based on comparable sales and market demand, while leaving room to negotiate. Consider:

- Recent sales of upgraded homes nearby.

- The overall inventory – lower in a seller’s market.

- Price just under key psychological thresholds.

- Room to negotiate down slightly.

Smart strategic pricing attracts buyers while optimizing sales proceeds.

Wide distribution

List the property across multiple platforms for maximum exposure. Options include:

- MLS – Realtors can directly promote to clients.

- Zillow, Trulia, Redfin – Broad online reach.

- Social media groups targeting local investors.

- Networks of direct mail list brokers.

Spreading the listing widely casts a wide net for potential buyers.

Targeted outreach

Beyond general listing distribution, directly contact selected prospects who may be particularly interested. For example:

- Investors who have bought similar properties.

- Clients of interior designers whose style it matches.

- Trade groups like contractors who appreciate the finishes.

- Past clients looking to upgrade from your previous sales.

Focused outreach to likely buyers saves time by avoiding tire kickers.

Effective open houses

Open houses create excitement and a sense of competition among buyers. Tips for successful ones include:

- Hold right after list for maximum exposure.

- Ensure the property shows at its absolute best.

- Have agent readily available to answer questions.

- Follow up promptly with all interested buyers.

Well-run open houses drive urgency to submit strong offers.

By leveraging targeted marketing strategies and showcasing the property smartly, you can optimize sales outcomes when flipping or wholesaling renovated homes.

If you’re ready to explore investing in an opportunity zone, the key is finding promising markets that are poised for growth and align with your investing strategy. Keep reading to learn how housing alerts for designated neighborhoods can help identify rehabilitation zones with strong investment potential.

Ready to Invest in Real Estate? Find Out How to: Get Housing Alerts for Neighborhood Rehabilitation Zones

Investing in real estate can be highly lucrative, but it also carries risk. Maximizing returns while minimizing risk requires deep knowledge of potential investment neighborhoods and areas poised for growth.

One strategy savvy investors use is targeting up and coming areas designated as opportunity zones or neighborhood rehabilitation zones. These are neighborhoods identified by local governments as needing investment and development. Investing early in these turnaround areas can deliver strong returns.

But how do you learn about neighborhood rehabilitation zones with promising investment potential? Signing up for housing alerts provides real-time notification when new opportunities arise.

Benefits of housing alerts

Housing alerts allow you to get timely information on opportunity zone neighborhoods and quickly act when the right deal comes along. Key benefits include:

- Early access to listings – Get real-time notifications when properties become available in designated zones before they hit the mass market.

- Focus on high-potential areas – Screen for housing alerts in specific neighborhoods identified as opportunity zones rather than sifting through irrelevant listings.

- Jump on time-sensitive deals – Be ready to move when deals or development incentives have tight timelines to maximize program benefits.

- Get pre-qualified – Being pre-approved for financing helps you act quickly when you find the right opportunity zone property.

Setting up alerts

Signing up for housing alerts is easy and free through many listing sites and real estate apps. Follow these steps:

- Search for opportunity zones or neighborhood rehabilitation areas in your city.

- Save these as favorite neighborhoods to monitor.

- Set up custom alerts for these zones to get notifications when new listings appear.

- Consider alerts for upcoming open houses so you can tour new rehabbed properties right away.

As new properties hit the market or open houses are scheduled in your targeted zones, you’ll get real-time alerts on your smartphone. This allows you to jump on promising listings before the competition.

Acting quickly on deals

Speed and decisiveness are critical when deals appear in up and coming areas. Follow these tips when your housing alerts notify you of a new opportunity:

- Research the listing and neighborhood to confirm it meets your criteria.

- Schedule a showing or attend the open house promptly.

- Pull together your offer documents and financial pre-approval letter.

- Submit your strongest offer as quickly as possible.

In many cases, being first through the door with an attractive offer gives you the edge in competitive opportunity zone areas. Your housing alerts will give you a jump start.

Invest in turnaround zones early

Housing alerts provide instant notifications when promising listings become available in rehabilitation zones and opportunity zones. Sign up for alerts on your target neighborhoods today, so you’re ready to invest when the right deal comes along.

If you’re looking to get started in real estate investing, one of the best strategies is to focus on neighborhoods that are primed for revitalization. Buying property in up-and-coming areas can allow you to purchase homes at a lower cost, fix them up, and then sell or rent them out at a significant profit once the neighborhood becomes more desirable. The key is identifying the right neighborhoods early before property values start rising rapidly.

Scaling your real estate investing strategy in neighborhoods primed for revitalization

So how do savvy investors spot good neighborhoods to buy into before they get too expensive? Here are some tips:

Look for areas close to major employment centers

Proximity to major employers like tech companies, hospitals, or universities is often a catalyst for gentrification. As these big employers grow and attract more talent, employees look for housing options close to work. Areas located within a 30-minute commute can see a surge in demand from new residents, so proximity is key.

Research infrastructure improvements planned for the area

Municipal investments like new parks, transit lines, bike lanes, facade improvement grants, or rezoning policies that allow for more mixed-use development are signs that a neighborhood is on the rise. Pay attention to any major infrastructure projects planned for nearby areas.

Talk to knowledgeable locals and scour neighborhood forums

Get insights from long-time residents, small business owners, and real estate agents who are tuned into the local market. Check out neighborhood-specific forums online to see what residents are saying about changes happening in the area. This can help you spot trends and momentum.

Look for indicators of gentrification

Early signs of gentrification include more young professionals or families moving into the area, houses being renovated, rents and property values increasing, new shops and restaurants opening up. But you want to invest before gentrification is in full swing and prices skyrocket.

Study market reports on price appreciation

Market reports from sites like Zillow can show you neighborhoods where home values are projected to increase substantially in the coming years. This data can help confirm your assessment that a particular area is poised for growth.

Use neighborhood rehabilitation zone alerts