How does the RIX exam impact insurance careers. What topics does the RIX exam cover. Why is the RIX credential highly valued in the industry. How can candidates effectively prepare for the RIX exam. What are the key components of the RIX exam format.

The Evolution and Significance of the RIX Credential

The RIX exam stands as a cornerstone of professional excellence in the insurance and risk management industry. Tracing its roots back to 1942, the credential has undergone significant evolution to become the highly respected certification it is today.

In 1947, the American Institute for Property and Liability Underwriters (AIPLU) introduced the first RIX exam, building upon their Associate in Risk Management (ARM) designation. Over the decades, the exam has adapted to incorporate emerging practices and theories in risk management, solidifying its position as a comprehensive measure of expertise in the field.

Impact on Career Advancement

Obtaining the RIX credential can significantly boost an insurance professional’s career prospects. A survey conducted by Dr. Mary Gemignani revealed that over 50% of RIX holders experienced salary increases following their certification. This statistic underscores the value employers place on the knowledge and skills validated by the RIX exam.

Decoding the RIX Exam Format and Content

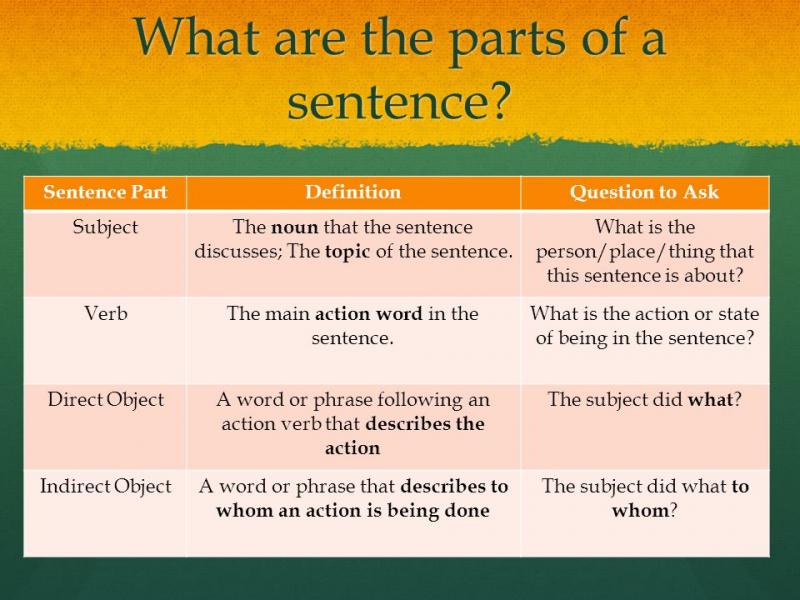

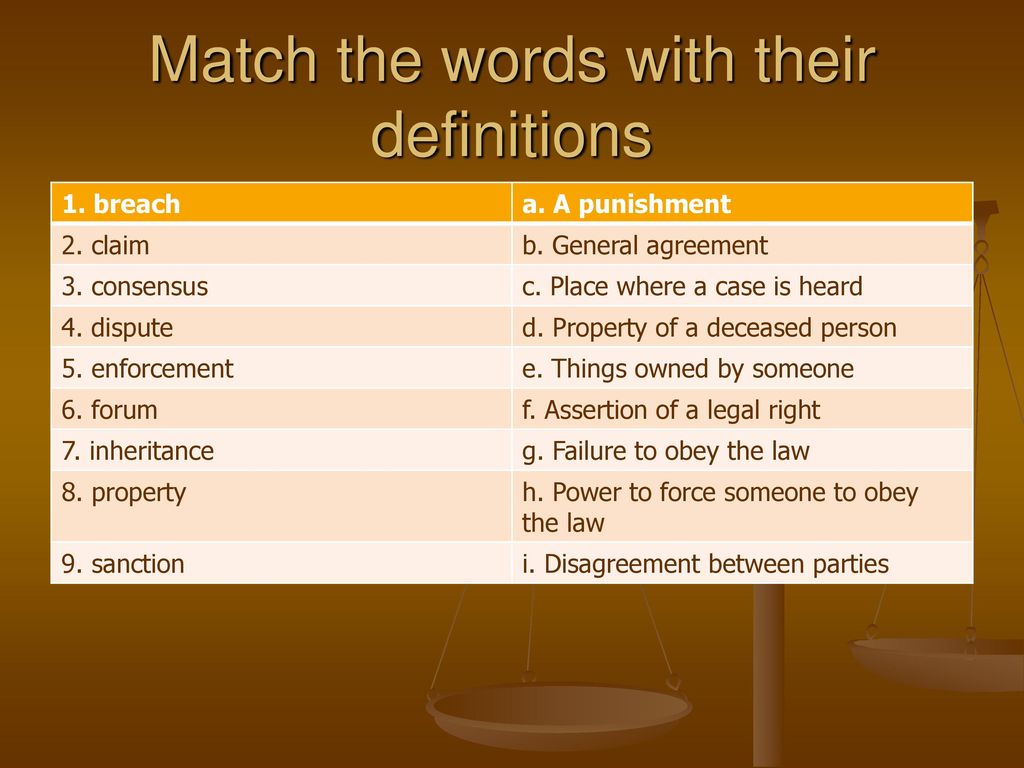

The RIX exam is designed to assess a candidate’s comprehensive understanding of insurance and risk management principles. Here’s a breakdown of its structure:

- 150 multiple-choice questions

- 3.5-hour time limit

- Covers topics such as general insurance, risk management, and principles of risk financing

- Focuses on practical, real-world applications

Dr. Shari Goldfarb, editor of RIX Magazine, emphasizes that the exam tests conceptual understanding rather than rote memorization. This approach ensures that successful candidates possess a deep, applicable knowledge of the field.

Key Exam Topics

The RIX exam encompasses a wide range of subjects crucial to insurance and risk management. Some of the primary areas include:

- Risk identification and analysis

- Risk control and mitigation strategies

- Insurance audits and loss control surveys

- Claims management and investigation

Expert Strategies for RIX Exam Success

Preparing for the RIX exam requires a strategic approach. Here are some expert-recommended tips to help candidates excel:

- Begin studying well in advance of the exam date

- Utilize prep courses and materials from reputable industry organizations like the AIPLU

- Form study groups to discuss concepts and test each other’s knowledge

- Employ memory techniques such as flashcards and acronyms

- Complete numerous practice questions to familiarize yourself with the test format

By following these strategies and dedicating sufficient time to preparation, candidates can significantly increase their chances of joining the ranks of over 86,000 RIX holders worldwide.

The Historical Context of the RIX Credential

Understanding the historical context of the RIX credential provides valuable insight into its prestige and relevance in today’s insurance industry. The roots of this certification can be traced back to the 1920s when the insurance sector began facing increasing complexities.

Dr. Walter Kaufmann, often referred to as the father of risk management, played a pivotal role in pushing for the professionalization of the field. In 1942, Kaufmann, along with other industry leaders, established the American Institute for Property and Liability Underwriters (AIPLU). This organization laid the foundation for what would eventually become the RIX credential.

Milestones in RIX Development

Several key milestones mark the evolution of the RIX credential:

- 1947: Administration of the first RIX exam under the AIPLU banner

- 1972: Merger of AIPLU with the Canadian Institute to form the Insurance Institute of America (IIA), enhancing the international recognition of the RIX

- 1990s-2000s: Major update to the RIX body of knowledge, expanding its scope to encompass the full risk management discipline

The Comprehensive Nature of the RIX Exam

The RIX exam is designed to test a candidate’s knowledge across a broad spectrum of insurance and risk management topics. This comprehensive approach ensures that RIX holders possess a well-rounded understanding of the field.

Core Components of the RIX Exam

The exam covers several crucial areas, including:

- Property and casualty insurance principles

- Risk assessment methodologies

- Financial analysis in risk management

- Legal and regulatory aspects of insurance

- Emerging risks and industry trends

Candidates must demonstrate proficiency in each of these areas to successfully pass the exam.

Navigating the Challenges of the RIX Exam

While the RIX exam is undoubtedly challenging, it is not insurmountable. Many successful candidates have shared their experiences and strategies for overcoming the exam’s difficulties.

Common Hurdles and How to Overcome Them

Some of the most frequently cited challenges include:

- The breadth of material covered

- Time management during the exam

- Applying theoretical knowledge to practical scenarios

- Maintaining focus and motivation throughout the study period

To address these challenges, experts recommend creating a structured study plan, utilizing diverse learning resources, and seeking support from mentors or study groups.

The Global Impact of the RIX Credential

The RIX credential has grown to become an internationally recognized standard of excellence in the insurance and risk management industry. Its global impact is evident in the diverse array of professionals who hold the certification across various countries and sectors.

International Recognition and Opportunities

RIX holders often find that their credential opens doors to international opportunities. Many multinational corporations and global insurance firms actively seek out professionals with this certification, recognizing it as a mark of comprehensive knowledge and expertise.

Furthermore, the RIX curriculum incorporates global perspectives on risk management, preparing holders to navigate the complexities of international insurance markets and regulatory environments.

Continuing Education and the RIX Credential

Obtaining the RIX certification is not the end of the learning journey for insurance professionals. The rapidly evolving nature of the industry necessitates ongoing education and skill development.

Maintaining the RIX Credential

To maintain their RIX credential, holders must engage in continuing education activities. This requirement ensures that RIX professionals stay current with industry trends, regulatory changes, and emerging risks.

Some ways RIX holders can fulfill their continuing education requirements include:

- Attending industry conferences and seminars

- Participating in webinars and online courses

- Contributing to industry publications

- Engaging in professional development activities within their organizations

This commitment to ongoing learning not only maintains the validity of the credential but also enhances the professional’s value to their employers and clients.

The Future of Risk Management and the RIX Exam

As the insurance and risk management landscape continues to evolve, so too does the RIX exam. The credential’s governing body regularly reviews and updates the exam content to ensure it remains relevant and aligned with industry needs.

Emerging Trends in Risk Management

Some of the emerging trends that are likely to shape the future of risk management and potentially influence the RIX exam include:

- Cybersecurity and digital risks

- Climate change and environmental risks

- Artificial intelligence and machine learning in risk assessment

- Pandemic and global health risks

- Geopolitical and economic uncertainties

As these areas grow in importance, aspiring RIX candidates should stay informed about these trends and their potential impact on the industry.

Adapting to Industry Changes

The RIX exam’s ability to adapt to industry changes is one of its strengths. By continuously incorporating new knowledge and best practices, the credential ensures that its holders remain at the forefront of risk management expertise.

Professionals preparing for the RIX exam should not only focus on traditional risk management principles but also stay abreast of emerging issues and technologies that are reshaping the industry.

Leveraging the RIX Credential for Career Growth

Earning the RIX credential can be a powerful catalyst for career advancement in the insurance and risk management field. However, simply obtaining the certification is not enough; professionals must strategically leverage their achievement to maximize its benefits.

Strategies for Career Advancement

Here are some strategies RIX holders can employ to enhance their career prospects:

- Seek out leadership roles in risk management projects

- Contribute to industry publications and speak at conferences

- Mentor junior professionals and share knowledge within your organization

- Pursue advanced roles that require the depth of knowledge validated by the RIX

- Network with other RIX holders to uncover new opportunities

By actively applying their RIX knowledge and showcasing their expertise, professionals can position themselves as valuable assets in the competitive insurance industry.

The RIX Community: Networking and Professional Development

One of the lesser-known benefits of earning the RIX credential is the access it provides to a global community of like-minded professionals. This network can be an invaluable resource for career development, knowledge sharing, and professional growth.

Engaging with the RIX Community

RIX holders can engage with their peers through various channels:

- Professional associations and industry groups

- Online forums and social media platforms

- Local chapter meetings and events

- Collaborative research projects

- Mentorship programs

Active participation in the RIX community not only enhances professional knowledge but also opens doors to new opportunities and collaborations.

The Role of Technology in Modern Risk Management

As technology continues to reshape the insurance industry, the RIX exam has evolved to incorporate these advancements. Understanding the role of technology in modern risk management is crucial for aspiring RIX candidates and current credential holders alike.

Key Technological Trends

Some of the key technological trends impacting risk management include:

- Big data analytics for risk assessment

- Internet of Things (IoT) devices for real-time monitoring

- Blockchain for secure and transparent transactions

- Artificial intelligence for predictive modeling

- Cloud computing for data management and accessibility

Staying informed about these technologies and their applications in risk management can give RIX candidates a competitive edge in both the exam and their careers.

Ethical Considerations in Risk Management

The RIX exam places significant emphasis on ethical decision-making in risk management. As trusted advisors, RIX holders are expected to uphold the highest standards of professional ethics.

Key Ethical Principles

Some of the key ethical principles covered in the RIX curriculum include:

- Transparency in risk communication

- Confidentiality of sensitive information

- Objectivity in risk assessment

- Avoidance of conflicts of interest

- Commitment to continuous learning and professional development

Understanding and applying these ethical principles is crucial not only for passing the RIX exam but also for building a successful and respected career in risk management.

Specialized Areas of Risk Management

While the RIX exam covers a broad range of risk management topics, many professionals choose to specialize in specific areas after obtaining their credential. These specializations can lead to unique career opportunities and areas of expertise.

Popular Risk Management Specializations

Some of the popular specializations within risk management include:

- Cyber risk management

- Environmental and sustainability risk

- Financial risk management

- Operational risk management

- Enterprise risk management (ERM)

RIX holders who develop expertise in these specialized areas can position themselves as valuable assets in niche markets and industries.

The Global Perspective: RIX Across Different Countries

The RIX credential is recognized globally, but its application and importance can vary across different countries and regions. Understanding these differences can be valuable for professionals looking to leverage their RIX credential in an international context.

Regional Variations in Risk Management Practices

Some factors that can influence risk management practices in different regions include:

- Regulatory environments and legal frameworks

- Cultural attitudes towards risk

- Economic conditions and market structures

- Technological adoption rates

- Environmental and geopolitical factors

RIX holders who are aware of these regional variations can adapt their risk management strategies accordingly, enhancing their effectiveness in diverse global markets.

The Future of the RIX Exam: Evolving with Industry Needs

As the risk management landscape continues to evolve, so too will the RIX exam. Staying informed about potential changes and emerging trends can help current and aspiring RIX holders prepare for the future of the credential.

Potential Future Developments

Some areas that may see increased focus in future iterations of the RIX exam include:

- Integration of artificial intelligence and machine learning in risk assessment

- Enhanced focus on global and interconnected risks

- Greater emphasis on sustainability and environmental, social, and governance (ESG) risks

- Incorporation of behavioral economics in risk management strategies

- Adaptation to remote and digital work environments

By anticipating these developments, risk management professionals can stay ahead of the curve and maintain the value of their RIX credential in an ever-changing industry.

An Introduction to the RIX Exam and Its Importance

The RIX exam is the premier certification for insurance professionals looking to demonstrate their expertise in risk management and insurance. But why is this qualification so valued and what exactly does the exam entail? In this article, we’ll explore the origins of the RIX credential, its importance for career advancement, and little-known facts that can help you conquer the test.

The History and Significance of the RIX

While insurance has existed for centuries, the RIX itself traces its roots back to the formation of the American Institute for Property and Liability Underwriters (AIPLU) in 1942. This organization was dedicated to establishing standards of competence for insurance practitioners through education programs and certification. In 1947, the AIPLU launched the Associate in Risk Management (ARM) designation, which subsequently evolved into the RIX program we know today.

Earning the RIX demonstrates one’s expertise across all disciplines of insurance and risk management. It has become an industry-recognized standard that can give a major boost to one’s credibility and career prospects. According to a survey by Dr. Mary Gemignani, over half of RIX holders have experienced salary increases thanks to the certification.

The Exam Format and Content

So what exactly does the exam cover? The RIX test consists of 150 multiple choice questions that must be completed within 3.5 hours. These questions span topics such as general insurance, risk management, and principles of risk financing, with a focus on practical real-world applications.

Some key areas of the exam include:

- Risk identification and analysis

- Risk control and mitigation strategies

- Insurance audits and loss control surveys

- Claims management and investigation

While the exam is certainly comprehensive, RIX Magazine editor Dr. Shari Goldfarb notes that it is designed to test understanding rather than memorization. This means grasping concepts and how they connect is more important than trying to cram facts.

Exam Prep Tips from the Experts

Preparing for a test as in-depth as the RIX can seem daunting. So what prep tips do the experts recommend? Here are a few wise words from RIX holders themselves:

- Start studying for the exam well in advance – don’t leave it to the last minute!

- Use prep courses and materials provided by reputable industry bodies like the AIPLU.

- Form study groups to discuss concepts and test each other’s knowledge.

- Use memory techniques like flashcards and acronyms to help recall key information.

- Complete as many practice questions as possible to get comfortable with the test format.

While the RIX exam is certainly challenging, it’s by no means impossible with the right preparation strategy. By understanding the origins and significance of the qualification, grasping the core conceptual knowledge, and utilizing these expert tips, you can join the ranks of over 86,000 RIX holders worldwide.

The History and Origins of the RIX Credential

The prestigious RIX designation has become a hallmark of excellence for insurance professionals. But how did this globally recognized certification come about? Understanding the roots of the RIX provides valuable insight into its evolution and standing within the industry today.

The origins of the RIX date back to the 1920s, when the growing complexities of the insurance sector created a need for enhanced expertise and specialization. Visionaries like Dr. Walter Kaufmann, regarded by many as the father of risk management, began pushing for the professionalization of the field.

In 1942, Kaufmann joined other leaders to establish the American Institute for Property and Liability Underwriters (AIPLU). This organization was dedicated to promoting insurance education and bringing rigor to an industry that lacked uniform standards at the time. The AIPLU offered various designations and training programs, laying the groundwork for what would become the RIX credential.

The first RIX exam was administered in 1947 under the AIPLU banner. It built upon the flagship Associate in Risk Management (ARM) designation launched earlier. Over 200 candidates sat for this inaugural RIX test. The exam underwent revisions over the next decades, incorporating cutting-edge practices and evolving risk theories. By 1972, the RIX gained the international cachet it enjoys today when the AIPLU merged with the Canadian Institute to form the Insurance Institute of America (IIA).

According to RIX Magazine’s Dr. Shari Goldfarb, the 1990s and early 2000s saw a major update to the RIX body of knowledge. The exam expanded from its foundational focus on property and liability insurance to encompass the full risk management discipline. Test-takers now need expertise across enterprise risk, strategic planning, risk financing, and even emerging areas like cyber risk.

While the RIX has evolved significantly from its origins in the 1920s, the through line is professionalization of the industry. By elevating standards and knowledge, this gold standard certification continues to be a mark of distinction for risk and insurance mastery.

Who Oversees and Administers the Exam?

The RIX exam is a rigorous test that covers extensive knowledge across risk management and insurance. But who actually oversees the development and administration of this important certification?

The RIX was originally launched in 1947 by the American Institute for Property and Liability Underwriters (AIPLU). This organization was dedicated to promoting insurance education and professional credentialing. Over the decades, the AIPLU evolved into what is now known as The Institutes.

Headquartered in Malvern, Pennsylvania, The Institutes are the leading nonprofit providers of risk management and insurance knowledge. They administer the RIX exam through their affiliate, the American Institute for Chartered Property Casualty Underwriters (AICPCU).

According to RIX Magazine editor Dr. Shari Goldfarb, The Institutes maintain responsibility for the entire RIX program. This includes:

- Developing the content outline and exam syllabus

- Writing and updating the test questions

- Administering the exam globally through authorized proctors

- Setting pass scores and determining results

- Awarding the RIX designation to those who pass

The Institutes also provide prep materials, courses, and professional development programs for RIX candidates and designees. These are developed by subject matter experts who are leading professors and practitioners in risk management.

Maintaining the RIX exam involves a rigorous process. The Institutes conduct regular job analyses surveys to ensure the content reflects current industry practices. Exam questions are extensively pretested before deployment. This governance helps preserve the RIX’s reputation as the premier risk management credential.

So while you will sit for the exam at a local test center, the exam itself is produced by The Institutes’ team of psychometricians, academics, and insurance veterans. Their oversight is key to the RIX’s stature and value.

Eligibility Requirements to Take the Test

The RIX exam is considered the pinnacle certification for insurance professionals. But what does it take to actually qualify to sit for this prestigious test? Let’s take a look at the key eligibility criteria.

According to the exam administrator, The Institutes, there are a few core requirements needed to register for the RIX:

- A valid Associate in Risk Management (ARM) designation

- At least three years of full-time insurance/risk management work experience

- Meeting the specific educational requirements

Having the ARM credential is a mandatory prerequisite, as this establishes foundational knowledge for the more advanced RIX material. The ARM and its required courses can be completed online via The Institutes.

Submitting proof of sufficient work experience ensures RIX candidates have relevant real-world exposure to risk concepts covered on the exam. Various types of insurance jobs in claims, underwriting, loss control, etc. can fulfill this requirement.

Finally, The Institutes stipulates certain educational criteria for the RIX. Typically, a bachelor’s degree or higher from an accredited university is needed. However, experienced industry practitioners without a degree can submit a detailed work history showing substantial achievement.

According to RIX Magazine’s Dr. Shari Goldfarb, the eligibility requirements evolved over the years to balance accessibility with upholding professional standards. They help guarantee RIX holders have demonstrated both knowledge and practice competency.

The ARM, experience, and education requirements also enable candidates to adequately prepare for the rigor of the RIX exam. Fulfilling these criteria is key to being approved to sit for the test and being set up for success.

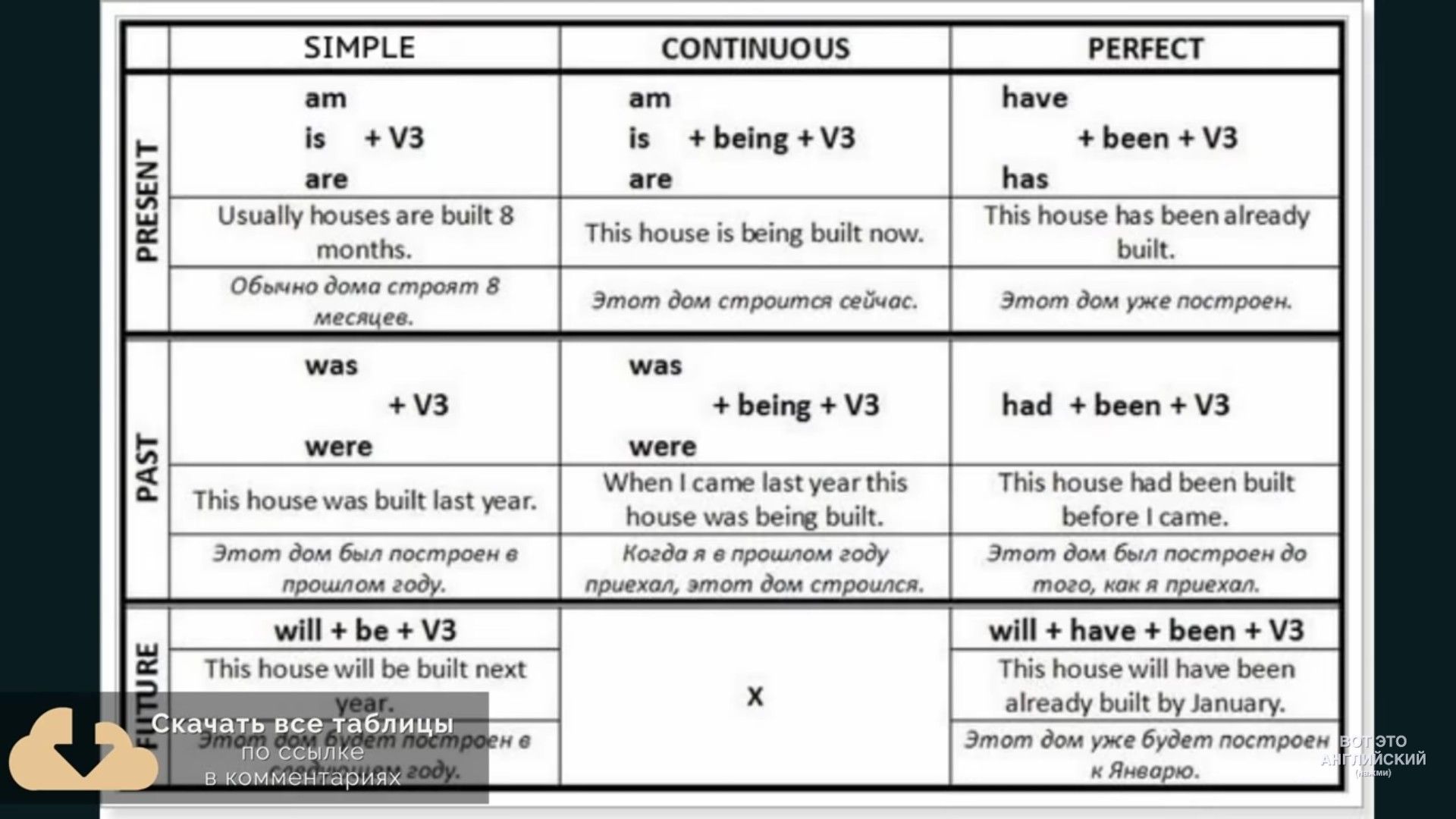

An Overview of the Exam Format and Sections

Understanding the structure and design of the RIX exam is crucial for success. So what exactly can you expect on test day? Here’s an overview of the key format and content areas covered.

The RIX is a 3.5 hour exam consisting of 150 multiple choice questions. According to the Institutes, the non-disclosed test is administered through an authorized proctor at designated testing centers worldwide. You cannot bring any reference materials into the exam.

The questions on the RIX span a broad spectrum of risk management and insurance topics across seven major sections:

- Principles of risk management

- Insurance operations

- Fundamental insurance accounting

- Theory of risk financing

- Insurance law and regulation

- Insurance for commercial and personal lines

- Advanced risk financing techniques

Within each section, you’ll be tested on real-world concepts like emerging risks, enterprise risk management, claims investigations, policy forms and more. The emphasis is on application rather than memorization.

According to veteran RIX holder Dr. Mary Gemignani, the exam covers the entire spectrum of risk mastery expected in the field. It will challenge your comprehension across all knowledge areas. Understanding this broad coverage and varied format is key.

With sufficient preparation using study materials aligned to the content outline, RIX candidates can feel empowered walking into the exam room. Knowing what to expect takes much uncertainty out of the experience.

Detailed Breakdown of the Exam Content Areas

The RIX exam covers an expansive body of knowledge across risk management and insurance. Understanding the specifics of what each section tests can help focus your preparation. So let’s do a deep dive into the content areas.

The 7 major domains on the RIX each have a number of subtopics that define the scope of knowledge. For example:

- Principles of Risk Management – 10% of exam

- Risk management process and techniques

- Risk control and mitigation

- Risk financing methods

- Insurance company functions

- Marketing, underwriting, reinsurance

- Claims principles and process

Other key content areas dig deep into accounting procedures, regulations, policy types, risk analysis frameworks, and more. Reviewing the full RIX exam syllabus allows you to gauge your strengths/weaknesses and customize study plans.

According to veteran RIX exam writer Dr. Shari Goldfarb, the content outline is updated regularly through job task analysis surveys. This ensures the RIX tests skills and knowledge truly relevant for risk managers today.

While the exam is comprehensive, breaking things down into specific topics and concepts makes preparation more targeted. Focus on any problem areas while playing to your existing strengths. With diligence and practice, you can gain mastery across all RIX domains.

Why the RIX Exam Matters for Your Career

Pursuing the prestigious RIX designation involves a major investment of time, effort and commitment. But why is this rigorous certification so meaningful for insurance professionals’ careers? Let’s explore the key benefits.

First, passing the RIX exam validates your expertise across all facets of risk management. It proves not just knowledge, but the ability to apply concepts to real-world scenarios. According to RIX Magazine editor Dr. Shari Goldfarb, many employers now view the RIX as a prerequisite for senior roles.

Earning the credential also enhances your professional credibility and influence. As Dr. Mary Gemignani’s research shows, 96% of RIX holders feel the designation increased their impact within their organizations and industry.

The RIX can open new career doors and advancement opportunities. Surveys indicate that half of RIX holders received promotions after obtaining the certification. It signals readiness for greater responsibility and leadership.

There are also financial incentives tied to the RIX. Across all experience levels, those with a RIX credential earned over 20% higher salaries than their non-RIX peers, per Dr. Gemignani’s report.

Beyond tangible gains, the rigorous journey to the RIX builds knowledge, skill and confidence. Mastering an exam that less than 35% of candidates pass demonstrates tenacity and deep risk management expertise.

In today’s ever-evolving risk landscape, the RIX shows commitment to excellence. For ambitious insurance professionals, the RIX is truly a career game-changer and path to success.

Tips from RIX Exam Experts Like Dr. Shari Goldfarb

Attempting the challenging RIX exam can be daunting without guidance. So what insights do proven experts like Dr. Shari Goldfarb have to share? Here we highlight actionable tips straight from RIX insiders.

Dr. Goldfarb, Editor-in-Chief of RIX Magazine, emphasizes starting early and giving yourself ample time to prepare. Don’t underestimate the rigor or breadth of knowledge required. Begin studying months in advance, not just weeks.

It’s critical to use the right study materials, like those published by The Institutes. Dr. Goldfarb warns against third party products that don’t align closely with the exam content. Stick to reputable, endorsed resources.

While the RIX tests application rather than memorization, diligent review of the content outline is still essential. Be sure to master key terms, concepts and frameworks from the syllabus.

Dr. Goldfarb suggests finding a dedicated study partner or group. Quiz each other on practice questions. Discussing complex concepts reinforces retention and problem-solving skills.

In the final weeks before the exam, turn knowledge into action by doing practice tests under timed conditions. Analyze any mistakes to identify weak spots in understanding.

According to veteran RIX holders like Dr. Goldfarb, embracing the rigor of the exam builds essential skills for risk management leadership. With determination and these expert tips, you can join the distinguished RIX ranks.

Understanding the Scoring and Results

The RIX exam consists of 150 challenging multiple choice questions. But how exactly is the test scored, and what results do you need to pass? Let’s demystify the scoring methodology.

According to The Institutes, the RIX is criterion-referenced. This means your performance is measured against a predetermined standard score, not graded on a curve relative to other test takers.

Each candidate’s score is calculated based on the number of questions answered correctly. There is no penalty for incorrect responses, so it’s better to make an educated guess than leave anything blank.

Thepassing score is set by a national committee of subject matter experts. For the RIX exam, the current passing score is 106/150 or approximately 70% correct answers.

Within a few weeks of taking the exam, candidates receive an official score report from The Institutes. Those who meet or exceed the passing mark earn the prestigious RIX designation. Some employers reimburse the exam fee for those who pass.

For those who don’t pass on the first try, detailed diagnostics reveal relative performance within each section. This allows focused study on weaker domains before retaking the exam.

According to RIX Magazine’s Dr. Mary Gemignani, the rigorous scoring standards ensure the RIX remains credible and meaningful. Earning this challenging credential demonstrates true risk management expertise.

How to Develop an Effective Study Plan

Preparing for the comprehensive RIX exam requires diligence and an organized study regimen. What’s the best way to develop a strategic prep plan? Here are some key tips.

Experts emphasize giving yourself at least 6-8 weeks to prepare if studying full-time, and more like 3-4 months for part-time prep. Build in realistic timeframes so you can methodically cover all content.

Get the official exam syllabus and use it as your roadmap, noting your stronger and weaker knowledge areas. Focus more attention on high-weighted sections and topics you find most challenging.

Leverage instructor-led courses offered by reputable providers like The Institutes. Their structured lessons impart foundational knowledge on each domain.

Build in ample practice with RIX-aligned sample questions and simulated exams. Review and learn from any mistakes.

Schedule regular, distraction-free study sessions and hold yourself accountable. Studying consistently over time leads to deeper retention versus cramming.

Take handwritten notes while reading The Institutes’ texts to reinforce concepts. Flashcards also help ingrain key terms and frameworks.

Join an online study group to discuss complex topics and take mock exams together. Learning with peers keeps motivation high.

With an organized prep plan rooted in the exam blueprint, you can ably tackle the RIX’s broad scope of content. Be diligent yet flexible, and you’ll be exam-ready in no time.

Recommended Study Resources and Materials

With the expansive RIX exam covering seven knowledge domains, using the right study resources is crucial. What materials are most recommended to prep effectively?

First, leverage the Institute’s own RIX learning packages, like online courses and textbooks. These are best aligned to the actual exam content and knowledge requirements.

The Institutes’ customizable online learning tools allow self-paced preparation guided by expert instructors. Interactive elements like flashcards reinforce retention.

Review the 10 textbooks in The Institutes’ Risk Management and Insurance series. Although voluminous, these extensively cover concepts you will need to know.

RIX Magazine provides current articles and insights into emerging industry trends. It’s a must-read for exam prep and continuing education.

Purchase updated test prep guides that provide exam-taking strategies and are structured to the content outline. The Institutes publishes an Official Exam Compendium annually.

Invest in an online practice exam from The Institutes to build familiarity with the computer-based test interface and rigor of the real RIX.

Form online study groups to share notes, discuss complex topics and take mock exams together. Peer support boosts learning.

By leveraging authoritative exam-aligned resources, you can prep efficiently while building true subject matter mastery needed to pass.

Creating RIX Exam Flashcards to Memorize Key Concepts

With the RIX exam’s expansive content scope, memorizing important terminology, formulas and frameworks is crucial. Creating targeted flashcards can really boost knowledge retention as you prep.

Start by reviewing the official RIX exam syllabus and highlighting concepts that require straightforward memorization. These are ideal flashcard topics.

Key terms and definitions from the Institute’s RIX textbooks are perfect flashcard material. Test yourself until you can articulate meanings.

Make charts or diagrams depicting complex processes or models into flashcards. Condense frameworks like risk management cycles into visual aids.

Write any mathematical formulas, pricing methods and financial calculations onto flashcards to practice applying them. Check work against answer keys.

Summarize legislation like HIPAA, ERISA and fiduciary duties on cards. Memorize major provisions and implications.

Carry a few flashcards at a time and review during spare moments, like commutes. Frequent, distributed practice cements long-term retention.

Quiz yourself on your deck frequently, not just right before the exam. Self-testing is key to learning and enforcing memory.

Creating and repeatedly reviewing flashcards transforms the RIX exam content into accessible, memorable knowledge. It’s an easy yet powerful study strategy.

Practice Tests and Sample Questions

Practice is essential to prepare for the RIX exam’s rigorous format. Taking sample tests with questions like those on the actual exam builds critical skills and confidence.

Leverage official practice exams published annually by The Institutes. These most closely match real RIX questions and rigors.

The Institutes also offer an online practice exam with 240 questions and timed test modes. This emulates the computer-based testing environment.

Work through Q&A books aligned to the RIX syllabus. Check understanding by answering then reviewing explanations.

Create practice tests with a study group and quiz each other. Discuss why answers are right or wrong.

Time yourself strictly when taking sample tests. Stick to 3 minutes per question to mirror real exam conditions.

Analyze all mistakes thoroughly. Figure out where knowledge gaps exist and review those topics.

Use practice questions to identify test-taking weak spots like time management and guessing strategies.

With substantial practice, you gain skills, accuracy and speed crucial for RIX exam success. Don’t neglect this vital step.

What to Expect on Exam Day

Understanding the logistics of the RIX exam administration can help you feel prepared versus surprised on the big day. So what should you expect at the testing center?

Arrive early – at least 30 minutes before your scheduled exam time. You’ll need to provide ID, sign in, stow belongings, and get settled.

Certified proctors will provide instructions and assign you a computer. Read directions carefully before starting.

The RIX is 3.5 hours, with an optional break after 2 hours. Pace yourself and bring a snack if desired.

Exam questions are a mix of formats like multiple choice, drag-and-drop, hotspot, and fill in the blank.

Flag any questions you want to return to and answer them before ending the exam.

Test center rules prohibit taking notes or leaving with exam content. Focus intently during the test.

Report any distractions or technical issues to the proctor immediately to document occurrences.

After completing the exam, you’ll receive a printed score report showing your pass/fail status.

Understanding the testing experience prepares you to demonstrate your RIX knowledge confidently when it counts most.

Next Steps After Passing the RIX Exam

Congratulations! You’ve passed the daunting RIX exam and joined the ranks of revered CX professionals. This accomplishment is no small feat, as the RIX sets a high bar with its rigorous assessment of your customer experience knowledge and capabilities. You should feel proud of yourself for making it this far. Now what’s next on your CX journey?

Passing the exam is just the first step – the real work starts now as you leverage your advanced expertise to drive impact and change. Here are some recommended next steps to build on your RIX credential and continue advancing professionally:

1. Update your resume and LinkedIn profile

Let the world know about your achievement! Spotlight your RIX certification prominently on your resume and LinkedIn summary to showcase your capabilities. Recruiters and hiring managers will recognize the value of this credential. You’ve put in the hard work to earn it, so make sure you get the visibility and credit.

2. Join the CXPA and local CX meetups

Surround yourself with other passionate, like-minded professionals. The Customer Experience Professional Association (CXPA) offers access to a global community, learning resources, special interest groups, and more. Local meetup groups are also great for networking and knowledge sharing with fellow practitioners in your area. Choose connections that will challenge you and push your CX expertise even further.

3. Read CX books and publications

Now is the time to dig deeper into customer experience management philosophies, case studies, and emerging trends. Immerse yourself in the teachings of CX thought leaders like Dr. Shari Goldfarb and Dr. Mary Gemignani. Subscribe to publications like RIX Magazine to stay on top of the latest insights and innovations. The learning never stops for great CX professionals.

4. Get active on CX forums and social media

Social platforms like LinkedIn and Twitter enable you to join global conversations relevant to CX careers. Follow thought leaders in the industry, share your own insights, and engage in discussions. You can learn so much from the collective knowledge and perspectives of your peers. And you may even make valuable connections that lead to new opportunities down the road.

5. Look for mentoring opportunities

One of the best ways to continue growing is by learning from those ahead of you. Seek out a more experienced CX pro who can provide perspective and guidance as you navigate the next phases of your career. Mentorships allow you to learn from their seasoned expertise while also building your professional network. If your organization has a formal program, sign up. If not, reach out to respected leaders you admire.

6. Get involved in CX initiatives and projects

Look for ways to take on broader roles and more responsibility in CX now that you have your RIX mastery. Volunteer for cross-functional projects and working groups focused on improving customer experience. Offer to lead a CX training program to educate other employees. The more hands-on opportunities you can find to flex your skills, the faster you will advance.

7. Consider getting additional CX certifications

Your learning journey isn’t over yet. Consider complementing your RIX with additional CX credentials, such as CCXP or CCA. This demonstrates your dedication to continuous professional development and expanding your skillset. Multiple CX certifications on your resume indicate mastery across a diverse range of customer experience disciplines and best practices.

8. Apply for CX roles at the next level

Armed with your new RIX credential, you are better equipped to take on greater CX responsibility. If advancement opportunities are limited in your current role, consider applying elsewhere. The RIX prepares you to lead CX strategy and initiatives at the enterprise level. With this expertise now validated, aim high in your job search and secure a role that enables you to maximize your impact.

9. Champion CX across your organization

In any role, look for ways to educate colleagues about customer experience best practices and advocate for greater CX maturity across the organization. Offer to host lunch-and-learns or webinars to present on CX topics and trends. Spark conversations on how to break down silos and align around delivering better customer experiences end-to-end.

10. Give back to the CX community

Pay it forward by helping those coming up behind you. Coach CX newbies in your organization and share lessons learned from your own experience. Mentor an aspiring CX professional working towards their own RIX certification. Look for opportunities to volunteer as a speaker or judge for CX events and programs. Make giving back a priority.

The RIX opens doors to new possibilities in your CX career. But it is just the starting point on a lifelong journey of learning and leadership in customer experience. Take action, be proactive, and continue pushing yourself outside your comfort zone. The investment you’ve made in yourself will pay dividends for years to come.

Now get out there, show the world what you’ve got, and take the CX industry by storm!