How many patents does Under Armour have. What types of technologies does Under Armour focus on in its patent portfolio. How has Under Armour’s patenting activity evolved over time. What insights can be gained from Under Armour’s intellectual property strategy.

Under Armour’s Patent Portfolio: An Overview

Under Armour, a prominent sportswear manufacturer founded in 1996, has built a significant intellectual property portfolio over the years. As of the latest analysis, the company holds 430 patents, showcasing its commitment to innovation in the sportswear industry. Of these patents, over 54% have been granted, while approximately 27% are still pending approval. This portfolio, although modest in comparison to some industry giants, demonstrates Under Armour’s dedication to protecting its designs and technological advancements.

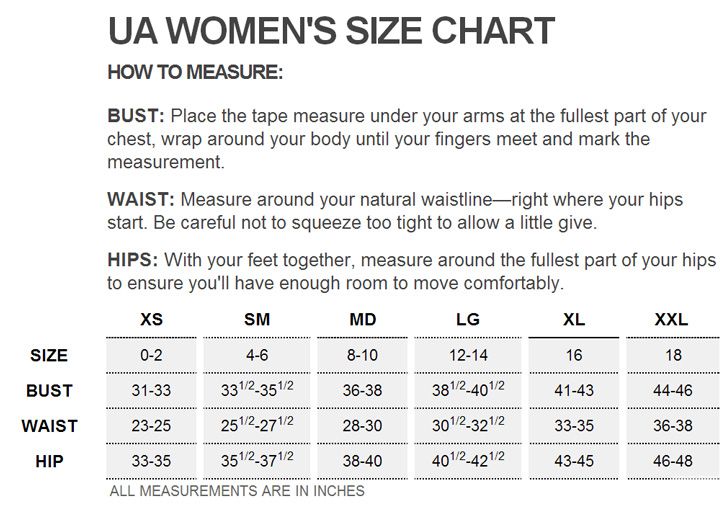

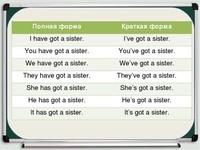

The composition of Under Armour’s patent portfolio is particularly interesting:

- 148 patents (34.4%) are design patents

- 292 patents (67.9%) are utility patents and inventions

This distribution indicates that while Under Armour places significant emphasis on protecting its product designs, it also invests heavily in functional innovations that enhance performance and user experience.

Technological Diversity in Under Armour’s Patent Portfolio

One of the most striking aspects of Under Armour’s patent strategy is its high degree of technological diversification. The company’s 292 utility patents and inventions encompass over 318 different international patent classification (IPC) codes. This broad spectrum of technologies reflects Under Armour’s commitment to exploring various avenues for innovation in sportswear and related fields.

The top technologies in Under Armour’s patent portfolio include:

- Footwear (IPC: A43)

- Clothing (IPC: A41)

- Physics-related technologies (IPC: G)

- Electricity-related technologies (IPC: H)

Notably, 170 patents (58% of non-design patents) are related to footwear and clothing technologies, underscoring Under Armour’s core focus on sportswear innovation.

Beyond Apparel: Under Armour’s Foray into Digital Technologies

While Under Armour’s foundation lies in sportswear, its patent portfolio reveals a strategic expansion into digital technologies. This shift began in 2013 with the acquisition of MapMyFitness, followed by the purchases of MyFitnessPal and Endomondo in 2015. These acquisitions have significantly influenced Under Armour’s patenting activities, particularly in the realms of physics (IPC: G) and electricity (IPC: H).

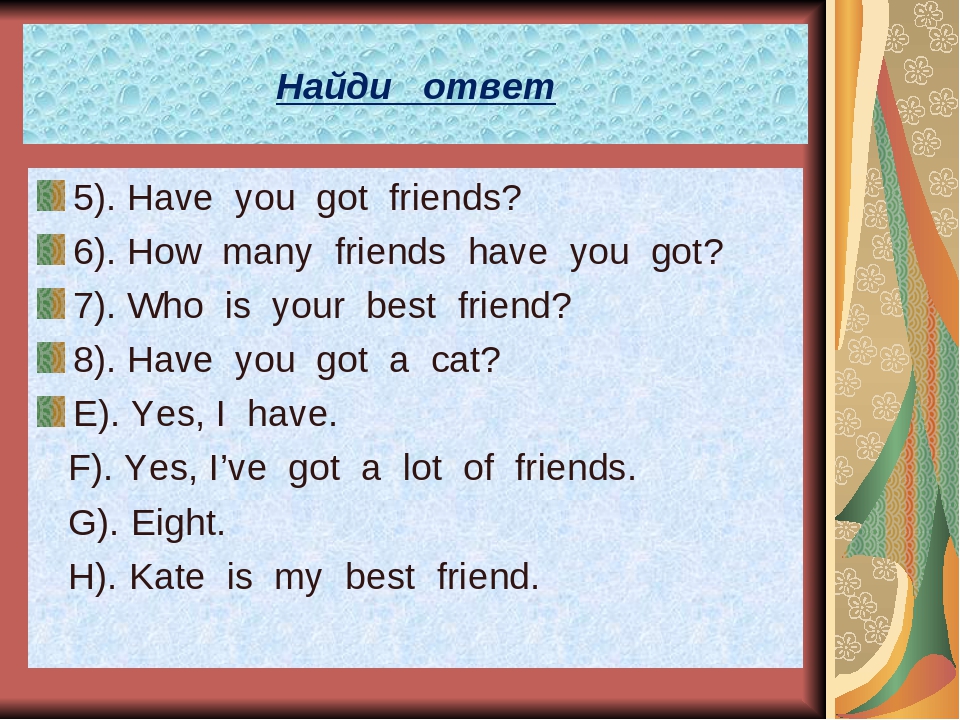

Key areas of digital innovation in Under Armour’s portfolio include:

- Speech recognition for nutrition and recipe identification (2 patents)

- Measuring and testing methods for speed, direction, and other parameters (11 patents)

- Computing and counting technologies (38 patents)

- Electronic communication techniques (17 patents)

These patents indicate Under Armour’s commitment to integrating digital technologies with traditional sportswear, potentially revolutionizing how athletes and fitness enthusiasts interact with their gear and track their performance.

Design Patents: Protecting Under Armour’s Visual Identity

Design patents play a crucial role in Under Armour’s intellectual property strategy, accounting for 148 of its 430 patents. These patents serve to protect the unique visual elements of Under Armour’s products, ensuring that competitors cannot simply copy the company’s distinctive designs.

The design patents in Under Armour’s portfolio cover a wide range of products:

- 61 patents specifically mention footwear or shoes in their titles

- 5 patents relate to display screens with graphical user interfaces

- The remaining patents cover various apparel and accessory designs

The inclusion of patents for graphical user interfaces further underscores Under Armour’s commitment to digital innovation and the integration of technology into its product offerings.

Under Armour’s Patent Growth and Evolution

An analysis of Under Armour’s patenting activity over time reveals a steady growth in its intellectual property portfolio. This growth not only indicates the company’s increasing investment in research and development but also reflects its adaptation to changing market demands and technological advancements.

Key trends in Under Armour’s patent evolution include:

- A consistent increase in the number of patents filed each year

- A shift towards more technologically diverse patents

- An increasing focus on digital technologies and smart apparel

- A balance between protecting core apparel innovations and exploring new areas

This evolution demonstrates Under Armour’s commitment to staying at the forefront of sportswear innovation while also expanding its technological capabilities to meet the demands of an increasingly digital-savvy consumer base.

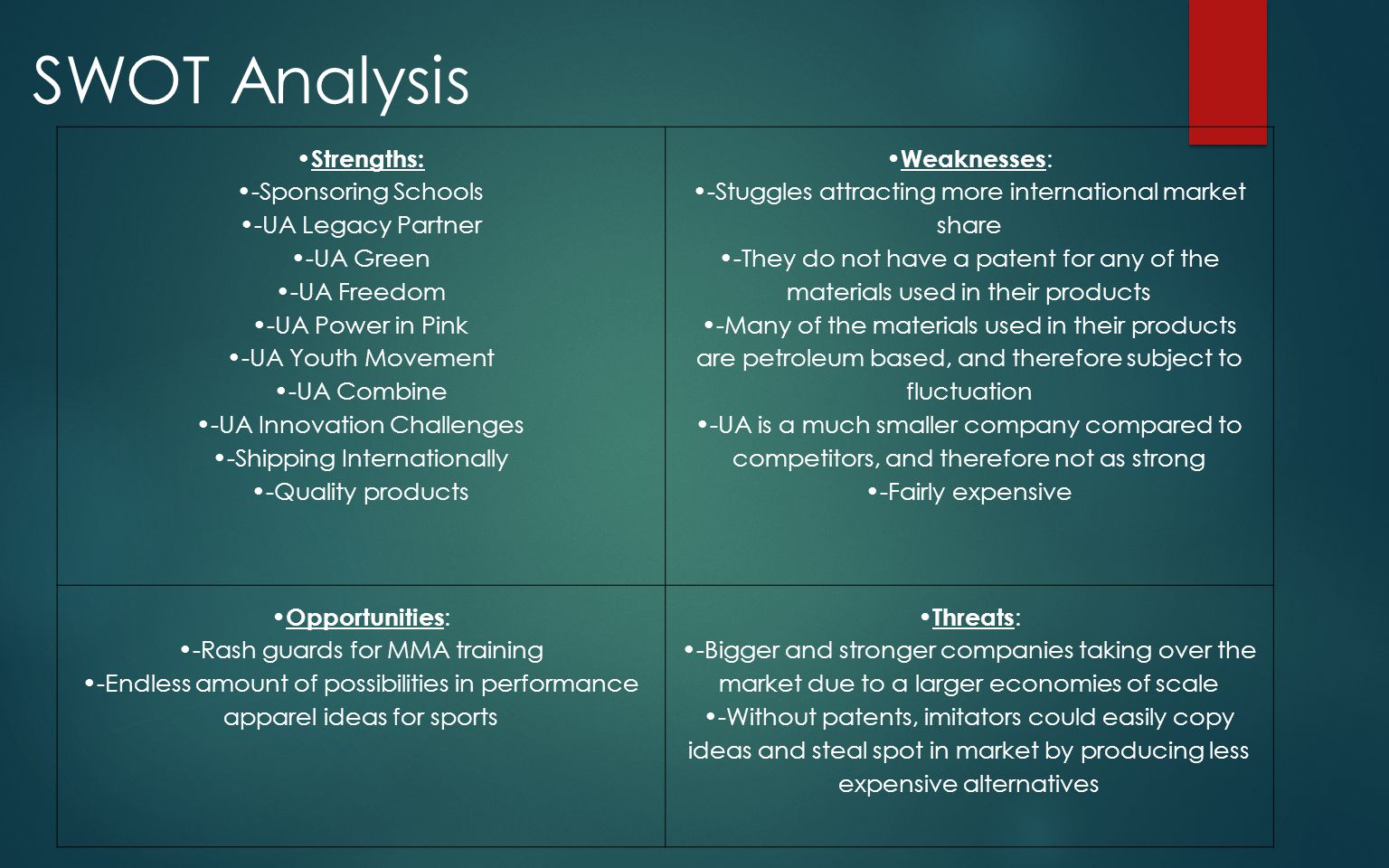

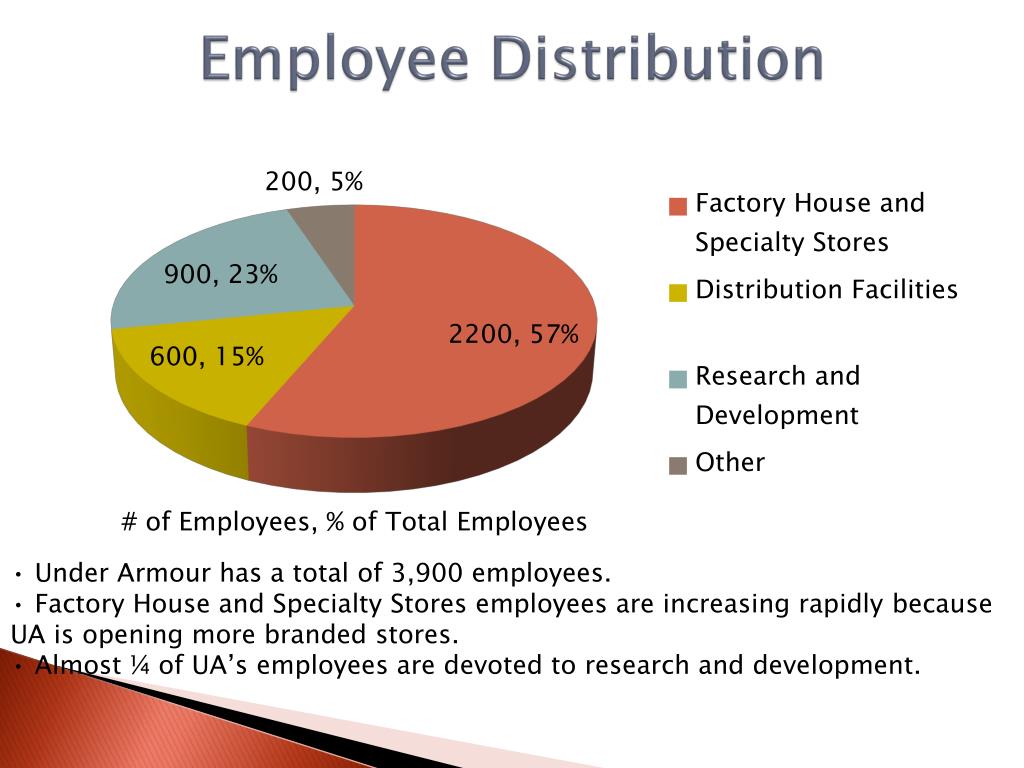

Competitive Landscape: Under Armour vs. Industry Giants

While Under Armour’s patent portfolio of 430 patents may seem modest compared to industry giants like Nike and Adidas, it’s important to consider the company’s relatively young age and its rapid growth in the sportswear market. Founded in 1996, Under Armour has quickly established itself as a significant player in the industry, with its innovative approach to sportswear and strategic expansion into digital technologies.

How does Under Armour’s patent portfolio compare to its competitors?

- Nike: Over 5,000 patents

- Adidas: Approximately 2,500 patents

- Under Armour: 430 patents

While the numbers may seem disparate, it’s crucial to consider the quality and strategic importance of the patents rather than just the quantity. Under Armour’s focused approach to patenting key innovations in both traditional sportswear and digital technologies demonstrates a strategic use of its resources to protect its most valuable intellectual property.

The Impact of Under Armour’s Patent Strategy on Its Market Position

Under Armour’s patent strategy has played a significant role in establishing and maintaining its position in the highly competitive sportswear market. By protecting its key innovations and designs, the company has been able to differentiate itself from competitors and create a unique brand identity.

The strategic benefits of Under Armour’s patent portfolio include:

- Protection of core product innovations, particularly in moisture-wicking fabrics and compression gear

- Safeguarding of distinctive product designs through design patents

- Establishment of a foothold in digital fitness technologies through strategic acquisitions and subsequent patenting

- Creation of barriers to entry for potential competitors in specific technological niches

These benefits have allowed Under Armour to compete effectively against larger, more established brands and carve out a significant market share in the sportswear industry.

The Role of Patents in Under Armour’s Brand Ambassador Strategy

Under Armour’s patent strategy also supports its marketing efforts, particularly in relation to its high-profile brand ambassadors. The company’s portfolio of innovative products, protected by patents, provides a strong foundation for collaborations with athletes and celebrities such as Dwayne ‘The Rock’ Johnson, Lindsey Vonn, Andy Murray, Cam Newton, and Gisele Bündchen.

How do patents enhance Under Armour’s brand ambassador partnerships?

- They provide exclusive technologies that ambassadors can promote

- They ensure that products associated with ambassadors are unique and cannot be easily replicated

- They demonstrate Under Armour’s commitment to innovation, attracting top-tier athletes and celebrities

By aligning its patent strategy with its marketing efforts, Under Armour has created a powerful synergy that enhances both its technological reputation and its brand appeal.

Future Directions: Under Armour’s Patent Pipeline

Analyzing Under Armour’s recent patent applications and technological focus areas provides insight into the company’s future direction and potential areas of innovation. The company’s patent pipeline suggests a continued emphasis on integrating digital technologies with traditional sportswear, as well as exploring new materials and manufacturing processes.

Key areas of focus in Under Armour’s patent pipeline include:

- Smart fabrics and connected apparel

- Advanced performance tracking and analysis technologies

- Personalized fitness and nutrition solutions

- Sustainable materials and manufacturing processes

- Virtual and augmented reality applications for fitness and training

These focus areas indicate that Under Armour is positioning itself at the intersection of sportswear and technology, aiming to provide comprehensive solutions that go beyond traditional apparel and footwear.

The Potential Impact of Under Armour’s Future Innovations

As Under Armour continues to innovate and expand its patent portfolio, the potential impact on the sportswear industry and consumer experience could be significant. The company’s focus on integrating digital technologies with physical products has the potential to revolutionize how athletes and fitness enthusiasts interact with their gear and monitor their performance.

Potential impacts of Under Armour’s future innovations include:

- More personalized and data-driven fitness experiences

- Enhanced performance through smart, responsive apparel

- Improved injury prevention and recovery through advanced materials and monitoring technologies

- Greater integration of virtual and physical fitness activities

- Increased sustainability in sportswear production and use

These potential impacts demonstrate how Under Armour’s patent strategy is not just about protecting its current products, but also about shaping the future of the sportswear industry.

The Role of Under Armour’s Lighthouse Innovation Center

Under Armour’s state-of-the-art research lab in Baltimore, Maryland, known as the Lighthouse, plays a crucial role in the company’s innovation and patenting efforts. This facility serves as a hub for product development, bringing together cutting-edge technologies and expertise to drive Under Armour’s research and development initiatives.

Key aspects of the Lighthouse’s contribution to Under Armour’s patent strategy include:

- Facilitating rapid prototyping and testing of new product concepts

- Providing advanced facilities for materials research and development

- Enabling collaboration between designers, engineers, and data scientists

- Supporting the integration of digital technologies into physical products

- Accelerating the patent application process through streamlined innovation workflows

The Lighthouse’s role in Under Armour’s innovation ecosystem underscores the company’s commitment to science-driven R&D and its ambition to lead the sportswear industry in technological advancement.

Collaborative Innovation and Open Innovation at Under Armour

While Under Armour’s patent portfolio primarily reflects internal innovation, the company has also engaged in collaborative and open innovation initiatives. These efforts allow Under Armour to tap into external expertise and resources, potentially accelerating its innovation process and expanding its technological capabilities.

Examples of Under Armour’s collaborative innovation efforts include:

- Partnerships with universities and research institutions

- Collaborations with technology companies for digital integration

- Engagement with the startup ecosystem through accelerator programs

- Co-development projects with key suppliers and manufacturers

These collaborative efforts complement Under Armour’s internal R&D activities and contribute to the company’s growing patent portfolio, ensuring a diverse range of innovations that can keep the company competitive in the rapidly evolving sportswear market.

The Global Reach of Under Armour’s Patent Strategy

While Under Armour is an American company, its patent strategy reflects a global perspective. The company’s international patent filings demonstrate its commitment to protecting its innovations in key markets around the world, supporting its global expansion efforts.

Key aspects of Under Armour’s global patent strategy include:

- Filing patents in major markets such as Europe, China, and Japan

- Tailoring patent applications to meet regional regulatory requirements

- Protecting innovations specific to local market needs and preferences

- Leveraging international patent treaties for broader protection

This global approach to patenting ensures that Under Armour can defend its intellectual property rights in key markets, supporting its international growth and competitiveness.

The Importance of Patent Quality in Under Armour’s Strategy

While the quantity of patents in a portfolio can be impressive, the quality of those patents is equally, if not more, important. Under Armour’s patent strategy appears to prioritize quality over quantity, focusing on protecting key innovations that provide significant competitive advantage.

Factors contributing to the quality of Under Armour’s patents include:

- Strong technical foundations based on rigorous R&D

- Clear and specific claims that provide robust protection

- Strategic alignment with the company’s business objectives

- Potential for commercial application and market impact

By prioritizing patent quality, Under Armour ensures that its intellectual property portfolio provides meaningful protection and supports its competitive position in the sportswear market.

The Economic Impact of Under Armour’s Patent Portfolio

Under Armour’s patent portfolio plays a significant role in the company’s economic performance and market valuation. While it’s challenging to directly quantify the value of patents, they contribute to Under Armour’s competitive advantage, brand equity, and potential for future growth.

Economic benefits of Under Armour’s patent portfolio include:

- Protection of market share by preventing direct copying of key innovations

- Potential for licensing revenue from patented technologies

- Enhanced brand value through association with innovative products

- Improved negotiating position with suppliers and partners

- Increased investor confidence in the company’s innovative capabilities

These economic benefits underscore the strategic importance of Under Armour’s patent portfolio in supporting the company’s overall business objectives and financial performance.

Challenges and Opportunities in Under Armour’s Patent Strategy

While Under Armour’s patent strategy has contributed significantly to its success, the company faces both challenges and opportunities as it continues to develop its intellectual property portfolio.

Key challenges include:

- Keeping pace with rapid technological advancements in sportswear and digital fitness

- Defending patents against potential infringement by competitors

- Balancing the costs of patenting with the potential benefits

- Navigating complex global patent regulations

Opportunities for Under Armour’s patent strategy include:

- Expanding into new technological areas such as AI and machine learning for personalized fitness

- Leveraging patents to support expansion into new product categories

- Developing a more robust patent licensing program

- Using patents to attract and retain top talent in R&D

By addressing these challenges and capitalizing on opportunities, Under Armour can continue to strengthen its patent portfolio and maintain its position as an innovative leader in the sportswear industry.

Under Armour – sportswear manufacturer IP analysis

A company portfolio analysis for Under Armour reveals 430 patents. Over 54% have already been granted and almost 27% are still awaiting approval. It’s a modest intellectual property portfolio, with around a third protecting its designs. It also shows that Under Armour’s patenting activity is growing and changing with the times.

Posted February 15, 2018

(Image source: Maryland GovPics)

We explore how intellectual property insights could level the playing field for a sports clothing and apparel firm against some long established competitors.

(Image source: Maryland GovPics)

Under Armour Inc.

Overview

In 1996, Kevin Plank—Under Armour’s founder—was sick and tired of exercising in heavy, sweat logged t-shirts. So, Plank started developing moisture wicking, compression base-layers from synthetic fabrics in his grandmother’s basement. The idea got traction, sales grew and Under Armour (UA) started making a dent into the sportswear market. It didn’t take long for the market leaders, Adidas and Nike, to cotton—or should that be synthetic fibre—on to the game and produce their own. But UA had already laid down a marker in their territory.

It didn’t take long for the market leaders, Adidas and Nike, to cotton—or should that be synthetic fibre—on to the game and produce their own. But UA had already laid down a marker in their territory.

Move forward 22 years and Under Armour have diversified their product lines. From the state-of-the-art research lab in Baltimore, Maryland—known as the Lighthouse—product development looks more like a science experiment. Footwear, bags and sports apps are just as likely to carry the distinctive UA logo as its underwear. And Dwayne ‘The Rock’ Johnson, Lindsey Vonn, Andy Murray, Cam Newton and Gisele Bündchen are just a selection of Under Armour’s brand ambassadors.

With annual sales of over $4.8 billion and a market cap of $10.1 billion, UA certainly appears to have a solid marketing strategy and financial clout, but does it have IP clout? And should key competitors be worried?

Under Armour’s IP Strategy Radar

A top level overview of UA’s IP strategy shows a high share of tech diversification within its patent portfolio which is growing year by year. But there also appears to be relatively little improvement indicated.

But there also appears to be relatively little improvement indicated.

Why would a global sportswear business need science driven R&D? Can it shy away from joint R&D? Not pay much heed to market demand? And avoid internationalisation?

Looking deeper into IP data often reveals much more insight than first impressions can provide.

Tech Diversification and specialisation

All-time patent filing

148 of Under Armour’s 430 patents are designs. These design patents can be useful in identifying the types of product UA is planning to bring to market.

Footwear/shoes are referred to in the title of 61 individual applications for design. And overall there aren’t any major surprises appearing in this list of 148 patents.

Although it is worth noting, at this point, that there are 5 design patents referring to a ‘display screen with graphical user interface’.

The remaining 292 patents are split into utilities and inventions—a utility patent is typically an invention that protects a smaller inventive step.

UA names over 318 different international patent classification (IPC) codes across this remaining portfolio. This helps validate the initial impression of high technological diversity.

Key technologies

The comparative footprint of UA’s top ten technologies focuses on IPCs A43 and A41. These relate to footwear and clothing, respectively, and one or both feature in 170 (58%) of UA’s remaining patents. Which all makes perfect sense for a company primarily known for its sports clothing.

This is helpful for determining UA’s core competencies and where it has allocated the most resources. With well over half of UA’s non-design patents featuring IPCs A41 and A43 this also explains the analysis of moderate specialisation.

However, there are 2 IPC groups, G and H, that sit below the headlines that may reveal more insight into UA’s future direction and perhaps explain the graphical user interface design patents.

Science-driven R&D

Let’s get physical

In 2013 UA purchased the digital app maker MapMyFitness. Two years later MyFitnessPal and Endomondo—two of the leading fitness and lifestyle apps—became part of the UA portfolio.

Two years later MyFitnessPal and Endomondo—two of the leading fitness and lifestyle apps—became part of the UA portfolio.

IPCs starting with G relate to physics and cover 54 of UA’s patents. Two of these patents are looking at speech recognition within nutrition and recipe identification patents. 11 come under ‘measuring or testing’ methods—such as speeds, direction and more. And 38 come under the loose header of computing and counting.

IPCs starting with H relate to electricity and cover 17 of UA’s patents. The core of these focus on electronic communication techniques.

And with a narrowed down search looking at the words described in patents including IPC codes G and H—it doesn’t take much to identify a clear intent to penetrate the wearable/trackable market.

Market-driven R&D

Innovation following market trends for smart sports apparel and tracking sensors

IP data isn’t a crystal ball—but it can often anticipate the future.

In early February 2018, Under Armour released the HOVR—smart running shoes with a built-in sensor to measure cadence, distance, stride and steps. Of course, you’ll need an app to connect to the smart sensor—UA’s MapMyRun app. Ta-da! The parts all begin to click into place.

Of course, you’ll need an app to connect to the smart sensor—UA’s MapMyRun app. Ta-da! The parts all begin to click into place.

You may say that all of this is obvious after the release of such a product—however many of these patent documents have been available well in advance of the HOVR’s launch. This flowchart details a system with multi-axis athletic performance tracking – US9734389, which was published in August 2017.

Could UA’s latest published patent applications give us some insight into what’s next?

Quantity and quality—Growth and improvement

A disciplined approach to patenting

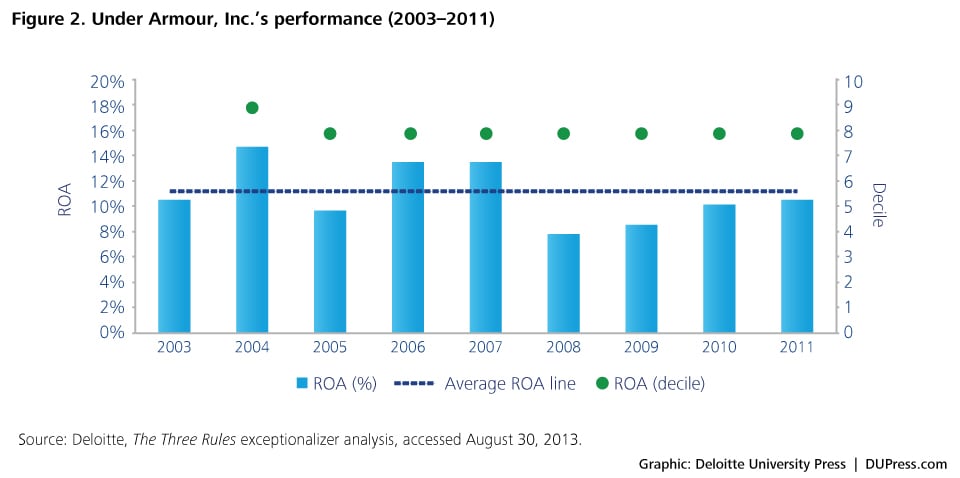

We can see that Under Armour’s patenting activity has grown over the past few years. This graph shows the yearly patenting trend of published patents by technology areas.

The size of the circle represents the number of patents filed in that particular year. UA’s patenting applications for its top IPCs are still on an steady upward trajectory.

But again, looking at the underlying G and H IPCs we can see a relative upsurge in patenting activity in the last 2 or 3 years. Interestingly, that outlier cluster of 3 patents under G01P15 (from 2000) are patents acquired by UA in 2014. They all refer to speed, spin rate and curve measuring using accelerometers and radio transmitters to communicate with a user interface. Is this the tech that is powering the HOVR’s central nervous system? If so, there’s only around 18 months until this patent expires—which means competitors could begin to build on the existing invention without fear of infringement in the not-too-distant future.

Interestingly, that outlier cluster of 3 patents under G01P15 (from 2000) are patents acquired by UA in 2014. They all refer to speed, spin rate and curve measuring using accelerometers and radio transmitters to communicate with a user interface. Is this the tech that is powering the HOVR’s central nervous system? If so, there’s only around 18 months until this patent expires—which means competitors could begin to build on the existing invention without fear of infringement in the not-too-distant future.

It’s also worth noting that some patent applications made in 2016 or later may still be pending publication.

Here we can observe Under Armour’s patenting pace and effectiveness of filing. In the early years of activity UA had a very measured and modest patenting strategy, but as the business has grown, so has its willingness to protect its intellectual property.

The general increase in patent applications has seen a moderate drop in grant rates—dipping below 50% for the first time in 2015—as UA seeks to put down an IP marker. It’s worth noting that 19 of the 60 patents applied for in 2015 are still pending so that grant rate could still increase.

It’s worth noting that 19 of the 60 patents applied for in 2015 are still pending so that grant rate could still increase.

Internationalisation

A US sportswear company with worldwide appeal—but not patenting globally

Under Armour is playing on a global platform but has minimal filings outside of the US—choosing to only file around a quarter of their IP in alternative juristictions.

Which means there is potential for some of Under Armour’s intellectual property to be appropriated and replicated outside of its protected regions.

Competitive Landscape

Under Armour’s key competitors – Identifying companies sharing common ground

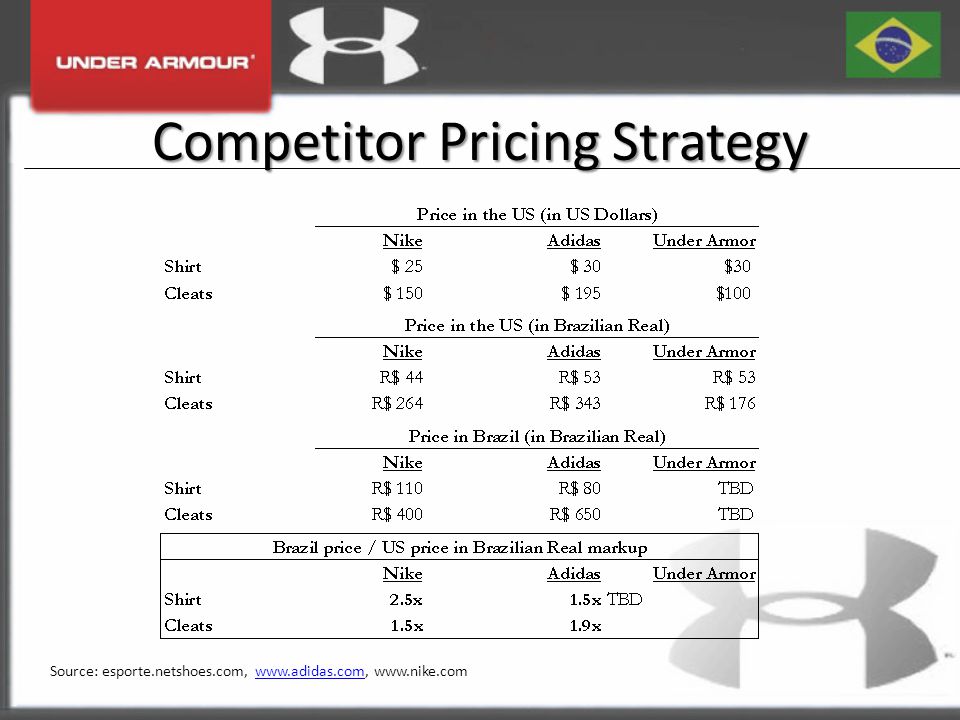

Under Armour are principally defined as a manufacturing company of sports clothing, apparel and footwear. Knowing that UA is making strides into activity tracking tech means companies such as Strava, Fitbit, Garmin and Suunto should now also be considered on the competitive radar. But for now we will look at the obvious key competitors in UA’s wider marketplace—Nike and Adidas.

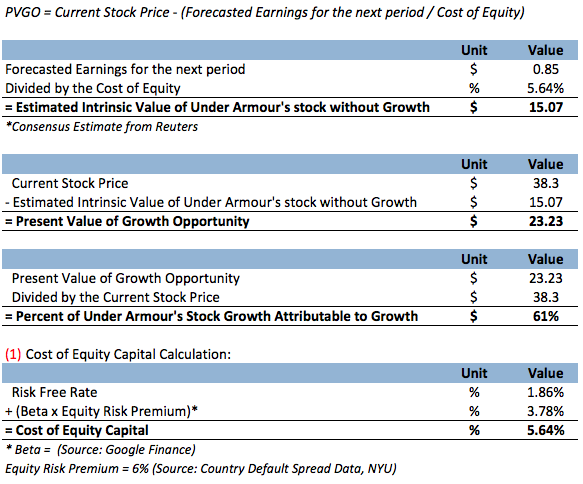

Financial and patent portfolio comparative overview

UA is certainly no slouch in terms of sales. But Nike’s annual revenue dwarfs that of UA by nearly 7 times. And Adidas outsell UA by over 4 times. Once we look at the patent portfolio size and value, that gulf widens even further. But it is also worth remembering that Nike has 54 years of experience and Adidas will be 94 this year.

Staying focussed

Adidas and Nike are no strangers to sports apps or associated tech. Recent developments include Adidas’ buy-out of the Runtastic App in 2015—it’s already announced plans to kill off the legacy miCoach service and migrate existing users to the Runtastic platform. And Nike has teamed up with Apple to launch a takeover version of the Apple Watch Nike+. With this in mind, we’ve kept our attentions focussed on patents that refer to International Patent Classifications G or H—and with a little refinement we are left with a manageable and more focussed portfolio of just 546 patents.

Increased volume and pace

Nike+ goes back over 10 years. A sensor chip that fit into the sole of your favourite running shoes—and connected to your iPod—was one of the earliest offerings. There were critiques on the accuracy of early devices. R&D teams were kicked into action and consequently patenting activity accelerated significantly. Leading to many companies taking steps to improve accuracy, reliability, functionality and user experience.

Steps that Under Armour has presumably put into action with the HOVR.

Areas of strength and weakness

Here we can see the main areas of patenting activity by technology field coverage and by company—based on a keyword analysis. This chart can help identify the strengths and weaknesses of the top patentees within this technology area, highlighting areas that may need improvement, as well as potential business or licensing opportunities. The most frequent keywords focus on portion, athletic activity/performance, footwear and determination. And Nike are fairly dominant—which considering the volume of patents they hold is unsurprising. Meanwhile, UA—who are outnumbered around 10 to 1 in terms of patent volumes—have some peripheral areas where they are holding their own including health tracking and wireless communications.

And Nike are fairly dominant—which considering the volume of patents they hold is unsurprising. Meanwhile, UA—who are outnumbered around 10 to 1 in terms of patent volumes—have some peripheral areas where they are holding their own including health tracking and wireless communications.

Identifying gaps in the market

Plotting patent data on a 3D landscape allows us to identify isolated space and areas with high densities of operation.

Elevated topography shows technology segments with high level of innovation activity. Meanwhile, low areas reveal white space with potential for exploitation. In particular, low-lying spaces between areas that have already experienced activity.

By isolating patents that have been applied for in the past 5 years we can observe an alteration to the landscape. And it feels like Under Armour are starting to stand shoulder to shoulder with over a century of prior experience combined.

Patents Assigned to Under Armour, Inc.

Publication number: 20210279787

Abstract: Methods, apparatus, computer applications, and systems are provided for enabling identification of content to be compiled into a shopping application at a user device. In one embodiment, a general layout for a number of content modules to be displayed and identifying information for content to be inserted are provided from a network server to a user device, the user device then calls the appropriate content and utilizes the layout to generate a page for display to the user natively. One specific variant, activity and profile data collected at the user device via a separate application may be stored at the network and used to select content by the server.

In one embodiment, a general layout for a number of content modules to be displayed and identifying information for content to be inserted are provided from a network server to a user device, the user device then calls the appropriate content and utilizes the layout to generate a page for display to the user natively. One specific variant, activity and profile data collected at the user device via a separate application may be stored at the network and used to select content by the server.

Type:

Application

Filed:

April 15, 2021

Publication date:

September 9, 2021

Applicant:

Under Armour, Inc.

Inventors:

Jeremy Zedell, Murtaza Nemat Ali, Ben Finnigan, Mary Lawyer

Why Nike Has More Patents Than Lockheed, Ford And Pfizer

Nike (NKE) has more U.S. patents than a defense contractor making stealth jets, a pharma developing cancer-fighting drugs, and an auto giant working on self-driving cars.

The athletic gear maker was granted about 500 patents last year and ended 2015 with 5,060 issued patents, which include those that expired, according to the U.S. Patent and Trademark Office (USPTO). That tops Lockheed Martin (LMT) (4,113), Ford Motor (F) (3,563) and Pfizer (PFE) (2,587). And that doesn’t even include patent applications.

That tops Lockheed Martin (LMT) (4,113), Ford Motor (F) (3,563) and Pfizer (PFE) (2,587). And that doesn’t even include patent applications.

Nike’s patents have nearly doubled since 2009, and CEO Mark Parker boasted last year the company has the third-largest U.S. portfolio of design patents. Nike has buried rivals Adidas and Under Armour (UA) in patents, as it looks to maintain its dominance with an avalanche of innovations in manufacturing and design while potentially toying with a wearable device that could appear alongside Apple’s (AAPL) smartwatches and Fitbit’s (FIT) trackers.

“Generally, you should see some type of correlation when a company is releasing innovative, game-changing products,” said Envision IP Managing Attorney Maulin Shah, who said that of Nike’s thousands of granted patents, over 4,200 of them are still active and in force.

Building A Manufacturing Edge

As Nike doubles down on automation and 3D printing capabilities, a recent Macquarie analysis of the USPTO library observed “a meaningful acceleration of (Nike) patents in recent months focusing on new ways to manufacture products. ”

”

Nike already has its own army of shoe-painting and water-free dyeing robots, just to name a few. And in October, it announced a partnership with Flextronics (FLEX), a manufacturer that has developed an automated way to cut material waste by 50%. Such savings, if flowed to the bottom line, could add 23 cents to Nike’s 2016 earnings per share, Macquarie analyst Laurent Vasilescu estimated in April.

Separately, Nike is building a “3D digital design system” in partnership with DreamWorks Animation (DWA) that includes “nearly instantaneous digital print applications, photo-real 3D visualizations and ultra-rapid prototyping.”

Compared to Nike’s more than 4,200 active patents, German rival Adidas has “kind of been stagnant,” with a U.S. patent portfolio that is about a ninth the size of Nike’s, not including those gained in its acquisition of golf equipment maker TaylorMade, said Shah. But Adidas does have a “relatively large” patent portfolio in Europe, he noted. Globally, Nike has about 19,500 patents and patent applications vs. Adidas’ roughly 2,400.

Globally, Nike has about 19,500 patents and patent applications vs. Adidas’ roughly 2,400.

Under Armour, which has been happy to be framed as a tech company with a penchant for snapping up fitness apps, only has about 104 issued U.S. patents, almost two-thirds of which are design and not utility patents, by Shah’s count. Utility patents in athletic apparel primarily deal with material — think compression, moisture-wicking — and manufacturing methods vs. patents for clothing designs.

Innovation aside, patents can also be an indicator for something far juicier: a peek into a company’s product strategy.

For example, Under Armour was granted on March 29 a patent for a one-armed compression sleeve designed to warm a pitcher’s throwing arm between innings — an interestingly specific item that indicated potential future investments in baseball. Indeed, a few weeks later, the company signed Washington Nationals outfielder Bryce Harper, the reigning National League MVP, to what ESPN said is the biggest endorsement deal ever for a baseball player, though terms weren’t disclosed.

Source: USPTO

Nike Still In The Gadgets Game?

While most of Nike’s recent patent activity is related to manufacturing, a dive into its sprawling portfolio indicates a potential shift in its device strategy.

Nike hasn’t been in the wearables business since axing most of its FuelBand team two years ago, and the TomTom-powered Nike+ Sportwatch is no more. Nike instead has been pushing its revamped Nike+ app over any hardware.

Some have said the athletic apparel giant is shying away from hardware development because of its partnership with Apple, particularly since its Nike+ app can be used on the Apple Watch. But its patents say otherwise.

There has been a “surge” in wearable-related applications from Nike in the last two or three years, Shah said, and the company now has 261 active patents related to wearable tech vs. Adidas’ 99 and Under Armour’s dozen patents.

Published with the USPTO recently, images from a patent for an “athletic watch” look an awful lot like the TomTom version of Nike’s watch: a boxy-looking accessory with a perforated band and large numbers. In fact, given the slight aesthetic differences — an extra button here, a missing button there, a thinner wristband — the drawings could easily be a newer edition of the Nike+ SportWatch, though it is not clear if that is the case.

In fact, given the slight aesthetic differences — an extra button here, a missing button there, a thinner wristband — the drawings could easily be a newer edition of the Nike+ SportWatch, though it is not clear if that is the case.

Both Nike and TomTom did not immediately respond to a request for comment.

.

Source: USPTO

“It definitely seems that Nike is keeping its options open on this front,” Macquarie’s Vasilescu told IBD after viewing an earlier trio of patent applications for an athletic watch that were published on March 17 and first filed last September.

Meanwhile, about 20% of Adidas’ patents are focused on wearables. But such products may never come to market, Shah said, noting that companies also license ideas if they aren’t in a position to make gadgets themselves.

Patent Stargazing: Days Of Future Past

Given the sheer number of applications that are filed with the USPTO each year – 629,647 in 2015 alone – some might consider it folly to think digging through musty government archives might shed any light on what kind of consumer products could hit shelves.

Indeed, trying to decipher a company’s product pipeline by looking at the U.S. patent library is a little bit like astronomy — both constellations and published patents are maps of the past. Starlight has to travel so far to reach Earth that some of those celestial bodies that appear to be burning in the night sky may already be dead, or dying.

Similarly, it takes about 24.6 months on average for filed patent applications to be published on the USPTO database, according to the agency. Most are actually published within a year and a half, Santa Clara University School of Law Assistant Professor Brian Love told IBD, though ideas were conceived and worked on well before a filing.

“It’s probably at least two years old, if not more, and then by the time the patent issues, you’re talking about tacking on a couple more years on top of that,” he said. “So it is kind of a window into the future, but it’s not that far of a window into the future.”

Still, filings can offer clues years in advance. Case in point: Nike rolled out self-lacing Marty McFly-inspired shoes in March, after Nike designer Tinker Hatfield confirmed in early 2014 that power lacing would be unveiled the following year. But the company’s “Back to the Future” resurrection could’ve been foreseen long before that. Nike’s first granted patent for an “automatic lacing system” appeared in 2011.

Case in point: Nike rolled out self-lacing Marty McFly-inspired shoes in March, after Nike designer Tinker Hatfield confirmed in early 2014 that power lacing would be unveiled the following year. But the company’s “Back to the Future” resurrection could’ve been foreseen long before that. Nike’s first granted patent for an “automatic lacing system” appeared in 2011.

Playing Defense

Of course, some companies stake out IP turf not for the purpose of developing those ideas, but to thwart competitors’ dreams. This type of defensive patent publishing, as it is known, is not uncommon with tech giants like IBM (IBM) or Alphabet (GOOGL) unit Google, say experts.

“The consequence of publishing something is that you lose any sort of trade secrets rights you might have in it, but you’re also stopping somebody else from patenting it,” said Love.

Watchmaker Swatch has reportedly been on a smartwatch-patent filing spree over the last few years. What it intends to do with them is a mystery.

What it intends to do with them is a mystery.

“There’s a lot of rumors in the patent industry: Will Swatch start suing competitors, or are they actually just building up patents because they’re about to launch an entirely new product line?” said Shah.

Regardless, no matter what Nike, Under Armour or Adidas wind up bringing to market, all of this patent-filing and R&D means that investors and consumers can likely expect growth from the activewear space.

“I think we are in the golden age of tech in the athletic footwear business,” said NPD Group analyst Matt Powell. “I have never seen so many new tech advances (in products and manufacturing) that we are currently seeing. So add that to the fact that there’s a record number of patents and the future looks really bright.”

%PDF-1.3

%

982 0 obj

>

endobj

xref

982 113

0000000016 00000 n

0000004391 00000 n

0000004569 00000 n

0000004619 00000 n

0000004663 00000 n

0000004856 00000 n

0000005139 00000 n

0000005187 00000 n

0000005235 00000 n

0000005283 00000 n

0000005321 00000 n

0000005400 00000 n

0000007877 00000 n

0000010245 00000 n

0000012614 00000 n

0000012692 00000 n

0000015147 00000 n

0000017938 00000 n

0000020066 00000 n

0000022510 00000 n

0000115262 00000 n

0000117565 00000 n

0000135880 00000 n

0000136078 00000 n

0000136194 00000 n

0000136320 00000 n

0000137968 00000 n

0000263714 00000 n

0000383499 00000 n

0000472782 00000 n

0000489422 00000 n

0000515915 00000 n

0000653659 00000 n

0000654655 00000 n

0000654730 00000 n

0000654843 00000 n

0000654893 00000 n

0000655010 00000 n

0000655127 00000 n

0000655177 00000 n

0000655300 00000 n

0000655382 00000 n

0000655514 00000 n

0000655564 00000 n

0000655699 00000 n

0000655818 00000 n

0000655949 00000 n

0000655999 00000 n

0000656187 00000 n

0000656285 00000 n

0000656335 00000 n

0000656453 00000 n

0000656503 00000 n

0000656681 00000 n

0000656731 00000 n

0000656868 00000 n

0000656918 00000 n

0000657071 00000 n

0000657127 00000 n

0000657306 00000 n

0000657356 00000 n

0000657473 00000 n

0000657523 00000 n

0000657573 00000 n

0000657623 00000 n

0000657791 00000 n

0000657841 00000 n

0000658030 00000 n

0000658080 00000 n

0000658197 00000 n

0000658247 00000 n

0000658297 00000 n

0000658347 00000 n

0000658397 00000 n

0000658447 00000 n

0000658573 00000 n

0000658676 00000 n

0000658726 00000 n

0000658874 00000 n

0000658924 00000 n

0000659018 00000 n

0000659122 00000 n

0000659172 00000 n

0000659292 00000 n

0000659342 00000 n

0000659449 00000 n

0000659499 00000 n

0000659549 00000 n

0000659599 00000 n

0000659678 00000 n

0000659771 00000 n

0000659821 00000 n

0000659916 00000 n

0000659966 00000 n

0000660063 00000 n

0000660113 00000 n

0000660220 00000 n

0000660270 00000 n

0000660376 00000 n

0000660426 00000 n

0000660557 00000 n

0000660607 00000 n

0000660723 00000 n

0000660773 00000 n

0000660870 00000 n

0000660920 00000 n

0000661028 00000 n

0000661078 00000 n

0000661187 00000 n

0000661237 00000 n

0000661331 00000 n

0000661381 00000 n

0000002556 00000 n

trailer

]/Prev 7465934>>

startxref

0

%%EOF

1094 0 obj

>stream

hWyPW6 ٬NCVc\$DC)U. ]iRDQAwUѢ;eǙ~9C}3}~}o_

]iRDQAwUѢ;eǙ~9C}3}~}o_

Under Armour Company Profile: Stock Performance & Earnings

Under Armour Overview

Update this profile

- Share Price

- $22.13

- (As of Thursday Closing)

Under Armour General Information

Description

Under Armour develops, markets, and distributes athletic apparel, footwear, and accessories in North America and other territories. Consumers of its apparel include professional and amateur athletes, sponsored college and professional teams, and people with active lifestyles. The company sells merchandise through wholesale and direct-to-consumer channels, including e-commerce and more than 400 total factory house and brand house stores. Under Armour also operates a digital fitness app called MapMyFitness. The Baltimore-based company was founded in 1996.

Contact Information

Want to dig into this profile?

We’ll help you find what you need

Learn more

Under Armour Stock Performance

(As of Thursday Closing)

| Stock Price | Previous Close | 52 wk Range | Market Cap | Shares | Average Volume | EPS |

|---|---|---|---|---|---|---|

$22. 13 13 | $21.72 | $13.16 – $26.45 | $9.4B | 468M | 5.84M | $0.80 |

Under Armour Financials Summary

| In Thousands, USD | TTM 30-Jun-2021 | FY 2020 31-Dec-2020 | FY 2019 31-Dec-2019 | FY 2018 31-Dec-2018 |

|---|---|---|---|---|

| EV | 9,685,275 | 8,437,510 | 10,083,168 | 8,217,956 |

| Revenue | 5,445,516 | 4,474,667 | 5,267,132 | 5,193,185 |

| EBITDA | 617,023 | (280,301) | 417,507 | 147,548 |

| Net Income | 360,358 | (549,177) | 92,139 | (46,302) |

| Total Assets | 4,871,509 | 5,030,628 | 4,843,531 | 4,245,022 |

| Total Debt | 1,707,175 | 2,005,531 | 1,299,222 | 728,834 |

Public Fundamental Data provided by Morningstar, Inc.

disclaimer

Under Armour Valuation & Funding

| Deal Type | Date | Amount | Valuation/ EBITDA | Post-Val | Status | Debt |

|---|

This information is available in the PitchBook Platform. To explore Under Armour‘s full profile, request access.

Request a free trial

Under Armour Comparisons

Description

Primary

Industry

HQ Location

Employees

Total Raised

Post Valuation

Last Financing Details

Under Armour develops, markets, and distributes athletic apparel, footwear, and accessories in North America and other t

Clothing

Baltimore, MD

16,600

As of 2020

00000

000000000

00000

0000

ud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in re

00000000

Beaverton, OR

00000

As of 0000

00000000

00000 00

irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepte

Excepte

00000000

New York, NY

00000

As of 0000

00000

0.000

0000-00-00

00000000

00000

Add Comparison

PitchBook’s comparison feature gives you a side-by-side look at key metrics for similar companies. Personalize which data points you want to see and create visualizations instantly.

Request a free trial

Under Armour Competitors (19)

| Company Name | Financing Status | Location | Employees | Total Raised | Last Financing Date/Type | Last Financing Amount |

|---|---|---|---|---|---|---|

| Nike | Corporation | Beaverton, OR | 00000 | 00000000 | ||

| 00000 000000 00000 | Corporation | New York, NY | 00000 | 00000 | 00000000 | 00000 |

| 00000000 000000000 | Corporation | Portland, OR | 0000 | 00000 | 00000000 | 00000 |

| 00 00000000000 | Corporation | Denver, CO | 00000 | 00000 | 000000000 | 00000 |

| 0000 | Formerly PE-Backed | Herzogenaurach, Germany | 00000 | 000. 00 00 | 00000000000 |

You’re viewing 5 of 19 competitors. Get the full list »

Under Armour Patents

645

Total Documents

Applications and Grants000

Total Patents

Families154

Granted

29

Pending

000

Expiring

in next 12 mo

Under Armour Recent Patent Activity

| Publication ID | Patent Title | Status | First Filing Date | Technology (CPC) | Citations |

|---|---|---|---|---|---|

| US-20210298375-A1 | Face mask and method of making the same | Pending | 30-Mar-2020 | 0000000000 | |

| US-20210251322-A1 | Apparel having a waist portion and sleeves with a thumbhole | Pending | 14-Feb-2020 | 0000000000 | |

| US-20210227926-A1 | Sole structure for an article of footwear | Pending | 23-Jan-2020 | 0000000000 | |

| US-20210212443-A1 | Backpack with clip | Pending | 15-Jan-2020 | 00000000 | |

| US-20210177102-A1 | Method of making an article of footwear with braided upper | Pending | 17-Dec-2019 | A43B1/04 |

Under Armour Executive Team (34)

Update this profile

| Name | Title | Board Seat | Contact Info |

|---|---|---|---|

| Patrik Frisk | Chief Executive Officer & Board Member | ||

| Stephanie Pugliese | President, Geographical | ||

| David Bergman | Chief Financial Officer, Finance & Chief Accounting Officer, Accounting | ||

| Colin Browne | Chief Operating Officer | ||

| Ryan Drew | Vice President & General Manager, Global Basketball |

You’re viewing 5 of 34 executive team members. Get the full list »

Under Armour Signals

Growth Rate

0.80%

Weekly

Growth

Weekly Growth

0.80%, 93rd %ile

-35.5%.

530%

Size Multiple

219x

Median

Size Multiple

219x, 100th %ile

0.00x

0.95x.

413Kx

Key Data Points

Twitter Followers

5.5k

Similarweb Unique Visitors

15.0K

Majestic Referring Domains

314

PitchBook’s non-financial metrics help you gauge a company’s traction and growth using web presence and social reach.

Request a free trial

Under Armour Investors

| Investor Name | Investor Type | Holding | Investor Since | Participating Rounds | Contact Info |

|---|

This information is available in the PitchBook Platform. To explore Under Armour‘s full profile, request access.

Request a free trial

Under Armour

Investments & Acquisitions (10)

| Company Name | Deal Date | Deal Type | Deal Size | Industry | Lead Partner |

|---|---|---|---|---|---|

| 000000 0000000 | 13-Sep-2021 | 0000 00000 | 00000 | Other Healthcare Technology Systems | 0000 00000 |

| 000000 000000 | 02-Mar-2020 | 000000000000000000 | 000.00 | Clothing | |

| 0000000 | 07-Apr-2016 | 00000 | 0000 | Beverages | 00000 00000 |

| 00000000 | 01-Jul-2015 | 000000000000000000 | Other Healthcare | ||

| MyFitnessPal | 17-Mar-2015 | Merger/Acquisition | 00000 | Application Software | 00000 00000 |

You’re viewing 5 of 10 investments and acquisitions. Get the full list »

Are You in the Sports IP Game? Protecting Your IP with Patents and Trade Secrets | Articles | Finnegan

In the sports and fitness industry, a thoroughly developed intellectual property (IP) strategy may not only help launch a company but also enable it to develop into a profitable and successful competitor in a fairly saturated marketplace.

For example, in its early stages, Under Armour protected its proprietary products and ideas, which eventually captured a relatively significant share of the sportswear market. Now, after just 20 years of existence, Under Armour thrives in the sportswear arena, with a market capitalization of $21 billion. Under Armour’s continued growth has been spurred, in part, by the acquisition of other well-known fitness companies, such as MapMyFitness, MyFitnessPal, and Endomondo, which also focused on protecting their innovations and proprietary technology. By protecting organic innovation as well as acquiring protected technology, Under Armour has developed a strong IP strategy that helped it compete in a marketplace already dominated by some major players and gave it leverage to stave off acquisition by larger competitors. Whether you are a startup, mid-sized company, or a large corporation, exploiting your potential IP assets will open new revenue streams and further safeguard your existing assets.

A good IP strategy requires a detailed examination of all company assets, including proprietary information, to determine which type of intellectual property is most effective for protecting assets. Trademarks protect a company’s name or logo, while copyright protects original works of authorship, like customized nutrition programs, fitness videos, payperview streams of games and matches, or even source code for a fitness app. However, when an asset is a product or information that is proprietary and valuable, like a new fabric, an improved shoe design, or a secret formula, then a company must strategically determine whether to protect the asset as a trade secret or through pursuing patent protection. We highlight and address the factors relevant to making this determination, as well as the implications this decision can have on a company’s survival and growth.

Disclosing the Asset

When determining whether an asset should be protected using patents or trade secrets, a company must understand what makes the asset valuable. For example, the success of some products may depend on public disclosure of an asset. Patent protection requires public disclosure of an asset in exchange for exclusive rights over the asset for 20 years. This is the quid pro quo of getting exclusive patent rights. Alternatively, companies sometimes protect their valuable designs and technology through trade secrets. A trade secret can be any proprietary business or technical information that has economic value. But trade secrets must be kept secret.

Under what circumstances might trade secret protection be preferred? A sports drink manufacturer, for example, may want to avoid applying for a patent relating to a proprietary formula, which would require publicizing the ingredients of its sports drink, for fear that others could slightly alter the formula to avoid infringement, while developing a nearly identical sports drink—and thereby sever part of its market share.

Coca-Cola is a perfect example. Coca-Cola has made extensive efforts to keep its recipe out of the public eye, protecting it as a very valuable trade secret. If Coca-Cola had obtained a patent on its formula, however, the recipe would have been disclosed to the public. While Coca-Cola would have had patent protection for 20 years excluding others from using its recipe during that time, the recipe would be less valuable to Coca-Cola after the patent expired and the public could freely copy the formula. In such a scenario, Coca-Cola would be engrossed in a highly competitive soft-drink market, forced to continuously innovate new formulas for new drinks to remain a dominant market participant.

In contrast, a golf club manufacturer may prefer to patent its innovative golf club technology because, once placed into the market, that technology could be easily reverse-engineered (not so easy with Coca-Cola’s formula). Additionally, a company must consider how an asset will be used in the ordinary course of business. If the asset is constantly at risk of being disclosed publically, then it may not be practical (or possible) to protect it as a trade secret.

Challenges to Obtaining and Maintaining Protection

Companies should also consider the different challenges in obtaining patent or trade secret protection. Acquiring a patent to protect an asset requires filing an application with the United States Patent and Trademark Office (“Patent Office”). This application process can be rigorous and lengthy under some circumstances.

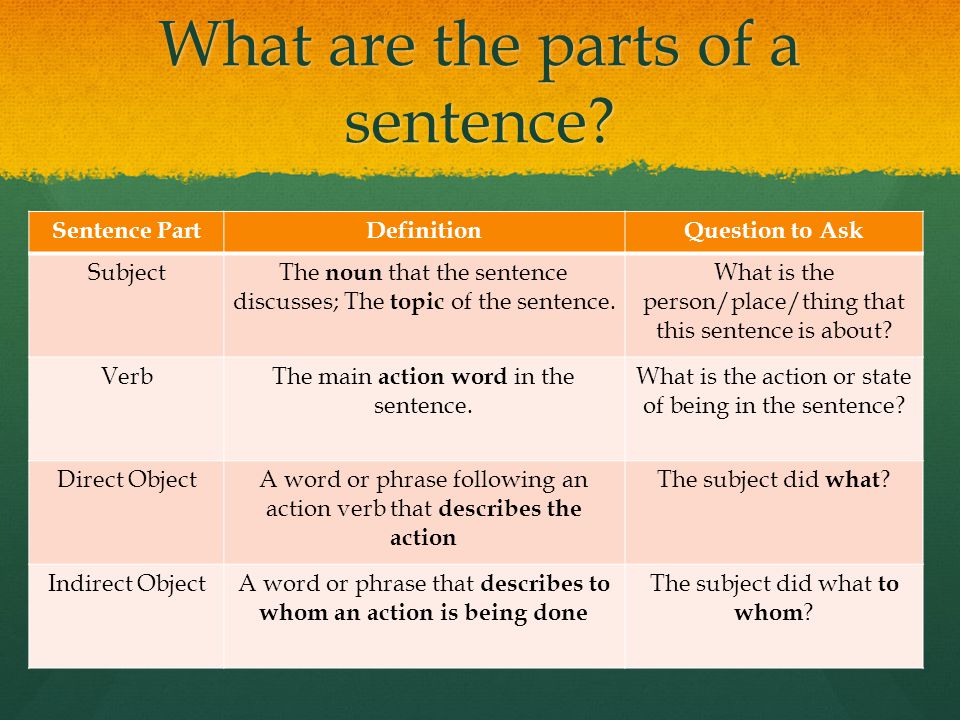

Utility v. Design Patent Protection

There are two types of patents, providing different scopes of protection: utility and design. Utility patents protect a specific function of an invention, and the application process determines if the invention is novel, useful, and nonobvious. As seen in the chart below, golfing and skiing/snowboarding technologies make up 75% of the sampled sports and fitness utility patents granted.

Design patents, on the other hand, protect visual ornamental characteristics of an article and have a much simpler application process. There has been a significant increase in the numbers of design patent applications in the last ten years (as indicated in the chart below), suggesting that companies are placing more value on protecting aesthetic designs as well as improved technology.

Numerous companies in the sports and fitness industry actively protect their innovations with utility and design patents. These companies have increasingly invested in design patents relating to, for example, sportswear, smart watches, golf clubs, and more. In addition to protecting functional and aesthetic aspects of these physical products, companies have shifted their focus towards protecting mobile technology. For example, Under Armour company MyFitnesssPal owns a utility patent on a mobile application that provides customers a diet and exercise management system, while another Under Armour company, MapMyFitness, owns one on its app’s ability to authenticate a user’s fitness-related activities (shown in the patent figures below).

Design patents are also available for protecting a mobile application’s graphical user interface features. For example, Samsung has design patents that protect its display screens on wearables (shown below).

Costs

Another consideration in obtaining patent rights is that utility patents cost significantly more than design patents, which are generally much less expensive. Trade secrets, on the other hand, do not require a registration process with the Patent Office and are immediately effective. However, in order to claim an asset as a trade secret, it cannot be generally known to the public, and a company must adopt reasonable security measures to maintain secrecy of the asset. The lore surrounding the lengths to which Coca-Cola guards its proprietary formula is a classic example. While your company might not need to keep your trade secret in a vault, always remember: secrecy is key. If the trade secret is ever disclosed or discovered through fair and honest means, than any previously held protections cease to exist.

Therefore, trade secret costs are driven by maintaining the asset’s secrecy, and vary drastically depending on the asset itself and how it is utilized. Some efforts are purely procedural and simple to adopt, such as sharing the asset only with need-to-know individuals and employees and requiring all individuals and employees with access to sign a nondisclosure agreement. Other efforts, which may be needed for more high-tech assets, may require separate laboratory space or intensive computer security software that limits access to and prevents theft of the asset.

Scope of Protection

Companies desire broad protection for their assets providing a wide and diverse scope of coverage. A patent applicant is obligated to succinctly describe its asset, the asset’s innovative qualities, and the scope the patent covers. In addition to this scope, the patent also covers any concepts that are not explicitly stated within the patent application but are obviously equivalent. The Patent Office, however, may require you to narrow the scope of your protection before granting a patent. This uncertainty may make it difficult for a company to predict exactly how broad their scope of protection will end up being and whether the public disclosure of their asset is worth the risk.

In contrast, for trade secrets, there are no formal requirements to define the scope of a trade secret. This allows companies to more loosely and broadly define the scope of their trade secret protection over an asset, thereby protecting underlying ideas that were not initially perceived as trade secrets. That being said, because trade secrets must be identified and labeled as trade secrets in order for a company to recover damages when trade secrets are stolen or misappropriated, careful management and reevaluation of trade secrets is necessary. Moreover, trade secret protection does not give a company an exclusive right to prevent others from using its trade secret, like a patent would. It only protects against illegitimate discovery or improper use of the trade secret (through, for example, misappropriation or breach of a nondisclosure agreement).

Maximizing Lifespan

Although trade secret protection and patent protection are mutually exclusive, companies can use both to maximize the valuable lifespan of their asset. For example, a company can seek patent protection for an asset that previously existed as a trade secret. This allows a company to take advantage of the indefinite duration of a trade secret, while still allowing it to obtain patent protection if the confidentiality of a trade secret becomes endangered. Additionally, a company that sufficiently protects its asset as a trade secret (through following established trade secret policies and diligent record keeping) can avoid being sued or enjoined from using that asset if a competitor later obtains a patent that covers the asset.

Enforcing Trade Secrets and Patents

As soon as a patent issues, a company can begin enforcing and monetizing the patent to maximize profitability margins. First, a company can surveil and target other companies that make, use, sell, offer to sell, or import a product or service that uses its patented technology or design and obtain judgments requiring the infringing companies to cease any further infringing activity and pay damages that resulted from the infringement. As illustrated below, damages for patent infringement have generally escalated in recent years, hitting an all-time high of nearly $3.5 billion awarded in 2012. And in some instances, companies may be successful in blocking any additional importations of the infringing product.

Second, a company can offer licenses to potentially infringing companies, and receive royalties for use of its patented technology or design. For example, sports apparel and equipment companies target professional leagues, such as the NFL, NBA, MLB, PGA, and college universities, for licensing deals, allowing them to have a stronghold on that specific market while promoting their own brand.

For trade secrets, a company can target any party that misappropriates their trade secrets, acquires them through improper means, or breaches a contractual or implied duty to maintain the confidentiality of the secret or restrict the use of it. As a remedy, the company can obtain a judgment from a court requiring the guilty party to stop any further misappropriation, maintain secrecy, and pay appropriate damages. A company may license a trade secret indefinitely; however, each licensing deal puts the trade secret’s confidentiality at further risk, which may necessitate additional protections. Trade secret misappropriation cases may also be more successful in obtaining preliminary injunctions, which allow a company to immediately prevent another party from disclosing the trade secret, well before a court ultimately decides liability.

Weakening Patents vs. Growing Positive Perception of Trade Secrets

There has been a substantial increase in patent litigation in the last decade, which has motivated companies to pursue patent protection over relying on trade secrets. Despite this increase, numerous cases in recent years have made it more difficult to obtain, keep, and enforce certain patents and forecasters predict that the trend will continue. Both the Patent Office and federal courts have denied patent applications or invalidated patents relating to mobile apps and computer software based on subject matter eligibility issues. However, recent cases in 2016 suggest that the pendulum may be swinging back in the other direction, allowing more software or computer-implemented inventions to receive patent protection, but just how far the pendulum will swing remains to be seen. Additionally, because of the uncertainty, obtaining patents has become increasingly more difficult, costly, and time consuming. In light of such varied patent protection afforded some technologies, companies are beginning to increase their reliance on trade secret protection, especially when doing so does not block them from obtaining patent protection down the road.

Additionally, the U.S. government, the courts, and the legal industry have focused on enhancing enforcement of trade secret rights and providing more effective remedies for trade secret violations. For example, President Obama signed into law the Defend Trade Secrets Act (DTSA) earlier this year, which created the first federal civil cause of action for trade secret misappropriation. Under this new law, companies can now bring suit and seek remedies in federal court, in addition to state court. The Act includes much stronger protection to preserve the secrecy of alleged trade secrets in lawsuits, which alleviates trade secret owners’ fear of disclosure.

Conclusion

Correctly protecting an asset not only maximizes the asset’s value, but can also lead to overall substantial growth. A company must always be proactive and invest resources to meticulously analyze an asset and apply the numerous factors discussed to any of its valuable assets.

Under Armour files trademark infringement lawsuit

Under Armour is an apparel manufacturer that specializes in sportswear and footwear. The company, which is based in Baltimore, filed a lawsuit on Oct. 8 against a company it says has violated its trademark.

In the lawsuit, which was filed in the U.S. District Court for the District of Maryland, Under Armour alleges that the Colorado company Ageas has been selling sportswear, similar to that sold by Under Armour, under the brand “Hotsuit” with a logo that resembles Under Armour’s logo. The lawsuit claims that the use of the logo has created confusion in the marketplace and unfairly raises the infringing company’s profile while harming both Under Armour and unwitting consumers.

Under Armour is demanding a trial by jury and wants the company to be prohibited from using the logo. The company says it is obligated to protect its brand from dilution caused by infringers seeking to give the false impression that their brand is somehow associated with Under Armour.

Intellectual property consists of not only just trademarks and logos, but also ideas, creative work, software design and more. Taking steps to protect trademarks and other intellectual property can be critical for a company or entrepreneur. Failing to take the proper steps to protect a trademark against an initial infringement can make it more difficult for a company or individual to do so in the future. An individual or a business that is concerned about theft of intellectual property or trademark infringement might want to consult an attorney about how to proceed. The first step is not necessarily a lawsuit. In some cases, it may be sufficient for an attorney to contact the company and address the matter. Companies might also want assistance with registering a trademark and taking preventative measures in order to avoid this type of infringement. Registration of a trademark may strengthen a lawsuit like the one filed by Under Armour.

90,000 Under Armor Brand Story: The Bar High

Comfortable and high-tech Under Armor sportswear, which the whole world knows today, Kevin Plank designed primarily for himself. As a professional athlete, he was keenly interested in breathable fabric technology. But before creating an innovative product and earning his first million, he had to sweat a lot, both literally and figuratively.

Dryness and comfort

Kevin’s first major job was selling flowers. He was engaged in the delivery of roses: he bought them cheaply a few days before the holiday (Valentine’s Day or March 8), kept them at home in a cold bath and sold them on the solemn day at a significant mark-up. This is how he first earned a substantial amount, which he set out to invest in his next business.

The young man quickly realized that speculation in someone else’s goods is not his topic, he is capable of more.Being an active and quick-witted guy, he dreamed of creating something of his own, something that no one else has. In 1996, when Kevin was playing for the University of Maryland football team, the idea literally came out of thin air. Changing another cotton T-shirt soaked through, the athlete complained about how great it would be to train in a uniform made from a special breathable fabric. At that time, moisture-wicking technologies were used only in the manufacture of shoes and outerwear. Planck took the topic seriously and quickly found a suitable fabric that absorbs moisture but stays dry.He ordered seven different designs of T-shirts from the tailor, handed them out to his teammates, and listened carefully to their feedback on the pros and cons of the new garment. The main thing that interested him was the athlete’s comfort level during training. Having chosen the optimal model, he named it # 0037 and ordered the sewing of a size line.

T-shirt # 0037 from Under Armor

In those days, Kevin had no office, no store, no advertising. The entire small business was located in the basement of his grandmother’s house, who believed in her restless grandson and supported him in everything.The guy was engaged in the first sales alone, traveling around the city and selling directly from the trunk of a car. A year of such painstaking work brought the novice entrepreneur only sixteen thousand dollars.

Always say yes

Kevin’s competitive advantage was that he never said no. When asked if he sews long-sleeved T-shirts or hoodies for cool weather, the guy replied without batting an eye that it was all there.And then he ran to make sketches of T-shirts and sweatshirts in order to provide the customer with ready-made models within a week. In his quest to please everyone, he often went into debt and suffered from an acute lack of free time. Demand outstripped supply, Planck realized that it was time to get into business seriously and began to look for a name for it. The first variants of the brand name, such as Heart and Body Armor, could not be patented – they were occupied. But in one of the patent applications, Colin, Kevin’s brother, made the mistake of writing the name Under Armor.It turned out to be free, and the brothers received the go-ahead for registration. By the end of 1996, several contracts were signed with the fledgling sportswear company.

In 1997, Kevin Planck created the ColdGear fabric to keep the athlete warm. In parallel with this, the AllSeasonGear line of clothing was sewn, allowing a person to feel comfortable in any weather. A distinctive feature of Under Armor was the testing phase. Any new product was initially provided free of charge to a group of schoolchildren and students who actively trained in it and shared their feedback.Based on their opinion, the director of the company brought the models to perfection. Satisfied with the results of his work, Kevin threw all his efforts into conquering large sales markets.

Commerce engine

The Under Armor brand was sorely lacking in advertising and Planck remembered the story he heard in his student years about how one startup sent a hat with his logo as a gift to Mike Tyson. The appearance of Iron Mike on television wearing a branded headdress has brought the manufacturer a huge number of lucrative orders.Kevin took this idea into service and sent a set of football kits to several famous football players with a request to take a photo in it, work out and write a review. Coincidentally or not, the Oakland Raiders football team’s quarterback appeared on the cover of USA Today, wearing signature Under Armor clothing. This advertisement helped to secure new large orders.

Still from the film “Every Sunday”

In 1999, Plank and his team signed a successful tailoring contract for the cast of Every Sunday, starring Al Pacino.Next came the picture “Understudies” with Keanu Reeves, flaunted on the screen in a red Under Armor T-shirt. Sales skyrocketed to $ 750,000 in a year, and Kevin appointed himself an official salary for the first time.

In the following years, Under Armor clothing appeared on multiple screens, for example, in the movie “Fast and Furious 5”.

Left my grandmother

It’s time to grow, and Under Armor has moved its headquarters from the basement of Grandma’s house to an old soap factory in south Baltimore.The company’s annual income by that time exceeded one hundred thousand dollars.

Former Procter and Gamble building in Baltimore, Maryland. Now part of Under Armor HQ

The popularity of the brand grew inexorably, and contracts rained down one after another. Baseball players, basketball players, athletes performed in Under Armor uniforms. Kevin Planck managed to sign contracts with the NBA and NHL. And in 2000, the company became an official partner of the US Olympic team.

In 2003, a viral advertisement for Protect This House appeared on television.The Under Armor brand was positioned in it as the choice of a new generation. It was a series of videos, invariably ending with the corporate slogan “I Will”. The participation of famous athletes and the inspirational music of Drum & Bass turned the video into an anthem for those who have chosen a sporty lifestyle.

Sportswomen, Komsomol members, beauties

Also, 2003 was marked by the release of a line of women’s clothing. Before that, the fair sex was undeservedly forgotten, because the main image exploited by Under Armor marketers was a brutal, pumped-up man with a strong-willed look, pulling iron.Creative director of the company Liane Fremer explained to her colleagues that girls are not only pink dresses with rhinestones. Gathering a team of like-minded people, she created a series of elegant sportswear for women.

American ballet soloist Misty Copeland in the Under Armor advertising campaign

Not only famous athletes were attracted to the advertisement, but also the first black-skinned soloist of the American ballet Misty Copeland, as well as the Brazilian supermodel Gisele Bundchen. Their task was to reflect the main idea of the campaign that Under Armor clothing is not only for professional athletes, but also for ordinary girls with an active lifestyle.The video made a splash and scored six million views on YouTube.

Shoes he wears Under Armor

In 2006, in the wake of success, Planck realized that, having conquered the clothing market, it was logical to move to shoes and accessories so that his company could meet all the needs of an athlete. This is how the Click-Clack series of football boots was born, which in its first year captured more than twenty percent of the football shoe market.

Click-Clack

A year later, the line also includes a model for softball, baseball and lacrosse.They also launched the sale of running shoes that were of high quality, interesting designs and affordable prices. Camouflage sneakers were especially popular. Later, the company released the legendary basketball shoes, in which Brandon Jennings scored fifty-five points per game in the NBA.

All of this brought about a number of positive changes: Under Armor opened its new headquarters in the old Olympic Stadium in Amsterdam and built its first brand store in Annapolis, Maryland.

2010 ended in a truly incredible financial victory as Under Armor surpassed $ 1 billion in annual revenue.

Kevin Planck on the cover of Forbes

On the wave of success

The popularity of Planck’s company has gone beyond the United States. Through partnerships with professional teams and players around the world, Under Armor is becoming a recognizable brand in Japan, Europe, Canada and Latin America. First store opens in China, Under Armor partners with Tottenham Hotspur football team.

Under Armor Tottenham Hotspur Kit Presentation

Years later, Kevin Planck finally removes the “enemy” label from cotton fabrics. The company’s technologists, through long painstaking work, are developing a revolutionary technology for waterproof yarn. This is how the Charged Cotton line of cotton sportswear is born, which dries quickly and does its job one hundred percent.

In 2013, Under Armor merged with Endomondo, an app for those who are actively involved in sports.In 2013, two technologies were introduced that made sports equipment similar to a computer. This system is able to measure the main indicators of an athlete during training (heart rate, intensity and quality of training, calories burned, tasks completed) and transmit data to a smartphone. Over time, the same sensors began to be built into shoes, which made it possible to even more accurately monitor a person’s condition. Over the past three years, Endomondo has confidently become the leader in the sports applications market, its audience is growing rapidly, and the functionality is becoming more and more interesting.

By the end of 2014, Under Armor had become the second largest sportswear brand in the United States.

Opening of Under Armor Steve Kwak, Baltimore, Maryland

On the company’s 20th anniversary in 2016, the first “smart boot”, the Speedform Gemini 2 Record Equipped, was launched to maximize the use of energy while running.

Secret Laboratory

Today, Under Armor is an innovative company with a closed research laboratory, to which no more than one percent of employees have access.The entrance to it is through a device that reads the pattern of veins. Inside, we are working on the most advanced products and concepts of the company and testing the latest developments on real athletes. The company annually holds a tender in the field of sports innovations Innovation Challenge. The UA management, led by Plank, personally selects the finalists, and the winner receives a fifty thousand dollar grant, as well as a unique opportunity to participate in the development of the brand’s products. The competition won such innovations as the Light Bohrd LED Night Run T-shirt and the one-handed magnetic zipper invented by engineer Scott Peters.

Under Armor Connected Fitness headquarters in Austin, Texas employs approximately 150 people, including former MapMyFitnes employees

Today Under Armor stands for the finest underwear for men and women in sports and casual wear. There is a division into seasons: HeatGear – for summer, ColdGear – for winter, AllSeasonsGear – for off-season. Representative offices of the company are located in many countries of the world, and there are branded stores in all major cities and capitals.

Text: Evgeniya Cherdantseva

Photo: wikimedia.org, forbes.com, underarmour.com, baltimoresun.com

90,000 How Nike overtook SpaceX, Intel and Dell in innovation

On January 12, the Boston Consulting Group released a list of the world’s most innovative companies. Digital revolutionaries such as Uber and Airbnb have burst into the top, displacing traditional leaders of the ranking – industrial innovators such as General Electric or Daimler.But the real breakthrough in the ranking was made by the companies – manufacturers of sportswear and footwear, which showed the fastest growth.

In 2016, Nike and the newcomer to the Under Armor rankings are perhaps the most prominent in the new BCG rankings. The first rose in the ranking by as much as 15 positions, and the second entered it for the first time, but immediately took 22nd place, ahead of Nike itself and a good half of the participants.

Sneakers without laces and more

Advertising on Forbes