What is the true value of a Mount Saint Mary College degree. How does it compare to other institutions in New York and nationwide. What factors affect the cost and quality of education at Mount Saint Mary College.

Mount Saint Mary College: An Overview of Educational Quality and Value

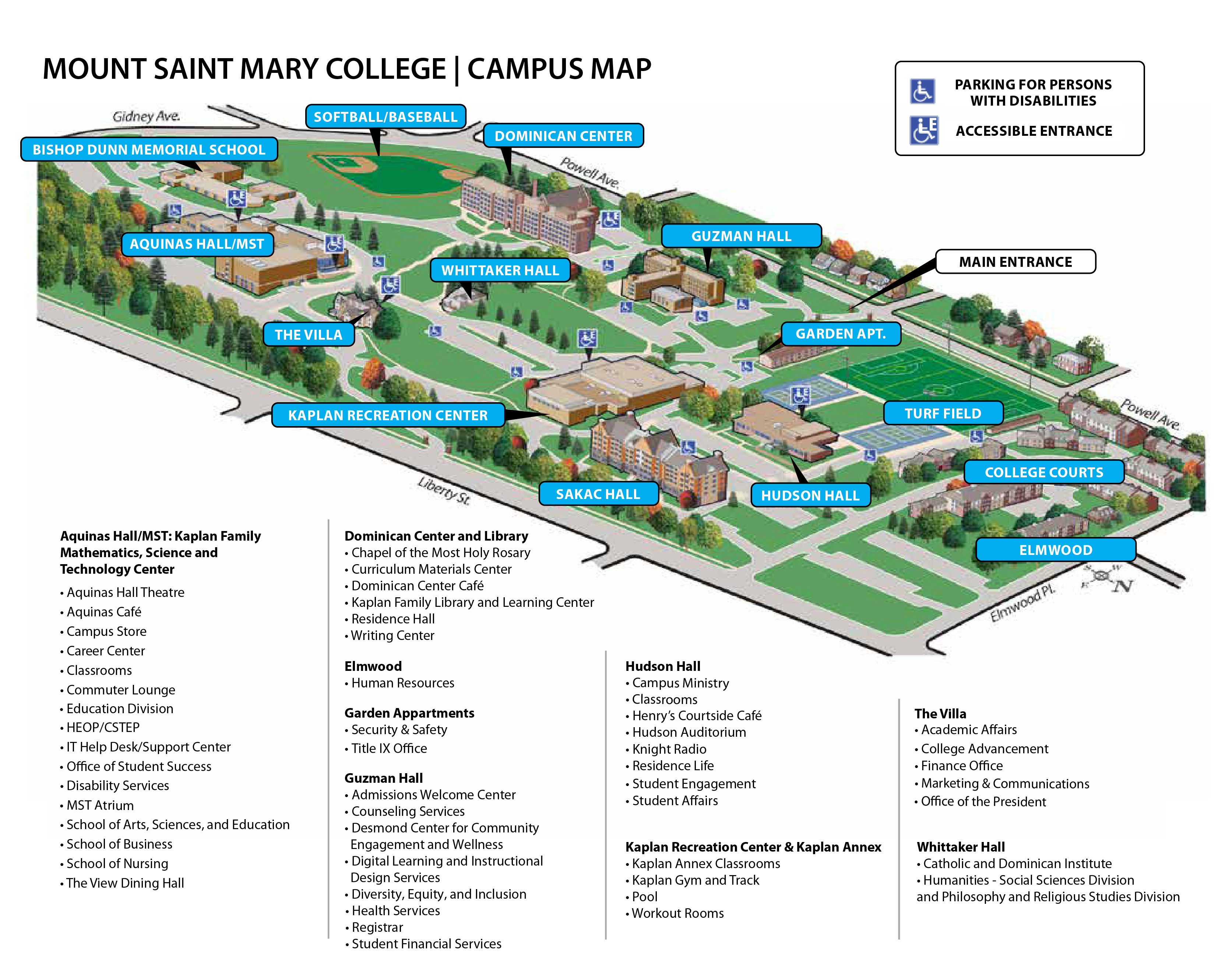

Mount Saint Mary College, located in Newburgh, New York, offers a unique educational experience to its students. However, when considering higher education options, it’s crucial to evaluate the institution’s overall value and quality. Let’s delve into a comprehensive analysis of Mount Saint Mary College’s standing in both state and national rankings.

State-level Performance

Within the state of New York, Mount Saint Mary College’s performance is mixed:

- Quality Ranking: #76 out of 132 institutions

- Value Ranking: #85 out of 113 institutions

- State Value Score: 24.78 out of 100

These rankings suggest that while the college provides average quality education, it may be overpriced compared to other institutions in New York. This assessment takes into account factors such as academic programs, faculty qualifications, and student outcomes.

National Standing

On a national scale, Mount Saint Mary College’s performance is less favorable:

- National Value Ranking: #1,142 out of 1,472 institutions

- National Value Score: 22.42 out of 100

These figures indicate that when compared to colleges across the United States, Mount Saint Mary College may be overpriced for the quality of education it provides. However, it’s important to note that individual circumstances, such as financial aid packages and personal goals, can significantly impact the overall value of education at any institution.

Breaking Down the Costs: Is Mount Saint Mary College Worth the Investment?

Understanding the financial implications of attending Mount Saint Mary College is crucial for prospective students and their families. Let’s examine the cost structure and potential return on investment.

Estimated Total Cost of Degree

Based on available data, here’s a breakdown of the estimated costs:

- Average Yearly Cost: $37,824

- Average Years to Graduate: 4.23

- Estimated Total Cost of Degree: $159,996

This total cost is significant and raises questions about the long-term value of the degree. How does this investment compare to potential career earnings and opportunities?

Financial Aid Considerations

It’s important to note that the actual cost for many students may be lower due to financial aid:

- Approximately 100% of Mount Saint Mary College students receive some form of financial aid

- The average cost for students receiving aid is $152,115

While financial aid can significantly reduce the overall cost, it’s crucial to consider whether the remaining expense aligns with the expected outcomes and career prospects.

Comparative Analysis: Mount Saint Mary College vs. Similar Institutions

To better understand Mount Saint Mary College’s value proposition, it’s helpful to compare it with other institutions of similar quality. How does it stack up against the competition?

Price Comparison with Similar Quality Institutions

Here’s a comparison of total prices for institutions with similar quality scores:

- Western Carolina University: $76,285 (Value Grade: A+)

- Lincoln Memorial University: $94,077 (Value Grade: A)

- Keene State College: $129,220 (Value Grade: B)

- Walla Walla University: $131,632 (Value Grade: B-)

- Florida Atlantic University: $136,569 (Value Grade: C)

- La Salle University: $138,838 (Value Grade: C)

- Mount St Mary’s University: $142,823 (Value Grade: D+)

- Immaculata University: $154,964 (Value Grade: D-)

- King’s College: $158,802 (Value Grade: D-)

- Mount Saint Mary College: $159,996 (Value Grade: D-)

- University of Massachusetts – Boston: $201,496 (Value Grade: F)

This comparison reveals that Mount Saint Mary College is among the more expensive options for institutions of similar quality. What factors contribute to this higher cost, and are there unique benefits that justify the price difference?

Factors Influencing the Value of a Mount Saint Mary College Degree

Several factors can impact the overall value of a degree from Mount Saint Mary College. Understanding these elements can help prospective students make informed decisions about their education.

Academic Programs and Specializations

The value of a degree often depends on the specific programs offered and their alignment with industry demands. What unique programs or specializations does Mount Saint Mary College offer that may set it apart from competitors?

Career Services and Alumni Network

The strength of an institution’s career services and alumni network can significantly impact post-graduation outcomes. How effective are Mount Saint Mary College’s career support services, and how engaged is its alumni network in supporting current students and recent graduates?

Location and Regional Opportunities

Newburgh, New York’s location may offer unique advantages or challenges. How does the college’s proximity to major cities and industries affect internship opportunities, job prospects, and overall career development for students?

Understanding the Financial Landscape of Mount Saint Mary College

To gain a more comprehensive understanding of Mount Saint Mary College’s financial situation, it’s helpful to examine its nonprofit status and financial disclosures.

Nonprofit Status and Form 990

As a nonprofit institution, Mount Saint Mary College is required to file Form 990 with the IRS annually. This form provides valuable insights into the college’s financial health, revenue sources, and expenditures. What key financial trends or patterns can be observed from recent Form 990 filings?

Federal Grant Audits

For organizations that spend $750,000 or more in Federal grant money in a single fiscal year, audits are required and made publicly available. Has Mount Saint Mary College undergone such audits, and if so, what do they reveal about the institution’s financial management and use of federal funds?

Evaluating the Return on Investment: Beyond the Numbers

While financial considerations are important, the value of a college education extends beyond mere dollars and cents. What intangible benefits does Mount Saint Mary College offer that may not be captured in traditional value rankings?

Student Experience and Campus Culture

The overall student experience, including extracurricular activities, campus culture, and community engagement, can significantly impact the value of a college education. How does Mount Saint Mary College foster a supportive and enriching environment for its students?

Faculty Expertise and Mentorship Opportunities

The quality of faculty and opportunities for mentorship can greatly enhance the educational experience. What is the caliber of Mount Saint Mary College’s faculty, and how accessible are they to students seeking guidance and support?

Post-Graduation Success Stories

While aggregate data provides a general picture, individual success stories can offer valuable insights. Are there notable alumni from Mount Saint Mary College who have achieved significant success in their fields, and how do they attribute their achievements to their education at the institution?

Making an Informed Decision: Is Mount Saint Mary College Right for You?

Choosing a college is a highly personal decision that depends on numerous factors. While the data presented here provides a general overview of Mount Saint Mary College’s value proposition, it’s essential to consider how these factors align with your individual goals, circumstances, and aspirations.

Personal Fit and Academic Goals

Consider how well Mount Saint Mary College’s academic programs, campus culture, and overall environment align with your personal and professional goals. Are there specific programs or opportunities offered by the college that are particularly relevant to your intended career path?

Financial Considerations and Aid Opportunities

While the sticker price of attending Mount Saint Mary College may seem high, it’s crucial to explore all available financial aid options. How might scholarships, grants, and other forms of aid reduce your overall cost of attendance? Consider reaching out to the college’s financial aid office to discuss your specific situation and potential aid packages.

Long-Term Career Prospects

Research the career outcomes of Mount Saint Mary College graduates in your field of interest. What is the employment rate for recent graduates, and what types of positions and industries do they typically enter? How do these outcomes align with your career aspirations and potential earning prospects?

By carefully considering these factors and conducting thorough research, you can make an informed decision about whether Mount Saint Mary College is the right investment for your educational and professional future. Remember that while data and rankings provide valuable insights, they are just one part of the equation in choosing the best college for your individual needs and goals.

What is the Value of a Mount Saint Mary College Degree?

Mount Saint Mary College Value Report

College Factual set out to determine if Mount Saint Mary is asking a fair price for the quality of education they provide. Keep reading for the detailed value report.

Within New York, Mount Saint Mary Offers Average Quality for a High Price.

Below Average

New York Value

Mount Saint Mary College is ranked #76 out of #132 in New York for quality and #85 out of #113 for New York value.

This makes it average quality that is overpriced in the state.

State Value Ranking 85 out of 113

State Value Score 24.78 out of 100

Do you qualify for in-state tuition? Check the Mount Saint Mary financial aid page to be sure.

Below Average Value Nationwide

Below Average

National Value

Mount Saint Mary College is ranked #1,142 out of 1,472 for value nationwide.

Based on our analysis of other colleges at similar price points, we believe Mount Saint Mary College is overpriced for the quality education it provides. (This takes into account average financial aid and may not apply to you if you have further scholarships, grant or aid provided to you.)

(This takes into account average financial aid and may not apply to you if you have further scholarships, grant or aid provided to you.)

National Value Ranking 1142 out of 1472

National Value Score 22.42 out of 100

Prices of Institutions with Similar Quality Scores

| School | Total Price | Value Grade |

|---|---|---|

| Western Carolina University | $76,285 | A+ |

| Lincoln Memorial University | $94,077 | A |

| Keene State College | $129,220 | B |

| Walla Walla University | $131,632 | B- |

| Florida Atlantic University | $136,569 | C |

| La Salle University | $138,838 | C |

| Mount St Mary’s University | $142,823 | D+ |

| Immaculata University | $154,964 | D- |

| King’s College | $158,802 | D- |

| Mount Saint Mary College | $159,996 | D- |

| University of Massachusetts – Boston | $201,496 | F |

*Total price is determined by multiplying average annual cost by time to graduate.

Bottom Line: You’ll Spend an Estimated $159,996 For That Piece of Paper

The Mount Saint Mary time to graduate is about 4.23 years and will cost an estimated $37,824 per year. This brings the total cost to 159,996.

| Amount | |

|---|---|

| Average Yearly Cost | $37,824 |

| Average Years to Graduate | 4.23 |

| Estimated Avg Total Cost of Degree | $159,996 |

Many Factors Affect Net Price

Depending on your personal circumstances, your net price may be well below the average Mount Saint Mary net price, which could make this school a better value. You may quality for more financial aid, or be able to complete your degree faster than average. Get more details on Mount Saint Mary cost.

Does This School Make Financial Sense To You?

$152,115

In-State With Aid

Most students will not pay the full sticker price and few students fit perfectly into averages.

Look at the table below to get a sense of how Mount Saint Mary value for your educational dollar might vary.

| Nationwide Value by Aid Group | Avg Degree Cost | Value Rank | Value Grade |

|---|---|---|---|

| Students with no Aid | $217,786 | #1,102 | D |

| All Students | $159,996 | #1,142 | D- |

| Only Students Receiving Aid | $152,115 | #1,209 | F |

| In-State Value by Aid Group | Avg Degree Cost | Value Rank | Value Grade |

|---|---|---|---|

| Students with no Aid | $217,786 | #82 | D |

| All Students | $159,996 | #85 | D- |

| Only Students Receiving Aid | $152,115 | #88 | D- |

Note: the Value Grade for in-state students is calculated by looking only at other schools in the state of New York.

About 100% of Mount Saint Mary students receive financial aid. Get more details on what Mount Saint Mary financial aid you may qualify for.

How to Calculate Value

College Factual calculates value by calculating average Mount Saint Mary cost multiplied by time to graduate, and then compares that number to other schools of a similar quality ranking. If the school is priced fairly based on the educational quality it receives a fair ranking. If it is underpriced it receives a good or excellent value.

Read the full Best for the Money Ranking Methodology.

References

report this ad

Mount Saint Mary College – Nonprofit Explorer

About This Data

Nonprofit Explorer includes summary data for nonprofit tax returns and full Form 990 documents, in both PDF and digital formats.

The summary data contains information processed by the IRS during the 2012-2019 calendar years; this generally consists of filings for the 2011-2018 fiscal years, but may include older records. This data release includes only a subset of what can be found in the full Form 990s.

This data release includes only a subset of what can be found in the full Form 990s.

In addition to the raw summary data, we link to PDFs and digital copies of full Form 990 documents wherever possible. This consists of separate releases by the IRS of Form 990 documents processed by the agency, which we update regularly.

We also link to copies of audits nonprofit organizations that spent $750,000 or more in Federal grant money in a single fiscal year since 2016. These audits are copied from the Federal Audit Clearinghouse.

Which Organizations Are Here?

Every organization that has been recognized as tax exempt by the IRS has to file Form 990 every year, unless they make less than $200,000 in revenue and have less than $500,000 in assets, in which case they have to file form 990-EZ. Organizations making less than $50,000 don’t have to file either form but do have to let the IRS they’re still in business via a Form 990N “e-Postcard.”

Nonprofit Explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a Form 990, Form 990EZ or Form 990PF. Taxable trusts and private foundations that are required to file a form 990PF are also included. Small organizations filing a Form 990N “e-Postcard” are not included in this data.

Taxable trusts and private foundations that are required to file a form 990PF are also included. Small organizations filing a Form 990N “e-Postcard” are not included in this data.

Types of Nonprofits

There are 27 nonprofit designations based on the numbered subsections of section 501(c) of the tax code. See the list »

How to Research Tax-Exempt Organizations

We’ve created a guide for investigating nonprofits for those just getting started as well as for seasoned pros.

API

The data powering this website is available programmatically, via an API. Read the API documentation »

Get the Data

For those interested in acquiring the original data from the source, here’s where our data comes from:

- Raw filing data. Includes EINs and summary financials as structured data.

- Exempt Organization profiles. Includes organization names, addresses, etc. You can merge this with the raw filing data using EIN numbers.

- Form 990 documents requested and processed by Public.

Resource.Org and ProPublica. We post bulk downloads of these documents at the Internet Archive.

Resource.Org and ProPublica. We post bulk downloads of these documents at the Internet Archive. - Form 990 documents as XML files. Includes complete filing data (financial details, names of officers, tax schedules, etc.) in machine-readable format. Only available for electronically filed documents.

- Audits. PDFs of single or program-specific audits for nonprofit organizations that spent $750,000 or more in Federal grant money in a single fiscal year. Available for 2016 and later.

Mount Saint Mary working to reverse drop in enrollment – News – recordonline.com

CITY OF NEWBURGH – Mount Saint Mary College is still trying to turn around a decline in admissions that has persisted for most of the past decade.

But Susana Alba, who joined the college as dean of admissions during the past year, is confident they will succeed.

“We are in a solid place,” Alba said.

In November last year, the Mount laid off its previous dean of admissions, and four directors and associate directors in the department.

That action came after the college saw enrollment decline 13 percent, to 2,323, between 2011 and 2018.

The current enrollment is 2,222. This year’s freshman class had 50 fewer students than last year’s, Alba said.

According to Alba, declining birth rates have contributed to an overall decline in the pool of traditional freshmen that’s affecting all colleges.

In New York and other Northeast states, that problem is compounded by a high cost of living, which drives people to other parts of the country.

Alba knows the remaining students “have a lot of options.”

To lure more students, the Mount is trying several approaches.

New courses have been, or soon will be introduced. New majors include a bachelor of arts degree in exercise science, and bachelor of science in cybersecurity. There’s also a new master of business administration degree with a concentration in health care.

Alba said the Mount is expanding the areas where it actively recruits beyond Connecticut and New Jersey, where most of its students not from New York have traditionally come from. They are doing more recruiting in Massachusetts, Pennsylvania, and as far away as Maryland.

They are doing more recruiting in Massachusetts, Pennsylvania, and as far away as Maryland.

Social media also plays a greater role in recruiting, these days.

If the Mount is going to be present at a college fair or similar promotional event, Alba says they will post that to social media. Alba said students do much of their initial research about colleges online, before they ever contact the Mount.

“We try to meet students where they are,” and that’s online, Alba said.

Alba said Mount representatives also speak to prospective students’ family members, because family often plays a role in college choices.

“Mom and dad still want to know they’re getting their best bang for the buck,” Alba said.

Alba said that while the Mount will come back from its admissions slump, it will never grow so big that it loses one of its selling points: a family-like atmosphere.

“You become more than a number here,” Alba said. “You get to know your professors, and your professors get to know you. ”

”

| Assc. | Bach. | Mast. | Doct. | |

|---|---|---|---|---|

| Accounting | ||||

| Biology/Biological Sciences, General | ||||

| Business Administration and Management, General | ||||

| Chemistry, General | ||||

| Criminology | ||||

| Digital Communication and Media/Multimedia | ||||

| Early Childhood Education and Teaching | ||||

| English Language and Literature, General | ||||

| History, General | ||||

| Human Services, General | ||||

| Information Technology | ||||

| Journalism | ||||

| Mass Communication/Media Studies | ||||

| Mathematics, General | ||||

| Multi-/Interdisciplinary Studies, General | ||||

| Natural Sciences | ||||

| Political Science and Government, General | ||||

| Psychology, General | ||||

| Public Relations, Advertising, and Applied Communication | ||||

| Registered Nursing/Registered Nurse | ||||

| Secondary Education and Teaching | ||||

| Social Sciences, General | ||||

| Sociology | ||||

| Spanish Language and Literature | ||||

| Teacher Education, Multiple Levels |

Mount Saint Mary College | Retirement Benefits

LOANS

Loans are available from a minimum of $1,000 to a maximum of $50,000 from each employer. How much you can borrow may depend on the amount you currently have in the plan that is eligible for loans and whether you have other outstanding loans. If you have money in other employer’s plans, you may be able to transfer or roll it over to the Mount Saint Mary College retirement plan to increase your maximum loan amount. This is only if the Mount Saint Mary College retirement plan accepts rollovers.

How much you can borrow may depend on the amount you currently have in the plan that is eligible for loans and whether you have other outstanding loans. If you have money in other employer’s plans, you may be able to transfer or roll it over to the Mount Saint Mary College retirement plan to increase your maximum loan amount. This is only if the Mount Saint Mary College retirement plan accepts rollovers.

Prior to rolling over, consider your other options. You may also be able to leave money in your current plan, withdraw cash or roll over the money to an IRA. Compare the differences in investment options, services, fees and expenses, withdrawal options, required minimum distributions, other plan features, and tax treatment.

DISTRIBUTIONS

Age based distribution

Your employer will typically allow you to withdraw funds once you’ve reached 59.50.

Lump-sum distribution

You can withdraw all or part of your account in a single cash payment, depending on your plan rules and the terms of your contracts.

- Your right to a lump-sum distribution from your TIAA Traditional Account may be restricted to taking periodic payments under the terms of the contract. Please refer to your contract or certificate for full details or contact us at 800-842-2252.

Systematic withdrawals

If your plan allows, you can choose to receive regular income payments (minimum $100) on a semimonthly, monthly, quarterly, semiannual or annual basis. You can increase, decrease or suspend the payments at any time.

- These withdrawals are not available from TIAA Traditional Account balances.

Small-sum distribution

When you leave your employer, you may be eligible to withdraw your retirement savings. Your plan may distribute your entire balance if the value does not exceed $2,000. Even if your plan doesn’t allow cash distributions, you can withdraw your entire retirement savings if your TIAA Traditional Account value does not exceed $2,000 and your overall account balance is below a limit set by your employer’s plan (either $1,000 or $5,000).

Disability

You can withdraw elective deferrals and earnings from your retirement plan while employed by your institution but not working due to a disability.

- To qualify you must be totally and permanently disabled, and the deferrals and earnings must have been credited to your plan on or after January 1, 1989.

- Disability withdrawals are not subject to the 10% IRS penalty on withdrawals prior to age 59.5.

Hardship

If your plan permits, you can withdraw some of the money you’ve put in over the years due to financial hardship, such as medical or funeral expenses, while still employed.

- Generally, you must show an immediate, significant need that cannot be met with other resources, which may or may not include loans from your retirement plan.

Lifetime retirement income

- One-life annuity – provides income for as long as you live.

- Two-life annuity – provides lifetime income for you and an annuity partner (your spouse or someone else you name) for as long as either of you live.

- One- or two-life annuity with guaranteed period – guarantees income for up to 20 years, as long as the period you choose does not exceed your life expectancy. It ensures that income continues to go to your beneficiaries for the remainder of the guaranteed period if you (one-life annuity) or both you and your annuity partner (two-life annuity) die before the end of that period.

Single-sum death benefit

A set amount your beneficiary(ies) will receive from your retirement account if you die before taking income.

Fixed period

You can choose to receive income for a set period of two to 30 years, depending on the terms of our contract and your plan’s rules (and not to exceed your life expectancy).

- Payments stop at the end of the period, during which you will have received all your principal and earnings.

Interest only

You can receive the current interest earned on your TIAA Traditional Account in monthly payments. Your principal remains intact while you receive the interest.

- These payments generally are available to individuals between ages 55 and 71 and must begin at least one year prior to reaching age 72.

Retirement transition benefit

In order to more easily transition into retirement, you may be able to withdraw up to 10%, in cash, of your lifetime annuity income. The amount you withdraw will reduce your lifetime annuity income accordingly.

TPA to cash

If you need some of your retirement savings in cash, you can withdraw your TIAA Traditional Account balance through a Transfer Payout Annuity (TPA) under the terms of the contract. A lump-sum payment, subject to a surrender fee, may be available depending on your plan rules and the terms of your contract.

For more information about the terms of your individual contract, contact your plan sponsor or financial advisor.

Rollover

Prior to rolling over, consider your other options. You may also be able to leave money in your current plan or withdraw cash. Compare the differences in investment options, services, fees and expenses, withdrawal options, required minimum distributions, other plan features, and tax treatment.

Compare the differences in investment options, services, fees and expenses, withdrawal options, required minimum distributions, other plan features, and tax treatment.

If you have had an IRS-defined “triggering event,” and your plan allows withdrawals, you can roll over your accumulations to another retirement plan that will accept them or to an Individual Retirement Account (IRA).

- Direct rollovers – from one account to another – are nontaxable and not reported as income to the federal government. Your plan’s rules specify when you are eligible for a distribution.

Minimum distribution option

Generally, you must begin taking minimum withdrawals from your account by April 1 following the year in which you turn age 72 or retire, whichever is later.

If you are married, you may be required to get spousal consent to receive any distribution option other than a qualified joint and survivor annuity.

This plan is designed to provide you with income throughout your retirement. Leaving money in your account may allow the funds to grow on a tax-deferred basis.

Leaving money in your account may allow the funds to grow on a tax-deferred basis.

This plan allows you to receive a cash withdrawal. This may be restricted by the terms of your TIAA contracts. Taxes and penalties may apply.

Adapter | |

Rooftop pool | |

Pool with a view | |

Shallow pool | |

Heated pool | |

Salt water pool | |

List all | |

Fan | |

Clothes hanger | |

Wardrobe | |

Hydromassage bath | |

Hypoallergenic pillow | |

Hypoallergenic | |

Ironing facilities | |

Seating area | |

Wooden or parquet floor | |

Cribs | |

Sofa | |

Sofa bed | |

Connecting rooms available | |

Pool protective cover | |

Soundproofing | |

Fireplace | |

Carpet covering | |

Air conditioner | |

Waste baskets | |

Mini-pool | |

mosquito net | |

Non-Feather Pillow | |

Electric blankets | |

Separate entrance | |

Heating | |

Panoramic pool | |

Feather pillow | |

Pajamas | |

Tiled / marble floor | |

Pool towels | |

Trouser press | |

Desktop | |

Folding bed | |

Socket near the bed | |

Safe | |

Private pool | |

Washing machine | |

Clothes dryer | |

Drying machine | |

Tatami (traditional Japanese floor mats) | |

Extra long beds (over 2 meters) | |

Iron | |

Cleaners | |

Wardrobe or wardrobe | |

Yukata | |

Show less | |

gaz.

wiki – gaz.wiki

wiki – gaz.wiki

Navigation

- Main page

Languages

- Deutsch

- Français

- Nederlands

- Russian

- Italiano

- Español

- Polski

- Português

- Norsk

- Suomen kieli

- Magyar

- Čeština

- Türkçe

- Dansk

- Română

- Svenska

| Location | ||

|---|---|---|---|

| Albany College of Pharmacy and Health Sciences | Albany | ||

| Albany Law School | Albany | ||

| Albany College of Medicine | Albany | ||

| Mary College | Albany | ||

| Saint Rose’s College | Albany | ||

| University of Albany, State University of New York | Albany | ||

| Alfred University | Alfred | ||

| SUNY College of Technology Alfred | Alfred | ||

| Daemen College | Amherst | ||

| Bard College | Annandale on Hudson | ||

| Wells College | Aurora | ||

| Briarcliffe College | Betpage | ||

| Brockport College | Brockport | ||

| Monroe College | Bronx.

| ||

| Concordia College-New York | Bronxville | ||

| Sarah Lawrence College | Bronxville | ||

| Brooklyn College | Brooklyn | ||

| Brooklyn Law School | Brooklyn | ||

| Long Island University | Brooklyn… | ||

| Medgar Evers College | Brooklyn | ||

| New York College of Technology, CUNY | Brooklyn | ||

| Pratt Institute | Brooklyn | ||

| St. Joseph’s College | Brooklyn … | ||

| SUNY Disabled Medical Center | Brooklyn | ||

| St.Francis | Brooklyn Heights | ||

| Bryant & Stratton College | Buffalo … | ||

| Buffalo State College | Buffalo | ||

| Canisius College | Buffalo | ||

| D’Conville College | Buffalo | ||

| Medaille College | Buffalo | ||

| Trocaire College | Buffalo | ||

| University of Buffalo, State University of New York | Buffalo.

| ||

| St. Lawrence University | Canton | ||

| SUNY Canton | Canton | ||

| Cazenovia College | Cazenovia | ||

| Villa Maria College | Chiktovaga | ||

| Hamilton College | Clinton | ||

| SUNY Cobleskill | Cobleskill | ||

| SUNY Cortland | Cortland | ||

| SUNY Delhi | Delhi | ||

| Five city colleges | Dix Hills | ||

| College of Mercy | Dobbs Ferry | ||

| Elmira College | Elmira | ||

| Farmingdale State College | Farmingdale | ||

| CUNY Law School | Flushing | ||

| Queens County College, City University of New York | Flushing | ||

| Vaughn College of Aeronautics and Technology | Flushing | ||

| State University of New York at Fredonia | Fredonia | ||

| Adelphi University | Garden City | ||

| SUNY Geneseo | Geneseo | ||

| Hobart & William Smith Colleges | Geneva | ||

| Webb Institute | Glen Cove | ||

| Hilbert College | Hamburg | ||

| Colgate University | Hamilton | ||

| Hofstra University | Hempstead | ||

| Houghton College | Houghton.

| ||

| Culinary Institute of America | Hyde Park | ||

| Cornell University | Ithaca | ||

| Ithaca College | Ithaca | ||

| York College, City University of New York | Jamaica | ||

| Davis College | Johnson City… | ||

| Keuka College | Keuka Park | ||

| United States Merchant Marine Academy | Point of Kings … | ||

| University of Niagara | Lewiston | ||

| College of Siena | Ludonville | ||

| State University of New York at New Paltz | New Paltz | ||

| Iona College | New Rochelle | ||

| College of New Rochelle | New Rochelle | ||

| Bank Street College of Education | New York | ||

| Barnard College | New York | ||

| Berkeley College | New York.

| ||

| Bernard M Baruch College, CUNY | New York | ||

| Puerto Rican College | New York | ||

| Columbia University | New York | ||

| Fashion Institute of Technology | New York | ||

| Hunter College, CUNY | New York | ||

| John Jay College of Forensic Science | New York | ||

| College LIMA | New York | ||

| Manhattan School of Music | New York | ||

| Marymount Manhattan College | New York | ||

| Metropolitan College of New York | New York | ||

| Mount Sinai School of Medicine | New York | ||

| New York Academy of Art | New York | ||

| New York College of Orthopedic Medicine | New York | ||

| New York Law School | New York | ||

| New York School of Interior Design | New York | ||

| New York University | New York.

| ||

| Pace University | New York … | ||

| School of Fine Arts | New York | ||

| SUNY College of Optometry | New York | ||

| City University of New York | New York | ||

| Cooper’s Union for the Promotion of Science and Art | New York | ||

| Postgraduate Studies, CUNY | New York | ||

| Juilliard School | New York | ||

| New school | New York | ||

| Rockefeller University | New York | ||

| Touro College | New York… | ||

| Yeshiva University | New York | ||

| Install Saint Mary’s College | Newburgh | ||

| Nayack College | Nyack | ||

| Dowling College | Oakdale .

| ||

| New York Institute of Technology | Old Westbury ….. | ||

| SUNY College Old Westbury | Old Westbury | ||

| Hartwick College | Oneonta | ||

| SUNY College Oneont | Oneonta | ||

| Dominican College | Orangeburg | ||

| State University of New York at Oswego | Oswego | ||

| Paul Smith College | Paul Smiths | ||

| State University of New York College Plattsburgh | Plattsburgh… | ||

| Clarkson University | Potsdam | ||

| State University of New York at Potsdam | Potsdam | ||

| Marist College | Poughkeepsie | ||

| Vassar College | Poughkeepsie | ||

| College Manhattanville | Purchase | ||

| College of Purchasing, State University of New York | Buy | ||

St. John John | Queens … | ||

| Nazareth College | Rochester | ||

| Roberts Wesleyan College | Rochester | ||

| Rochester Institute of Technology | Rochester | ||

| St John Fisherman’s College | Rochester | ||

| University of Rochester | Rochester | ||

| Molloy College | Rockville Center | ||

| Skidmore College | Saratoga Springs | ||

| SUNY Empire State College | Saratoga Springs | ||

| Union College | Schenectady | ||

| St.Thomas Equinas College | Sparkill | ||

| Saint Bonaventure University | St. Bonaventure | ||

| Staten Island College | Staten Island | ||

| Wagner College | Staten Island | ||

| Stone Creek University | Stone stream | ||

| Le Moyne College | Syracuse | ||

| SUNY College of Environmental Science and Forestry | Syracuse | ||

| Provincial SUNY State Medical University | Syracuse | ||

| University of Syracuse | Syracuse | ||

Mount St. Vincent College Vincent College | Bronx | ||

| Fordham University | Bronx… | ||

| Lehman College, CUNY | Bronx | ||

| Manhattan College | Bronx | ||

| SUNY Marine College | Throggs Neck | ||

| Renseller Polytechnic Institute | Troy … | ||

| Wise colleges | Troy … | ||

| State University of New York Institute of Technology | Utica | ||

| Utica College | Utica | ||

| New York Medical College | Valhalla | ||

| Binghamton University, State University of New York | Virgin | ||

| US Military Academy | West Point | ||

| > | |||

New York

Select region

Altai Territory

Amur Region

Arkhangelsk region

Astrakhan Region

Belgorod region

Bryansk region

Vladimir region

Volgograd Region

Vologda Region

Voronezh Region

Jewish Autonomous Region

Trans-Baikal Territory

Ivanovo region

Irkutsk Region

Kabardino-Balkaria

Kaliningrad region

Kaluga Region

Kamchatka Territory

Karachay-Cherkess Republic

Kemerovo Region

Kirov region

Kostroma region

Krasnodar Territory

Krasnoyarsk Territory

Kurgan Region

Kursk region

Leningrad Region

Lipetsk Region

Magadan Region

Moscow region

Murmansk region

Nizhny Novgorod Region

Novgorod region

Novosibirsk Region

Omsk region

Orenburg region

Oryol region

Penza region

Perm Territory

Primorsky Territory

Pskov region

Republic of Altai

Republic of Ingushetia

Republic of Karelia

Komi Republic

Republic of Crimea

Republic of Sakha (Yakutia)

Republic of Tuva

Rostov Region

Ryazan Region

Samara Region

St.

Resource.Org and ProPublica. We post bulk downloads of these documents at the Internet Archive.

Resource.Org and ProPublica. We post bulk downloads of these documents at the Internet Archive.

..

.. ..

.. ..

.. ..

.. ..

.. ..

..