What types of insurance do life coaches need. How can life coaches protect their business from potential risks. Which insurance providers offer suitable coverage for life coaches. How much does life coach insurance typically cost.

Understanding the Importance of Life Coach Insurance

Life coaching is a rewarding profession that helps individuals achieve their personal and professional goals. However, like any business, it comes with its own set of risks. Many life coaches overlook the importance of insurance, assuming their profession is low-risk. This misconception can lead to significant financial and legal challenges if unforeseen circumstances arise.

Insurance for life coaches serves multiple purposes:

- Protection against lawsuits from dissatisfied clients

- Coverage for property damage or loss

- Safeguarding confidential client information

- Financial security in case of accidents during coaching sessions

While the life coaching industry remains largely unregulated, this lack of standardization can sometimes lead to misunderstandings and mismatched expectations between coaches and clients. Even with a well-drafted coaching contract, legal disputes can arise, necessitating professional representation and potentially incurring substantial costs.

Professional Liability Insurance: Shielding Your Coaching Practice

Professional Liability Insurance, also known as Errors and Omissions (E&O) Insurance, is arguably the most crucial coverage for life coaches. This type of insurance protects you from claims alleging negligence, errors, or omissions in your professional services.

Consider these scenarios where Professional Liability Insurance could be invaluable:

- A client claims your advice led to financial losses

- You’re accused of breaching client confidentiality

- A client alleges emotional distress resulting from your coaching

Even if these claims are unfounded, defending against them can be costly. Professional Liability Insurance covers legal defense costs and any settlements or judgments against you, up to your policy limits.

Key Features of Professional Liability Insurance for Life Coaches

- Legal defense costs coverage

- Protection against claims of negligence

- Coverage for alleged breach of contract

- Protection against claims of failure to deliver promised results

How much does Professional Liability Insurance typically cost for life coaches? The cost can vary widely based on factors such as your experience, revenue, and coverage limits. On average, life coaches might expect to pay between $500 to $1,500 annually for a basic policy.

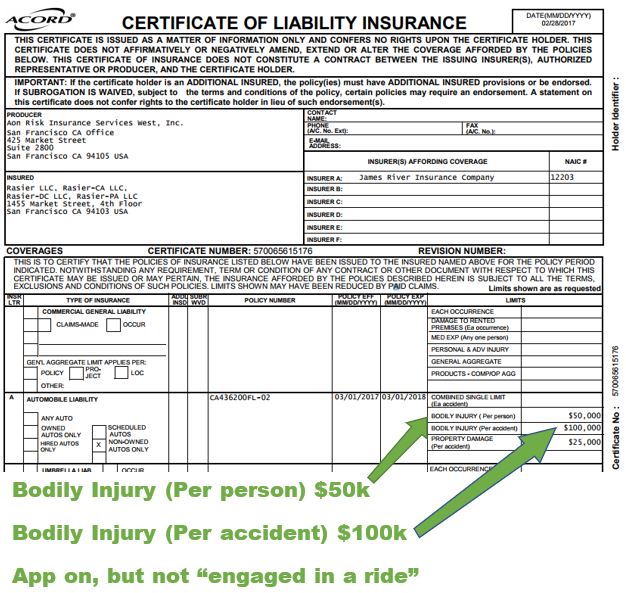

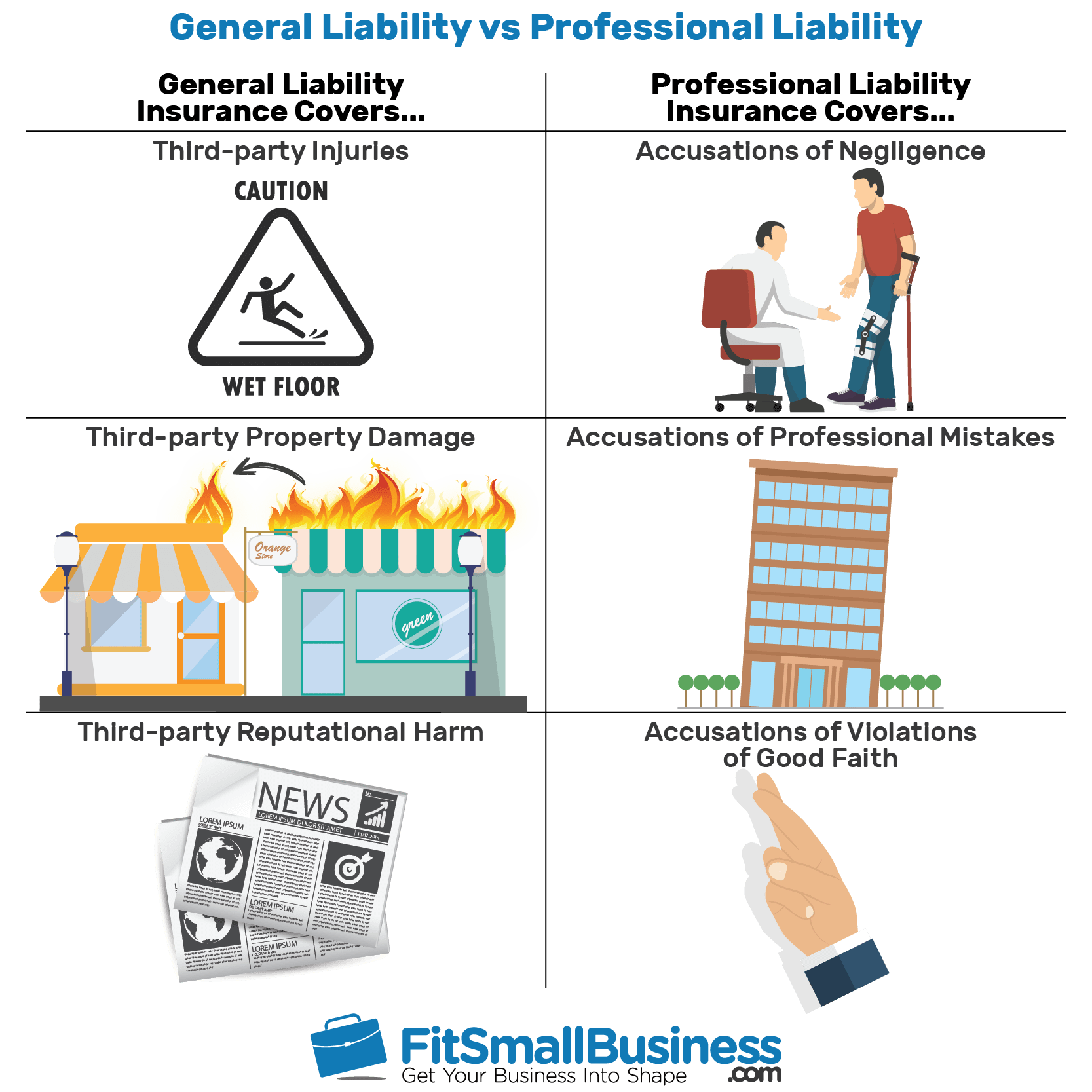

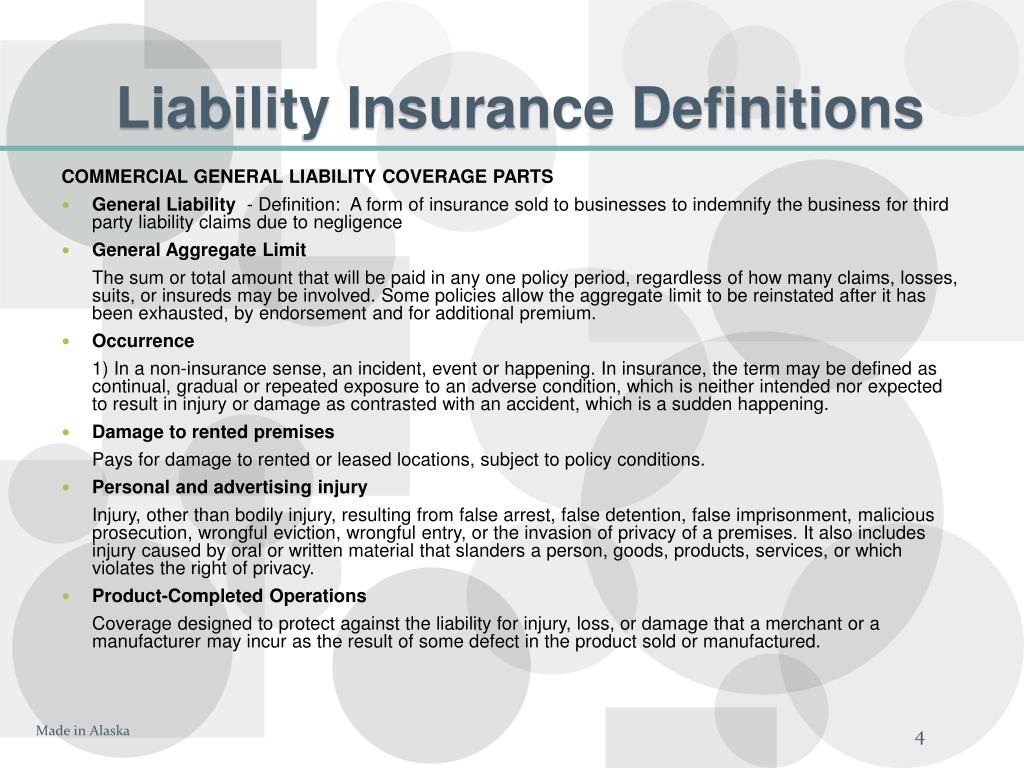

General Liability Insurance: Protecting Against Third-Party Claims

While Professional Liability Insurance covers issues related to your coaching services, General Liability Insurance protects you from third-party claims of bodily injury, property damage, or personal injury. This coverage is essential for life coaches who meet clients in person, whether in a rented office space or their own premises.

Scenarios where General Liability Insurance proves valuable include:

- A client slips and falls in your office, sustaining an injury

- You accidentally damage a client’s property during a coaching session

- A competitor claims you’ve engaged in copyright infringement in your marketing materials

General Liability Insurance covers medical expenses, legal fees, and settlements related to these types of incidents. It’s often required by landlords if you rent office space or by clients if you provide services at their location.

Components of General Liability Insurance

- Bodily Injury coverage

- Property Damage protection

- Personal and Advertising Injury coverage

- Medical Payments coverage

The cost of General Liability Insurance for life coaches typically ranges from $300 to $1,000 per year, depending on factors such as your location, the size of your business, and the coverage limits you choose.

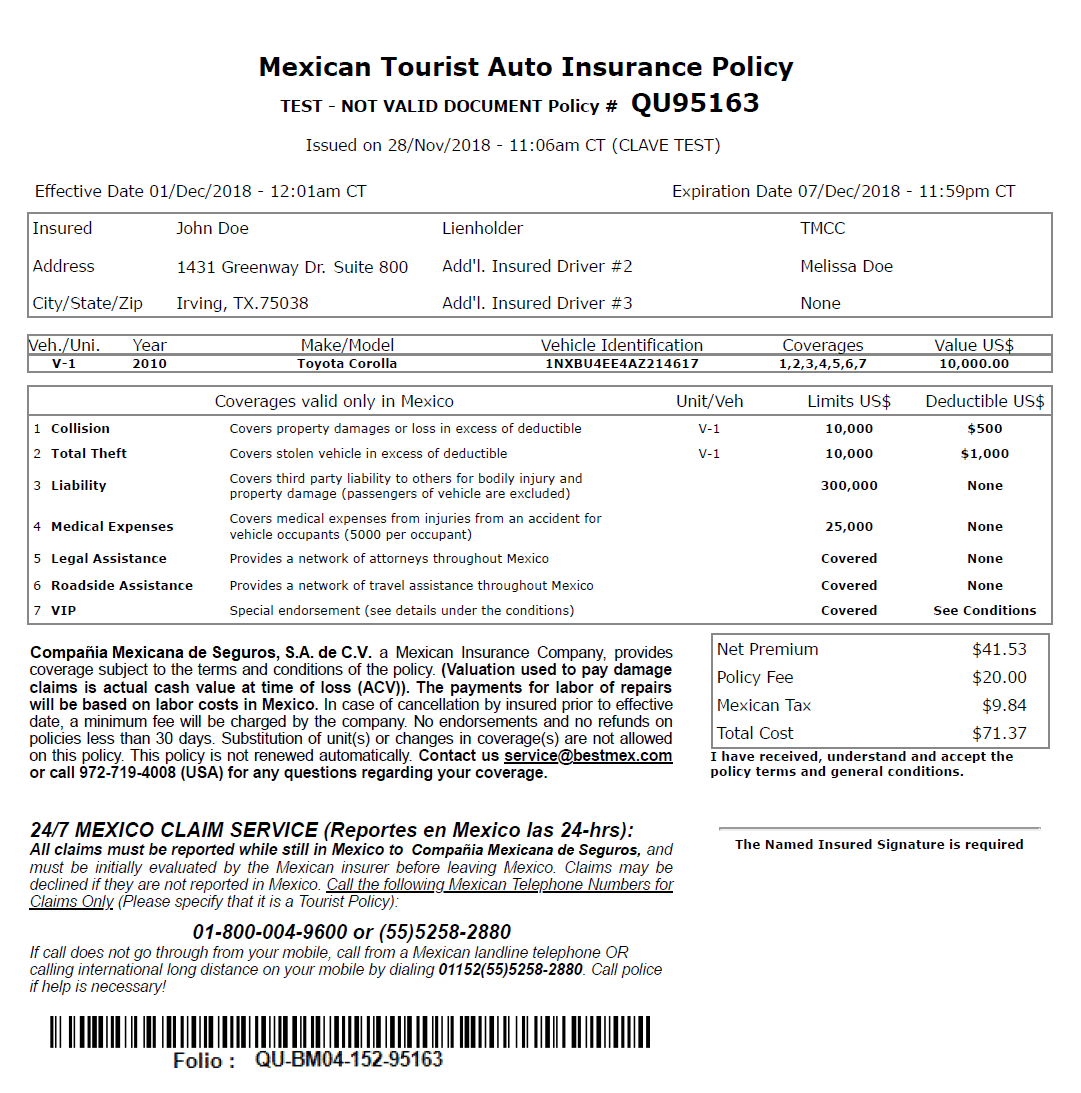

Commercial Property Insurance: Safeguarding Your Business Assets

If you own or rent a physical office space for your life coaching practice, Commercial Property Insurance is crucial. This coverage protects your business assets, including your office building, furniture, equipment, and inventory, from events such as fire, theft, or natural disasters.

Commercial Property Insurance typically covers:

- Your office building (if owned)

- Office furniture and equipment

- Computers and electronic devices

- Important documents and records

- Inventory (such as books or coaching materials you sell)

How does Commercial Property Insurance benefit life coaches? It ensures that you can quickly recover and resume operations if your business property is damaged or destroyed. Without this coverage, you might face significant out-of-pocket expenses to replace essential items or rebuild your office.

Factors Affecting Commercial Property Insurance Costs

- Location of your property

- Type and age of the building

- Value of your business property and equipment

- Security measures in place

- Claims history

The cost of Commercial Property Insurance can vary widely, but life coaches with a small office might expect to pay between $300 and $1,000 annually, depending on the factors mentioned above and the coverage limits chosen.

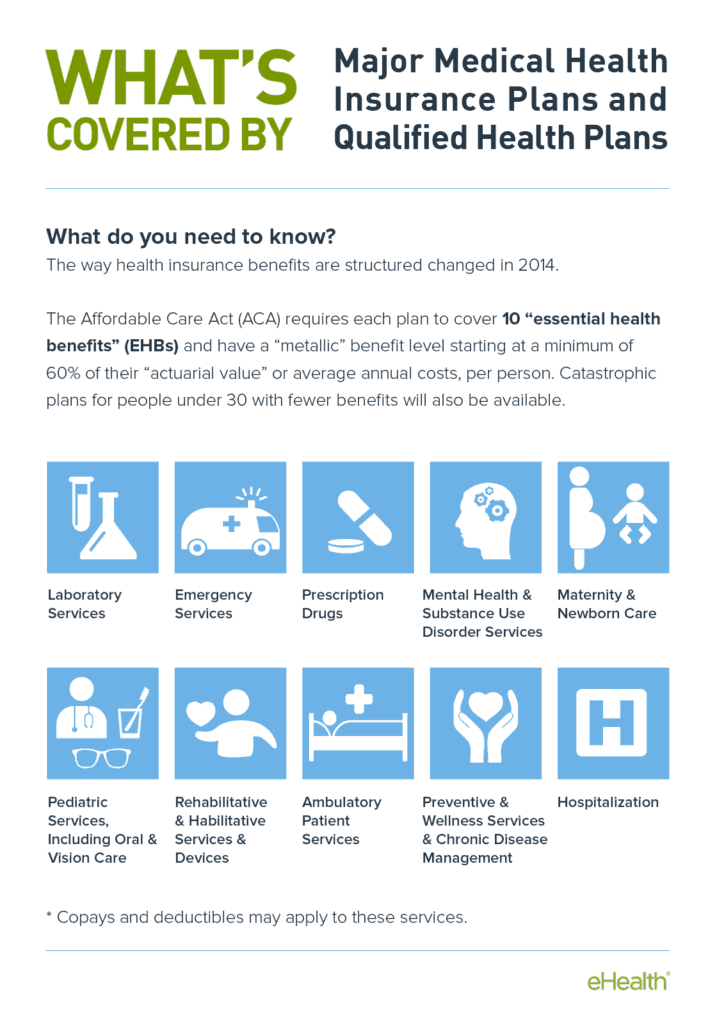

Cyber Liability Insurance: Protecting Digital Assets and Client Data

In today’s digital age, life coaches often store sensitive client information electronically. Cyber Liability Insurance protects your business from the financial consequences of data breaches, cyberattacks, and other digital risks.

Why is Cyber Liability Insurance important for life coaches? Consider these potential scenarios:

- Your computer is hacked, exposing confidential client information

- A virus corrupts your client database, leading to data loss

- You fall victim to a phishing scam, compromising your business accounts

Cyber Liability Insurance can cover costs associated with data recovery, legal fees, notification expenses, and even public relations efforts to restore your reputation following a cyber incident.

Key Components of Cyber Liability Insurance

- Data Breach coverage

- Cyber Extortion protection

- Business Interruption coverage due to cyber events

- Reputation management services

The cost of Cyber Liability Insurance for life coaches typically ranges from $500 to $2,000 per year, depending on factors such as the amount of sensitive data you handle, your security measures, and your chosen coverage limits.

Business Owner’s Policy: Comprehensive Coverage for Life Coaches

A Business Owner’s Policy (BOP) is a comprehensive insurance package that combines General Liability Insurance, Commercial Property Insurance, and often Business Interruption Insurance into one convenient policy. This type of coverage is particularly well-suited for small to medium-sized life coaching practices.

What are the advantages of a Business Owner’s Policy for life coaches?

- Cost-effective: Often cheaper than purchasing individual policies

- Convenient: Simplifies insurance management with a single policy

- Customizable: Can be tailored to your specific business needs

- Comprehensive: Provides broad coverage for common business risks

A typical BOP for life coaches might include coverage for your office space, equipment, liability claims, and lost income if your business is temporarily unable to operate due to a covered event.

Components of a Business Owner’s Policy

- General Liability Insurance

- Commercial Property Insurance

- Business Interruption Insurance

- Optional add-ons (e.g., data breach coverage)

The cost of a Business Owner’s Policy can vary widely based on your specific needs and risk factors. However, life coaches might expect to pay between $500 and $2,000 annually for a basic BOP, potentially offering significant savings compared to purchasing separate policies.

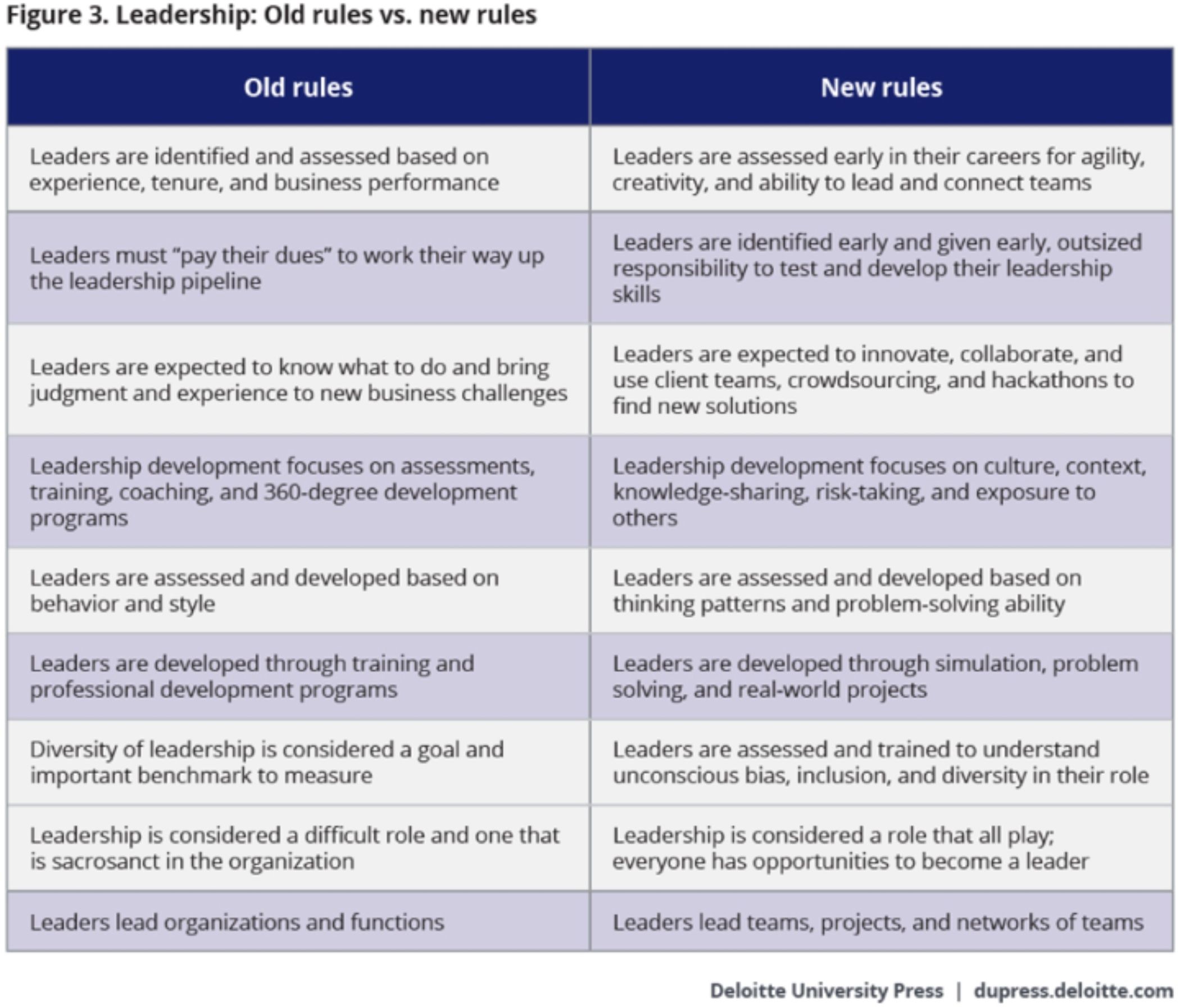

Selecting the Right Insurance Provider for Life Coaches

Choosing the right insurance provider is crucial for ensuring you have appropriate coverage at a competitive price. When selecting an insurance company for your life coaching practice, consider the following factors:

- Experience with life coaching or similar professional services

- Reputation for customer service and claims handling

- Financial stability and ratings from independent agencies

- Flexibility in customizing policies to your specific needs

- Competitive pricing and available discounts

Several insurance providers offer policies tailored to the needs of life coaches and other professional service providers. Here are a few options to consider:

Top Insurance Providers for Life Coaches

- Hiscox: Known for its specialized coverage for small businesses and professional services

- The Hartford: Offers comprehensive Business Owner’s Policies with industry-specific coverage

- Chubb: Provides tailored insurance solutions for professional services firms

- Travelers: Offers a range of customizable business insurance options

- BizInsure: An online platform that allows you to compare quotes from multiple insurers

When evaluating insurance providers, be sure to obtain quotes from multiple companies and carefully review the coverage details to ensure they align with your specific needs as a life coach.

Maximizing Your Life Coach Insurance Coverage

Once you’ve selected appropriate insurance coverage for your life coaching practice, it’s important to maximize its value and ensure you’re fully protected. Consider these strategies to get the most out of your insurance policies:

- Regularly review and update your coverage as your business grows

- Implement risk management practices to reduce the likelihood of claims

- Keep detailed records of your coaching activities and client interactions

- Understand your policy limits and consider umbrella coverage for additional protection

- Stay informed about industry trends and emerging risks that may affect your insurance needs

How can life coaches effectively manage their insurance costs while maintaining adequate coverage? Consider these tips:

Cost-Saving Strategies for Life Coach Insurance

- Bundle policies when possible (e.g., with a Business Owner’s Policy)

- Opt for higher deductibles to lower premiums, if you can afford the out-of-pocket expense

- Implement strong risk management practices to potentially qualify for discounts

- Pay premiums annually instead of monthly to avoid installment fees

- Regularly shop around and compare quotes from different providers

By carefully selecting and managing your insurance coverage, you can protect your life coaching practice from potential risks while focusing on what matters most: helping your clients achieve their goals and transform their lives.

The 5 Types of Life Coach Insurance You Might Actually Need (+ Provider Suggestions)

OK, life coach insurance might not be your favorite topic. But just like any other small business owner, you need to protect your business from any unforeseen risks and financial damages. Whether you’re looking to change your insurance package to something more suitable or it’s the first time you ever hear about the need for insurance as a life coach, we’ve gathered everything you need to know in this article to help you make the right decision.

We’ll cover the importance of insurance for life coaches, the various types of insurance packages you can consider, how much they cost, and some insurance providers who get life coaches and the typical risks their businesses face.

Why Do Life Coaches Need Life Insurance?

As a life coach, you provide professional advice and guidance to your clients. While you’re not responsible for how that advice is taken and implemented, it doesn’t mean you won’t face lawsuits from potential clients who raise claims against you. It can happen to anyone.

It can happen to anyone.

Life coaching is a highly unregulated industry, where you don’t have legal requirements to start your practice. There are a lot of different coaching programs and services on the market, and they are often confused with other similar services, such as consulting or therapy. Such misunderstandings can create mismatched expectations, even when you did everything right.

While a sound contract can set the right expectations beforehand and provide a good reference point for any potential legal conflicts, you will still need to cover the expenses of hiring a lawyer. Even if the case has no basis.

[ Read: How To Create A Legally Binding Coaching Contract From Scratch ]

Other potential reasons you could need insurance as a life coach is to protect your property (such as your office, laptop, or car used for business), cover the costs of any accidents that take place at the location of your sessions, and to keep confidential data about your clients safe.

Let’s look at what all of these mean in insurance terminology.

Types of Life Coach Insurance You Need

Now, since we’re looking at insurance here, we’re going to mention some worst-case scenarios that might happen to coaching professionals and their businesses. We don’t mean to scare you, but it’s better to be prepared than sorry (which is the whole point of getting insured). Here are some of the risks that might occur when running a life coaching business — and how to stay protected against them.

Professional Liability Insurance

Professional liability insurance protects your business if you are sued for negligently performing your services, even if you haven’t made a mistake. Any life coach can be sued for causing harm with their advice, breaking the confidentiality clause in their agreement, or even sexual harassment (especially in close contact situations).

Even if you face false accusations, you will need to respond to them and work with a legal professional to protect your business against claims. Your professional liability insurance (also called errors and omissions insurance or indemnity insurance) will cover the expenses of legal defense by your lawyer as well as any settlement or damage that might come up in your case.

Your professional liability insurance (also called errors and omissions insurance or indemnity insurance) will cover the expenses of legal defense by your lawyer as well as any settlement or damage that might come up in your case.

General Liability Insurance

General liability insurance provides insurance coverage for your business when your client makes claims against you for bodily injury, damage to property, or personal injury. If it all sounds too far-fetched to happen to you, here are a few everyday incidents that could easily take place at your sessions.

Let’s say a client claims that you spilled water on their laptop during the session or accidentally drops their phone while bumping into you at the door. That could be considered damage to property.

If your client slips on the stairs while walking into your office and hurts themselves, they can sue you for personal injury. In these cases, your general liability insurance will cover the costs of the lawsuit, the damage caused, and any medical expenses that your client needs to pay.

Commercial Property & Auto Insurance

Commercial property insurance and commercial auto insurance protect the assets that belong to your business, such as your office building along with its equipment and furniture, your laptop and other electronics you use for work, and the car you drive for business meetings.

If you meet with an accident or a small fire causes damage to your property, this insurance type will cover the costs of the damage. If someone breaks into your office or steals any of your business-owned belongings, that will be covered too. Insurance policies typically define a blanket limit for all costs that occur at a single business location. Make sure you opt for one that’s sufficient for your property and vehicles.

Cyber Liability Insurance

Cyber liability insurance covers the costs that come from cyberattacks and data breaches. In your case, this could mean someone hacks into your computer to access private, confidential information about your clients.

Cyber liability insurance or cyber security insurance protects you from malware and phishing, and also covers the cost of lawsuits from clients in the event of their confidential data being leaked. Life coaching sessions cover all kinds of personal topics which can impact the reputation of someone, especially if you’re working with more publicly known clients or representatives of large brands.

Workers Compensation Insurance

If you have a team who works for your life coaching business, workers compensation insurance will protect your employees and your business from any work-related accidents, illnesses, and even death.

By law, you are required to provide medical insurance and sick leaves for your team members in most states of the US and in many other countries too. You will need insurance to cover medical costs and lost wages, even if you only have one employee. This, of course, doesn’t apply to you if you fly solo or work with a virtual assistant.

How Much Does Insurance Cost for Life Coaches?

Insurance costs for your life coaching business depend on a bunch of different factors. For example, where your business is located, your claim history, whether you own or rent an office space, your equipment value, and the size of your team (if you have employees).

For example, where your business is located, your claim history, whether you own or rent an office space, your equipment value, and the size of your team (if you have employees).

According to statistics, the average life coach in America spends between $350-$650 per year for $1 million in general liability coverage, but insurance packages for life coaches can cost up to $3,100 annually depending on the size of the business.

If you’re working by yourself or only hire freelancers, the cost of your business insurance package will be much lower. If you work from home, use your personal equipment, and don’t drive a car for business purposes, the annual rate of your package will likely be even lower.

The general best practice for life coaches and other small business owners is to go for a customizable business owner’s policy (or BOP). These packages commonly include general liability and other types of insurance from the examples mentioned above that fit your individual business needs.

It’s best to explore your options early on and include insurance costs in your business plan since your insurance package won’t cover losses that have already occurred.

[ Read: 8 Expert Tips for Writing Your Life Coaching Business Plan ]

These are some general rates insurance companies normally charge when it comes to life coaches, but we encourage you to do your own research and ask for quotations from the insurance companies you’re considering.

| Policy | Annual Cost | Coverage Amount Per Occurrence | Aggregate Coverage Amount | Deductible |

| Professional Liability | $400 to $1,800 | $1 million | $2 million | $1,000 |

| General Liability | $300 to $1,300 | $1 million | $2 million | $500 |

| Commercial Property | $300 to $600 | $20,000 | $20,000 | $1,500 |

| Cyber Liability | $500 to $1,500 | $1 million | $1 million | $1,000 to $5,000 |

Top Insurance Providers for Life Coaches

Hiscox (Our Top Pick)

Hiscox is a top-rated insurance provider that covers 180+ professions in 49 states. They specialize in microbusinesses and small businesses, including sole proprietors. Hiscox works with niche industries such as therapy, consulting, and life coaching. You can buy insurance packages with them online through an easy application process, and they have several options to customize your package and choose what fits you best. We’ve heard from coaches that Hiscox is online-focused and makes the process easy.

They specialize in microbusinesses and small businesses, including sole proprietors. Hiscox works with niche industries such as therapy, consulting, and life coaching. You can buy insurance packages with them online through an easy application process, and they have several options to customize your package and choose what fits you best. We’ve heard from coaches that Hiscox is online-focused and makes the process easy.

Thimble

Thimble prides itself as an insurance provider that can get you covered in 60 seconds. They work with businesses that work on a more ad hoc basis, so if you’re not always actively working with clients, you can even get insured for as little as a few hours with them.

* Since originally publishing this post, Thimble has reached out to let us know they currently aren’t offering coverage for life coaches. However, they do cover “many consulting professions”, make sure to reach out to them directly for coverage details.

SimplyBusiness

Simply Business is an online platform that lists top insurance carriers for small business owners to compare and get a quotation from. They have several options for life coaches who are looking for general liability and professional liability coverage at a reasonable rate. This way, you can receive multiple quotations in one place and choose the one that matches your expectations in terms of coverage, duration, and price.

They have several options for life coaches who are looking for general liability and professional liability coverage at a reasonable rate. This way, you can receive multiple quotations in one place and choose the one that matches your expectations in terms of coverage, duration, and price.

AXA

With 54 countries covered, AXA is one of the largest insurance companies in the world. Despite their size, they provide customized insurance packages to sole proprietors, such as life coaches, with the essentials of professional indemnity, public liability, and business equipment insurance. They have a 24/7 expert helpline to navigate you through their policies and help you choose the coverage that works best for you.

Life Coach Professional Liability Insurance

Let’s Get Started:

What state are you working in?

SelectAlabamaAlaskaArizonaArkansasCaliforniaColoradoConnecticutDelawareDistrict of ColumbiaFloridaFlorida – BrowardFlorida – DadeGeorgiaHawaiiIdahoIllinoisIllinois – CookIndianaIowaKansasKentuckyLouisianaMaineMarylandMassachusettsMichiganMichigan – MacombMichigan – OaklandMichigan – WayneMinnesotaMississippiMissouriMontanaNebraskaNevadaNew HampshireNew JerseyNew MexicoNew YorkNew York – BronxNew York – BrooklynNew York – ManhattanNew York – NassauNew York – QueensNew York – Staten IslandNew York – SuffolkNew York – WestchesterNorth CarolinaNorth DakotaOhioOklahomaOregonPennsylvaniaPennsylvania – DelawarePennsylvania – MontgomeryPennsylvania – PhiladelphiaRhode IslandSouth CarolinaSouth DakotaTennesseeTexasTexas – BrazoriaTexas – CameronTexas – Fort BendTexas – GalvestonTexas – HarrisTexas – HidalgoTexas – JeffersonTexas – MontgomeryTexas – OrangeUtahVermontVirginiaWashingtonWest VirginiaWisconsinWyoming

Affordable, Reliable Life Coach Insurance.

Trust Your Career With CM&F!

Protecting Healthcare Professionals For Over 100 Years

Get A Quote

Apply Now

Life Coach Liability Insurance

CM&F specializes in life coach professional liability insurance, also known as life coach malpractice insurance, that is tailored to your individual needs. Designed to protect your assets, license and reputation, CM&F’s superior professional liability insurance brings peace of mind to life coaches.

CM&F’s life coach liability insurance policies are comprehensive, portable, and flexible – offering 24/7 coverage that is inclusive of any services outlined within your scope of practice according to relevant state laws, as outlined within your policy agreement.

CM&F is one of the country’s longest-standing professional liability insurance providers, with over 100,000 healthcare providers across the U.S. putting their careers in the hands of CM&F. With excellent service, innovative technology, and even better coverage, CM&F has your back with the market’s best professional liability insurance for life coaches.

Life Coach Professional Liability Insurance Benefits

- Coverage Options up to $2 Million per Claim

- Full Consent to Settle Claims

- Telemedicine/Telehealth Coverage

- License Defense Coverage

- General Liability Available

- Defense Costs in Addition to Liability Limits

- Sexual Misconduct Defense

- HIPAA Defense Coverage

- 24/7 Portable Coverage That Covers You Everywhere You Go – Even in Volunteer, Telehealth, Per Diem or Moonlighting Assignments

In the Spotlight:

Getting Coverage Is Simple!

- Quote

View coverage options and make sure the price fits your budget. - Apply

Access your quote, finalize your options and purchase coverage - Download

Access your proof of coverage to share or download, instantly.

Why Choose CM&F?

Family owned and operated since 1919, CM&F has been a trusted partner to millions of healthcare professionals over the years. Developing the very first liability insurance policy for registered nurses in 1947, and nurse practitioners in 1987, CM&F has been at the forefront of protecting their clients personal and professional livelihoods for over 100 years. CM&F continues to lead the way forward in protecting over 200 professional specialties across the healthcare industry, with a singular focus on providing superior service and innovative insurance products.

CM&F continues to invest in service and technology helping to support our clients wherever they are. Whether you need to quickly buy insurance online, access your policy documents in real-time, or discuss a coverage question over the phone, CM&F is there for you.

Get life coach professional liability insurance coverage through CM&F today!

Thousands of professionals have trusted us with their career, and it’s easy to see why. CM&F only partners with insurance carriers who carry the highest A.M. Best ratings in the market today!

CM&F only partners with insurance carriers who carry the highest A.M. Best ratings in the market today!

Own a Group or Clinic?

View Healthcare Group Liability Insurance

Not a Life Coach Professional?

View The Individual Professionals We Cover

Your “per occurrence,” sometimes written as “per claim,” limit refers to the total amount the insurance company will pay per incident during the policy term. Your “aggregate” limit is the total amount the insurance company will pay for multiple claims over the course of one policy term (which is often one year).

“Occurrence” or “claims made” refers to the type of policy coverage you’d be purchasing. This affects when you are able to report a claim on your policy.

What is a claims made policy?

You are only able to report a claim on a claims made policy while the policy is active. For instance, if you let your policy expire, and then six months later a former patient brings a lawsuit against you for an incident which occurred during the policy period, a claims made policy would no longer cover that claim (unless you purchased an Extended Reporting Endorsement, or “Tail Coverage”).

What is an occurrence policy?

An occurrence policy covers you indefinitely for incidents that occur within the policy period, meaning you are covered for the time period during which you had the policy even if it is no longer active. It is essentially the same as a claims made policy with a built-in Tail.

For our Allied Health clients:

All CM&F insurance products include occurrence coverage, and so you never have to worry about purchasing tail coverage!

If you apply for coverage online via CM&F’s secure Insured Access Portal, you can pay for and receive proof of coverage in just MINUTES! If you have the ability to pay with a credit card, we recommend applying for coverage online. Once you submit your application, you are emailed your coverage documents in minutes – No Delay, No Headache.

Your documents are also available for access 24/7 in your personal insured access portal account. Within the portal, all clients are able to download, print, or email their documents whenever needed.

If you are unable to purchase coverage online, please contact us for a paper application. We can accept applications through the mail or via fax. Please know, this can delay the receipt of your coverage documents by a few weeks due to processing and shipping time.

*Need help applying? Contact us for further instructions and assistance on accessing our Online Applications.

Our insurance plans are extremely flexible. We offer full-time, part-time, moonlighting or contracting policies for almost all professionals. Your coverage follows you wherever you work, 24/7.

Yes, we cover self-employed healthcare professionals. Please select “Self-employed” in the dropdown when choosing employment status.

If you have an occurrence policy, you can simply purchase the CM&F professional liability insurance policy when the policy with your current insurance provider expires. When using our online application, you are able to select your coverage date at least 30 days in advance, so you don’t have to worry about coming back to apply on the exact day.

If your current policy is a claims-made policy, it is best to discuss the transition options with a CM&F service professional. We will help to ensure there are no gaps in your liability insurance coverage.

You may add additional insured to your policy at anytime. This can be done during the application process, as well as throughout the lifetime of the policy.

Ready to Apply?

Apply Now

Get A Quote

Page Not Found – National Collective

It is important to know that the above policy has been built on years of experience and extensive knowledge in the field to provide a comprehensive response to kindergarten injuries!

A. Third party insurance: 105 NIS.

Liability limit for the case 2,500,000 shekels – for the whole year 5,000,000 shekels.

There is also additional third party liability insurance (umbrella insurance that covers all kindergartens in the collective) within the limits of liability:

$1,500,000 per event and $6,000,000 per period for renewal at no additional cost kindergarten / kindergarten.

The policy also includes legal fees in excess of the liability limit.

Criminal defense and defamation.

Franchise: only 600 shekels.

B. Accidents with children: NIS 95 per child per year (coverage is valid during kindergarten classes)

This insurance covers kindergarten children against injuries, God forbid (regardless of whether there was negligence) according to the following breakdown :

1. 580,000 NIS for disability due to an accident.

2. 150,000 shekels in case of death (God forbid).

3. NIS 40,000 for medical expenses not included in the health basket.

4. 200 shekels for each day of hospitalization for up to a month. (more than 3 days)

5. Also, the policy will cover the compensation of tuition fees up to 3 months, due to the absence of a child due to an accident that occurred as part of activities in a kindergarten.

Deduction: 3 days.

Includes: unlimited hours of activity, outdoor activities (every 10 children are responsible for adults), car accidents, terrorism.

In accordance with the terms of policy

third. Employer’s liability insurance at no additional cost, covering $5,000,000.

d. Content insurance and business structure

Content for NIS 200,000

Structure NIS 350,000

Includes water damage to structure and contents, glass panels, fire, burglary, simple theft.

at no additional cost.

This section can be expanded upon customer request.

Natural Damage Deduction $2,500. Earthquake $7,500

Third party damage deductible and employer liability NIS 135 per year (not included in offer)

God. Kindergarten accident insurance, 24 hours!!! (not included in the offer)

and. NIS 163,500 death due to an accident, NIS

163,000 disability due to an accident,

monthly compensation NIS 4,500, NIS

282, NIS

218,000 death due to an accident

218 00 0 shekels – disability as a result of an accident case

Monthly compensation NIS 6000

376 shekels,

NIS 272,500 death due to an accident

NIS 272,500 disability due to an accident

Monthly compensation NIS 7,500.

470 shekels,

Compensation from the 3rd day!

D. Sick/Accident Days Cover (not included in the offer)

Compensation 900 per week for up to 90 days.

(Accident from day 8. Sickness from day 15)

This section does not cover: hernia, back pain, beauty treatments, biking/quad biking and dangerous hobbies.

Nikolay Petrovich Nikolenko, Candidate of Economic Sciences, Associate Professor, Certified International Business Trainer | INSURANCE TODAY

Go to expert list

| Nikolenko Nikolay Petrovich PhD in Economics, Associate Professor, Certified International Business Trainer Nikolai Petrovich Nikolenko was born at 1956 year. Three higher educations. Candidate of Economic Sciences, Associate Professor. More than 30 years in the insurance business. In 1992, he worked at SOAO “Military Insurance Company” as chief accountant. Since 1994 – in CJSC SG UralSib (former name – Industrial Insurance Company) as head of the pension insurance department. For 11 years, he held eleven positions from the head of the department to the general director. Since 2005, he has been the Chief Executive Officer for the Insurance Business of the Financial Corporation UralSib. From mid-March 2006 to December 25, 2010 – First Deputy Chairman of the Board of SOJSC Russian Insurance Center. He supervised issues related to the development of the company and strengthening its position in the classic corporate insurance market. He was engaged in the development of a strategic management system, building multi-channel sales systems, managing business processes and the organizational structure of the company, corporate culture, and regional network. In January 2011, he was appointed Deputy General Director of CJSC CJSC GEFEST and scientific director of the company’s management school and sales school. Responsible for strategy development, organizational development, business process optimization, employee training, marketing, advertising and public relations. From December 2014 to October 2019, he headed the board of directors of LLC IC INCOR Insurance (until November 30, 2017 – LLC IC ROSINCOR Reserve). Author of more than 200 publications on management issues in the insurance company, including the books “How to manage an insurance company”, “Reengineering the business processes of an insurance company”, “Reengineering an insurance company”, “Reengineering for the sake of the client”, “Human resource management ”, “Strategic management of an insurance company”, “Organization of sales in an insurance company”. Has an international certificate of a business coach-universal. Certified business coach according to the Structogram method. Conducts trainings on management, sales and personnel management. Updated: October 1, 2019 | Publications on the website: DIRECT SPEECH | materials: 19 INTERVIEW | materials: 3 REPLICATIONS total replicas: 4 Nikolay Petrovich Nikolenko – references Total references: 101

|

|

Nikolay Petrovich Nikolenko – replicas

total replicas: 4

Pages: .

Nikolay Petrovich Nikolenko

Deputy General Director of ZAO Gefest CJSC, Candidate of Economic Sciences, Associate Professor, Certified International Business Trainer

OSAGO is a socially significant and most widespread type of insurance in our country, therefore all arguments of insurance companies, their arguments will be considered by legislators through the prism of influence on society. The cost of OSAGO cannot be increased by 30-40%, as this will cause a wave of indignation among car owners, which, of course, no one will allow. It is clear that the state in this matter puts the social aspect in the first place to the detriment of economic calculations. At the same time, of course, insurance companies should use all possible and reasonable methods to pay attention to the calculations and show what can happen if the limits are raised without tariff adjustments.

It is clear that the state in this matter puts the social aspect in the first place to the detriment of economic calculations. At the same time, of course, insurance companies should use all possible and reasonable methods to pay attention to the calculations and show what can happen if the limits are raised without tariff adjustments.

Unfortunately, over the 9 years of work on OSAGO, insurance companies have rather lost than gained credibility in the eyes of car owners and authorities. The insurers themselves are to blame for this. That is why we must prove the opposite, and for this we need to pay compensation in full and strictly within the time limits allotted by law. Indeed, in insurance, the best advertising is payments.

July 2, 2012

What impact will the new carrier liability insurance law have on the development of transport insurance?

|

Nikolenko Nikolai Petrovich

Deputy General Director of CJSC CJSC Gefest, Candidate of Economic Sciences, Associate Professor, Certified International Business Trainer

about heading for the introduction of compulsory types of insurance in the largest industries in order to transfer the payment of compensation to victims from themselves to the direct perpetrators and to guarantee, with the help of this financial instrument, the timeliness and completeness of compensation. In particular, the high statistics of accidents in recent years in transport, as well as the insignificance of the amounts of payments that victims could count on in the event of harm to their life, health and property, led to the introduction of insurance in this industry.

The introduction of compulsory types of insurance, as a rule, significantly changes the situation in the industry where it is introduced. What is important – it leads to mass insurance coverage and, as a result, an increase in the insurance culture of individuals and legal entities, an increase in cross-sales in related segments. Perhaps, in the transport industry, the introduction of this law will give impetus to the growth of transport insurance within the framework of CASCO, property insurance, especially in the regions of the country where the level of insurance penetration in this segment remains at a very low level.

What is important – it leads to mass insurance coverage and, as a result, an increase in the insurance culture of individuals and legal entities, an increase in cross-sales in related segments. Perhaps, in the transport industry, the introduction of this law will give impetus to the growth of transport insurance within the framework of CASCO, property insurance, especially in the regions of the country where the level of insurance penetration in this segment remains at a very low level.

March 2, 2009

The financial crisis in the market is becoming protracted and prolonged. How can top management reduce the impact of the crisis on the insurance company and ensure its sustainability?

Nikolenko Nikolai Petrovich

First Deputy Chairman of the Board of SOJSC Russian Insurance Center until December 25, 2010

It has been known for a long time that a bad manager cuts expenses, while a good one increases income.