How does a nonprofit organization obtain tax-exempt status. What are the requirements for maintaining tax exemption. Can a nonprofit lose its tax-exempt status. How often must nonprofits file returns with the IRS.

The Basics of Nonprofit Tax Exemption

Nonprofit organizations play a crucial role in society, providing valuable services and support to communities. One of the key benefits of being a nonprofit is the potential for tax exemption. But what exactly does this mean, and how does an organization achieve and maintain this status?

Tax-exempt status allows a nonprofit organization to avoid paying taxes on certain income. This can provide significant financial benefits, allowing the organization to allocate more resources towards its mission. However, obtaining and maintaining tax-exempt status requires careful adherence to specific rules and regulations.

What qualifies an organization for tax-exempt status?

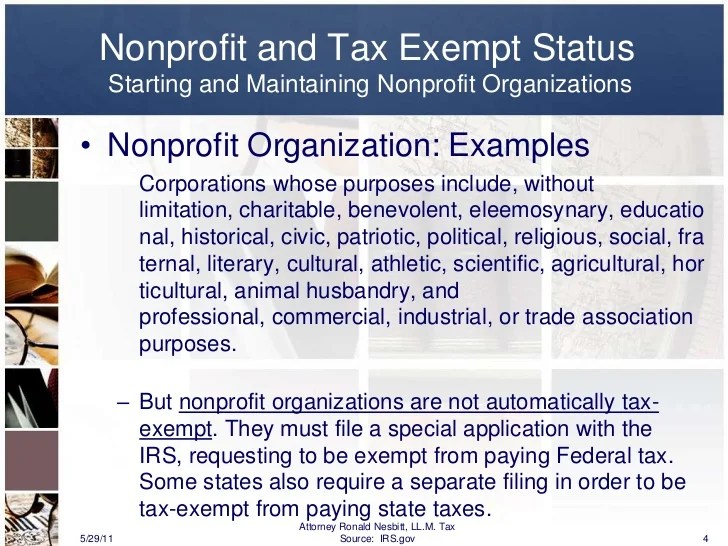

To qualify for tax-exempt status, an organization must meet certain criteria set by the Internal Revenue Service (IRS). These typically include:

- Operating for charitable, religious, educational, scientific, or literary purposes

- Ensuring that no part of the organization’s net earnings benefit private shareholders or individuals

- Refraining from substantial lobbying activities

- Not participating in political campaigns for or against candidates

It’s important to note that while these are general guidelines, specific requirements may vary depending on the type of nonprofit organization and the particular tax-exempt status sought.

Applying for Tax-Exempt Status: A Step-by-Step Guide

Obtaining tax-exempt status is not an automatic process. Organizations must apply to the IRS and, in many cases, to state tax authorities as well. Here’s a general overview of the steps involved:

- Form a nonprofit corporation or organization according to state laws

- Obtain an Employer Identification Number (EIN) from the IRS

- Determine the appropriate tax-exempt classification (e.g., 501(c)(3), 501(c)(4), etc.)

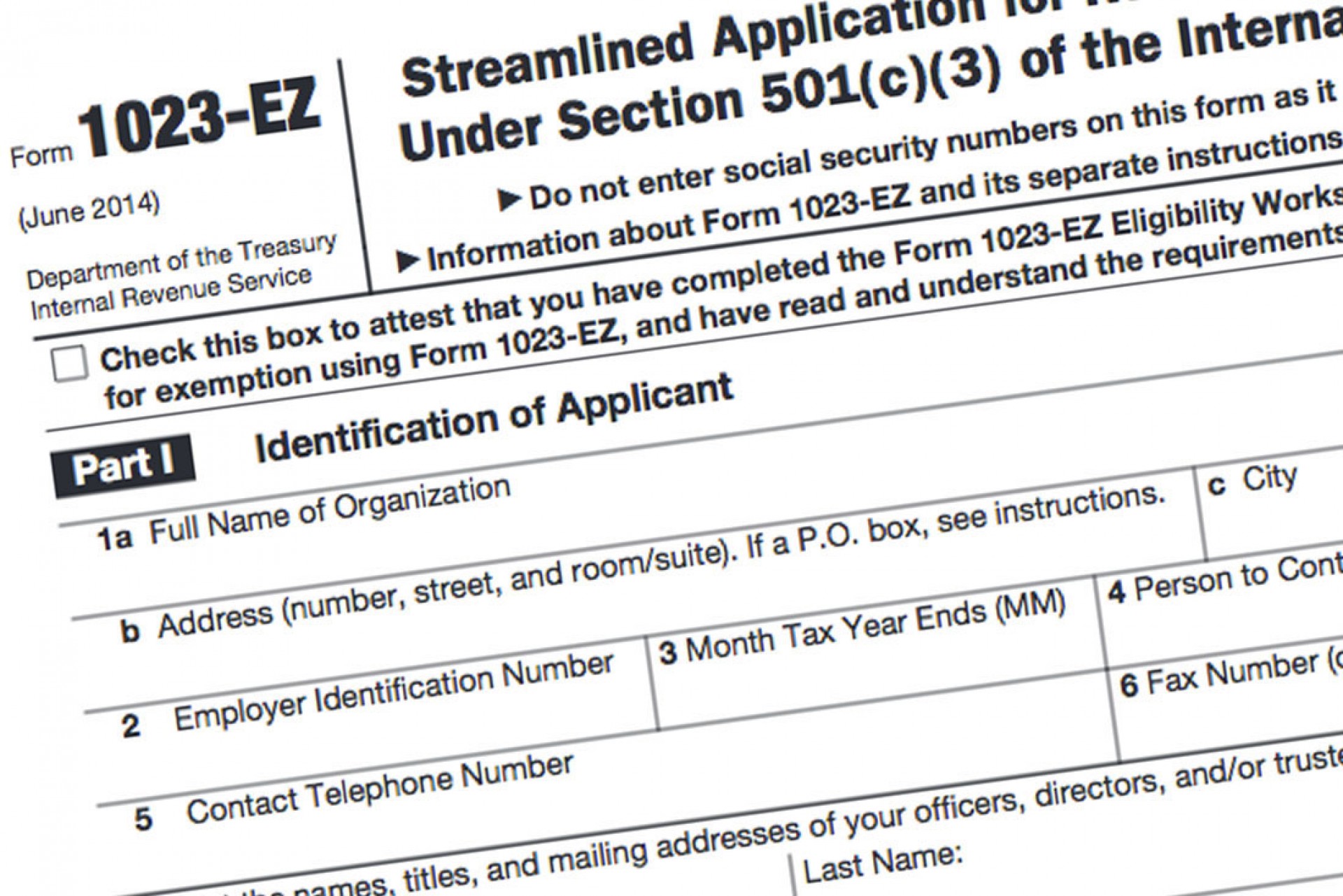

- Prepare and file the appropriate IRS form (typically Form 1023 or Form 1024)

- Pay the required filing fee

- Await IRS review and determination

The process can be complex and time-consuming, often taking several months for the IRS to review and make a determination. Many organizations choose to seek professional assistance to navigate this process effectively.

Are there expedited options for obtaining tax-exempt status?

In some cases, organizations may qualify for expedited processing of their tax-exempt application. This is typically reserved for organizations facing emergency situations or those with pending grants that require tax-exempt status. However, expedited processing is not guaranteed and is granted at the discretion of the IRS.

Maintaining Tax-Exempt Status: Ongoing Responsibilities

Once an organization obtains tax-exempt status, it must take steps to maintain this status. This involves ongoing compliance with IRS regulations and regular reporting requirements.

What are the key responsibilities for maintaining tax-exempt status?

Nonprofit organizations must:

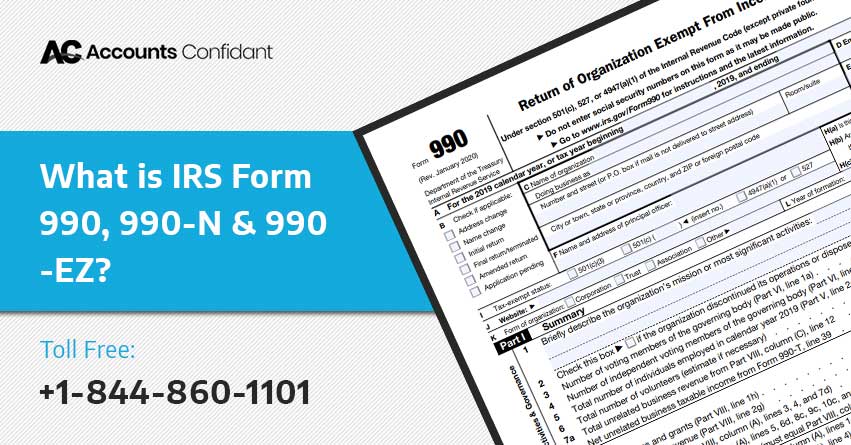

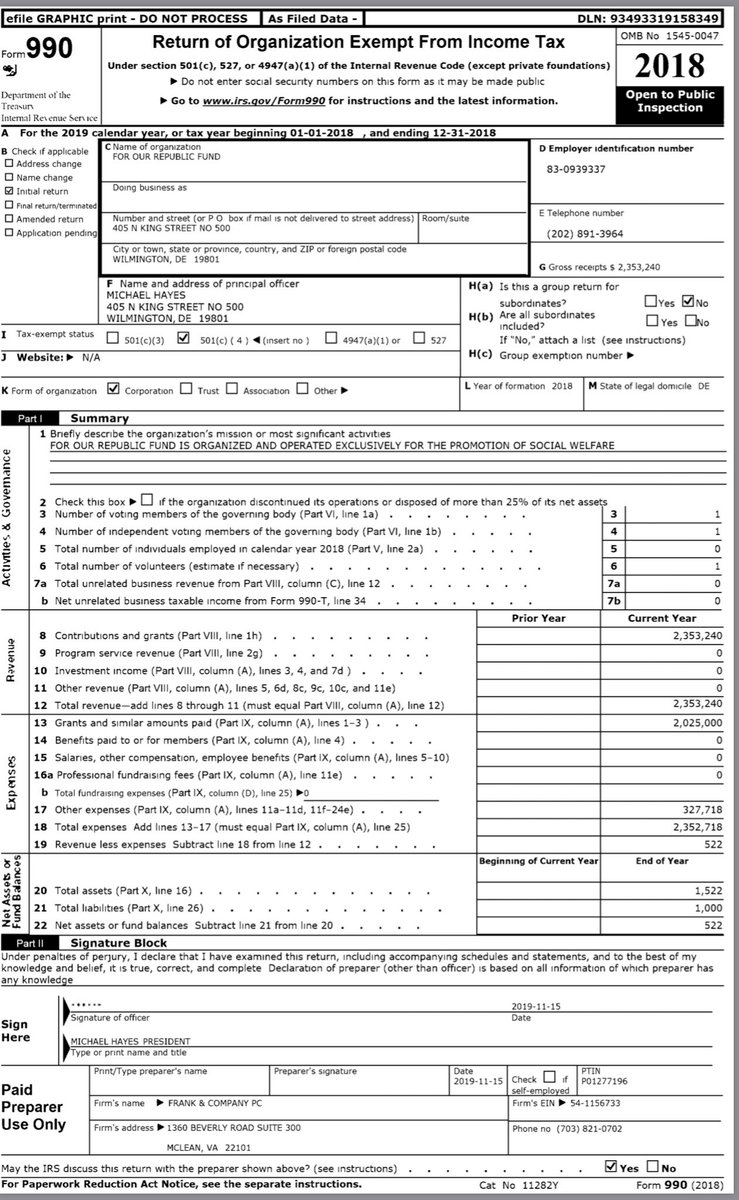

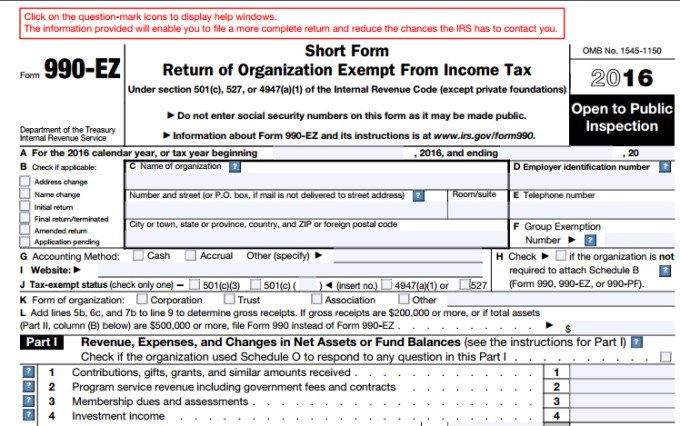

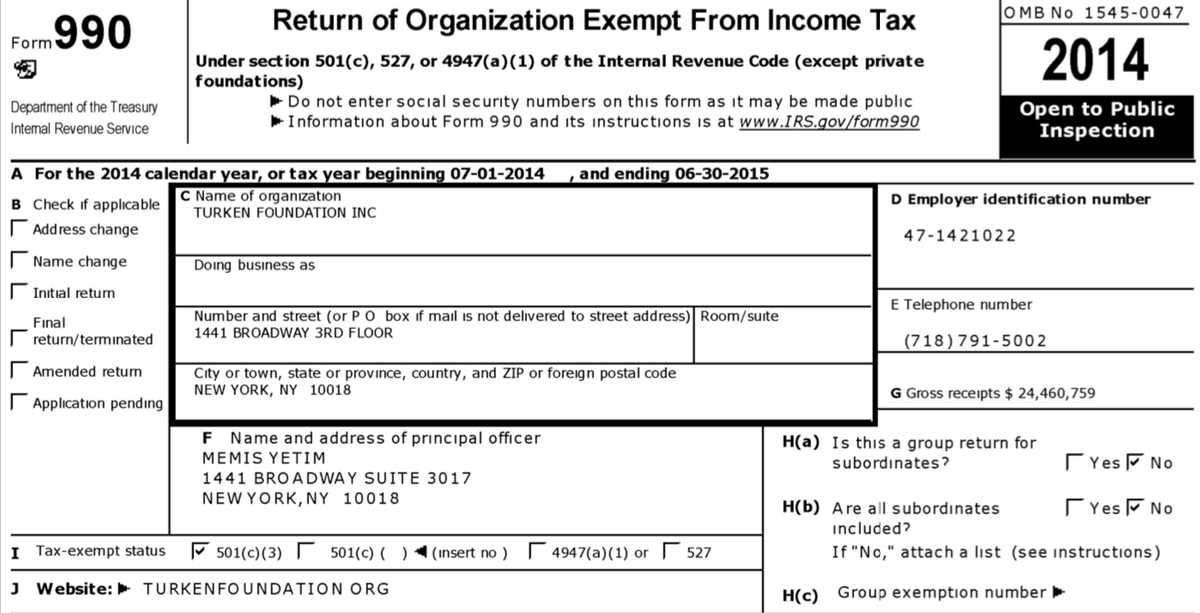

- File annual information returns (Form 990 series) with the IRS

- Keep detailed records of finances and activities

- Comply with public disclosure requirements

- Avoid engaging in activities that could jeopardize tax-exempt status

- Report any significant changes in organizational structure or activities to the IRS

Failure to meet these responsibilities can result in penalties or even the loss of tax-exempt status.

State-Level Tax Exemption: Additional Considerations

While federal tax-exempt status is crucial, many nonprofit organizations also seek exemption from state taxes. The process for obtaining state-level tax exemption can vary significantly from one state to another.

How does state-level tax exemption differ from federal exemption?

State-level tax exemption often requires a separate application process, even if an organization has already obtained federal tax-exempt status. Some states may automatically recognize federal exemption, while others require a separate state-specific application. Additionally, the types of taxes from which an organization is exempt can vary by state, potentially including sales tax, property tax, and state income tax.

For example, in California, nonprofit organizations must apply separately to the Franchise Tax Board for state tax exemption. This process involves submitting either Form 3500 (Exemption Application) or Form 3500A (Submission of Exemption Request), depending on whether the organization already has federal tax-exempt status.

Common Challenges in Maintaining Nonprofit Status

While obtaining tax-exempt status is a significant milestone, maintaining it can present ongoing challenges for nonprofit organizations. Understanding these potential pitfalls can help organizations proactively address issues and ensure continued compliance.

What are some common issues that can jeopardize tax-exempt status?

Several factors can put an organization’s tax-exempt status at risk:

- Engaging in excessive unrelated business activities

- Failing to file required annual returns or notices

- Violating prohibitions on private inurement or private benefit

- Engaging in prohibited political activities

- Failing to maintain proper documentation of financial transactions and activities

Regular self-audits and consulting with tax professionals can help organizations identify and address potential issues before they become serious problems.

The Role of Transparency in Nonprofit Operations

Transparency is a crucial aspect of nonprofit operations, particularly for tax-exempt organizations. Not only is it required by law in many cases, but it also helps build trust with donors, volunteers, and the general public.

How can nonprofits ensure transparency in their operations?

To maintain transparency, nonprofit organizations should:

- Make financial statements and annual reports easily accessible to the public

- Clearly communicate the organization’s mission, goals, and achievements

- Provide detailed information about how donations are used

- Maintain open communication channels with stakeholders

- Comply with all legal requirements for public disclosure

By prioritizing transparency, nonprofits can demonstrate their commitment to ethical operations and build stronger relationships with their supporters.

Navigating IRS Audits and Examinations

Tax-exempt organizations are subject to IRS audits and examinations, just like for-profit entities. While the prospect of an audit can be daunting, understanding the process can help organizations prepare and respond effectively.

How should a nonprofit prepare for an IRS audit?

To prepare for a potential IRS audit, nonprofit organizations should:

- Maintain accurate and complete financial records

- Keep detailed documentation of all activities and programs

- Ensure all required filings are up-to-date and accurate

- Develop internal policies and procedures for financial management and compliance

- Consider conducting regular internal audits or reviews

- Seek professional advice if complex issues arise

By maintaining good records and staying prepared, organizations can approach an IRS audit with confidence and minimize potential disruptions to their operations.

The Future of Nonprofit Tax Exemption

As the nonprofit sector continues to evolve, so too does the landscape of tax exemption. Understanding current trends and potential future changes can help organizations prepare for what lies ahead.

What changes might we see in nonprofit tax exemption in the coming years?

Several factors could influence the future of nonprofit tax exemption:

- Increased scrutiny of nonprofit operations and finances

- Potential changes to tax laws affecting charitable giving

- Growing emphasis on impact measurement and reporting

- Evolving definitions of charitable purposes in response to societal changes

- Increased use of technology in nonprofit operations and compliance

While the core principles of nonprofit tax exemption are likely to remain stable, organizations should stay informed about potential changes and be prepared to adapt as necessary.

In conclusion, understanding and navigating the complexities of nonprofit tax exemption is crucial for organizations seeking to maximize their impact and ensure long-term sustainability. By staying informed, maintaining compliance, and prioritizing transparency, nonprofit organizations can continue to benefit from tax-exempt status while fulfilling their important missions in society.

Charities and nonprofits | FTB.ca.gov

If you have a charity or nonprofit, you may qualify for tax exemption. Tax-exempt status means your organization will not pay tax on certain nonprofit income.

Your organization must apply to get tax-exempt status from us.

Check your account status

Find out if your account with us is active or suspended:

- Entity Status Letter

- Revoked exempt organizations

We provide account status information for current exempt organizations. Account status information is updated weekly.

Apply for or reinstate your tax exemption

There are 2 ways to get tax-exempt status in California:

1. Exemption Application (Form 3500)

- Download the form

- Determine your exemption type, complete, print, and mail your application

Limited Liability Companies may become exempt if owned and operated by an exempt nonprofit and have proof of accepted Entity Classification Election (IRS Form 8832).

2. Submission of Exemption Request (Form 3500A)

If you have a federal determination letter:

- Download the form (If your status was revoked, you cannot use this form)

- Complete, print, and mail your request with your federal determination letter to:

- Exempt Organizations Unit MS F120

- Franchise Tax Board

PO Box 1286

Rancho Cordova CA 95741-1286

What happens after you apply

- We’ll review your information to verify if you qualify. It may take several months to process your application

- If we need more detailed information, we’ll contact you

- If approved, you’ll receive a grant letter

Rush request

Nonprofit organizations may qualify for rush processing in limited circumstances. A rush request can be submitted if you meet all of the following:

- You’re in good standing

- You want exemption under 23701d (501(c)(3))

- Have a pending and verifiable grant of $3,000 (or more) and required to be tax-exempt to receive the funds

Or

- You’re suspended and in legal action (court records must be provided)

Additional items that may be required when requesting a rush:

- Completion of the Exemption Application (FTB 3500) or Submission of Exemption Request (FTB 3500A)

- Fees:

- $40 if you are not suspended

- $56 if you’re suspended

- File any missing returns

- Pay any outstanding balances

- File the Statement of Information with the Secretary of State

- File with the Attorney General’s Office, Registry of Charitable Trusts, if applicable

Contact the Exempt Organizations Unit for information on how to submit a rush request.

Contact Us

This Google™ translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. Consult with a translator for official business.

The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. If you have any questions related to the information contained in the translation, refer to the English version.

We translate some pages on the FTB website into Spanish. These pages do not include the Google™ translation application. For a complete listing of the FTB’s official Spanish pages, visit La esta pagina en Espanol (Spanish home page).

For a complete listing of the FTB’s official Spanish pages, visit La esta pagina en Espanol (Spanish home page).

We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool.

Forms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google™ translation application tool. For forms and publications, visit the Forms and Publications search tool.

Choose your language

Maintain Non Profit Organizations

-

How to apply for a Missouri Sales/Use Tax Exemption Letter -

Important things to remember when completing the application -

Proper use of an exemption letter -

What can I do if the seller will not accept my exemption letter? -

Requesting an updated copy of my exemption letter -

Updating my exemption account -

Renewing an exemption letter

How to apply for a Missouri Sales/Use Tax Exemption Letter

Any social, civic, religious, political subdivision or educational organization can apply for a sales tax exemption by completing Form 1746, Missouri Sales Tax

Exemption Application. This form lists the information needed to verify the organization is indeed a tax-exempt non-profit organization.

This form lists the information needed to verify the organization is indeed a tax-exempt non-profit organization.

Important things to remember when completing the application

Description of Organization

Summarize the primary organizational purpose in one or two brief statements. List the main activities of the organization or agency. You must include a description of how the exemption letter will

be used, if issued.

Signature

The application must be signed by a listed officer in Section Eight of the application.

Obtaining a 501 (c) exemption

A 501(c) is an Internal Revenue Service (IRS) exemption, if you have not received an exemption letter from the IRS, you can obtain Form 1023, Application for Recognition of Exemption, by visiting

their web site at http://www.irs.gov/ or call 877-829-5500. Obtaining a 501 (C) does not guarantee that the organization is exempt for Missouri sales tax

Obtaining a 501 (C) does not guarantee that the organization is exempt for Missouri sales tax

purposes, but it does assist the Department in making a determination that the organization qualifies under Missouri statute.

Bylaws

By-laws are the rules or law governing internal affairs of a group or organization. The bylaws should also address what happens to the assets of the organization if it dissolves.

Articles of incorporation

Articles of incorporation detail how the corporation will be operated and its purpose. The articles should also detail how the assets are distributed upon dissolution. You can obtain more

information here.

Charter number or certificate of incorporation

This is a number issued by the Missouri Secretary of State’s office when a corporation has registered with their office to do business in Missouri as a non-profit corporation.

The financial statement (am I required to have one for three years?)

A financial statement should provide the sources/amounts of income and a breakdown of the expenses of the organization for the past three years.

A three year financial statement is determined by the date of incorporation and/or the date the 501(c) exemption is issued.

The financial statement can be in the form of a spreadsheet, ledger book or you may submit copies of the 990 return (must include all pages). If the schedules are not provided we may write back for

a better financial statement that provides this detailed information, which may delay your application.

We do not accept bank statements.

Do not use abbreviations or if you do please provide an explanation of what they stand for.

If the organization has just started (less than 6 months old) a projected budget for one year should be provided. The projected budget must include projected sources/amounts of income and projected

The projected budget must include projected sources/amounts of income and projected

expenses for one year.

Proper use of an exemption letter

Exemption letters are limited exemptions issued to various types of organizations that are exempt under the statute. The organization’s use of the letter depends on the type of organization and

what is permitted by statute.

Exemption letters issued to religious and charitable organizations can be used for their religious, charitable, and educational functions and activities. Civic, social, service, and fraternal

organizations may use the exemption letters in their civic and charitable functions and activities. These organizations are exempt from sales and purchases, as long as those sales or

purchases are for their exempt functions and activities.

The Missouri Sales/Use Tax Exemption Letter cannot be used for personal purchases. This includes:

This includes:

- Personal hotel rooms;

- Meals; and

- Other personal items purchased for individual use.

The exemption is only an exemption for sales and use tax purposes. It is not an exemption for excise taxes or other fees and does not document that the organization is exempt from personal property

tax. The exemption letter is not assignable or transferable and is only good for the organization whose name appears on the letter.

The exemption letter may not be used to engage in a competitive commercial business that serves the general public, even if the profits are used for your exempt charitable, religious and

educational functions. This type of activity requires a Missouri Retail Sales Tax License.

What can I do if the seller will not accept my exemption letter?

The seller is under no obligation to accept a claim of exemption. The seller can be held liable if he/she accepts an exemption that is not in “good faith”. If the vendor does not want to accept

The seller can be held liable if he/she accepts an exemption that is not in “good faith”. If the vendor does not want to accept

your exemption you must pay tax on the purchase or choose another vendor.

Requesting an updated copy of my exemption letter

The seller is required to update their records every five years. To obtain a new copy of your exemption letter you can contact us by phone at 573-751-2836, fax 573-522-1271, email [email protected] or mail your request to: Missouri Department of Revenue, PO Box 358, Jefferson City, MO 65105. Please make sure you provide

your Missouri Tax ID Number on all correspondence submitted to the Department.

Updating my exemption account

To update the account a Missouri Tax Registration Change Request, Form 126 can be completed and submitted. The organization can also send a letter providing the updated

information to: Missouri Department of Revenue, PO Box 358, Jefferson City, MO 65105 or fax it to 573-522-1271. Please make sure you indicate your Missouri Tax ID Number when corresponding. It is

Please make sure you indicate your Missouri Tax ID Number when corresponding. It is

important that the account be kept up to date since we can only provide confidential tax information to those individuals listed on the Missouri Tax Account.

Expired exemption letter

If your exemption letter has expired, the organization must complete a Missouri Sales and Use Tax Exemption Application, Form 1746 and provide the attachments listed

on the application.

DNT IRS, Grozny (TIN 2014261662), details, extract from the Unified State Register of Legal Entities, address, mail, website, telephone, financial indicators

Refresh browser

Refresh browser

Possibilities

Integration

About the system

Statistics

Contacts

CfDJ8KhhAkvpk5VPj2mnJQbPpPH_3WbAGvVs8Dz2q1oz9nQmwCZtH5tFtCiBMdy3u6alxeruhASkQgmwPHLCjGQVYNJodALT9VPs6NxvlPh09qjyhrj4RWhWly3n-ZUz9iNDG q3h2rstyXh9b1Dt-J4ZxnA

Description of the search engine

search encyclopedia

TIN

OGRN

Sanction lists

Company search

Head of the organization

Court cases

Affiliation Check

Execution proceedings

Organization details

Information about the beneficiaries

Organization’s current account

Credit risk assessment

Unreliable companies

Checking the blocking of the current account

Number of employees

Authorized capital of the organization

Bankruptcy check

Date of registration

Checking the counterparty by TIN

checkpoint

OKPO

Tenders and public procurement

Customer search (B2B)

Legal address

Analysis of the financial condition

Organization founders

Financial statements

OKTMO

OKVED

Company Comparison

Trademark Check

License check

Extract from the Unified State Register of Legal Entities

Competitor analysis

Organization website

OKOPF

Registration Information

OKFS

Branches and representative offices

OKOGU

OKATO

Register of dishonest suppliers

Company rating

Check yourself and the counterparty

due diligence

Banking licenses

Scoring of counterparties

Alcohol licenses

Media monitoring

Signs of economic activity

Reputational risks

Compliance

Requisites

Full name of the organization

COUNTRY NON-COMMERCIAL COMPANY “IRS”

English name

DNT “IRS”

Address

Chechen rep. , Grozny, st. Petropavlovskoe Shosse, 16

, Grozny, st. Petropavlovskoe Shosse, 16

OKFS

Private property

OKOPF

Horticultural, horticultural or dacha non-profit partnerships

OKOGU

Organizations established legal entities or citizens, or legal entities and citizens jointly

TIN

2014261662

PSRN

1082031006496

KPP

201401001

9 0002 OKATO

Chechen Republic, Grozny, Akhmatovsky

OKPO

87459454

OKTMO

Chechen Republic, Urban districts of the Chechen Republic, Grozny

Phone

No information

Website

No information

Information about the company

Head

Size of the enterprise

Number of employees

Branches

Data without updates available in the SPARK system.

For up-to-date data – .

Information on state registration

Date of registration

December 22, 2008

Registration authority

Federal Tax Service of Russia for the Chechen Republic

Address of the registration authority

364021, Grozny, Subbotnikov st. 03

Activities

Main type of activity according to OKVED

94.99

Activities of other public organizations and non-profit organizations, except for religious and political organizations

Additional activities

01.11.1

Cultivation of grain crops

01.11.2

Cultivation of leguminous crops

01.13.1

900 02 Growing vegetables

01.25.1

Growing other fruit and berry crops

Description

Company DNT IRS, address: Chechen Republic, Grozny, st. Petropavlovskoe Shosse, 16 was registered on 12/22/2008. The organization was assigned TIN 2014261662, OGRN 1082031006496, KPP 201401001. The main activity is the activities of other public organizations and non-profit organizations, except for religious and political organizations, in total 5 types of activities are registered according to OKVED. There are no connections with other companies.

The main activity is the activities of other public organizations and non-profit organizations, except for religious and political organizations, in total 5 types of activities are registered according to OKVED. There are no connections with other companies.

chairman – Magamadova Raisa Movladievna.

DNT IRS did not participate in tenders. 1 enforcement proceedings were initiated against the company. DNT IRS participated in 1 arbitration case: in 1 as a plaintiff

Details of DNT IRS, legal address, official website and extract from the Unified State Register of Legal Entities are available in the SPARK system (demo access is free).

Company status

Ready reports DNT IRS

SPARK-Risks

One-page report with the most important information from SPARK

299₽

- Company registration data

- Manager and main owners

- Contact information

- Risk factors

- Signs of economic activity

- Key financial indicators in dynamics

- Check according to the registers of the Federal Tax Service

Buy

ExampleSPARK-Profile

Full information report

from SPARK999₽

Change monitoring enabled for year

- Company registration data

- History of changes in managers, names, addresses

- Full list of addresses, phone numbers, websites

- Data on co-owners from various sources

- Related companies

- Activity details

- Financial statements for several years

- Financial assessment

Buy

ExampleIs this your competitor?

Are you a member of this company?

for free

- Your counterparty, being a member of SPARK REGISTER, can send you a link to receive a free report from SPARK

- A representative of your company has the ability to view full information about the company contained in SPARK

- Becoming a SPARK REGISTER member, you can add information about your company

More

SPARK-Risks for 1C

Reliability assessment

and counterparty monitoring

Application for demo access

Applications with corporate emails are processed faster.

Logging into the system will be possible only from the IP address from which the application was submitted.

Company

Telephone

We will send a confirmation code

Email mail

We will send a link to enter

By clicking the button, you agree to the terms of use and processing of personal data

The State of the Art in Nonprofit Transparency 2008

GuideStar (“Guidestar”) is a nonprofit organization founded in the United States in 1994. GuideStar’s mission is to revolutionize the practice of philanthropic and nonprofit organizations through disclosure that ensures transparency, empowers information users make better decisions and encourage charitable giving.

GuideStar/UK was established in 2003 and GuideStar International in 2004 with projects in Germany, Hungary, Ireland, the Netherlands, Belgium, as well as India, Israel, South Africa and South Korea.

GuideStar builds and maintains a database of non-profit organizations (more than 1.7 million NPOs in the US, more than 169,000 NPOs in the UK), helps donors choose the best option for charitable activities, and conducts research on the non-profit sector. GuideStar is a trusted source of information for most philanthropic institutions, corporations, private donors, government agencies, the research community, and the media.

Below are some of the results of the 2008 US Nonprofit Transparency Survey conducted by Hydestar.

Translated by Evolution&Philanthropy.

Key Points

Insights

First, the good news:

· A high percentage (93 percent) of non-profit organizations use the Internet to post information about their programs and services. Also, nearly three-quarters of organizations list the names of people who serve on governing bodies and key people who manage organizations and oversee programs and services.

Now for the other facts:

· A total of 43 percent of the non-profit organizations surveyed had annual reports posted on their websites. Higher-income organizations were more likely to make their annual reports available on the World Wide Web.

Higher-income organizations were more likely to make their annual reports available on the World Wide Web.

· Only 13 percent posted audited financial statements on their websites. The results of our research showed a reluctance to openly publish audited financial indicators. While not all not-for-profit organizations conduct audits of financial statements, the study sample includes organizations of this size for which an audit is a reasonable and necessary tool for assessing the financial ability of management and the financial health of the organization.

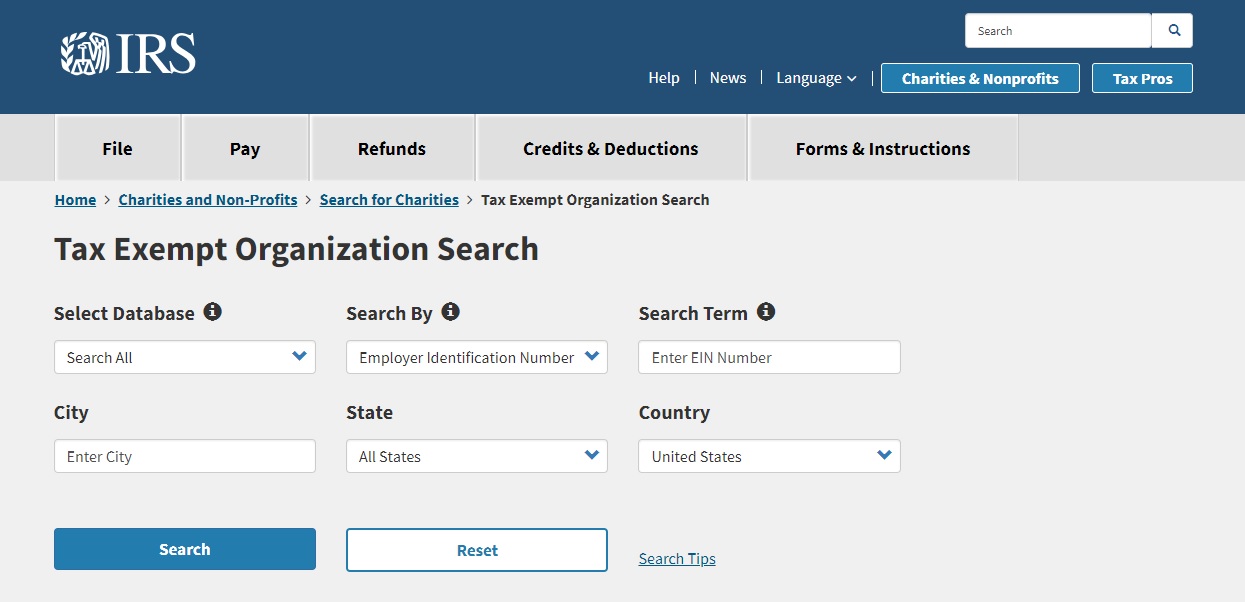

· Only 3 percent posted proper IRS[1] tax exemption notices on their websites. The results of our study showed a strong reluctance on the part of organizations to display this foundational tax-exempt status document, even though every tax-exempt organization is required to make its tax-exempt application, any supporting documentation, and any a letter or document issued by the IRS in response to this application.

GuideStar Recommendations

We recommend five simple steps that will go a long way in promoting nonprofit transparency.

· Not-for-profit organizations should regularly update their websites with current detailed information about programs and evaluations. Access to strategy information, evidence-based metrics, and a preference for theory of change will enhance the quality of programmatic information that is currently widely available on nonprofit websites. This information is the essence of social change and is decisive for involving new “investors” in good deeds – skilled users of the World Wide Web.

· In addition to the names and titles of board members and key employees, nonprofit organizations should post biographical information about these significant leaders. Biographies should describe the skills and contributions that these individuals provide to the organization; they are the people who make changes that affect the quality of life we live, work, act and express appreciation for.

· Each non-profit organization that prepares an annual report should post it on its website. Despite the fact that the law does not require it, for a non-profit organization, issuing an annual report is a big deal.

Despite the fact that the law does not require it, for a non-profit organization, issuing an annual report is a big deal.

· Every non-profit organization with audited financial results should post this information on its website. Although federal law does not require an audit of tax-exempt enterprises, and state audit requirements vary, disclosure of audit results is common practice for non-profit organizations that apply for grants from private foundations.

· Every non-profit organization that has an IRS tax exemption notice should post it on its website. The results of our study showed a strong reluctance on the part of organizations to show this foundational document confirming their tax-exempt status. As mentioned above, this notice is a public document. As well as disclosure of audit results, access to tax exemption notices is a common practice for non-profit organizations that apply for grants from private foundations.

The definition and importance of transparency in non-profit organizations

WHAT IS NPO transparency? Why should this be given attention?

Ann Florini, a renowned scholar at the Brookings Institution, defines transparency as “the release/publication of information relating to the evaluation of these institutions. ” Transparency is closely related to accountability, as the disclosure of relevant information allows institutions to be held accountable for their activities.

” Transparency is closely related to accountability, as the disclosure of relevant information allows institutions to be held accountable for their activities.

TRANSPARENCY: Release/publication of information relating to the assessment of…these institutions. /Anne Florini, Brookings Institution/

Today we hear calls for greater transparency in all areas of society. The public demands greater transparency from business in order to improve the regulation of financial markets. From the government, voters are asking for more transparency regarding contacts, appropriations and lobbying activities. In terms of education, parents, educators and government officials are pushing for more transparency about student achievement and teacher competence in schools. Once you’ve identified the problem, you’re more likely to find a need to share relevant information that allows people to assess whether the problem is being solved or worsened—in other words, it’s about greater transparency.

Thus, the need for more transparency is not unique. But they are also urgent. Non-profit organizations deal with the fulfillment of the social contract. Tax exemptions and, in many cases, the ability to receive donations that are tax deductible oblige non-profit organizations to be accountable to the public. Transparency about proper information is what allows non-profit organizations to demonstrate their accountability.

At the same time, non-profit organizations remain private institutions. Although the purpose of non-profit organizations is to serve the public, the private and voluntary nature of such organizations must be understood, valued and protected.

Transparency about the right information is what allows non-profits to demonstrate their…accountability. /GuideStar/

The GuideStar Exchange is open to all non-profit organizations seeking greater transparency. In exchange for posting new reports on GuideStar, we will provide additional access to GuideStar Premium, our most powerful and user-friendly search and reporting tool.