What is a 501(c)(3) nonprofit organization. How to apply for tax-exempt status with the IRS. What are the requirements for maintaining nonprofit status. What are the advantages and disadvantages of becoming a 501(c)(3).

Understanding 501(c)(3) Nonprofit Status

A 501(c)(3) is a type of corporation that receives tax-exempt status from the Internal Revenue Service (IRS). This designation allows organizations to operate without paying federal taxes on their revenues and income, provided they meet certain criteria and follow specific guidelines.

To obtain 501(c)(3) status, a corporation must file for a Recognition of Exemption with the IRS. While some services offer to handle this process for a fee, organizations can apply directly to the IRS for a $600 filing fee.

Key Aspects of 501(c)(3) Status

- Tax exemption on revenues and income

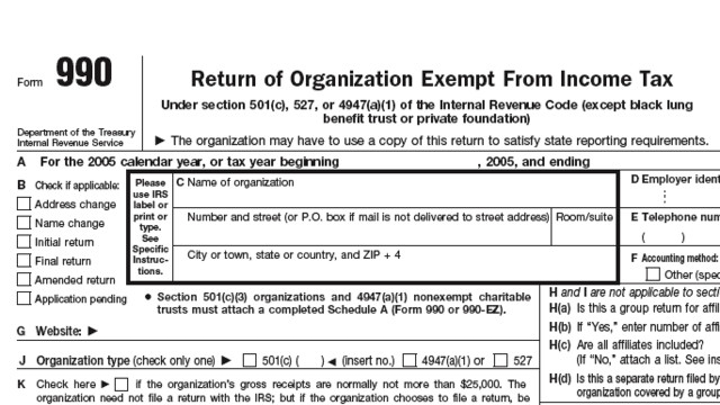

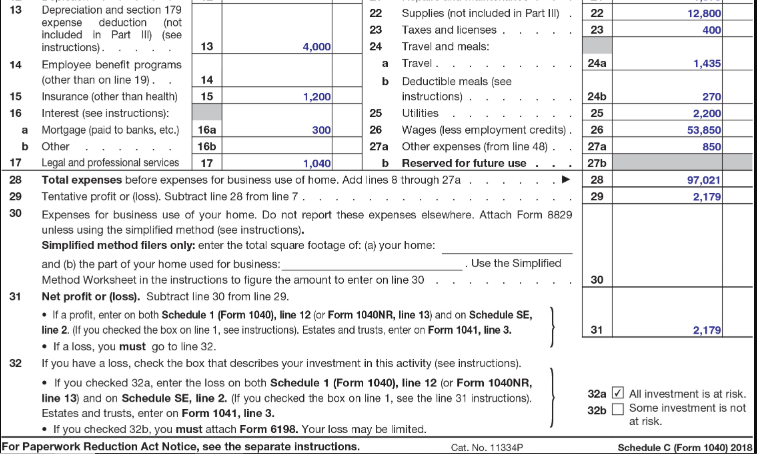

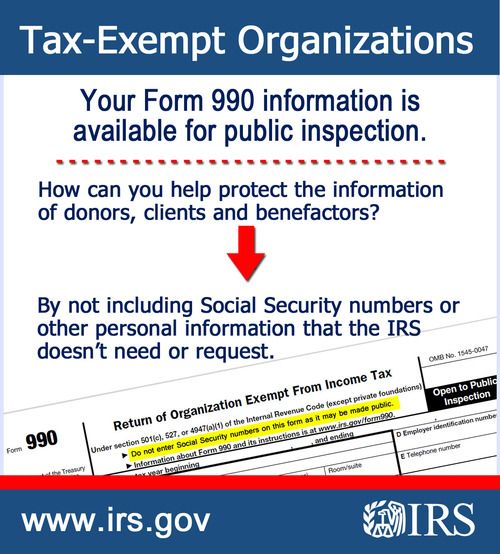

- Requirement to file annual tax returns (Form 990)

- Public scrutiny of financial data

- Obligation to operate for public benefit

Is 501(c)(3) status permanent? No, it’s not. Organizations must maintain compliance with IRS regulations and continue to operate in accordance with their exempt purpose to retain their tax-exempt status.

The Structure and Operation of 501(c)(3) Nonprofits

501(c)(3) organizations function similarly to other C corporations, with a few key differences. These entities must adhere to the organizational rules of their underlying business structure, whether it’s a corporation, trust, LLC, or unincorporated association.

Organizational Components

- Articles of incorporation

- Bylaws

- Board of directors

- Employees (optional)

Can 501(c)(3) organizations pay salaries? Yes, they can. Nonprofits are allowed to hire employees and compensate them with salaries and benefits. However, the IRS stipulates that these salaries must be “reasonable” and in line with the organization’s mission.

How does the IRS define a “reasonable salary” for nonprofit employees? The IRS doesn’t provide specific parameters, but it reviews compensation as part of the annual tax filing. If salaries appear inflated or inconsistent with the organization’s purpose, the IRS may investigate and potentially revoke the tax-exempt status.

Maintaining 501(c)(3) Nonprofit Status

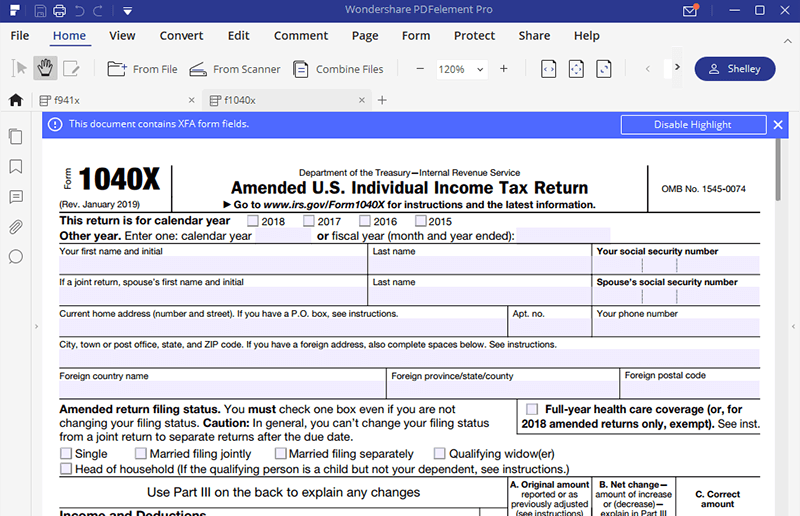

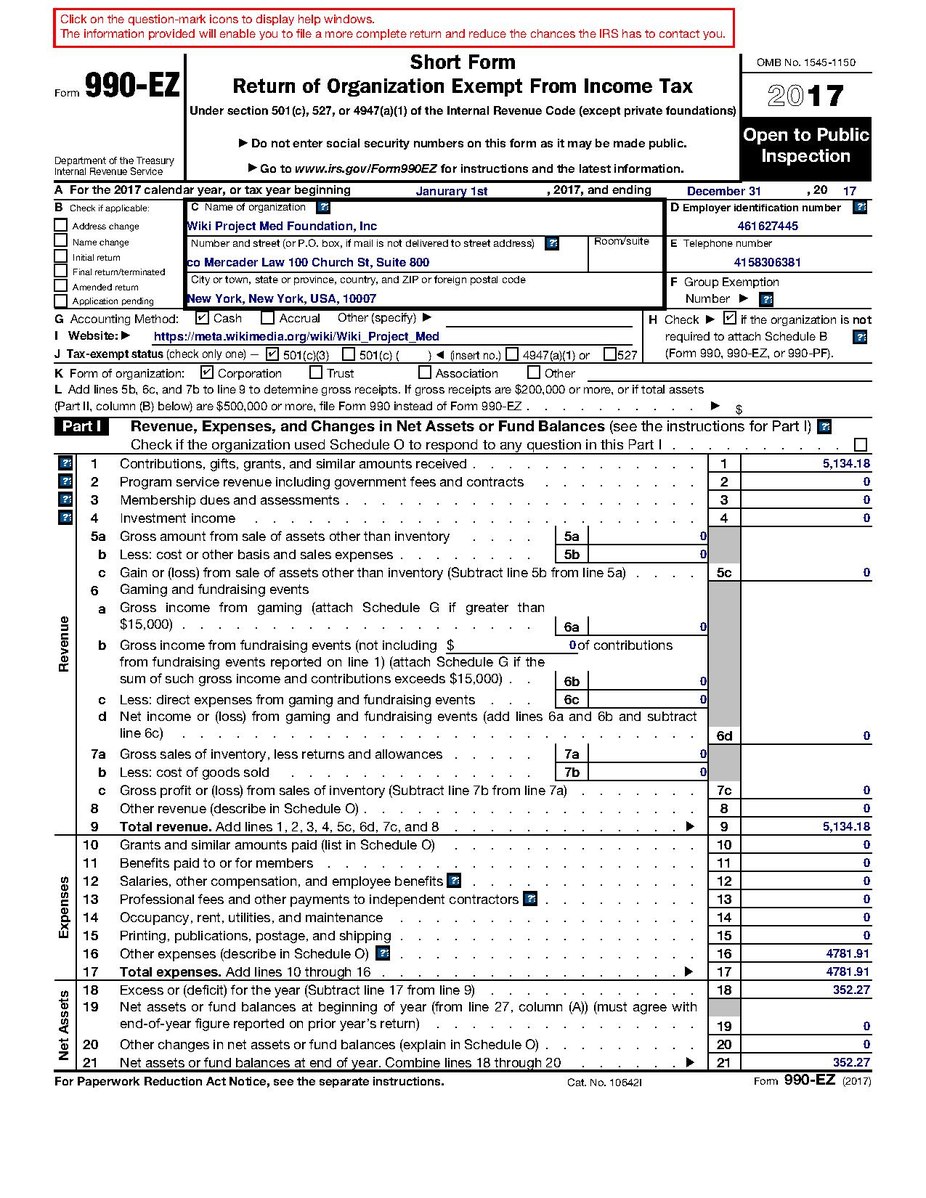

Retaining 501(c)(3) status requires ongoing compliance with IRS regulations and adherence to the organization’s stated exempt purpose. The primary obligation is the annual filing of Form 990, which provides a comprehensive overview of the organization’s activities, finances, and governance.

Form 990 Components

- Mission and volunteer details

- Revenue summary

- Expense summary

- Net asset summary

What activities should 501(c)(3) organizations avoid to maintain their status? To preserve their tax-exempt status, nonprofits should refrain from:

- Participating in political campaigns

- Engaging in substantial lobbying activities

- Operating in ways unrelated to their exempt mission

- Violating public policy

- Failing to file tax returns for three consecutive years

- Prioritizing private interests over public benefit

Are there limitations on unrelated business activities for 501(c)(3) organizations? Yes, nonprofits are only permitted to engage in minimal levels of unrelated business activities. These are revenue-generating activities not directly tied to fundraising efforts, such as renting out office space or selling merchandise.

Advantages of 501(c)(3) Nonprofit Status

Obtaining 501(c)(3) status offers several benefits to organizations dedicated to charitable, educational, religious, or scientific purposes. These advantages can significantly impact an organization’s ability to fulfill its mission and attract support.

Key Benefits

- Tax exemption

- Grant eligibility

- Formal organizational structure

- Enhanced credibility

- Potential for tax-deductible donations

How does tax exemption benefit 501(c)(3) organizations? The tax-exempt status allows nonprofits to allocate more resources towards fulfilling their goals, as they don’t have to pay federal taxes on their revenues and income. This can result in a significant increase in funds available for programs and services.

Why is grant eligibility important for nonprofits? Many public and private grants are exclusively available to registered 501(c)(3) organizations. This status opens up additional funding opportunities that can be crucial for sustaining and expanding nonprofit operations.

Disadvantages of 501(c)(3) Nonprofit Status

While the benefits of 501(c)(3) status are substantial, organizations should also be aware of potential drawbacks. These challenges can impact operational flexibility and require additional resources to manage.

Potential Drawbacks

- Increased paperwork and reporting requirements

- Restrictions on political activities

- Limitations on unrelated business income

- Public scrutiny of financial information

- Potential for IRS audits

How do reporting requirements affect 501(c)(3) organizations? Nonprofits must file annual tax returns (Form 990) and maintain detailed records of their activities and finances. This increased administrative burden can be challenging for smaller organizations with limited staff and resources.

Do restrictions on political activities limit a nonprofit’s advocacy efforts? While 501(c)(3) organizations are prohibited from participating in political campaigns, they can engage in limited lobbying activities related to their exempt purpose. However, these activities must not constitute a substantial part of the organization’s overall efforts.

The Application Process for 501(c)(3) Status

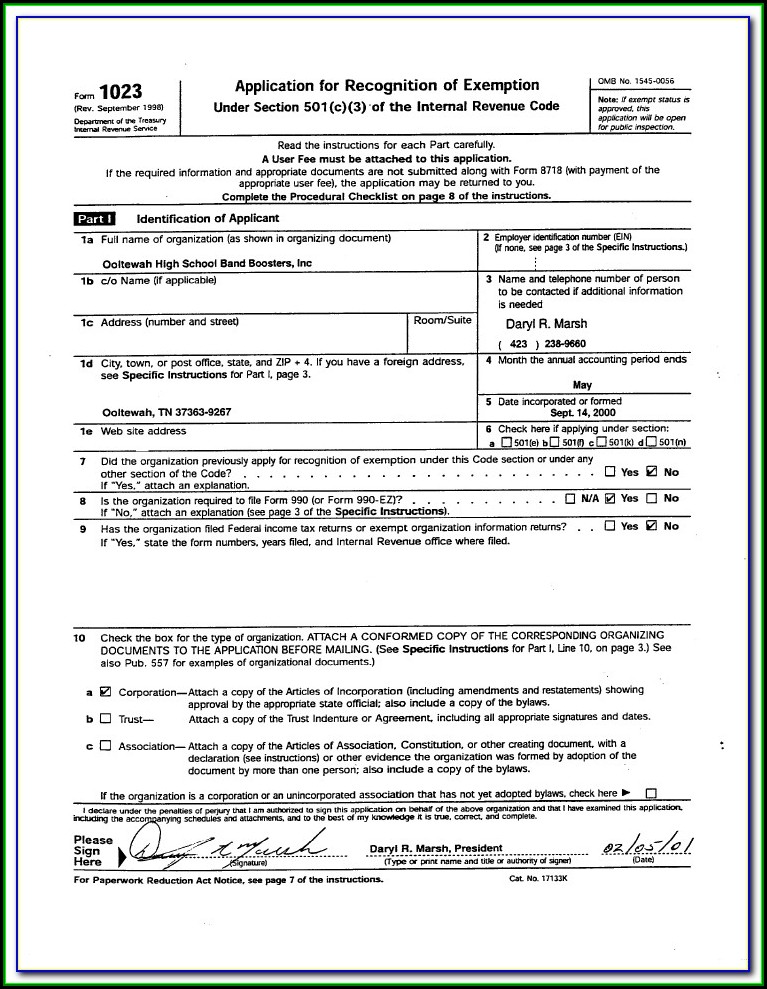

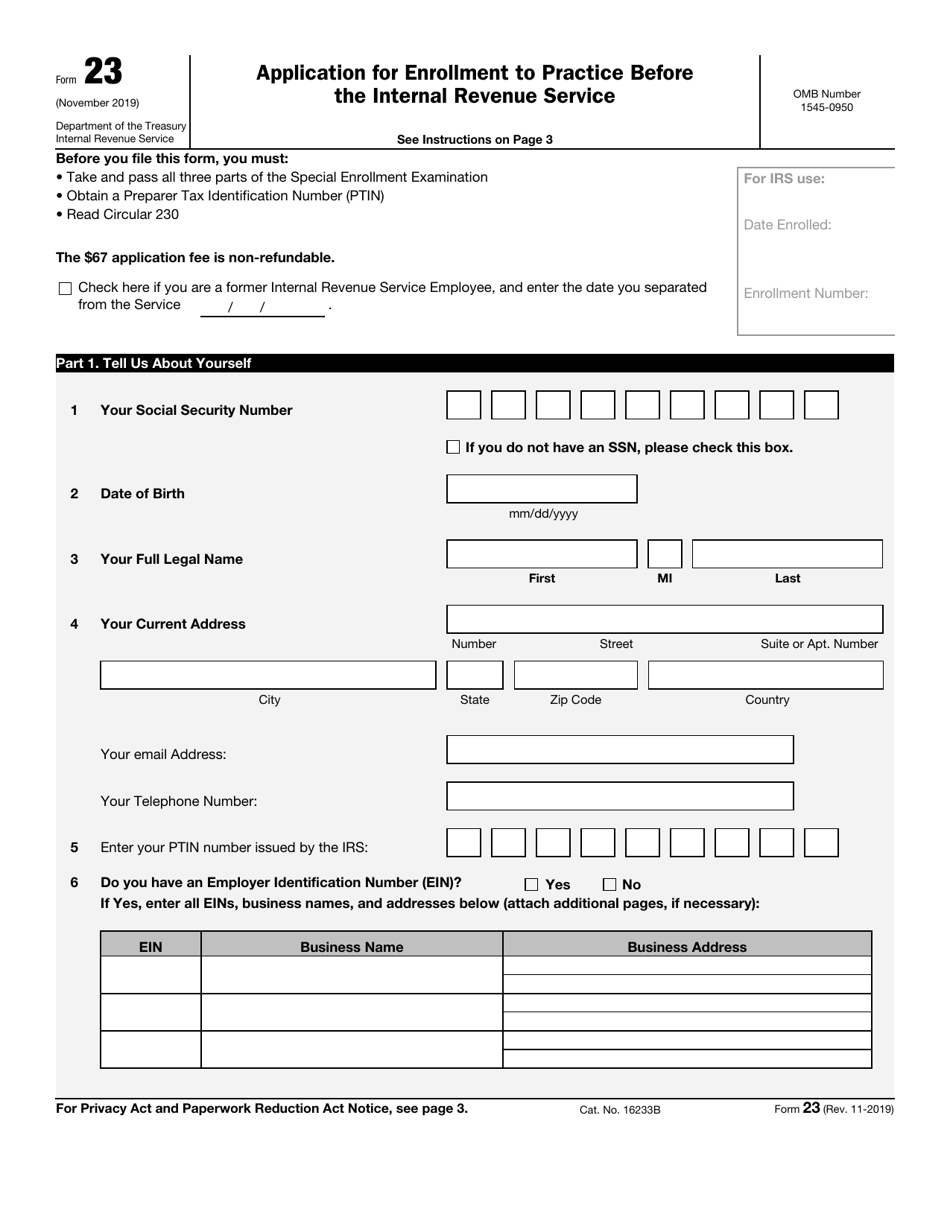

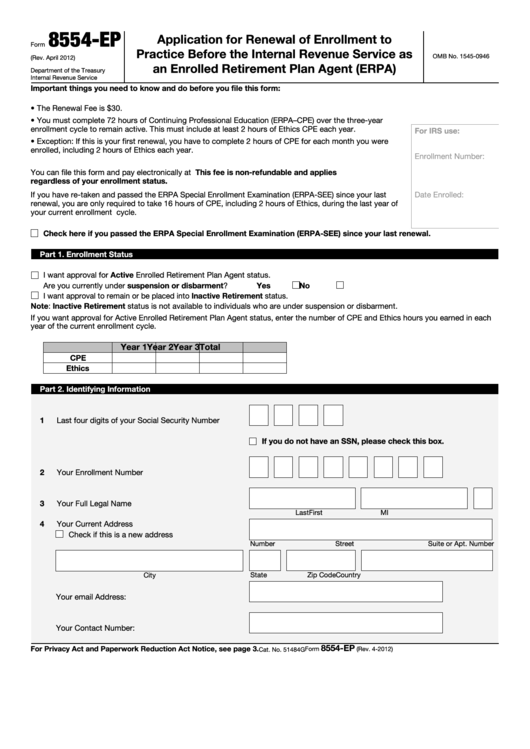

Obtaining 501(c)(3) status requires careful preparation and submission of the appropriate documentation to the IRS. Organizations must complete Form 1023 or Form 1023-EZ, depending on their size and anticipated annual gross receipts.

Steps to Apply for 501(c)(3) Status

- Incorporate the organization

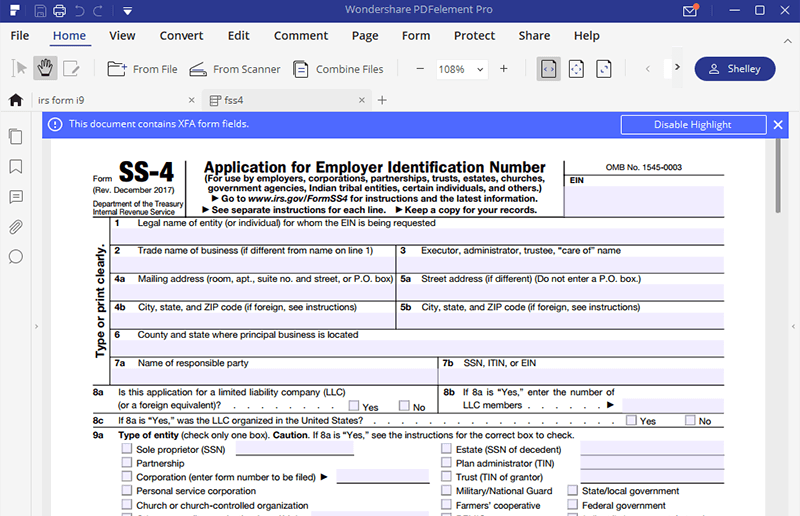

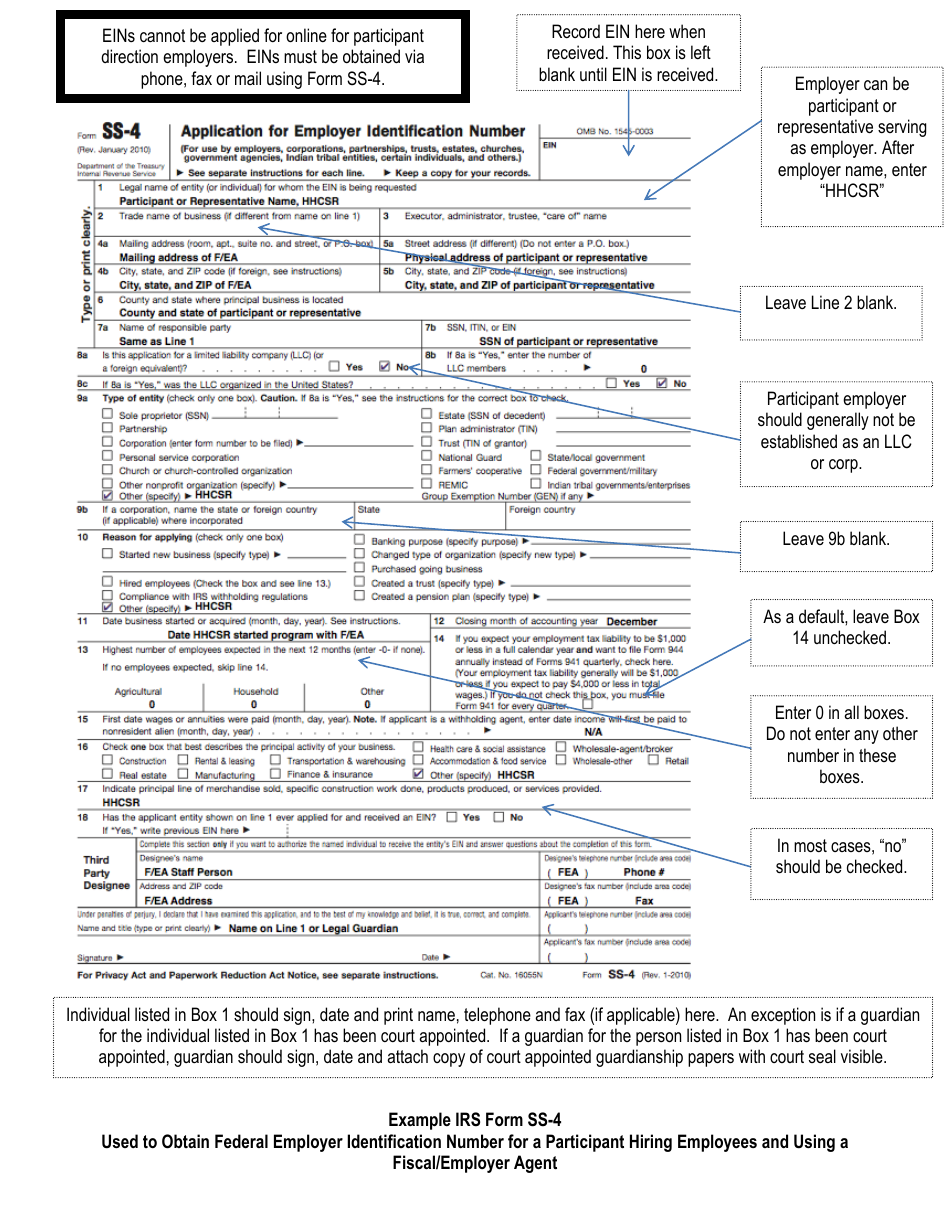

- Obtain an Employer Identification Number (EIN)

- Gather required documentation

- Complete Form 1023 or Form 1023-EZ

- Pay the filing fee

- Submit the application to the IRS

- Respond to any IRS inquiries or requests for additional information

What documents are needed to apply for 501(c)(3) status? Organizations typically need to provide:

- Articles of incorporation

- Bylaws

- Detailed description of activities and purposes

- Financial statements or projections

- List of officers, directors, and key employees

How long does it take to receive a decision on a 501(c)(3) application? The processing time can vary depending on the complexity of the application and the IRS workload. Generally, it takes between 3 to 6 months for the IRS to review and make a determination on a 501(c)(3) application.

Alternatives to 501(c)(3) Status

While 501(c)(3) status is the most common form of tax-exempt classification for charitable organizations, it’s not the only option available. Depending on an organization’s purpose and activities, other tax-exempt classifications may be more appropriate.

Other Tax-Exempt Classifications

- 501(c)(4) – Social welfare organizations

- 501(c)(5) – Labor unions and agricultural organizations

- 501(c)(6) – Business leagues and chambers of commerce

- 501(c)(7) – Social and recreational clubs

- 501(c)(8) – Fraternal beneficiary societies

How do these alternatives differ from 501(c)(3) status? While these organizations may also be tax-exempt, they often have different restrictions on activities and may not be eligible for the same benefits as 501(c)(3) organizations. For example, donations to 501(c)(4) organizations are typically not tax-deductible for donors.

Can an organization change its tax-exempt classification? Yes, it’s possible to change tax-exempt classifications, but it requires filing a new application with the IRS and potentially restructuring the organization’s activities to comply with the new classification’s requirements.

Best Practices for 501(c)(3) Organizations

To maintain compliance and maximize the benefits of 501(c)(3) status, organizations should adhere to best practices in governance, financial management, and program implementation. These practices not only help ensure continued tax-exempt status but also enhance the organization’s effectiveness and reputation.

Key Best Practices

- Maintain accurate and transparent financial records

- Develop and follow a conflict of interest policy

- Regularly review and update organizational bylaws

- Implement strong internal controls and financial oversight

- Conduct periodic program evaluations

- Engage in strategic planning

- Foster a culture of ethical behavior and accountability

Why is financial transparency important for 501(c)(3) organizations? Transparency builds trust with donors, grantmakers, and the public. It also helps demonstrate compliance with IRS regulations and can make the annual Form 990 filing process smoother.

How can nonprofits ensure effective governance? Establishing a diverse and engaged board of directors, implementing clear policies and procedures, and regularly assessing organizational performance are crucial steps in maintaining effective governance.

Common Challenges Faced by 501(c)(3) Organizations

While 501(c)(3) status offers numerous benefits, nonprofit organizations often face unique challenges in their operations and sustainability. Understanding these common issues can help organizations develop strategies to overcome them and thrive in their missions.

Frequently Encountered Challenges

- Fundraising and financial stability

- Volunteer recruitment and retention

- Mission drift

- Compliance with changing regulations

- Board development and succession planning

- Technology adoption and digital transformation

- Measuring and communicating impact

How can nonprofits address funding challenges? Diversifying revenue streams, developing strong donor relationships, and implementing effective grant management processes can help organizations maintain financial stability. Additionally, exploring innovative fundraising methods, such as crowdfunding or social enterprise models, may provide new avenues for support.

What strategies can help prevent mission drift? Regular strategic planning sessions, clear communication of organizational values, and ongoing program evaluation can help nonprofits stay focused on their core mission. Involving stakeholders in decision-making processes and maintaining a strong connection to the community served can also prevent unintended shifts in organizational focus.

The Future of 501(c)(3) Organizations

As the nonprofit sector continues to evolve, 501(c)(3) organizations must adapt to changing societal needs, technological advancements, and shifting donor expectations. Understanding emerging trends and preparing for future challenges can help nonprofits remain relevant and effective in their missions.

Emerging Trends and Considerations

- Increased focus on impact measurement and outcomes

- Growing importance of digital engagement and online fundraising

- Rise of social entrepreneurship and hybrid organizational models

- Emphasis on diversity, equity, and inclusion in nonprofit leadership

- Collaborative approaches to addressing complex social issues

- Adaptation to changing demographics and generational giving patterns

- Integration of artificial intelligence and data analytics in nonprofit operations

How can 501(c)(3) organizations prepare for the future? Nonprofits should invest in professional development for staff and board members, stay informed about sector trends, and remain flexible in their approaches to fulfilling their missions. Embracing technology, fostering innovation, and building strong partnerships can help organizations navigate an increasingly complex landscape.

What role will technology play in the future of 501(c)(3) organizations? Technology is likely to become increasingly integral to nonprofit operations, from streamlining administrative tasks to enhancing program delivery and donor engagement. Organizations that effectively leverage technology may find new opportunities for impact and efficiency in their work.

As the nonprofit sector continues to evolve, 501(c)(3) organizations must remain adaptable and committed to their core missions. By understanding the complexities of obtaining and maintaining tax-exempt status, embracing best practices, and preparing for future challenges, these organizations can continue to make significant contributions to society and drive positive change in their communities.

How To Obtain Nonprofit Status – Forbes Advisor

Updated: Apr 18, 2023, 1:24am

Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors’ opinions or evaluations.

Getty

A 501(c)(3) is a corporation that receives tax-exempt status from the Internal Revenue Service (IRS). To get the 501(c)(3) status, a corporation must file for a Recognition of Exemption. While there are services that will do this for you for an inflated fee, there is only a $600 fee when filing the application directly to the IRS. Here’s what you need to know about the 501(c)(3) application process, including instructions on how to complete the necessary forms.

What Does 501(c)(3) Status Mean?

The 501(c)(3) status means that the corporation is exempt from paying federal taxes on revenues and income generated in the organization. It does not exempt the organization from filing tax returns. You must still file Form 990 with the IRS to account for the income that comes into the organization.

Featured Partners

Advertisement

1

LegalZoom

Our ratings take into account a product’s cost, features, ease of use, customer service and other category-specific attributes. All ratings are determined solely by our editorial team.

1

LegalZoom

Our ratings take into account a product’s cost, features, ease of use, customer service and other category-specific attributes. All ratings are determined solely by our editorial team.

Learn More

On LegalZoom’s Website

2

ZenBusiness

Our ratings take into account a product’s cost, features, ease of use, customer service and other category-specific attributes. All ratings are determined solely by our editorial team.

2

ZenBusiness

Our ratings take into account a product’s cost, features, ease of use, customer service and other category-specific attributes. All ratings are determined solely by our editorial team.

Learn More

On ZenBusiness’ Website

3

Tailor Brands

3

Tailor Brands

Learn More

On Tailor Brand’s Website

How a 501(c)(3) Nonprofit Works

A 501(c)(3) works like most other C corporations. The main difference is that the financial data of a 501(c)(3) is subject to public review, whereas a private organization is able to maintain its books without this type of potential scrutiny.

The main difference is that the financial data of a 501(c)(3) is subject to public review, whereas a private organization is able to maintain its books without this type of potential scrutiny.

It’s important to remember that the nonprofit is fundamentally a corporation, trust, LLC or unincorporated association and must follow the organizational rules of the underlying business entity. For example, with a corporation, you’ll have articles of incorporation with bylaws that dictate how you run your organization. A board of directors is elected to oversee the company’s operations. The nonprofit can hire people and pay them a salary and benefits from revenues generated. Where the scrutiny comes is how much of the incoming revenues is paid toward fulfilling the mission of the organization.

While the IRS says that 501(c)(3) nonprofit organizations can pay employees a “reasonable salary,” it doesn’t give a definitive set of parameters. But if the IRS, in reviewing the annual tax filing, feels that the status is just a tax shelter for a profit organization paying inflated salaries, it could revoke the status.

What Is Required To Maintain Status

The primary thing that an organization needs to do to maintain its 501(c)(3) nonprofit status is to do the annual filing. This is done with Form 990 and any subsequent schedules accompanying the form. IRS Form 990 has four parts to the summary section. The first reviews details about the organization’s mission and volunteer base, the second summarizes revenues, the third summarizes expenses and the fourth summarizes net assets.

Aside from filing the annual tax forms, the organization should avoid engaging in activities that could jeopardize the tax-exempt status. Activities that should be avoided include:

- Participating in political campaigns at any level

- Lobbying as a substantial part of its regular activities

- Operating in a way unrelated to its exempt mission

- Violating public policy with activities

- Not filing a return for three consecutive years

- Not operating for the benefit of public interest

Additionally, a nonprofit is only allowed minimum levels of unrelated business activities. These are activities that generate revenues but aren’t directly related to fundraising efforts and include things like renting out office space or selling merchandise.

These are activities that generate revenues but aren’t directly related to fundraising efforts and include things like renting out office space or selling merchandise.

Advantages and Disadvantages of Nonprofit Status

As with anything, there are pros and cons to becoming a 501(c)(3) nonprofit.

The advantages of becoming a nonprofit include:

- Tax advantage: The tax exemption status allows nonprofits to put more money to the fulfillment of their goals.

- Grant eligibility: Many public and private grants won’t consider organizations that aren’t a registered 501(c)(3).

- Formal structure: Being a formal structure keeps founders and volunteers separate from the organization. This helps limit the liabilities of the organization away from founders, board of directors and volunteers unless someone used the organization to shield illegal or irresponsible actions.

The disadvantages of becoming a nonprofit include:

- Administrative work: Nonprofits require detailed records that must be kept along with annual filings to the IRS.

- Shared control: Most states require a 501(c)(3) nonprofit to have several members on the board who are responsible for electing officers who determine organizational policy.

- Public scrutiny: Because a nonprofit is dedicated to the public interest, it is subject to having its records and accounts reviewed by the public upon request. This includes salaries and expenditures.

How To Apply for 501(c)(3) Status

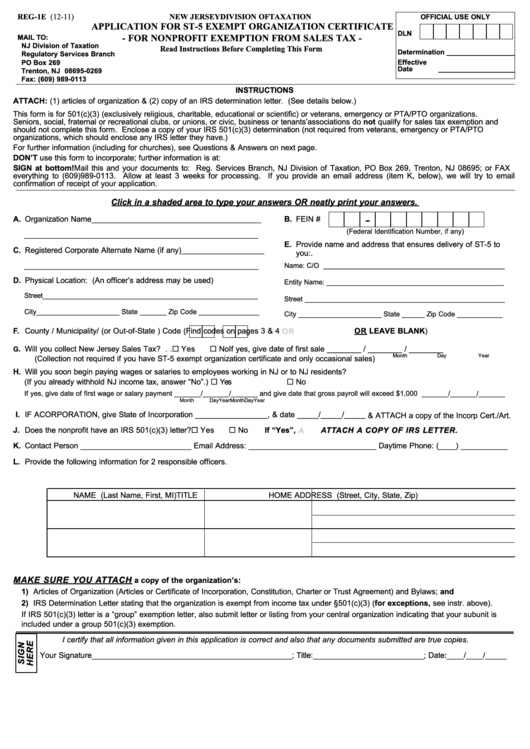

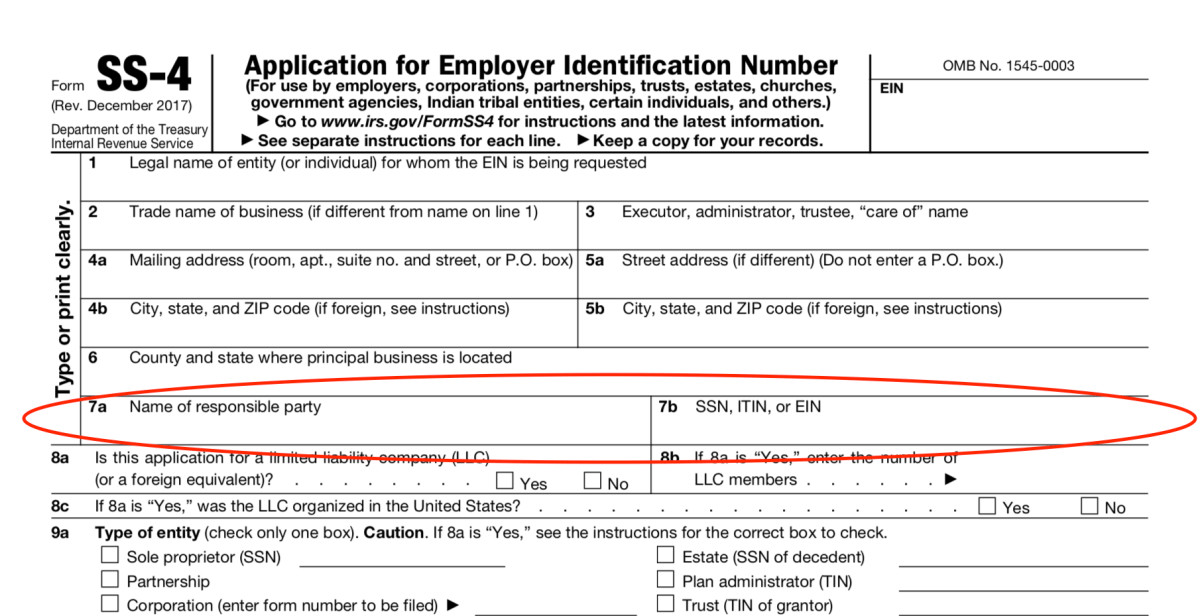

Before applying for 501(c)(3) status, an organization must complete organizational paperwork with the state, whether that is articles of incorporation, a trust or other organizational entity. The organization must then apply for an Employer Identification Number (EIN) with the IRS by completing Form SS-4.

Applications for nonprofit status must be submitted online to the IRS. If an organization is eligible to apply for nonprofit status with Form 1023-EZ, the process can take as little as four weeks. For those who must file Form 1023, the process could take up to six months or longer.

You may be eligible to file Form 1023-EZ if you meet the following requirements:

- Gross income under $50,000 for three prior years

- Estimate gross income under $50,000 for next three years

- Have less than $250,000 in fair market assets

- Formed in the U.S. with a domestic mailing address

- Organized as a corporation, unincorporated association or trust

- Cannot be a successor to a for-profit entity

Required Documentation and Infrastructure

With Form 1023, you’ll need to include other paperwork items. Failure to provide one or more of the items will lead to delays in processing your application or denial of 501(c)(3) status. It’s best to follow the checklist carefully.

The documentation you’ll send to the IRS includes:

- Form 1023 Checklist

- Application (Form 1023 with applicable Schedules A–H)

- Articles of Incorporation or other organizing documents

- Any amendments to organizing documents (in order of changes)

- Organization bylaws

- Other attachments, including financial data, printed materials and explanations

- Check for $600 fee made payable to the Department of the Treasury

Be sure that each document has the organization name and EIN on it.

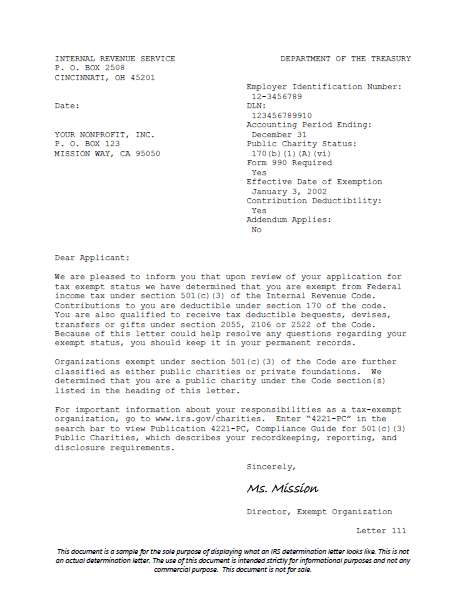

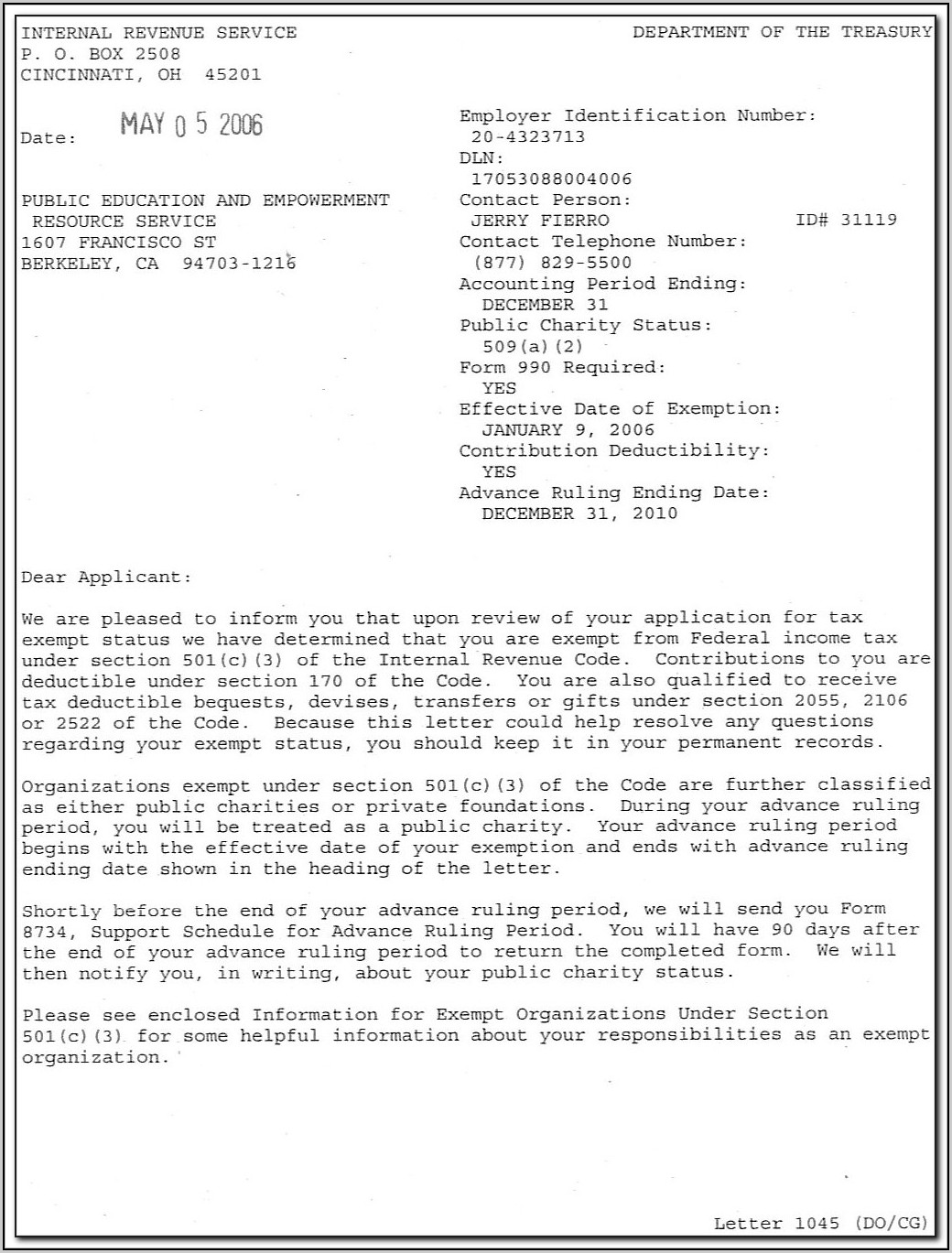

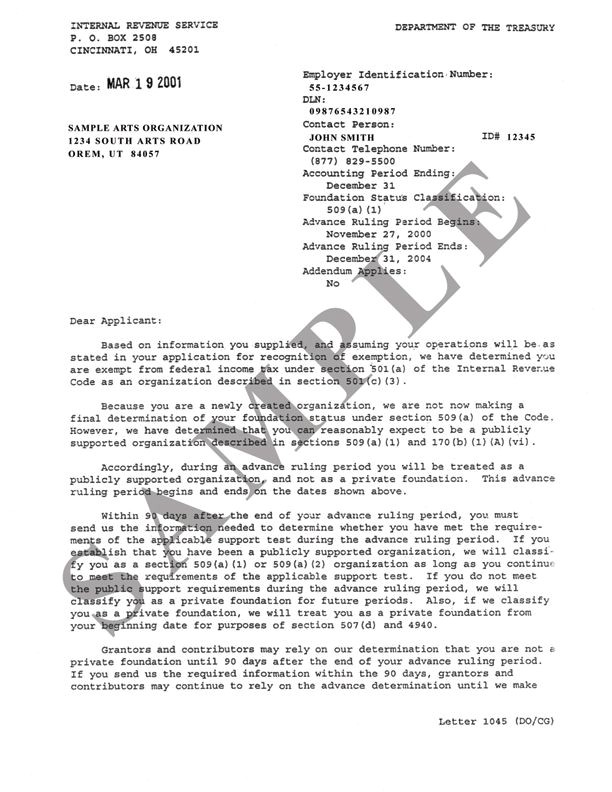

The IRS will send requests for information if it needs it. This will delay processing time, so it’s best to make sure the application is complete when first submitting. Once approved, the IRS sends a determination letter, which should be kept with the organization’s bylaws.

Featured Partners

Advertisement

1

LegalZoom

Our ratings take into account a product’s cost, features, ease of use, customer service and other category-specific attributes. All ratings are determined solely by our editorial team.

1

LegalZoom

Our ratings take into account a product’s cost, features, ease of use, customer service and other category-specific attributes. All ratings are determined solely by our editorial team.

Learn More

On LegalZoom’s Website

2

ZenBusiness

Our ratings take into account a product’s cost, features, ease of use, customer service and other category-specific attributes. All ratings are determined solely by our editorial team.

2

ZenBusiness

Our ratings take into account a product’s cost, features, ease of use, customer service and other category-specific attributes. All ratings are determined solely by our editorial team.

Learn More

On ZenBusiness’ Website

3

Tailor Brands

3

Tailor Brands

Learn More

On Tailor Brand’s Website

Submitting Your Completed Application

Once you have gathered all of the above documentation, you can create an account to submit your completed Form 1023 online at www.pay.gov and mail the supporting information to:

Internal Revenue Service

P.O. Box 12192

Covington, KY 41012-0192

If you’re in a rush you can use express mail or delivery service to send details to this address:

Internal Revenue Service

Mail Stop 31A: Team 105

7940 Kentucky Drive

Florence, KY 41042

Frequently Asked Questions

How do I check the status of my 501(c)(3) application?

Confirm receipt of application and status by calling the IRS at 877-829-5500. You’ll need to have the organization’s legal name and EIN. With that, the agent will be able to determine the status.

You’ll need to have the organization’s legal name and EIN. With that, the agent will be able to determine the status.

How Long Does It Take for a 501(c)(3) To Be Approved?

Once you submit an IRS Form 1023 or a Form 1023-EZ for federal tax exemption recognition, the IRS often takes weeks to months to send you a determination letter. However, if you have a compelling reason to request expedited processing and you filed IRS Form 1023, the IRS will often work with organizations for a quicker determination.

How long does a 501(c)(3) status last?

There is no expiration on your nonprofit status. As long as you continue to file the annual tax returns and don’t engage in activities to jeopardize your status, the 501(c)(3) designation remains indefinitely.

How much does it cost to set up a 501(c)(3)?

If you go through an attorney or CPA, it can cost several thousand dollars to establish your nonprofit. Most organizations are simple enough to set up the organization directly with the IRS for the $600 Form 1023 user fee.:max_bytes(150000):strip_icc()/Screenshot55-6fbd092750324b07977e11baa7d9be23.png)

What type of businesses qualify as 501(c)3 organizations?

According to the IRS, the exempt purposes outlined in section 501(c)(3) are charitable, religious, educational, scientific, literary, testing for public safety, fostering national or international amateur sports competition and preventing cruelty to children or animals. This includes operations like day care centers, food banks, theater groups, colleges, low-income housing organizations and museums.

Are there other types of nonprofit organizations that are tax-exempt?

There are several types of nonprofit organizations that are tax exempt. Some examples of these include 501(c)(4), which is for civic leagues and social welfare organizations; 501(c)(5), which is for labor, agricultural and horticultural organizations; 501(c)(7), which is for social and recreational clubs; 501(c)(14), which is for credit unions and other mutual financial organizations; and 501(c)(19), which is for veterans’ organizations.

Was this article helpful?

Rate this Article

★

★

★

★

★

Please rate the article

Please enter valid email address

Comments

We’d love to hear from you, please enter your comments.

Invalid email address

Thank You for your feedback!

Something went wrong. Please try again later.

More from

Information provided on Forbes Advisor is for educational purposes only. Your financial situation is unique and the products and services we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication. Past performance is not indicative of future results.

Forbes Advisor adheres to strict editorial integrity standards. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners.

Kimberlee Leonard has taken her professional experience as an insurance agency owner and financial advisor and translated that into a finance writing career that helps business owners and professionals succeed. Her work has appeared on Business.com, Business News Daily, FitSmallBusiness.com, CentsibleMoney.com, and Kin Insurance.

Jane Haskins practiced law for 20 years, representing small businesses in startup, dissolution, business transactions and litigation. She has written hundreds of articles on legal, intellectual property and tax issues affecting small businesses.

Cassie is a deputy editor, collaborating with teams around the world while living in the beautiful hills of Kentucky. She is passionate about economic development and is on the board of two non-profit organizations seeking to revitalize her former railroad town. Prior to joining the team at Forbes Advisor, Cassie was a Content Operations Manager and Copywriting Manager at Fit Small Business.

She is passionate about economic development and is on the board of two non-profit organizations seeking to revitalize her former railroad town. Prior to joining the team at Forbes Advisor, Cassie was a Content Operations Manager and Copywriting Manager at Fit Small Business.

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. This compensation comes from two main sources. First, we provide paid placements to advertisers to present their offers. The compensation we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market. Second, we also include links to advertisers’ offers in some of our articles; these “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. Here is a list of our partners who offer products that we have affiliate links for.

The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. Here is a list of our partners who offer products that we have affiliate links for.

Are you sure you want to rest your choices?

How to Obtain 501(c)(3) Tax-Exempt Status for Your Nonprofit

After you’ve incorporated, obtaining federal tax-exempt status is a critical step in forming a nonprofit organization. Most of the real benefits of being a nonprofit flow from your 501(c)(3) tax-exempt status, such as the tax-deductibility of donations, access to grant money, and income and property tax exemptions.

To apply for tax-exempt status, you must complete IRS Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code. Completing this form can be a daunting task because of the legal and tax technicalities you’ll need to understand. Here, we provide an overview of the form so you can familiarize yourself with the type of questions you’ll be asked to address.

When to File For 501(c)(3) Status

To get the most out of your tax-exempt status, you’ll want to file your Form 1023 within 27 months of the date you file your nonprofit articles of incorporation. If you file within this time period, your nonprofit’s tax exemption takes effect on the date you filed your articles of incorporation (and all donations received from the point of incorporation onward will be tax-deductible). If you file later than this and can’t show “reasonable cause” for your delay (that is, convince the IRS that your tardiness was understandable and excusable), your group’s tax-exempt status will begin as of the postmark date on its IRS Form 1023 application.

Form 1023-EZ: The Streamlined Application

Smaller nonprofits may be eligible to file Form 1023-EZ, Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code. This is a shorter, simpler application form that you complete online. Form 1023-EZ may only be filed by nonprofits with less than $50,000 in annual receipts and $250,000 in total assets. If you’re in the ballpark, complete the Form 1023-EZ Eligibility Worksheet contained in the Form 1023-EZ Instructions to determine if your nonprofit meets all the requirements for using the shorter streamlined form. If you are eligible to use it, this version of the form is much easier to complete and will take you much less time. The filing fee is also much smaller.

Form 1023: The Long Form Application

Now let’s take a look at Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code. Form 1023 is divided into 11 parts, and is covered in more detail below.

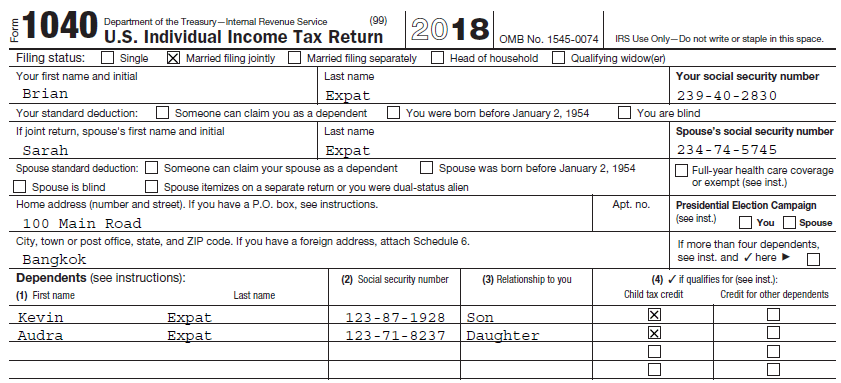

Identification of Applicant

This section tells the IRS about your organization. It asks for basic information like the name of your nonprofit corporation, contact information, and when you filed your articles of incorporation.

Your nonprofit must have a federal employer identification number (EIN) prior to applying for 501(c)(3) tax exemption, even if it doesn’t have employees. This can be done quickly and easily. Even if your organization held an EIN prior to incorporation, you must obtain a new one for the nonprofit corporate entity. For information on how to apply for an EIN, including information about applying online, visit the Employer ID Numbers page on the IRS website.

Organizational Structure

This section requires that you attach a copy of your articles of incorporation and your bylaws to the application form. Most nonprofits seeking 501(c)(3) status are corporations. If your entity is an LLC, unincorporated association, or nonprofit trust, you should seek the help of a lawyer with experience in nonprofit tax law to complete your Form 1023 application.

Required Provisions in Your Organizing Document

There are certain clauses that you must have in your articles of incorporation in order to get your 501(c)(3) exemption, including:

- a clause stating that your corporation was formed for a recognized 501(c)(3) tax-exempt purpose (charitable, religious, scientific, literary, and/or educational), and

- a clause stating that any assets of the nonprofit that remain after the entity dissolves will be distributed to another 501(c)(3) tax-exempt nonprofit — or to a federal, state, or local government for a public purpose.

In this section, you state where these clauses can be found in your articles (by page, article, and paragraph).

Narrative Description of Your Activities

Here you provide a detailed, narrative description of all of your organization’s activities — past, present, and future — in their order of importance (that is, in order of the amount of time and resources devoted to each activity). For each activity, explain in detail:

For each activity, explain in detail:

- the activity itself, how it furthers an exempt purpose of your organization, and the percentage of time your group will devote to it

- when it was begun (or, if it hasn’t yet begun, when it will begin)

- where and by whom it will be conducted, and

- how it will be funded (the financial information or projections you provide later in your application should be consistent with the funding methods or mechanisms you mention here).

Compensation and Financial Arrangements

The purpose of this section is to prevent people from creating and operating a nonprofit for the sole benefit of its founders, insiders, or major contributors. You’ll need to give information about all proposed compensation to, and financial arrangements with:

- initial directors

- initial officers (such as the president, chief executive officer, vice president, secretary, treasurer, chief financial officer, or any other officer in your organization)

- trustees

- the five top-paid employees who will earn more than $50,000 per year, and

- the five top-paid independent contractors who will earn more than $50,000 per year.

In computing the amount of compensation paid, include employer contributions made to employee benefit plans, 401(k)s, IRAs, expected bonus payments, and the like. You must also answer questions relating to possible conflicts of interest, which is an important part of the application.

Members and Others That Receive Benefits From the Nonprofit

If your nonprofit will provide goods or services as part of its exempt-purpose activities, you must report this on Form 1023. The IRS wants to ensure that your nonprofit is set up to provide goods and services to all members of the public — or at least a segment of the public that is not limited to particular individuals.

Your History

If your nonprofit is a “successor” to an incorporated or preexisting organization (such as an unincorporated association), the IRS wants to know this. Your nonprofit is most likely a successor organization if it has:

- taken over the activities of a prior organization

- taken over 25% or more of the assets of a preexisting nonprofit, or

- been legally converted from the previous association to a nonprofit.

Details on Your Specific Activities

This part asks about certain types of activities, such as political activity and fundraising, that the IRS scrutinizes closely. For example:

- 501(c)(3) nonprofit organizations may not participate in political campaigns (although some voter education drives and political debate activities are permitted).

- Certain types of fundraising are restricted, including bingo and gaming activities, fundraising for other nonprofits, or using a professional fundraiser.

Financial Data

All groups wishing to obtain 501(c)(3) exempt status must provide a statement of revenues and expenses and a balance sheet. An organization that has been in existence for five years or more must provide financial data for its most recent five years. Other groups must provide financial data for each year they have been in existence and good faith estimates for future years for a total of three or four years, depending on how long the organization has been in existence.

These revised financial data requirements relate to IRS rules that automatically classify all new 501(c)(3) groups as public charities as long as they can show in their Form 1023 that they reasonably expect to receive qualifying public support. If your nonprofit is a public charity, you will want to include all the information necessary to avoid misclassification as a private foundation.

Public Charity or Private Foundation

This section relates to your nonprofit’s classification as a public charity or private foundation. Public charities, which include churches, schools, hospitals, and a number of other groups, derive most of their support from the public or receive most of their revenue from activities related to tax-exempt purposes. Most groups want to be classified as a public charity because private foundations are subject to strict operating rules and regulations.

Under IRS regulations all new 501(c)(3) groups are automatically classified as public charities for the first five years as long as they demonstrate in their Form 1023 that they reasonably expect to receive qualifying public support. This way new groups applying for 501(c)(3) tax-exempt status need not seek an advance IRS ruling on their public charity status.

This way new groups applying for 501(c)(3) tax-exempt status need not seek an advance IRS ruling on their public charity status.

For the first five years, the group will maintain its public charity status regardless of how much public support it actually receives. After the initial five-year period, the IRS will start to monitor whether the group receives the public support necessary to qualify as a public charity.

Fee Information

You must pay a fee when you submit your Form 1023 application. Check the IRS website for the current user fee.

Additional Schedules

Certain types of nonprofits must attach an additional schedule to their Form 1023 application. Most of these schedules concern statutory public charities–nonprofits like churches and hospitals that are automatically classified as a public charity no matter how much public support they receive. Each schedule asks for additional information geared to the type of nonprofit. For example, Schedule A for churches asks a series of questions designed to show whether the organization really is a church for tax purposes, such as whether it has a creed or form of worship. These schedules include:

These schedules include:

- Schedule A: filed by churches

- Schedule B: filed by schools, colleges, and universities

- Schedule C: filed by hospitals and medical research organizations

- Schedule D: filed by supporting organizations

- Schedule E: filed by nonprofits over 27 months old

- Schedule F: filed by homes for the elderly or handicapped, or low-income housing

- Schedule G: filed by successors to other nonprofits.

After You File

After you submit your application, your will first receive an acknowledgment notice from the IRS, which simply states that the IRS has received your paperwork. If the IRS needs more information, they may assign your case to an Exempt Organization specialist, who may request further information.

If the IRS has all the information they need, they will send you a determination letter, which will do one of two things: grant your federal tax exemption, or issue a proposed adverse determination (a denial of tax exemption that becomes effective 30 days from the date of issuance). If you receive a proposed denial of tax-exempt status and you wish to appeal, see a lawyer immediately.

If you receive a proposed denial of tax-exempt status and you wish to appeal, see a lawyer immediately.

To check on the status of your application, first review the IRS page that lists the current wait times, available here. For more information on your application, you may call, fax, or mail the Exempt Organizations department of the IRS.

Additional Resource

For all the information you need to form a 501(c)(3) nonprofit, including line-by-line instructions on completing Form 1023 to get tax-exempt status, get How to Form a Nonprofit Corporation, by Anthony Mancuso (Nolo). You can also view the Interactive Form 1023 Presentation on the IRS website that includes helpful tips and links. Here, we provide an overview of the form so you can familiarize yourself with the type of questions you’ll be asked to address.

How political NGOs are being punished in the US

Tea Party activists rallied outside the Capitol on June 19, 2013 to express their dissatisfaction with IRS bias and rising bureaucracy / J. Applewhite / AP

Applewhite / AP

Recently, a scandal erupted in the US: Director Internal Revenue Service (IRS) Steven Miller was fired because his department put pressure on non-profit organizations (NPOs) that were considered opposition to the White House. The latter waited for tax-free status much longer than other organizations. They were checked with special care, requiring to provide lists of donors and other confidential information. However, no political motives were found in the actions of the tax authorities, they were condemned by both Democrats and Republicans.

Pre-emptive Maneuver

The thunder came on May 10, 2013, when senior IRS official Lois Lerner admitted at a conference of tax attorneys that the inspectors were too zealous in checking conservative organizations that usually support the Republican Party and on many issues take an even tougher than she, position. According to Lerner, the tax authorities proceeded from “unacceptable criteria”: they looked closely at groups whose names included the words “patriots”, “tea party” and “Project 9/12”.

Lerner stressed that the employees of the office in Cincinnati, who committed violations, acted at their own peril and risk, without instructions from above, and that malicious political intent should not be sought here. She apologized for the mistakes made on behalf of the entire department.

Lerner, who is in charge of the tax exemption of organizations at the IRS, planned her speech in advance: one of the conference participants asked a prepared question and received a prepared answer. Cincinnati violations) to assuage lawmakers’ anger with a “frank confession”. But a storm arose in Congress: Republicans and Democrats came out as a united front. Democrat Max Baucus, who chairs the Senate finance committee, described the incident as “an astounding and cynical use of public authorities” and volunteered to head a Senate investigation.

US President Barack Obama was quick to distance himself from the scandal, calling the actions of the IRS inappropriate and unforgivable. US Treasury Secretary Jack Lew fired Miller. Lerner was placed on administrative leave; It looks like she won’t be able to stay in office. US Attorney General Eric Holder ordered the FBI to investigate the incident. It is possible that criminal charges will be brought against the tax authorities.

US Treasury Secretary Jack Lew fired Miller. Lerner was placed on administrative leave; It looks like she won’t be able to stay in office. US Attorney General Eric Holder ordered the FBI to investigate the incident. It is possible that criminal charges will be brought against the tax authorities.

The Obama administration is forced to prove that before the 2012 elections it did not harass objectionable NGOs with the help of the tax service. The IRS leadership insists that ordinary employees who have shown inappropriate initiative on the ground are to blame for everything, and that the “tops” did not know what the “bottoms” were doing.

Going through the pain

IRS red tape complaints are nothing new to Congress. So, a year before Lerner’s recognition, Republican Tom McClintock, speaking in the House of Representatives, accused the tax authorities of obstructing the conservative parties from the Tea Party Movement and even persecuting some of its leaders, finding fault with their declarations and charging huge penalties.

The Tea Party (a reference to the Boston Tea Party, a protest by American colonists in 1773 that started the American Revolution and became one of the catalysts for the Revolutionary War) did a lot to win the Republican elections in the lower house of Congress in 2010. This is an amorphous association of people of different views (libertarians, populists, Mormons, nationalists), who are united by the rejection of the reforms carried out by the Democrats and the desire to return to “fundamental values”.

Although McClintock did not name the victims, Reuters was able to identify them. This is Ginny Rapini from North Carolina, who heads the NorCal Tea Party, and her husband. While they were seeking tax-free status for their NPO, the tax authorities came to check on them – and found that the couple “forgot” to pay $20,000 in taxes. The Rapinis have acknowledged a “mistake in financial calculations” but are still contesting the $43,000 fine. They believe there is a direct link between raising money for the NGO ($100,000 in 2012) and the IRS visit. Their organization filled out questionnaires twice and collected documents: the IRS found discrepancies in the answers. NorCal Tea Party went tax free three weeks after McClintock’s performance.

Their organization filled out questionnaires twice and collected documents: the IRS found discrepancies in the answers. NorCal Tea Party went tax free three weeks after McClintock’s performance.

Rapini’s case is far from unique. Additional checks on conservative NGOs included questionnaires with multiple bullet points and sub-questions, requests for meeting minutes and copies of training materials, donor identification, e-mail retellings, and more. filed a total of 23,000 pages of various documents, writes The Wall Street Journal. Some NGOs have been waiting for tax-free status for more than a year, and sometimes for about three years.

One pattern is found here (it was pointed out by the conservatives themselves). Large NGOs – seemingly the greatest threat to the Democrats as the party in power – won tax exemptions easily and simply. Small groups with small budgets (sort of “family” NGOs) waged a “trench war” with the IRS. “In all this harassment of conservative groups, it’s somehow overlooked that it’s mostly the little fish that have been hurt, not the big ones like FreedomWorks, Tea Party Patriots, or Americans for Prosperity,” said Don Wildman, president of SoCal Tax Revolt Coalition, a conservative organizations in South Carolina. According to the American Center for Law and Justice (it has provided assistance to 27 organizations), NPOs that collected as little as $3,000-4,000 a year became “victims of tax arbitrariness.”

According to the American Center for Law and Justice (it has provided assistance to 27 organizations), NPOs that collected as little as $3,000-4,000 a year became “victims of tax arbitrariness.”

Large organizations hire lawyers to help them with paperwork and application forms. Small ones fill them out themselves – and get confused in the testimony. The questions that the tax authorities were asked to answer can really be confusing: what do you pray about at meetings, what books do you read, what do you write about on Facebook, and which politicians do you personally know. “Our representative [in Congress] … worked as a veterinarian. He treated my dog. And what, should I write about him as a good friend? asks Reuters correspondent Toby Marie Walker, leader of the tiny Waco Tea Party.

Todd Maines, a tax specialist at Kirkland & Ellis law firm, is surprised that an organization as “fair and efficient” as he used to think of the IRS asks such outlandish questions (quoted by Reuters): “This is not the IRS that I remember. ” According to the Ministry of Finance, NGOs were forced to answer irrelevant questions in 58% of cases (in 98 out of 170 considered during the work on the report).

” According to the Ministry of Finance, NGOs were forced to answer irrelevant questions in 58% of cases (in 98 out of 170 considered during the work on the report).

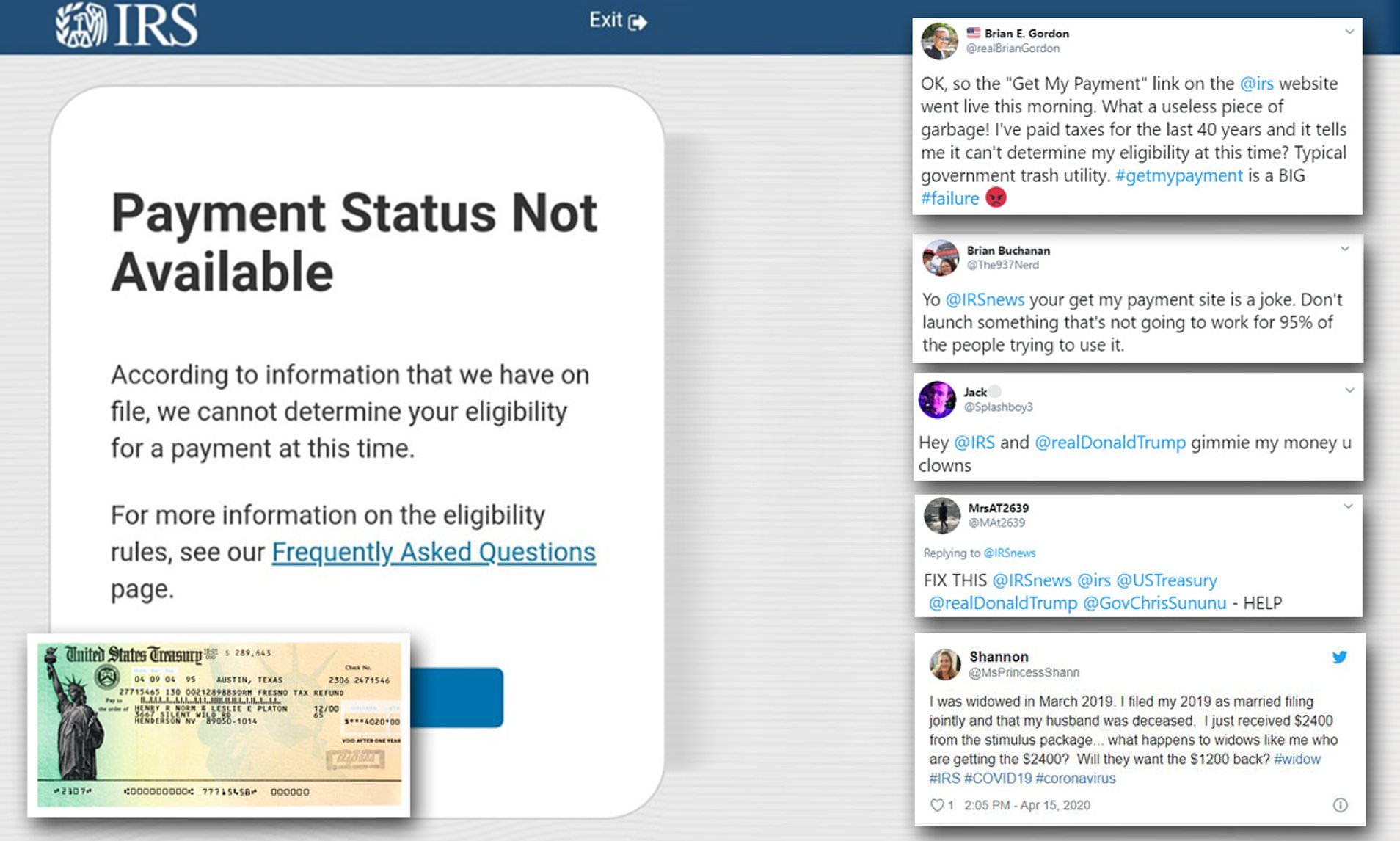

The IRS itself understands that everything is not all right with them: on the IRS website you can find an explanation of what is happening.

Tax Kitchen

The main perpetrator is the IRS office in Cincinnati (other offices in Baltimore and Washington are only occasionally mentioned in the media). The reason for this is simple: all applications for granting tax-free status are sent here. Experts in Cincinnati (there are less than 200 of them) annually study about 70,000 (!) applications. The workload is huge, there are not enough workers, there is a constant rotation of staff in the office, the process is often led not by permanent managers, but by “acting”. Responsible decisions are made on the spot, without proper control from management and without support from lawyers: they work in the capital’s office, and the correspondence stretches for weeks, or even months.

Despite a sharp increase in workload since 2010 (the IRS complains it has at least doubled), the budget has been severely cut. Hence the poor training of the staff and the gross mistakes made by them, starting from the methods of sorting applications and ending with questions in the questionnaires.

Unable to keep up with the sheer volume of work, the tax officials in Cincinnati resorted to a tried and tested trick: they began to group organizations by type in order to develop uniform criteria for each group. As Congress found out, the technique of “centralization” has been practiced in the IRS for a long time, both officially and unofficially. Tax officials make their lives easier by red-flagging organizations in excel spreadsheets that have come under suspicion or whose number is growing uncontrollably. “Putting individual cases together to see a trend is very helpful,” Bonnie Esrig, a longtime manager at the IRS, told The Wall Street Journal (WSJ) who only left in January 2013. Prior to that, she served in Cincinnati for a year and a half. – in the department that dealt with the consideration of applications from NGOs

Prior to that, she served in Cincinnati for a year and a half. – in the department that dealt with the consideration of applications from NGOs

Mid-2000s The IRS re-examined credit consulting groups: their activities were far from what they claimed to be. The tax authorities took into account the mistakes and tightened their approach to consultants, not allowing them to hide financial information. They read records of telephone conversations, studied forms of documents, and even listened in on telephone conversations with clients. Honest organizations felt innocently guilty, but the IRS was able to stop the violations. In 2006, NGOs were targeted, which, under the guise of gratuitous assistance to the population when buying houses, were engaged in the promotion of real estate on the market. A few years ago, Jewish charities were sympathetic to additional scrutiny: the IRS was in tandem with the FBI, which discovered that certain Brooklyn foundations were laundering money, and a rabbi was brokering the black market for organ donors.

In 2010-2012 Tax officials marked NPOs if their names contained the words “tea party”, “patriots” and “9/12”. As the IRS explains on its website, this is the usual “centralization” procedure, although the principle of merging is not entirely correct: it would be better to start “not from the name of the organization, but from the information contained in the application.” And these groups attracted attention simply because their number grew by leaps and bounds. Of the 300 organizations grouped for further scrutiny, 75 participated in the tea party movement, Lerner said, a whopping 25%.

The Treasury found out that those NPOs that indicated in policy documents that they were going to “make America better”, intend to study the US constitution, discuss the budgetary and tax policy of the White House, were also marked with a red flag.

True, out of 300 organizations, more than 175 received the go-ahead, and these are very often conservative groups: American Patriots Against Government Excess, Conserve Our Republic Dignity, Dallas Tea Party, etc. (the list can be found on the IRS website).

(the list can be found on the IRS website).

The Ministry of Finance did not find any “political bias” in the misconduct of the tax authorities. But he pointed to the incompetence of employees and the lack of control by management.

Law loopholes

The tax code describes 30 categories of non-profit organizations that can claim tax exemption. The Cincinnati office handled two categories – 501(c)(3) and 501(c)(4). By law, the former are required to file an application with the IRS, the latter do so on a voluntary basis. The former include various charitable and educational organizations that are prohibited from participating in political struggle (for example, the Red Cross). The second are organizations dealing with “social issues” and acting “for the good of society”, which can be engaged in politics, but just not put it at the forefront. They can lobby for the interests of certain groups, but they cannot directly support candidates in elections (examples are the conservative Crossroads Grassroots Policy Strategies, or Crossroads GPS, and the liberal Citizens for Strength and Security).

Here the tax authorities are stepping on shaky legal ground. The criteria are blurred, the line between permitted or prohibited political activity is extremely fluid. How to determine what outweighs in the activities of NGOs – politics or social activities? What is considered election campaigning and what is not? “The same $50,000 political ad may or may not be allowed, depending on the moment and which issue is at the center of the campaign,” Ellen Aprill, a professor at Loyola Law School in Los Angeles, told WSJ. Angeles. The IRS has created problems for itself by explaining that campaigning should not be the main activity, but in general it is not forbidden.

Many NPOs influence political life while enjoying a tax-exempt status and without disclosing the names of donors – this is another important advantage of section 501 (c) (4). It circumvents the law that requires political parties to report sources of funding. You can declare that the purpose of “activities is to protect the public interest” and not “pre-election campaign” and get out of the control of the Federal Election Commission: the IRS is much more comfortable, since it is not physically able to follow everyone.

Whereas in 2010 there were 1,500 501(c)(4) applications filed with the IRS, in 2012 there were 3,400, according to Reuters. The number of applications has grown exponentially since the historic victory of the conservative Citizens United over the Federal Election Commission: in 2010, the Supreme Court allowed corporations to donate unlimited amounts of money to politics.

Since then, companies have been actively transferring money to “free associations of citizens”. Among the latter appeared “political action committees” (PACs) and supercommittees (superPACS), which spent more on election campaigning than the headquarters of presidential candidates. But many corporations, especially public corporations, are much more comfortable with 501(c)(4) non-profit organizations: unlike committees, they don’t have to report to an election commission or make public lists of donors. You can apply to the IRS and calmly wait for tax-free status for at least years: its absence does not interfere with activity in any way, no matter what the conservatives say.

According to Reuters, 501(c)(4) organizations spent $92 million on campaigning in 2010 and $254 million in 2012 (according to the independent Center for Responsive Politics). According to The New York Times (NYT), during the 2012 election campaign, 16 501(c)(4) organizations spent at least $1 million on political advertising. ; they let several million more into the election campaign.

The IRS failed to bring large groups to clean water – and with a vengeance took on small ones, breeding in line with the “tea party movement” or “project 9/12” (the name of the latter refers to September 12, the day after the 2001 attacks, as well as 9 principles and 12 values that the project participants believe were shared by the founding fathers of the United States). None of the 15 “tea” groups that sought help from lawyer Jay Chekulow at the American Center for Law and Justice spent a dollar on airing political ads during the 2009 period.-2012, according to research organization Campaign Media Analysis Group.

“We complained about certain large organizations, but the IRS did not answer us. They’d rather be checking out the big fish – groups that paid hundreds of millions of dollars to influence the election – than spending money on hundreds of small groups that probably didn’t spend much during the campaign,” Paul Ryan told the NYT. , lead consultant at the Campaign Legal Center.

In the meantime, the Ministry of Finance has come up with a sound initiative. In an oversight report, the Inspector General cited a lawyer as suggesting that the IRS be exempted from inspections of NPOs. The main responsibility of the administration is to levy taxes and carry out audits. In order to monitor the political activity of non-profit organizations, it has neither the resources nor the competencies. In addition, an organization that values its non-partisan status so much, in principle, should not control pre-election expenses.

FATCA/CRS / PJSC “SPB Bank”

In connection with the entry into force of the US Foreign Account Taxation Act (hereinafter referred to as FATCA), PJSC “SPB Bank” (hereinafter referred to as the Bank) registered with the IRS ).

The Bank was assigned a Global Intermediary Identification Number (GIIN): B57WNA.99999.SL.643

qualified intermediary (QI) with the additional status of a qualified derivatives dealer (Qualified Derivatives Dealer, QDD), who has assumed primary responsibility for withholding at the source of US FDAP payments paid in respect of underlying US securities and dividend equivalents (payments on potential transactions associated with section 871(m)).

This designation is assigned to the Bank following the successful completion of periodic certification of QI compliance procedures for documentation, reporting and tax obligations to the IRS. As part of this audit, the US tax regulator certified the Bank as a financial institution that satisfies US tax obligations by building effective internal control mechanisms.

Due to the status obtained, the Bank, which acts as a settlement depository in a closed cycle of exchange, settlement and clearing services for professional participants in the securities market, following the results of organized trading at PJSC SPB Exchange, will provide Russian market participants with a technology for settling tax liabilities when exercising the rights of owners of these valuable papers. Specifically, the Bank, as a QI, is able to make adjustments to amounts paid to account holders by applying refund or credit procedures to US source income tax liabilities. This service is available to all clearing members and customers of the Bank.

Specifically, the Bank, as a QI, is able to make adjustments to amounts paid to account holders by applying refund or credit procedures to US source income tax liabilities. This service is available to all clearing members and customers of the Bank.

CRS (Common Reporting Standard) – A standard for the automatic exchange of information on financial accounts, developed by the OECD (Organization for Economic Co-operation and Development). CRS is an international analogue of FATCA, aimed at increasing tax transparency and preventing global tax evasion. The Russian Federation in May 2016 confirmed its participation in the implementation of the CRS requirements.

The Federal Tax Service of Russia opened a section on the official website dedicated to the international automatic exchange of information, where documents and frequently asked questions are published: https://340fzreport.nalog.ru/

According to Federal Law No. 340-FZ dated November 27, 2017 “On Amendments to Part One of the Tax Code of the Russian Federation in Connection with the Implementation of the International Automatic Exchange of Information and Documentation on International Groups of Companies”, persons concluding (have entered into) an agreement with the Bank providing for the provision of financial services are obliged to provide the Bank with information that allows establishing tax residency in relation to themselves, beneficiaries and (or) persons directly or indirectly controlling them.

In order to comply with the above laws, the Bank’s customers are surveyed using forms approved by internal documents of PJSC “SPB Bank”:

- Questionnaire of an individual and an individual entrepreneur for FATCA purposes (including an individual entrepreneur),

- Questionnaire of a legal entity for FATCA purposes,

- Form of confirmation of the status of tax resident for clients of individuals and individual entrepreneurs,

- Form confirming the status of tax resident of a legal entity (including a financial market organization), including for a foreign organization,

- Criteria for classifying clients of PJSC “SPB Bank” as foreign taxpayers and methods for obtaining the necessary information from them.

| Forms | Meaning | Form (translation) | Filling instructions (translation) |

|---|---|---|---|

| W-8BEN | To be completed by non-U. S. individuals who are the beneficial owners of income received S. individuals who are the beneficial owners of income received | Form (translation) | Instructions for completion (translation) |

| W-8BEN-E | To be completed non-US legal entities that are the beneficial owners of income received | Form (translation) | Instructions for filling out (translation) | Instructions for completion (translation) |

| W-8IMY | To be completed by organizations that are intermediaries in the process of transferring income to their beneficial owners | Form (translation) | Instructions for completion (translation) |

| W-8ECI | water) | Instruction manual (translation) | |

| W-9 | To be completed by US tax residents | Form (translation) | Instructions for filling out (translation) |

Requirements for automated processing of tax identification forms in PJSC SPB Bank.

The procedure for depository accounting and submission of information for the purpose of fulfilling the requirements of the US Tax Code by depositors of PJSC “SPB Bank” when receiving income from securities of US issuers.

- Application for tax withholding upon payment of income on securities of US issuers, to which the provisions of chapters 3 and 4 of the US Internal Revenue Code are applicable, on the holder’s custody accounts from the Depositor of PJSC SPB Bank, who is not a US tax resident. ( Statement of the owner of the depositor 01.07.2019),

- Application for withholding tax on the payment of income on US securities subject to chapters 3 and 4 of the Internal Revenue Code on nominee/trustee custody accounts from a Bank Depositor who does not qualify as a Qualified Intermediary under the Internal Revenue Code ( Statement NQI 07/01/2019),

- Application for withholding foreign tax on the payment of income on U.S. securities subject to Chapters 3 and 4 of the U.

S. Internal Revenue Code on nominee/trustee custody accounts from a Depositor of a Bank that is a Qualified Intermediary under the U.S. Internal Revenue Code. ( Statement of the nominee – QI 01.07.2019),

S. Internal Revenue Code on nominee/trustee custody accounts from a Depositor of a Bank that is a Qualified Intermediary under the U.S. Internal Revenue Code. ( Statement of the nominee – QI 01.07.2019), - Application for withholding foreign tax on the payment of income on securities of US issuers, to which the provisions of Chapters 3 and 4 of the US Internal Revenue Code are applicable, on sub-accounts of depo of nominee / trust management from a client of the depository of PJSC SPB Bank, having the status of a Qualified Intermediary in accordance with with IRS

- Application for tax withholding upon payment of income on securities of US issuers, to which the provisions of chapters 3 and 4 of the US Internal Revenue Code are applicable, on sub-accounts of depo of nominee / trustee from a client of the depository of PJSC SPB Bank, who does not have the status of a Qualified Intermediary in accordance with with the US Internal Revenue Code,

- Application for tax withholding upon payment of income on securities of US issuers, to which the provisions of chapters 3 and 4 of the US Internal Revenue Code are applicable, on subaccounts of the owner’s depository from a non-US tax resident PJSC SPB Bank depositary client.

S. Internal Revenue Code on nominee/trustee custody accounts from a Depositor of a Bank that is a Qualified Intermediary under the U.S. Internal Revenue Code. ( Statement of the nominee – QI 01.07.2019),

S. Internal Revenue Code on nominee/trustee custody accounts from a Depositor of a Bank that is a Qualified Intermediary under the U.S. Internal Revenue Code. ( Statement of the nominee – QI 01.07.2019),