What is a Certificate of Insurance. How does it differ from an insurance policy. Why do businesses need COIs. What information is included on a Certificate of Insurance. How can you obtain a COI for your New Jersey business.

What is a Certificate of Insurance (COI)?

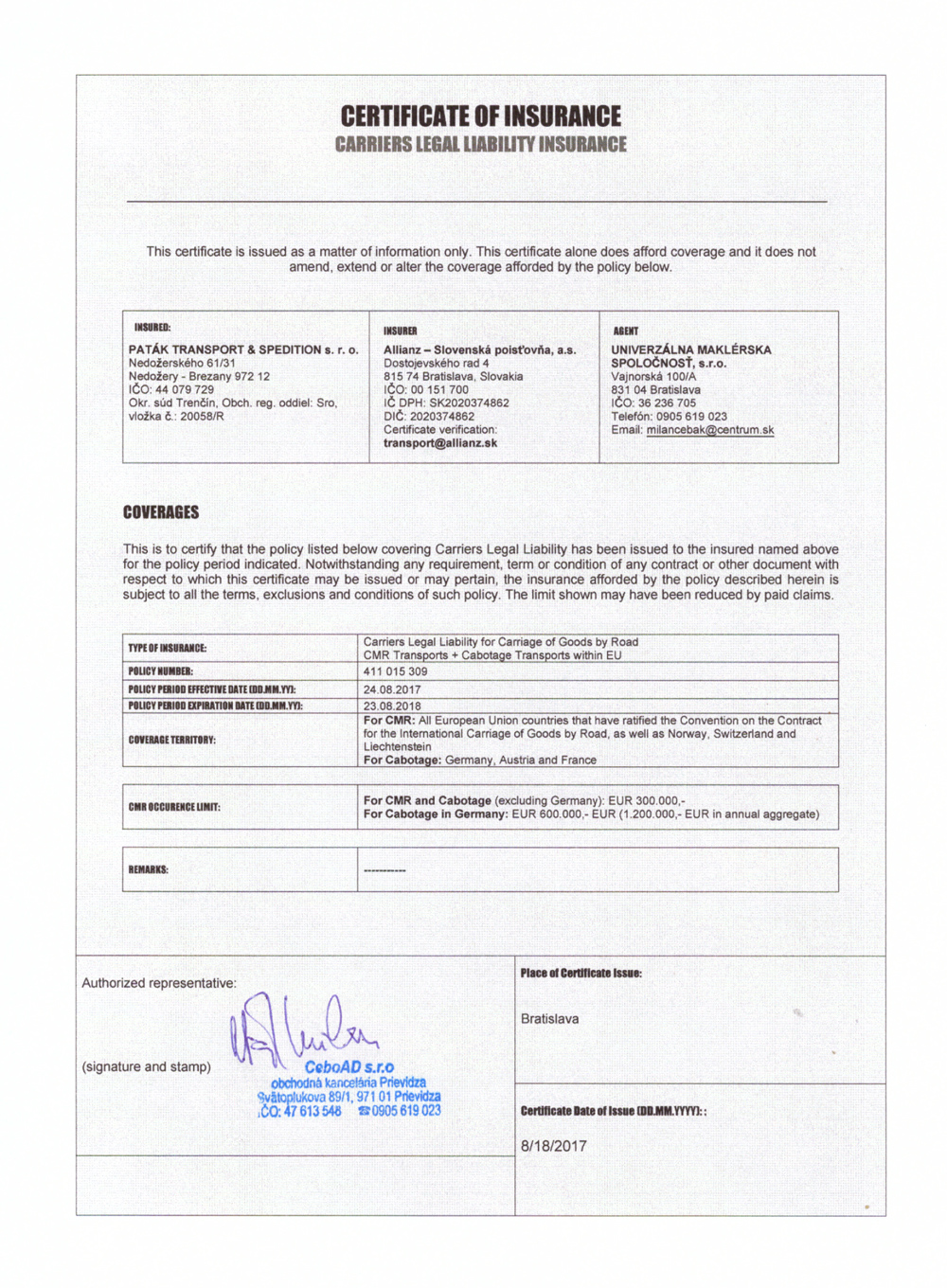

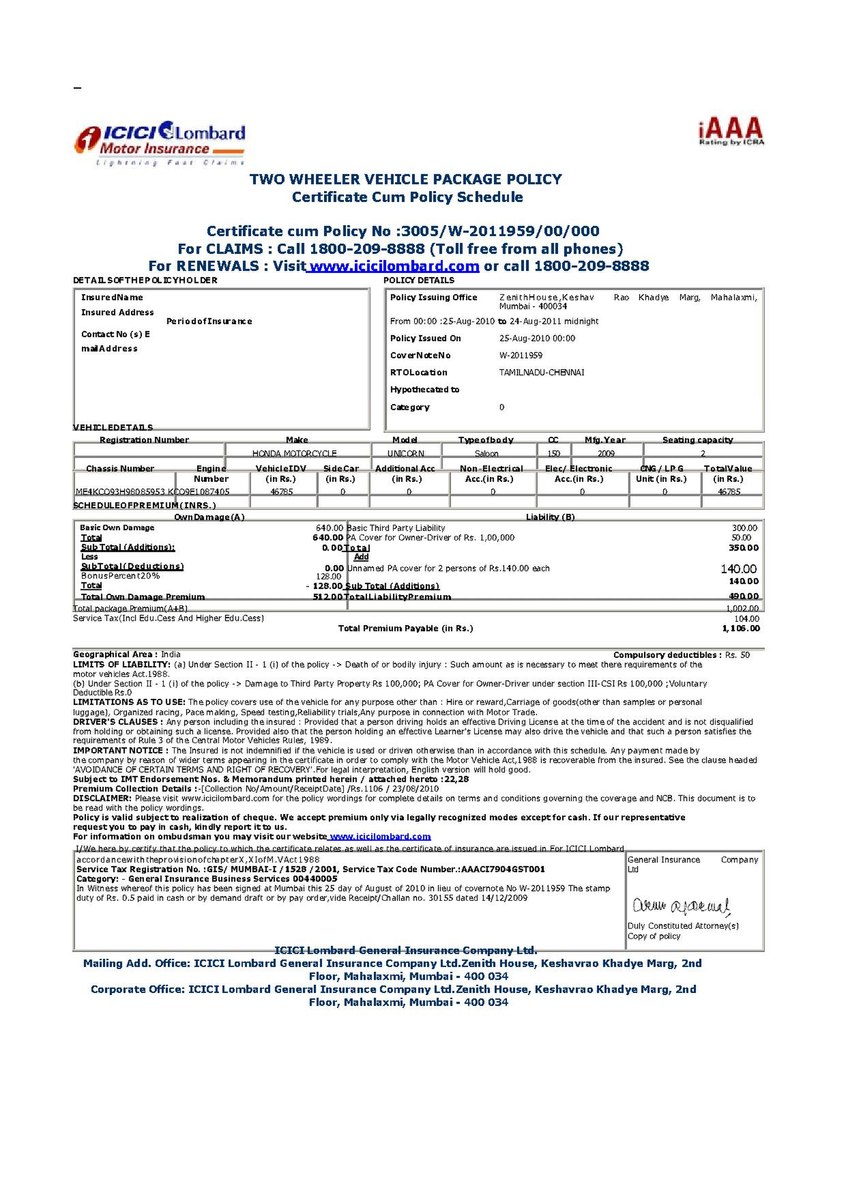

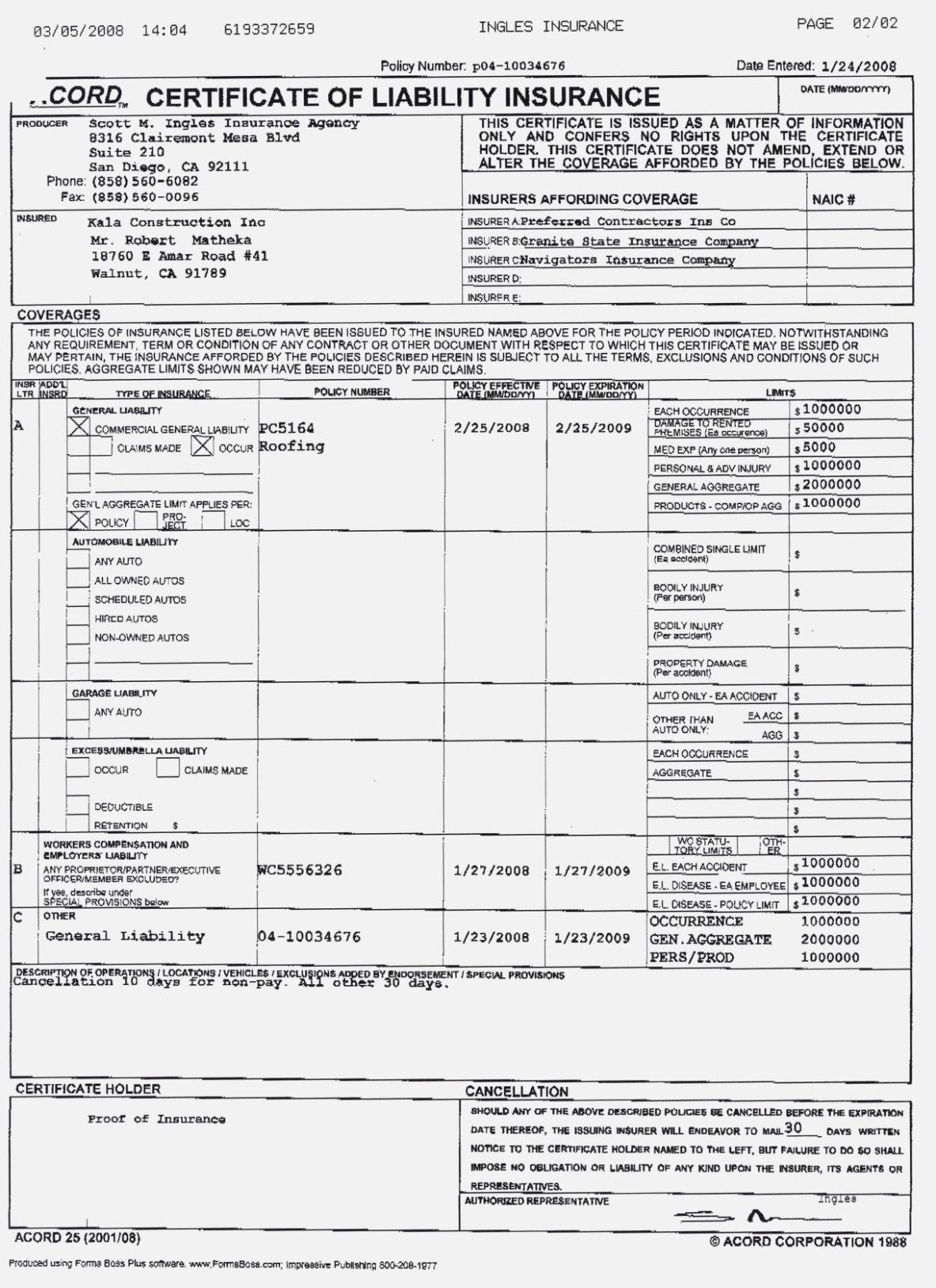

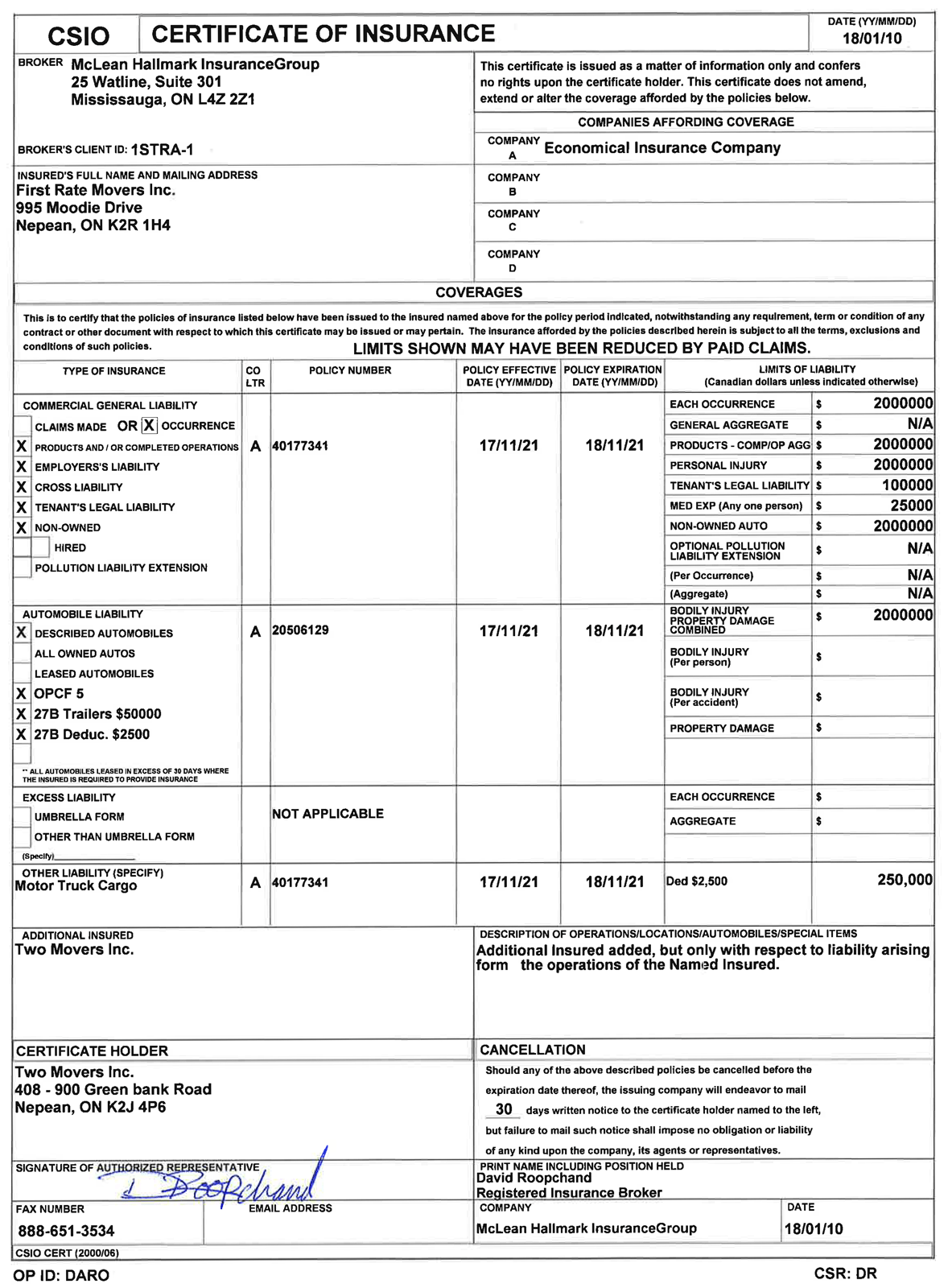

A Certificate of Insurance (COI) is a vital document in the business world, especially for contractors and service providers. But what exactly is it? A COI is an official document issued by an insurance company or agent that verifies the existence of an insurance policy. It serves as proof of insurance coverage, providing key details about the policy without revealing all the intricate terms and conditions.

Unlike a full insurance policy, a COI is a concise summary that typically fits on a single page. It’s designed to quickly convey essential information to third parties who need to verify your insurance status. This document doesn’t alter your coverage or form part of your policy; instead, it acts as a snapshot of your insurance at a specific point in time.

Key Functions of a Certificate of Insurance

- Verification of coverage

- Proof of insurance for clients and contractors

- Fulfillment of contractual requirements

- Protection for both the insured and the client

Do COIs replace insurance policies? No, they don’t. A COI is merely a representation of your coverage, not the coverage itself. The actual terms, conditions, and exclusions of your insurance are still governed by the full policy document.

The Importance of COIs in Business Transactions

Why are Certificates of Insurance so crucial in today’s business environment? COIs play a pivotal role in mitigating risks and establishing trust between businesses and their clients or contractors. They’re particularly important in situations where significant property losses or liability claims could occur.

For instance, if you’re a landscaping business in New Jersey, potential clients may require you to provide a COI before commencing work on their property. This requirement serves multiple purposes:

- It assures the client that you have adequate insurance coverage.

- It protects the client from potential liability arising from your work.

- It demonstrates your professionalism and commitment to risk management.

Are COIs always mandatory? While not always legally required, many businesses and property owners insist on seeing a COI before entering into a contract. This practice has become standard across various industries, from construction to event planning.

What Information Does a Certificate of Insurance Contain?

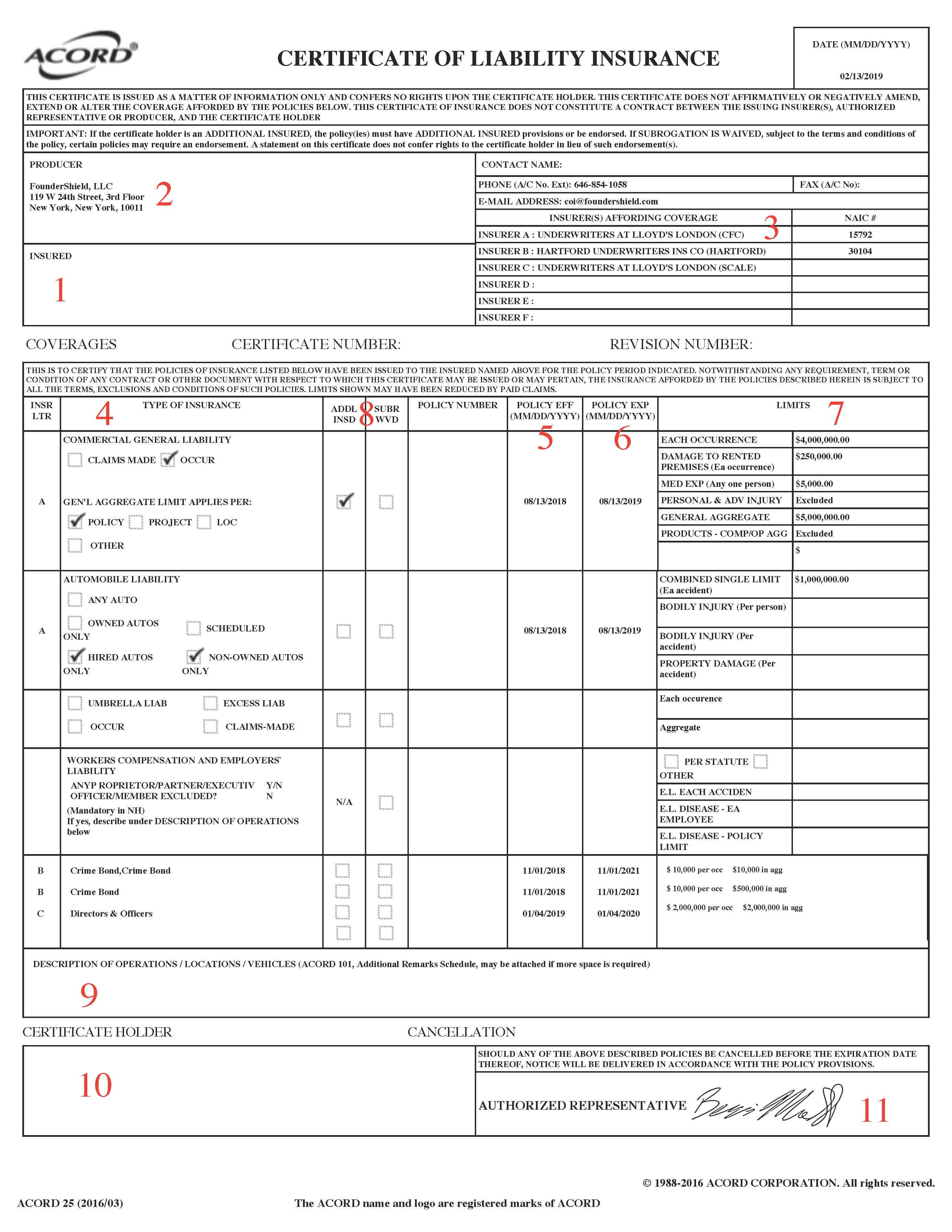

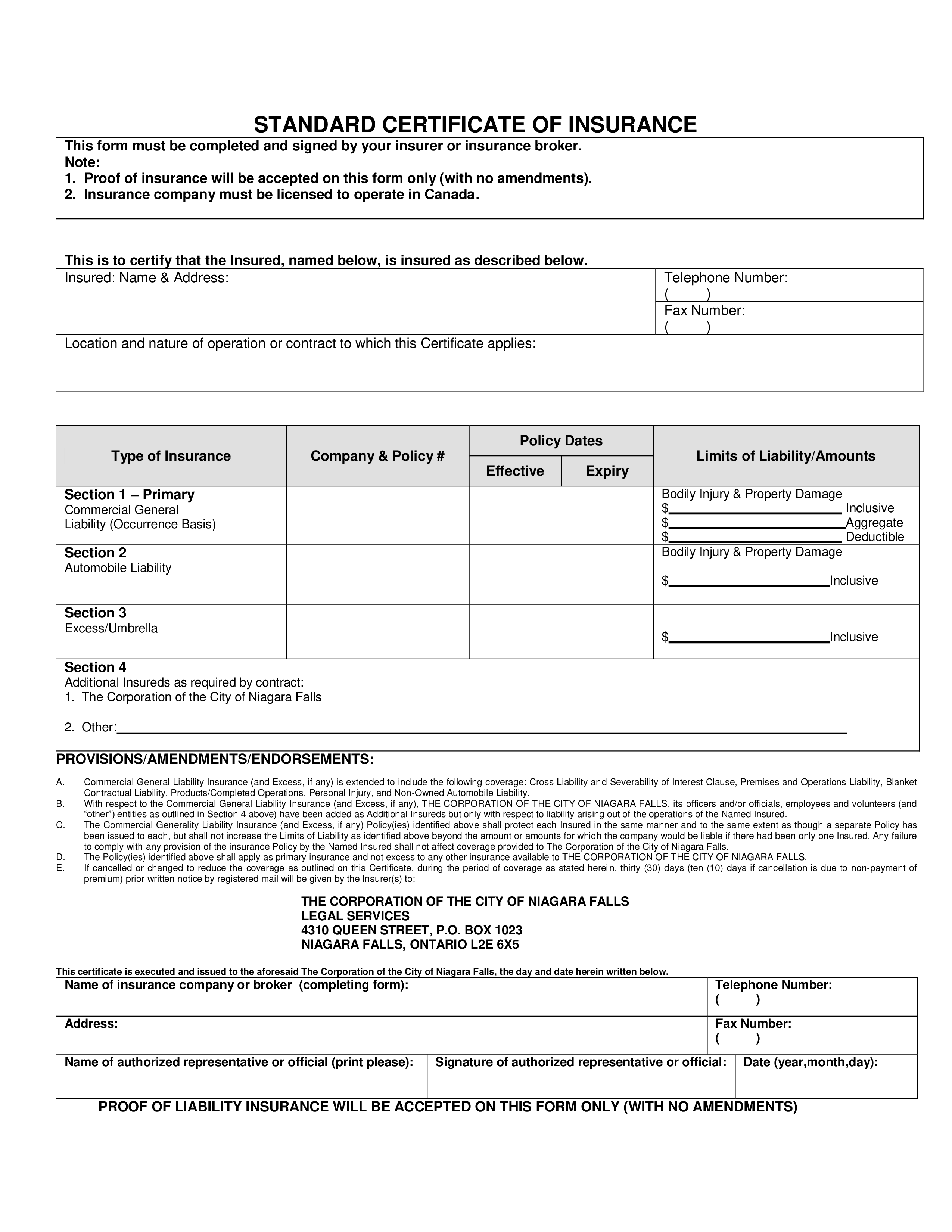

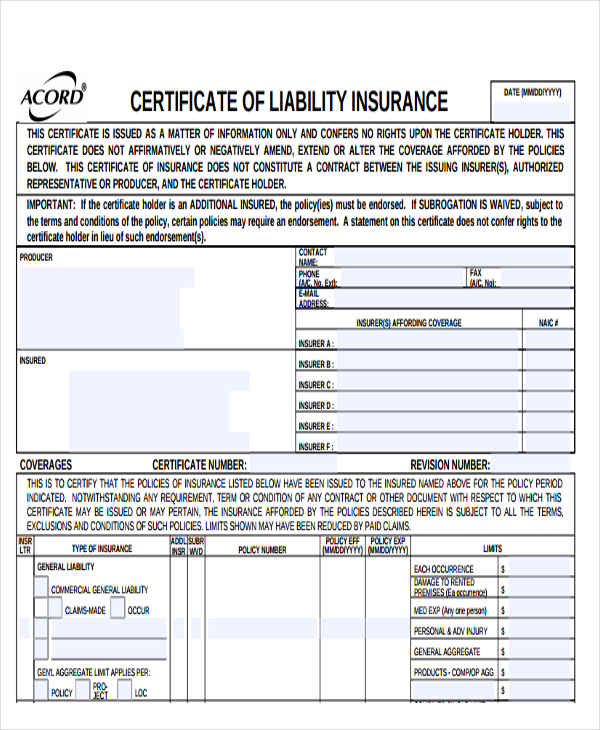

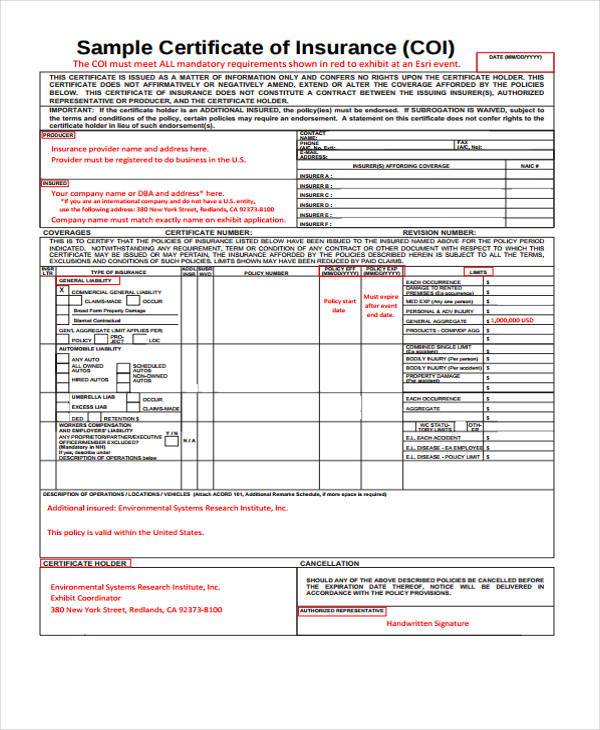

A Certificate of Insurance is designed to provide a comprehensive overview of your insurance coverage. But what specific details does it include? Let’s break down the key components typically found on a COI:

- Policyholder’s name and contact information

- Insurance company’s details

- Policy number(s)

- Types of coverage (e.g., general liability, workers’ compensation)

- Policy limits for each type of coverage

- Policy effective dates

- Additional insured parties (if applicable)

Does a COI list all policy exclusions and conditions? Generally, no. While a COI provides an overview of coverage, it doesn’t typically detail all exclusions or conditions. For this reason, it’s important to remember that the COI is not a substitute for the full policy document.

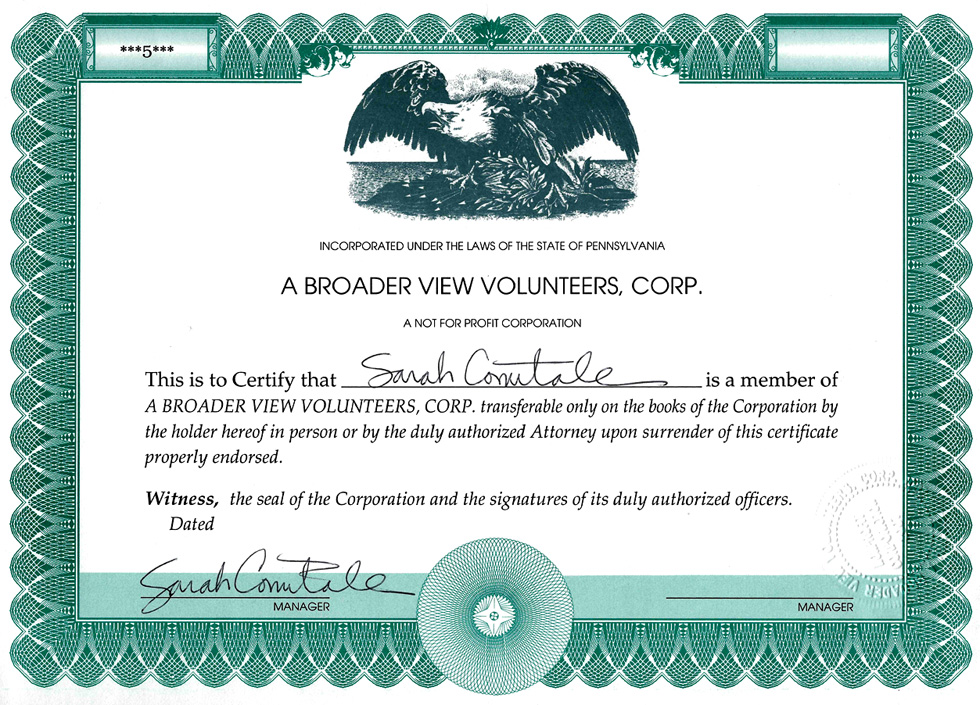

The Concept of Additional Insured Status

When discussing Certificates of Insurance, the term “additional insured” often comes up. But what does it mean to be an additional insured? An additional insured is a person or entity that is added to an insurance policy, granting them certain coverages under the policy.

In many business relationships, especially in contracting scenarios, clients may request to be added as an additional insured on your policy. This status provides them with a layer of protection under your insurance coverage for claims that might arise from your work or operations.

Benefits of Additional Insured Status

- Extended coverage to the client

- Protection against third-party lawsuits

- Fulfillment of contractual requirements

Is being named as an additional insured the same as being a policyholder? No, it’s not. Additional insureds have more limited rights under the policy compared to the primary policyholder. They typically can’t make changes to the policy or cancel it.

How to Obtain a Certificate of Insurance

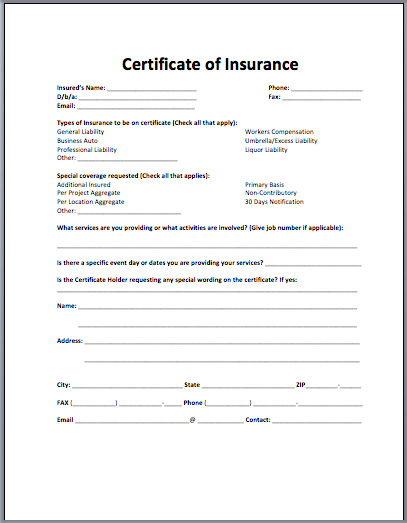

For New Jersey businesses needing to secure a Certificate of Insurance, the process is generally straightforward. Here’s a step-by-step guide on how to obtain your COI:

- Contact your insurance agent or company

- Specify the type of certificate needed (e.g., general liability, workers’ compensation)

- Provide details of any additional insureds to be listed

- Clarify the purpose of the certificate (e.g., for a specific contract or client)

- Review the certificate for accuracy once received

Can you generate a COI yourself? While some insurance companies offer online portals where policyholders can generate their own COIs, it’s generally recommended to go through your agent to ensure accuracy and compliance with any specific requirements.

Common Misconceptions About Certificates of Insurance

Despite their widespread use, there are several misconceptions about Certificates of Insurance that can lead to misunderstandings or even legal issues. Let’s address some of these common misbeliefs:

Myth 1: A COI Guarantees Coverage

A prevalent misconception is that a COI guarantees coverage in all situations. In reality, a COI is merely evidence that a policy existed at the time the certificate was issued. It doesn’t guarantee that the policy is still in force, hasn’t been cancelled, or that it will cover a specific claim.

Myth 2: COIs and Policies Are Interchangeable

Some people mistakenly believe that a COI is equivalent to an insurance policy. This is not the case. A COI is a summary document, while the policy is the comprehensive, legally binding contract that details all terms, conditions, and exclusions.

Myth 3: Additional Insured Status Is Automatic

Another common misunderstanding is that being named on a COI automatically confers additional insured status. In most cases, the policy itself must be endorsed to add an additional insured. The COI merely reflects this status; it doesn’t create it.

Do these misconceptions pose risks? Absolutely. Relying on these misunderstandings can lead to gaps in coverage, unexpected liabilities, and potential legal disputes. It’s crucial for both certificate holders and those requesting COIs to understand their limitations and proper use.

The Legal Implications of Certificates of Insurance

While Certificates of Insurance play a crucial role in business transactions, they also carry significant legal implications. Understanding these can help New Jersey businesses navigate potential pitfalls and ensure they’re properly protected.

COIs and Contract Law

In many cases, COIs are required as part of contractual agreements. However, it’s important to note that the COI itself is not typically considered part of the contract. Instead, it serves as evidence that the insured party has met the insurance requirements stipulated in the contract.

Misrepresentation and Liability

Providing false or misleading information on a COI can lead to serious legal consequences. Both the insured and the insurance agent issuing the certificate could potentially face liability for misrepresentation if the information on the COI is inaccurate.

Reliance on COIs

Courts have generally held that third parties have a right to rely on the information provided in a COI. However, this reliance is not absolute. In some cases, courts have ruled that sophisticated parties should investigate further rather than relying solely on the COI.

Can a COI create coverage where none exists? Generally, no. Courts have typically held that a COI cannot create coverage that doesn’t exist in the underlying policy. However, there have been exceptions in cases of clear misrepresentation or where the certificate holder’s reliance on the COI was deemed reasonable.

Best Practices for Handling Certificates of Insurance

For New Jersey businesses, whether you’re providing or requesting Certificates of Insurance, following best practices can help ensure smooth transactions and adequate protection. Here are some key recommendations:

For Certificate Holders (Insured Parties)

- Regularly review your COIs for accuracy

- Promptly notify your agent of any changes in your business that might affect your coverage

- Keep copies of all issued COIs

- Understand the limitations of your COI and be prepared to provide additional information if requested

For Those Requesting COIs

- Clearly communicate your insurance requirements to vendors or contractors

- Verify the information on received COIs

- Follow up on any discrepancies or unclear information

- Implement a system for tracking and managing received COIs

Should you always accept a COI at face value? While COIs are generally reliable, it’s wise to verify crucial information, especially for high-value or high-risk contracts. This might involve contacting the issuing insurance company to confirm coverage details.

By adhering to these best practices, businesses can maximize the protective value of Certificates of Insurance while minimizing potential risks and misunderstandings.

Certificates of Insurance serve as a crucial tool in the business world, particularly for New Jersey companies engaged in contracting or providing services. They offer a quick and efficient way to verify insurance coverage, facilitate business transactions, and help manage risk. However, it’s essential to understand their limitations and use them correctly to ensure they provide the intended protection and peace of mind.

As the business landscape continues to evolve, staying informed about insurance requirements and best practices remains vital. Whether you’re a small business owner, a contractor, or a large corporation, proper management of Certificates of Insurance can contribute significantly to your risk management strategy and overall business success.

What Is a Certificate of Insurance? | Insurance Center of North Jersey

In the world of insurance, you’ll come across a lot of fancy words and strange jargon that can be extremely challenging to understand. If you’re a contractor, for instance, and you’re speaking with a potential client on the phone, it might seem things are going smoothly, and then they ask you for proof of insurance coverage.

You might automatically think they want to see a copy of your current policies and then come to find they’re requesting for you to provide a certificate of insurance (COI).

But, do you know what this is exactly and what it does? To help you make the differentiation, you’ll learn more about a COI document and what it means to hold one.

1. What is a Certificate of Insurance?

So, what is a COI form? It’s essentially a form your insurance agent or company provides you to verify you have insurance. It won’t change your coverage, and it isn’t a part of your regular policy.

It provides information about your policy. This document is used to show your clients the coverages provided by your policy that will protect them from the fallout of claims or negligence on your part.

Often, a contract requires you to hold specific levels of liability insurance coverage. The certificate of general liability insurance is your client’s way to check that you have the proper coverage for the job. They’ll ask to have a certificate of insurance (COI) in hand before you begin any work.

2. Why Do You Need a Certificate of Insurance?

A COI is requested when large property losses and liability claims are a concern. So, if you own a landscaping business, for instance, a client might require you to show your COI to prove you’re covered for workers’ compensation and certain liabilities during the course of the project.

Regardless of the type of client you’re dealing with, being an insurance certificate holder and having proof of insurance protects both your client and you, giving you both peace of mind.

In some cases, it’s frequently a requirement for you to win a contract with some businesses. Many people and companies hiring contractors want to know they aren’t going to be held liable for things like:

- Bodily Injuries

- Property Damages

- Substandard work-related losses

So, they’ll require you to carry liability and workers’ compensation insurance.

Even if your clients don’t ask you to show your certificate of insurance, having proof your business is covered is still an added benefit. Your insurance agent should include your COI in your initial insurance documentation. If they don’t, ask them to provide you with one.

3. What’s Included on your Certificate of Insurance?

You’ll be named as the policyholder on the certificate of insurance – because you’re the insured. Other essential information on a COI includes:

- The insurance company’s contact information

- Your mailing address

- Coverage limits

- Policy effective dates

- Type of coverage(s) provided

- An additional insured (other companies or individuals on the policy as requested) if required by contract

For instance, a certificate of insurance for a company with small business insurance will have to outline its general liability insurance details, workers’ compensation, and commercial auto insurance coverage.

After you request your COI, your name and contact information may also be on the certificate.

4. What Does it Mean When a Client Becomes an Additional Insured?

Certain contracts will require the client to be added as an additional insured. For you to add your client as an additional insured, you’ll need to ask your insurance agent to process an endorsement and add them to your insurance policy. This is a policy addition that will adjust coverage and possibly increase your premium. The endorsement must be there in effect for your client to be seen as an additional insured.

When the client is an additional insured, your insurance also covers them. Therefore, if your business does something that gets you and the client sued, they’ll be provided coverage under your policy.

If the contract requires the client to get additional insured status, they might have to see a declaration on the certificate that says they’re indeed an additional insured.

Your policy might already include specific individuals as additional insured, which means there doesn’t need to be an endorsement. Certain policies are written so that any client the insured works for has a contractual responsibility to include the additional insured through the policy. So, you’ll want to talk with your agent carefully about this to ensure you’re clear on how the policy is handling additional insureds.

Certain policies are written so that any client the insured works for has a contractual responsibility to include the additional insured through the policy. So, you’ll want to talk with your agent carefully about this to ensure you’re clear on how the policy is handling additional insureds.

5. How to Get a Certificate of Liability Insurance

If you have to request proof of COI from your insurance agent, here are the basic steps you’ll have to take:

- Ask the client requesting the COI what the coverage limits and minimums should be based on the contract requirements. Be sure to get their name, tax identification number, and address too in the event there’s an increase in the premium.

- Contact your agent and let them know the minimum coverage amount(s) and that a client is asking for proof of insurance. If the requirements are already met in the policy, the agent will issue the COI. If you must increase coverage for the job, the agent will ask you to provide some details so an endorsement request can be prepared and submitted.

- Once you’re all set, the agent will then create the certificate of insurance as required and send you out a printed COI. You’ll then send it to the client so you can sign the contract and begin your collaboration.

Although the process is relatively simple to understand, you should note that it could take several days to obtain the COI if changes to your existing policy are quired to comply with the contract, so keep that in mind when communicating with the client.

6. How Much is a COI?

There isn’t a cost to obtain a COI since it’s a complimentary service your insurance agent or provider is offering you in most cases. If the project requires extra coverage that isn’t met already through your policy, you may have to pay an additional premium to cover the costs. However, other than this, the agent shouldn’t charge you a fee to provide you a COI.

Contact The Insurance Center of North Jersey

The Insurance Center of North Jersey is an independent insurance agency that represents many insurance companies. We provide a highly personalized service to ensure all your insurance needs are met adequately and efficiently.

We provide a highly personalized service to ensure all your insurance needs are met adequately and efficiently.

If you’re looking into liability insurance or other types of insurance, contact our office for a quote.

Certificates of Insurance: Do They Matter?

Certificates of Insurance: Do They Matter?

All too often after a lawsuit is filed our clients come to us and say, “We required the contractor to name the association as an additional insured and obtained proof of insurance by requiring them to submit a certificate of insurance,” why then are we not covered by the contractor’s policy? The truth is, a certificate of insurance has little to no value if that is all you are requiring to show proof of insurance and additional insured coverage. This issue has become far more serious recently as carriers have insisted on added-insured endorsements that significantly limit coverage.

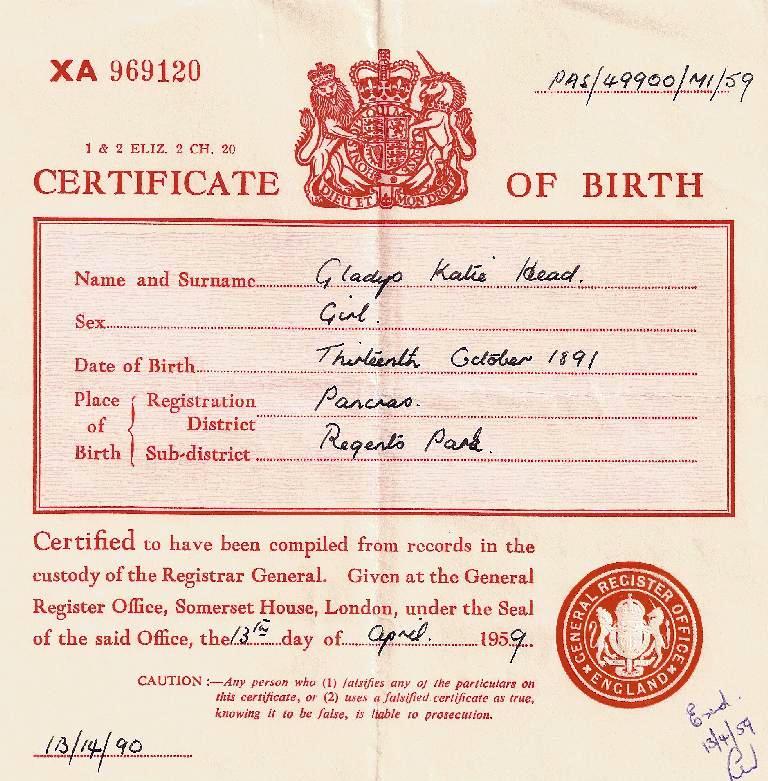

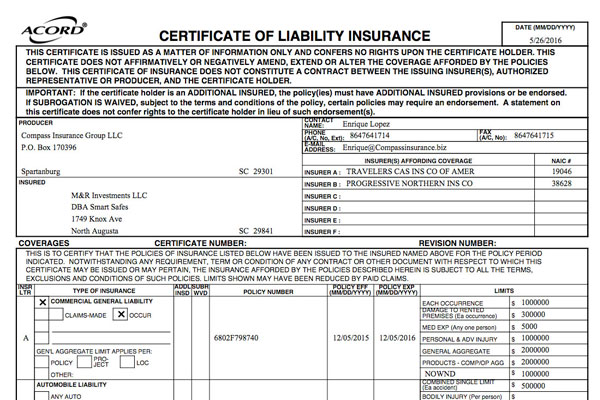

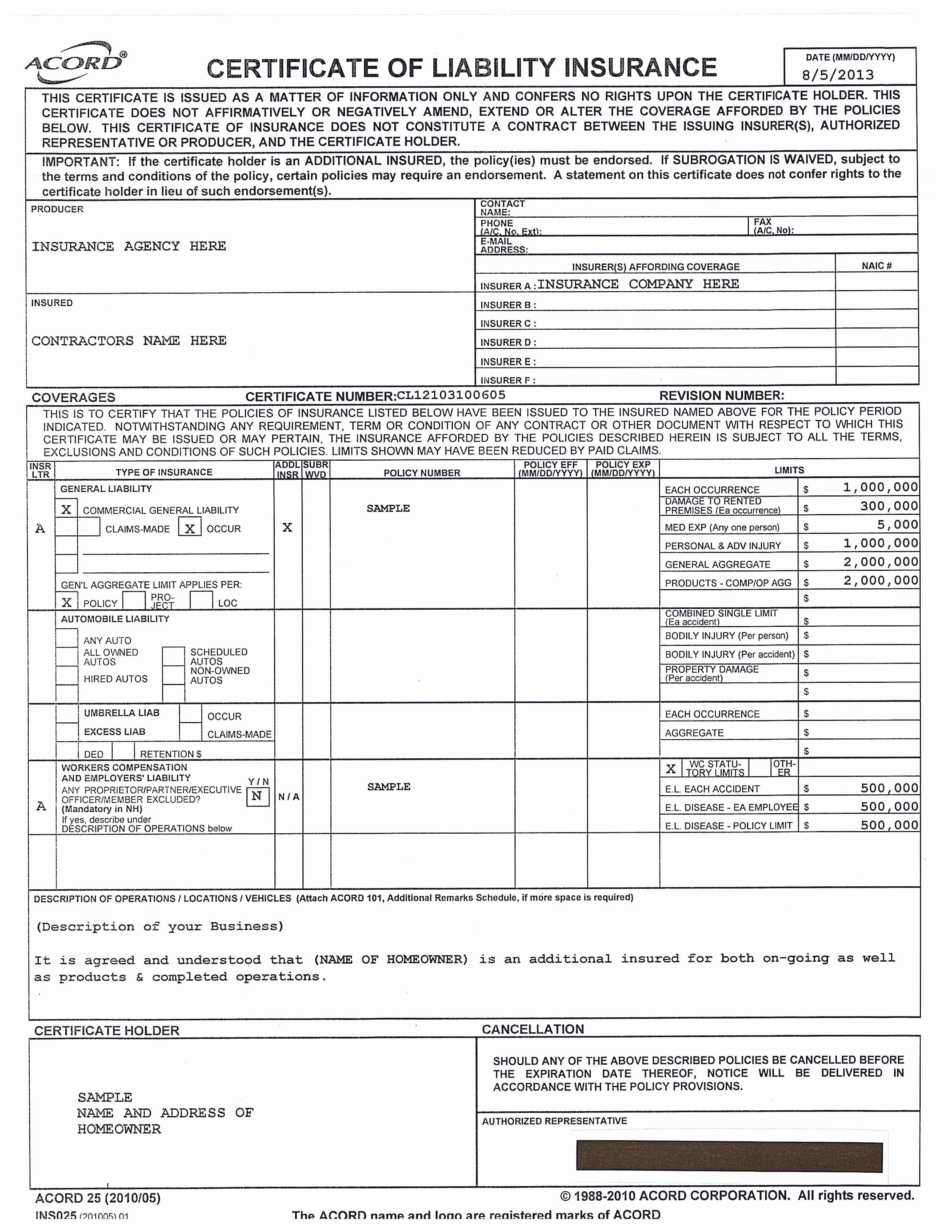

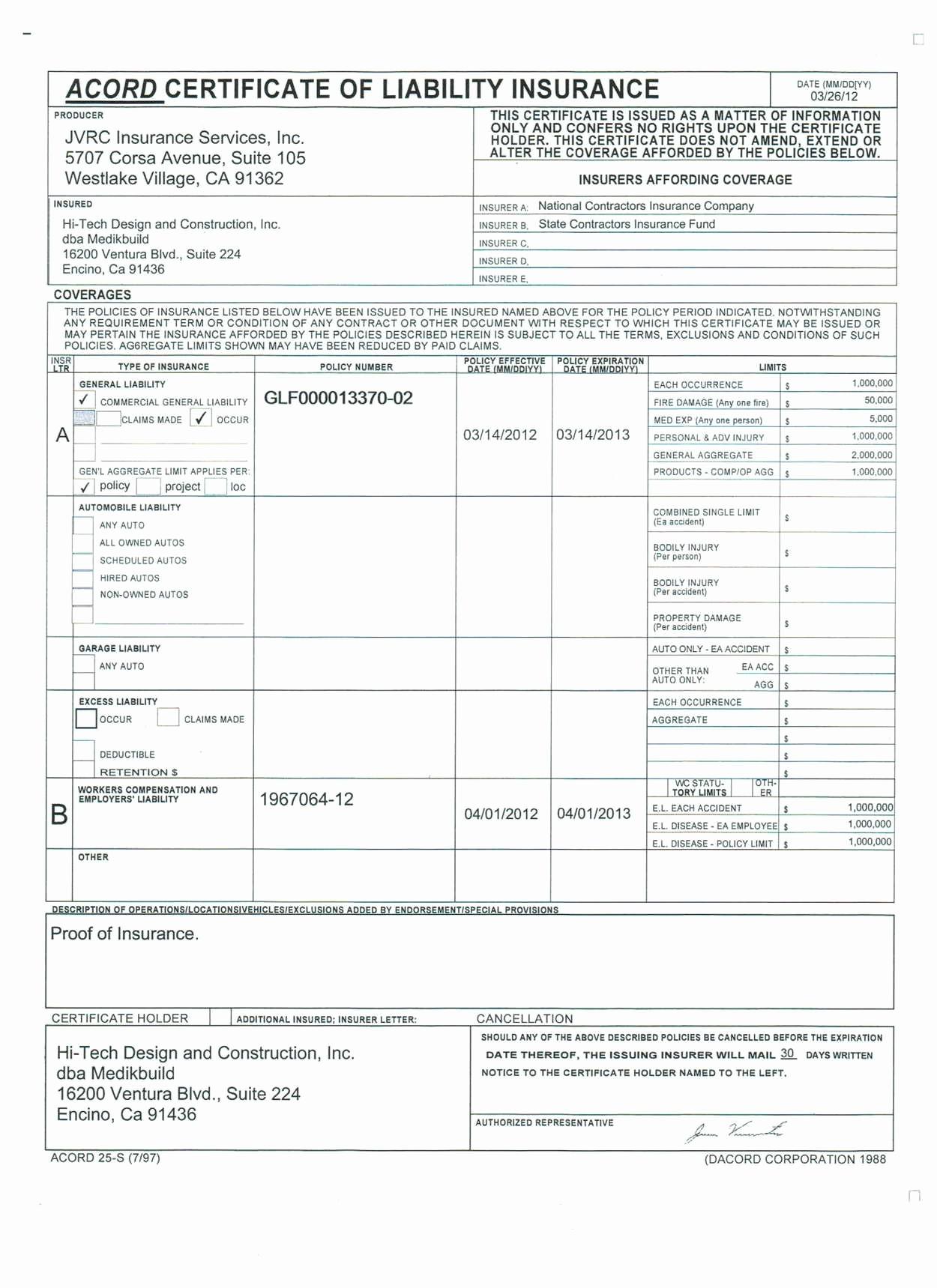

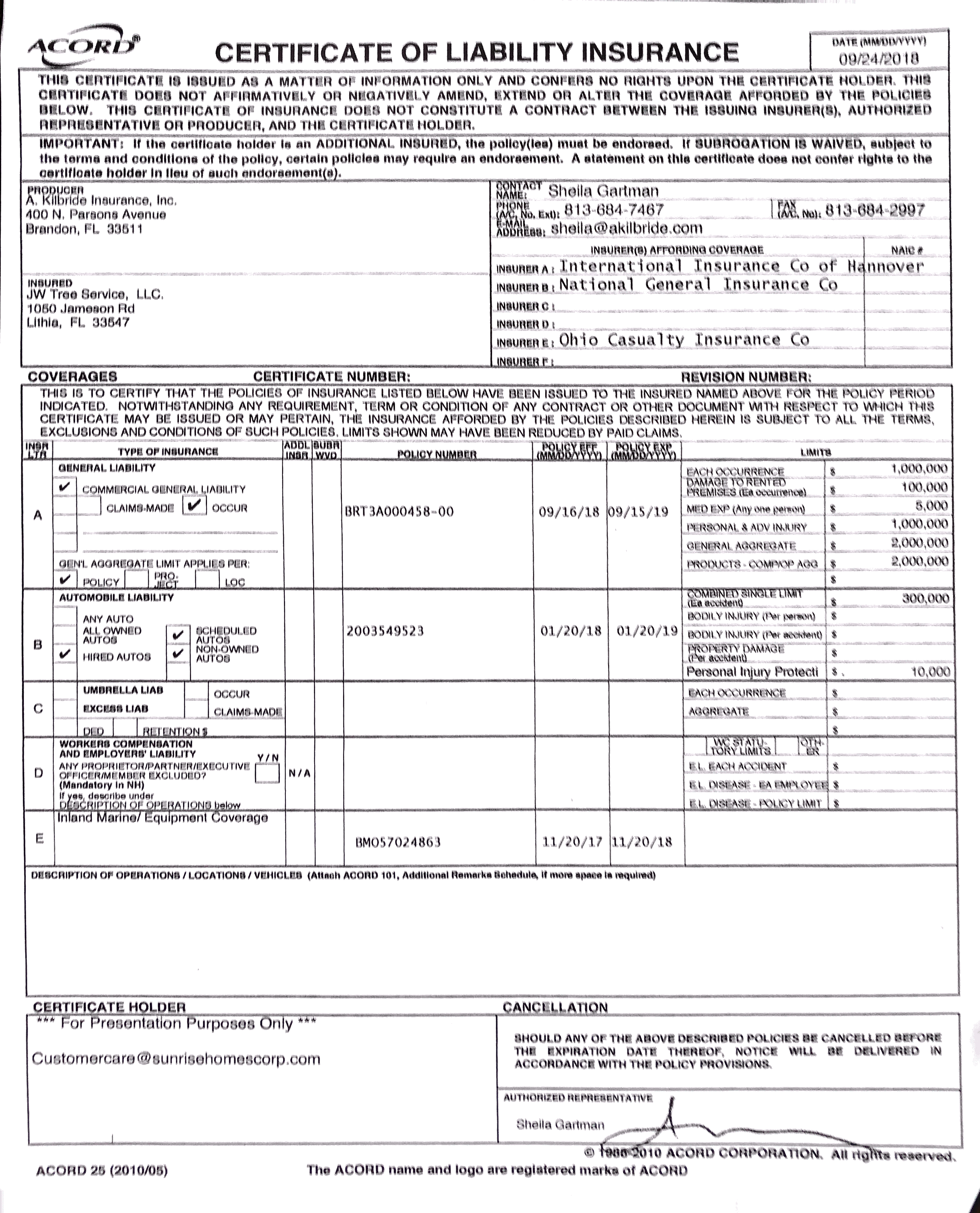

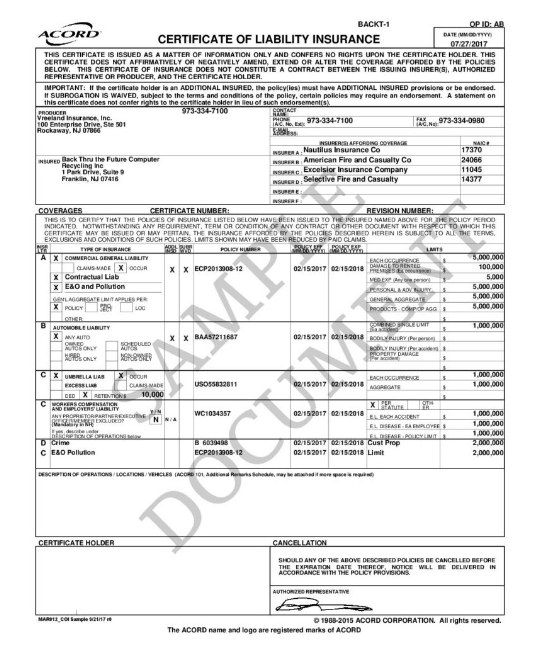

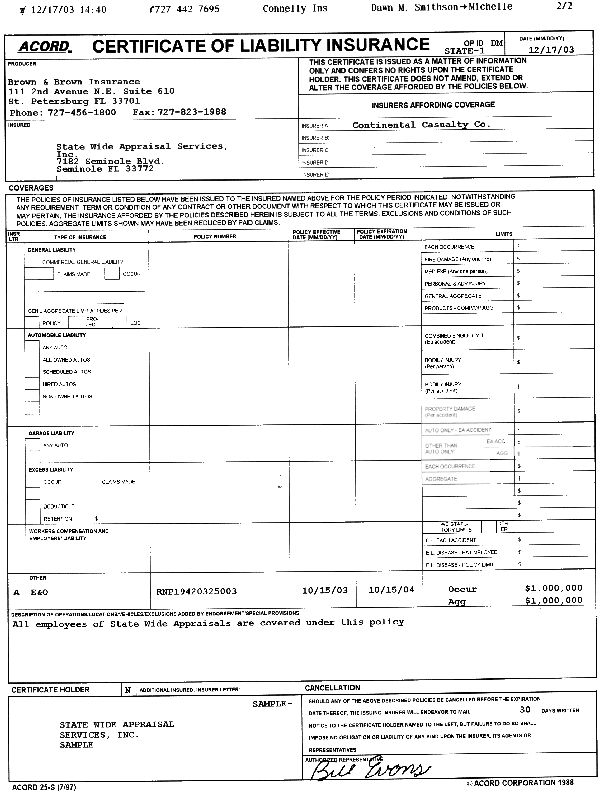

A certificate of insurance is typically a one-page document that identifies the insured (i. e. the vendor/contractor), the insurer issuing the policy, the types and limits of coverage, and the entity requesting the certificate (i.e. the certificate holder). It is similar to an automobile insurance identification card you are required to keep with your vehicle. It shows that somewhere, at some time, an insurer issued the insured an insurance policy. That is all it is meant to convey.

e. the vendor/contractor), the insurer issuing the policy, the types and limits of coverage, and the entity requesting the certificate (i.e. the certificate holder). It is similar to an automobile insurance identification card you are required to keep with your vehicle. It shows that somewhere, at some time, an insurer issued the insured an insurance policy. That is all it is meant to convey.

If you rely only on a certificate of insurance, you are left with a false sense of security since it is not proof that your association is actually named as an additional insured; and, if it was named as an additional insured, whether the exclusions to coverage that may apply limit the association’s protections under such policy. Simply put, depending on the type of added-insured endorsement provided by the carrier, additional insureds do not receive the same type and extent of coverage as a named insured. Another problem with certificates of insurance is that they can be easily forged. For example, an insured could obtain a certificate of insurance for one project and fraudulently edit the form for another. However unlikely that may seem, it is just as easy for an insured to provide you with a certificate of insurance for a policy that has since been cancelled.

For example, an insured could obtain a certificate of insurance for one project and fraudulently edit the form for another. However unlikely that may seem, it is just as easy for an insured to provide you with a certificate of insurance for a policy that has since been cancelled.

While it may come as a surprise to many, nearly every certificate of insurance advises the certificate holder that the certificate does not convey any rights on the certificate holder:

THIS CERTIFICATE IS ISSUED AS A MATTER OF INFORMATION ONLY AND CONFERS NO RIGHTS ON THE CERTIFICATE HOLDER. THIS CERTIFICATE DOES NOT AMEND, EXTEND OR ALTER THE COVERAGE REPORTED BY THE POLICIES DESCRIBED BELOW.THIS CERTIFICATE OF INSURANCE DOES NOT CONSTITUTE A CONTRACT BETWEEN THE ISSUING INSURER(S), AUTHORIZED REPRESENTATIVE OR PRODUCER, AND THE CERTIFICATE HOLDER.

IMPORTANT: If the certificate holder is an ADDITIONAL INSURED, the policy(ies) must be endorsed. If SUBROGATION IS WAIVED, subject to the terms and conditions of the policy, certain policies may require an endorsement. A statement on this certificate does not confer rights to the certificate holder in lieu of such endorsement(s).

A statement on this certificate does not confer rights to the certificate holder in lieu of such endorsement(s).

Stated differently, the mere issuance of a certificate of insurance is not enough to confer additional insured status on the certificate holder. In addition to the problems discussed above, insurance policies are filled with exclusionary language and definitions of “additional insured” that are designed to exclude or limit coverage to those other than the primary insured. Thus, it is critical that your association confirm that it has actually obtained appropriate additional insured status.

To obtain additional insured status, there must be a contractual agreement between the insurer and the insured, which is reflected by an endorsement to the policy. Without an endorsement, there is no right to additional insured coverage – regardless of what the certificate of insurance may indicate. Accordingly, it is important that associations require vendors and contractors to provide: (a) a certificate of insurance that identifies the particular additional insured endorsement obtained for the association; (b) a copy of the endorsement itself; and, (c) a copy of the policy. There are several forms of added-insured endorsements that vary widely in the extent of coverage provided. While it is possible that you would be denied the policy, you at least put the association in a position to argue for coverage if you obtain an inaccurate or incomplete certificate of insurance or endorsement.

There are several forms of added-insured endorsements that vary widely in the extent of coverage provided. While it is possible that you would be denied the policy, you at least put the association in a position to argue for coverage if you obtain an inaccurate or incomplete certificate of insurance or endorsement.

If you take only one thing away from this article, it should be that obtaining an additional insured endorsement from your vendors and contractors is a must. Even if you obtain a certificate of insurance listing the particular additional insured endorsement obtained, that is not sufficient proof of additional insured coverage. The certificate of insurance is ultimately issued for informational purposes only and cannot be relied upon to determine or enforce coverage. Further, your insurance agent is an excellent source to tap to review the actual form of added-insured coverage provided.

Becker strongly recommends that you consult with an attorney and your insurance agent whenever dealing with issues pertaining to contracts and insurance coverage. If you have any questions, or would like to speak with an attorney, please feel free to contact us.

If you have any questions, or would like to speak with an attorney, please feel free to contact us.

WHAT IS AN INSURANCE CERTIFICATE? Who needs it and when

The document that serves as evidence of insurance coverage is known as an insurance certificate. It is issued by an insurance company or broker and contains important information about the insurance policy. An insurance certificate is often used to demonstrate that a company or contractor has workers’ compensation and liability insurance to carry out work under a contract. It can also be used to confirm information about other insurance policies, such as the characteristics of home or vehicle insurance coverage. In this blog post, we will define an insurance certificate for suppliers, contractors, subcontractors, and for relocation.

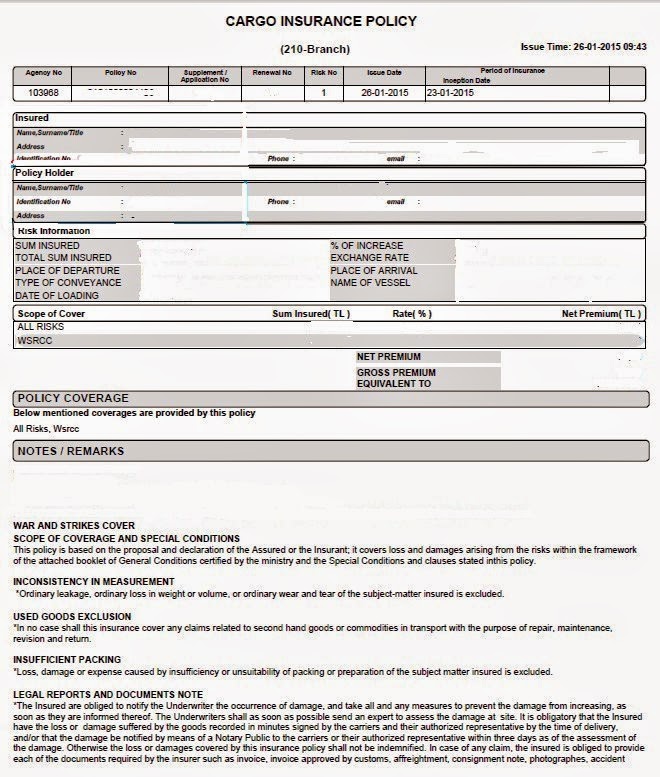

What is a certificate of insurance (COI)?

The broker or insurance company will issue a certificate of insurance (COI). The COI confirms the existence of an insurance policy and lists its main features and conditions. A typical COI will contain the policyholder’s name, policy effective date, coverage type, policy limits, and other important information.

A typical COI will contain the policyholder’s name, policy effective date, coverage type, policy limits, and other important information.

How certificates of insurance (COIs) work

Most business scenarios require certificates of insurance (COIs) and involve situations where the issue of liability and significant loss arises. The confirmation of insurance coverage is an insurance certificate. 9The 0015 COI is often given to small business owners and contractors as proof of their work accident and personal injury insurance coverage. The insurance company often offers an insurance certificate when you buy liability insurance.

It can be difficult for a business owner or contractor to get a contract without a COI. The client should be aware that the business owner or contractor has liability insurance because many businesses and people use contractors. This way they won’t have to take any risk if the contractor is liable for damage, injury or poor workmanship.

What is a Supplier Insurance Certificate ?

In its simplest form, a supplier’s insurance certificate is a statement by the insurance agent or agents of the supplier that the supplier currently has the insurance coverage specified in the certificate.

These are used by your company to make sure that contract insurance requirements are met and that suppliers have insurance that transfers any risk they create into their risk promoter. An insurance traceability certificate is a method used to ensure that these “COIs”, as they are known, say what they are supposed to and continue to be valid.

How to request an insurance certificate from suppliers

When do you need a certificate of insurance from suppliers if you are a contractor or a business? The solution is quite simple: you must have an insurance certificate from any supplier before they enter your company or project site to do work or take any other action that may present a risk.

We understand that this seems a bit vague, but it’s true. Whether we create it or not, danger is all around us. The last thing you want to do is take the risk your salesperson put you in by refusing to get an insurance certificate.

You ask what is a supplier insurance certificate?” and you answer the same as other organizations you work for. It must state the supplier’s coverage, any limitations or exclusions, and other standard details. When hiring suppliers, be sure to ask for their insurance certificates. Insurance claim templates are especially useful in this case.

Understanding how to request an insurance certificate from a supplier likely depends on how your company interacts with suppliers. In many cases, vendors are required to provide COIs containing the minimum insurance requirements for their business as part of the application process, or these requirements have been specified in an RFP, contract, or other document. Otherwise, it is often necessary before the supplier can start doing their job.

If you work with many vendors, you can often save a lot of time by having a sample letter or other type of template on hand that requests insurance certificates from vendors.

Supplier Minimum Insurance Requirements

We know that our cutting edge technology and unrivaled experienced insurance team make us the best solution for any firm dealing with hundreds or thousands of certificates, so don’t worry about inappropriate Certificates of Insurance (COI) for your business. We know the best procedures for insurance certificates through our experience with hundreds of businesses.

There is a wide range of knowledge about supplier insurance regulations and insurance certificates. For example, new risk managers or compliance officers may find out about the need to include an insurance clause in supplier agreements just before new subcontractors request examples of supplier insurance needs.

Tracking and managing insurance certificates is very difficult. Knowing where to look for certificates online and how to request an insurance certificate from vendors is just the beginning. To ensure that the COIs you receive are indeed eligible for the coverage you need to see to approve a provider for a job, you should also be aware of your company’s insurance coverage requirements.

Knowing where to look for certificates online and how to request an insurance certificate from vendors is just the beginning. To ensure that the COIs you receive are indeed eligible for the coverage you need to see to approve a provider for a job, you should also be aware of your company’s insurance coverage requirements.

What is a contractor’s insurance certificate?

An official document from your insurance company showing your insurance coverage is called an insurance certificate. Form ACORD 25 is another name. These documents are used by independent contractors to demonstrate their coverage to clients, landlords and lenders.

Commercial liability insurance is the most popular form of coverage for independent contractors. This policy protects contractors from financial burden if they are liable for anyone’s personal injury, loss of property, libel, or copyright infringement.

Why do contractors need an insurance certificate?

To be eligible to enter into a contract, sign a commercial lease, or work for a client, independent contractors in any industry may be required to provide proof of liability insurance. General contractors may be required to provide proof of insurance before starting a project.

General contractors may be required to provide proof of insurance before starting a project.

Error and omission (E&O) insurance, commonly referred to as professional liability insurance, may be requested by some contractor and subcontractor customers. He pays the cost of lawsuits caused by poor workmanship, missed deadlines and errors.

Most states require workers’ compensation insurance for companies with one or more employees. For individual owners in risky roles in the construction sector, such as roofing, workers’ compensation is required in some states.

How can I get a contractor insurance certificate?

After requesting a quote, most Insureon customers receive an insurance certificate within a few hours. Companies with higher insurance costs can usually receive a COI in less than 48 hours. For advice on what type of insurance you need, what policy limits to choose, or for any other questions, you can talk to a registered insurance representative.

What is an insurance certificate for subcontractors

Do you receive insurance certificates from your subcontractors and keep them so they are never taken away? It is vital to know that there is a proper method for collecting and updating subcontractor insurance certificates. When the annual insurance audit comes, poor quality or incorrect record keeping can haunt you.

First things first

The subcontractor’s insurance company will provide a certificate of insurance (COI), which is just a standard form detailing the coverage that the subcontractor has. It is highly recommended that you only work with subcontractors who can offer COI.

Each COI must be properly reviewed to prevent fraud. Look up an insurance company’s financial strength rating if you’re unfamiliar with it. Refrain from taking the ISP directly from the subwoofer. Ask the insurance company to send it. The COI must state that the subcontractor has at least general liability and workers’ compensation insurance.

Organized record keeping is important

We recommend keeping a file of all COIs with subcontractor names listed in alphabetical order. Before the project is completed, some policies may become invalid. We recommend setting up a reminder mechanism for subscribers so that their agents release updated COIs a week before their policy expires.

All COI must be kept in a safe place until the immunity period expires. Until then, the landlord must sue the developer for damages to the property.

Do subcontractors need an insurance certificate?

Subcontractors may be required to hold certain types of insurance to meet the requirements of the main contractor, even though contractors are generally responsible for meeting customer insurance claims and complying with state laws.

Another option for the general contractor may be to add any subcontractors as additional insured to their insurance policy, which will then cover them. Thus, the subcontractor will have the same insurance coverage as the general contractor.

Thus, the subcontractor will have the same insurance coverage as the general contractor.

If the contractor and subcontractor cooperate regularly, this coverage may be limited by the duration of the project or the policy itself.

What is a moving insurance certificate

One of the most important conditions for moving is an insurance certificate. Before allowing you to move into a building, many office and apartment buildings will ask for it. To ensure that property (elevator, corridors and floors) is insured against any damage along the way, COI serves as proof of liability insurance. COI simply gives you, your movers and the building the confidence that everyone is covered in the event of a problem.

Why is COI relocation important?

Relocation insurance must be obtained in the first place because it is required. Many structures do not allow movers into their property unless they have a moving COI. Many people only find out about it on moving days, which negates their months of preparation. Nobody wants this to happen, which is why it’s important to get COI.

Nobody wants this to happen, which is why it’s important to get COI.

While COI may seem like a formality, it serves a purpose. It serves as a backup plan in case the building gets damaged while you are moving. Wouldn’t you feel more comfortable if you had $10 million in insurance against significant damage?

What is a moving COI?

A building management firm may request a certificate of move insurance (COI) from your moving company, whether you are a local or long distance mover moving out of or into a residential complex or apartment. This is a legal document from the insurance company that protects both you and the transport business in the event of any damage.

To ensure that they are not liable for anything within their property, COI guarantees building management businesses that the moving company they use is insured to cover all potential losses during the move. Your belongings are simultaneously transferred to a new apartment.

Buildings are legally protected from damage through the transport company’s general liability and umbrella insurance through a certificate of insurance (COI). Compensation to the worker for missed days is paid by the insurance company if he was injured during the move.

How can I get a travel insurance certificate (COI)?

It’s time to take notes on how to get an insurance certificate for your move, now that you’re familiar with its basic components. While this may seem like a lot of work, obtaining COI is not. Apart from hiring a reputable moving company, there is essentially nothing for you to do. They will be the ones to do all the hard work once they are on board.

COI can be obtained in three simple steps and is a simple process. Let’s take a look at each one individually:

Step 1: Hire movers with the highest insurance coverage

As we mentioned earlier, you should choose a moving company that offers you additional coverage. For example, Roadway Moving offers you up to $10 million in protection that includes liability insurance, workers’ compensation, cargo insurance, umbrella insurance, and cargo insurance.

For example, Roadway Moving offers you up to $10 million in protection that includes liability insurance, workers’ compensation, cargo insurance, umbrella insurance, and cargo insurance.

Step 2: Request Sample Building Management Documents

Companies that manage buildings and need a COI provide a sample document that describes everything they need. In addition to the name and contact information of the building management representative, it also contains information about the additional insured area. This information is critical because without it you will not be able to file a COI request with your shipping company.

Step 3: Send Mover a certificate request.

Once you have all the required details, you must request a COI from your transport company. Since they will need time to process your COI request, it would be helpful if you did so at least a week before your move date. Don’t procrastinate and don’t wait until the last minute, because it can undo months of work and leave you feeling down.

How important is an insurance certificate?

The basic information about an insurance policy is presented in an understandable standardized form in insurance certificates (CICs), which are documents. The COI is intended to demonstrate the validity of the policy, provide easy access to information about its coverage, reduce exposure to risk, and protect the policyholder from liability to third parties.

What are insurance certificates used for?

The COI is designed to demonstrate the validity of the policy, provide easy access to coverage information, reduce exposure to risk, and protect the policyholder from liability to third parties.

Why would someone ask for an insurance certificate?

Generally, when there is possible liability for this third party, someone may try to see your insurance certificate. For example, if you provide data recovery services to a customer, they may request proof of insurance.

Is an insurance certificate the same as an insurance policy?

No. An insurance certificate does not provide coverage and is not an insurance policy. It simply serves as evidence that the coverage was in effect on the date the certificate was issued.

How long is the insurance certificate valid?

COI usually lasts five years.

When do I have to receive an insurance certificate?

Simply put, a Certificate of Insurance (COI) should be requested if you are contracting a firm or independent contractor to provide services on your property.

Conclusion

A Certificate of Insurance (COI) may be required in various circumstances. Typically, a customer will ask your insurance company for a COI to make sure you have the coverage you need. Even if you have previously worked with a contractor, you should consider getting a COI from their insurance company if you hire them because their insurance coverage may have changed.

Related articles

- LIABILITY INSURANCE CERTIFICATE: meaning, how to obtain and guidance

- CERTIFICATE HOLDER INSURANCE: what is it and everything you need to know?

- WHAT CONTRACTORS DO: responsibilities, salary and everything you need to know

- COI INSURANCE: meaning and how to get an insurance certificate

- Construction project: value, examples and best software

Recommendations

- Mycoitracking

- Insurance

- Roadway

Schengen visa insurance – European travel insurance for Schengen visa

When visiting Europe, travelers must be able to use medical services and cover the costs associated with an accident, injury or any other sudden event.

Travel insurance has been proven to provide travelers with financial support and comfort while continuing their journey without having to worry about unexpected expenses incurred during the trip.

Schengen visa insurance requirements

Schengen visa health insurance must meet the following criteria:

- Minimum coverage of at least EUR 30,000.

- Insurance coverage must cover all Schengen member states.

- Insurance coverage must cover any costs that may arise in connection with repatriation for medical reasons, medical emergencies and/or emergency hospitalization or death.

Two travel insurance companies, Europ Assistance and MondialCare provide the mandatory insurance certificate required when applying for a Schengen visa.

While all travelers in Europe should have health insurance, it is not mandatory for everyone. Having a travel insurance policy is a requirement only for travelers who need to apply for a Schengen visa. This group of travelers must always have the necessary insurance coverage for the entire duration of their stay in Europe, whether for work, tourism, study, leisure or other reasons.

Foreign travelers visiting Europe who enjoy visa-free access to the Schengen area can take out travel insurance if they wish, but although this is highly recommended, they are not required to do so.

Insurance for a Schengen visa is compulsory

Extract from “Regulation EC 810/2009 of the European Parliament and of the Council of 13 July 2009”, which entered into force on 5 April 2010:

“…applicants for a single single or double entry visa must prove that they have adequate and valid travel health insurance to cover any expenses that may arise from repatriation for medical reasons, medical emergencies and/or urgent hospital emergencies or deaths while in the territory of the Member States.

The insurance policy must be valid in the territory of the Member States and cover the entire period of the person’s intended stay or transit. The minimum amount of insurance must be EUR 30,000” (…)

Who is required to purchase Schengen travel insurance for Europe?

Anyone who is temporarily traveling to Europe from a country subject to visa requirements, whether they are individual visitors or members of a group, tourists or business people.

Schengen visa insurance policy can be easily purchased online from Europ Assistance or MondialCare at a very low price.

Who provides Schengen travel insurance?

First of all, a health insurance policy, which may already be included in your employment contract, may cover international emergency medical expenses, however, there are usually limitations in coverage, and therefore it is necessary to be well aware of what should and should not be expected in the event of a medical problem in the Schengen area.

Travelers usually purchase an individual Schengen travel insurance policy for the days they plan to spend in Europe from a legitimate insurance provider.

We recommend purchasing Schengen visa insurance from Europ Assistance or MondialCare . Both travel insurance companies are recognized by European embassies and consulates around the world. You can also cancel your policy free of charge if you provide proof of your visa refusal.

Make sure the company you choose is licensed and recognized in the Schengen country you are planning to travel to.

Do Schengen visa insurances cover COVID-19 related costs?

Yes, some Schengen travel insurance policies cover COVID-related illness, provided you comply with the laws and regulations of your home government and the World Health Organization (WHO) during your trip. COVID-19 Insurancecovers:

- COVID-19 related health emergencies, including treatment, medications and hospitalization;

- PCR test (sometimes).

Quarantine requirements such as living in quarantine are not covered.

COVID coverage varies by policy. For example, AXA pays for your medical and repatriation costs if you are sick with COVID-19 and “comorbidities”, whereas MondialCare covers all medical consequences of COVID-19 infection, as well as a PCR test if the result is positive (the cost of a test with a negative result is not covered).

At the same time, some insurance companies do not, under any circumstances, cover any costs associated with epidemics or pandemics, including COVID-19.

Whether an insurance company will cover COVID is found in its policies and conditions, so be sure to read the specific conditions in fine print carefully.

What if the embassy requests an insurance policy for the Schengen area covering COVID-related expenses?

If your insurance policy includes coverage for COVID, this must be clearly stated on the policy. If the policy does not specifically cover COVID expenses, you can ask your insurer to provide you with such coverage.

Can I extend my European travel health insurance if my trip is delayed due to COVID-19 travel restrictions?

If your trip to Europe is delayed due to the COVID travel ban and your travel insurance is about to expire, you can purchase a new insurance policy or renew your current one. Of course, you will need to pay extra. The rules for renewing or renewing the policy should be clarified with the insurance company that issued the travel insurance.

The rules for renewing or renewing the policy should be clarified with the insurance company that issued the travel insurance.

If I need to extend my trip due to airport closures or official travel restrictions, can I extend my European travel health insurance?

Each travel insurance company has its own rules. Contact her customer service for details. It must be possible to get a refund for the current travel policy or to renew it.

Helpful Tips for European Visa Insurance

As already mentioned, before purchasing insurance for your upcoming trip to Europe, you need to make sure that the policy you already have does not cover or reduce any international emergency medical expenses.

If your policy covers certain international medical expenses, carefully check the restrictions and disclaimers on your travel insurance policy.

If you’re traveling in the Schengen area by car and can’t afford to pay crazy amounts of money in the event of an unpredictable car accident – or just don’t want to give all that money away – you should consider purchasing a combined travel insurance that includes health problems. as well as valuables.

as well as valuables.

Depending on the destination, the risk of disease varies due to changes in climate or natural habitat (unfamiliar germs). People with pre-existing medical conditions, such as allergies, are strongly advised, for example, to have a medical record from their personal physician containing a description of the illness and medications prescribed to treat it. In addition, if you suffer from a chronic illness, it is wise to have enough prescribed medicines for your days in Europe.

What does European travel insurance usually cover?

A good European travel insurance policy should cover the following costs:

- Medical emergency (accident or illness) while in the Schengen area

- Emergency evacuation

- Repatriation of remains

- Return imperfect travel

- Trip cancellation

- Trip interruption

- Insurance indemnity in case of death, injury or disability

- Foreign funeral expenses

- Lost, stolen or damaged luggage, personal effects or travel documents other transport when leaving or entering due to weather conditions

- Aircraft hijacking

- Typically, insurers cover pregnancy-related expenses if the trip occurs during the first trimester.

After that, coverage varies by insurer.

After that, coverage varies by insurer.

Travel health insurance policies for travel to Europe that meet Schengen visa requirements can be purchased online directly from the Europ Assistance website or MondialCare

USD does the travel visa insurance policy cover all countries Schengen zone?

Yes, the travel health insurance policy must cover all Schengen Member States: Austria, Belgium, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Lithuania, Luxembourg, Malta, Holland, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, Switzerland and Liechtenstein.

What can be excluded or added to a normal travel insurance policy?

All travel insurance companies are different. However, there are companies that offer additional cost coverage if necessary. If not, you can buy additional insurance to cover cash costs such as:

- Existing medical conditions (eg asthma, diabetes).

- Extreme sports (eg skiing, scuba diving).

- Travel to countries with a high level of risk (for example, war, natural disasters or terrorist attacks).

- Acute attack of illness. This means a sudden, unexpected onset of an existing illness without prior warning from a medical professional. If you already have a medical condition, be sure to get coverage to protect you from any emergencies that may arise from an existing medical condition despite treatment.

How to find cheap travel insurance for Europe?

Finding suitable cheap insurance for a European tourist visa requires a separate and deeper research. This means that you will have to search for a suitable insurance policy on the Internet yourself. Before deciding which company offers the cheapest and best Schengen visa travel insurance, it is a good idea to do a comparison of products and companies.

The price should not confuse you, because not all low-cost travel insurance policies provide poor quality services, and not all expensive insurance plans are of high quality. That’s why the safest way to make the right choice among the limitless offers of travel insurance companies is not to choose the cheapest travel insurance, but a policy that covers all areas, as required by the Schengen visa application requirements.

That’s why the safest way to make the right choice among the limitless offers of travel insurance companies is not to choose the cheapest travel insurance, but a policy that covers all areas, as required by the Schengen visa application requirements.

Why do we suggest you choose MondialCare or Europ Assistance as your travel insurance partner for your trip to Europe?

- Both companies are leaders in travel insurance

- Both companies meet all Schengen visa requirements

- Ideal for the following categories:

- Visitors or guests (visit visa)

- Business people (business visa)

- Tourists (tourist visa)

- Group visitors (guest visa for tourist groups)

- Upload your insurance certificate/letter immediately

- Reimbursement in case of visa refusal (free of charge subject to proof of visa refusal)

Purchasing an insurance policy for a tourist visa from Europ Assistance or MondialCare will allow you to fully enjoy your trip to the Schengen area and Europe.

Citizens of which countries are required to purchase travel insurance in order to obtain a Schengen visa?

Citizens and passport holders of any of the following countries are required to purchase travel insurance in order to be able to apply for a Schengen visa.

Get your Schengen visa health insurance at a very low price from Europ Assistance or MondialCare now.

What is travel health insurance?

Travel health insurance covers medical expenses in the event of an injury or unexpected illness during a trip. The need to purchase health insurance for traveling abroad depends on the country of destination, as well as the ability to pay for medical services while living abroad.

However, an insured trip is a must for most travelers, especially the elderly and sick people in need of constant care or if the traveler intends to travel to an underdeveloped area.

In addition to medical expenses, travel insurance is designed to cover various losses incurred during a trip in your own country and other countries. Unexpected occurrences such as lost luggage, last-minute flight cancellations, or the bankruptcy of a travel agency or hotel can ruin your trip. Therefore, travel insurance also provides cancellation insurance with a full or partial refund.

Unexpected occurrences such as lost luggage, last-minute flight cancellations, or the bankruptcy of a travel agency or hotel can ruin your trip. Therefore, travel insurance also provides cancellation insurance with a full or partial refund.

For a single trip or multiple trips within a short time, travel insurance will cover the exact number of days spent in an international territory, in this case the Schengen area, and the price will change accordingly.

What are the general limits and restrictions?

- As mentioned above, there are insurance companies that do not cover existing illness abroad. If you fall ill before departure, you should consult your doctor and begin treatment. If you decide to travel abroad, in this case to the Schengen area, you can reduce any medical costs with the help of your insurer. If a person considers himself fit to travel and is in control of his condition, travel insurance usually covers acute illnesses and unexpected medical incidents when traveling abroad.

- Sports – participation in extreme sports such as scuba diving, skydiving, etc. may be excluded.

- War – Policies may exclude coverage for injuries sustained as a result of war while traveling to a dangerous war zone.

- Duration – many policies specify a time limit for coverage (eg 60 days) and the cost varies accordingly.

Foreign or domestic suicide and self-harm are excluded from all insurance policies. - If you abuse alcohol or drugs abroad or in the country, medical expenses are not covered by the insurance policy.

Is health insurance compulsory for third-country nationals entering the Schengen area under a visa-free regime?

Travel health insurance is optional for third-country nationals entering under the visa-free regime. However, it is strongly recommended to take out an insurance policy in case of a trip to the Schengen countries.

You can get European travel health insurance at a very low price from Europ Assistance or MondialCare .

After that, coverage varies by insurer.

After that, coverage varies by insurer.