How is Softbank reshaping the tech landscape with its massive Vision Fund investments. What are the potential risks and rewards of Softbank’s ambitious bets on emerging technologies. Can Softbank’s strategic investments in established players like ARM Holdings deliver long-term value. Will Softbank’s moonshot mentality in sectors like autonomous driving and augmented reality ultimately pay off.

Softbank’s Vision Fund: A Game-Changing Force in Tech Investing

Softbank, under the leadership of CEO Masayoshi Son, has emerged as a dominant force in the tech investment landscape through its massive Vision Fund. With over $100 billion at its disposal, the Vision Fund has been making waves by pouring unprecedented sums into ambitious startups aiming to disrupt entire industries. This approach has sparked both excitement and skepticism within the tech community.

Why has Softbank’s investment strategy garnered so much attention? The sheer scale of their investments sets them apart from traditional venture capital firms. By deploying enormous amounts of capital into select companies, Softbank aims to accelerate their growth and market dominance. This strategy has the potential to reshape entire sectors of the tech industry, but it also comes with significant risks.

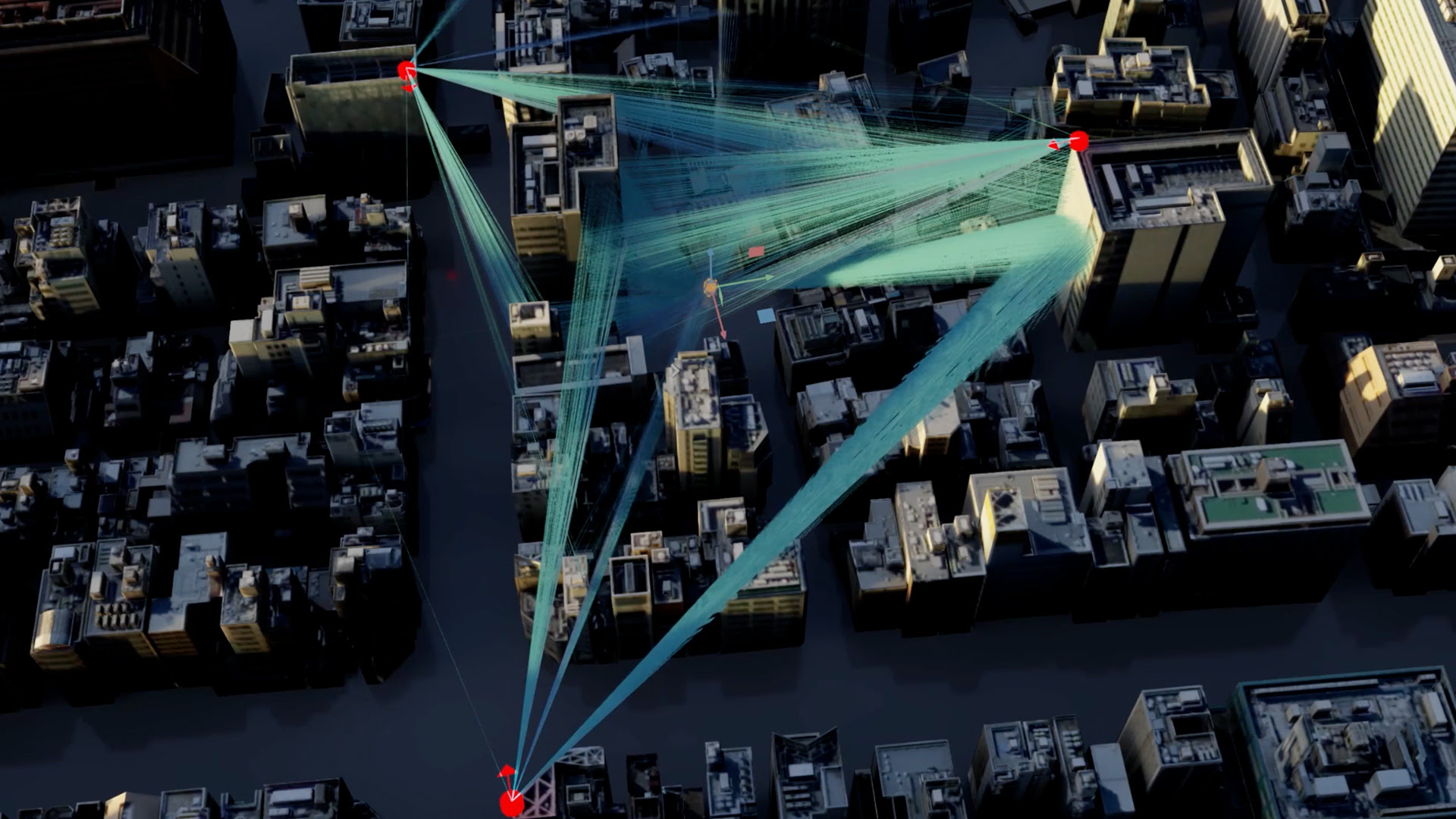

Autonomous Driving: Softbank’s Bold Bet on the Future of Transportation

One of Softbank’s most notable investments has been in the autonomous driving sector. The company led a staggering $2.25 billion investment into GM’s self-driving unit, Cruise Automation. This massive infusion of capital has undoubtedly accelerated the development of autonomous vehicle technology.

How close are we to seeing fully autonomous vehicles on our roads? Despite the rapid progress, experts suggest that widespread adoption of Level 5 autonomy (fully autonomous vehicles capable of operating in all conditions) is still years away. Technical challenges, regulatory hurdles, and public acceptance remain significant obstacles.

Is Softbank’s investment in Cruise Automation likely to pay off? While the potential market for autonomous vehicles is enormous, the timeline for widespread adoption remains uncertain. Softbank’s massive investment has certainly given Cruise a competitive advantage in terms of resources and development speed. However, the long-term success of this bet will depend on Cruise’s ability to overcome technical challenges and navigate the complex regulatory landscape surrounding autonomous vehicles.

Key Challenges Facing Autonomous Vehicle Adoption:

- Ensuring safety and reliability in all driving conditions

- Developing robust AI systems capable of handling complex traffic scenarios

- Addressing cybersecurity concerns

- Gaining public trust and acceptance

- Navigating the evolving regulatory landscape across different jurisdictions

Augmented Reality: Softbank’s Moonshot Investment in Magic Leap

Softbank’s willingness to take big risks on emerging technologies is exemplified by its $542 million investment in Magic Leap, a secretive augmented reality (AR) startup. This massive funding round in 2014 sparked intense speculation about the potential of AR technology to revolutionize how we interact with digital information.

Has Softbank’s bet on Magic Leap paid off? The journey has been rocky. Magic Leap’s first consumer headset, released in 2018, received mixed reviews and struggled to gain widespread adoption. This outcome highlights the inherent risks of Softbank’s approach – pouring huge sums into cutting-edge technologies before their market potential is fully proven.

What lessons can be learned from the Magic Leap investment? While AR technology still holds immense promise, Magic Leap’s struggles demonstrate the challenges of bringing revolutionary hardware products to market. Factors such as price point, user experience, and compelling use cases are crucial for adoption. Softbank’s moonshot mentality led them to bet big upfront on AR, but a more staged investment approach might have allowed for better risk management.

Potential Applications of AR Technology:

- Enhanced workplace productivity and training

- Immersive gaming and entertainment experiences

- Improved medical visualization and surgical planning

- Revolutionary retail and e-commerce experiences

- Advanced navigation and spatial computing

ARM Holdings: Softbank’s Strategic Play in the Mobile Ecosystem

Not all of Softbank’s investments focus on unproven technologies. The $32 billion acquisition of ARM Holdings in 2016 represents a savvy strategic move to gain control of a critical player in the mobile ecosystem. ARM’s energy-efficient chip designs power the vast majority of smartphones and are increasingly important in the growing Internet of Things (IoT) market.

Why is the ARM acquisition considered a safer bet than some of Softbank’s other investments? Unlike speculative bets on emerging technologies, ARM has an established market position and a clear path to future growth. As the world becomes increasingly connected, demand for ARM’s chip designs is likely to grow across various device categories.

How does the ARM acquisition fit into Softbank’s broader strategy? By owning ARM, Softbank gains valuable insights and influence over the future direction of mobile and IoT technologies. This strategic position could create synergies across Softbank’s portfolio of companies and inform future investment decisions.

Key Benefits of Softbank’s ARM Acquisition:

- Direct access to cutting-edge mobile chip technology

- Influence over the future direction of IoT and connected devices

- Potential for cross-pollination of ideas across Softbank’s portfolio

- Steady revenue stream from ARM’s licensing model

- Strategic position in the growing AI and machine learning chip market

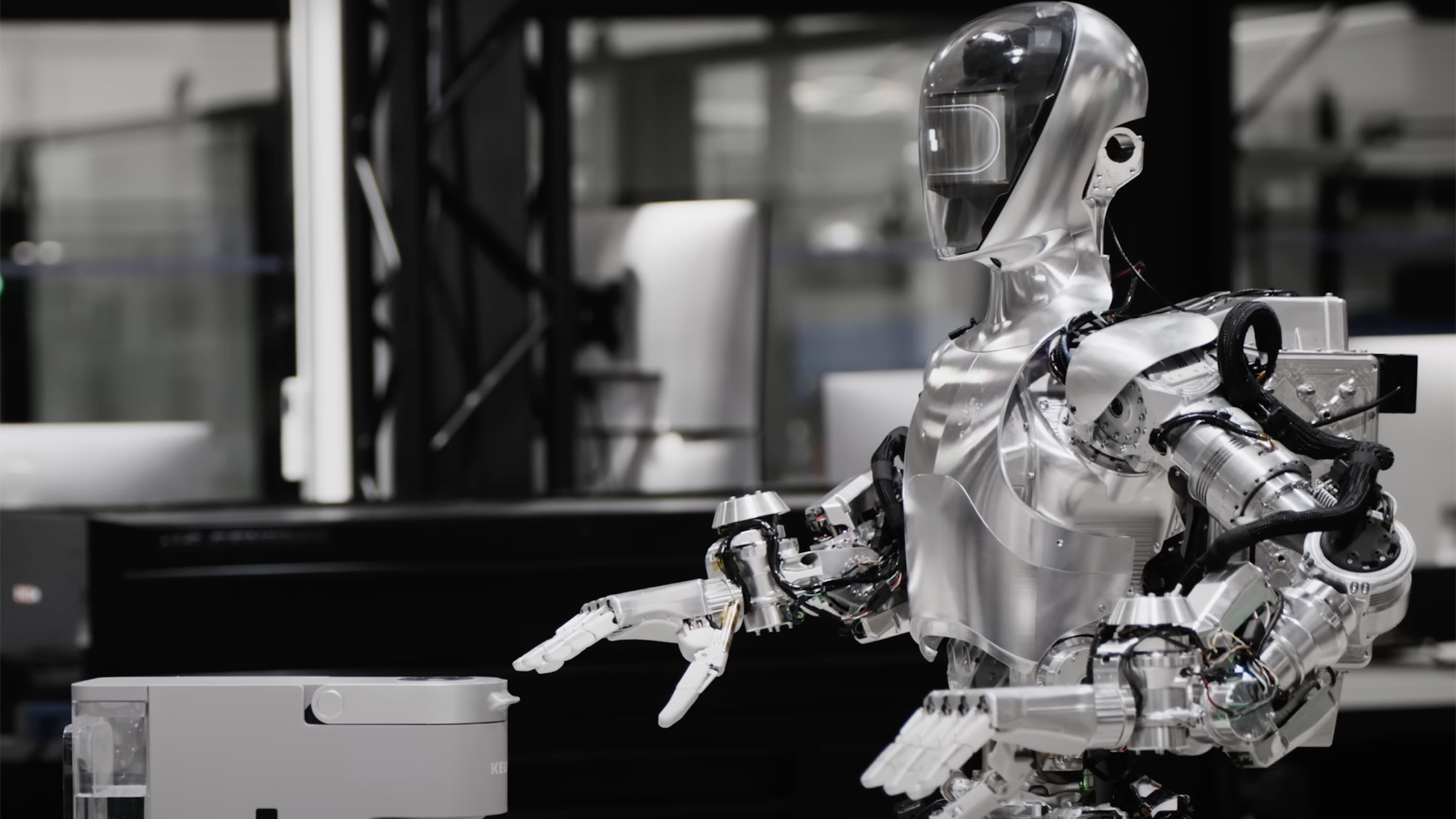

Boston Dynamics: Softbank’s Foray into Advanced Robotics

Softbank’s acquisition and subsequent sale of robotics firm Boston Dynamics showcases the company’s flexibility in managing its portfolio. After purchasing Boston Dynamics from Google in 2017, Softbank sold the company to Hyundai in 2020 for $1.1 billion – more than tripling their initial investment.

What made Boston Dynamics an attractive investment for Softbank? The company’s advanced robots, such as Spot and Atlas, have captured public imagination with their remarkable mobility and versatility. However, commercializing these robots beyond military and research applications has proven challenging.

Why did Softbank choose to sell Boston Dynamics? The sale to Hyundai likely represents a strategic decision to capitalize on the increased value of Boston Dynamics while avoiding the complexities of bringing cutting-edge robots to mainstream markets. This move demonstrates Softbank’s ability to generate returns on risky investments without necessarily seeing them through to full commercialization.

Potential Applications for Boston Dynamics’ Robots:

- Industrial automation and inspection

- Search and rescue operations

- Construction and infrastructure maintenance

- Entertainment and theme park attractions

- Scientific research in challenging environments

E-commerce Dominance: Softbank’s Massive Investment in Coupang

While Softbank is known for its investments in cutting-edge technologies, the company has also made significant bets in more established markets. A prime example is its over $3 billion investment in Coupang, South Korea’s leading e-commerce platform.

How does the Coupang investment differ from Softbank’s more speculative bets? Unlike investments in emerging technologies like autonomous vehicles, Coupang operates in the well-established e-commerce market. This represents a lower-risk opportunity for Softbank to deploy capital at scale and consolidate power in a crucial sector of the digital economy.

What potential synergies exist between Coupang and other Softbank investments? As Coupang continues to grow and dominate the Asian e-commerce market, it could provide valuable opportunities for collaboration with other companies in Softbank’s portfolio. For example, Coupang’s logistics network could be leveraged to test and deploy robotics technologies from other Softbank-backed firms.

Key Factors Driving Coupang’s Success:

- Robust logistics network enabling fast delivery

- Strong mobile-first approach catering to smartphone-centric consumers

- Innovative services like dawn delivery and hassle-free returns

- Strategic focus on customer experience and satisfaction

- Continuous investment in technology and automation

Blockchain and Cryptocurrency: Softbank’s Cautious Exploration

As the tech landscape continues to evolve, Softbank has shown interest in emerging fields like blockchain and cryptocurrency. The company has made select investments in this space, such as backing blockchain platform Dragonchain.

How does Softbank’s approach to blockchain differ from its other investments? Unlike the massive bets placed on companies like Cruise Automation or ARM Holdings, Softbank’s blockchain investments have been relatively modest. This cautious approach suggests that while the company recognizes the potential of blockchain technology, it is still evaluating the long-term prospects of the sector.

What potential applications of blockchain technology might interest Softbank? Given Softbank’s diverse portfolio, blockchain could offer interesting opportunities for integration across various industries. From improving supply chain transparency to enabling new financial services, blockchain technology has the potential to impact many sectors in which Softbank has invested.

Potential Blockchain Applications Relevant to Softbank’s Portfolio:

- Secure and transparent supply chain management for e-commerce

- Decentralized identity solutions for mobile and IoT devices

- Smart contracts for automating business processes

- Tokenization of assets in real estate and other industries

- Blockchain-based platforms for secure data sharing in AI and robotics research

Softbank’s cautious approach to blockchain investments reflects the still-evolving nature of the technology. While blockchain has shown promise in various applications, widespread adoption and clear business models are still developing. Softbank’s strategy appears to be one of staying informed and positioned to capitalize on blockchain’s potential without overcommitting resources to unproven solutions.

The Vision Fund’s Impact on Startup Ecosystems

Softbank’s Vision Fund has had a profound impact on the global startup ecosystem, reshaping funding dynamics and company growth trajectories. The sheer size of Vision Fund investments has raised questions about sustainable growth and market distortions.

How has the Vision Fund changed the startup funding landscape? The availability of massive funding rounds from Softbank has allowed some startups to delay going public or seeking alternative funding sources. This has enabled rapid scaling but also raised concerns about overvaluation and the creation of so-called “unicorn bubbles.”

What are the potential long-term consequences of Softbank’s investment strategy? While the influx of capital has undoubtedly accelerated innovation in many sectors, it has also led to concerns about market concentration and the crowding out of smaller investors. Some critics argue that the Vision Fund’s approach may be creating unsustainable growth patterns and unrealistic expectations for startup success.

Key Impacts of the Vision Fund on Startup Ecosystems:

- Increased competition for top-tier startups among investors

- Pressure on traditional VCs to raise larger funds

- Extended private company lifecycles with delayed IPOs

- Potential market distortions due to overvaluation

- Accelerated innovation and scaling in select industries

The long-term success of Softbank’s Vision Fund strategy remains to be seen. While some investments have already yielded significant returns, others face ongoing challenges. The true test will be whether the fund’s portfolio companies can achieve sustainable profitability and deliver on their disruptive promises.

Evaluating Softbank’s Investment Philosophy

Softbank’s investment strategy under Masayoshi Son has been characterized by a unique blend of long-term vision and high-risk tolerance. This approach has led to both spectacular successes and notable failures.

What distinguishes Softbank’s investment philosophy from traditional venture capital? Unlike many VCs who focus on stage-specific investments or particular sectors, Softbank takes a more holistic view of the tech ecosystem. The company is willing to make massive bets across various stages and industries, often with the goal of creating synergies within its portfolio.

How does Softbank balance moonshot investments with more conservative plays? While headline-grabbing investments in cutting-edge technologies like autonomous vehicles and AR grab attention, Softbank also makes strategic investments in established players like ARM and Coupang. This diversified approach allows the company to potentially offset the risks of its more speculative bets with steadier returns from proven businesses.

Key Elements of Softbank’s Investment Philosophy:

- Long-term vision focused on transformative technologies

- Willingness to deploy massive amounts of capital

- Emphasis on market leaders and potential category dominators

- Balancing of high-risk, high-reward bets with strategic acquisitions

- Focus on creating an ecosystem of complementary technologies and businesses

Softbank’s bold investment strategy has reshaped the tech investment landscape, but it also carries significant risks. The success of the Vision Fund will ultimately depend on the ability of its portfolio companies to deliver on their ambitious promises and achieve sustainable profitability.

The Future of Softbank’s Tech Investments

As Softbank continues to deploy capital through its Vision Fund and other investment vehicles, the tech industry watches closely to see which bets will pay off and which may falter. The company’s investments span a wide range of technologies and markets, each with its own trajectory and challenges.

What emerging technologies might Softbank target for future investments? Given the company’s interest in transformative technologies, areas like quantum computing, advanced AI, space technology, and sustainable energy solutions could be potential targets for future Softbank investments.

How might geopolitical factors impact Softbank’s investment strategy? As a global investor, Softbank must navigate complex geopolitical landscapes, including tensions between major technology powers like the US and China. These factors could influence future investment decisions and portfolio management strategies.

Potential Future Focus Areas for Softbank Investments:

- Quantum computing and advanced AI applications

- Space technology and satellite communications

- Sustainable energy and climate tech solutions

- Advanced materials and nanotechnology

- Biotechnology and personalized medicine

The success of Softbank’s epoch-defining investments will likely take years to fully evaluate. While some bets, like the ARM acquisition, have already shown promise, others remain speculative. The true test will be whether Softbank’s portfolio companies can translate their massive funding into sustainable businesses that deliver on their transformative potential.

As the tech landscape continues to evolve, Softbank’s willingness to make bold, long-term bets on emerging technologies will undoubtedly continue to shape the industry. Whether these investments ultimately pay off will depend on a complex interplay of technological progress, market dynamics, and the execution capabilities of Softbank’s portfolio companies.

Introduction to Softbank’s vision fund investments

In recent years, Softbank has made waves in the tech industry with their gargantuan Vision Fund, which has poured over $100 billion into ambitious and often controversial startups. Led by CEO Masayoshi Son, Softbank has not been afraid to make huge bets on unproven companies aiming to disrupt entire industries. But will these epoch-defining investments ultimately pay off?

Pouring gas on the autonomous driving race

One of Softbank’s most debated moves was leading a $2.25 billion investment into GM’s self-driving unit, Cruise Automation. This eye-popping sum accelerated the race to develop safe autonomous vehicles. But some analysts wonder whether VCs like Softbank are fueling unrealistic expectations around the imminent arrival of self-driving cars. Though Cruise is a leader in the space, we’re still likely years away from Level 5 autonomy becoming commonplace. And even then, will the public trust driverless vehicles? Softbank’s massive checks have sped up development – but will they deliver returns?

Placing a moonshot bet on augmented reality

Magic Leap was one of the most hyped and secretive startups working on augmented reality headsets. And Softbank placed a gigantic bet on their potential, leading a $542 million funding round back in 2014. Since then, Magic Leap has run into difficulties – their headset received mixed reviews and struggled to gain traction. This highlights the risks of Softbank’s approach – pouring huge sums into cutting-edge technologies that may or may not be poised to go mainstream. Other VCs might have staged smaller investments to monitor Magic Leap’s progress. But Softbank’s moonshot mentality led them to bet big upfront on AR taking off.

An epoch-shaping investment in chipmaker ARM

While some of Softbank’s investments have focused on bleeding edge tech, others have targeted established players poised for further growth. Their $32 billion acquisition of ARM Holdings falls into the latter category. ARM is the most influential chip designer for smartphones, with its energy-efficient architectures powering devices from Apple, Samsung, and Qualcomm. As internet-connected gadgets continue proliferating globally, ARM’s technologies will likely be in higher demand. Softbank gaining ownership of this critical tech provider was a savvy strategic play for the future, providing valuable integration opportunities across its sprawling portfolio of holdings.

Though not without risks, Softbank securing ARM was likely a safer bet than pouring billions into untested self-driving startups like Cruise. With its fingers directly on the pulse of the mobile ecosystem, ARM gives Softbank capabilities to shape the next generation of devices and applications.

Experimenting with robotics via Boston Dynamics

Other than ARM, one of Softbank’s most lucrative acquisitions has been robotics firm Boston Dynamics. After buying it from Google in 2017, Softbank recently turned around and sold it to Hyundai last year for $1.1 billion – more than triple what they originally paid. Boston Dynamics makes remarkable robots with advanced mobility, but they have struggled to commercialize them beyond military and research contexts. Hyundai likely sees big potential in bringing their robots into industrial settings.

For Softbank, flipping Boston Dynamics provided a sizable return on investment fairly rapidly. And it allows them to avoid navigating the complexities of actually bringing weird but viral robots like Spot and Atlas into mainstream use. Overall, the Boston Dynamics saga illustrates Softbank’s willingness to take risks on cutting-edge technologies while also maintaining flexibility.

Making e-commerce a priority with Coupang

Softbank hasn’t focused exclusively on bleeding-edge technologies – it has also made big bets on prominent startups in massive existing markets. South Korean e-commerce leader Coupang is a prime example, with Softbank investing over $3 billion into the company. This has fueled Coupang’s growth into a formidable Amazon competitor in Asia handling over $10 billion in annual sales. E-commerce represents an established market where Softbank can deploy capital at scale to consolidate power for its portfolio companies.

Unlike autonomous vehicle startups which still face technical challenges, Coupang is operating in a more straightforward e-commerce sphere. So backing Coupang aligns with Softbank’s strategy of combining moonshot investments with lower risk plays in proven markets. And having a thriving e-commerce operation could allow synergies with other Softbank startups down the road.

Exploring blockchain via Dragonchain investment

In the constantly evolving tech landscape, Softbank also keeps an eye out for emerging spaces like blockchain. To gain exposure here, it led a funding round in Dragonchain, a blockchain-based developer platform. Though cryptocurrencies have gone through boom and bust cycles, underpinning blockchain technologies could still transform fintech, supply chain management, health records, and more.

For Softbank, investing in Dragonchain provides insight and access into blockchain advancements. This hedges their bets should distributed ledger platforms become integral for future businesses and consumers. The Dragonchain bet aligns with Softbank’s strategy of supporting cutting-edge innovations. And compared to many overhyped crypto projects, Dragonchain seems focused on delivering practical blockchain applications.

Controversial investment: HackingTeam

Not all of Softbank’s investments have been universally praised, however. Back in 2012, they infused $5 million into controversial cybersecurity firm HackingTeam. This company came under fire after selling surveillance capabilities to oppressive regimes, which allegedly utilized them to spy on journalists and dissidents. While Softbank divested from HackingTeam after the outcry, this investment sparked concerns about the ethical implications of some of their funding decisions.

The HackingTeam debacle highlights potential downsides to Softbank’s broad investment mandate, where they support startups across a dizzying array of fields. Surveillance software represents just one sector where the ethics are complex. Softbank will need to closely evaluate the societal impacts of the technologies they empower going forward.

Funding the future of agriculture

Along with futuristic technologies, Softbank has notably backed startups aiming to revolutionize agriculture. For example, they’ve poured over $200 million into Plenty, which utilizes indoor vertical farming to enhance crop yields. With global population rising, improving agricultural techniques will be crucial for sustainably feeding more people.

For Softbank, Plenty represents a surprising foray into agricultural tech after focusing predominantly on information technology. But this aligns with Masayoshi Son’s long-term strategic vision. And initiatives like Plenty could help Softbank diversify into less conventional domains beyond just AI and communications.

The challenges of managing a sprawling portfolio

While Softbank has proven willing to make big bets across domains, some analysts caution that it may be overextending itself with too broad of an investment mandate. With over 90 companies in their Vision Fund spanning everything from satellites to real estate, effectively overseeing each investment will prove challenging even for Softbank’s seasoned leadership.

Rather than placing dozens of moonshot bets, critics argue Softbank would be better served strategically identifying just a few emerging sectors with the highest upside. Their current diversified approach runs the risk of diluting efforts and undermining returns. With unicorns like WeWork already stumbling, Softbank may need to pare back its focus if they hope to thrive long-term.

Scrutiny from regulators

Along with concerns about focus, Softbank also faces regulatory challenges regarding their Vision Fund’s size and reach. Regulators have already started probing potential anti-competitive practices, such as whether Softbank pressures the companies they invest in to favor each other rather than competitors. This scrutiny could limit Softbank’s strategic flexibility going forward.

Softbank’s massive pool of capital does carry the potential for conflicts of interest and unfair competitive practices. They will need to closely adhere to regulations around exercising undue influence over portfolio companies. Any missteps could trigger pushback from oversight agencies.

Delivering returns for investors

Given the scale of the Vision Fund, one of Softbank’s biggest challenges will be generating solid returns for their investors. Japanese banks and Saudi Arabia’s sovereign wealth fund both committed huge sums. But naked vdings driving delayed share offerings and layoffs, Softbank is under growing pressure to justify massive bets on companies like WeWork and Oyo. Otherwise, future funding for additional vision funds could dry up.

For any VC firm, ending up with too much invested in failing startups can spell disaster. Softbank will need to continue having enough wins like ARM to offset risky startup bets that fail to pan out. Only consistent solid returns can attract investors for the long haul.

The historic significance of Softbank’s investments

Whether Softbank’s Future Fund yields big successes or flops, it’s undeniable that their gargantuan investments have shaped the trajectory of multiple tech sectors. Plowing billions into autonomous vehicles like Cruise directly impacted that industry’s pace of development. And acquisitions like ARM tipped the scales in key competitive domains.

Masayoshi Son has made it abundantly clear he is not afraid to make big, unorthodox bets in pursuit of emerging technologies. Softbank’s influence across the global startup ecosystem is now assured. But it remains to be seen whether their epoch-defining investments will pay off in the long run.

Controversy around large investments in unproven startups

Softbank has ruffled feathers in the VC world with their willingness to pour billions into emerging startups still proving out their business models and technologies. Critics argue these gigantic checks inflate valuations and allow unvetted startups to spend recklessly before demonstrating real traction.

For example, workplace software firm WeWork was once valued at an astounding $47 billion after Softbank invested over $10 billion. But WeWork’s core business model was unprofitable, and its valuation soon collapsed down to $5 billion as it failed to go public. Softbank endured major losses.

Autonomous driving startup Cruise Automation also received a massive $2.25 billion cash infusion from Softbank. But some analysts think driverless car development is progressing slower than expected, making Cruise’s ultimate value uncertain. If technologies like lidar and computer vision don’t advance sufficiently to enable safe Level 5 autonomy, Cruise could underwhelm.

These cases reveal potential pitfalls of Softbank’s investment thesis. By handing over such staggering amounts of capital to unproven startups, Softbank reduces incentives for prudent financial management. Startups may expand too fast or overlook weaknesses in core offerings.

More disciplined VCs might wait to invest smaller amounts until seeing clear signs of traction. But Softbank’s huge checks enable startups to operate more freely without needing to immediately validate business models. This leaves little urgency to demonstrate sustainability.

Softbank believes pouring gasoline on the fire will let innovative startups accelerate disruption of industries. But unchecked spending of easy money can also breed waste and excess. Proven fiscal discipline often leads to the strongest long-term companies.

Of course, not all of Softbank’s moonshot bets will likely fail. The wins could far outweigh the losses. But when valuations detach too much from fundamentals, eventual corrections can be painful. Softbank will need to carefully balance vision and pragmatism moving forward.

Magic Leap overpromises on augmented reality capabilities

Augmented reality startup Magic Leap provides another example where Softbank’s funding contributed to disconnects between hype and reality. Magic Leap promised revolutionary AR capabilities, but its first product was panned for lacking unique value.

Years of mystery around Magic Leap fed grandiose expectations. Softbank added momentum by leading a $542 million funding round. But Magic Leap ultimately underdelivered – its headset merely provided incremental AR improvements.

By allowing Magic Leap to operate secretly for so long without proving practical applications, Softbank funding may have enabled overhype. More transparency earlier could have led to realistic expectations. AR holds long-term potential, but Magic Leap’s struggles highlight the risks of funding vaporware.

WeWork debacle spotlights dangers of easy money

If any startup showcased the perils of lavish funding detached from fundamentals, it was WeWork. WeWork leased office spaces and subleased them flexibly, but losses mounted quickly at its core coworking operation. Still, Softbank infused over $10 billion into the company.

This allowed WeWork to expand rapidly without needing to demonstrate viable economics. Fueled by Softbank’s investments, WeWork’s valuation inflated exponentially to $47 billion. But when WeWork finally unveiled IPO plans, deep flaws were exposed.

once reliant on Softbank’s easy money, WeWork had few incentives to control costs or move toward profitability. Instead, the funding subsidized excessive expenses like private jets for executives. WeWork personified startups blinded by unlimited capital without accountability.

Softbank belatedly acknowledged WeWork’s systemic issues, leading to their CEO’s ouster. But Softbank’s unchecked funding enabled WeWork’s wasteful culture in the first place. More prudent investment stewardship earlier could have imposed financial discipline.

Autonomous driving startups pursue radically different strategies

Beyond risks like overhype and waste, another danger of large generalized investments is lack of strategic focus. For example, Softbank has poured billions into over half a dozen autonomous vehicle startups like Cruise, Nuro and DoorDash.

These firms use very different technical approaches, ranging from lidars to camera-only systems. Unlike a focused manufacturer like Tesla integrating end-to-end, Softbank is essentially placing separate bets on multiple horses simultaneously.

This shotgun strategy increases the odds of picking a winner. But it can also breed internal redundancies and inefficiencies across a complex portfolio. Streamlining investments around fewer core platforms might improve overall returns.

There are merits to diversification in emerging industries. But Taken too far, overdiversification can prevent necessary focus. Concentrated bets guided by long-term vision are often what reshape markets.

Anti-competitive potential needs monitoring

A final risk posed by gigantic centralized funds like Softbank’s Vision Fund is anti-competitive practices. Regulators are already examining potential abuses of power given Softbank’s sprawling footprint.

For example, Softbank could theoretically push their portfolio companies to share sensitive data like usage patterns while excluding competitors. Or they may pressure startups to exclusively partner with or purchase from other Vision Fund companies.

These anti-competitive dynamics could disadvantage startups unaffiliated with Softbank’s orbit. And they can enable conflicts of interest where Vision Fund companies privilege relationships over customers.

Softbank will need to ensure a level competitive playing field as their fund’s influence expands. No single VC player should dominate access to markets or disproportionately control outcomes.

Done responsibly, Softbank’s capital can spur innovation benefiting consumers and lowering prices. But undue influence over funded startups will require ongoing monitoring to prevent anti-competitive encroachment.

Potentially risky bets on autonomous driving with Cruise

One of Softbank’s most controversial moves was leading a gigantic $2.25 billion investment into GM’s self-driving unit, Cruise Automation, back in 2018. This deal exemplifies Softbank’s approach of making huge bets on emerging technologies before commercial viability is proven.

Autonomous vehicles clearly represent a potential next paradigm shift in transportation. But significant technical hurdles remain before fully driverless cars can safely navigate all conditions. Sensor costs need to decrease and software requires massive improvements.

Despite these ongoing challenges, Softbank’s massive capital infusion essentially poured gasoline on the autonomous driving race. It allowed Cruise to operate more aggressively by increasing hiring and ambitious testing programs.

But investing such enormous sums into an unproven startup like Cruise likely inflated its valuation detached from actual capabilities. And it reduced pressure to commercialize and generate revenue. More prudent investors might have staged smaller investments tied to clear milestone achievements.

Lidar costs decline but remain prohibitive

A key element of Cruise’s autonomous system is lidar, laser-based sensors that build detailed 3D representations of a vehicle’s surroundings. But lidar remains extremely expensive. Current hardware from suppliers like Velodyne costs upwards of $100,000 per car.

Softbank’s funding allows Cruise to essentially ignore these massive sensor costs for now. Butexpensive lidar is one reason why autonomous taxis still struggle to operate profitably. This hardware pricing issue reveals how autonomous vehicles remain a ways off from large-scale commercial viability.

Until lidar costs decrease by 10x or more, they threaten the underlying unit economics of robotaxis. Softbank and Cruise seem to be brushing this core challenge under the rug for the future. But affordable lidar solutions will be necessary to build economically sustainable AV businesses.

Public skepticism of driverless cars persists

Beyond just technical and cost hurdles, another uncertainty for autonomous vehicles is public trust and adoption. Polls show many people still harbor deep wariness about giving up control to robot drivers.

After Tesla’s Autopilot was implicated in crashes, acceptance of autonomous capabilities decreased. Fostering consumer confidence in self-driving will require far more flawless miles driven than today’s prototypes achieve. This extensive validation process cannot be shortcut just by increasing capital invested.

By injecting over $2 billion into Cruise, Softbank signals confidence in imminent driverless cars. But the average consumer likely remains far more skeptical. Until public perception shifts, viable mainstream businesses will be constrained no matter how aggressively funded.

Competition from Waymo remains fierce

While Softbank’s capital has fueled Cruise’s growth, the autonomous vehicle race hasanother well-funded giant in Waymo. With over a decade perfecting self-driving technology and backed by Alphabet, Waymo remains the leader.

Waymo already operates an extensive robotaxi service in Phoenix, surpassing Cruise’s capabilities. And they’ve partnered with established automakers like Volvo for fleet deployments. With Google’s resources, Waymo can subsidize scaling without VC funding.

This competitive dynamic highlights a possible flaw in Softbank’s investment strategy – assuming capital alone is enough to guarantee market dominance. But proprietary technology and engineering still power success, areas where Cruise likely trails Waymo substantially despite Softbank’s billions.

Premature scaling risks wasting resources

More broadly, by accelerating Cruise’s growth before core technology matures, Softbank’s investment risks wasting substantial resources. Engineering initially focused on safety and fundamentals often proves superior to prematurely pursuing scale.

For example, Cruise acquired a massive Sherman Oaks office complex in 2018 to rapidly expand its workforce. But all that space now likely harbors redundancy as AV progress slowed. Excessive hiring and real estate exemplify how Softbank’s capital subsidizes bloat.

Economics driven by venture funding can obscure lack of product-market fit. A sparser, more deliberate scaling approach tied directly to milestones would impose discipline and conserve resources long-term.

Partnering with Walmart opens new opportunities

While Cruise’s core robotaxi business faces challenges, its partnership with Walmart revealsPromise in utilizing AV technology for logistics and deliveries near-term.

By using automated vehicles for transporting goods rather than passengers, Cruise mitigates public skepticism risks. Backroad driving routes for deliveries are also simpler to navigate than busy urban centers.

The Walmart deal exemplifies how autonomous vehicles can target specific commercial applications today that play to their strengths. This provides revenue while awaitimg technology improvements needed for widespread robotaxi adoption.

Softbank’s capital gives Cruise flexibility to experiment with approaches like Walmart alongside longer-term pursuits. Focused logistics deployments generate valuable real-world operational learnings – and income.

GM’s resources contribute manufacturing expertise

While Softbank provides abundant capital, Cruise also benefits from the manufacturing and automotive know-how of parent company GM.

Leveraging GM’s vehicle production infrastructure could allow Cruise to one day scale up deployment rapidly. And GM’s technical experience developing safe, reliable cars over decades also offer advantages.

This combination of Softbank’s funding with GM’s auto expertise contrasts favorably to competitors like Waymo focused just on software. Access to proven automakers’ resources helps mitigate risks in actually manufacturing autonomous cars.

Still, GM’s bureaucratic culture differs greatly from nimble startups. Managing the Cruise relationship to maximize synergies while maintaining agility will remain an ongoing balancing act.

Huge wagers in augmented reality via Magic Leap

One of Softbank’s most mysterious and hype-shrouded investments was leading a massive $542 million funding round into secretive AR startup Magic Leap back in 2014. This deal exemplifies Softbank’s penchant for speculative bets on exotic technologies before seeing an actual product.

Magic Leap operated in stealth mode for years, allowing imaginations to run wild about its capabilities. Softbank added momentum by financing such a huge sum before Magic Leap released anything beyond concept videos.

But the first Magic Leap One headset finally unveiled in 2018 failed to live up to astronomical expectations. By pouring fuel on the AR hype fire years before any real demonstration, Softbank contributed to eventual disillusionment.

Early demonstrations lack functionality

When Magic Leap finally revealed details about its technology in 2016, early prototypes showed only rudimentary functionality. Yet based on flashy concept videos years earlier, expectations of stunning lifelike visuals had already grown impossibly high.

Softbank’s unprecedented investment further signaled Magic Leap was poised to deliver revolutionary AR experiences. In reality, enormous software and hardware challenges remained.

This exemplifies the risk of overinvesting in unproven technologies primarily on persuasive presentations rather than seeing substantive capabilities firsthand.

Reality falls short of visionary promises

When the Magic Leap One finally launched, reviewers found its AR experiences no more impressive than Microsoft’s Hololens. It projected only simplistic graphics within a limited field of view.

Years of mysterious hype and Softbank’s financing had fueled perceptions Magic Leap would astound people with photorealistic 3D simulations indistinguishable from reality. But the actual product proved far more incremental.

This reveals the gap between visionary AR promises and achievable functionality today. Softbank’s capital allowed Magic Leap to operate unchecked by market realities for years.

True mainstream AR adoption remains distant

Like many emerging technologies, Magic Leap also found business models and use cases challenging. Outside specialized enterprise applications, widespread consumer AR uptake appears distant still.

Magic Leap planned on upending industries by altering how people perceive reality. But pricing its headset at over $2000 meant only developers and businesses could access it, not consumers.

Without compelling software experiences drawing users, Magic Leap struggled to escape niche status. The device underwhelmed relative to expectations – a cautionary tale of too much funding too soon.

Facebook scales more patiently

In contrast to Magic Leap’s struggles, Facebook demonstrated greater patience in advancing AR incrementally with products like Oculus for enterprise and prototype smartglasses.

By focusing first on lower risk investments rather than overpromising, Facebook discovered more sustainable paths toward mainstream AR, including VR and eventual integration into smartglasses.

Magic Leap’s implosion after so much funding and hype underscores the merits of Facebook’s more measured approach. Hyperbolic visions detached from technical and economic realities often backfire.

Enterprise sector shows most near-term promise

Where Magic Leap finally gained modest traction was with enterprises, not consumers. Business applications like surgical visualization offered clearer value vs. trying to design killer apps for average users.

This reinforces perceptions that AR’s initial beachhead will be with companies, not retail consumers. Promising B2B use cases exist like factory floor enhancements and remote assistance.

By concentrating more on pragmatic industry applications rather than wide consumer adoption, Magic Leap ultimately could achieve meaningful impact. Hype notwithstanding, the headset does offer capabilities of interest to enterprises.

Investment motivations raise eyebrows

Compared to other Softbank investments, the rationale for pouring so much money so quickly into Magic Leap does raise eyebrows. What specifically motivated this highly atypical mega-investment in such an opaque startup?

Son was reportedly enthralled by webvideos showing concept imagery. But something drove Softbank to neglect standard due diligence like trying an actual prototype before funding such a huge round.

This apparent deviation from normal investment discipline does make one wonder what dynamics were at play behind the scenes. Softbank’s unchecked funding contributed to Magic Leap hype spiraling out of control.

AR adoption driven by concrete use cases

Magic Leap’s saga underscores that true AR advances will come from solving specific problems, not grandiose visionary promises. Incremental enhancements focused on real needs is what will push the technology forward.

Rather than vague futuristic concepts like Magic Leap promoting, AR benefits from tangible applications that offer clear value. Niche functionality that proves useful is what will eventually coalesce into mass adoption.

For AR to progress sustainably, hype needs grounding in practical utility. Even with Softbank’s capital, Magic Leap’s detached vision failed to deliver realities matching expectations.

Epoch-shaping investment in leading chipmaker ARM

While Softbank is known for financing emerging technologies still proving viability, their 2016 acquisition of prominent chip designer ARM for $32 billion represented a different type of strategic bet.

ARM stood as an established player with hardware architectures already powering the vast majority of smartphones globally. By securing ARM, Softbank gained control over foundational technologies poised for growth as connected devices proliferate.

This move exemplified Softbank’s willingness to make bold investments in leading companies with dominant positions in markets critical for the future. The ARM deal was an epoch-shaping play to shape technological trajectories worldwide.

Prevalence of ARM chips continues expanding

ARM designs energy-efficient chip architectures licensed across the tech industry, especially mobile. Their designs are found in over 130 billion chips from companies like Apple, Samsung, Qualcomm, and Huawei.

As more devices require embedded processing globally, ARM’s architectural licenses expand in value. Their energy efficiency makes ARM ideal for deployments ranging from smartphones to IoT sensors.

By acquiring this rare asset well-positioned as computation spreads, Softbank strategically obtained substantial influence over emerging device categories.

Internet of Things drives demand growth

ARM coresShould see demand growth accelerate as more appliances and objects gain internet connectivity and require chips. The Internet of Things revolution will likely fuel strong ARM chip sales long-term.

Everything from smart home gadgets to vehicles to wearables will need compact, efficient processors just like mobile phones. No other architectures scale down as well as ARM’s for such low-power embedded applications.

Softbank purchasing ARM effectively invested in the ground floor of computational proliferation across industries. Trillions of future chips for IoT will leverage ARM’s ip.

Strategic synergies across Softbank portfolio

Beyond just ARM’s existing position, Softbank’s acquisition also provides opportunities to strategically integrate ARM technology throughout its sprawling global portfolio of companies.

For example, Softbank-owned chip designer Renesas could optimize its offerings using ARM architectures. And ARM processors could power internet satellites from OneWeb and autonomous vehicles at Cruise.

Such complementary deployment of ARM ip across Softbank investments provides intriguing synergies. ARM becomes part of a vertically-integrated technology stack enabling Softbank’s broader vision.

Licensing model retains wide accessibility

Importantly, acquiring ARM does not limit access to ARM’s architectures, as their licensing model remains open to the industry.

This preserves ARM’s broad ecosystem and existing partnerships across multiple markets. But now Softbank can guide technology development and standard-setting dynamics to benefit its interests and portfolio.

Maintaining ARM’s independence and neutrality will maximize its value. Softbank simply obtained ultimate influence over ARM’s strategic direction in technology and business.

Concerns over monopolistic potential

However, ARM’s acquisition has faced criticism from analysts worried about monopolistic impacts of Softbank controlling this critical technology provider.

With ARM ip inside so many competitors’ devices, critics argue Softbank could potentially exert anti-competitive influence over markets by restricting access to licenses.

These concerns highlight the need for oversight ensuring ARM’s architectures remain accessible to all clients fairly. As ARM’s owner, Softbank must not abuse its position against rivals.

Valuation funded by Saudi sovereign wealth

To finance ARM’s hefty $32 billion price tag, Softbank utilized capital from Saudi Arabia’s Public Investment Fund rather than typical VC sources.

This demonstrates Softbank’s ability to tap unconventional sources like sovereign wealth to enable acquisitions at scale disrupting entire industries. The Saudi fund took a quick path to high-impact deployment rather than modest returns.

Visionary buys like ARM illustrate how Softbank pairs risky startup bets with shrewd plays on established innovators already dominating strategic fields.

Partnership brings IoT scale and synergies

Softbank has partnered extensively with ARM since acquiring it, demonstrating how ARM strengthens Softbank’s hand across emerging technology domains.

For example, Softbank and ARM jointly established the Softbank Innovation Fund focused on developing an ecosystem of Internet of Things companies leveraging ARM’s architectures.

This initiative engages ARM with Softbank’s resources and portfolio for mutual benefit. Such creative partnerships unlock long-term value from Softbank’s epoch-defining purchase of ARM.

Robotics play with acquisition of Boston Dynamics

Beyond software startups, Softbank has also made strategic bets in robotics, most prominently acquiring Boston Dynamics from Google in 2017. Boston Dynamics manufactures remarkable robots like Spot and Atlas with advanced mobility capabilities.

Acquiring this leading robotics firm allowed Softbank to gain a foothold in yet another emerging technology arena. And the subsequent sale of Boston Dynamics just three years later exemplified Softbank’s willingness to flip assets for quick returns.

Google struggled commercializing Boston Dynamics

Google originally acquired Boston Dynamics in 2013, but struggled to find commercial applications for its visually stunning but niche robots. This led Google to eventually sell Boston Dynamics to Softbank.

While Boston Dynamics’ robots can walk, jump and climb with impressive agility, they remain expensive over-engineered curiosities without mass market viability. Softbank was betting its resources could unlock monetization potential.

The homeless Boston Dynamics sale highlighted the gap between abstract robotics appeal and real-world economics. Turning research projects into businesses requires concrete use cases.

Hyundai acquisition for $1.1 billion

In another demonstration of Softbank’s asset flipping strategy, they sold Boston Dynamics to Hyundai just three years after acquiring it. The sale price of $1.1 billion represented over a threefold return for Softbank.

For Hyundai, Boston Dynamics brought advanced robotics capabilities that could be directed toward automotive applications like factory automation. Softbank pocketed substantial gains while handing off longer-term challenges.

Fluid dealmaking prowess allows Softbank to rapidly cycle capital through emerging technologies, extracting value regardless of ultimate sector outcomes.

Spot’s commercial prospects remain uncertain

Boston Dynamics’ famous quadruped Spot seemed best positioned to transition from research to commercial sales. But even Spot’s business prospects remain cloudy beyond mostly publicity-oriented deployments.

Hardware costs likely remain extremely high for Spot. And the need for full remote operation restricts use cases. Without wider autonomous capabilities, monetizing Spot as more than a novelty will prove challenging.

Despite viral videos, Spot demonstrates that robotics still require major progress before finding mainstream utility. Even companies with advanced test demos struggle to productize robots.

Atlas impresses but lacks application

Like Spot, Boston Dynamics’ humanoid Atlas wows observers with backflips and other dexterous feats. But translating that into real revenue has proved elusive.

Atlas hardware is far too expensive for commercial purposes currently. And its limited mobility autonomy makes it reliant on full teleoperation for now. Like other Boston Dynamics robots, applications are constrained until costs drop and autonomy increases.

Viral Atlas videos shorthand Softbank’s PR savvy side. But economic realities mean Atlas serves little purpose beyond R&D experimentation today. The gap between technology showcase and product remains substantial.

Softbank adds robotics to diversified portfolio

By acquiring Boston Dynamics, Softbank gained robotics exposure to complement its wide range of technology startup investments.

Even if Boston Dynamics itself faced challenges monetizing advanced research prototypes, ownership provided Softbank options to integrate robotics across its broader ecosystem down the road. Having cutting-edge robotics in the portfolio expanded strategic flexibility.

Whenblockbuster acquisitions become available, Softbank can pounce across multiple sectors. Boston Dynamics filled a key robotics gap in Softbank’s vast investment mosaic

Defense industry struggles transitioning to commercial

Boston Dynamics’ struggles underscore the difficult transition from defense and research focused robotics development to commercial products.

During its time owned by Google and Softbank, Boston Dynamics remained an R&D-centric organization. It must now adapt to cost constraints and customer needs under Hyundai.

This highlights the common gap between technology proofs-of-concept designed for research versus economical real-world products. Bridging this divide often proves the biggest commercialization hurdle.

Doubled-down on e-commerce with Coupang funding

While Softbank is known for financing futuristic technologies, the firm has also directed enormous capital into more established opportunities like e-commerce leader Coupang.

Softbank first invested $1 billion into the South Korean company back in 2015. They’ve since poured over $3 billion more into Coupang, which now handles upwards of $10 billion in annual gross merchandise value.

With Softbank’s backing, Coupang has consolidated power in Asia’s burgeoning e-commerce landscape, cementing its position as a major Amazon competitor in the region.

Explosive growth in South Korean ecommerce

Softbank’s huge bet on Coupang rides surging e-commerce adoption trends in South Korea and broader Asia. Online shopping growth has exploded in South Korea, growing over 20% annually.

Coupang has ridden this wave to become Korea’s top online retailer covering all major shopping categories. Its revenues reportedly topped $10 billion in 2020, cementing its market lead.

Softbank’s capital fueled this massive growth, allowing Coupang to aggressively expand logistics infrastructure like fulfillment centers as demand ballooned.

Amazon-like logistics buildout underway

Like Amazon, a key part of Coupang’s expansion strategy involves heavy investment in last-mile logistics and delivery infrastructure.

Softbank’s funding is supporting ambitious buildouts of fulfillment centers close to population centers to enable same-day delivery. Coupang promises delivery speeds comparable to some of the fastest globally.

Having an Amazon-esque logistics network establishes durable competitive advantages for Coupang. Softbank’s backing supercharges this infrastructure race.

Majority stake provides influence over strategy

Thanks to over $3 billion invested to date, Softbank now holds around a 70% ownership stake in Coupang. This gives Softbank enormous influence guiding Coupang’s strategic direction.

Unlike mere financial investments, such majority control allows Softbank to actively shape Coupang’s business plans. They can steer priorities and expansion initiatives in alignment with Softbank’s broader interests.

The hefty proportion of Coupang owned by Softbank illustrates a consolidation of power within its e-commerce holdings rivaling giants like Amazon.

Softbankselective in overseas ecommerce bets

Softbank has funneled capital into overseas e-commerce selectively, concentrating efforts around proven leaders like Coupang with dominant market share.

They passed on pouring additional billions into struggling company like Coupang’s regional rival Tokopedia. This disciplined prioritization provides better overall returns than diffuse investments.

In Softbank’s vast portfolio, massive bets like Coupang represent pillars foundational to overall strategic aims. Coupang helps solidify Softbank’s footingin Asian e-commerce long-term.

Korean market presents growth runway

While South Korea has already embraced online shopping, its e-commerce adoption still trails markets like the United States and China, presenting room for continued expansion.

Coupang is estimated to have between 20-25% market share currently. Ongoing growth could potentially double or triple Coupang’s share as Korean e-commerce gains sophistication.

Korea’s relatively early stage in e-commerce development provides Coupang a long runway for growth given its existing dominance. Softbank’s capital positions Coupang to consolidate leadership over time.

Opportunity to expand beyond Korea

Looking beyond just Korea, Coupang also has opportunities to expand into other Asian markets as Softbank’s backing continues allowing geographic growth.

They have already begun offering limited cross-border delivery to Japan, another lucrative e-commerce arena. Further localization and regional infrastructure could help Coupang broaden its reach.

Softbank’s firepower gives Coupang the resources to consider spreading beyond Korea. Becoming a pan-Asia retail leader would realize Softbank’s ambition of creating an e-commerce titan.

Major profits still a distant target

Despite meteoric top line growth, Coupang has yet to become profitable due to infrastructure and logistics costs from its aggressive expansion.

But Softbank’s continued capital injections keep losses from derailing Coupang’s ambitions. The playbook mirrors Amazon’s strategy of prioritizing growth over profits initially while cementing leadership.

Coupang will need to eventually demonstrate sustainable economics. But Softbank funding buys time to establish dominance before pressuring near-term profitability.

Big blockchain technology bet on Dragonchain

As an investor eager to ride the next waves of technological disruption, Softbank has also steadily built exposure in blockchain and cryptocurrencies over the past few years.

One of their more notable plays was leading an investment round into Dragonchain, an enterprise-focused blockchain development platform. Softbank put around $15 million into Dragonchain in late 2017 as blockchain hype approached feverish levels.

Though cryptocurrency prices subsequently crashed from all-time highs, Softbank maintained its foothold in the blockchain ecosystem through bets like Dragonchain.

Enterprise focus contrasts with speculators

Unlike the hordes of speculative crypto investors chasing overnight riches, Softbank’s blockchain investments have focused more on foundational infrastructure and commercial applications.

Dragonchain, for example, concentrates on enabling developers to build robust decentralized applications for real-world businesses and partners.

This contrasts favorably against largely speculative cryptocurrencies with unclear utility. While loosely correlated, Softbank isolates underlying blockchain potential from crypto mania.

Interoperability across chains holds promise

Dragonchain’s open source hybrid blockchain framework provides interoperability across major protocols like Ethereum, Neo, and EOS. This flexibility helps developers utilize the ideal decentralized network for their particular use case.

Cross-ecosystem interoperability will grow in importance as blockchain adoption spreads. Projects allowing seamless integration between decentralized networks offer strategic value.

With this advantage, Dragonchain gained an early foothold in overcoming a major limitation of fragmented blockchain protocols.

Evolution from Disney origins provides legitimacy

Dragonchain originated from within Disney as part of its incubator program before spinning off into an independent entity. This gives Dragonchain more credibility than the typical unknown crypto startup.

Disney utilized Dragonchain internally for managing digital assets before open-sourcing the code. This pedigree provides confidence in Dragonchain’s technology foundations and talent.

The Disney origins help legitimize Dragonchain as it works to establish itself as an enterprise blockchain leader with commercial deployments.

Beware of development delays and distractions

Despite its promising technology, Dragonchain has encountered delays in releasing promised features and enterprise products. This highlights execution risks common among cryptofunded startups.

There have also been questionable distractions like launching a location-based cryptocurrency gaming app. Maintaining focus on core platform rollout should take priority over speculative side projects.

For Softbank’s investment to pay dividends, Dragonchain must follow through on initial potential with punctual deliverables, not gambling on crypto fads.

Cryptocurrency correlations pose challenges

Though fundamentally focused on underlying technology, Dragonchain’s valuation and funding still correlate partially with cryptocurrency price swings.

This subjects Dragonchain to adverse effects like shaken confidence and budget shortfalls when cryptomarkets enter bear phases. Separating underlying project viability from token speculation remains an ongoing struggle in the blockchain space.

Dragonchain and other blockchain infrastructure players must continue maturing beyond reliance on fairweather crypto investors to build sustainable businesses.

Platform provides launchpad for decentralized apps

If Dragonchain can execute on its technology roadmap, its developer platform provides a springboard for the next generation of decentralized applications across industries.

By abstracting away blockchain complexities, Dragonchain allows creators to focus on building robust use cases in verticals like supply chain, healthcare, and more.

For Softbank, Dragonchain could provide portfolio companies a smooth on-ramp to incorporating decentralization where it proves advantageous. Increased transparency and data integrity hold strong appeal.

True disruption requires progress beyond hype

Like many emerging technologies, blockchain has gone through booms and busts of hype detached from practicable realities thus far. But steady progress by infrastructure builders could still enable paradigm shifts.

If platforms like Dragonchain can tap into blockchain’s true potential while avoiding speculative distractions, major disruption could emerge. But sustainable returns require blocking out market manias to focus on concrete utility.

In the long run, blockchain’s lasting impact will be powered by platforms turning ambitious possibilities into everyday business realities beyond hype promises.

Security concerns with investment in HackingTeam

While most of Softbank’s investments focus on consumer and enterprise technologies, one controversial exception was cybersecurity firm HackingTeam.

Softbank invested $5 million into HackingTeam back in 2012. But the startup soon faced major backlash when leaked documents revealed it sold surveillance capabilities to authoritarian regimes.

The HackingTeam investment highlighted potential ethical blindspots in Softbank’s investment strategy spanning diverse global markets.

Surveillance tech sold to oppressive governments

HackingTeam developed sophisticated cyber tools for remotely compromising devices and extracting sensitive information. But investigations showed their clients included dictatorial governments with records of human rights abuses.

These regimes allegedly utilized HackingTeam’s capabilities to target journalists and dissidents. The revelations sparked outrage over complicity with authoritarian surveillance and censorship.

Softbank’s capital helped enable human rights violations by funding technology deliberately opaque to public scrutiny. This exemplified risks of unchecked investments.

Lack of due diligence magnifies controversy

The HackingTeam controversy was magnified by apparent lack of proper due diligence by Softbank about the startup’s clientele and practices before investing.

For a firm investing billions in startups worldwide, overlooking who surveillance technology is sold to represented a major oversight failure. It contradicted ethical investment principles.

Earlier scrutiny could have preempted involvement with technologies enabling oppression. Softbank suffered brand damage by associating with HackingTeam’s abuses.

Reputation harmed among human rights supporters

The HackingTeam investment sparked protests by human rights advocates accusing Softbank of complicity in censorship and violence against dissidents.

Rather than carefully assessing recipients of sensitive capabilities, Softbank valued HackingTeam’s technology apart from real-world context. This alienated socially conscious critics.

More thoughtful filtering of startup partners could have prevented indirect empowerment of dictators. The HackingTeam deal stained Softbank’s reputation as a socially responsible investor.

Belated divestment from HackingTeam

Following the swell of criticism, Softbank eventually divested itself from ties and ownership stakes in HackingTeam.

But this corrective action came only after public pressure, not proactive reflection. The delayed response highlighted reactive rather than principled decision-making.

Severing relations with controversial partners only in hindsight provides weak assurance against future lapses in judgement. Softbank’s culture needs deeper accountability.

Greater transparency needed on deals

To prevent associations with unethical companies, Softbank should enact stricter disclosure requirements on deals to reveal telling details.

Salient facts on clientele and intended usages of technologies like HackingTeam’s would empower more informed evaluations by both Softbank leadership and the public.

Sunlight remains the best disinfectant. Softbank should draw lessons from the HackingTeam debacle to demand heightened transparency from investment partners globally.

Security capabilities require ethical oversight

The HackingTeam case exemplifies the maxim that with great power comes great responsibility. Surveillance tools create opportunities for abuse at scale.

Well-intentioned technologies often take on harmful dimensions in practice. Unconstrained by values, capabilities become liabilities rather than assets.

Softbank’s capital should incorporate rigorous moral examination into investment decisions, not just business cases. Even security startups require ethical oversight.

Large investment in agricultural technology via Plenty

Demonstrating its willingness to make bold bets across diverse sectors, Softbank has also funneled over $200 million into Plenty, an agricultural tech startup pioneering indoor vertical farming.

This investment highlights Softbank’s interest in major challenges beyond just information technology, like food production. Plenty’s indoor farms aim to enhance yields, conserve resources, and improve sustainability.

For Softbank, Plenty represents both a surprising foray into agricultural tech and an ambition to back startups tackling fundamental real-world needs.

Indoor vertical farming boosts yields

Plenty utilizes vertical farming techniques to grow produce indoors in stacked layers. This allows greater control and optimization of variables like lighting, humidity, and nutrients.

Initial trials show vertical farming can achieve yields over 300x traditional methods per acre. This has intriguing implications for addressing food security as global population rises.

By financing Plenty’s pioneering approach, Softbank helped catalyze innovation in a staid industry vital to human needs.

More sustainable use of resources

Beyond boosting raw yields, Plenty’s controlled indoor environment also provides sustainability benefits.

Indoor farming can reduce water usage by over 90% compared to conventional irrigation-heavy agriculture. And crops can be grown year-round near urban consumers.

For Softbank, Plenty represented an opportunity to harness technology to nourish people more efficiently. Its capital funded sustainability alongside productivity.

Partnership brings expertise to retail

To help bring their crops to market, Plenty partnered with food retailer Albertsons. This provided crucial expertise launching products in stores.

Albertsons rolled out Plenty greens across hundreds of locations in 2021. The alignment of skills allowed agtech innovation to reach mainstream consumers at scale.

For startups commercializing new categories, the right strategic partners can prove instrumental in bridging into public acceptance.

New technology faces adoption hurdles

While indoor farming holds promise, Plenty still faces challenges getting produce buyers accustomed to differences from field-grown foods.

Consumer education on qualities like taste and texture will take time and marketing. And Plenty must prove large-scale operational viability and cost-effectiveness.

As with any novel approach, technology merits only form part of the battle. Changing entrenched human behaviors can lag far behind invention.

Visionary leadership guides unconventional bets

Plenty represents the type of unconventional investment tied closely to founder Masayoshi Son’s global vision and values.

In steering Softbank into agriculture, Son followed convictions that technology could address fundamental challenges like feeding the planet.

Such bold bets on non-tech fields illustrate how principled leadership sharpens strategic focus beyond standard VC opportunities.

Pressure mounts to show financial viability

While socially impactful, Plenty will still need to demonstrate sustainable economics to justify Softbank’s capital. Recouping investments in agriculture may have longer time horizons.

But Plenty will eventually need to translate optimism about reversing food scarcity into real-world profitable farming operations. The metric for success remains financial, not just conceptual.

Softbank’s patient capital can nurse lofty goals toward reality. But upside requires grounding vision with pragmatic performance.

Questions around sustainability of vision fund model

The size and breadth of Softbank’s Vision Fund has raised questions regarding whether their investment model can deliver sustainable returns long-term.

With over 90 companies backed across diverse industries like real estate and satellites, critics argue Softbank may be spread too thin without enough focus.

Concerns linger over whether gargantuan bets on startups at scale can generate profits proportional to the risks and capital involved.

Many disparate investments to oversee

From AI to fintech to transportation, Softbank’s Vision Fund has poured billions into startups across sectors. This has resulted in a sprawling global portfolio.

But trying to add value to so many different companies could stretch even Softbank’s resources and expertise thin. Can they adequately guide and govern such a vast empire?

Breadth seems prioritized over depth in the investment strategy. But few companies succeed by diluting focus everywhere rather than on core competencies.

High valuations magnify downside risk

By injecting so much capital into startups like WeWork and DoorDash, Softbank has also inflated valuations that magnify downside vulnerability.

Startups worth tens of billions now face immense pressure to scale and monetize fast enough to justify those valuations before capital runs dry.

Excessive funding contributing to detachment from fundamentals puts a heavy burden on Softbank portfolio companies to hypergrow. Otherwise, painful corrections loom large.

Limited partners scrutinize performance

Softbank manages the Vision Fund capital on behalf of a range of limited partner investors like Saudi Arabia’s sovereign wealth fund and Apple.

But missed targets and underperforming investments have reportedly fueled partner dissatisfaction. Softbank now faces more LP pressure to justify strategy and improve returns.

This exemplifies how even mammoth funds face accountability for the results they deliver back to underlying investors. No investment firm has unlimited leash.

Consolidating around core sectors could sharpen focus

To address sprawl, Softbank could consider consolidating future Vision Fund investments around fewer core sectors.

Deepening expertise in areas like AI while cutting lagging performers could improve oversight and value contribution to standout companies.

Some critics argue a more focused fund on Softbank’s best-performing segments could better reward investors. Scattershot bets invite mean performance regression.

But diversity also hedges risks

Of course, Softbank’s broad spread does provide benefits like diversification. If some bets underperform, others may overdeliver to balance the portfolio.

The sheer scale of the Vision Fund also allows access to deals and liquidity unavailable to smaller funds. This provides advantages when deploying huge amounts of capital.

So while intense focus helps drive some top returns, Softbank’s diversity may prove prudent long-term for massive deployments.

Patience required to realize long-term gains

Ultimately, Softbank’s returns will depend on the timeframe considered. Many emerging technologies require longer maturation.

The 10-year fund life means near-term gains matter less than where portfolio values stand by the end. Some Roth startup bets may take years to fulfill potential.

With patience and nurturing, flashes of brilliance today could still compound into stellar successes tomorrow. But impatience by LPs or founders could prematurely sever lifelines.

Regulatory scrutiny of anti-competitive practices

With its sprawling influence and access to huge sums of capital, Softbank’s Vision Fund model has faced increasing scrutiny from regulators worried about potential anti-competitive impacts.

In particular, regulators have signaled concerns around whether Softbank pressures startups they invest in to favor other Vision Fund companies, to the disadvantage of competitors.

Managing a vast ecosystem of interlinked portfolio companies provides Softbank opportunities to dictate outcomes in competitive markets.

Concerns over self-dealing between portfolio companies

A core regulatory worry is Softbank nudging their startups to exclusively partner with or purchase from other Vision Fund companies rather than best-of-breed vendors.

For example, Softbank could emphasize synergies by having portfolio companies adopt Dragonchain’s blockchain. But that may displace better decentralized solutions for some needs.

Such self-dealing risks could disadvantage ventures outside of Softbank’s orbit. Scrutiny aims to maintain level competitive playing fields.

Questions over data sharing practices

Regulators also harbor concerns around Softbank-backed startups feeling pressured to share user data like purchasing patterns with other Vision Fund companies in anti-competitive ways.

collectively mining data across portfolio ventures could provide unfair insights. But data siloing and isolation protects consumers and prevents conflicts of interest.

Softbank will need to take care to not create perverse incentives for companies to improperly collude or exclude rivals from markets.

Wariness from competitors and acquisition targets

Beyond regulators, Softbank’s sprawl has bred distrust regarding motives among portfolio company competitors and acquisition targets.

Rivals worry about Vision Fund startups having unfair access to capital and partnerships that disadvantage competitors. And founders considering sales to Softbank-backed companies have voiced concerns over loss of independence post-acquisition.

Maintaining trust in competitive dynamics and startup autonomy remains crucial despite Softbank’s scale. Deals perceived as coerced or conflicted backfire.

But benefits also possible from synergies

That said, some coordination and resource pooling among Vision Fund portfolio ventures could also breed pro-consumer benefits.

For example, collaboration on technology problems across companies could accelerate innovation in sectors like AI. And data sharing may enable new functionality and efficiencies.

With oversight, Softbank can still allow win-wins without dictating outcomes. The vision fund model holds potential if harnessed responsibly.

Commitment to fair competition crucial

To address regulatory concerns, Softbank must commit to upholding rigorous barriers between portfolio companies to enable honest competition and innovation.

Governance structures that insulate portfolio ventures and ensure choice will be crucial to realize the vision fund model’s full possibilities with public trust.

By fostering competitive balance amidst interconnections, Softbank can bring vision to life – and returns – at scale.

Pressure to generate returns for investors

With the Vision Fund now managing over $100 billion from limited partners like Saudi Arabia’s sovereign wealth fund, Softbank faces escalating pressure to generate solid returns.

Recent stumbles at key investments like WeWork and delayed IPOs have fueled dissatisfaction among LPs about Softbank’s investment oversight and value contribution.

Ensuring the mammoth Vision Fund can ultimately deliver ample financial upside for underlying investors remains imperative.

Promised 45% returns now uncertain

When initially pitching the Vision Fund, Softbank projected annual returns of 45% based on upside from fast-growing tech startups.

But write-downs at WeWork and other unprofitable portfolio companies have made such heady returns seem dubious. Flagging IPO markets have also postponed lucrative exits.

This failure to match lofty expectations reveals the gap between salesmanship and sober risk management. Softbank must now work doubly hard to restore LP trust.

Saudi wealth fund looking for big payoff

Saudi Arabia’s Public Investment Fund contributed a substantial $45 billion chunk to the Vision Fund as part of the kingdom’s effort to diversify economically beyond oil.