What is a Wisconsin Seller’s Permit. Who needs a Wisconsin Seller’s Permit. How to apply for a Wisconsin Seller’s Permit. What information is needed to apply for a Seller’s Permit. How to fill out the Seller’s Permit Application Form. What are the Seller’s Permit fees in Wisconsin. How to properly display your Wisconsin Seller’s Permit.

Understanding the Wisconsin Seller’s Permit

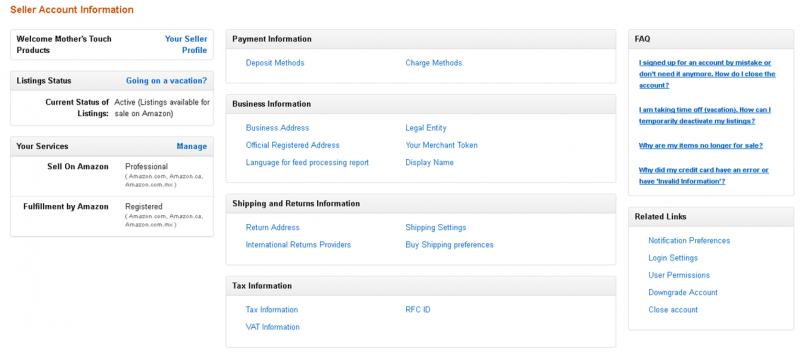

A Wisconsin seller’s permit, also known as a resale certificate or sales tax permit, is a crucial document for businesses operating in the Badger State. This permit empowers businesses to collect and remit sales tax on products sold within Wisconsin’s borders. It’s not just a piece of paper; it’s your ticket to legally conducting retail sales in the state.

But what exactly does this permit allow you to do? With a Wisconsin seller’s permit in hand, you can purchase products without paying sales tax upfront. Instead, you’ll collect sales tax from your customers on taxable sales and then remit it to the Wisconsin Department of Revenue. This system ensures that businesses aren’t burdened with paying sales tax on items they intend to resell.

Who Needs to Obtain a Wisconsin Seller’s Permit?

Are you wondering if your business requires a Wisconsin seller’s permit? The answer likely depends on the nature and scope of your operations. Generally, if you plan to sell products or services in Wisconsin, you’ll need to obtain this permit. Let’s break down the specific categories of businesses that typically require a Wisconsin seller’s permit:

- Wisconsin-based businesses selling products at retail locations, trade shows, fairs, or online

- Out-of-state sellers with nexus in Wisconsin (e.g., inventory stored in the state, employees based in Wisconsin, frequent sales to Wisconsin customers)

- Marketplace sellers on platforms like Amazon, eBay, or Etsy with taxable Wisconsin sales exceeding $10,000 per year

- Service providers such as restaurants, hotels, and repair shops making taxable sales

However, there are exceptions to this rule. You may not need a permit if you only make sales for resale or if you’re an occasional seller making less than $10,000 in taxable Wisconsin sales per year. Understanding these distinctions can save you time and potential legal headaches down the road.

The Step-by-Step Process of Applying for a Wisconsin Seller’s Permit

Obtaining your Wisconsin seller’s permit doesn’t have to be a daunting task. By following these straightforward steps, you can secure your permit and start your reselling journey on the right foot:

- Obtain a Business Tax Registration Certificate from the Wisconsin Department of Financial Institutions

- Complete the seller’s permit application form (Form S-240) online through My Tax Account

- Pay a $20 permit fee if you expect taxable sales over $10,000 in the first year

- Display your permit number on all sales invoices and receipts

- File periodic sales and use tax returns

It’s worth noting that you’ll receive your permit number immediately after submitting the online application. This allows you to start your business operations without delay. Additionally, permits are renewed every two years at a cost of $10, ensuring ongoing compliance with state regulations.

Essential Information for Your Seller’s Permit Application

Preparing to apply for your Wisconsin seller’s permit? Make sure you have all the necessary information at your fingertips. The application process requires specific details about your business to ensure accurate registration and tax reporting. Here’s a comprehensive list of the information you’ll need to provide:

- Legal business name and any trade names (DBA)

- Business ownership structure (sole proprietor, LLC, corporation, etc.)

- Primary business address and phone number

- Mailing address for tax returns, if different from the primary address

- Names, home addresses, phone numbers, and ownership percentages of all business owners

- Type of sales you make (retail, wholesale, manufacturing, etc.)

- Estimate of your expected annual taxable sales

This information serves as the foundation for setting up your sales tax account with the state. Remember to keep these details updated if any changes occur in your business structure or operations. Accurate and current information helps maintain smooth interactions with the Wisconsin Department of Revenue.

Navigating the Seller’s Permit Application Form

The S-240 form is your gateway to obtaining a Wisconsin seller’s permit. To ensure a smooth application process, follow these tips for accurately completing the form:

- Check the box indicating “This is an application for a Wisconsin sellers permit”

- Enter your business information in Sections A-C

- Provide an estimate of your expected taxable sales in Section D

- Select your preferred filing frequency in Section E (quarterly or monthly reporting)

- Carefully read the statement in Section F and sign/date at the bottom

- Mail the completed form along with your fee to the Department of Revenue address provided

Taking your time to fill out each section completely and double-checking for errors can save you potential headaches down the road. Accurate permit applications help streamline the process and reduce the likelihood of follow-up questions or delays from the Department of Revenue.

Understanding Wisconsin Seller’s Permit Fees

When it comes to obtaining and maintaining your Wisconsin seller’s permit, understanding the associated fees is crucial for proper budgeting and compliance. Here’s a breakdown of the fees you can expect:

- Initial Application Fee: $20 if you expect to make over $10,000 in taxable sales within the first year

- No fee is due if your expected sales are under $10,000

- Renewal Fee: $10 regardless of your sales volume, due every two years

These fees contribute to covering the administrative costs associated with issuing and monitoring seller’s permits in Wisconsin. By understanding and budgeting for these fees, you can ensure smooth renewals and uninterrupted business operations.

Properly Displaying Your Wisconsin Seller’s Permit

Once you’ve successfully obtained your Wisconsin seller’s permit, it’s crucial to display it correctly. Proper display not only ensures compliance with state regulations but also builds trust with your customers and suppliers. Here’s how to correctly showcase your permit:

- Print the phrase “Seller’s Permit #” followed by your unique permit number

- Display this information prominently on all invoices, receipts, websites, and other relevant business documents

- Ensure the permit number is easily visible to customers and suppliers

By properly displaying your seller’s permit number, you demonstrate your commitment to legal and ethical business practices. This transparency can enhance your reputation and help build stronger relationships with both customers and suppliers.

The Importance of Compliance in Wisconsin Retail Operations

Operating a retail business in Wisconsin comes with responsibilities, and obtaining a seller’s permit is just the beginning. Ongoing compliance is crucial for maintaining your business’s good standing with the state. This includes:

- Timely filing of sales tax returns

- Accurate record-keeping of all sales and purchases

- Prompt payment of collected sales taxes to the Wisconsin Department of Revenue

- Updating your permit information if there are changes in your business structure or operations

By staying on top of these compliance requirements, you protect your business from potential penalties and ensure smooth operations in the long run.

Leveraging Your Wisconsin Seller’s Permit for Business Growth

Your Wisconsin seller’s permit is more than just a regulatory requirement; it’s a tool for business growth. Here’s how you can leverage your permit to expand your operations:

- Use it to establish relationships with wholesalers and manufacturers, allowing you to purchase inventory tax-free

- Expand your sales channels, including online marketplaces and physical locations across Wisconsin

- Participate in trade shows and fairs, showcasing your products to a wider audience

- Build credibility with customers by demonstrating your compliance with state regulations

By strategically using your seller’s permit, you can open doors to new opportunities and position your business for sustainable growth in the Wisconsin market.

Common Pitfalls to Avoid When Obtaining and Using Your Wisconsin Seller’s Permit

While the process of obtaining a Wisconsin seller’s permit is straightforward, there are some common mistakes that businesses should be aware of and avoid:

- Underestimating your expected sales, which could lead to incorrect fee payments or reporting requirements

- Failing to renew your permit on time, potentially resulting in penalties or business disruptions

- Neglecting to update your permit information when your business details change

- Misusing your permit by purchasing items for personal use tax-free

- Forgetting to collect and remit sales tax on taxable items

By being aware of these potential pitfalls, you can ensure smooth sailing in your Wisconsin retail operations and maintain a positive relationship with state tax authorities.

The Role of Technology in Managing Your Wisconsin Seller’s Permit

In today’s digital age, technology plays a crucial role in streamlining the management of your Wisconsin seller’s permit and related tax obligations. Here are some ways you can leverage technology:

- Use e-commerce platforms that automatically calculate and collect the correct sales tax rates for Wisconsin

- Implement accounting software that tracks sales and helps prepare accurate tax returns

- Set up digital reminders for permit renewals and tax filing deadlines

- Utilize the Wisconsin Department of Revenue’s online portal for easy permit management and tax filing

By embracing these technological solutions, you can reduce the administrative burden of managing your seller’s permit and focus more on growing your business.

Expanding Beyond Wisconsin: Multi-State Seller’s Permits

As your business grows, you may find opportunities to sell in other states. Understanding how your Wisconsin seller’s permit fits into a multi-state operation is crucial. Consider the following:

- Research the seller’s permit requirements for each state you plan to operate in

- Look into streamlined sales tax agreements that simplify multi-state compliance

- Consider working with a tax professional who specializes in multi-state retail operations

- Implement systems to track sales and tax obligations across different states

By proactively addressing multi-state permit requirements, you can position your business for seamless expansion beyond Wisconsin’s borders.

Resources for Ongoing Support and Education

Navigating the world of seller’s permits and sales tax can be complex, but you don’t have to go it alone. Wisconsin offers various resources to support businesses in maintaining compliance and understanding their obligations:

- Wisconsin Department of Revenue website: Offers comprehensive guides and FAQs on seller’s permits and sales tax

- Small Business Development Centers: Provide free or low-cost consultations on business compliance matters

- Wisconsin Economic Development Corporation: Offers resources and support for businesses operating in the state

- Professional associations: Many industry-specific associations offer guidance on regulatory compliance

By taking advantage of these resources, you can stay informed about changes in regulations and best practices for managing your Wisconsin seller’s permit.

What is a Wisconsin Seller’s Permit?

A Wisconsin seller’s permit, also known as a resale certificate or sales tax permit, is a license that allows businesses to collect and remit sales tax on products sold in Wisconsin. This permit is mandatory for any business making retail sales in the state, including online sellers who have nexus in Wisconsin.

The Wisconsin seller’s permit authorizes you to purchase products without paying sales tax upfront. Instead, you collect sales tax from customers on taxable sales and remit it to the Wisconsin Department of Revenue.

Who Needs a Wisconsin Seller’s Permit?

If you plan to sell products or services in Wisconsin, you likely need a seller’s permit. This includes:

- Wisconsin-based businesses selling products at retail locations, trade shows, fairs, online, etc.

- Out-of-state sellers with nexus in Wisconsin (inventory stored in the state, employees based in Wisconsin, frequent sales to Wisconsin customers, etc.)

- Marketplace sellers on sites like Amazon, eBay, Etsy with taxable Wisconsin sales exceeding $10,000/year

- Service providers such as restaurants, hotels, repair shops making taxable sales

You do not need a permit if you only make sales for resale or are an occasional seller making less than $10,000 in taxable Wisconsin sales per year.

How to Apply for a Wisconsin Seller’s Permit

Applying for a Wisconsin seller’s permit is a quick and straightforward process. Here are the basic steps:

- Obtain a Business Tax Registration Certificate from the Wisconsin Department of Financial Institutions.

- Complete the seller’s permit application form (Form S-240). This can be done online through My Tax Account.

- Pay a $20 permit fee if you expect taxable sales over $10,000 in the first year.

- Display your permit number on all sales invoices and receipts.

- File periodic sales and use tax returns.

Some key things to know:

- You’ll receive your permit number immediately after submitting the online application.

- Permits are renewed every two years and cost $10 for renewal.

- You can register for sales tax and seller’s permit in one unified application process.

Information Needed to Apply for a Seller’s Permit

To complete the seller’s permit application, you’ll need to provide some basic information about your business:

- Legal business name and any trade names (DBA)

- Business ownership structure (sole proprietor, LLC, corporation, etc.)

- Primary business address and phone number

- Mailing address for tax returns, if different

- Owners’ names, home addresses, phone numbers, and percentages owned

- Type of sales you make (retail, wholesale, manufacturing, etc.)

- Estimate of your expected annual taxable sales

This info will be used to set up your sales tax account. Be sure to keep it updated if anything changes.

Filling Out the Seller’s Permit Application Form

Wisconsin uses the S-240 form for seller’s permit applications. Here are some tips for completing it accurately:

- Check the box for “This is an application for a Wisconsin sellers permit.”

- Enter your business information in Sections A-C.

- Estimate your expected taxable sales in Section D.

- Select a filing frequency in Section E (quarterly or monthly reporting).

- Read the statement in Section F and sign/date at the bottom.

- Mail the completed form with your fee to the Department of Revenue address.

Take your time to fill out each section completely and double check for errors. Accurate permit applications help avoid issues down the road.

Seller’s Permit Fees in Wisconsin

Wisconsin charges a one-time $20 fee when you first apply for a seller’s permit, if you expect to make over $10,000 in taxable sales within the first year. No fee is due if sales will be under $10,000.

When renewing a seller’s permit, the renewal fee is $10 regardless of your sales volume.

These fees help cover the administrative costs of issuing and monitoring seller’s permits in Wisconsin.

Displaying Your Wisconsin Seller’s Permit

Once approved, your WI seller’s permit number will be emailed and mailed to you. This permit number should be displayed on all receipts, invoices, and sales forms as follows:

- Print the phrase “Seller’s Permit #” followed by your permit number.

- Display the permit number prominently on invoices, receipts, websites, etc.

- This number shows customers and suppliers that you are authorized to collect WI sales tax.

Properly displaying your seller’s permit number proves that your business is complying with state tax laws.

So in summary, obtaining a Wisconsin seller’s permit is a straightforward process vital for legally operating a retail business in the state. Following the proper application procedure, displaying your permit number, and filing timely sales tax returns will help your business stay compliant. Reach out to the Wisconsin Department of Revenue if you have any other questions about getting or renewing a seller’s permit.

Who Needs a Wisconsin Seller’s Permit?

Starting a business in Wisconsin and looking to make some sales? If you plan on selling tangible goods or taxable services in the Badger State, you’ll need to obtain a Wisconsin seller’s permit, also known as a sales tax permit or reseller license. This permit allows you to collect sales tax from customers and remit it to the Wisconsin Department of Revenue. Without it, you’d be liable for all unpaid sales tax on your transactions.

Getting a seller’s permit may sound intimidating, but the process is actually quite straightforward. In this article, we’ll walk through the steps to get your Wisconsin reseller license so you can start or grow your business in compliance with state law. Whether you’re an online seller, flea market vendor, concessionaire or wholesaler, follow these five steps to obtain your seller’s permit.

Step 1: Determine If You Need a Seller’s Permit

In Wisconsin, you’re required to collect sales tax if you sell taxable tangible personal property, items, or goods, or certain services. This includes all retail sales and wholesale transactions for resale. Some examples of sellers who need a permit include:

- Retailers selling goods in a store, online, by mail order, at craft fairs, etc.

- Wholesalers selling to other businesses for resale

- Concessionaires located in Wisconsin

You do not need a seller’s permit if you only make sales that are exempt from sales tax, such as most groceries, prescription drugs, gasoline, or services like legal, dental, medical, financial, or educational services. If all your sales are tax-exempt, you can skip getting a seller’s permit.

Step 2: Apply for Your Wisconsin Seller’s Permit

To get a Wisconsin seller’s permit, you’ll need to complete the Wisconsin Business Tax Registration application. This can be done online through the Wisconsin Department of Revenue website. You’ll just need some basic information about your business, such as:

- Your business name and ownership structure

- Your business address and contact info

- A description of your business activities

- Your bank account information

The online application only takes about 15 minutes to complete. Be sure to have the necessary details on hand before you get started. There is no fee to obtain your Wisconsin seller’s permit.

Step 3: Receive Your Permit

After submitting your seller’s permit application, you’ll receive a confirmation number. Within 2-3 weeks, your official Wisconsin seller’s permit certificate will arrive by mail. Make sure to post this certificate prominently at your business location. If you’re an online business, keep it available digitally to produce upon request.

Your seller’s permit number, also called a Wisconsin tax account number, will be listed on the certificate. You’ll need this number when filing your sales and use tax returns. Speaking of returns…

Step 4: Understand Sales Tax Filing

As a Wisconsin seller’s permit holder, you’ll be responsible for collecting sales tax from customers on taxable purchases and remitting it to the Department of Revenue. This is done by filing regular sales and use tax returns.

Returns must be filed electronically on a monthly, quarterly or annual basis depending on your sales volume. You’ll report your gross sales, exempt sales, taxable sales, and sales tax due. The filing frequency depends on how much sales tax you collected in the prior year:

- Monthly: $5,000+ in annual sales tax

- Quarterly: $1,200 – $4,999

- Annually: Less than $1,200

Sales tax returns and payments are due the last day of the month following the filing period. For example, if you file quarterly, your Q1 return covering January-March sales is due April 30. Be sure to consult the Wisconsin Department of Revenue website for specific due dates and instructions on filing your returns.

Step 5: Collect and Remit Sales Tax

Now comes the part where you put your seller’s permit into action! When making taxable sales in Wisconsin, you’ll need to:

- Calculate the correct sales tax rate based on the customer’s location

- Collect this tax from the customer at the time of sale

- Record these taxable transactions in your books

- Report and submit the sales tax with your returns

Wisconsin has a 5% statewide sales tax rate plus any applicable local taxes. Sellers can utilize tools like tax rate lookup tables and sales tax calculators to determine the correct rate. Be sure to keep detailed records of all transactions and taxes collected.

By collecting and remitting sales tax as required, you’ll stay compliant with Wisconsin law. This prevents tax deficiencies and penalties for your business. Plus, you’ll build credibility with customers by showing your business is properly licensed.

And there you have it – the five steps to getting your Wisconsin seller’s permit! Following this straightforward process allows you to legally make retail sales and wholesale transactions in the state. With your reseller license in hand, you can focus on growing your Wisconsin-based business.

Starting a business? Zoom into compliance with a Wisconsin seller’s permit. This simple license lets you make sales and collect sales tax, avoiding issues down the road. Follow our guide to apply for your permit, understand filing requirements, and start making legal sales in the Badger State. Let us know if you have any other questions!

How to Apply for a Wisconsin Seller’s Permit

Got a new business venture in the works? If you’ll be selling products or services in Wisconsin, one of the first steps is getting your seller’s permit. This license allows you to legally collect and remit sales tax in the state. Read on to learn how to apply for your Wisconsin reseller permit in just a few easy steps.

Whether you’re opening a retail store, starting an ecommerce business, or even just planning to sell at craft fairs, a seller’s permit is essential. This license, also called a sales tax permit or resale certificate, gives you authority from the Wisconsin Department of Revenue to charge sales tax on items you sell. As a permit holder, you’ll be responsible for submitting these collected taxes to the state on a regular basis.

Don’t let the tax aspects scare you off though. Securing your seller’s permit is a smooth process that can be done completely online. Follow this quick guide to get your Wisconsin reseller license application going:

1. Confirm You Need a Permit

First things first – determine if your business truly requires a seller’s permit. In Wisconsin, you must collect sales tax if you sell taxable tangible goods or certain services at retail. Typically, the following sellers need a permit:

- Retail stores and websites selling merchandise

- Wholesalers supplying goods to retailers for resale

- Craft fair and flea market vendors

- Concessionaires located in Wisconsin

You likely don’t need a permit if you only make nontaxable sales, like most groceries, medical services, or gasoline. Review Wisconsin’s taxability rules to confirm before moving to the application.

2. Prepare the Necessary Information

To complete the seller’s permit application, you’ll need some key details about your business. Make sure to have the following info ready to input:

- Your business name, ownership type, and contact details

- Address where your business is located

- Description of the products/services you will sell

- Your bank account numbers for tax payments

Gathering this information ahead of time will make the application process smooth and simple.

3. Visit the Seller’s Permit Website

The Wisconsin Department of Revenue handles seller’s permit applications online through their Business Tax Registration portal. To begin, just visit their website and click on the “Register My Business” link.

This will take you to the new registration landing page. Make sure to select the option for “I need to register for Wisconsin tax accounts.” Then you can start the straightforward application.

4. Complete the Online Application

The online seller’s permit application will walk you through entering all the required business details from Step 2. You’ll also need to create a log-in ID and password for their system.

Make sure to double check all your entries for accuracy before submitting. The entire application usually only takes about 15 minutes to finish. Don’t worry, there is no fee to obtain your Wisconsin seller’s permit.

5. Receive Your Seller’s Permit

After applying online, you’ll get an immediate confirmation number. Within 2-3 weeks, your official Wisconsin seller’s permit certificate will arrive in the mail. This will include your sales tax account number, which you’ll need when filing returns.

Be sure to display your seller’s permit certificate prominently at your business location. For ecommerce businesses, keep it available digitally to provide upon request.

Following these five simple steps will get your Wisconsin reseller license up and running. Now you’ll be ready to legally collect and charge sales tax when you make retail sales. Contact the Wisconsin Department of Revenue if you have any other questions about obtaining your seller’s permit.

Kickstarting a business in Wisconsin? Don’t forget to register for your seller’s permit. This sales tax license allows you to legally collect and charge sales tax on items you sell. Our guide outlines the quick and easy application process. Get your Wisconsin reseller permit in just five steps!

Information Needed to Apply for a Seller’s Permit

Preparing to sell taxable goods or services in Wisconsin? One of the first steps is obtaining your seller’s permit from the state. This license allows you to legally collect and remit sales tax. To complete the application process, you’ll need to have some key details about your business ready.

The Wisconsin Department of Revenue provides a streamlined online application for seller’s permits through their Business Tax Registration portal. This allows you to get your sales tax license (also called a reseller permit or resale certificate) completely online in just minutes.

While easy to complete, the application does require certain information about your business. Having these details prepared ahead of time ensures the process goes smoothly. Here’s an overview of what you’ll need to provide:

Your Business Information

First, you’ll enter some basic information about your business itself, including:

- Your business legal name

- Ownership type (sole proprietor, LLC, corporation, etc.)

- Primary contact information

- Your business’ physical address

Make sure to have your official registered business name and current address handy when you sit down to apply.

Business Description

The application will ask you to briefly describe your business activities. Provide a 1-2 sentence summary such as:

“Online retailer selling homemade crafts and jewelry.”

This helps the Department of Revenue categorize your permit correctly.

Bank Account Information

You’ll need to input your business bank account information, including:

- Bank name

- Routing number

- Account number

This allows the state to directly debit any sales tax due. Have your checkbook or bank account details handy.

Owner/Officer Details

For sole proprietors or partnerships, you’ll provide your personal identifying information. For corporations, LLCs or nonprofits, be prepared to input details (name, title, address, phone, email) for the primary officers or members.

Sales Details

The application asks for an estimate of your:

- Expected monthly sales

- Expected monthly taxable sales

Provide your best estimate based on your business plan and financial projections.

Tax Filing Preferences

Finally, you can indicate if you prefer filing sales tax returns monthly, quarterly or annually based on your estimated monthly taxable sales.

And that’s it! With these pieces of information handy, you’ll be able to quickly complete the online seller’s permit application. The Department of Revenue will follow up if any clarification is needed. Otherwise, expect your official permit certificate in 2-3 weeks. Then you’ll be all set to start legally collecting and remitting sales tax for your Wisconsin business.

Starting a new venture in the Badger State? Don’t leave home without your seller’s permit! This sales tax license allows you to legally collect and charge sales tax on retail transactions. Our guide outlines the key details you’ll need to provide to apply for your permit and start doing business in compliance with state law.

Filling Out the Seller’s Permit Application Form

Starting a business venture in Wisconsin? One key task is obtaining your seller’s permit (also called a sales tax permit or reseller license). This allows you to legally collect and charge sales tax on items you sell. To get your permit, you’ll need to fill out the state’s application form.

The Wisconsin Department of Revenue provides the seller’s permit application online through their streamlined Business Tax Registration process. This allows you to get your sales tax license completely electronically in just minutes.

While easy to complete, the application does ask for specific details about your business. Preparing this information ahead of time ensures the process goes smoothly. Here’s what to expect when filling out the Wisconsin seller’s permit form:

Business Information

First, you’ll enter key details about your business itself, including:

- Your registered business name

- Ownership type (sole proprietor, LLC, corporation, etc)

- Primary contact details

- Physical business address

Have your official registered name, ownership status, contact info and current address ready.

Business Description

The form asks for a 1-2 sentence summary of your business activities. Provide a brief description like:

“Online clothing boutique selling women’s apparel and accessories.”

This helps the Department of Revenue categorize your permit properly.

Sales Details

You’ll enter estimates of your:

- Expected monthly sales

- Expected monthly taxable sales

Provide your best projections based on your business plan and financials.

Tax Filing Preferences

Select if you prefer filing sales tax returns monthly, quarterly or annually based on your estimated taxable sales.

Bank Account Information

Input your business bank account details, including:

- Bank name

- Routing number

- Account number

This allows the state to directly debit any sales tax due.

Owner/Officer Details

For sole proprietors or partnerships, you’ll provide your personal details. For corporations, LLCs or nonprofits, enter info (name, title, address, phone, email) for the primary officers or members.

Signature

Digitally sign the application by typing your name and title at the end of the form.

Payment

There is no fee to obtain your Wisconsin seller’s permit, so no payment is required.

With these steps completed, you can submit the application digitally for prompt processing. Double check all entries for accuracy before submitting. The Department of Revenue may contact you with any questions as they review and approve issuing your permit.

Expect to receive your official seller’s permit certificate by mail in 2-3 weeks. This will include your sales tax account number to use when filing returns. Display your permit prominently if operating a physical store. For online businesses, keep it available digitally.

Now that you know what to expect when completing the seller’s permit application form, you’ll breeze through obtaining your Wisconsin sales tax license. Let the Department of Revenue know if any questions come up in the process.

Starting or growing a business in Wisconsin? Don’t forget to apply for your seller’s permit. This sales tax license allows you to legally collect and charge sales tax on retail transactions. We outline what information you’ll need to provide when filling out the streamlined online application form. Get ready to enter key business details!

Seller’s Permit Fees in Wisconsin

If you’re starting or growing a business in Wisconsin, obtaining a seller’s permit should be high on your to-do list. This sales tax license allows you to legally collect and charge sales tax on items you sell. But does it cost anything to apply for a Wisconsin seller’s permit?

The good news is there are no fees charged by the Wisconsin Department of Revenue to obtain your seller’s permit, also known as a sales tax permit or reseller license. You can complete the application process entirely online in just minutes without any cost.

However, as a seller’s permit holder, you will have ongoing responsibilities for collecting, reporting, and remitting sales tax on taxable transactions. So while the permit itself is free, there are some related costs you’ll want to be aware of.

No Permit Application Fees

Applying for your Wisconsin seller’s permit through the Department of Revenue’s streamlined online system is 100% free. You’ll simply need to provide some basic information about your business to get the application started.

The online form takes about 15 minutes to complete. You’ll provide your business details, description of activities, owner information, bank account numbers, and estimated sales. No payment is required when you submit the application.

Within 2-3 weeks after applying, your official Wisconsin seller’s permit certificate will arrive in the mail. You can then display this license at your business location to show customers you’re authorized to collect sales tax.

Account Maintenance Fees

There are also no ongoing account maintenance fees associated with your Wisconsin seller’s permit. Your sales tax account remains open as long as you continue doing business in the state and file returns as required.

Some states do charge annual or monthly fees to keep a seller’s permit active. But Wisconsin does not currently have any recurring fees, so your account remains open at no cost.

Reporting and Remittance Responsibilities

While the permit itself is free, being a seller’s permit holder does entail certain sales tax responsibilities:

- Collecting tax from customers on taxable sales

- Reporting your total sales and sales tax due

- Remitting the collected tax to the Department of Revenue

You’ll need to file regular sales tax returns, either monthly, quarterly or annually, depending on your sales volume. There are fees involved if you miss filing deadlines or have a balance due.

Transaction Fees

When remitting the sales tax you’ve collected, you’ll want to choose an efficient payment method. Mailing a physical check comes with fees for postage, envelopes, and potential late delivery.

Instead, consider electronic payment options like ACH or credit card payments. These come with lower transaction fees. Just remember to account for these fees in your budget.

While obtaining your Wisconsin seller’s permit is free, make sure to anticipate the ongoing costs of tax reporting and remittance. With a little planning, you can keep permit-related fees to a minimum.

Kicking off a new venture in Wisconsin? The good news is there are no fees to apply for your essential seller’s permit. This sales tax license allows you to legally collect and charge sales tax on retail sales. Keep in mind the responsibilities for reporting and paying collected tax that come with being a permit holder.

Displaying Your Wisconsin Seller’s Permit

Obtained your seller’s permit in Wisconsin? Congratulations! This license allows you to legally collect and charge sales tax on retail transactions in the state. But what should you do once you actually receive your permit certificate in the mail?

Properly displaying your Wisconsin seller’s permit is an important next step. This shows customers and state regulators that your business is authorized and compliant with sales tax laws. Requirements vary depending on your business type and location.

Displaying In a Physical Store

For brick-and-mortar stores located in Wisconsin, you must post your seller’s permit certificate in a visible place on the premises. Typical options include:

- Hanging near the cash register

- Mounting on a front window or door

- Posting in the back office or breakroom

Choose a prominent, high-traffic spot where customers can easily see the permit. State inspectors will look for proper display during audits or site visits.

Displaying Online

Ecommerce businesses and online sellers don’t have a physical store to post their permit. In this case, you should keep a digital copy readily available to provide upon request.

Typical ways to display your seller’s permit online include:

- Listing the permit number on your website

- Showing the permit in your online seller profile

- Emailing a copy to customers if requested

Make sure the permit is accessible in case regulators need to verify your credentials for remote audits or investigations.

Displaying at Trade Shows

If you make sales at temporary events like craft fairs, flea markets or trade shows, you must also display proof that you’re a permitted seller in Wisconsin. Options include:

- Hanging a photocopy of your permit at your booth

- Keeping the permit binder open at your checkout display

- Posting signage that says you collect Wisconsin sales tax

Without visible proof, event organizers may require you to furnish your permit before allowing you to set up.

Displaying Out-of-State

If your business is located outside Wisconsin but you make taxable sales in the state, you still need a seller’s permit. Requirements vary if you have nexus in multiple states.

Check with the Department of Revenue on proper display rules if your physical location differs from your sales location. You may need to show permits from multiple states.

Properly showcasing your seller’s permit legitimizes your business and shows your intention to comply with Wisconsin sales tax laws. Follow state guidelines on permit display to avoid issues or penalties.

Received your Wisconsin seller’s permit in the mail? Don’t just file it away! Proper display rules require showcasing your permit visibly in your business location. We outline requirements for physical and online stores, trade shows, out-of-state sellers and more. Stay compliant and show customers you’re authorized to collect sales tax!

Renewing Your Wisconsin Seller’s Permit

Operating a business in Wisconsin? If you have a seller’s permit, be aware this license needs to be renewed periodically to remain valid. Failing to renew your permit on time can lead to lapses in your authority to collect Wisconsin sales tax.

To prevent issues, make sure you know the expiration date of your seller’s permit and complete the simple renewal steps. Here’s what Wisconsin businesses need to know about renewing seller’s permits:

Seller’s Permits Don’t Expire

The good news is Wisconsin seller’s permits don’t have defined expiration dates. Once issued, your sales tax permit remains continuously valid as long as you continue doing business in Wisconsin and filing required returns.

This differs from some states where seller’s permits must be renewed every 1-2 years. As long as you maintain compliance, your Wisconsin permit won’t expire.

Inactive Accounts Can Lapse

However, if your business becomes inactive in Wisconsin, your seller’s permit can lapse. Specifically, if you:

- Stop filing sales tax returns for eight or more consecutive quarters

- Fail to renew an expired business registration with the state

In these cases, the Department of Revenue may declare your permit inactive and require you to renew before collecting sales tax again.

Renewing Lapsed Seller’s Permits

To renew a lapsed Wisconsin seller’s permit, you’ll need to:

- Reactivate your business registration

- File any missing returns from inactive periods

- Pay any unpaid sales tax due

Once your business is compliant again, you can request reactivation of your sales tax account to resume collecting. Any penalties may still apply.

Changing Business Structure

If your business structure changes, such as switching from a sole proprietorship to a corporation, you’ll need to cancel your existing permit and apply for a new one.

Legal entity changes require an updated application, even if the business remains the same. Follow the initial permit application process.

Changing Ownership

Seller’s permits can’t be transferred if you sell or transfer ownership of your business. The new owner must apply for their own unique permit.

Make sure the new owner knows they must register for a new sales tax account. Don’t let them operate under your existing permit.

While Wisconsin seller’s permits don’t expire, stay aware of events that may invalidate your license. Renew promptly after periods of inactivity and ownership changes to avoid sales tax gaps or penalties.

Already have your Wisconsin seller’s permit? Read on for information about renewing this important sales tax license. While permits don’t expire, you may need to renew after business changes or inactive periods. Stay up-to-date to avoid issues collecting tax!

Making Tax-Exempt Purchases with Your Permit

One key benefit of having a Wisconsin seller’s permit is the ability to buy inventory and supplies tax-free. By providing your permit to vendors, you can make wholesale and resale purchases without paying sales tax.

This tax break allows you to avoid “double taxation” – collecting tax on products you’ve already been taxed on. But you must follow some guidelines to properly claim tax exemptions when sourcing products and materials.

Purchasing Inventory Tax-Free

With a Wisconsin seller’s permit, you can buy any products you intend to resell without paying sales tax. For example, a clothing boutique can use its permit to buy wholesale garments tax-free.

When purchasing inventory or goods for resale, provide vendors with:

- A copy of your permit

- A completed exemption certificate

Keep copies of these documents for your records. You’ll later collect sales tax when you resell the items to customers.

Purchasing Supplies Tax-Free

In addition to inventory, you can use your seller’s permit to buy materials and supplies tax-free if they are used for business purposes. For example:

- Packing materials

- Racks, shelves, fixtures

- Office supplies

Clearly inform vendors these purchases are for business use and exempt from tax.

Paying Use Tax on Taxable Purchases

Keep in mind you can only make tax-exempt purchases of items used for resale or directly in your business. If you buy taxable supplies for personal use, you’ll pay sales tax.

For example, purchasing office furniture for your home or catering for an employee party are taxable. Report use tax on these types of purchases when filing sales tax returns.

Keeping Detailed Records

When making tax-exempt purchases with your seller’s permit, be sure to keep invoices and exemption certificates for your records. These provide proof the purchases were legitimate business expenses if ever audited.

Proper documentation also helps you accurately track taxable vs. non-taxable purchases when reporting and remitting use tax.

One of the biggest perks of obtaining a seller’s permit in Wisconsin is the ability to source inventory and supplies tax-free. Just be sure to only make exempt purchases for legitimate business use and keep detailed records.

Have a Wisconsin seller’s permit? Use it to buy inventory and supplies without paying sales tax. We explain how to make tax-exempt purchases for resale and business use. Follow the guidelines to avoid issues or tax deficiencies down the road.

Filing Wisconsin Sales Tax Returns

One key responsibility that comes with a Wisconsin seller’s permit is filing regular sales tax returns. These reports detail the amount of sales tax you’ve collected from customers that must now be remitted to the state.

Understanding how to properly file your Wisconsin sales and use tax returns ensures you stay compliant as a permit holder. Follow these tips to report your collected sales tax on time and avoid penalties.

Reporting Frequency

In Wisconsin, sales tax return filing frequencies are based on your expected annual taxable sales:

- Monthly filing: $5,000+ estimated annual sales tax collections

- Quarterly filing: $1,200 – $4,999 estimated annual sales tax

- Annual filing: Less than $1,200 estimated annual sales tax

Higher sales volumes require more frequent reporting. Choose your desired filing frequency when applying for your seller’s permit.

Return Deadlines

Sales tax returns are due on the last day of the month following the filing period. For example:

- Monthly returns are due by the last day of the next month

- Quarterly returns are due by April 30, July 31, October 31, and January 31

- Annual returns are due by January 31 of the next year

Mark your calendar with these deadlines to avoid late fees. Missed filings can also impact your seller’s permit.

Filing Online

Wisconsin requires electronic filing for sales tax returns. Submit returns through My Tax Account, the Department of Revenue’s online filing system.

Electronic filing only takes a few minutes. You’ll enter totals for gross sales, exempt sales, taxable sales, and sales tax due. The system calculates everything for you.

Reporting Sales Tax Collected

The key figure on your sales tax return is the total sales tax collected from customers during the filing period. Have your records of taxable sales and taxes collected handy to accurately complete your return.

You’ll also report any use tax due on taxable purchases you made.

Remitting Payment

Your sales tax return shows how muchsales tax is owed to Wisconsin. You must submit this payment by the due date to avoid penalties.

Electronic payment options include ACH debit, credit card, and wire transfer. You can also mail a physical check.

Staying on top of filing and payment deadlines keeps your business compliant. Set reminders and utilize an accounting system to organize tax data.

One key duty of Wisconsin seller’s permit holders is submitting regular sales tax returns. File electronically and remit payment on time to avoid fines. Our guide outlines filing schedules, deadlines, and reporting requirements so you can stay compliant.

Keeping Records of Sales and Purchases

Starting a reselling business in Wisconsin can be an exciting endeavor, but before diving in, it’s crucial to understand the permit requirements. While the process may seem daunting at first, obtaining your Wisconsin seller’s permit can be straightforward by following these key steps:

1. Determine if You Need a Wisconsin Seller’s Permit

In Wisconsin, you are legally required to register for a seller’s permit if you plan to sell tangible goods or taxable services at retail. This applies whether you operate out of a physical store, online, at craft fairs, or any other selling venue. The permit allows you to purchase inventory without paying sales tax upfront and instead collect sales tax from your customers. It also serves as your business tax ID number for reporting and filing returns.

There are a few exemptions where a seller’s permit is not needed, such as for sales of groceries or prescription drugs. But for most retail sales, including antiques, art, clothing, electronics, household goods, jewelry, toys, etc., a permit will be required. Don’t risk hefty penalties by neglecting to register if your business qualifies.

2. Apply for Your Reseller Permit

To officially obtain a Wisconsin seller’s permit, you must submit an application to the Wisconsin Department of Revenue. This can be done either online through the department’s eReg system, by mail, or in-person at a department service center. The quickest and easiest route is generally online.

You will need to provide key details about your business such as legal name, address, ownership structure, and description of operations. There is no fee to apply. Processing time is typically 1-2 weeks, after which you will receive your permit in the mail if approved.

Make sure to display your seller’s permit publicly at your business location and provide it any time you make wholesale purchases. It serves as proof that you can buy inventory tax-free for later resale.

3. Understand Your Tax Collection Responsibilities

One of the main purposes of the seller’s permit is tax collection. As a reseller, you are responsible for collecting sales tax from customers on taxable sales and remitting it to the state. Wisconsin’s base sales tax rate is 5%, but local taxes in your jurisdiction may increase it up to 5.5%.

You must collect sales tax at the time of purchase, whether in-person, online, by invoice, or any other method. The tax applies to both Wisconsin residents and non-residents purchasing taxable goods or services sourced to Wisconsin. There are special rates and rules for certain products like clothing, food, lumber, and more.

Be sure to understand what’s taxable and any exemptions before you begin selling. Keep up-to-date records of all sales and taxes collected, as you will need to file regular returns to report the tax.

4. Comply With Record Keeping Requirements

Proper record keeping is crucial when holding a Wisconsin seller’s permit. You must keep detailed records of all inventory purchased and sold, sales transactions, sales tax collected, expenses, and other financial documentation. These records must be kept for a minimum of four years.

Your bookkeeping system can be paper-based or digital, but should allow you to easily track your sales activity. This is not only necessary for filing accurate tax returns, but also provides key insights into your business performance. Take time upfront to implement a reliable record keeping process.

In addition to financial records, you may need to keep purchase orders, shipping documents, and resale certificates documenting your wholesale purchases. Having proper records facilitates audits if you ever get reviewed by the Department of Revenue.

5. File Periodic Sales and Use Tax Returns

Depending on your business volume, you will need to file sales and use tax returns either monthly, quarterly, or annually. Returns are due the last day of the month following each filing period. You can submit them online through My Tax Account or by mail.

Your returns report total sales, any exempt sales, total taxable sales, sales tax collected, and sales tax due for the filing period. Carefully report these figures based on your sales records. You must pay any sales tax due when you submit the return to avoid penalties.

Keep your old returns for at least four years in case you ever need to reference them. By diligently filing on time, you avoid late fees and stay compliant as a Wisconsin reseller.

Following these five key steps will help you obtain your seller’s permit, understand your obligations, and operate successfully as a reseller in Wisconsin. Keep your permit visible, charge appropriate sales tax, maintain detailed records, and file returns on schedule. Let this checklist guide you as you embark on an exciting retail business venture in the Badger State.

Penalties for Not Having a Wisconsin Seller’s Permit

Starting a reselling business in Wisconsin can be an exciting venture, but there are important legal requirements to consider first. Namely, obtaining a Wisconsin seller’s permit, also known as a direct seller’s license or reseller permit. Failure to secure this essential business license can lead to stiff penalties that may derail your entrepreneurial aspirations before they even get off the ground.

Let’s walk through what can happen if you try to operate a retail business in the Badger State without a seller’s permit.

Fines and Legal Action

Perhaps the most direct consequence is substantial fines imposed by the Wisconsin Department of Revenue (DOR). Operating without a seller’s permit is considered tax evasion, which can warrant fines of $200 to $5,000 under Wisconsin law. The severity depends on the estimated amount of unpaid taxes resulting from unpermitted sales activities.

Criminal charges may also ensue if authorities determine you have intentionally avoided tax obligations by not obtaining a seller’s permit. You may face misdemeanor or felony tax fraud charges, which can mean thousands of dollars in additional fines and even jail time in extreme cases.

The DOR often initiates audits of businesses suspected of not having a seller’s permit. If selected for audit, you’ll have to provide extensive documentation about your sales history and tax liabilities. This can be a lengthy, stressful, and costly process, especially if the audit confirms tax violations. Any taxes, penalties, and interest will come due immediately.

Jeopardizing Your Business

Without a seller’s permit, your business is operating outside the law. If discovered, the DOR may force you to shut down until you secure the proper licensing. This business disruption can mean lost sales, profits, and customers.

You also won’t be able to provide customers with receipts for tax-exempt purchases, since you won’t have a seller’s permit number to include. Some customers may take their business elsewhere rather than pay sales tax unnecessarily.

Operating illegally without permits casts doubt on the validity and ethics of your business as a whole. This could damage your brand reputation and make it difficult to win over customers and establish partner relationships.

Missing Out on Tax Advantages

A seller’s permit unlocks crucial sales tax advantages. It allows you to purchase inventory tax-free from wholesalers and manufacturers for resale. Without it, you’ll have to pay full sales tax on these purchases, cutting into your profits.

You can also avoid double taxation on items purchased for resale with an out-of-state seller’s permit. Otherwise, you may end up paying tax twice – once to the original seller and again to Wisconsin.

When you’re ready to sell your business, a permit also establishes a sales tax record that may increase your company’s valuation. Permit-less businesses are much harder to value accurately.

Want to Start Reselling in Wisconsin This Year? Discover How to Get Your Reseller Permit in Just 5 Steps

Given the many downsides of operating without proper licensing, obtaining a Wisconsin seller’s permit should be a top priority when starting a resale business. The good news is that getting your permit can be a quick and straightforward process by following these five key steps:

1. Determine If You Need a Seller’s Permit

First things first – confirm whether your specific business activities legally require a seller’s permit in Wisconsin. The permit is mandatory for making retail sales of tangible goods or taxable services. This includes retail stores, online shops, flea markets, craft fairs, and service providers like auto repair shops. Wholesalers and manufacturers selling to resellers also need a permit.

On the other hand, you likely don’t need a permit if you only make occasional sales, such as at a garage sale or on an online marketplace. If your sales are infrequent and small-scale, they may be exempt.

2. Choose a Business Structure

Decide how your business will be legally structured. Popular options include sole proprietorship, partnership, corporation, or LLC. Your structure will determine what name to put on your seller’s permit application.

For instance, if you form an LLC, the permit would be under your company’s LLC name. For sole proprietorships, use your personal name followed by “DBA [your business name]”. The correct name is crucial to avoid future tax complications.

3. Complete the Seller’s Permit Application

The quickest way to apply is through the Wisconsin Business Tax Registration System. You’ll need to provide key details like your business name, ownership structure, contact information, and business description.

Double check that all information entered is accurate, as mistakes can delay processing. You may need to mail additional documentation depending on your business structure and activities.

4. Pay the $20 Permit Fee

The application fee for a standard Wisconsin seller’s permit is just $20 – one of the most affordable in the nation. This fee is non-refundable if your application is approved. You can pay online via E-Check or credit card when submitting your application.

5. Display Your Permit

Once approved, you’ll receive your permit certificate by mail in 5-7 business days. Be sure to prominently display this certificate at your business location where customers can see it. This communicates that you are a licensed and compliant business.

You’ll also receive a permit ID number to write on sales receipts. This number allows you to make tax-exempt purchases for resale and provides added legitimacy.

Following these five steps helps ensure your Wisconsin reselling business starts off on the right foot. A seller’s permit sets the foundation for smooth business operations and total compliance. Don’t leave yourself open to steep penalties and disruptions – take care of this critical licensing requirement before making your first Wisconsin sale.

Selling Restricted Items with a Seller’s Permit

For Wisconsin resellers, a state seller’s permit allows you to operate a retail business legally. But even with a permit, some products come with restrictions on how and to whom they can be sold. Understanding these limitations is key to remaining compliant when selling regulated merchandise.

Certain categories like alcohol, tobacco, firearms, and even specific items like spray paint have extra rules around sales – regardless of your seller’s permit status. Failure to adhere to these regulations when making transactions can lead to revoked licenses, inventory seizures, and criminal penalties.

Let’s explore some of the most common restricted products and how to sell them properly with your Wisconsin seller’s permit.

Alcohol

Alcohol is highly regulated for public health and safety reasons. Your standard seller’s permit does not authorize alcohol sales. An additional liquor license from your local municipality is required to sell beer, wine, or spirits to the public.

These liquor licenses also dictate where and when alcohol can be sold. For instance, liquor sales may be prohibited after 9pm or on Sundays depending on the type of license. Failing to follow these restrictions can get your liquor license suspended or revoked.

Tobacco

Tobacco products like cigarettes, e-cigarettes, and vaping supplies cannot be sold legally to those under 18 years old. As a tobacco retailer, you must verify ID for all tobacco purchases to confirm the customer meets the minimum age requirement.

Violating these age verification rules exposes your business to fines of $50 to $200 for a first offense. Subsequent violations come with penalties of $200 to $500. Five or more offenses in a five-year period can result in permit suspension or revocation.

Firearms

Firearm sales require several licenses beyond just a seller’s permit. A Federal Firearms License (FFL) issued by the ATF is mandatory for gun dealers. You’ll also need a state Firearm Dealer license from the Wisconsin Department of Justice.

Background checks must be performed for all firearm sales to screen buyers. Store your inventory securely and maintain meticulous transaction records. Failing to adhere to the myriad gun sale regulations can lead to criminal charges.

Spray Paint

In Wisconsin, you cannot sell spray paint or markers to anyone under 18 without parental consent. Be sure to check ID and have minors verified by a parent at the point of sale. Violations can lead to fines of $25 to $300.

Other Age-Restricted Goods

There are various other products with minimum age requirements for purchase in Wisconsin, including:

- E-cigarettes and vaping supplies – 18+

- Tattooing services – 18+

- Hunting licenses – 12+ for small game only

- Lottery tickets – 18+

- Pseudoephedrine (for meth production) – 18+

Check a patron’s photo ID and verify their age before selling age-restricted merchandise. Doing this protects your business from legal trouble.

Explosives

Items like fireworks, dynamite, and detonators are heavily regulated under federal law. Buying and selling these explosives requires special Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) permits or licenses.

Without proper licensing, the storage, transportation, and sale of explosives is strictly prohibited – even with a standard seller’s permit. Punishments like prison time and massive fines apply to violations.

The Bottom Line

While a seller’s permit grants the ability to operate a retail business in Wisconsin, certain products require additional licensing and oversight. Before selling regulated merchandise, be sure to research and obtain all necessary permits, licenses, or certificates required on the federal, state, and local levels.

Train staff thoroughly on all compliance protocols when transacting restricted items. Taking these measures allows your business to legally provide products that customers want, while avoiding penalties that could severely damage your company’s finances and reputation.

With some extra diligence and care, a Wisconsin seller’s permit can give you the flexibility to sell a wide range of retail products responsibly and successfully.

Applying for a Temporary Seller’s Permit

Starting a new retail business in Wisconsin requires obtaining a state seller’s permit from the Department of Revenue. But the process of getting a standard permit can take weeks. If you need to operate legally on shorter notice for a temporary event, a temporary seller’s permit may be the solution.

Temporary permits allow you to make taxable sales for a limited period of time. They offer more flexibility for resellers participating in craft fairs, markets, pop-up shops, and other short-term sales events.

Here’s what you need to know about qualifying for and applying for a temporary Wisconsin seller’s permit:

Am I Eligible?

You can apply for a temporary permit if you meet both of these criteria:

- You are making retail sales of tangible goods or taxable services in Wisconsin

- You will conduct business temporarily for less than 60 days at one location

Common examples include an out-of-state vendor selling at a weekend craft fair or a business running a two-week holiday pop-up shop. Permanent businesses cannot use temporary permits.

What Do I Need to Apply?

Gather these items before starting your temporary permit application:

- Your business name, address, and contact information

- A description of the products/services you will sell

- The exact dates and location of your sales event

- Social Security Number or FEIN

- Payment for the $20 permit fee

Having all required information ready speeds processing so you receive your permit in time for your event.

How Do I Apply?

The quickest way to apply is through the state’s online Business Tax Registration system. You’ll fill out the temporary permit application and pay the $20 fee electronically.

If applying by mail, complete Form BTR-101 and submit along with your $20 payment to the Department of Revenue. Be sure to apply early, as mailed applications take longer to process.

After submitting the application, you should receive your temporary permit certificate within 5-7 business days if applying online, or 2-3 weeks by mail.

When Can I Start Selling?

You must wait until the permit start date you listed on your application before making sales. This is usually the first day of your temporary event or sales promotion.

You can continue selling for the duration of the event, up to 60 days maximum from the start date. All sales must cease on the end date you provided on your application.

What Are My Responsibilities?

A temporary permit comes with the same sales tax collection and filing duties as a standard seller’s permit. This includes:

- Collecting sales tax on all taxable transactions

- Properly exempting qualified tax-exempt sales

- Remitting collected sales tax to the state

- Keeping detailed sales records

You’ll need to file tax returns reporting sales made during the permit’s validity period. Failing to meet these requirements can jeopardize your permit and create tax liabilities.

Can I Renew a Temporary Permit?

Temporary Wisconsin seller’s permits cannot be renewed or extended. You must fully complete the application process again to receive a new temporary permit for any future events.

If you need to make sales for more than 60 days or intend to operate long-term, apply for a regular annual seller’s permit instead.

Get Started Selling at Your Temporary Event

Short term selling events like fairs, markets, and pop-ups offer great low-risk ways to test new products, markets, and approaches for your Wisconsin retail business. A temporary seller’s permit allows you capitalize on these opportunities fully legally.

Applying is quick and affordable. Just provide the key details, pay the $20 fee, and display your permit when the event starts. Handling all required sales tax obligations keeps your business compliant.

With proper planning and preparation, a Wisconsin temporary seller’s permit can help you successfully and legally launch temporary sales events to grow your business.

Getting Help from the Wisconsin Department of Revenue

Navigating the licensing requirements to legally operate a retail business in Wisconsin can be confusing, especially for first-time entrepreneurs. Fortunately, the Wisconsin Department of Revenue (DOR) provides extensive help and support to guide sellers through the process of obtaining a state seller’s permit.

From permit applications to ongoing compliance, the DOR aims to make interfacing with state tax authorities as straightforward as possible. Read on to discover the many resources offered to assist with your seller’s permit needs.

Permit Application Assistance

The DOR provides step-by-step guidance to make applying for your initial seller’s permit smooth and simple. Resources include:

- Instructional videos walking through the online application

- Detailed applicant checklists and requirement overviews

- Pre-application consultations by phone or email

- Foreign language assistance for non-native English speakers

DOR staff can also review your application before submission to catch any errors upfront. This helps avoid processing delays.

Ongoing Operations Support

The DOR helps sellers remain compliant after receiving their permit too. Education is provided on topics like:

- Properly calculating sales tax on transactions

- Collecting and reporting sales tax

- Accepting tax exemption certificates

- Recordkeeping and accounting procedures

- Completing and filing tax returns

Free tax workshops and webinars offer sellers convenient training opportunities. Detailed guidance materials are also available covering all permit operations.

Tax Policy Information

Stay up-to-date on the latest Wisconsin tax laws and policies that affect your seller’s permit with resources like:

- Email newsletters and alerts on policy changes

- Online tax bulletins detailing new rulings and interpretations

- Annotated statutes clearly outlining current tax codes

Knowing how evolving tax regulations impact your business ensures continued legal compliance.

Audit Assistance

The DOR strives to make seller’s permit audits – while never fun – as straightforward as possible. Support includes:

- An audit checklist explaining the process

- Sample records requests so you know what to expect

- Tips for preparing for an audit

- Guidance on appeal rights if disputes arise

While audits aim to validate compliance, the DOR’s assistance can help sellers get through them with minimal disruption.

Let the DOR Help You Succeed

Don’t struggle alone – leverage the Wisconsin DOR’s vast seller’s permit resources. From application to audit, their expertise and services empower entrepreneurs to launch and grow retail businesses legally and successfully.

Get started on the path to reselling compliance in Wisconsin by contacting the Department of Revenue. Making the DOR your ally positions your business for smooth setup, ongoing operations, and long-term viability.