How do Universal Visa gift cards function. Where can you purchase them. What are the benefits of using Universal Visa gift cards. How to check balance and register your card. Where can Universal Visa gift cards be used. What are the rewards programs associated with these cards. How businesses can utilize Universal Visa gift cards. What are the options for sending e-gift cards.

Understanding Universal Visa Gift Cards: A Comprehensive Guide

Universal Visa gift cards have become increasingly popular as a flexible gifting option and a convenient method for everyday purchases. These prepaid debit cards offer the versatility of a Visa card with the added benefit of being preloaded with a specific amount. But how exactly do they work, and what makes them stand out from other gift card options?

What Are Universal Visa Gift Cards?

Universal Visa gift cards are prepaid debit cards that can be used wherever Visa is accepted. They function similarly to standard Visa debit cards, with the key difference being that they are loaded with a predetermined amount of funds. These cards can be purchased with amounts ranging from $10 to $1000, making them suitable for various gifting scenarios and personal use.

How Do Universal Visa Gift Cards Function?

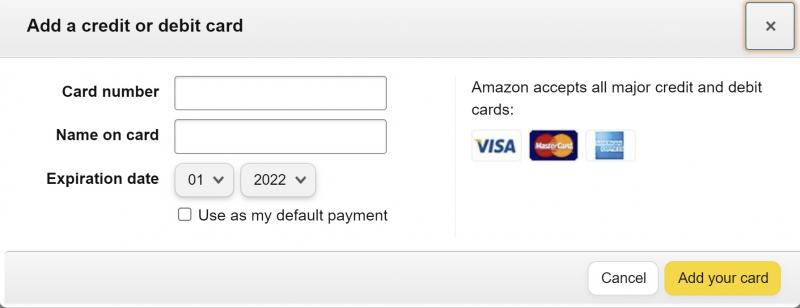

When you purchase a Universal Visa gift card, it is activated at the point of sale. The card comes with a 16-digit card number, expiration date, and security code, just like a regular Visa card. This allows the cardholder to use it for both in-store and online purchases. As transactions are made, the purchase amount is deducted from the card’s balance.

Can Universal Visa gift cards expire? Unlike some other gift cards, Universal Visa gift cards do not have an expiration date for the funds. This means that any remaining balance can be used indefinitely, providing long-term value for the recipient.

Purchasing Universal Visa Gift Cards: Online and In-Store Options

Universal Visa gift cards are widely available, making them a convenient option for both givers and recipients. But where exactly can you purchase these versatile cards?

In-Store Purchase Options

Many major retailers offer Universal Visa gift cards in their stores. You can find them at:

- Walmart

- CVS

- Walgreens

- Target

- Grocery stores

- Convenience stores

When buying in-store, you’ll typically find these cards on gift card racks alongside other options. At checkout, inform the cashier of the amount you’d like to load onto the card.

Online Purchase Options

For those who prefer the convenience of online shopping, Universal Visa gift cards can be purchased from several websites:

- Amazon

- GiftCards.com

- The official Universal Gift Card website

When buying online, you can select your desired card design and amount, add it to your cart, and complete the checkout process. You’ll receive a claim code to retrieve the active card, and e-cards can be delivered instantly via email.

Are there any tricks to maximizing the value of your Universal Visa gift card purchase? Indeed, savvy shoppers should keep an eye out for promotions and discounts, especially on sites like GiftCards.com. These deals can help you get more bang for your buck when buying Universal Visa gift cards.

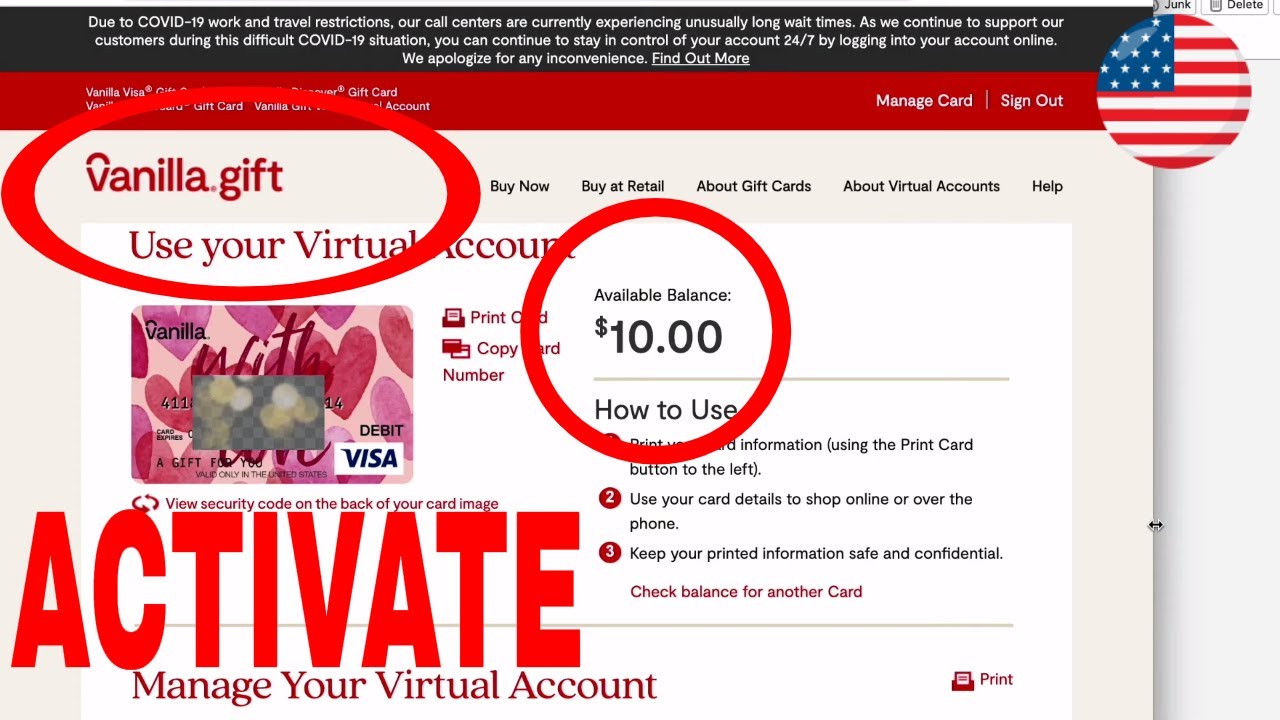

Managing Your Universal Visa Gift Card: Balance Checks and Registration

Once you’ve purchased a Universal Visa gift card, it’s important to know how to manage it effectively. This includes checking the balance and registering the card for added protection.

How to Check Your Gift Card Balance

Checking the balance on your Universal Visa gift card is a straightforward process:

- Visit the “Balance Inquiry” page at UniversalGiftCard.com

- Enter the 16-digit card number and security code

- The remaining balance will be displayed

This feature allows both the giver and the recipient to keep track of the available funds on the card.

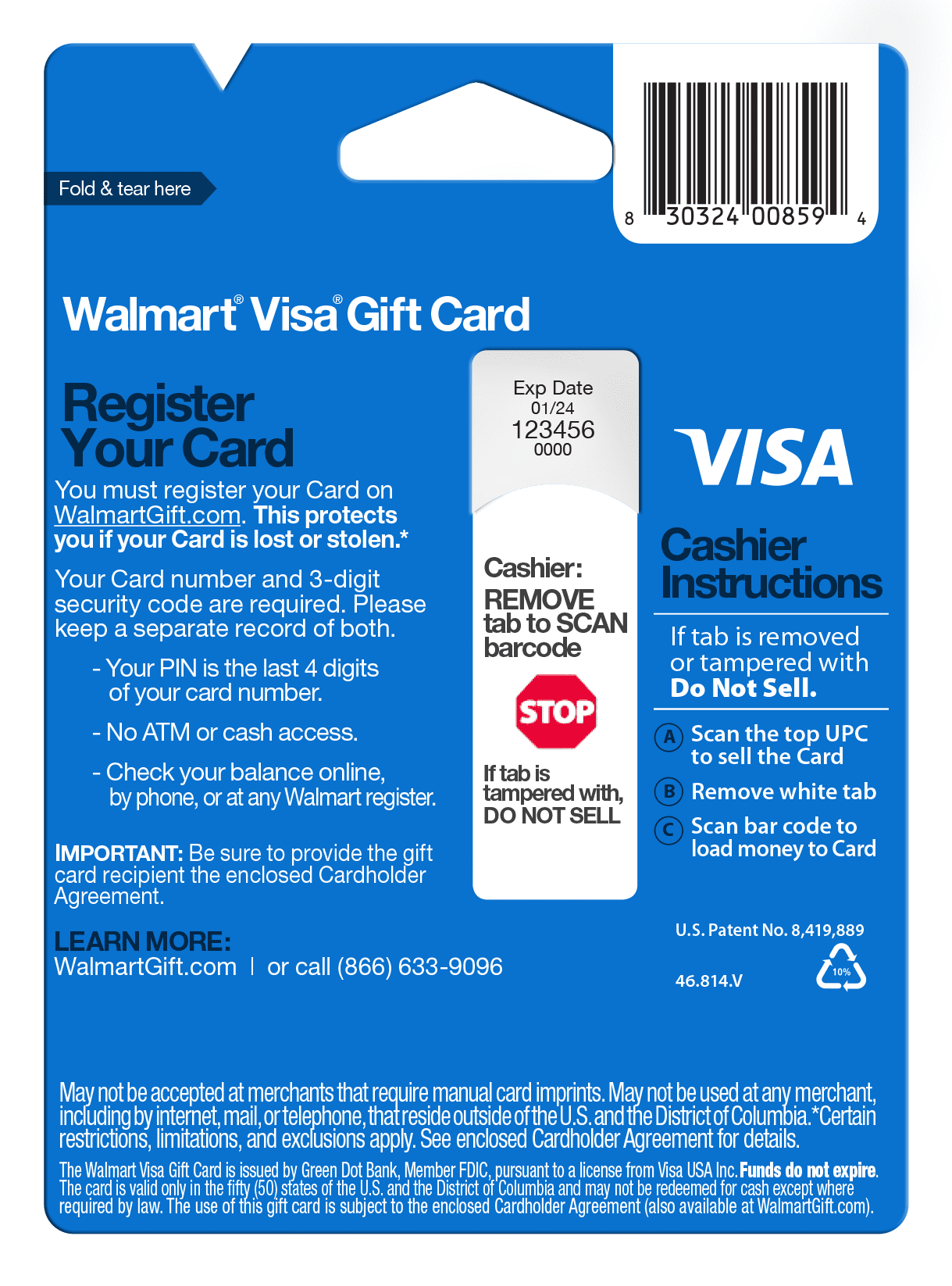

Registering Your Card for Protection

To ensure the security of your Universal Visa gift card, it’s recommended to register it on the official website. This process links the card to your personal information, providing an extra layer of protection in case the card is lost or stolen. To register your card:

- Go to the “Card Registration” page on UniversalGiftCard.com

- Enter the required card information and personal details

- Complete the registration process

By taking this step, you can safeguard your card’s value and potentially recover the funds if something happens to the physical card.

The Versatility of Universal Visa Gift Cards: Where Can They Be Used?

One of the most significant advantages of Universal Visa gift cards is their wide acceptance. These cards can be used virtually anywhere that accepts Visa debit payments, both in-store and online.

In-Store Usage

Universal Visa gift cards can be used at a vast array of physical locations, including:

- Supermarkets and grocery stores

- Gas stations

- Drugstores and pharmacies

- Clothing and electronics retailers

- Home goods stores

- Entertainment venues (movie theaters, amusement parks)

- Restaurants and cafes

- Healthcare providers (doctors’ offices, clinics)

This wide acceptance makes Universal Visa gift cards an ideal choice for recipients with diverse spending preferences.

Online and Service-Based Usage

The versatility of Universal Visa gift cards extends to the digital realm and service-based purchases:

- Online shopping platforms

- Travel bookings (flights, hotels, rental cars)

- Food delivery services

- Streaming services

- Phone and utility bill payments

- Fitness center memberships

This flexibility allows recipients to use their gift cards for both everyday expenses and special purchases.

Does the wide acceptance of Universal Visa gift cards make them a more practical gift option compared to store-specific gift cards? In many cases, yes. The ability to use these cards at a vast number of merchants and for various services provides recipients with ultimate flexibility and convenience.

Rewards Programs and Branded Universal Visa Gift Cards

Some Universal Visa gift cards offer additional value through rewards programs and co-branding partnerships. These features can make the cards even more attractive to both givers and recipients.

Universal Rewards: Earning Points on Purchases

Certain Universal Visa gift cards are offered in partnership with specific brands, such as Lacrosse. These co-branded cards often come with rewards programs that allow users to earn points on their purchases. For example, a Lacrosse Universal Visa card might offer 1 point for every $1 spent.

How can you maximize the benefits of these rewards programs? Consider the following strategies:

- Compare different branded cards to find the best rewards rate

- Use the card for everyday purchases to accumulate points faster

- Keep track of point expiration dates and redemption options

- Look for special promotions that offer bonus points

By leveraging these rewards programs effectively, cardholders can extract additional value from their Universal Visa gift cards.

Redeeming Rewards Points

The points earned through these rewards programs can often be redeemed for a variety of perks:

- Merchant gift cards

- Travel deals and discounts

- Sweepstakes entries

- Merchandise

- Charitable donations

The specific redemption options may vary depending on the branded card and its associated rewards program.

Universal Visa Gift Cards for Business: Customization and Bulk Purchasing

Beyond personal gifting, Universal Visa gift cards offer valuable solutions for businesses and organizations. These cards can be used for various corporate purposes, from employee incentives to customer promotions.

Customized Universal Visa Gift Cards

Businesses have the option to order customized Universal Visa gift cards featuring:

- Company logos

- Brand colors

- Custom designs

- Personalized messages

These customized cards can help reinforce brand identity while providing a valuable and flexible reward.

Bulk Purchasing for Business Needs

For companies looking to purchase Universal Visa gift cards in large quantities, there are significant advantages:

- Volume discounts for bulk orders

- Streamlined ordering process

- Consistent reward values across multiple recipients

- Simplified expense tracking

These benefits make Universal Visa gift cards an attractive option for corporate gifting, employee recognition programs, and large-scale promotions.

How can businesses effectively incorporate Universal Visa gift cards into their reward and incentive programs? Consider the following strategies:

- Use them as performance bonuses for employees

- Offer them as prizes in customer contests or loyalty programs

- Include them in welcome packages for new clients or employees

- Use them as incentives for completing surveys or providing feedback

By leveraging the flexibility and wide acceptance of Universal Visa gift cards, businesses can create compelling reward programs that appeal to a broad range of recipients.

E-Gift Cards: The Digital Evolution of Universal Visa Gift Cards

In today’s digital age, the convenience of e-gift cards has become increasingly popular. Universal Visa gift cards have adapted to this trend, offering electronic versions that can be sent instantly to recipients.

How Do Universal Visa E-Gift Cards Work?

Universal Visa e-gift cards function similarly to their physical counterparts but exist in a digital format. Here’s how they typically work:

- The purchaser selects the e-gift card option when buying online

- They choose the card design and amount

- The purchaser provides the recipient’s email address

- The e-gift card is sent instantly to the recipient’s email

- The recipient can then use the card information for online purchases or add it to a digital wallet for in-store use

This digital format offers immediate delivery, making it an excellent option for last-minute gifts or when physical delivery isn’t practical.

Advantages of E-Gift Cards

Universal Visa e-gift cards offer several benefits over traditional physical cards:

- Instant delivery

- No risk of physical loss or theft

- Easy to store in digital wallets

- Environmentally friendly (no plastic waste)

- Can be easily forwarded or transferred to others

These advantages make e-gift cards an increasingly popular choice for both personal and business gifting.

Are there any drawbacks to choosing e-gift cards over physical Universal Visa gift cards? While e-gift cards offer many benefits, some recipients may prefer the tangible nature of a physical card. Additionally, using e-gift cards for in-store purchases may require a smartphone or other device, which could be a limitation for some users.

In conclusion, Universal Visa gift cards, whether physical or digital, offer a flexible and convenient gifting solution. Their wide acceptance, potential for rewards, and ease of use make them an attractive option for both personal and business purposes. By understanding how these cards work and how to maximize their value, both givers and recipients can enjoy the full benefits of this versatile payment method.

Universal Visa gift cards offer a versatile prepaid option for gifting money or making everyday purchases. Here’s a deep dive into how these popular gift cards work and the many benefits they provide:

What Are Universal Visa Gift Cards And How Do They Work?

A Universal Visa gift card is a prepaid debit card that can be used anywhere Visa debit is accepted – both online and in stores. They function similarly to a standard Visa debit card, with the key difference being that they are loaded with a set amount of funds that you prepay.

When you purchase a Universal Visa card, you can load it with any amount between $10 and $1000. The card is activated at the register when it’s purchased. You can then use it to make purchases directly by swiping or tapping the card at checkout. The purchase amount is deducted from the remaining balance.

Universal Visa cards can also be used for online shopping, phone/mail orders, bill payments, and more. Each card has a 16-digit card number, expiration date, and security code that you enter just like a regular Visa card for online transactions. The funds act as a prepaid debit balance.

An advantage of Universal Visa cards is that the recipient can spend the funds wherever they’d like – the gift card isn’t tied to just one merchant. This makes it an extremely flexible gift idea. Universal Visa cards also never expire, so leftover funds can be used indefinitely.

Where To Buy Universal Visa Gift Cards Online Or In Stores

You can purchase Universal Visa gift cards at many major retailers like Walmart, CVS, Walgreens, Target, and more. They are also available for purchase directly online through sites like Amazon, GiftCards.com, and the official Universal Gift Card website.

When buying in-store, you’ll find Universal Visa cards on gift card racks alongside other options like retailer-specific cards. At the register, let the cashier know the amount you’d like to load on the card between $10 and $1000. You can pay with any standard payment method.

To buy online, simply select your desired design and amount, add it to your cart, and check out. You’ll receive a claim code to retrieve the active card. E-cards can also be delivered instantly via email.

Pro tip: Check sites like GiftCards.com for discounts and promotions on Universal Visa cards to maximize the value of your gift card purchase.

Check Gift Card Balance And Register Your Card For Protection

After purchasing a Universal Visa gift card, be sure to document the 16-digit card number and security code. You can check the balance by visiting the “Balance Inquiry” page at UniversalGiftCard.com and entering this info. This allows both you and the recipient to check the remaining funds.

It’s also advised to register your Universal Visa card using the “Card Registration” page on the website. This links the card to your personal info and provides protection in case the card is lost or stolen.

Use Universal Visa Gift Cards Anywhere Visa Is Accepted

A major perk of Universal Visa cards is that they can be used for practically any type of purchase. The prepaid funds are redeemable anywhere that accepts Visa debit payments, which includes:

- Supermarkets, gas stations, drugstores

- Clothing, electronics, home goods stores

- Movie theaters, amusement parks, other entertainment venues

- Flights, hotels, rental cars, and other travel purchases

- Online shopping at millions of sites

- Restaurants, cafes, and food delivery services

- Doctors’ offices, pharmacies, and other healthcare spends

- Fitness centers, streaming services, phone bills, and more

So whether you’re gifting to a family member, friend, or employee, a Universal Visa gives them ultimate flexibility and convenience.

Universal Rewards: Earn Points On Purchases With Branded Cards

Some Universal Visa cards are offered in partnership with brands like Lacrosse. These co-branded cards allow you to earn rewards points on your purchases. For example, using a Lacrosse Universal Visa may earn 1 point per $1 spent.

Rewards cards add an extra layer of value. Points can often be redeemed for things like merchant gift cards, travel deals, sweepstakes entries, and more. Compare rewards programs when picking out a branded Universal Visa card.

Buy Customized Or Bulk Universal Gift Cards For Business

Along with buying Universal Visa cards as personal gifts, they also make excellent rewards, incentives, or promotional items for businesses and organizations. You can order customized cards with your company logo and special designs.

For large volume orders, significant discounts are offered when you buy in bulk. This makes Universal Visa cards very budget-friendly for corporate gifting, staff rewards, customer giveaways, and more.

Send E-Gift Cards Instantly To Friends And Family Online

In addition to physical gift cards, many websites offer instant online delivery of Universal Visa e-gift cards. These are sent right to the recipient’s email as a virtual card.

E-gift cards allow you to conveniently send a monetary gift last-minute for birthdays, holidays, or surprising occasions. The flexible funds can be used immediately for online shopping or anywhere else visa is accepted.

Universal Gift Cards Never Expire – Use Leftover Funds Later

A hassle-free benefit of Universal Visa cards is that they have no fees or expiration dates associated with them. If your gift card is not used up completely, the remaining balance stays valid indefinitely.

Many other gift cards must be used within a short window or expire after a certain time period. With a Universal Visa, you can hang onto it and use the leftover amount months or even years down the road.

Save Money With Discounted Universal Gift Cards Online

Looking to save on Universal Visa gift card purchases? Check sites like GiftCards.com and CardCash, which often sell discounted gift cards at up to 20% off face value.

These are unused Universal Visa cards that were returned or forfeited. The prepaid balances are steeply discounted, allowing you to score major savings. It’s a great way to stretch your gift card budget further.

Just be sure discounted gift cards are sold by reputable sellers with guarantees. Also double check the balance online after purchase.

Compare Fees And Limits When Buying Prepaid Visa Cards

While Universal Visa cards have no fees themselves, some retailers may charge purchase or activation fees. It helps to compare a few places that sell the cards.

Also take note of maximum load limits. Most stores cap the amount you can load between $100 and $500. For high balance cards, buy directly from UniversalGiftCard.com.

Be aware that prepaid Visa cards have higher fees than debit or credit cards when used overseas or converted into foreign currencies.

Important Security Tips For Safely Using And Protecting Gift Cards

To safely redeem your Universal Visa gift card, always treat it like cash and guard the card number. Avoid emailing the card details. Also, register your card in case it’s lost or stolen.

When buying cards online, ensure the seller has a secure site and delivery guarantees. Beware of gift card scams by sticking to reputable sellers.

For added security, some Universal Visa cards offer PIN capability for chip-and-PIN transactions. You can set a PIN to prevent unauthorized use if your card is compromised.

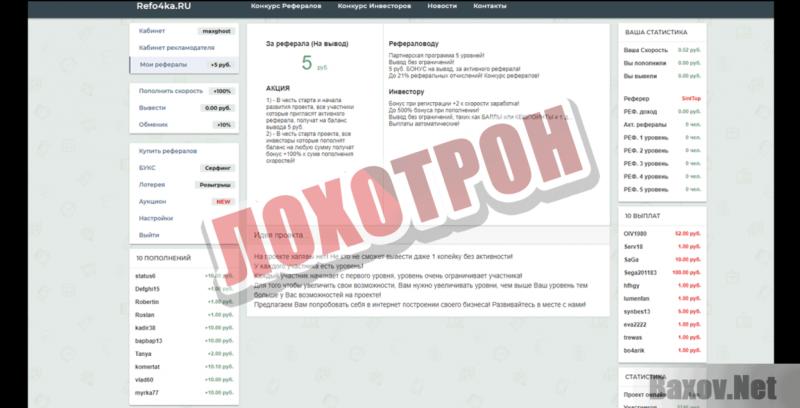

How To Avoid Gift Card Scams And Fake Card Websites

Unfortunately, fake Visa gift card websites exist that aim to steal your money or personal information. Protect yourself by double checking URLs and only buying from legitimate sellers like UniversalGiftCard.com.

Use extra caution when purchasing discounted or bulk gift cards from third parties. Only buy from reputable secure sites with money-back guarantees in case of issues.

Avoid offers that seem too good to be true, like super low-priced cards or huge bulk discounts. These are red flags for scams. Trust your gut if an offer raises suspicion.

Check If Lost Or Stolen Gift Cards Are Protected By Purchase Guarantee

If you happen to misplace or lose a Universal Visa gift card, check if the seller provides any purchase protection or refund policy. Many major retailers allow you to call in and cancel lost cards.

Registering your card also helps for loss and theft protection. Universal Visa may be able to refund the balance to you or issue a replacement depending on where it was purchased.

Note that Universal Visa’s own lost/stolen policy does not provide refunds itself. But the original retailer may guarantee it. Check policies before buying.

Contact Universal Visa Customer Service For Balance Inquiries

If you need any help checking your Universal Visa card’s balance or have other questions, you can contact customer service for assistance. Call the toll-free number listed on the back of your card.

You can also get support through the website UniversalGiftCard.com, which has live chat available. Expect fast and friendly help from trained customer service agents.

Give The Flexible Gift Of A Universal Visa Card For Any Occasion

A prepaid Universal Visa gift card makes a thoughtful present for birthdays, holidays, graduations, weddings, and more. With the ability to spend the funds anywhere, you’re giving an extremely versatile and useful gift.

Universal Visa cards are widely available both online and in physical retail stores. Look for special designs or customization options to make your gift extra special. Add your own personal message for that finishing touch.

With no fees, expiration dates, or restrictions on where the card can be used, a Universal Visa gives your gift recipient ultimate freedom and convenience.

Looking to get your hands on a Universal Visa gift card? These versatile prepaid cards can be purchased easily both online and in-store. Here’s a quick guide to finding Universal Visa cards at major retailers or through convenient online options.

Where To Buy Universal Visa Gift Cards Online Or In Stores

For grab-and-go convenience, your best bet is stopping by local grocery stores, pharmacies, big box stores, and other major retailers. Universal Visa cards are readily available at most locations where standard gift cards are sold. Just a few examples:

- Walmart – Find Universal Visa cards at checkout lanes or on gift card displays

- Target – Sold on gift card racks near the front of stores

- CVS – Look for the brightly colored Universal Visa designs in the gift card section

- Walgreens – Ask the cashier or visit the gift card aisle

- Rite Aid, Dollar General, and 7-Eleven also typically carry them

At the register, let the cashier know you’d like to purchase a Universal Visa card and the amount you want to load between $10 and $500. Pay, and you’ll receive the activated card to use or gift right away.

For wider selection and convenience, browse major online retailers like Amazon, Walmart.com, or Target.com. You can have the e-gift card delivered straight to your inbox or physical card shipped to your doorstep.

Some grocery delivery sites like Instacart also allow you to add a Universal Visa e-gift card to your order. It’ll be delivered along with your groceries for easy one-stop shopping.

Another option is to go directly through Universal’s website at UniversalGiftCard.com. Here you can choose from loads of specialty card designs and even add custom photos.

Gift card reseller sites like GiftCards.com and CardCash are also safe online sources. They offer new Universal Visa e-gift cards as well as discounted or bulk options.

Pro tip: Check for current promotions at online gift card sites to save extra money. Occasional discounts like 20% off or rebates on Universal Visa cards are offered.

Compare Where To Buy Based on Amounts and Fees

When deciding the best spot to pick up a Universal Visa, take a few factors into account:

- In-store maximums – Most retailers cap load amounts around $100 to $500

- Online selection – More design and high value options

- Activation or purchase fees – Vary by retailer

- Discounts – Online card sites tend to offer better promos

For example, if you want a card with a high balance exceeding $500, an online source like Universal’s website is best. Walmart caps in-store loads at $500, while Target has a max of just $200.

Walgreens charges a $3.95 card purchase fee, so avoid them if you want to dodge this. Amazon offers lots of e-gift card promotions, so check for current deals.

Take some time to compare where to buy Universal Visa cards based on your desired amount, fees, and any available discounts or coupon codes.

Order Custom Photo Cards Directly Through Universal

Looking for a unique, personalized Universal Visa gift card? Order directly from UniversalGiftCard.com to create custom designs.

You can upload photos like family portraits, pet pics, scenic shots, or whatever image you prefer. Add text like names, messages, or well wishes to complete your one-of-a-kind creation.

Universal’s site makes the design process easy. You can instantly see a preview of your custom card before final purchase. Just keep in mind a small fee applies for photo personalization.

Custom Universal Visa cards allow you to gift a prepaid card tailored specifically for your recipient. The handy funds also come with your thoughtful touch.

Buy Discounted Gift Cards to Save on Universal Visa

If you’re hoping to keep costs down, consider purchasing discounted Universal Visa cards online. Sites like CardCash offer gift cards at up to 25% below face value.

These are unused card balances from returned or forfeited cards. The prepaid funds on the card are steeply marked down from the original value.

Just ensure discounted card sites have buyer guarantees in case any issues arise. Confirm the balance online after purchase. When buying from reputable dealers, major savings can be scored.

With some smart comparison shopping at the right retailers or websites, you can conveniently purchase Universal Visa gift cards online or in-store. Look for special promotions and custom designs to make the cards extra special.

Once you’ve purchased a Universal Visa gift card, be sure to take advantage of the online tools available to check your balance and register your card. Here are some tips on how gift card registration and balance tracking can protect your funds and provide peace of mind.

Check Gift Card Balance And Register Your Card For Protection

After buying or receiving a Universal Visa as a gift, you’ll want to document the 16-digit card number, expiration date, and security code located on the back of the card. This info allows you to register and check the balance online.

Visit UniversalGiftCard.com and click on “Balance Inquiry”. Enter your card details to view the available funds. You can check periodically to see your running balance as you use the card.

Registration is also advised in order to link your personal details to the card. On Universal’s site, click “Card Registration” and provide your name, address, email, phone, and other info. This comes in handy if your card gets lost or stolen down the road.

Why register a gift card, you may ask? Registration creates an online record connecting you to the funds. This way Universal can assist if your card is ever misplaced, stolen, or damaged. The balance may potentially be replaced or refunded in verified cases.

Without registration, there is little recourse if something happens to an anonymous gift card. So take the extra minute to register and protect your investment.

Check Balance Before Finalizing Transactions

When using your Universal Visa to pay for purchases, it’s always smart to double check the balance to ensure sufficient funds. This takes just seconds either on Universal’s website or mobile app.

The last thing you want is to be surprised by a declined card at checkout due to not realizing your balance was lower than expected. Prevent any embarrassing moments by quick pre-purchase balance checks.

Similarly, review the balance after big transactions to confirm the correct amount was deducted. Mistakes can occasionally happen, so verify withdrawals reflect your actual spending.

Setup Alerts for Real-Time Balance Notifications

For hands-off balance monitoring, enroll in text or email alerts through Universal’s website. You’ll receive automatic notifications whenever money is added or spent on your card.

Real-time alerts let you track usage without constantly logging in to manually check. They act like instant receipts for gift card transactions, allowing you to closely follow the balance.

Alert preferences can be customized to your liking. You may choose to receive notifications for all transactions, only when fund expire, or for purchases over a certain dollar amount.

Use Mobile App to Check Balance On-the-Go

Universal Gift Cards offers a free mobile app for iPhone and Android to make checking your balance even more convenient.

The app allows card lookup by scanning the card barcode or manually entering your details. You can check the balance in just seconds right from your smartphone anywhere you go.

The app also displays transaction history, lets you set balance alerts, provides customer service contact info, and more. All your card management essentials in one place.

With the tools provided by Universal Visa, you can monitor your gift card activity, be notified of new transactions, and access your balance from anywhere. A few simple steps helps safeguard your funds.

Check Expiration Dates on Gift Card Packaging

One final tip when starting to use a new Universal Visa gift card – remember to check the printed expiration date on the card packaging or sleeve.

The funds themselves on Universal Visa cards do not expire. However, the physical card does need to be replaced after a few years for security purposes.

So when your card reaches its printed expiration date, simply exchange it for a new card at any location that sells Universal Visa. Your balance will transfer over to the fresh card.

Keeping tabs on the balance and expiration date helps ensure your Universal Visa gift card provides you maximum convenience and enjoyment.

Use Universal Visa Gift Cards Anywhere Visa Is Accepted

Want To Get The Most From Gift Cards Online? Learn How Universal Visa Cards Work:

Gift cards have become an increasingly popular gift-giving option in recent years. While store-specific gift cards limit you to purchases at particular retailers, universal Visa gift cards offer much more flexibility. Universal Visa gift cards allow you to shop at millions of locations worldwide that accept Visa debit cards.

If you’re considering giving (or hoping to receive!) a universal Visa gift card, read on to learn how they work and how to get the most value from these versatile cards.

What Are Universal Visa Gift Cards?

Universal Visa gift cards function similarly to prepaid Visa debit cards. When you purchase a universal Visa card, you load a specified amount of money onto the card. The recipient can then use the card anywhere that Visa debit cards are accepted, whether in-store, online, over the phone, or for mail order purchases.

Unlike store-specific gift cards, universal Visa cards aren’t restricted to just one retailer. This makes them convenient for both the giver and recipient – you don’t have to try to guess someone’s favorite store, and they can shop wherever they please.

Where Can You Use a Universal Visa Gift Card?

One of the biggest benefits of universal Visa gift cards is the virtually limitless number of places you can use them. Any merchant that accepts Visa debit cards will also accept a universal Visa gift card. This includes:

- Popular retail stores like Target, Walmart, Amazon, etc.

- Grocery stores and pharmacies

- Gas stations

- Restaurants, coffee shops, and other food establishments

- Entertainment venues like movie theaters, amusement parks, concerts, etc.

- Online shopping at thousands of ecommerce sites

- Travel-related purchases like hotels, car rentals, trains, cruises, etc.

- Medical offices, hospitals, and other healthcare providers

- Service providers like salons, gyms, subscriptions, etc.

Because Visa has such wide acceptance, it’s likely that anywhere the recipient normally shops, dines, travels, or spends money will accept a universal Visa gift card. This extensive usage gives recipients the flexibility to use the card wherever is most convenient or valuable to them.

Benefits of Universal Visa Gift Cards

There are many reasons universal Visa gift cards make great gifts:

- Convenience: Recipients can easily use the card wherever Visa is accepted without having to carry multiple store-specific cards.

- Flexibility: Allows recipients to purchase what they truly want or need.

- Budget-friendly: Givers can control exactly how much they spend on a gift.

- Practicality: Recipients can purchase necessities like groceries or gas.

- Enhanced gifting experience: More meaningful than giving cash.

While store gift cards are still popular, statistics show consumers tend to prefer the flexibility of Visa cards. In one survey, 75% of respondents said they’d rather receive a Visa gift card over a store-specific card.

How to Buy a Universal Visa Gift Card

You can purchase universal Visa gift cards from a variety of retailers and websites, including:

- Grocery stores like Safeway or Kroger

- Pharmacies like CVS, Walgreens, or Rite Aid

- Big box stores like Target or Walmart

- Online retailers like Amazon

- Prepaid card websites like GiftCards.com

When purchasing a universal Visa card, you’ll select the amount you wish to load onto it, typically ranging from $25 up to $500. Many retailers charge purchase fees ranging from $2-$6 per card. Be sure to read the fine print so you understand any fees.

You can often choose either a physical plastic gift card or an eGift card delivered by email. Digital cards allow you to buy a last-minute gift without waiting for shipping. However, plastic cards may feel more tangible when given as a gift.

Using and Maximizing Your Universal Visa Gift Card

Using a universal Visa gift card is easy. Simply swipe or scan your card just like you would any other Visa debit or credit card. You’ll sign for the purchase rather than entering a PIN. The purchase amount will be deducted from the card’s balance.

To get the most from your universal Visa gift card, be sure to:

- Register your card online if possible. This will allow you to access your balance and transaction history.

- Treat it like cash. Don’t lose your card, as replacements usually aren’t available.

- Spend your entire balance. Discard cards with low balances as you can’t get cash back.

- Watch expiration dates, which are usually 6-12 months from purchase.

- Save your receipts to track your spending.

By understanding how universal Visa gift cards work, you can give (and receive) these versatile cards confidently. With acceptance almost everywhere, recipients will appreciate the flexibility to shop wherever they please!

Earning points on purchases is a great way to get a little extra value from your spending. Branded credit cards that offer universal rewards programs allow you to accumulate points on purchases that can then be redeemed for gift cards, travel, merchandise, and more. Let’s take a closer look at how universal rewards cards work and how you can maximize value.

Universal Rewards: Earn Points On Purchases With Branded Cards

Universal rewards cards are credit cards that allow you to earn points on purchases across multiple brands, rather than being tied to just one company’s loyalty program. The points earned can then be redeemed for gift cards that are applicable at hundreds of different retailers, restaurants, travel companies, and more. This provides a great deal of flexibility and versatility.

Popular examples of universal rewards cards include the Chase Ultimate Rewards card, the Citi ThankYou Rewards card, and the Capital One Venture Rewards card. While each program differs slightly, the core concept is the same – earn points on everyday purchases and redeem those points for gift cards or other rewards.

How Do Universal Reward Points Work?

With a universal rewards credit card, you’ll earn points on purchases at grocery stores, gas stations, restaurants, travel expenses, online shopping, and more. The exact earn rate depends on the card, but it’s often 2x or 3x points per $1 spent. Some cards offer bonus earn rates on certain purchase categories too.

As you use the card, your points will accumulate in your account. Once you hit the redemption threshold, usually at least 1000 points, you can log in to your account and redeem points for gift cards. Gift card options range from big box stores like Amazon and Walmart to specialty retailers, hotels, airlines, and restaurants.

Redemption values vary, but a common benchmark is 1 cent per point. So 1000 points could be redeemed for a $10 gift card. However, if you redeem for gift cards to certain merchants you may get a better value, like 1.25 cents per point.

Benefits of Universal Reward Programs

The flexibility of being able to earn points on everyday purchases across multiple brands, and then redeem those points for gift cards applicable at hundreds of retailers, provides some nice advantages compared to traditional loyalty programs:

- You’re not locked in to just one merchant. Points can be earned and redeemed widely.

- There’s no need to worry about points expiring with most programs.

- You can pool points earned across authorized users on your account.

- Redemption is simple – just select a gift card and the points are deducted.

- Points don’t usually have blackout dates or seating capacity limits.

This opens up a lot of possibilities to earn and burn points conveniently, from everyday spending at the supermarket to special occasions like birthdays and holidays.

Maximizing Your Universal Rewards Earnings

To get the most from a universal rewards credit card, here are some tips:

- Use it as your primary spending card to rack up points fast.

- Take advantage of bonus earn categories – some cards offer 5x or more points on certain purchases.

- See if you qualify for a sign-up bonus – many cards offer extra points for spending a certain amount within the first 3 months.

- Shop through the card’s bonus rewards portal – you can earn extra points by clicking through the portal before shopping online.

- Pay your bill on time to avoid interest charges – carrying a balance can negate the value of earned rewards.

- Compare redemption values and opt for the best gift card deals.

Using Gift Card Rewards

Once you’ve earned a good stash of universal reward points, it’s time to start redeeming them for gift cards. Here are some tips for getting the most value from gift card redemptions:

- Browse all gift card options – don’t just redeem for the first retailer you think of.

- Compare redemption values – some merchants provide a better per-point value.

- Maximize savings with coupon stacking – look for additional discounts you can combine with the gift card.

- Stick to your budget – only redeem points for things you would have purchased anyway.

- Give gift cards as presents for birthdays, holidays, weddings, etc.

- Re-gift unused gift cards – give them to someone who will use them if you have leftovers.

Following these tips can help you get the very most from every point earned with a universal rewards credit card. The flexibility and wide range of redemption options make these types of cards a great option for savvy shoppers.

Incentivizing employees and customers with gift cards is a great way for businesses to show appreciation, boost engagement, and drive repeat sales. To implement a high-impact gift card program, companies should consider purchasing customized or bulk batches of universal gift cards that offer flexibility and scale.

Buy Customized Or Bulk Universal Gift Cards For Business

Universal gift cards that can be spent at hundreds of different retailers make excellent business gifts, rewards, and incentives. Their wide acceptance and flexibility provides options for every recipient. Companies can take their gift card programs to the next level by investing in customized or bulk orders of universal gift cards.

Customizing Universal Gift Cards

To align universal gift card rewards with branding, many providers offer customization options. Businesses can upload their logo and color scheme to be displayed prominently on the gift card.

Personalizing gift cards makes them easily identifiable as coming from your company. This strengthens brand impressions and shows recipients that you invested extra care into providing them a special gift.

Other customizations may include:

- A custom message or greeting printed on the card

- A custom card holder or sleeve

- The ability to set custom denomination amounts

Gift card providers like Tango Card and Blackhawk Network offer excellent customization options to help businesses brand and personalize universal rewards cards.

Buying Universal Gift Cards in Bulk

For companies that plan to distribute gifts cards en masse, whether as incentives, rewards, or holiday gifts, buying universal gift cards in bulk can provide big savings. Providers typically offer significant discounts for large batches of gift cards, such as:

- 5-10% off for orders of 250+ cards

- 15-20% off for 500+ cards

- 25-30% off for 1000+ cards

Bulk orders also simplify logistics. Rather than placing small repeated orders, you can get everything you need in one shipment. For holiday gifts, it’s especially convenient to buy all gift cards ahead of time.

Some key benefits of bulk universal gift card purchases:

- Cost savings from bulk discounts

- Convenience of large one-time order

- Streamlined distribution and tracking

- Easier budgeting when bought in advance

Buying in bulk allows you to maximize the value of your gift card program. Be sure to compare rates across vendors to get the best deal.

Using Universal Gift Cards for Business

Some of the most impactful ways businesses can utilize bulk or customized orders of universal gift cards include:

- Employee rewards and recognition

- Sales incentives for channel partners

- Customer loyalty programs

- Contests, sweepstakes, and giveaways

- Thank you gifts for vendors/partners

- Holiday gifts for top customers

Because universal gift cards offer such wide flexibility and acceptance, they work for virtually any use case. Employees can pick their favorite retailers, partners can choose based on personal tastes, and customers have total freedom to spend the cards how they want.

Compared to restrictive single-merchant cards, customizable and bulk ordered universal gift cards enable businesses to scale up gift card programs in ways that maximize perceived value, convenience, and flexibility for recipients.

Ordering Tips for Businesses

When buying bulk or customized universal gift cards, keep these tips in mind:

- Compare rates across multiple vendors

- Inquire about design, shipment, and tracking services

- Confirm expected delivery timelines

- Ask about security measures for online card management

- Request samples before finalizing custom designs

- Buy enough cards to last 3-6 months to maximize bulk savings

Taking the time to find the right gift card partner can pay dividends through discounts, convenience, and service. The result will be a highly professional rewards program your company can be proud of.

E-gift cards delivered online provide a quick and convenient way to gift friends and family no matter where they are. Digital gift cards from leading providers offer instant delivery along with flexibility and personalization options that physical plastic gift cards can’t match.

Send E-Gift Cards Instantly To Friends And Family Online

While plastic gift cards from major retailers remain popular gifting options, e-gift cards have gained significant ground in recent years. With e-gift cards, the card information and funds are delivered instantly via email or text message. This provides unparalleled convenience for both senders and recipients.

Top gift card providers like Tango Card, GiftCards.com, and Amazon now offer extensive e-gift card selections. You can choose from hundreds of top brands and customize the gift card message for a personal touch. The flexible delivery options make e-gifting ideal for last minute gifts, remote recipients, and busy givers on the go.

Benefits of E-Gifted Cards

Compared to physical gift cards, e-gifted cards provide some key advantages:

- Instant delivery to email or phone – no shipping required

- More design and personalization options

- Easy tracking and management online

- Flexible for remote family and friends

- Convenient for last-minute gifts

The instant delivery is perfect for putting together a gift at the last minute. You don’t have to visit a store or wait for shipping. Just select your e-card, customize the message, send, and it’s there for the recipient in seconds.

Choosing an E-Gift Card

Many e-gift card providers have hundreds of brand options spanning:

- Retailers

- Restaurants

- Travel

- Entertainment

- Grocery and gas

- Experiences

You can search or filter by category to find just the right brand and amount for each recipient. Options range from $10 up to several hundred dollars. Some providers also allow you to set a custom amount.

Customizing Your E-Gift Card

One of the best features of e-gifted cards is the ability to customize the presentation and message. You can often choose from various card designs and themes or even upload a personal photo.

The gift message field allows you to write a custom sentiment like “Happy Birthday Mom!” or “Congratulations on your graduation!”. You can make each e-gift card unique and heartfelt.

Delivering E-Gift Cards

Instant delivery options for e-gift cards include:

- Email – The gift card details are emailed instantly. Recipients can print it or save to their phone.

- SMS text – The card info is sent directly as a text message.

- Mobile wallet – Cards can be added right to a digital wallet like Apple Pay.

- Social media – Some services let you send cards via platforms like Facebook Messenger.

Email and text delivery are the most popular options. Double check the recipient’s contact info before sending to ensure smooth delivery. Some providers also allow you to schedule the delivery in advance.

Managing and Tracking

One of the nice perks of e-gifted cards from major providers is the ability to track, manage, and reuse cards all in one online account. You can:

- See when recipients view and redeem cards

- Resend card details if needed

- Add more funds or trade card balances

- Redeem unused cards for yourself

Having a centralized hub to manage all your e-gifting makes the experience smooth and organized for both senders and recipients.

E-Gift Cards for Every Occasion

The flexibility and convenience of e-gifted cards makes them work for almost any gifting occasion, such as:

- Birthdays

- Anniversaries

- Graduations

- Weddings

- Baby showers

- Holidays like Christmas and Hanukkah

- Thank you gifts

Because you can customize the design, message, and delivery method, e-gift cards make gifting easy whether the occasion is big or small. The instant delivery means you can brighten someone’s day even if you forgot their special event.

The Digital Gifting Experience

E-gifted gift cards provide unmatched convenience through instant digital delivery and centralized online management. The wide selection of brands and customization options give you flexibility to find the perfect gift. With just a few clicks you can send a thoughtful gift to delight friends, family, and colleagues across town or across the country.

One frustration with traditional plastic gift cards is when they expire before you can use up the balance. Fortunately, many universal gift cards from leading providers don’t expire. Your funds stay valid indefinitely, giving you flexibility if life gets busy.

Universal Gift Cards Never Expire – Use Leftover Funds Later

Forget about gift card funds vanishing into thin air. With major universal gift card brands like Tango Card, GiftCards.com, and Blackhawk Network, unused balances stay active and redeemable for years to come.

Non-expiring gift card balances provide great convenience. You don’t have to rush to use funds or meticulously track various expiration dates. Your gift card dollars will wait patiently to be redeemed down the road.

No Stress Over Expiration Dates

Traditional retailer-issued gift cards often carry short 12-24 month expiration dates. This forces you to redeem balances quicker, even if it means spending funds on things you don’t really need or want.

With universal gift cards, you can relax. Most major providers let you carry unused balances indefinitely. As long as you have the gift card information, those funds will be there when you’re ready to redeem.

Keep Track of Leftover Balances

To take advantage of never-expiring gift card funds, be sure to track and manage your balances carefully:

- Keep gift card numbers and access codes stored securely

- Log balances and details in a gift card tracker app

- Hold on to gift card emails for future reference

- Check balances periodically before funds expire

- Consolidate smaller balances onto one card when possible

Well-organized gift card records ensure you can leverage every last dollar on your cards when the timing is right.

Reactivating Old Gift Cards

For traditional plastic gift cards you may have lost track of, don’t assume the balances are gone for good. Many merchants now allow you to check balance and reactivate expired cards if funds remain.

Options to reactivate old gift cards include:

- Calling the 1-800 number on the card

- Visiting the merchant’s gift card portal online

- Stopping in a brick-and-mortar store if applicable

As long as the card is still in their system with an unused balance, most retailers can look it up and make those funds usable again. Reactivating instead of buying new cards keeps dollars in your pocket.

Spend Down Small Balances

One scenario where non-expiring policies come in very handy is when you’re left with small balances on various cards. Maybe it’s $3 on one card, $8 on another, and $12 on a third.

Rather than letting those small amounts languish, you can now patiently accumulate and consolidate them onto a single card. Once you’ve aggregated the balances, you can redeem for a more significant purchase.

Strategies for Maximizing Leftover Funds

To fully capitalize on never-expiring universal gift cards, employ strategies like:

- Set calendar reminders to periodically review and consolidate balances

- Stack gift cards with coupons and promotions when shopping

- Purchase discounted gift cards to score savings on top of existing balances

- Hold funds until you have a major purchase coming up

With a thoughtful approach, those extra dollars lingering on unused gift cards can add up to some major savings over time.

Flexibility and Convenience

At a time when most companies look for ways to cut costs and force faster spending, universal gift card providers offering non-expiring funds stand out. The no-rush experience gives you time to redeem balances thoughtfully.

So don’t stress about letting gift card funds languish. As long as you keep proper records, leftover balances on major universal gift cards will wait patiently for the right opportunity for you to maximize their value.

Universal gift cards that can be redeemed at hundreds of top brands are already tremendously flexible and convenient. Savvy shoppers can take the value to the next level by purchasing discounted universal gift cards online.

Save Money With Discounted Universal Gift Cards Online

Many leading gift card marketplaces like CardCash, Raise, and GiftCardGranny offer discounted universal gift cards for less than face value. This allows you to stretch your gift card dollars further at no extra effort when redeeming. It’s a smart way to save on brands you were already planning to shop at.

What are Discounted Gift Cards?

Discounted gift cards are original retailer gift cards that are resold by third party marketplaces at less than face value.Reasons cards may be discounted include:

- Overstock from gift card promotions

- Reselling unwanted card gifts

- Unused rewards cards

By reselling these cards, the marketplaces can pass on savings to customers. Discounts often range from 5-10% but can sometimes be 20% or more.

Where to Buy Discounted Universal Gift Cards

Top marketplaces to purchase discounted universal gift cards include:

- CardCash – Wide selection of discounted cards from 2% to 35% off or more.

- Raise – Typically offers 8-10% off gift cards with higher discounts sometimes available.

- GiftCardGranny – Aggregates inventory across multiple discount sites to find the best universal gift card deals.

- CardBearer – Specializes in discounted virtual eGift cards for quick delivery.

These sites offer a reliable way to save money on brands you know and trust. Discounts apply to both digital eGift cards as well as physical plastic gift cards.

Stack Savings with Coupons

One of the best aspects of discounted universal gift cards is the ability to double up on savings. Look for additional coupons and cash back offers you can apply at the time of redeeming your gift card for maximum value. Ways to stack include:

- Using card-linked retail coupon apps

- Combining with in-store percent-off coupons

- Shopping discounted gift cards during sales or promotions

- Going through a cash back portal before purchasing

With discounted gift cards, the initial discount is just the beginning. You can add significant additional savings on top.

Tips for Buying Discounted Universal Gift Cards

To find the best discounted universal gift card deals, keep these tips in mind:

- Compare rates across marketplaces

- Focus on popular brands you’ll definitely use

- Maximize savings by combining discounts and coupons

- Check reviews and terms for each marketplace

- Consider bulk discounts if purchasing multiple cards

Taking the time to find and utilize discounted universal gift cards strategically can help you save big on regular shopping trips and everyday essentials.

Discounted Digital Delivery

For convenience, many marketplaces now offer discounted universal eGift cards delivered instantly via email. Benefits include:

- Immediate delivery to your inbox

- Easy to store on your phone

- Can purchase and redeem quickly

Digital delivery means you don’t have to wait to realize the savings from your discounted gift card.

Discount Gifting

Along with great savings for yourself, discounted universal gift cards make excellent gifts. You can pass along the value by gifting cards to friends and family. A few ideas:

- Give discounted gas station gift cards

- Gift discounted retail cards for birthdays

- Send discounted streaming service cards to entertain

- Gift discounted grocery cards to help loved ones save

The recipient enjoys the full face value while you got to gift the card below face value. It’s a win-win when gifting discounted universal gift cards.

With huge selections across brands, steep discounts, and instant digital delivery, purchasing discounted gift cards takes an already versatile gift card option and makes it even more valuable. Universal gift cards provide flexibility, and discounted cards provide serious savings through strategic stacking.

When it comes to buying prepaid Visa cards, it’s important to compare fees and limits across different providers to ensure you’re getting the best deal. Prepaid Visa cards, also known as gift cards, are a convenient way to shop online or give monetary gifts, but they can come with various fees that cut into the card’s value. By doing your research and understanding the fine print, you can make sure you maximize the usefulness of the prepaid card.

Compare Fees And Limits When Buying Prepaid Visa Cards

The most important fees to look out for when comparing prepaid Visa cards are:

- Purchase fees – This is a one-time fee when you initially buy the card, usually between $2-$10.

- Monthly fees – Some cards charge a monthly maintenance fee, typically $1-$5 per month if the card has not been used.

- ATM withdrawal fees – There is sometimes a charge for withdrawing cash from an ATM, around $2-$5 each time.

- Point-of-sale fees – Some cards will charge a small fee when making a purchase in-store, around $0-$2 per transaction.

- Inactivity fees – If the card sits unused for a period of time, an inactivity fee kicks in, usually $2-$5 per month.

- Balance inquiry fees – Checking your balance at an ATM or by calling customer service can trigger a small fee, around $1 per inquiry.

When buying a prepaid Visa card, it’s advisable to look for options with no or low purchase fees, no monthly fees, and no point-of-sale transaction fees. These are the charges that will have the biggest impact on maximizing the value you get from the card. Paying ATM withdrawal fees only when you need cash can be an acceptable compromise.

In addition to fees, prepaid Visa cards come with maximum balance limits you can load onto the card, ranging anywhere from $500 to $10,000. The limits allow retailers to manage risk, but also determine the usefulness of the card. Look for the highest balance limit you can reasonably need for your intended use, keeping in mind that you may pay higher purchase fees for higher limits.

Here’s an overview of some of the most popular prepaid Visa cards and their fee structures:

NetSpend

- Purchase fee: $0-$9.95

- Monthly fee: $0 or $9.95 depending on plan

- ATM withdrawal fee: $2.50 (out-of-network); free (in-network)

- Point-of-sale transaction fee: $0

- Maximum balance: Up to $10,000

GreenDot

- Purchase fee: $0-$4.95

- Monthly fee: $0

- ATM withdrawal fee: $2.50

- Point-of-sale transaction fee: $0

- Maximum balance: Up to $1,000

Vanilla Visa

- Purchase fee: $4.95-$6.95

- Monthly fee: $0

- ATM withdrawal fee: $4.95

- Point-of-sale transaction fee: $0

- Maximum balance: Up to $500

PayPal Prepaid

- Purchase fee: $0-$5.95

- Monthly fee: $0

- ATM withdrawal fee: $3

- Point-of-sale transaction fee: $0

- Maximum balance: Up to $10,000

As you can see, fees and limits can vary significantly across providers. PayPal Prepaid offers high balance limits but charges occasional fees, while Vanilla Visa has no monthly fees but low balance limits and high ATM charges. Choosing the right card depends on your spending habits and needs.

Tips for Maximizing Prepaid Visa Cards

Once you’ve selected a prepaid Visa card with reasonable fees, here are some tips to get the most out of the card:

- Register it online or via the provider’s app for easier account management and balance tracking.

- Set up text or email alerts to be notified of transactions, low balances, fees, expiration dates, and other key notifications.

- Take advantage of any discounts for shopping at partner merchants or restaurant affiliations.

- Avoid fees by using in-network ATMs listed on the provider website and minimizing balance inquiries.

- Be strategic with purchases to avoid going over the card’s maximum balance limit.

- Treat it like cash and avoid losing it—prepaid Visa cards have zero liability if lost or stolen but replacing the funds can be a hassle.

- Use it for budgeting, setting monthly spending limits and tracking expenses.

The convenience and versatility of prepaid Visa cards makes them a smart choice for many situations, from online shopping to vacation budgets. Just be sure to assess the fees and find a provider that fits your likely usage. Taking the time to compare options will ensure you get maximum value with minimal hassle. Prepaid cards have restrictions compared to credit cards and debit cards linked to a bank account, but can serve as an important financial tool with some diligent research upfront.

Gift cards provide convenience and flexibility, but also require some caution to use safely and avoid losing money. Understanding gift card security best practices can give you peace of mind that your card balance and personal information are protected.

Important Security Tips For Safely Using And Protecting Gift Cards

Here are some key tips for keeping your gift cards secure:

Activate and Register the Card

Activating a new gift card links it to your identity and prevents others from using it. Registering it on the retailer website lets you manage the balance online and set up alerts. Don’t delay activation as inactive cards are vulnerable to theft.

Treat it Like Cash

Once activated, a gift card works like cash. Never share photos of the full card number or pin online as scammers can steal the value. Also avoid mailing physical cards where they can be intercepted.

Obscure the Card Number

When carrying or storing a physical gift card, keep the number covered or obscured so it can’t be stolen through visual hacking. Avoid keeping the card number on a post-it note in your wallet or an unsecured digital file.

Avoid Gift Card Resale Sites

Third-party gift card exchange sites often have fraudulent card listings or very low payout offers. Only buy directly from trusted retailers and restaurants to avoid resale scams.

Use Gift Card Balances Quickly

Spending gift card funds quickly minimizes the risk of losing the card or having the number stolen. Also, zero balances are less enticing targets for thieves.

Pay Attention to Expiration Dates

Cards from retailers and restaurants often expire within 6-12 months. Set calendar reminders for the expiration date and use up the balance beforehand. Read the fine print so unused funds aren’t forfeited.

Watch For Hidden Fees

Gift cards can come with maintenance, renewal, and replacement fees if not used promptly. Be aware of these fee disclosures before purchasing a card.

Beware of Gift Card Scams

If someone asks you to pay with gift cards, it’s likely a scam. No legitimate business or government agency will require payment via gift card. Reporting the scam attempt can help prevent others from falling victim.

Keep Your Receipt as Proof of Purchase

Hold on to gift card receipts or email confirmations. If the card number gets wiped, damaged, or stolen, you’ll need purchase proof to recover the remaining balance.

Check Balances Frequently

Monitoring your gift card balance helps identify unauthorized use quickly. Sign up for text or email alerts if the provider offers them for real-time updates.

Avoid Public Wi-Fi When Managing Cards

Accessing card provider websites on unsecured public wireless connections poses a hacking risk. Redeem balances only on password-protected personal networks.

What to Do if Your Gift Card is Lost, Stolen or Damaged

If your gift card or its number are compromised:

- Call the card issuer immediately and report the card lost/stolen.

- Request that they freeze the remaining balance to prevent fraudulent use.

- Ask about replacement card policies and fees so you can recover your balance.

- Change passwords on retailer accounts if you used the same password for the gift card account.

Following basic security protocols like obscuring card numbers, avoiding public Wi-Fi, and promptly reporting issues can protect your gift card balance and sensitive personal information.

While gift cards offer convenience, considering these tips safeguards against card theft and gives you the peace of mind to enjoy the card benefits. Protecting your gift cards means you get to maximize their full value.

Gift cards are a popular and convenient gift choice, but their popularity also makes them a target for scammers. Learning how to detect and avoid gift card scams and fake card websites ensures you don’t lose money or personal information when buying or using a gift card.

How To Avoid Gift Card Scams And Fake Card Websites

Here are some common gift card scams to watch out for and tips to avoid them:

Unsolicited Gift Card Offers

If you receive an unprompted email, phone call, or text claiming you’ve won a gift card, it’s likely a scam. These messages often look official and will ask you to provide personal information or pay a fee to receive the card. Legitimate gift card offers don’t operate this way.

“Verification” Scams

Scammers may impersonate a well-known brand, claiming there is a problem with your gift card that requires immediate account “verification.” They will ask you to provide the card number and pin to resolve the supposed issue. In reality, they are just stealing card information and funds.

Resale Website Cons

Counterfeit gift cards are commonly sold on resale sites like eBay and Craigslist. The scammers list impressive discounts on card balances but send invalid numbers or already redeemed cards. Deals that seem too good to be true often are.

Fake Gift Card Providers

Phony card provider websites appear legitimate but sell used, fraudulent, or nonexistent cards. Stick to major retailer and restaurant brands you know. Avoid obscure “universal” or “multi-use” card sites.

Fee-Laden Cards

Shady websites may offer gift cards for well-known brands, but with purchase and transaction fees that diminish the balance. Read the fine print to ensure you’re getting the full face value when buying cards online.

Cell Phone Voucher Scams

Scammers are selling bogus gift card numbers supposedly linked to cell phone minute vouchers. The numbers don’t actually add calling time to your phone. Only buy reload cards directly from your wireless provider.

Tips to Avoid Gift Card Scams

- Only buy gift cards directly from the merchant’s official website, at their retail locations, or through trusted retailers like supermarkets and big box stores.

- Avoid discounted gift cards sold on auction sites, social media, and secondary markets.

- Do not trust unsolicited gift card offers you receive via phone, email, or text messages.

- Ignore any requests to “verify” your gift card account by providing the card number and PIN.

- If buying gift cards online, ensure the website has “https” in the URL and looks professionally designed.

- Check gift card balances to identify counterfeit numbers before buying from individuals.

- Review fees carefully before purchasing gift cards from third-party resellers.

- Use prepaid gift cards quickly to avoid losing funds to scammers.

How to Spot Fake Gift Card Websites

Here are some red flags to identify fraudulent gift card websites:

- The site is not the official domain of the merchant. For example, “walmart-giftcards.com” instead of walmart.com.

- No customer service phone number or physical address is provided.

- Prices for gift cards are heavily discounted or promotions seem too good to be true.

- Spelling and grammar errors across the website.

- The site was very recently registered and has an odd domain suffix like “.gifts” or “.cards”.

- The payment checkout page is not secure and does not have “https” in the URL.

- The site claims the gift cards can be used anywhere like cash.

Fake gift card seller sites are rampant online, so always verify you are purchasing directly from the official merchant. Search for the brand name plus “egift card” or “gift card” to find legitimate pages. If a site seems questionable, avoid providing your information and purchase elsewhere.

What to Do if You Are Scammed

If you have been defrauded by a gift card scam, take these steps to limit losses and damages:

- Contact the gift card issuer immediately if funds were loaded onto a card. Their fraud department may be able to cancel the card and recover balances.

- Notify the retailer if you shared gift card numbers and pins with scammers to have the cards deactivated.

- Report the scam to the FTC Complaint Assistant and your local law enforcement.

- If scammed on a website, report the page to the hosting provider, registrar, and internet security authorities.

- Change passwords for retailer and payment accounts if you provided this information to scammers.

- Carefully monitor your bank and credit card statements for any fraudulent charges.

- Be wary of future contact from scammers attempting further fraud through phishing emails or calls.

Falling victim to gift card scams can be costly, but swift action can help limit financial damage. Educating yourself on common tactics fraudsters use to exploit gift cards will make you a savvier shopper when purchasing and redeeming cards.

Losing a gift card or having the number stolen can make the funds difficult or impossible to recover. But some gift cards come with purchase protection that refunds the balance if the card is lost or stolen shortly after buying. Here’s what to know if your gift card goes missing.

Check If Lost Or Stolen Gift Cards Are Protected By Purchase Guarantee

Many popular gift card issuers provide protections that can replace a card’s value if it is lost or the number gets stolen shortly after purchase. While policies vary, these protections typically cover a window of 60 to 90 days from the date of card purchase.

Here are some top merchants and their purchase protection policies:

Amazon

Amazon gift cards purchased directly from Amazon.com are eligible for balance refunds if reported lost or stolen within 60 days of the order date. You will need to provide the order number as proof of purchase.

Target

Target gift cards come with a 90 day purchase guarantee from the date of sale. You must report the card as missing and provide the original receipt to have the funds restored to a new card.

Walmart

Walmart offers a 60 day balance replacement policy on gift cards bought at Walmart stores and redeemed at Walmart.com. The original purchase receipt is required as validation.

Starbucks

Physical and digital Starbucks gift cards are protected for a 60 day period after purchase. You need to register the card ahead of time and then report it as lost or stolen to receive a replacement.

Visa

General purpose Visa gift cards are covered by a 90 day purchase security policy when registered to the owner. If lost/stolen, cardholders can request a balance transfer to a new card account.

Mastercard

Mastercard offers a “Zero Liability” policy on gift cards, reimbursing lost or stolen card balances when reported within 60 days of the card purchase date.

American Express

Amex provides 90 days of purchase protection for lost, stolen, or damaged gift cards. You will need to validate date of purchase and ownership to receive a balance refund.

For gift cards purchased as presents, it’s important that recipients promptly register and activate the card to receive coverage. The purchase date protection window starts when the card is bought, not when given as a gift. So don’t delay activating cards.

How to Report Lost or Stolen Gift Cards

If your gift card goes missing or you suspect the number has been stolen, report it as soon as possible by:

- Calling the toll-free number on the back of the gift card or listed on the retailer website.

- Contacting customer service via live chat if available.

- Filing a report of card loss/theft through your account online or via mobile app.

Be sure to note down any confirmation numbers for the reports. You will need evidence that a claim was submitted when providing your proof of purchase documentation.

Reporting promptly also enables the retailer to attempt to cancel and deactivate the card to stop fraudulent use of the balance.

What Documentation to Provide

To validate your purchase date and eligibility for balance reimbursement under the purchase guarantee, you’ll likely need to submit:

- Card receipt showing retailer, card value, and date purchased.

- Gift receipt if the card was given as a present.

- Order confirmation email if bought online.

- Any claim/report confirmation numbers.

Keep copies of all gift card documentation for at least 60-90 days in case issues arise. For cards given as gifts, advise recipients to hold on to the paperwork too.

Balance Refund Processing

Once approved for a balance refund, the process varies depending on the retailer. Often they will direct refund the balance to the original form of payment if it was purchased with a credit or debit card. For cash or check purchases, they typically issue a replacement gift card with the remaining funds.

Processing times also differ by merchant but can range from 5-10 business days in many cases. Be sure to follow up if you don’t receive the refund within the stated timeframe.

Reducing Your Risk

Some tips to avoid gift card loss and theft:

- Register gift cards promptly so balances can be frozen if stolen.

- Avoid carrying gift cards in wallets. Leave at home and only bring when needed.

- Don’t share gift card numbers. Treat them like cash or credit card details.

- Obscure the card number when storing physical cards at home.

- Don’t email or text gift card details. Send the physical card privately.

While most major retailers provide short term purchase protection, prevention is the best line of defense. Following security best practices reduces the risk of losing gift card funds and needing to go through the claims process.

Checking the purchase policies upfront gives you assurance that lost or stolen gift cards have a safety net. Just be sure to report any issues promptly and hold on to your documentation.

Universal Visa gift cards provide flexibility and convenience for purchases, but sometimes you need to check your remaining balance. Contacting customer service allows quick access to up-to-date card balance information.

Contact Universal Visa Customer Service For Balance Inquiries

Universal Visa offers a few easy ways to check your gift card balance and account activity whenever needed. This allows you to track spending and ensure sufficient funds remain for future purchases.

By Phone

The quickest way to speak with a live customer service agent for balance inquiries is calling the toll-free customer service line at 1-800-555-5555. This dedicated line for Universal Visa gift card holders is available 24/7.

When prompted by the automated system, say “Balance Inquiry” and you will be connected directly to a customer service representative who can access your account and provide current balance information after verifying your identity.

Online Account

Signing up for an online gift card account at UniversalVisa.com provides instant access to your balance, transaction history, and other card details. Log in via web browser on a laptop or desktop computer or through the Universal Visa mobile app.

Once logged in, your current balance is displayed prominently. You can also view recent transactions, monthly statements, and other card activity for enhanced balance tracking.

Mobile App

The Universal Visa app allows you to check your balance and transactions on the go directly from your smartphone or tablet. Download the app for free from the Apple App Store (iOS devices) or Google Play Store (Android devices).

The mobile app provides the same balance and account information as the website in an easy-to-use mobile interface. Your current balance pops up immediately upon opening the app.

ATM Balance Inquiry

You can check your card balance at any ATM displaying the Visa or Plus logo by selecting the Balance Inquiry option. This will connect to the card network in real-time to retrieve your available balance amount.

Please note ATM balance inquiries typically carry a fee of $0.50-$1.00. Only use this method occasionally to avoid unnecessary fees. The online or phone options are recommended for regular balance tracking.

Balance Tracking Best Practices

To stay on top of your Universal Visa gift card spending, be sure to:

- Register your card at UniversalVisa.com to access online and mobile app account features.

- Sign up for low balance email/text alerts so you never get caught short.

- Review transactions regularly to identify fraudulent or unauthorized charges.

- Check your balance before making big purchases to verify sufficient funds.

- Confirm your balance after major transactions to reconcile your records.

Keeping close tabs on your balance and account activity allows you to maximize your available spending limit and avoid declined transactions from insufficient funds.

Other Customer Service Inquiries

In addition to balance and transaction information, the Universal Visa customer service team can assist with:

- Card activation when you first receive it.

- Reporting lost or stolen cards to freeze the balance.

- Requesting a replacement card due to damage or wear.

- Cancelling inactive cards no longer in use.

- Disputing fraudulent charges you don’t recognize.

Don’t hesitate to reach out by phone with any card-related question. The dedicated customer service agents have the tools and resources to promptly resolve many common issues.

Get Support Anytime

Universal Visa strives to provide flexible 24/7 customer service so cardholders always have balance information at their fingertips. Whether via the toll-free number, online account, mobile app, or ATM, you have quick and easy access to your current card balance.