How can you discover if you have unclaimed funds waiting for you. What is the process for claiming a lump sum payment from the government. Why should you take the time to search for unclaimed assets. How much money could you potentially receive through the Lump Sum Payment program.

Understanding the Lump Sum Payment Program

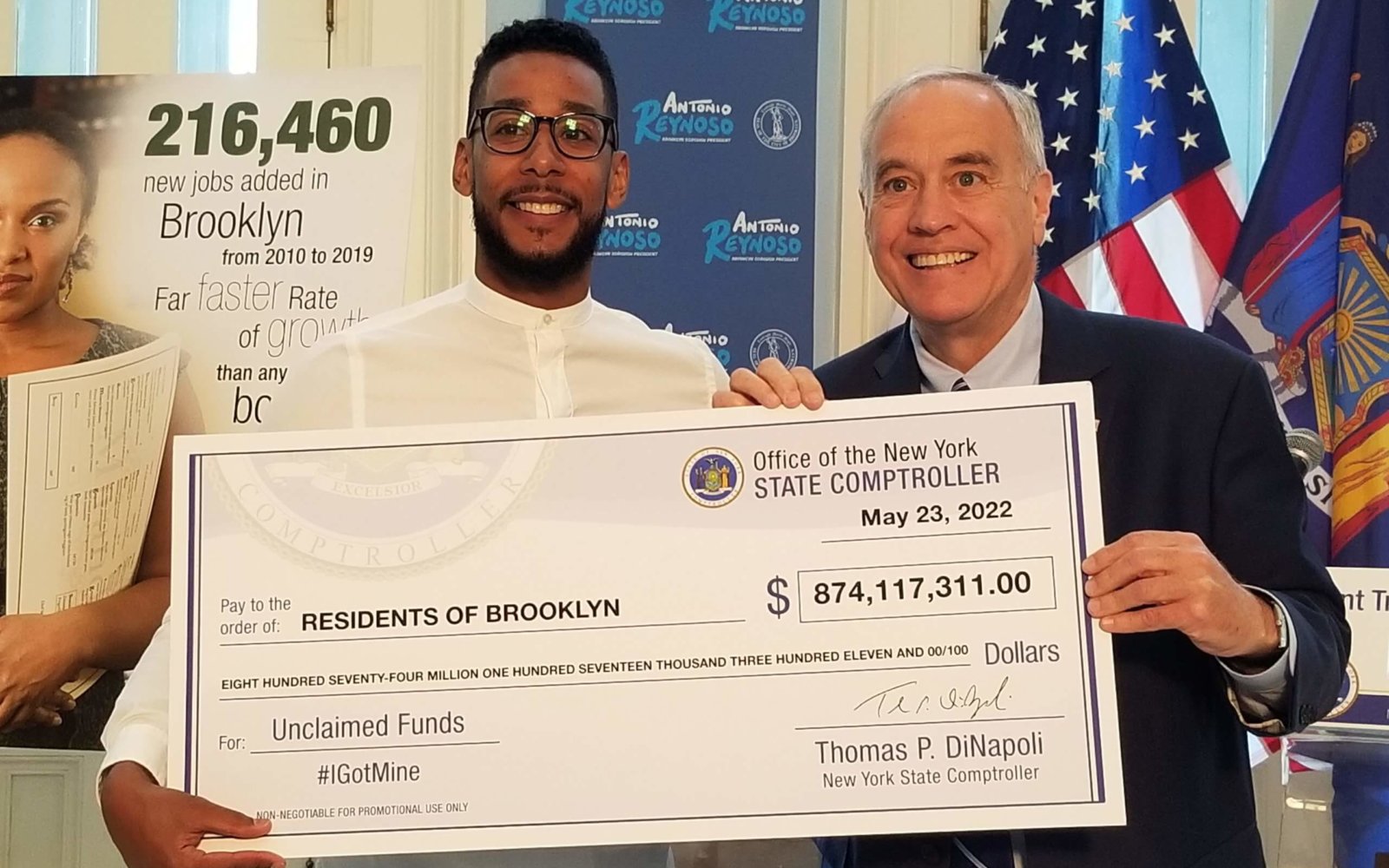

The Lump Sum Payment program is an initiative by the United States Treasury Department that allows individuals to claim funds owed to them by the government in a single payment. This program provides access to billions of dollars in unclaimed funds that have accumulated over time from various sources.

These unclaimed funds can originate from:

- Undelivered tax refunds

- Pension payments

- Unredeemed savings bonds

- Unpaid life insurance benefits

- Leftover funds in forgotten bank accounts

The Treasury Department collects these unclaimed assets and makes them available for rightful owners to claim. This program serves as a vital link between individuals and their forgotten or lost funds, potentially transforming their financial situation with unexpected windfalls.

How to Check if You Have Unclaimed Funds

Checking if you have unclaimed funds is a simple process that can be done online. Here’s how you can do it:

- Visit the National Association of Unclaimed Property Administrator’s website

- Enter your legal name and state of residence in the search database

- Review the results to see if your name appears

If your name is listed in the database, you can start the process of filing a claim to collect your lump sum payment. It’s important to note that businesses and organizations may also have unclaimed funds, so it’s worth searching on behalf of your company, church, school, or non-profit group as well.

Can anyone search for unclaimed funds?

Yes, anyone can search for unclaimed funds. The database is accessible to all individuals, regardless of their background or financial status. It’s a public service provided to ensure that people can reclaim their rightful assets.

The Application Process for Claiming Your Funds

Once you’ve identified potential unclaimed funds in your name, the next step is to file a claim. The application process is designed to be straightforward and user-friendly. Here’s what you need to do:

- Provide personal details to verify your identity

- Submit documentation to prove you are the rightful recipient of the funds

- Wait for approval from the government

- Receive a check for the full balance of your unclaimed assets

One of the benefits of this program is that no additional tax forms or paperwork are required after you receive your payment. The process is designed to be as simple and hassle-free as possible.

Is there a fee to claim unclaimed funds?

No, there is no fee to search for or claim unclaimed funds through official government channels. Be wary of any service that charges a fee to help you find or claim unclaimed money, as these are often unnecessary and sometimes fraudulent.

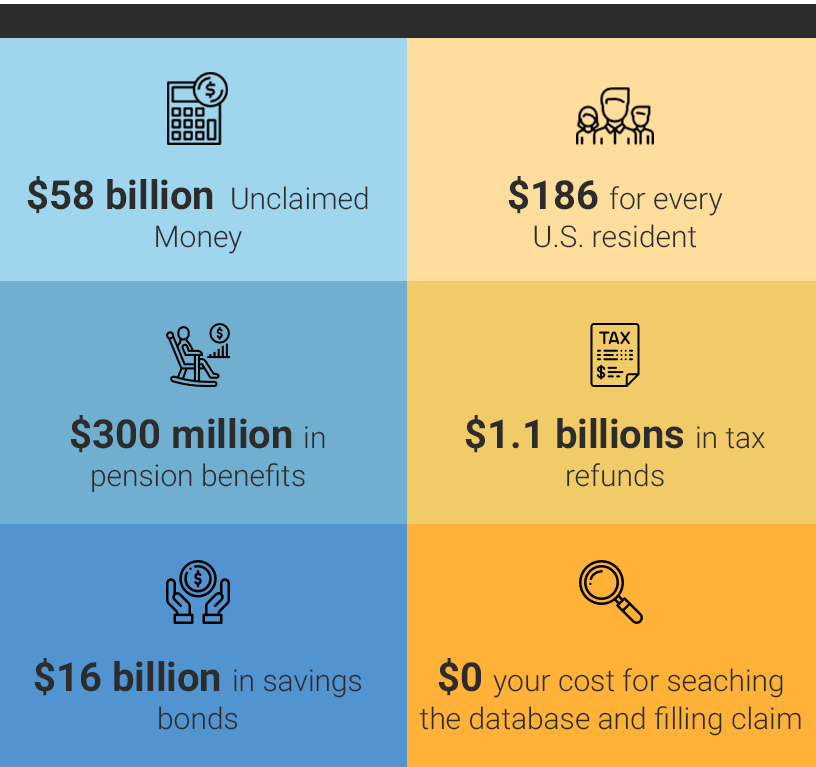

Potential Amounts You Could Receive

The amount of money you could potentially receive through the Lump Sum Payment program varies widely. Some individuals might find they are owed just a few hundred dollars, while others could discover thousands of dollars in unclaimed assets.

Here’s a breakdown of potential amounts:

- Small amounts: $100 – $500

- Medium amounts: $500 – $5,000

- Large amounts: $5,000 – $50,000

- Rare cases: Over $50,000

While it’s rare to find extremely large sums, even a small unexpected windfall can make a significant difference in your financial situation. This extra cash could help pay down debt, build up savings, or cover unexpected bills.

Are there any limitations on how you can use the money?

No, there are no restrictions on how you can use the money you receive from unclaimed funds. Once the payment is made to you, it’s yours to use as you see fit, whether for personal expenses, investments, or any other purpose.

Who Qualifies for Lump Sum Payments?

The Lump Sum Payment program is designed to be inclusive, meaning that a wide range of individuals and entities may qualify for unclaimed asset payouts. Here are some key groups who might be owed money:

- Former homeowners

- Anyone who has moved and changed addresses

- Heirs of estates

- Former employees

- Investors

- Consumers

Each of these groups may have different types of unclaimed assets waiting for them. For instance, former homeowners might have funds from utility deposits or property tax overpayments, while heirs of estates could have access to unclaimed assets from deceased relatives.

Can businesses claim unclaimed funds too?

Yes, businesses can also claim unclaimed funds. In fact, it’s recommended that business owners search for unclaimed assets on behalf of their companies. This could include unclaimed tax refunds, overpayments to vendors, or uncashed checks from customers.

The Importance of Regularly Checking for Unclaimed Funds

While it might seem like a one-time task, regularly checking for unclaimed funds is actually quite important. New unclaimed assets are added to the database frequently, so even if you’ve searched before and found nothing, it’s worth checking again periodically.

Here are some reasons why you should make it a habit to check for unclaimed funds:

- Life changes: Moving, changing jobs, or experiencing other life events can lead to unclaimed funds

- Inherited assets: You might become entitled to unclaimed funds from deceased relatives

- Oversight: Sometimes, funds go unclaimed simply due to oversight or forgetfulness

- Accumulation: Small amounts can accumulate over time, leading to a substantial sum

By making it a habit to check for unclaimed funds annually, you ensure that you’re not missing out on any money that rightfully belongs to you.

How often should you check for unclaimed funds?

It’s recommended to check for unclaimed funds at least once a year. However, if you’ve recently moved, changed jobs, or experienced other significant life changes, it might be worth checking more frequently, perhaps every six months.

Potential Uses for Your Lump Sum Payment

Once you’ve successfully claimed your unclaimed funds, you might be wondering how best to use this unexpected windfall. While the decision ultimately depends on your personal financial situation, here are some potential uses to consider:

- Pay off high-interest debt

- Build an emergency fund

- Invest in your retirement

- Make home improvements

- Invest in personal development or education

- Start or expand a business

- Make a charitable donation

Remember, it’s always a good idea to consult with a financial advisor before making any significant financial decisions, especially if you’ve received a large sum of money.

Should you treat unclaimed funds differently than other income?

While unclaimed funds are essentially ‘found money’, it’s wise to treat them as you would any other income. This means considering your overall financial goals, current financial situation, and future needs before deciding how to use the funds. Avoid the temptation to view this money as ‘extra’ and spend it frivolously.

Protecting Yourself from Scams Related to Unclaimed Funds

Unfortunately, where there’s money involved, there’s always a potential for scams. It’s important to be aware of potential frauds related to unclaimed funds and know how to protect yourself. Here are some tips:

- Only use official government websites to search for unclaimed funds

- Be wary of unsolicited emails or phone calls about unclaimed money

- Never pay a fee to search for or claim unclaimed funds

- Don’t share personal information unless you’re sure you’re dealing with a legitimate government agency

- If in doubt, contact your state’s unclaimed property office directly

Remember, legitimate government agencies will never ask you to pay a fee to claim your unclaimed funds. If anyone asks for payment, it’s likely a scam.

What should you do if you suspect a scam?

If you suspect you’ve encountered a scam related to unclaimed funds, report it immediately to your local law enforcement agency and the Federal Trade Commission (FTC). Provide as much information as possible about the suspected scam, including any communications you’ve received.

By staying vigilant and informed, you can protect yourself from potential frauds while still taking advantage of the legitimate opportunities provided by the Lump Sum Payment program. Remember, unclaimed funds are your money – don’t let scammers take advantage of what’s rightfully yours.

In conclusion, the Lump Sum Payment program offers a unique opportunity to reclaim forgotten assets and potentially boost your financial situation. By understanding how the program works, regularly checking for unclaimed funds, and knowing how to protect yourself from scams, you can make the most of this valuable resource. Don’t let your hard-earned money go to waste – take a few minutes to search the national database and submit a claim. You never know what forgotten sums might be waiting to be discovered.

What is the Lump Sum Payment Program Offered by the US Treasury Department?

Have you ever wondered if you might be owed money by the government that you don’t even know about? Well, you’re not alone. The United States Treasury Department actually has billions of dollars in unclaimed funds just waiting to be returned to their rightful owners. One little-known program that can put cash directly into your pocket is the Lump Sum Payment program.

The Lump Sum Payment program allows individuals to claim funds owed to them by the government in one single payment. This money can come from a variety of sources – undelivered tax refunds, pension payments, unredeemed savings bonds, unpaid life insurance benefits, or leftover funds in forgotten bank accounts. The treasury department collects these unclaimed assets over time and makes them available for people to claim.

To find out if you have any unclaimed funds waiting for you, all you need to do is search your name in the government’s database. This can easily be done online at the National Association of Unclaimed Property Administrator’s website. All you need is your legal name and state of residence. If your name appears in the database, you can then begin the process of filing a claim to collect the lump sum payment owed to you.

The application process is straightforward – you’ll just need to provide some personal details and documentation to prove your identity and verify that you are the rightful recipient of the funds. Once approved, the government will issue you a check for the full balance of your unclaimed assets. No tax forms or additional paperwork required!

People are often surprised at how much money they are owed by the government. Lump sum payments can range from just a few hundred dollars to tens of thousands in rare cases. But even a small unexpected windfall can make a difference in your financial situation. That extra cash could help pay down debt, build up your savings, or cover unexpected bills.

In addition to individual payments, businesses and organizations may also have unclaimed funds owed to them. So it’s a good idea to search on behalf of your company, church, school, or non-profit group. You never know what forgotten sums might be waiting to be discovered.

Don’t let your hard-earned money go to waste! Take a few minutes to search the national database and submit a claim. The lump sum payment program allows you to easily collect everything you’re owed all at once. It’s always wise to keep tabs on what Uncle Sam might be holding for you.

A little effort goes a long way. You could uncover hundreds or even thousands of dollars just waiting to be claimed. With the lump sum payment program, the United States Treasury Department makes it simple to get back what is rightfully yours. So transform your income and grow your wealth today with money you never knew existed.

Key Takeaways:

- The Lump Sum Payment program allows people to claim money owed by the government in one payment.

- Funds can come from undelivered refunds, pensions, bonds, insurance benefits, forgotten accounts.

- Search online at the National Association of Unclaimed Property Administrators.

- Provide documentation to verify identity and eligibility.

- Amounts can range from hundreds to tens of thousands of dollars.

- Businesses and organizations may also have unclaimed assets to collect.

- Take a few minutes to search the national database and submit a claim!

Who Qualifies for Lump Sum Payments from Unclaimed Assets?

Did you know that state and federal agencies are holding billions of dollars in unclaimed funds that belong to ordinary Americans? This forgotten money comes from inactive bank accounts, uncollected insurance benefits, forgotten pensions, unredeemed savings bonds, uncashed dividend checks, and more. Thanks to lump sum payment programs, collecting these funds is easier than ever.

But who exactly qualifies for these unclaimed asset payouts? The short answer is – just about anyone! Here are some of the key groups who may be owed money that can be claimed in a single lump sum payment:

– Former homeowners – Funds from utility deposits or property tax overpayments that were never collected can be claimed.

– Anyone who has moved and changed addresses – Undelivered tax refunds or last paychecks may await you.

– Heirs of estates – Deceased relatives may have unclaimed assets you can now collect.

– Former employees – Pension funds and unpaid wages should be claimed.

– Investors – Dividend checks, bonds, and stock accounts could hold uncollected payments.

– Consumers – Refunds, rebates, or gift card balances may be available for you to claim.

To find out if you qualify, search online at MissingMoney.com or Unclaimed.org, the official databases for unclaimed property programs in participating states. All you need is your legal name and state of residence. It’s wise to check records for all states where you have lived or worked.

Once you locate unclaimed funds in your name, you can start the claims process. Requirements vary slightly by state. But in general you’ll need to provide personal documentation like your social security number, birth date, former addresses, and a copy of your photo ID. This helps verify you as the rightful recipient.

For larger claims over a certain threshold, you may need to provide additional proof like old tax records, pay stubs, bank statements or stock certificates. An attorney can assist you with compiling the necessary paperwork if your claim is substantial.

Be aware that scammers try to steal identities and claim others’ unclaimed assets. Never pay upfront fees for lump sum payments. And only share sensitive data through official state claim forms.

Once the agency verifies your identity and documents, you simply wait for the lump sum check to arrive in your mailbox. This avoids the hassle of collecting small increments over time. You get your full payout all at once.

Some notable lump sum claims have made headlines in recent years:

– A Texas woman collected an astounding $1.2 million in unclaimed oil and gas royalties owed to her deceased father.

– A Boston musician recovered $100,000 in forgotten pension funds after searching a national unclaimed property database.

– A California teacher obtained $30,000 in life insurance proceeds that were owed to her mother dating back decades.

While your own claim may be more modest, even a few hundred extra dollars can make a real difference. Be sure to check regularly for new assets, as more funds can show up over time.

Don’t let Uncle Sam keep what is rightfully yours. Thanks to lump sum payment programs, getting back lost money is easier than ever. A little time searching online can uncover long-forgotten assets ready to be claimed. If your name turns up, you’ll join the millions of Americans collecting payments from unclaimed property funds.

Key Takeaways:

- Ordinary Americans with common names may have unclaimed assets spread across multiple states.

- Former employees, account holders, investors, heirs, and consumers often have funds to claim.

- Verify your identity thoroughly with documentation like an ID, SSN, and records.

- Watch out for scammers trying to steal identities and claim your funds.

- Payments typically arrive in a lump sum check once approved.

- Claims can range from a few hundred to hundreds of thousands in rare cases.

- Check back regularly for new unclaimed assets in your name.

5 Types of Unclaimed Assets Eligible for Lump Sums

State treasuries and federal agencies accumulate billions of dollars in unclaimed assets each year. This forgotten money comes from a variety of sources. Thanks to lump sum payment programs, collecting these funds has never been easier. Here are 5 of the most common types of unclaimed assets that may be owed to you:

1. Bank Accounts

When savings or checking accounts remain inactive for years, banks are required to turn the funds over to the state as unclaimed property. Common scenarios include changed addresses after moving, deaths of original owners, or simply lost track of old accounts. Even small balances add up over time. Search state databases to reunite with your unclaimed bank funds.

2. Uncashed Checks

Payroll checks, insurance claim checks, dividends, reimbursements, and other uncashed checks eventually get passed to unclaimed property programs. Lump sum payments allow you to collect these outstanding checks all at once. Be sure to search for misplaced checks issued in your name.

3. Utility and Rental Deposits

When you close utility accounts or move from a rental unit, leftover deposits belong to you. But often the forwarding address is lost. Unclaimed deposit refunds then go to the state after a dormancy period, available for retrieval via a lump sum claim.

4. Investment Accounts

Brokerage firms and investment companies also surrender inactive accounts. This includes unclaimed dividends, bearer bonds, expired certificates of deposit, and uncollected proceeds from stocks and mutual funds. Reclaim your lost investments through lump sum reunification services.

5. Insurance Payouts

Life insurance settlements, unpaid health claim reimbursements, lost policyholder dividends, and uncollected annuity payments are turned over to state controllers’ offices after a period of inactivity. Unclaimed insurance assets are a huge source of forgotten funds. Search to see if lump sum payouts await you.

To check if any of these unclaimed asset types belong to you, search missing money databases online. Every state, plus Washington DC and Puerto Rico, participates in unclaimed property programs under a common framework. But you’ll need to look in each state where you lived, worked, held accounts or owned property.

Start your hunt at the National Association of Unclaimed Property Administrators’ website, MissingMoney.com. This links to official state sites where you can search by name for free. For additional multi-state searches, try Unclaimed.org or ClaimIt.com.

Once you find unclaimed asset records, carefully note the contact details provided. Each state has its own claims process and requirements. You’ll likely need personal details like your Social Security Number, former addresses, account numbers, etc. Have ID and records handy to verify your identity and ownership.

Most states allow you to submit claims for any amount. But stricter proof is needed for larger claims above a threshold, usually $5,000 or more. An unclaimed property lawyer can help compile documentation if you find substantial lost assets.

While claims can take time to process, you ultimately receive the full value found in a convenient lump sum check. No piecemeal installments needed. This makes unclaimed asset reunification more rewarding.

Even if you never moved or changed names, it still pays to check regularly. New assets can be reported in your name in the future. A few minutes of searching today could uncover hundreds of dollars or more just waiting to be claimed.

Don’t let the government keep what rightfully belongs to you. Thanks to lump sum payments, you can finally collect those long-lost funds and put them back to good use. Reconnecting with unclaimed assets is one of the best ways to boost your income and unlock new financial opportunities.

Key Takeaways:

- Bank accounts, uncashed checks, deposits, investments, and insurance are common sources of unclaimed assets.

- Search free databases in every state where you lived, worked, or held accounts.

- Provide detailed personal information and records to verify your identity.

- It pays to check regularly as new assets can be reported over time.

- Lump sum payments allow convenient reunification with the full amounts owed.

- Even small dollar claims add up and are worthwhile to collect.

How to Check for Unclaimed Assets in Your Name With State Treasurers

Did you know state treasurers may be holding onto forgotten funds or assets in your name? Unclaimed property programs reunite people with billions of dollars every year. Checking for unclaimed assets only takes a few minutes. Here’s a step-by-step guide on how to search state databases and collect owed lump sum payments:

1. Gather Basic Personal Details

To start your search, have the following information handy:

– Your legal name and any former names (maiden names, married surnames, aliases, etc.)

– Current and past addresses where you lived

– Social Security Number if possible

– Birth date and birth place

– Phone number

– Email address

This identifies you and allows cross-checking across multiple data sources. Make a list of everywhere you’ve lived so you can check each state.

2. Visit the NAUPA Website

Go to www.MissingMoney.com, the official unclaimed property portal managed by the National Association of Unclaimed Property Administrators (NAUPA). This links to official state sites for checking databases.

3. Click Your State

On MissingMoney.com, browse the map and listings to select your state. Or use the search bar to find a specific state’s unclaimed property site. You’ll be redirected to your state’s official treasurer website where you can start searching.

4. Enter Your Information

On your state’s unclaimed property page, look for the search or claim form. Enter your personal details such as full legal name, SSN, former addresses, etc. Make sure entries match your records exactly. Run searches for all name variations.

5. Identify Matches

If assets are found, you’ll see a list of unclaimed property matches. Common types include bank accounts, uncashed checks, refunds, stocks, insurance benefits and more. Carefully verify the details match your own.

6. Repeat For Other States

Don’t just check your current state of residence. Repeat steps 3-5 to run searches in every other state where you lived, worked, held accounts, or owned property. Different states may have assets reported in your name.

7. Start Your Claim

Once you confirm unclaimed assets owed to you, begin the claims process. Requirements vary by state but often include verifying your identity and eligibility. Follow instructions carefully and provide all requested documentation.

8. Track and Receive Your Payment

It may take some time to process claims, but you can contact the state treasurer’s office to track status. Once approved, you’ll receive the full value of your unclaimed assets in one convenient lump sum payment!

Don’t pay any upfront fees for searches or claims services. Official state sites offer databases and forms for free. However, you can choose to hire an unclaimed property recovery firm for assistance completing the process.

Be persistent and thorough in your search. Different state databases can reveal new unclaimed assets over time. Bookmark treasurer websites and set reminders to rerun searches annually.

Also consider checking records on behalf of relatives who may have unclaimed assets waiting as well. Billions sit untouched, so even small amounts are worth reuniting with.

Turn forgotten funds into found money for your future. Following these steps makes checking state unclaimed property programs quick and easy. A few minutes could uncover hundreds, even thousands, in lump sum cash payments you never knew were owed to you.

Key Takeaways:

- Have personal details ready before starting your search.

- Visit MissingMoney.com to access official state treasurer websites.

- Search thoroughly in every state where you lived or held accounts.

- Verify matches carefully before starting the claims process.

- Provide complete documentation to confirm your identity.

- Follow up persistently and check back regularly for new assets.

- Collect your lump sum payment once approved and get your money faster!

Locate Lost Stocks, 401ks, Pensions, Insurance Payouts, and More

Over time, many Americans lose track of investments, benefits, and other assets that may be owed to them. But unclaimed property programs make it possible to reunite with lost accounts and overlooked payments. Lump sum payouts allow you to collect the full amounts easier than ever.

Here are some of the key categories to check when searching for unclaimed financial assets:

Stocks and Dividends

When brokerage accounts remain inactive, firms eventually surrender unclaimed shares and uncashed dividends to the state. Search databases for orphaned investments you may have forgotten about over the years.

401(k) Funds

Changing jobs often leads to lost track of old retirement plan balances. Uncashed checks and dormant 401(k) accounts regularly show up on unclaimed property listings. Look for missing money from past employers.

Pension Payments

Earned pension benefits don’t always find their way to the recipient. Uncollected pension checks and funds from inactive accounts can be claimed. Retirees especially should check for owed payments.

Life Insurance Settlements

Beneficiaries aren’t always aware of existing policies or proceeds not claimed after a death. Billions in unclaimed life insurance funds are waiting to be reunited with rightful heirs.

Health Insurance Refunds

Reimbursements from health plans and insurance companies can go uncollected over time. Dormant HSA accounts also get transferred. Check for unclaimed medical payments in your name.

Utility Deposits

When you close accounts with utility companies, leftover deposits belong to you. But often the forwarding address is lost. Unclaimed deposit refunds then go to the state after a dormancy period.

Gift Cards and Store Credit

Unused gift card balances and merchandise credits from retailers and restaurants are regularly turned over to state treasurers. Search to uncover forgotten funds on old cards and accounts.

To check for lost financial assets like these, search online at MissingMoney.com. This National Association of Unclaimed Property Administrators site provides links to every state’s official unclaimed property databases. Millions of accounts worth billions wait to be found!

Provide key personal details like your legal name, SSN, former addresses, and phone number to aid the search. Double check matches to your own records.

Once you locate unclaimed assets in your name, follow the claims process for your state. Verify your identity and eligibility with documents like photo ID, account records, tax returns and more. Then just wait for your lump sum check to arrive!

Persistence and regular checks are key. New assets can be reported in your name over time as accounts continue to lie dormant. Don’t let the government keep your hard-earned money and forgotten investments.

Use free online searches to maximize your income potential. Locating lost accounts and claiming owed lump sum payments lets you finally collect the money and put it back into your own pocket where it belongs.

Key Takeaways:

- Stocks, 401(k)s, pensions and insurance are common lost investment assets.

- Utility deposits, gift cards, forgotten deposits round out unclaimed property.

- Search official state databases linked at MissingMoney.com.

- Provide personal details and verify matches thoroughly.

- Follow the claims procedure carefully for your state.

- Collect lump sum checks faster with reunification programs.

- Check back regularly as new assets get reported over time.

Claiming Abandoned Bank Accounts, Uncashed Checks, and Cash Deposits

When accounts go unused for years, banks and financial institutions turn over unclaimed funds to state treasurers. But dormant accounts with leftover balances still rightfully belong to their owners. Thanks to lump sum payment programs, it’s easier than ever to reunite with lost money.

Common sources of unclaimed financial assets include:

Inactive Bank Accounts

Savings or checking accounts that remain untouched eventually get closed and surrendered to the state. Changed addresses and forgotten accounts are main reasons. Search unclaimed property records to find lost funds.

Uncashed Checks

Various uncashed checks also wind up with treasurers. This includes payroll checks, insurance payouts, refunds, legal settlements, and more. Even cashier’s checks turn unclaimed after several years.

Maturing CDs

Uncollected funds from certificates of deposit that matured and closed end up on unclaimed property listings. Be sure to search for forgotten CDs in your name.

Expired Money Orders

Unredeemed money orders are required to be submitted as unclaimed property after 5-7 years. Search state databases for abandoned money orders you purchased.

Safe Deposit Box Contents

When rental terms end for unclaimed safe deposit boxes, banks open and turn over contents to the state. Search for forgotten cash, stocks, bonds or valuables unknowingly left behind.

To locate bank accounts, uncashed checks, and other abandoned financial assets, search online at MissingMoney.com. This National Association of Unclaimed Property Administrators site provides links to every state’s official databases – all freely searchable by name.

Make sure to check records in every state where you’ve lived, worked, or held accounts. Different states may be holding assets reported in your name over the years.

Once you locate unclaimed bank funds, follow the claims procedures for that state. Requirements vary but always include verifying your identity with personal documentation. Then submit records proving your ownership of the assets.

Most states do not charge fees to claim unclaimed property. But you may need help from a lawyer or unclaimed asset investigator for large, complicated claims. Be wary of any service charging upfront fees for lump sum payments.

While processing times vary, approved claims ultimately result in the state mailing you the full value found – no need to collect small installments. This convenience makes lump sum payouts highly worthwhile.

Don’t let past moves, career changes, or poor record-keeping deprive you of your own hard-earned money. Use online lookup tools to find and recover abandoned accounts and uncashed checks. Even small forgotten funds can add up to hundreds or thousands over time.

Key Takeaways:

- Inactive bank accounts, uncashed checks, and unclaimed deposits get surrendered to state treasurers.

- Search online databases in every state where you lived or held accounts.

- Verify matches thoroughly and provide documentation proving ownership.

- Follow state claims procedures carefully to collect lump sum payouts.

- Reuniting with forgotten funds is fast and convenient through official programs.

- Don’t pay any fees – use free searches to uncover assets owed to you.

Getting Paid: The Steps to Take After Finding Unclaimed Property

Locating unclaimed assets in your name is an exciting find! But collecting owed lump sum payments requires following the proper procedures. Don’t leave money on the table – be sure to take key steps to prove ownership and finalize your claim.

Once your online search turns up unclaimed property records, here’s what to do next:

1. Verify Matches Thoroughly

Carefully review each listing connected to your name. Make sure details like addresses, account numbers, sources, etc. match your personal records. This ensures you pursue legitimate claims likely to be approved.

2. Gather Documentation

To make a claim, you’ll need to prove your identity and establish ownership of assets. Have the following ready to submit:

– Photo ID / Passport

– Social Security card

– Former addresses

– Account statements

– Tax returns

– Legal records

3. Complete Claim Forms

Each state has its own claim process. Visit your state treasurer’s website for forms and instructions. Provide all requested personal, contact, and asset details. Sign and submit complete, accurate claim packages.

4. Follow Up Persistently

Processing times vary. Expect several weeks or months. Check status regularly by calling the claims processing department. Politely follow up if delays arise or additional paperwork is needed.

5. Avoid Scams

Watch for unofficial third-parties charging fees for forms or searches. Use only official state websites and direct contacts. If needing claim help, hire a reputable unclaimed property recovery firm.

6. Take Payment Options

You’ll typically receive a lump sum check for the full value of unclaimed assets owed. For very large amounts, you may be offered options like direct deposit or even property auctions.

7. Pay Taxes If Required

While most states don’t tax unclaimed property claims, some like California do. Verify any tax obligations in advance and plan accordingly when received.

8. Repeat Searches Annually

Bookmark state treasurer sites and rerun searches every year for new accounts. As assets age, more unclaimed property can be reported in your name.

Reuniting with unclaimed assets takes diligence and patience. But you can claim what’s rightfully yours by knowing and following proper procedures.

Don’t leave free money on the table. Verify records thoroughly, provide complete documentation, and stick with the process until your lump sum payment arrives. Unclaimed assets not only recover lost funds but provide found money to improve your future!

Key Takeaways:

- Carefully validate match details before claiming unclaimed property.

- Have necessary personal documentation ready to submit.

- Use official state forms and contacts only.

- Follow up regularly until your claim is closed.

- Take full lump sum payment when possible.

- Pay any taxes if required in your state.

- Check back annually for new unclaimed asset reports.

How Much Could Your Lump Sum Payment Be Worth?

When searching unclaimed property databases, you may uncover owed assets ranging from just a few dollars to surprisingly large sums. Lump sum payout programs allow you to collect the full amounts easier than ever. So exactly how much money could be waiting for you?

While amounts vary widely, here’s a look at potential values by different asset types:

Bank Accounts

Unclaimed checking and savings accounts often hold $100 to $1,000 or more. Even small forgotten accounts add up over years of dormancy and interest.

Stocks and Bonds

Orphaned investments like uncashed dividends or unclaimed stock shares can be worth hundreds of dollars. Historical bearer bonds may total thousands.

Safe Deposit Boxes

While difficult to predict, recovered contents from unclaimed safe deposit boxes have exceeded $100,000 in rare cases. Cash, jewelry and securities may be uncovered.

Insurance Payouts

Uncollected life insurance settlements average $2,000 but can be far higher for larger policies. Health insurance refunds may hold several hundred dollars.

Utility Deposits

Forgotten utility security deposits range from $50 to $500 when closing accounts and moving. Lump sum return is easier than tracking down old providers.

Pension Funds

Uncashed pension checks can accumulate to thousands over retirement. Additionally, orphaned 401(k) accounts may hold sizable balances.

While individual claims generally fall in the hundreds to low thousands, there are unique cases exceeding $1 million:

– In 2019, two siblings claimed over $13 million in stock holdings from an unclaimed account of their deceased father.

– A Texas woman collected an astounding $1.2 million in mineral rights royalties she inherited but left unclaimed for decades.

– In 2022, a Maryland man recovered $1.6 million in forgotten shares left behind by his immigrant parents in a Swiss bank account.

No matter the amount, reuniting with lost assets improves your finances. Depending on your state, you may even collect interest on top of the original sums.

Don’t let the government keep your hard-earned money and abandoned accounts. Even small funds can make a difference. Take action to claim everything you’re owed with convenient lump sum payments.

Key Takeaways:

- Bank accounts may contain hundreds or more when claimed.

- Investment-related assets like stocks can accumulate to thousands.

- Insurance, pensions, deposits provide hundreds typically.

- Rare cases exceed $1 million for exceptionally large accounts.

- Interest may be added to your lump sum in some states.

- Don’t underestimate small amounts which add up quickly.

- Check thoroughly – you never know what you might find!

Tips to Avoid Scams and Safely Claim Your Unclaimed Assets

Searching for unclaimed property can uncover forgotten funds, but you need to take steps to avoid scams. Follow best practices to safely claim owed lump sum payments:

Use Official Databases

Only search on your state’s official unclaimed property website or the National Association of Unclaimed Property Administrators at MissingMoney.com. Avoid unauthorized third-party sites.

Don’t Pay Upfront Fees

It’s free to search state databases yourself. Don’t fall for services charging money upfront to search or file claims for you. Fees should only come after assets are successfully recovered.

Verify Matches Thoroughly

Double check results to ensure assets like accounts or uncashed checks legitimately belong to you. Scammers try to claim property illegally in others’ names.

Submit Claims Yourself

Work directly with your state treasurer’s office to submit claim forms and documentation. Don’t trust third parties to file claims and collect money on your behalf.

Follow Official Procedures

Review government websites for proper claims filing procedures. Don’t provide personal details outside required forms and contacts. Follow official instructions closely.

Obtain Professional Help if Needed

For more complex claims, reputable unclaimed property recovery firms can assist for a fee after assets are recovered. But avoid those asking for money upfront.

Don’t Pay for Record Research

You can research missing records like old addresses and account numbers yourself online and at government offices. Don’t fall for offers to look up your records for a fee.

Confirm Payment Details

Before finalizing a claim, ensure you know how and when you’ll be paid. Most states issue lump sum checks. Don’t agree to questionable payment methods or creditors claiming your assets.

Report Suspicious Activity

If you observe questionable claims activity or experience fraud attempts, report it immediately to your state treasurer’s office and consumer protection agencies.

Follow these tips and trust your instincts to avoid compromising personal information or losing rightful assets. Do your own searching, vet matches carefully, submit official forms, and collect lump sum payments directly to keep the full funds you’re owed.

Key Takeaways:

- Use only official state government databases to search.

- Don’t pay any fees upfront before recovering assets.

- Confirm ownership thoroughly before claiming property.

- Work directly and only with state treasurer’s offices.

- Follow official procedures exactly as provided.

- Report suspicious sites or services to authorities.

- Collect payments directly from the state to get your full funds.

What to Do Once You Receive Your Lump Sum Windfall

Finally getting that long-lost lump sum payment in the mail is a wonderful feeling! But before racing off to spend the windfall, use strategic planning to put your found money to work in the smartest ways possible:

1. Pay Down Debt

If you have high interest credit card or loan balances, use your influx of cash to aggressively pay them down. This saves money on interest payments and frees up cash flow going forward.

2. Build an Emergency Fund

Stash some of the lump sum into a savings account for life’s unexpected costs. Having 3-6 months of living expenses available prevents relying on credit when emergencies strike.

3. Invest for Retirement

Max out contributions to tax-advantaged retirement accounts like 401(k)s and IRAs while you can. Every dollar invested today grows exponentially thanks to the power of compound interest over time.

4. Fund Education

If you have kids to put through school, use windfall money to open 529 college savings accounts. Or pay down student debt to get your own loans paid off faster.

5. Make Home Improvements

Consider investing lump sum funds into major home upgrades like a kitchen remodel or bathroom addition that will improve your quality of life and boost resale value.

6. Enjoy Experiences

It’s OK to spend some windfall on fun! Plan that dream vacation you’ve put off or attend events that create lasting memories with family.

7. Give to Charity

Donating a portion of found money does good and provides tax benefits. Research causes aligned with your passions and beliefs for targeted giving.

8. Hire Financial Guidance

Wealth managers and financial advisors provide objective insight on wisely growing your money. Their expertise helps maximize lump sum windfalls.

Of course, your own financial situation dictates the best ways to utilize surprise windfalls. But following strategic priorities focused on debt relief, savings, and smart investing sets you up for long-term success.

Don’t let newly found money burn a hole in your pocket! Protect it and make it grow by harnessing professional guidance and sticking to sound financial planning principles.

Key Takeaways:

- Pay down high interest debts to save money.

- Build emergency savings to be prepared.

- Max out retirement contributions early to benefit from compound growth.

- Contribute to education funds for yourself or family.

- Make useful home upgrades that improve quality of life.

- Have some fun with memorable experiences.

- Donate to charity causes important to you.

- Consult financial advisors to maximize windfalls wisely.

Investing Lump Sums Wisely: Pros and Cons of Different Options

Coming into a lump sum windfall is a great opportunity to grow your wealth for the future. But where’s the best place to invest a sizeable influx of cash? Consider the pros and cons of these common choices:

Stocks

Pros: Historically earn higher long-term returns. Allow investing in brands you know and support. Can pick individual stocks or diversified funds.

Cons: Prices fluctuate meaningfully in short-term. Individual stocks risky compared to mutual funds. Research required to invest wisely.

Bonds

Pros: Provide steady income through interest payments. Relatively low risk compared to stocks. Government and corporate bonds highly stable.

Cons: Lower returns than stocks over time. Vulnerable to interest rate hikes. Less exciting than stock-picking.

Real Estate

Pros: Tangible asset you control. Potential for appreciation over time. Can generate rental income. Leverage financing options.

Cons: Illiquid compared to financial assets. Requires hands-on management if renting out. High transaction costs.

CDs and Money Markets

Pros: Very low risk investment options. FDIC insured for security. More liquidity than real estate.

Cons: Extremely low returns these days. Barely keeps pace with inflation.

Retirement Accounts

Pros: Tax-deferred growth potential. Can contribute lump sum all at once up to annual limits. More discipline than normal investing.

Cons: Locks up funds until retirement. Withdrawal penalties if accessed early.

Every investor’s needs are unique. While higher risk stocks may make sense for long-term goals, conservative bonds and CDs work better for near-term savings. Most advisors suggest diversifying across asset classes.

Investing lump sums takes research and planning. Work with a fiduciary financial advisor for guidance on allocating windfalls in ways optimized for your personal financial situation and goals.

Don’t squander unexpected windfalls. Put in the time upfront to craft a tailored investment approach. Patience and diversification are key to steadily growing lump sum money into lasting wealth over time.

Key Takeaways:

- Stocks offer higher long-term returns but more risk.

- Bonds provide steady income with less volatility.

- Real estate can hedge inflation but requires hands-on management.

- CDs and money markets offer security with minimal returns.

- Retirement accounts provide tax benefits but limit access.

- Diversify across multiple asset classes based on your needs.

- Work with a trusted financial advisor to optimize lump sum investing.

Paying Off Debt vs Investing: How to Decide What’s Best For You

The first consideration is your current debt load – specifically, the interest rates you’re paying. Credit card debt tends to carry high double-digit interest rates, often 15% or more. Meanwhile, reasonable long-term investment returns are typically in the 5-8% range. This suggests paying off high-interest credit card balances should take priority before investing extra money.

However, the math changes when you have fixed-rate installment loans like student loans, auto loans and mortgages. Interest rates on these tend to be lower, often between 3-7%. In this case, investing extra funds may make more sense than prepaying low-interest debt. You need to crunch the numbers for your specific situation.

Your time horizon until retirement or other financial goals also matters. The younger you are, the more time you have for compound growth to work its magic through long-term investing. Prepaying debt provides guaranteed returns equal to your interest rates, but over the long haul, the stock market’s average annual returns are significantly higher.

Risk tolerance should factor in as well. Eliminating debt provides a sure return and lowers overall risk in your financial picture. Investing brings the potential for higher long-term returns but involves market volatility and risk along the way. How much risk you can stomach could sway the debt vs. investing decision.

Psychology also comes into play. Some people get great satisfaction from demolishing debt obligations. For them, the emotional payoff of becoming debt-free may be worth more than the potential returns from investing the money instead. Others don’t mind carrying debt as much but want to see their wealth grow.

Tips for Deciding What’s Best

- List out all debts and corresponding interest rates.

- Prioritize paying off high-interest credit card balances first.

- Consider paying ahead on fixed lower rate installment loans like mortgages.

- Compare debt interest rates to expected investment returns.

- Factor in your time horizon and stomach for investment risk.

- Think about the psychological benefits of eliminating debt.

- Don’t delay other critical steps like building an emergency fund.

The Case for Paying Off Debt First

Guaranteed returns – Paying off a debt with 10% interest provides a guaranteed 10% return on your money. Investment returns involve risk and can fluctuate significantly.

Cash flow benefits – Eliminating debt payments frees up cash flow for saving and investing in the future. This can supercharge wealth building down the road.

Reduced risk – With less debt, you have less risk of falling behind if you lose your job or have a pay cut. This helps stabilize your finances.

Peace of mind – Becoming debt-free can provide tremendous psychological benefits and reduce stress. Many people sleep better at night without worrying about debt hanging over them.

When to Consider Investing First

Long time horizon – If retirement or other financial goals are many years away, time becomes your ally. Long investment time horizons allow compound returns to work their magic.

Low debt interest rates – Interest rates below 5% or so tip the scale toward investing if you can earn higher average returns.

Tax advantages – Tax-deferred retirement accounts multiply returns further, strengthening the case for investing if debt rates are reasonable.

Higher risk capacity – If you have plenty of cash flow to cover debt payments, investing may be advisable for those with higher risk tolerance.

Strategies to Do Both

Split extra cash flow – Allocate a portion to debt repayment and a portion to investing. For example, put half toward high-interest debt and half into retirement accounts.

Shift over time – First focus intensely on debt repayment. Once high-rate balances are eliminated, redirect those payments to boost investing.

Invest just enough to get employer match – Contribute at least enough to 401(k) to maximize any company matching funds before directing extra cash to debt.

Shift mindset – View debt repayment as a form of investing with a guaranteed return. This helps provide motivation to knock out balances.

The Bottom Line

Professional financial advisors take a comprehensive view of your financial situation. This enables them to provide tailored advice on how to allocate your cash flow in a way that best advances your long-term interests.

Rather than follow a rigid one-size-fits-all template, a good advisor will work with you to create a custom strategy. Here are some of the key benefits a financial advisor can offer:

Organize Your Financial Picture

For example, a review might reveal high-interest credit card debt that is siphoning away cash flow. Or it could uncover an employer 401(k) match you aren’t fully utilizing. Understanding the full landscape is crucial for optimal planning.

Analyze Debt Repayment Options

An advisor can also evaluate whether debt consolidation loans or balance transfers might reduce your interest costs. The goal is to pay off debts in a way that saves you the most money.

Recommend a Custom Investment Plan

For example, they may guide you to open and fully fund a Roth IRA before putting extra funds in taxable accounts. Or they may recommend allocating 60% of portfolio assets to stocks and 40% to bonds based on your situation.

Help Balance Debt Payoff and Investing

- Contributing enough to your 401(k) to get the full employer match

- Putting 20% of extra funds to credit card debt and 80% into an IRA

- Once high-rate debt is gone, redirecting those payments to boost investing

Provide Accountability and Encouragement

They can periodically review progress and offer suggestions to overcome roadblocks. This accountability combined with professional expertise helps motivate you to achieve objectives like becoming debt-free.

Modify the Plan as Needed

This ongoing advice ensures your financial plan adapts optimally over time to help you achieve financial freedom.

Seeking Unbiased Professional Guidance

Take the time to consult an experienced fee-only advisor. Their comprehensive advice, tailored specifically to your situation, can prove invaluable in charting the optimal path. With the help of an advisor, you can craft a strategy that maximizes debt repayment while also building wealth.

The Tax Implications of Lump Sum Payments and How to Prepare

Lump sum payments can come from a variety of sources – lottery or gambling winnings, legal settlements, inheritance, insurance payouts, and more. The tax treatment varies based on where the funds come from.

Lottery and Gambling Winnings

The withholding is only a prepayment of taxes. You must report gambling winnings as income when you file your tax return. Additional tax could be owed if not enough was withheld. Or you may get a refund if too much tax was withheld up front.

Legal Settlements

Legal settlements often don’t have tax withheld up front. But that doesn’t mean taxes aren’t owed. You must report settlement income on your tax return. Failure to do so could lead to tax evasion charges.

Inheritances

However, any investment gains or earnings on inherited assets are taxable. For example, interest income from an inherited CD would be taxable.

Insurance Payouts

Disability insurance benefits and workers’ compensation are tax-free. However, long-term care insurance payouts may be partly taxable if premiums were previously deducted on tax returns.

Other Lump Sum Sources

Strategies to Minimize Taxes

- Defer taking taxable payouts to a lower income tax year if possible.

- Consider spreading withdrawals over multiple years to avoid huge spikes in income.

- Deduct professional fees, union dues, and other qualifying expenses that help offset taxes.

- Contribute to tax-deferred retirement accounts, which reduces current year taxable income.

- Invest in assets eligible for special capital gains tax rates when suitable.

Planning for Estimated Taxes

Getting Professional Tax Help

- Accurately report income

- Take all allowable deductions

- Minimize your current year tax liability

- Avoid any errors or omissions that could trigger an audit

The Takeaway

Finding yourself suddenly flush with cash from an unexpected windfall like a tax refund, inheritance, or lottery winning can be both exciting and overwhelming. Without proper planning, that influx of funds that seems like a ticket to easy street could disappear faster than you realize. By making smart financial choices, however, you can parlay your surprise money into lasting wealth and financial security.

The first step is not to let the euphoria of sudden riches go to your head. Avoid making any big-ticket luxury purchases right off the bat. Sit down and carefully consider your options. Create a budget to see where this windfall can fill in gaps in savings and debt repayment. Consulting an experienced financial advisor can provide guidance on wise investment and wealth management strategies.

One smart move is to immediately boost your emergency fund until you have 6-12 months of living expenses set aside. This provides a safety net so you don’t have to go into debt to cover unexpected expenses. Paying off high-interest debts like credit cards also gives your overall finances a healthy boost by saving money on finance charges.

Next, consider maximizing tax-advantaged retirement accounts like 401(k)s and IRAs. Funding these accounts with lump sum contributions can really supercharge your retirement savings. The key is to avoid rashly overextending your contributions beyond what is fiscally prudent for your financial situation and goals.

With remaining windfall cash, look into options like low-cost, diversified index funds, real estate crowdfunding platforms, or meeting with an investor to develop an investment portfolio. Again, reasonable, long-term investments tailored to your risk tolerance and time horizon are the best bet for sustainable returns.

Parking a portion of your windfall into taxable, high-yield savings accounts provides easy access in case of emergencies. CD and money market accounts offer higher interest rates for funds you won’t need access to in the short term. Just don’t let too much wealth languish in accounts earning negligible returns.

Rather than undergoing sudden lifestyle inflation, make financial moves like paying off your mortgage or remodeling your kitchen in gradual steps. Avoid blowing all your cash on luxuries you don’t really need. Moderation is key when integrating unexpected wealth into your life.

Sudden influxes of cash from an inheritance, tax refunds from the OPC US Treasury Payment, or the Wisconsin treasurer can disrupt otherwise stable finances. With careful planning, however, these windfalls can be parlayed into lasting wealth and long-term security rather than short-lived indulgences. A trusted financial advisor can guide you in making the smartest choices.

The key is always keeping the big picture in mind – how to strategically grow your wealth over time rather than letting impulsiveness undermine financial stability. With a balanced approach and an eye on the long game, a surprise windfall can be converted into lasting returns and give your overall finances a shot in the arm.

Rather than jumping into hasty decisions, take time to cautiously weigh your options. Seek trusted guidance to moderate the giddy thrill of sudden riches with practical wisdom. Carefully allocated across tax-advantaged accounts, diversified investments, strategic savings goals and reasonable lifestyle upgrades over time, a surprise influx of funds can transform into lifelong financial health and security.