Thousands in Back Taxes. How to Get Out from Under Wisconsin Property Tax DebtThousands in Back Taxes. How to Get Out from Under Wisconsin Property Tax Debt

Understanding Delinquent Property Taxes in Wisconsin

Finding yourself on the county’s tax bill roll can be an anxious and stressful experience. As a Wisconsin homeowner, seeing that dreaded notice of unpaid property taxes in your mailbox means you’ve fallen behind on one of the most fundamental financial obligations of homeownership.

But take a deep breath – having back taxes or tax liens does not automatically mean you will lose your home. There are ways to get out from under this property tax debt and protect yourself from foreclosure. Let’s walk through what happens when you don’t pay your property taxes on time in Wisconsin, and most importantly, the different options you have to resolve delinquent taxes and tax liens.

Consequences of Not Paying on Time

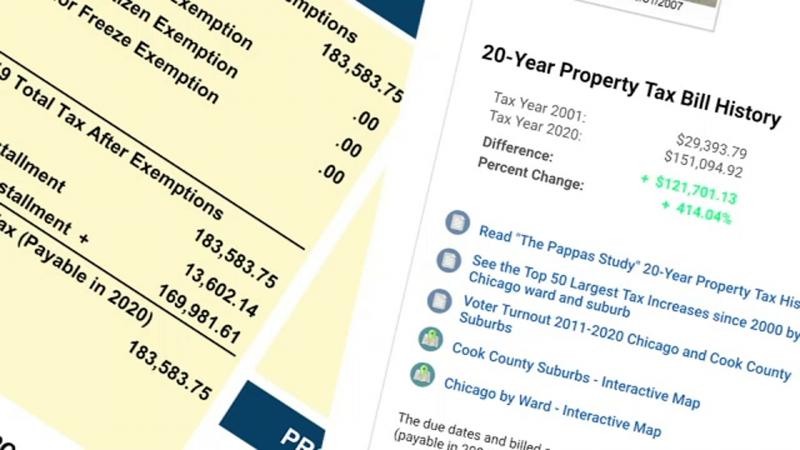

In Wisconsin, property taxes are paid in arrears – meaning the bill you receive in December is for the previous year. Taxes are considered delinquent if not paid by January 31 of the current year. At this point, penalties and interest start accruing on top of the unpaid balance.

By the end of February, the county treasurer will issue tax certificates against any properties with unpaid taxes from the previous year. This gives the county the right to take ownership of the property if the taxes remain unpaid. The properties are published on the county’s annual tax roll or tax bill roll.

Seeing your name on this public list is embarrassing, but it also serves as a warning that foreclosure could happen if you don’t take action. In Wisconsin, the legal process for foreclosure begins after taxes are delinquent for 3 years.

Payment Plans

If you simply missed the January due date, one of the easiest options is to set up a payment plan (also called an installment agreement) with your county treasurer. This allows you to gradually pay back the overdue taxes over 6-12 months while avoiding further penalties.

Payment plans are generally interest-free. Just be sure to make the monthly payments on time, or the agreement could be voided and penalties reapplied. An added benefit of enrolling in a payment plan is stopping the foreclosure countdown clock, provided you stick to the terms.

Tax Refund Interception

Another consequence of having delinquent property taxes is the loss of your state income tax refund. Wisconsin is allowed to seize refunds and apply them to back taxes owed. You will receive a notice indicating the amount intercepted.

If you are counting on that refund to help catch up, you may need to find another source of funds quickly before the state takes it. Again, enrolling in a payment plan shows good faith effort and may prevent refund interception.

Redemption

If your property has been certified for nonpayment of taxes, you still have the right to “redeem” it by paying the taxes in full before it goes to auction. This requires paying all back taxes, penalties, interest, and fees.

Redemption essentially buys back the tax lien and stops the foreclosure. It removes your property from the tax roll and gives you a fresh start. But the costs can add up quickly, so be sure you have the funds available before committing.

Hardship Assistance

Some counties and municipalities have hardship assistance programs that temporarily pay a portion of overdue taxes for qualified low-income homeowners. This helps them get caught up without the threat of foreclosure.

In addition, non-profit agencies like Consumer Credit Counseling provide financial coaching and mediation with lenders and tax authorities to help negotiate repayment plans for those struggling with mortgage payments, property taxes, and other debt.

Bankruptcy

Key Dates in Wisconsin’s Property Tax Calendar

- December: Property tax bills issued for the previous year

- January 31: Deadline for paying property taxes without penalties

- February: County treasurers issue tax certificates for unpaid taxes

- 3 years of delinquency: Legal foreclosure process may begin

Consequences of Delinquent Property Taxes in Wisconsin

Falling behind on property taxes in Wisconsin can have serious repercussions. What happens when taxes go unpaid? The consequences escalate over time, potentially leading to the loss of your home.

Immediate Impacts of Tax Delinquency

- Accrual of penalties and interest on the unpaid balance

- Issuance of tax certificates by the county treasurer

- Publication of property on the county’s tax roll

- Potential interception of state income tax refunds

How quickly do penalties accumulate? Interest and penalties begin accruing immediately after the January 31 deadline, increasing the total amount owed each month. This compounding effect can make it increasingly difficult for homeowners to catch up on their tax debt.

Long-Term Consequences of Unpaid Property Taxes

If property taxes remain unpaid for an extended period, the stakes become much higher. After three years of delinquency, the county may initiate foreclosure proceedings. This process can result in the loss of your home and severe damage to your credit score.

Navigating Payment Plans for Delinquent Taxes

For homeowners who have missed the January due date, setting up a payment plan with the county treasurer can be an effective solution. These installment agreements allow for gradual repayment of overdue taxes while avoiding further penalties.

Benefits of Property Tax Payment Plans

- Interest-free repayment over 6-12 months

- Prevention of further penalties if payments are made on time

- Halting of the foreclosure countdown clock

- Potential protection from tax refund interception

How do you set up a payment plan? Contact your county treasurer’s office to discuss your options. They will assess your situation and work with you to create a manageable repayment schedule. Be prepared to provide information about your income and expenses to determine an appropriate monthly payment amount.

Redeeming Properties with Tax Liens

Even if your property has been certified for nonpayment of taxes, you still have the right to redeem it. Redemption involves paying all back taxes, penalties, interest, and fees before the property goes to auction.

The Redemption Process

- Contact the county treasurer to determine the total amount owed

- Gather the necessary funds to cover all taxes, penalties, and fees

- Pay the full amount to the county treasurer

- Receive confirmation that the tax lien has been removed

Is redemption always the best option? While redemption can save your property from foreclosure, it requires a significant lump sum payment. For some homeowners, exploring alternative options like payment plans or hardship assistance programs may be more feasible.

Exploring Hardship Assistance Programs

For low-income homeowners struggling with property tax debt, hardship assistance programs can provide much-needed relief. These programs, offered by some counties and municipalities, may temporarily cover a portion of overdue taxes to help homeowners avoid foreclosure.

Types of Hardship Assistance Available

- Partial payment of overdue taxes by local government programs

- Financial coaching and debt counseling services

- Mediation with lenders and tax authorities

- Negotiation of repayment plans for various debts

How do you qualify for hardship assistance? Eligibility criteria vary by program but typically consider factors such as income level, property value, and the reason for financial hardship. Contact your local government or non-profit organizations like Consumer Credit Counseling to explore available options.

The Impact of Bankruptcy on Property Tax Debt

Declaring bankruptcy can provide temporary relief from property tax collection actions, including foreclosure. However, it’s crucial to understand the long-term implications of this decision.

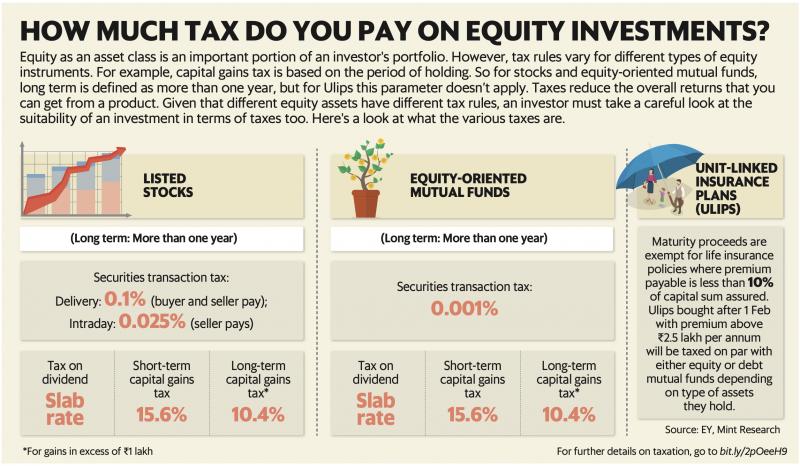

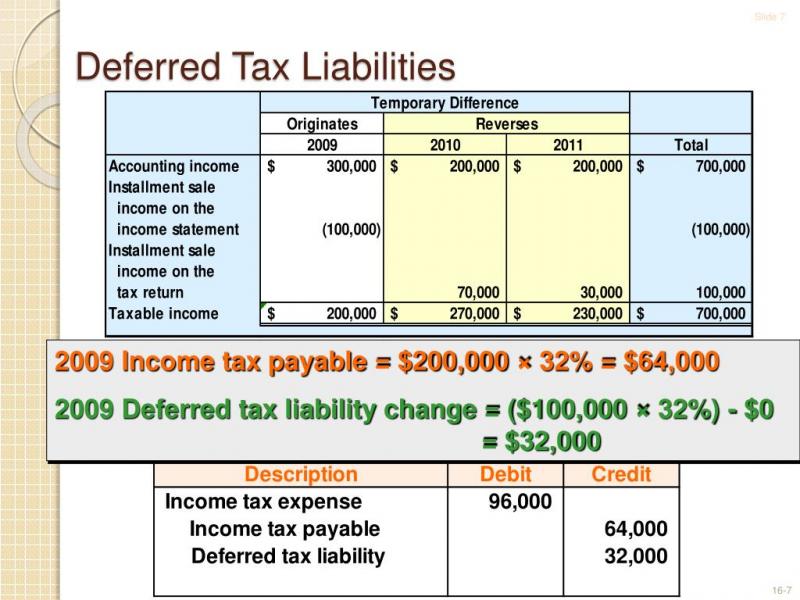

Chapter 7 vs. Chapter 13 Bankruptcy

Chapter 7 bankruptcy may discharge unsecured debts but typically doesn’t eliminate property tax obligations. Chapter 13 bankruptcy allows for a repayment plan that can include property tax arrears, potentially helping you catch up over time.

Does bankruptcy permanently solve property tax debt? No, bankruptcy provides temporary relief and a structured repayment plan. You’ll still need to address your property tax debt eventually to avoid foreclosure. Consulting with a bankruptcy attorney is crucial to understand how this option impacts your specific situation.

Selling Your Home to Resolve Tax Debt

When other options have been exhausted, selling your home may be the most practical solution to resolve property tax debt. This approach allows you to satisfy the tax obligation and potentially avoid foreclosure.

Pros and Cons of Selling to Resolve Tax Debt

Pros:

- Satisfies tax debt quickly

- Avoids foreclosure and its impact on credit

- Allows for a fresh start financially

Cons:

- May result in loss of equity due to decreased property value

- Requires finding new housing

- Emotional stress of leaving your home

How does tax debt affect the sale price? Properties with delinquent taxes often sell for less than market value. However, a short sale can still be preferable to foreclosure, as it allows you to have more control over the process and potentially walk away with some proceeds.

Alternative Solutions: Voluntary Deeding and Tax Lien Sales

For homeowners facing insurmountable tax debt, voluntary deeding and tax lien sales present alternative options to traditional foreclosure. These approaches can provide quicker resolutions and potentially less damaging outcomes.

Voluntary Deeding: A Last Resort Option

Voluntary deeding, also known as “deed in lieu of foreclosure,” involves transferring ownership of the property directly to the county. This process bypasses the lengthy foreclosure proceedings and public auctions.

What are the benefits of voluntary deeding?

- Faster resolution than traditional foreclosure

- Potential release from residual tax debts

- Avoidance of public auction and associated stress

- Possible negotiation for more favorable terms

How do you initiate the voluntary deeding process? Contact your county treasurer’s office to express your interest in this option. They will guide you through the necessary steps and required documentation. Be prepared to demonstrate that you’ve exhausted other options for resolving your tax debt.

Understanding Tax Lien Sales

In some cases, counties may opt to sell tax liens to investors rather than pursuing foreclosure. This process can impact homeowners with delinquent taxes in several ways.

How do tax lien sales work?

- The county auctions off the right to collect delinquent taxes to investors

- Investors pay the county for the tax lien certificate

- Homeowners must then repay the investor, often with high interest rates

- If the homeowner fails to repay, the investor may foreclose on the property

What are the implications for homeowners? While tax lien sales provide immediate revenue for counties, they can create additional challenges for homeowners. Interest rates on tax lien certificates are often higher than those charged by the county, potentially increasing the overall debt burden.

Preventing Future Property Tax Delinquency

After resolving current tax debt issues, it’s crucial to implement strategies to prevent future delinquencies. Proactive management of property tax obligations can help homeowners avoid the stress and financial strain of unpaid taxes.

Budgeting for Property Taxes

How can homeowners effectively budget for property taxes?

- Set aside a portion of monthly income specifically for property taxes

- Consider opening a separate savings account for tax payments

- Explore options for monthly tax payments through your mortgage escrow

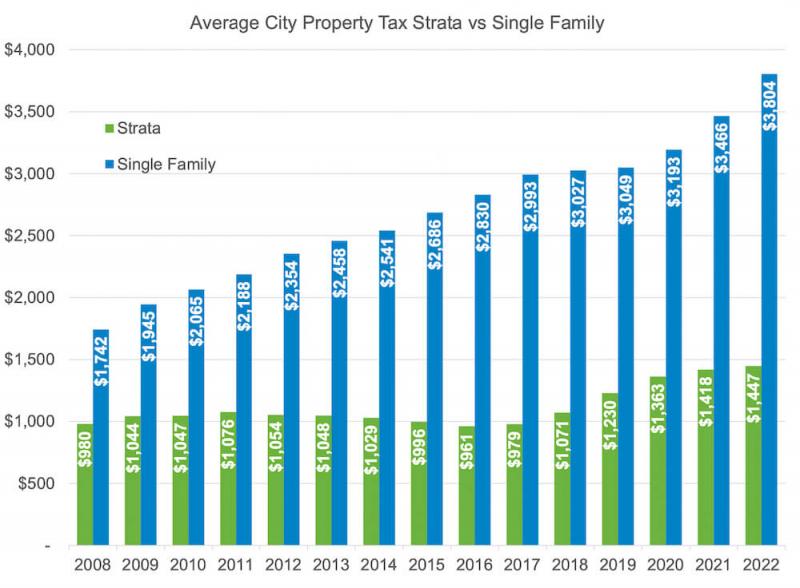

- Stay informed about potential changes in property tax rates

Why is consistent budgeting important? Regular savings throughout the year can prevent the shock of a large lump sum payment in January. This approach also helps homeowners maintain better overall financial health and stability.

Monitoring Property Assessments

Keeping track of your property’s assessed value is crucial for ensuring fair taxation. Overassessment can lead to inflated tax bills, potentially contributing to financial strain.

How can homeowners challenge property assessments?

- Review your property assessment notice carefully

- Compare your assessment to similar properties in your area

- Gather evidence to support your case for a lower assessment

- File an appeal with your local assessment review board

- Consider hiring a professional appraiser if needed

When should you consider appealing your assessment? If you believe your property has been significantly overvalued, or if there are errors in the assessment, it’s worth pursuing an appeal. Even a small reduction in assessed value can lead to meaningful tax savings over time.

Leveraging Property Tax Relief Programs

Wisconsin offers various property tax relief programs that can help homeowners manage their tax obligations more effectively. Understanding and utilizing these programs can significantly reduce the risk of future delinquencies.

Homestead Credit Program

The Homestead Credit program provides tax relief for low-income homeowners and renters in Wisconsin. This refundable income tax credit can offset a portion of property taxes or rent paid on a primary residence.

Who qualifies for the Homestead Credit?

- Wisconsin residents who owned or rented a home during the tax year

- Individuals with household income below the program’s threshold

- Those who are not claimed as a dependent on another tax return

- Homeowners who paid property taxes on their primary residence

How much can you save with the Homestead Credit? The credit amount varies based on income and property taxes paid, with a maximum credit of $1,168 for the 2023 tax year. Even a partial credit can provide valuable relief for struggling homeowners.

Property Tax Deferral Loan Program

Wisconsin’s Property Tax Deferral Loan Program allows eligible elderly homeowners to postpone payment of property taxes. This program can provide significant relief for seniors on fixed incomes.

What are the key features of the Property Tax Deferral Loan Program?

- Loans to cover current year property taxes

- Deferred repayment until the home is sold or the owner’s death

- Interest accrues annually on the loan balance

- Eligibility based on age, income, and equity in the home

Is the Property Tax Deferral Loan Program right for you? While this program can provide immediate relief, it’s important to consider the long-term implications. The accruing interest and impact on home equity should be carefully weighed against other options.

Seeking Professional Guidance for Tax Debt Resolution

Navigating property tax debt can be complex and overwhelming. In many cases, seeking professional guidance can lead to better outcomes and more sustainable solutions.

Types of Professionals to Consider

- Tax Attorneys: Specialize in tax law and can provide legal advice on debt resolution

- Certified Public Accountants (CPAs): Offer expertise in tax planning and financial management

- Financial Advisors: Help develop comprehensive strategies for managing debt and improving overall financial health

- Housing Counselors: Provide guidance on housing-related financial issues, including property taxes

How do you choose the right professional? Consider your specific needs, the complexity of your situation, and your budget. Many professionals offer free initial consultations, allowing you to assess their expertise and approach before committing.

Benefits of Professional Assistance

Why should homeowners consider professional help for tax debt issues?

- In-depth knowledge of tax laws and regulations

- Experience negotiating with tax authorities

- Ability to identify relief programs you may have overlooked

- Guidance on long-term financial planning to prevent future issues

- Stress reduction through expert handling of complex processes

Can professional help save you money in the long run? While there are costs associated with professional services, the potential savings in reduced tax liability, avoided penalties, and improved financial management can often outweigh these expenses.

Embracing Financial Literacy for Long-Term Stability

Resolving property tax debt is an important step, but maintaining long-term financial stability requires ongoing education and mindful financial practices. Embracing financial literacy can help homeowners avoid future tax issues and build a more secure financial future.

Key Areas of Financial Literacy for Homeowners

- Budgeting and expense tracking

- Understanding credit and debt management

- Savings and investment strategies

- Insurance and risk management

- Tax planning and preparation

How can homeowners improve their financial literacy? Many resources are available, including free online courses, workshops offered by local financial institutions, and educational materials from government agencies. Committing to ongoing learning can significantly impact your financial well-being.

Implementing Financial Best Practices

What are some key financial habits that can help prevent future tax debt?

- Maintain an emergency fund to cover unexpected expenses

- Regularly review and adjust your budget to reflect changing circumstances

- Stay informed about changes in property tax laws and assessments

- Consider automating savings for property taxes to ensure consistent contributions

- Periodically review your overall financial strategy with a professional advisor

Why is consistency important in financial management? Developing and maintaining good financial habits creates a foundation for long-term stability. This proactive approach can help you weather financial challenges and avoid the stress of tax delinquency in the future.

Understanding Delinquent Property Taxes in Wisconsin

Finding yourself on the county’s tax bill roll can be an anxious and stressful experience. As a Wisconsin homeowner, seeing that dreaded notice of unpaid property taxes in your mailbox means you’ve fallen behind on one of the most fundamental financial obligations of homeownership.

But take a deep breath – having back taxes or tax liens does not automatically mean you will lose your home. There are ways to get out from under this property tax debt and protect yourself from foreclosure. Let’s walk through what happens when you don’t pay your property taxes on time in Wisconsin, and most importantly, the different options you have to resolve delinquent taxes and tax liens.

Consequences of Not Paying on Time

In Wisconsin, property taxes are paid in arrears – meaning the bill you receive in December is for the previous year. Taxes are considered delinquent if not paid by January 31 of the current year. At this point, penalties and interest start accruing on top of the unpaid balance.

By the end of February, the county treasurer will issue tax certificates against any properties with unpaid taxes from the previous year. This gives the county the right to take ownership of the property if the taxes remain unpaid. The properties are published on the county’s annual tax roll or tax bill roll.

Seeing your name on this public list is embarrassing, but it also serves as a warning that foreclosure could happen if you don’t take action. In Wisconsin, the legal process for foreclosure begins after taxes are delinquent for 3 years.

Payment Plans

If you simply missed the January due date, one of the easiest options is to set up a payment plan (also called an installment agreement) with your county treasurer. This allows you to gradually pay back the overdue taxes over 6-12 months while avoiding further penalties.

Payment plans are generally interest-free. Just be sure to make the monthly payments on time, or the agreement could be voided and penalties reapplied. An added benefit of enrolling in a payment plan is stopping the foreclosure countdown clock, provided you stick to the terms.

Tax Refund Interception

Another consequence of having delinquent property taxes is the loss of your state income tax refund. Wisconsin is allowed to seize refunds and apply them to back taxes owed. You will receive a notice indicating the amount intercepted.

If you are counting on that refund to help catch up, you may need to find another source of funds quickly before the state takes it. Again, enrolling in a payment plan shows good faith effort and may prevent refund interception.

Redemption

If your property has been certified for nonpayment of taxes, you still have the right to “redeem” it by paying the taxes in full before it goes to auction. This requires paying all back taxes, penalties, interest, and fees.

Redemption essentially buys back the tax lien and stops the foreclosure. It removes your property from the tax roll and gives you a fresh start. But the costs can add up quickly, so be sure you have the funds available before committing.

Hardship Assistance

Some counties and municipalities have hardship assistance programs that temporarily pay a portion of overdue taxes for qualified low-income homeowners. This helps them get caught up without the threat of foreclosure.

In addition, non-profit agencies like Consumer Credit Counseling provide financial coaching and mediation with lenders and tax authorities to help negotiate repayment plans for those struggling with mortgage payments, property taxes, and other debt.

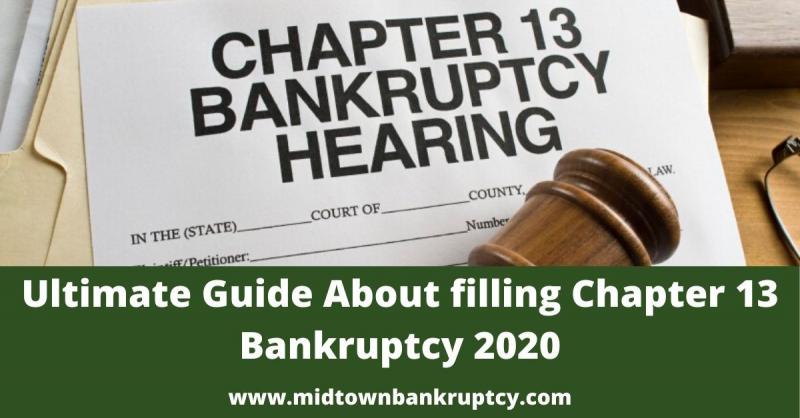

Bankruptcy

Declaring Chapter 7 or Chapter 13 bankruptcy stops all collection actions against you, including property tax foreclosure. This can provide temporary relief while you work with the court to discharge unsecured debt and get on a repayment plan.

However, you will still have to catch up on property taxes eventually or risk foreclosure restarting. Consult a bankruptcy attorney to understand how this impacts your situation.

Selling Your Home

If you simply cannot afford the back taxes plus penalties and interest, selling your home may be the most practical option before foreclosure begins. This satisfies the tax debt and allows you to walk away without a foreclosure on your record.

However, home values tend to drop once taxes are delinquent, so you may not walk away with much equity. Still, a short sale closes much faster than foreclosure and allows you to start fresh.

Voluntary Deeding

You also have the option to voluntarily “deed in lieu of foreclosure”, transferring ownership directly to the county. This avoids the lengthy foreclosure process and auctions. It requires approval and releases you from residual tax debts.

Like bankruptcy, it can provide temporary relief and protection while planning your next steps. However, it means giving up your home for good.

The Foreclosure Process

If delinquent taxes remain unpaid after 3 years, Wisconsin counties can begin the formal foreclosure process by filing a lawsuit and obtaining a judgement ordering the sale of the property at public auction.

Notices will be published in local newspapers and sent to the property owner. You as the owner have multiple opportunities to pay the taxes or object to stop the foreclosure before the county takes ownership (known as “confirmation”).

Objections and Defenses

A tax foreclosure lawsuit can be opposed on several legal grounds if you have a legitimate defense, such as not receiving proper notice or errors in calculating the amounts owed. An attorney can advise you on the merits of filing an objection.

You can also attend the court hearing and petition the judge to halt the proceedings. The goal is to delay confirmation of the foreclosure until you can resolve the back taxes.

Reclaiming Your Property

In some cases, it’s possible to reclaim your home even after losing it in a tax foreclosure auction. Wisconsin’s redemption law allows previous owners to buy back the property within 6 months of confirmation by repaying the sale price plus 10% interest.

So don’t give up hope – speak with a real estate attorney about “post-confirmation redemption” if you want another chance to keep your house.

Moving On

Losing a home is emotionally devastating. But remember this does not define you or your financial future. In fact, foreclosure may wiped out personal liability for the delinquent taxes, allowing you to start rebuilding your credit.

Focus on creating a new budget, pay down other debts, and in time you can qualify to buy again. Don’t be afraid to seek credit counseling to get back on stable footing. With determination, you can overcome this setback.

Dealing with delinquent property taxes in Wisconsin can seem daunting. But there are always alternatives to foreclosure. Learn your options, act quickly, and consult professionals who can help negotiate the best path forward.

Consequences of Not Paying Property Taxes on Time

Paying property taxes on time is crucial for any Wisconsin homeowner. Failure to pay property taxes by the due date can lead to severe financial consequences that quickly spiral out of control. If you find yourself facing delinquent property taxes, it’s important to understand the repercussions and take action quickly before the situation worsens.

Tax Lien

The first consequence of missing your property tax payment deadline is the placement of a tax lien on your home. This gives the county the legal right to your home as collateral for the unpaid taxes. The county has first claim on your house if you don’t eventually pay what you owe.

Although the county hasn’t taken ownership of your home yet with a tax lien, this encumbrance makes it difficult to sell or refinance the property. You’ll have to satisfy the tax lien first before conducting any transactions. The longer the tax lien remains unpaid, the more it will negatively impact your credit score and financial standing.

Penalty Fees and Interest

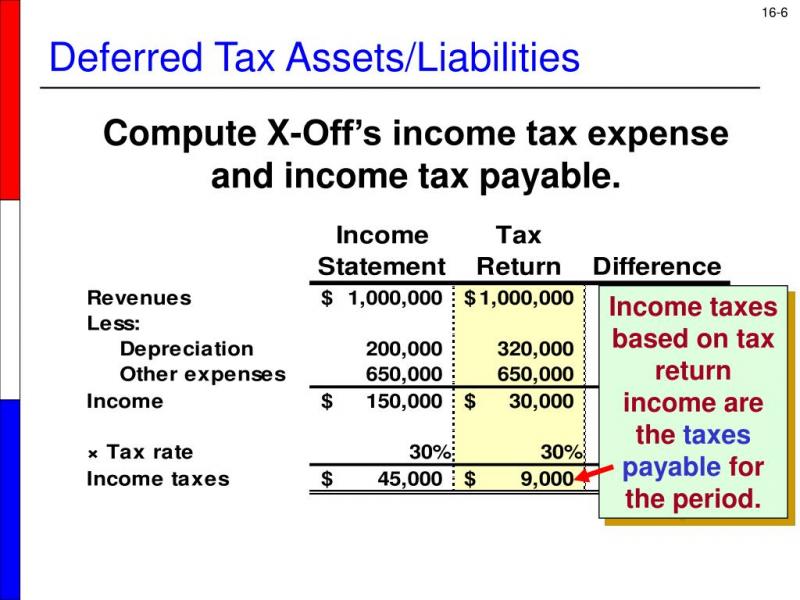

In addition to the base amount of unpaid taxes, you’ll also face escalating penalty fees and interest on the balance. In Wisconsin, a 1% penalty per month is assessed on overdue property taxes, along with 1% interest compounded monthly. So your total tax burden grows rapidly if you let it slide.

For example, if you failed to pay a $3,000 property tax bill, after just one year the amount due would climb to $3,363 including penalties and interest. Wait two years to settle up and you’ll owe $3,977 – a 33% increase over the original tax amount.

Tax Foreclosure

If several years pass without paying the property taxes, the county has the right to begin foreclosure proceedings by filing a lawsuit against the delinquent taxpayer. This leads to the forced sale of the home at public auction in order to recover the unpaid taxes.

Wisconsin law allows tax foreclosure after 3 years of delinquency. The county will first try to contact the homeowner to work out a payment plan or hardship assistance. But if the back taxes remain unpaid, foreclosure gets triggered.

Losing your home is the worst case outcome, but tax foreclosure auction sales often recoup just pennies on the dollar. This wipes out all the equity you built up, damages your credit badly, and leaves you still owing any shortfall between the auction price and amount owed.

Bankruptcy

As a last resort, declaring bankruptcy may seem like an option if you’re facing foreclosure over unpaid property taxes. However, property taxes usually can’t be discharged through bankruptcy.

The bankruptcy court will likely consider property taxes a statutory lien that runs with the land, not a claim against you personally. So the tax burden remains tied to the home even after bankruptcy.

Bankruptcy also damages your credit and finances almost as badly as foreclosure would. Consult with a bankruptcy attorney before taking this serious step.

Payment Plans

If temporarily unable to pay your property taxes, contact your county treasurer’s office as soon as possible to set up a payment plan. Most Wisconsin municipalities allow 12 monthly installments to catch up.

Setting up a payment plan prevents penalties and interest from accumulating at high rates. It also avoids foreclosure. Just be sure to follow through on the agreed schedule.

Hardship assistance programs may also be available if you face extenuating circumstances like medical problems or unemployment. Ask the treasurer’s office about options to delay your property tax bill.

Tax Refund Intercept

Wisconsin also has the ability to intercept and seize your state income tax refund to pay off delinquent property taxes. The Department of Revenue coordinates with the county to capture any refund you’re due and apply it to your property tax debt.

Tax refund intercepts don’t require any notice to the taxpayer. Your refund simply gets redirected without an opportunity to contest it.

Avoiding this outcome provides another reason to proactively communicate with your county treasurer and settle up unpaid property taxes.

Unpaid property taxes in Wisconsin can quickly snowball from bad to worse. Tax liens, mounting interest and penalties, foreclosure, and loss of tax refunds are all consequences that threaten homeowners who fall behind. If you receive a delinquency notice, reach out right away to make payment arrangements. With prompt action, you can avoid substantial financial damage and the possible loss of your home.

Tax Bill Roll: What It Means When Your Name’s On It

Seeing your name show up on Wisconsin’s tax bill roll is a clear sign you’ve fallen behind on paying property taxes. This public list of delinquent taxpayers is a warning shot across the bow from the county treasurer – pay up or major consequences are coming your way.

The tax bill roll, published annually by each county, names all property owners with overdue taxes from the prior year. If you find yourself on this roll of shame, it means trouble lies ahead unless you take action.

Foreclosure Deadline Now Set

Being on the tax bill roll starts the 3-year clock ticking toward potential foreclosure proceedings on your home. Wisconsin law allows counties to take delinquent properties through tax foreclosure after 3 years of unpaid taxes.

So if your name appears on this year’s tax roll, it means you haven’t paid your property tax bill from 3 years ago. That puts your home at risk of foreclosure and public auction if you can’t pay off the back taxes soon.

Interest and Penalties Adding Up

Making the tax bill roll also means interest and penalties are steadily accumulating on top of the unpaid taxes. Wisconsin charges 1% interest per month on overdue property taxes, along with a 1% per month penalty.

For a $3,000 delinquent tax bill, you would owe $363 more after the first year. After two years it climbs to $727. And by year three you’re looking at over $1,000 in added interest and penalties.

Being on the public tax roll is a wake-up call that you need to pay now before it gets out of hand.

Tax Lien In Force

The tax bill roll confirms that the county has placed a tax lien on your home for the unpaid amount. This lien gives the county first claim on your house as collateral until the taxes get paid.

The lien makes it very difficult to sell or refinance your home. You’ll have to satisfy the lien before conducting any transactions. It also wrecks your credit score if left in place too long.

Communicate With the County

Being placed on the tax bill roll means it’s absolutely crucial to contact your county treasurer’s office as soon as possible. Discuss payment plan options to catch up gradually over 12 months.

If facing financial hardship, ask about delaying your taxes or reducing penalties. Some counties have assistance programs for struggling homeowners.

Setting up a formal payment agreement can remove your name from the tax roll. It shows good faith effort to settle up and pauses foreclosure action.

Tax Refunds May Be Intercepted

The tax bill roll triggers potential seizure of your state income tax refund to pay the overdue property taxes. Wisconsin can coordinate with the county to capture refunds you’re owed and apply them to your tax debt.

There’s no notice this refund intercept is coming. Your refund just gets redirected without recourse once your name’s on the roll.

Avoid this nasty surprise by working out a deal to remove your name from the county’s tax bill roll.

Property Value Implications

Being on the published tax roll also signals to potential home buyers that you’ve mismanaged finances. It makes your property less attractive and drags down the presumed market value.

Buyers will be wary of taking on your tax liabilities. They can lowball offers since public records show you’re distressed.

Get off the tax roll quickly to avoid this value-killing scarlet letter when it comes time to sell.

What To Do Next

Now that you understand the gravity of being named on Wisconsin’s tax bill roll for delinquent accounts, here are the steps to take immediately:

- Contact county treasurer to discuss payment plans

- Ask about hardship assistance programs if qualified

- Set up monthly installments to gradually repay taxes

- Get on a plan to remove your name from the tax roll

- Avoid foreclosure by making consistent payments

Being on the county’s tax bill roll puts your financial future at serious risk. But you can get back on track by facing the problem directly and making a cooperative effort to pay. Take advantage of payment plans and assistance programs to settle up your delinquent property taxes before harsh consequences hit.

Options to Resolve Back Taxes Before Foreclosure

Falling behind on property taxes can put Wisconsin homeowners on the fast track to foreclosure. But even if you receive a delinquency notice, all is not lost. You still have time to resolve back taxes and save your home.

When property taxes go unpaid after the annual due date, interest and penalties start adding up. The county can place a tax lien against your home and even put your name on the published tax bill roll.

But foreclosure typically takes at least 3 years to complete in Wisconsin. You have options to avoid this worst-case outcome if you take action quickly.

Payment Plans

Most counties allow homeowners to enter into payment plans to gradually repay delinquent property taxes over time. You may qualify for 12 monthly installments to catch up.

Payment plans stop additional interest and penalties from accumulating. They show good faith effort to comply over a reasonable timeframe. This can delay foreclosure proceedings while you settle up.

Just be sure to follow through on the monthly payments. Defaulting on a payment plan often triggers immediate foreclosure action.

Hardship Assistance

If facing financial challenges due to job loss, illness, or other factors, you may qualify for hardship assistance programs. These can temporarily delay your tax bill or reduce penalties.

Bring documentation of your circumstances when meeting with the county treasurer’s office. Assistance programs are discretionary, so make your case persuasively.

Qualified non-profit credit counseling agencies can also negotiate with the county on your behalf if you sign up for debt management services.

Borrow Against Home Equity

Tapping available equity through a home equity loan or line of credit can produce a lump sum to get caught up on back taxes quickly. This turns the unpaid bill into a manageable monthly payment.

Home equity borrowing involves fees and interest charges. But it may buy you time to improve your overall financial picture before the next tax bill comes due.

Just be cautious not to over-leverage your home with additional debt that puts you right back in the same bind later.

Hard Money Loans

If you have considerable equity but don’t qualify for a normal home equity loan, a hard money lender may offer rescue financing based on the property value rather than your credit.

Hard money loans charge much higher interest rates and fees than conventional loans. But they can be an option of last resort to tap your equity and halt foreclosure.

Explore all other paths first before resorting to this very expensive form of financing.

Borrow from 401(k)

Withdrawing funds from your 401(k) or IRA to pay delinquent taxes involves penalties and should be a last choice. But this option beats losing your home entirely.

You can borrow up to $50,000 from a 401(k) and repay it over 5 years to avoid penalties. An IRA hardship withdrawal incurs a 10% penalty but removes the tax burden.

Use retirement funds only as a lifeline if you have no other way to save your home from tax foreclosure.

Installment Agreement

Even if you can’t pay off all back taxes at once, making regular monthly payments shows good faith. The county may halt foreclosure proceedings if you make consistent installments.

Automate payments from your bank account so you never miss an installment. This demonstrates responsibility and buys more time.

Just be sure the payment amount meaningfully reduces the overall tax debt each month. Token payments won’t suffice.

Partial Payment

If unable to pay the full amount owed, see if the county will accept partial payment. Get written confirmation of the partial payment agreement terms.

This stops additional interest and penalties from accumulating on the paid portion. Over time, a series of partial payments can resolve the full balance.

A partial payment plan requires discipline to follow through. But it can steer you away from foreclosure if consistently executed.

If you suddenly find yourself delinquent on property taxes in Wisconsin, take heart. You likely have at least a year before foreclosure gets underway. Tap every option possible, from payment plans to borrowing against equity, to resolve back taxes and save your home.

Payment Plans to Catch Up on Overdue Property Taxes

Falling behind on property taxes doesn’t mean you’re doomed to lose your home. Wisconsin counties offer payment plans to help homeowners gradually repay overdue taxes over time.

Payment plans stop escalating interest and penalties and can prevent foreclosure while you work in good faith to get caught up. If you’ve received a delinquency notice, a payment plan should be your first step.

How Payment Plans Work

Payment plans allow you to divide up back taxes into smaller, more manageable monthly installments. Many counties permit 12 monthly payments, but longer 18 or 24 month plans may be available for larger balances.

The county calculates the payment amount needed to adequately chip away at the total tax debt based on your timeline. You’ll need to make consistent on-time payments each month.

As long as you satisfy the payment schedule, the county pauses additional interest and penalties during the plan. Foreclosure proceedings also get put on hold.

Requirements to Qualify

To qualify for a property tax payment plan, you’ll need to submit a formal application to the county showing you can handle the proposed monthly amount. Proof of income may be required.

The county will run your credit report and evaluate other debts and expenses. You’ll have to demonstrate sufficient monthly cash flow to take on the new installment payment.

As long as you can make a good case for affordability, the county will usually approve your payment plan request.

Getting Started

Contact your county treasurer’s office as soon as possible after receiving a delinquency notice to ask about payment plan options. The sooner you enroll in a plan, the less interest and penalties will accrue.

Complete the required application providing personal information, financial details, and proposed monthly payment amount. The county will do a financial review and get back to you with an approved schedule.

Once accepted, you must follow through by making consistent monthly payments. Autopay is recommended so you never miss an installment.

Breach of Payment Plan

If you default on the payment plan by missing installments, the treasurer’s office will issue a breach of contract notice. This gives you 30 days to become current again.

If you fail to resume payments after receiving a breach notice, the payment plan gets voided. The full unpaid tax amount plus accumulating interest and penalties becomes due immediately.

At this point, foreclosure proceedings typically get underway. So it’s critical to avoid violating the payment plan terms.

Benefits of Payment Plans

Setting up a reasonable tax payment plan with the county provides these key benefits:

- Prevents rapidly compounding interest and penalties

- Puts foreclosure on hold while repaying taxes

- Allows gradual repayment over 12+ monthly installments

- Demonstrates good faith effort to comply

- Removes your name from the published tax roll

- Allows time to improve finances before next tax bill

Just be sure to stick closely to the agreed schedule. Timely payments are essential to satisfy your property tax debt while avoiding foreclosure.

Other Repayment Options

If you don’t qualify for a typical payment plan, the county may approve:

- Interest-only payments – Pay only accumulating interest until you improve finances

- Partial payments – Make consistent monthly installments of what you can afford

- Lump sum extension – One-time extension to gather a large payment

- Delayed payments – Pause payments temporarily then make up months later

Explore every option to find a workable tax repayment schedule. With persistence and good faith effort, you can avoid foreclosure and gradually eliminate your delinquent property tax debt in Wisconsin.

Tax Refund Interception for Delinquent Property Owners

Property owners in Wisconsin who fall behind on their taxes face a nasty surprise – the state can seize your income tax refund to pay delinquent property taxes.

Tax refund interception gives counties a powerful tool to collect overdue taxes. If you land on the published tax roll, don’t expect that refund you normally count on each spring.

How Refund Interception Works

When a property owner appears on the county’s annual tax roll for non-payment, this triggers eligibility for refund intercept. The county submits the delinquent account to the Department of Revenue.

If you’re owed a state tax refund, the DOR captures it before the check gets issued. The funds then get sent straight to the county to satisfy part or all of your overdue property taxes.

No notice is given when a refund gets intercepted. The money is simply redirected without opportunity for appeal.

Refunds Vulnerable to Capture

Any Wisconsin state income tax refund you’re entitled to can get intercepted, including:

- Individual filer refund

- Joint filer refund

- Homestead tax credit

- Earned income tax credit

- Manufacturing credit

Business tax refunds associated with a delinquent property owner may also face seizure in some cases.

Order of Distribution

If you jointly file a return with a spouse who doesn’t own the delinquent property, the intercepted refund gets applied in this order:

- Overdue property taxes

- Past-due child support

- Debts owed to other state agencies

- Remaining refund to non-delinquent spouse

The state will capture the refund up the amount owed on back taxes before distributing the excess.

Avoiding Refund Interception

To avoid losing your refund to unpaid property taxes, take these steps:

- Pay delinquent taxes in full immediately

- Enter into payment plan with county

- Apply for hardship assistance from county

- Prove taxes were paid or appealed

- File injury claim and seek compensation

The county can choose to release the refund intercept if you resolve the back taxes or have a valid hardship situation.

What To Do If Your Refund Gets Taken

If you already filed your return and your refund never appeared, contact the Wisconsin DOR to see if an intercept occurred.

Work directly with your county treasurer’s office to rectify the unpaid property taxes. Get on a payment plan or provide evidence that taxes were paid or are under appeal.

If the intercept was improper, the treasurer’s office can release the refund back to you. But you must take action – it won’t automatically get returned.

Avoiding Future Intercepts

Once you resolve the unpaid property taxes, here are some tips to avoid refund seizure going forward:

- Enroll in auto-pay for property tax payments

- Review records carefully to resolve discrepancies right away

- If appealing assessment, pay under protest to avoid delinquency

- Consult tax advisor about strategies to minimize refund amount

- Maintain rainy day fund for emergencies that may affect property tax payment

Getting your tax refund intercepted is frustrating, but being proactive about property tax obligations can help avoid this fate. Work closely with the county treasurer anytime taxes become delinquent to halt penalty fees, interest charges, and refund seizures.

Redemption: Paying Off Tax Liens Before Auction

Finding out you owe thousands in back taxes on your Wisconsin property can feel like getting hit by a tidal wave. Your first instinct may be to panic. How will you come up with the money? What will happen if you can’t pay? Will you lose your home?

While owing back taxes is serious, it’s not necessarily the end of the road. Under Wisconsin law, homeowners have opportunities to “redeem” their property by paying the owed taxes before the property goes to auction. This process is called tax lien redemption.

What Is a Tax Lien?

When property taxes go unpaid in Wisconsin, the county places a tax lien on the property. This gives them the legal right to seize and sell the property to recover the unpaid taxes. Each year, thousands of Wisconsin properties get tax liens.

The county treasurer creates a list of all properties with delinquent taxes by August 31 every year. This is called the tax roll or bill roll. It shows the amount of unpaid taxes on each property. The treasurer files this list with the county clerk by the third Monday in December.

At this point, the tax lien is attached to the property. This lien will remain until the overdue taxes and fees are paid in full (redeemed). If not redeemed, the property may be sold at auction after 2 years of delinquency.

Redeeming the Property Before Auction

Luckily, Wisconsin gives homeowners ample time to redeem their property and avoid auction. Here’s how it works:

- Year 1: Taxes are overdue. The property is added to the county’s tax roll.

- Year 2: Taxes must be paid by January 31 to remove the property from the current tax roll. Otherwise, the tax lien remains.

- Year 3: Final redemption deadline. All back taxes and interest must be paid by the close of business on August 31.

- Year 4: If still unpaid, the property goes to auction in August or September.

As you can see, homeowners have up to 3 years to redeem before their property hits the auction block. This gives you ample time to get your finances in order.

Paying Off Tax Liens

To redeem your property and satisfy the tax lien, you must pay the county treasurer the total amount owed. This includes:

- Unpaid taxes from current and prior years

- Interest on the overdue amounts (typically 1% per month)

- Penalties (up to 0.5% per month)

- Fees for the tax lien and any legal notices

The county treasurer can provide a statement showing the full redemption amount owed. Some Wisconsin counties let you pay and redeem tax liens online for convenience.

Once paid in full, the treasurer will issue a redemption certificate proving the lien is settled. They will also record this with the register of deeds to update the public records. The tax lien will be removed, and no auction will take place.

Getting Help

Coming up with thousands to pay back taxes can be daunting. Here are some options if you’re struggling to redeem a tax lien in Wisconsin:

- Payment plans – Most counties allow payment plans to pay back taxes over time. You may need to pay a setup fee.

- Borrow against home equity – If you have equity, a home equity loan or line of credit can provide funds to redeem the taxes.

- Mortgage refinance – In some cases, lenders may be willing to roll the owed taxes into a new mortgage.

- Personal loan – An unsecured personal loan is another way to borrow money to get out of tax debt.

- Hardship assistance – Some Wisconsin municipalities have hardship programs to help struggling taxpayers.

- Tax Resolution Firms – For a fee, tax resolution firms can negotiate payment plans and settlements with the county to reduce interest and penalties.

Don’t wait until the last minute to take action on unpaid property taxes. Redeeming well before the August 31 deadline gives you more options. If you owe back taxes, consult with the county treasurer right away to discuss payment plans. Act fast to avoid putting your property at risk of being auctioned off.

Hardship Assistance for Low Income Homeowners

Owing back taxes on your Wisconsin home can be downright scary, especially if you’re already struggling to make ends meet. Unfortunately, many low income families find themselves facing mounting property tax debt through no fault of their own.

When you’re living paycheck to paycheck, coming up with thousands to pay off tax liens seems impossible. You may feel like you have no options except losing your house to auction. But don’t despair – help is available!

If you’re a low income homeowner in Wisconsin, you may qualify for hardship assistance programs and relief. Here’s what you need to know.

Causes of Property Tax Delinquency

Low income homeowners often end up with unpaid property taxes for reasons beyond their control. Some common causes include:

- Job loss or reduced work hours

- High medical bills

- Divorce or death of a spouse

- Predatory lending practices

- Sudden expenses like home repairs or car troubles

- Lack of tax withholding on retirement income

Whatever the reason, tax delinquency puts your home at risk once tax liens are attached. So what can you do?

Applying for Hardship Assistance

Many Wisconsin municipalities have hardship assistance programs to help struggling homeowners avoid tax foreclosure. These programs go by different names but generally work the same way:

- Homeowner applies describing their hardship.

- Financial records are reviewed to verify income.

- If approved, delinquent property taxes may be reduced or waived.

- A affordable monthly payment plan is worked out.

Every Wisconsin county handles hardship assistance differently. Some key programs to know about include:

- Tax deferral – Delinquent taxes are deferred until the property transfers.

- Tax rebate – Part of the taxes owed are rebated based on financial need.

- Tax freeze – Keeps taxes at an affordable amount based on income.

These programs provide huge relief, often reducing property taxes by thousands of dollars. Make sure to apply well before the August tax lien deadline for the best chance of approval.

Meeting the Eligibility Criteria

Hardship assistance programs are designed for vulnerable groups like seniors, disabled residents, and low income families. Common criteria include:

- Home is your primary residence.

- You own no other real estate.

- Total household income below a set limit.

- Not able to pay taxes due to hardship.

The income thresholds vary but are usually quite low. For example, Dane County’s tax deferral program is open to households earning less than $45,000 a year. Provide proof of all eligibility criteria when applying.

Other Relief Options

Beyond hardship programs, other forms of property tax relief may be available. For instance:

- Payment plans – Set up affordable monthly payments.

- Penalty waivers – Get interest and penalties reduced or eliminated.

- Tax credits – Offset taxes through Homestead or Earned Income Tax Credits.

Nonprofit groups like Consumer Credit Counseling Service also provide free tax debt counseling for low income homeowners. An advocate can help you negotiate better terms.

With the right relief program, you can avoid losing your house over back taxes. Don’t be afraid to speak up and ask for help. Take action now before unpaid taxes put you at risk of foreclosure.

Bankruptcy: Temporary Protection from Foreclosure

If you’re a Wisconsin homeowner overwhelmed by back property taxes and facing foreclosure, bankruptcy may help you hit pause. Filing for bankruptcy triggers an automatic stay that halts most collection efforts and lawsuits against you, providing temporary relief.

This breather lasts while your bankruptcy case is active, giving you time to catch up on taxes or work out other solutions. Here’s how it works.

The Automatic Stay

The automatic stay is a powerful legal protection that starts the moment you file for bankruptcy. It immediately stops:

- Foreclosure sales and proceedings

- Tax lien auctions

- Wage garnishments

- Utility shut-offs

- Vehicle repossessions

- Debt collection calls and lawsuits

This gives you a financial fresh start while working through the bankruptcy process. The stay remains in effect until your debts are discharged.

Halting Tax Foreclosure

With delinquent property taxes in Wisconsin, the stay specifically prevents:

- The tax lien foreclosure auction

- Filing of a foreclosure lawsuit against you

- Further action if a case is already filed

Your lender also cannot legally foreclose or take possession of your home during this time. The stay protection kicks in immediately on filing day.

Duration of the Stay

How long does this last? The automatic stay remains in effect throughout your active bankruptcy case, which is typically:

- Chapter 7: up to 6 months

- Chapter 13: 3-5 years

The stay ends when you receive a discharge. Any dismissed or abandoned bankruptcy cases also lift the stay. So bankruptcy can “pause” a foreclosure for quite some time if you stick with it.

Getting Your Finances in Order

This breathing room gives you vital time to improve your situation. You can potentially:

- Find a new job or increase your income

- Work out affordable payment plans

- Lower monthly expenses

- Access hardship assistance programs

- Sell assets or tap home equity

As a last resort, bankruptcy at least delays foreclosure while you plan your next steps. Just beware – the taxes and liens don’t disappear. Avoid false hope.

The Catch: Tax Liens Survive

Here’s the big caveat: your property tax debts themselves are not discharged in bankruptcy. While the stay halts collections and foreclosure, the liens remain attached to your home.

After bankruptcy, the debts spring back to life. The county still has legal right to pursue payment or foreclose in the future. Make sure you have a plan to deal with the taxes.

Bankruptcy also damages your credit and stays on your record for years. Still, it can be a lifeline if you’re on the brink of foreclosure. Use the stay wisely to get back on your feet financially.

If tax liens are threatening your home, meet with a bankruptcy attorney. They can help you decide if bankruptcy is your best line of defense during this stressful time.

Selling Your Home to Avoid Foreclosure and Tax Debt

If you’re facing mounting back taxes and tax liens on your Wisconsin property, selling your home may be the best way out. This allows you to pay off the owed taxes and walk away before a foreclosure happens.

While not an easy choice, it can be a relief to leave all the property tax debt behind you. And if done right, you may even walk away with cash in your pocket.

How Selling Prevents Foreclosure

Here’s the benefit of selling with unpaid property taxes:

- The sale proceeds pay off your tax liens and owed taxes.

- The county is made whole, so they won’t pursue foreclosure.

- You are released from the debts and can move on.

By satisfying those obligations, you avoid having your home seized and sold at auction over delinquent taxes.

Using a Short Sale

If you owe more on your mortgage than the home’s current value, a short sale is the way to go. Here’s how it works:

- Home is listed below market value.

- Sale proceeds pay mortgage lender and property taxes.

- Lender accepts less than full loan payoff.

- Remaining tax debt may be waived.

While not ideal for the lender, a short sale prevents a lengthier foreclosure. Consult professionals to negotiate the best deal.

Maximizing Your Sale Proceeds

To net the most out of the sale and satisfy overdue taxes, be sure to:

- Price home competitively based on comps

- Offer flexibility on closing dates

- Make any needed repairs to maximize offers

- Stage home and declutter to show well

A few upgrades like paint, carpets, and landscaping go a long way. Bring in more offers to get top dollar. You want excess revenue after taxes to walk away with cash.

Understanding the Tax Implications

Any unpaid taxes not satisfied by the sale become your personal liability. The IRS treats this as taxable cancellation of debt income unless you meet insolvency requirements.

Selling may also result in capital gains taxes on any home appreciation. Consult a tax pro to understand your obligations.

Your Next Move After Selling

Once the home sells, make sure outstanding taxes are paid right away. Get documentation from the county showing $0 balance.

For your next move, consider downsizing to a more affordable property you can maintain long-term. Renting may be smartest if you no longer want homeowner responsibilities.

Review what went wrong and adjust accordingly. Build an emergency fund so you never end up in this spot again. With the debts cleared, you get a fresh start.

While emotionally difficult, selling to avoid foreclosure can be wise financially. Meet with a real estate attorney and agent to navigate the process smoothly.

Deeding Your Property to the County Voluntarily

If you’re facing mounting property tax debt in Wisconsin with no way to pay, voluntarily deeding your home to the county may be an option. This releases you from the unpaid taxes and transfers ownership, preventing foreclosure.

While not ideal, it can provide a relatively clean exit if you’re in over your head financially. Here’s how it works.

How Deeding Over Property Works

With overdue property taxes, you can essentially give or “deed” the home to the county assessor’s office. This includes signing over the title and keys free of charge.

The process is technically called a “conveyance in lieu of tax foreclosure.” By relinquishing ownership, it:

- Satisfies the delinquent property taxes

- Transfers maintenance responsibilities

- Allows you to walk away without owing anything further

Because the county becomes the rightful owner, they no longer have reason to pursue foreclosure against you.

Qualifying for a Deed in Lieu

To qualify for a deed in lieu in Wisconsin, the following conditions typically apply:

- Home is your primary residence

- Mortgage is smaller than property’s assessed value

- No other federal tax liens on the property

- You have minimal assets and can’t pay debts

Proper documentation and good faith efforts to pay are generally required. The assessor has discretion whether to accept the deed.

The Foreclosure Pros and Cons

Deeding over your property voluntarily has advantages and disadvantages:

Pros:

- Avoids credit damage and stress of a foreclosure

- No remaining mortgage deficiency or unpaid tax debts

- Allows you to walk away from burdensome property

- Takes less time than foreclosure process

Cons:

- You lose the property and equity for nothing

- No cash payout like in a home sale

- Won’t help with other debts owed

- Less change of reclaiming possessions left behind

If your only major debt is property taxes, deeding may make sense. But consult professionals first.

Alternatives to Consider First

Before voluntarily handing over property, be sure to explore all alternatives:

- Hardship assistance programs

- Payment plans

- Borrowing against home equity

- Selling the property yourself

- Bankruptcy to pause foreclosure

A deed in lieu should be a last resort. Consult with real estate and bankruptcy lawyers to negotiate the best outcome.

Foreclosure Process in Wisconsin: Auction and Beyond

In Wisconsin, properties with delinquent taxes owed for over 2 years face foreclosure – the legal process where the county seizes and sells your home at public auction. Here is what happens at each stage of tax foreclosure, from auction through eviction.

The Foreclosure Timeline

Wisconsin has a lengthy foreclosure procedure to give homeowners ample opportunities to pay before facing auction. Here’s how it progresses:

- Tax lien attached – After taxes go unpaid, a lien is placed on the property the following year.

- 2 year redemption period – Homeowner has 2 years to pay in full before foreclosure starts.

- Notice filed – County files a lis pendens notice that foreclosure may proceed.

- Lawsuit – County treasurer files suit for foreclosure judgment around March.

- Judgment – If no objection, judgment entered around June.

- Notice of sale – Property is advertised for public auction.

- Auction – typically held in August or September.

- Confirmation – Court confirms winning auction bid.

- Eviction – New owner can have previous owners evicted.

This process takes over 2.5 years from the initial tax delinquency. But once judgment occurs, foreclosure auction usually happens quickly.

The Foreclosure Auction

The public foreclosure auction is where the county sells your home to the highest bidder, usually on the courthouse steps. Here’s what to expect:

- Open bid process, with opening bid based on owed taxes.

- Cash deposit required from winning bidder.

- Excess money pays mortgage/other liens.

- Homeowner can redeem property until auction starts.

A third party buyer gets ownership after court confirmation. Auctions transfer property “as-is” with no guarantees.

After the Auction

If your home sells at foreclosure auction, here’s what to expect next:

- Pay any remaining deficiency – You owe any debt not covered by sale proceeds.

- Right of redemption expires – No undoing sale after court confirmation.

- Eviction notice – New owner will require you to move out.

- Vacate the property – Failure to leave may lead to forcible eviction.

- Credit damage – Foreclosure wrecks your credit for years.

The new tax deed owner has full legal rights. A foreclosure auction means permanently losing your property.

Avoiding Auction

To avoid foreclosure auction, be sure to redeem delinquent taxes before the judgment. Work out affordable repayment plans or access hardship resources. Consult professionals to negotiate alternatives like bankruptcy or deed in lieu.

Foreclosure is emotionally devastating and financially damaging. If you receive a foreclosure notice, don’t wait – take immediate steps to defend your property rights.

Defenses and Objections to Stop a Tax Foreclosure

Finding yourself facing a tax foreclosure can be an incredibly stressful and uncertain time. With your home or property on the line, you may feel powerless against the local government pursuing action against you. However, there are a number of defenses and objections you can raise to potentially stop a tax foreclosure in its tracks in Wisconsin.

The first step is understanding the foreclosure process. In Wisconsin, if you fail to pay property taxes for one or more years, your property can be placed on the annual tax bill “roll.” This means the county has now taken a tax certificate against your property due to the delinquent taxes. You will receive multiple notices informing you of the amount owed and requesting payment. If the past due taxes remain unpaid after a period of time specified by the county (often 2 years), your property will be put up for public auction or tax deed sale.

To stop this process, you have to act quickly and decisively when you receive notices about owing back taxes. Some of the most common defenses and objections include:

- Improper notice – If you were not properly informed of the unpaid taxes or pending foreclosure, you may be able to challenge the foreclosure proceedings. Be sure to keep all notices and letters from the taxing authority.

- Payment already made – If you have evidence you already paid the taxes owed, such as cancelled checks or money order receipts, present this to the county treasurer.

- Financial hardship – You may be able to delay a foreclosure proceeding if you can demonstrate facing unusual financial hardship, such as job loss or major medical bills.

- Tax exemption – If your property should have been tax exempt, you can challenge the underlying tax bill.

- Incorrect property assessment – You may fight the foreclosure if your property value was assessed inaccurately, resulting in higher taxes.

- Bankruptcy – Filing for bankruptcy triggers an automatic stay, pausing any tax foreclosure while the bankruptcy case proceeds.

- Violations of federal law – If you believe the foreclosure proceedings violate the Fair Debt Collection Practices Act or other federal laws, you may sue to stop the foreclosure.

In addition to defenses that could completely stop a Wisconsin tax foreclosure, you may also raise objections to delay the process and buy yourself more time. Here are some common ways to object to a tax foreclosure:

- Request a payment plan – Rather than pay the full past due amount, you may ask the county treasurer for a manageable installment agreement to pay back the delinquent taxes over time.

- Request an extension to pay – If you explain your financial hardship, the county may grant you several extra months to come up with the money before they proceed with foreclosure.

- Ask about special programs – Many counties have special programs to assist taxpayers who have fallen behind, such as tax deferral for seniors or tax abatement for low-income households.

- File a property tax appeal – You may be able to lower your overall property tax burden by challenging the assessed value or classification of your property.

- Attempt tax debt settlement – Some counties will agree to settle tax debts for less than the full amount owed, if you can pay promptly in a lump sum.

As you can see, Wisconsin law provides many potential defenses and objections if you find yourself facing tax foreclosure. To fully protect your rights and property, consult with a local real estate attorney as soon as possible after receiving any notices about delinquent property taxes. An experienced lawyer can carefully review your case and help craft the strongest defense or objection to stop the foreclosure. Don’t wait until the last minute or you could be at risk of losing your property!

Reclaiming Your Property After Foreclosure

Losing a home or property to foreclosure can be devastating. Not only is it emotionally taxing, but you may also believe there is no way to reclaim your property after the foreclosure auction or tax deed sale. However, Wisconsin law does provide certain rights for previous owners to buy back foreclosed property under specific circumstances.

If your home goes into foreclosure because you fell behind on mortgage payments, the lender that held the mortgage will become the owner after the foreclosure sale. In most cases, there is no right of redemption – meaning no way to undo the sale and reclaim the property. However, an exception applies if the purchaser at the sale was the original mortgage lender. You then have 12 months after the sale to repay the lender the foreclosure sale purchase price plus 5% interest and costs, after which you can take ownership again.

For tax foreclosures, the process is different. If your property is foreclosed on due to delinquent property taxes, the county becomes the owner. However, Wisconsin provides a lengthy redemption period of 2 to 5 years, during which you can reclaim the property by paying the back taxes, interest, and penalties. The exact length depends on population:

- 2 years for counties with population over 500,000

- 3 years for counties between 250,000 and 500,000

- 4 years for counties between 100,000 and 250,000

- 5 years for counties under 100,000

It’s important to note the redemption window closes quickly once the county petitions for a tax deed, so act fast. You must pay all owed amounts before the court issues the tax deed transferring full ownership. If you fail to redeem during this period, your right to reclaim the property likely disappears forever.

For both mortgage and tax redemption periods, there are very specific procedures to follow. Here are some tips that can help you navigate the process:

- Get the details – Contact the county treasurer’s office to find out the exact amount needed to redeem the property, including any interest and fees.

- Verify the deadline – Confirm the last day you have to repay before losing redemption rights.

- Avoid delays – Start the redemption process early, as it can take weeks to get full payment approved.

- Send proper payment – Carefully follow instructions about approved payment methods, who to make the check payable to, where to send funds, etc.

- Follow up – After sending payment, follow up to ensure the county received it and is processing the redemption.

- Consult an attorney – Have a real estate lawyer review your case to protect your redemption rights.

While not required, hiring an attorney is highly recommended when trying to reclaim a foreclosed property. The redemption process has strict deadlines and complexities that can jeopardize your rights if handled improperly. An experienced real estate lawyer can walk you through the steps, defend your interests, and give your case the best possible chance of success.

Beyond paying the redemption amount, there are other options that may allow you to reclaim a foreclosed home:

- Loan assumption – If the property was bought by an investor at auction, you may be able to strike a deal to assume their loan and take over ownership.

- Purchase from new owner – The new owner after foreclosure may be willing to sell the property back to you.

- Bankruptcy – In some limited cases, filing bankruptcy can unwind a completed foreclosure and help you reclaim the property.

- Loan modification – If facing mortgage foreclosure, you may qualify for an alternative arrangement to avoid foreclosure and remain the owner.

While foreclosure cuts off your legal ownership rights, there are still options to reclaim your property in Wisconsin. Understanding the redemption process and consulting an attorney gives you the best shot at getting your house or land back after foreclosure.

Moving On: Rebuilding Your Finances After Losing a Home

Losing your home to foreclosure or being forced to do a short sale can be a massive financial and emotional setback. Your credit score likely took a hit, and you may have lost all the equity you had built up. While it may take time to recover, with the right focus and discipline, you can get your finances back on track after losing a home in Wisconsin.

The first priority is finding stable housing you can afford. Consider lower cost options like renting an apartment or even staying with family temporarily. Make sure your total housing expenses account for no more than 30% of your monthly gross income. If you need assistance, programs like Section 8 Housing Vouchers can help cover a portion of your rent.

Next, take control of your budget. Track all monthly income sources, either from a job, child support, government benefits, etc. Then list out essential expenses like rent, utilities, groceries, and debt payments. Look for areas where you can trim spending, like eating out less, lowering your phone plan, or canceling unused subscriptions. Having a detailed budget helps you focus cash on priorities until you get back on your feet.

While it may be tempting to use credit cards or payday loans to get by, avoid taking on new high-interest debt whenever possible. These predatory lending products often trap borrowers in cycles of ever mounting payments and fees. Don’t compound your financial issues.

If you do need money, explore alternatives like borrowing from family or friends, using low-interest financing from a credit union, or applying for government and nonprofit assistance grants.

You’ll also want to start rebuilding your credit. Pull your credit reports and review all negative items that resulted from the foreclosure or short sale. Time is your ally here, as most derogatory marks stay on your reports for 7 years or less. As they age, they’ll hurt your score less. You can also offset them by consistently paying all other accounts on time and keeping credit balances low.

Additional tips for credit repair include:

- Pay down card balances to lower your credit utilization ratio

- Become an authorized user on someone else’s account in good standing

- Request goodwill removals of late payments reported in error

- Dispute any inaccurate information with the credit bureaus

Saving up an emergency fund must become a top savings goal after losing a home.Aim to stockpile 3-6 months of living expenses in a savings account. This provides a financial cushion so you don’t miss bill payments if you lose a job or face an unexpected expense. Even small, regular contributions to savings add up over time.

Lastly, consider talking to a housing counselor or non-profit credit counseling agency for guidance tailored to your situation. They can help you make a personalized plan and take advantage of programs designed for people recovering from foreclosure and debt hardship.

Rebuilding financially after losing your home takes diligence, patience, and perseverance. But implementing budgeting strategies, limiting debts, and improving your credit can put you back on a stable path. Don’t get discouraged – take it one step at a time. With commitment to better financial habits, you can recover and create a fresh foundation for your future.