How are strategic partnerships reshaping the sports licensing landscape. What innovative deal structures are unlocking new value in sports licensing. Why is understanding fan motivations crucial for successful sports licensing programs. How can sports brands expand their reach through strategic licensing partnerships.

The Evolution of Sports Licensing as a Major Revenue Stream

Sports licensing has come a long way since its humble beginnings in the 1970s. What started as simple trademark licensing of team names and logos has blossomed into a multi-billion dollar industry. How did this transformation occur? The growth was largely driven by fans’ insatiable desire to show support for their favorite teams through merchandise.

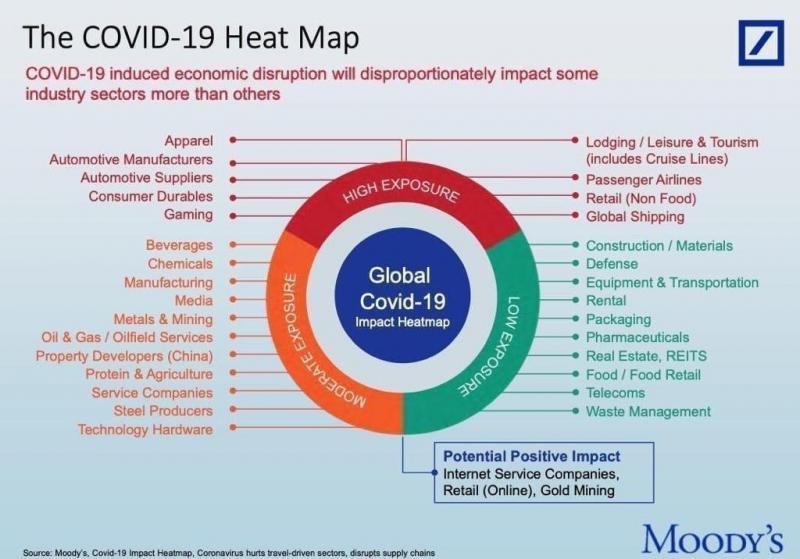

Today, the sports licensing ecosystem spans an incredibly diverse range of consumer product categories. From apparel and collectibles to food, beverages, electronics, and even financial services, licensed sports products have permeated nearly every aspect of consumer life.

Strategic partnerships have played a pivotal role in accelerating this growth. Major apparel and footwear brands striking deals with leagues have expanded retail distribution into new channels. Individual athletes partnering with consumer product companies have created massive new licensing opportunities. The rise of fantasy sports and legalized betting has opened up licensing potential around statistics and gaming.

The Financial Impact of Sports Licensing

To grasp the sheer scale of sports licensing today, consider these figures:

- The NFL generates over $1.5 billion annually from licensing revenue

- The NBA brings in around $900 million per year from licensing

- Even small market teams can earn tens of millions annually from licensing deals

These numbers underscore how licensing has transitioned from an afterthought into a major enterprise within the sports industry. Rights holders now devote significant resources to managing partnerships and exploring new licensing frontiers.

Key Trends Reshaping the Sports Licensing Landscape

The sports licensing market is constantly evolving, driven by shifts in consumer behavior, technology, and societal trends. Understanding these changes is crucial for rights holders looking to maximize their licensing revenue. What are some of the key trends reshaping the landscape?

The Ecommerce Revolution

How has the rise of ecommerce impacted sports licensing? Online platforms now account for over 30% of licensed merchandise sales, providing access to a global consumer base. This shift necessitates an online-first mentality for sports licensing programs. Brands must optimize their digital presence and ensure seamless online purchasing experiences for fans.

The Surge in Women’s Sports

Women’s sports are experiencing unprecedented growth in viewership and participation. How should licensing programs adapt? There’s a growing need to emphasize inclusivity and develop gender-neutral product lines. Brands that successfully tap into this market can unlock significant new revenue streams.

Direct-to-Consumer Sales

Why are more sports brands selling merchandise through owned ecommerce channels? Direct-to-consumer sales allow brands to build deeper fan connections and leverage first-party customer data. This data can be used to personalize offers and create more targeted marketing campaigns.

Gaming and Fantasy Sports

How have gaming and fantasy sports transformed the licensing landscape? The legalization of sports betting and the popularity of fantasy sports have turned statistics and highlights into lucrative assets to license. This opens up entirely new categories for sports licensing programs to explore.

International Market Potential

While North America still dominates the sports licensing market, emerging markets in Asia and Latin America offer untapped potential. How can brands capitalize on this opportunity? Tailoring licensing strategies to local preferences and partnering with region-specific retailers can help sports brands expand their global footprint.

Innovative Partnership Structures Unlocking New Value

Gone are the days when sports licensing partnerships followed a simple, one-size-fits-all structure. Today’s complex marketplace demands more creative deal structures tailored to each partner’s strengths. What are some of the innovative approaches being used?

Co-Branded Merchandise Lines

How can co-branded merchandise lines benefit both parties? When sports brands collaborate with major consumer brands on unique product lines, they can leverage each other’s strengths. This approach can lead to premium pricing, expanded distribution, and increased brand exposure for both partners.

Data Sharing Agreements

Why are data sharing agreements becoming more common in sports licensing deals? As the value of consumer data continues to grow, partnerships that include provisions for sharing customer insights can be mutually beneficial. This data can inform product development, marketing strategies, and future licensing opportunities.

Revenue Sharing Models

How do revenue sharing models differ from traditional licensing agreements? Instead of a fixed royalty rate, some partnerships now involve more complex revenue sharing structures. These can include tiered royalty rates based on sales targets, profit-sharing arrangements, or even equity stakes in licensee companies.

Exclusive Limited-Edition Drops

Why are exclusive, limited-edition product drops becoming popular in sports licensing? These strategies create a sense of urgency and exclusivity that can drive fan engagement and boost sales. They’re particularly effective when tied to specific events or milestones.

Understanding Fan Motivations: The Key to Successful Licensing Programs

At the heart of any successful sports licensing program lies a deep understanding of fan motivations. Why do fans buy licensed merchandise? What emotional needs are they fulfilling? By answering these questions, rights holders can create more targeted and effective licensing strategies.

The Psychology of Fandom

How does psychology play into sports merchandise purchases? Fans often buy licensed products as a way to express their identity and feel connected to their favorite teams or athletes. Understanding these psychological drivers can inform product development and marketing strategies.

Generational Differences in Fan Behavior

Do different generations engage with sports brands in different ways? Absolutely. While older fans might prioritize traditional memorabilia, younger fans often seek out more lifestyle-oriented products that integrate with their daily lives. Successful licensing programs cater to these diverse preferences.

The Role of Social Media

How has social media changed the game for sports licensing? Platforms like Instagram and TikTok have become powerful tools for showcasing licensed products and driving sales. They also provide valuable insights into fan preferences and trends.

Expanding Reach Through Strategic Partnerships

Strategic partnerships are key to expanding the reach of sports licensing programs. How can rights holders identify and leverage the right partnerships to maximize their impact?

Tapping into New Demographics

How can partnerships help sports brands reach new audiences? By partnering with brands that have strong followings in different demographic groups, sports properties can expand their fan base and create new licensing opportunities.

Geographical Expansion

What role do partnerships play in geographical expansion? Local partners can provide invaluable insights into regional preferences and help navigate cultural nuances when entering new markets.

Cross-Industry Collaborations

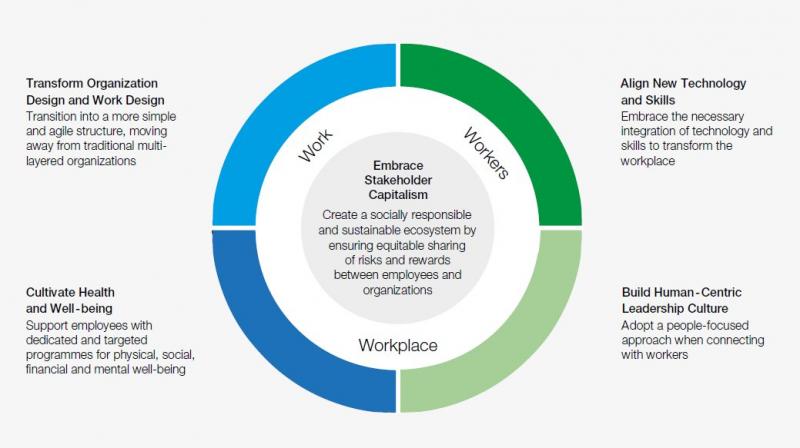

Why are cross-industry collaborations becoming more common in sports licensing? Partnerships that bridge different industries can create unique product offerings that appeal to a broader range of consumers. For example, a sports team partnering with a tech company to create smart apparel or wearable devices.

The Future of Sports Licensing: Embracing Technology and Innovation

As we look to the future of sports licensing, technology and innovation will play increasingly important roles. How are cutting-edge technologies shaping the industry?

The Impact of Augmented and Virtual Reality

How might AR and VR technologies transform sports licensing? These technologies could create entirely new categories of licensed products, such as virtual merchandise for avatars or AR-enhanced collectibles.

Blockchain and NFTs

What potential do blockchain and NFTs hold for sports licensing? Non-fungible tokens (NFTs) have already made waves in the sports collectibles market. As this technology matures, it could revolutionize how digital sports assets are licensed and traded.

Personalization at Scale

How is technology enabling greater personalization in sports licensing? Advanced manufacturing techniques like 3D printing and on-demand production are making it possible to offer highly customized licensed products at scale.

Navigating Challenges in the Sports Licensing Landscape

While the future of sports licensing looks bright, it’s not without its challenges. What are some of the key issues that rights holders and licensees need to navigate?

Counterfeiting and Brand Protection

How can sports brands protect themselves against counterfeiting? As the market for licensed sports merchandise grows, so does the threat of counterfeiting. Implementing robust brand protection strategies, including the use of advanced authentication technologies, is crucial.

Balancing Exclusivity and Accessibility

How can brands strike the right balance between exclusivity and accessibility? While limited-edition drops can drive excitement, brands also need to ensure that core fans have access to affordable licensed merchandise.

Sustainability Concerns

How are sustainability concerns impacting sports licensing? With growing consumer awareness about environmental issues, sports brands need to consider the sustainability of their licensed products. This could involve using eco-friendly materials or implementing circular economy principles in production.

Adapting to Rapidly Changing Consumer Trends

How can licensing programs stay agile in the face of rapidly changing consumer trends? Implementing robust market research processes and maintaining flexibility in partnership agreements can help brands quickly adapt to shifting consumer preferences.

As we’ve explored throughout this article, strategic partnerships are indeed key to maximizing revenue in the future of sports licensing. By understanding market trends, innovating in partnership structures, tapping into fan motivations, and leveraging technology, sports brands can unlock tremendous value through their licensing programs. The future of sports licensing is dynamic and full of opportunity for those willing to think creatively and forge strategic alliances.

Introduction – The importance of strategic licensing partnerships in sports

Sports licensing has evolved from a niche revenue stream into a multi-billion dollar industry over the past few decades. As sports properties have become more sophisticated in monetizing their brands, strategic partnerships have emerged as a key driver of licensing revenue. For both sports leagues and individual teams, choosing licensing partners carefully and creatively tapping into new revenue opportunities can pay major dividends.

In an era of exploding media rights fees and massive investments in stadiums and facilities, licensing stands out for its ability to generate revenue at a high profit margin. This article will examine why thoughtful licensing programs and partnerships are critical for fully capitalizing on sports brands in today’s marketplace. We’ll look at trends reshaping the sports licensing landscape, innovative new deal structures, and case studies of impactful partnerships. The future success of sports licensing hinges on the ability to think creatively, understand fan motivations, and align with partners who can expand reach into new demographics, regions, and retail channels.

The Evolution of Sports Licensing into a Major Revenue Stream

The sports licensing industry began with trademark licensing of team names and logos in the 1970s. For many years, it was viewed as secondary to ticket sales, media rights, and sponsorships in terms of revenue generation. However, licensing revenue grew steadily, driven by fans’ desire to show their support for favorite teams through merchandise. This built the foundation for today’s licensing ecosystem which spans consumer products categories ranging from apparel and collectibles to food, beverages, electronics, and financial services.

Strategic partnerships have accelerated the growth. Leagues striking deals with major apparel and footwear brands expanded retail distribution into new channels. Individual athletes partnering with consumer product companies created massive new licensing opportunities. The rise of fantasy sports and legalized betting created licensing potential around statistics and gaming. Today’s mix of endemic and non-endemic partnerships provide rights holders with a diversified portfolio of licensed products generating royalties.

NFL licensing revenue now totals over $1.5 billion annually, while the NBA generates around $900 million. Even small market teams bring in tens of millions per year. As this overview shows, licensing has transitioned from an afterthought into a major enterprise within the sports industry. Rights holders now devote significant resources to managing partnerships and exploring new licensing frontiers. The next sections will examine current trends and innovative deals powering this growth.

Key Trends Reshaping the Sports Licensing Landscape

Several marketplace shifts have sports leagues and teams reexamining their licensing strategies. The following trends are driving increases in both revenue and partnership opportunities:

- Rise of ecommerce expands retail availability – Ecommerce now accounts for over 30% of licensed merchandise sales. Online platforms provide access to a global consumer base. Sports licensing must adopt an online-first mentality.

- Growth of women’s sports – Viewership and participation in women’s sports is surging. Licensing programs must emphasize inclusivity and gender-neutral product lines.

- Direct-to-consumer sales build deeper fan connections – Sports brands now sell merchandise through owned ecommerce channels, leveraging first-party customer data to personalize offers.

- Gaming and fantasy sports open new categories – Legal sports betting and fantasy sports transform statistics and highlights into lucrative assets to license.

- International markets represent untapped potential – While North America still dominates, emerging markets in Asia and Latin America offer new licensing frontiers.

Rights holders must continually assess partnerships to ensure they align with major trends. Some legacy deals may not provide the capabilities needed to capitalize on these marketplace shifts. Being willing to replace partners that cannot evolve allows leagues and teams to fully exploit new licensing opportunities.

Innovative Partnership Structures Unlock Value

Traditional sports licensing partnerships followed a simple structure: a league or team grants a license to use trademarks on products in certain categories and earns a royalty rate around 5-15% of wholesale revenue. But today’s complex marketplace demands more creative deal structures tailored to each partner’s strengths. Some innovative new partnership approaches include:

- Co-branded merchandise lines – Sports brands collaborating with major consumer brands on unique product collections (Nike/NBA jerseys).

- Multi-year category exclusivity – Granting one brand exclusive long-term access to highly coveted categories (Fanatics’ 10-year trading card exclusivity with MLB/MLBPA).

- League equity stakes – Taking partial ownership in licensees to incentivize growth (MLB taking a stake in Fanatics).

- Royalty relief for expansion into new channels – Lowering royalty rates to incentivize partners to penetrate new channels and regions.

- Revenue sharing models – Sharing net profits from licensed products instead of earning fixed royalty rates.

Rights holders must consider granting additional benefits beyond basic IP access in order to incentivize partners to maximize licensing potential. Offering preferential access, equity components, or royalties relief gives licensees more motivation to expand distribution and penetrate new product segments.

Case Studies of High-Impact Licensing Partnerships

Let’s examine case studies showing how innovative partnerships can reap major benefits:

The NFL granted Fanatics broad ecommerce rights, leading to the creation of online stores for all 32 NFL teams. Fanatics gained deep access to NFL brands and brought its expertise in manufacturing, distribution, and online retail. This provided NFL fans globally with a seamless destination for licensed merchandise. Fanatics has since expanded into trading cards through acquiring Topps. The NFL subsequently granted Fanatics long-term exclusivity in the category. This mutually beneficial partnership remains a blueprint for how to maximize licensing through ecommerce.

This game-changing partnership set a new standard for sports league co-branding. Nike gained the rights to produce NBA uniforms and apparel featuring both brand logos. Nike could then sell co-branded NBA merchandise at its 30,000 global retail outlets. The NBA mandated that teams have three core uniforms with Nike designing a vast array of alternate and classic edition jerseys. This expanded product selection and catalyzed sales of licensed NBA merchandise. Annual NBA licensing revenue jumped from $400 million with Adidas to over $1 billion with Nike.

This partnership exemplifies creative co-branding even beyond major pro sports. Little League Baseball and Lids teamed up to create custom co-branded hats for participating Little League teams. This allowed parents and fans to purchase merchandise identical to what their child wears on the field, fueling emotional connections with the brand. The program helped Little League extend its reach into headwear and broaden merchandise sales beyond just baseballs and jerseys.

Conclusion

As these examples illustrate, sports licensing partnerships have evolved far beyond basic trademark licensing agreements. Capturing the full value of a sports brand requires creative thinking and willingness to implement innovative deal structures. Licensees who can expand distribution into new channels and regions, penetrate new product categories, and provide compelling co-branded merchandise will emerge as the most attractive partners.

Sports leagues and teams must continually re-assess the fast-changing licensing landscape to identify areas of untapped potential. Partners unable to evolve should be replaced by brands offering the capabilities needed to capitalize on emerging trends. With a thoughtful strategy and the right partners in place, sports licensing can continue growing into an increasingly critical revenue stream. The future winners will be brands who leverage partnerships strategically to provide fans with the products they want, when and how they want them.

Current state of the sports licensing industry and market size

The sports licensing industry has grown tremendously over the past few decades, evolving from a niche business into a multi-billion dollar global enterprise. Fueled by fans’ insatiable demand for merchandise representing their favorite sports brands, leagues, and athletes, licensing now generates significant revenue across major professional and college sports.

According to industry analysts, global retail sales of licensed sports merchandise hit $27 billion in 2019. The market size decreased to $21.6 billion in 2020 due to the COVID-19 pandemic’s impact, but revenues are projected to rebound to over $31 billion by 2025. Clearly, sports licensing has proven its resilience and long-term growth trajectory.

In North America, the NHL, NBA, MLB, MLS, and NFL each generate between $300 million to over $1.5 billion annually in licensing revenue through retail sales of products bearing their intellectual property. College sports also represent a lucrative licensing market, with powerhouse programs like University of Texas and LSU each earning over $10 million per year in royalties.

Even outside the major pro and college ranks, licensing opens up revenue potential. For example, the Irvine-based National Wheelchair Basketball Association brokers deals for its players to earn licensing income, demonstrating the scope of possibilities.

Apparel Dominates But New Categories Emerge

Currently, apparel represents over 75% of the global licensed sports merchandise market. This includes team jerseys, athlete-branded t-shirts, caps, jackets, and other garments displaying sports league and team logos and graphics. Fan affinity for showing off their team pride by wearing branded apparel fuels massive sales volumes.

However, sports licensing now encompasses a diverse range of consumer products. Categories like video games, toys, accessories, home goods, gifts, novelty items, and youth equipment generate billions in additional revenue. Rights holders also earn licensing income from sporting goods, collectibles, and trading cards featuring their brands and intellectual property.

Newer licensing categories have emerged around sporting events, performance data, and legalized sports betting. For instance, the NFL earns royalties from companies like Caesars Sportsbook and DraftKings for use of NFL trademarks and game data. These expanded licensing frontiers offer incremental revenue streams.

Strategic Partnerships Fuel Growth

Strategic licensing partnerships serve as the engine propelling sports licensing’s growth. Leagues and teams collaborating with licensees to reach untapped markets and expand product offerings generates mutual benefits.

On the apparel front, the NBA’s co-branding partnership with Nike transformed the league’s licensed merchandise sales. Deals providing major consumer brands like Adidas, Under Armour, and Fanatics with long-term exclusivity in key categories incentivize them to maximize royalties. Sports organizations granting licensees royalty reductions for reaching new international markets accelerates global expansion.

These creative partnership frameworks provide licensees with the incentives needed to develop innovative products and penetrate new distribution channels. In turn, leagues and teams earn dramatically higher licensing revenues.

Ecommerce Emerges as Critical Channel

As consumer shopping patterns shift online, ecommerce has emerged as the most important retail channel for sports licensing. Many industry analysts now estimate over 30% of licensed merchandise sales occur through online stores and marketplaces like Amazon, Fanatics, Walmart.com, and Target.com.

Sports brands have adapted by launching online “team stores” to sell licensed merchandise directly to fans. The NFL, NBA, and MLB have created ecommerce partnerships with Fanatics to develop official online stores spanning all their teams. College athletic programs are also getting in on the action, leveraging e-commerce to sell licensed gear to alumni and fans nationwide.

With global digital access, ecommerce provides rights holders an efficient channel to tap into the insatiable appetite of fans worldwide for sports licensed merchandise. Savvy organizations recognize online retail’s current and future importance to licensing programs.

Flexibility Needed Amid Industry Shifts

While the sports licensing industry exhibits strong growth, it remains imperative for participants to continually reevaluate strategies. Trends like the rise of player marketing, movement toward gender-neutral products, expansion into developing markets, and Web3 licensing requires flexibility.

Leagues and licensees must monitor shifts in consumer preferences, economic conditions, and technology to capitalize on emerging opportunities. Adapting through innovative new partnership models, retail activations, and product development will propel future success. Sports licensing industry leaders realize they must evolve strategies along with fan desires and marketplace dynamics in order to maximize revenues.

The Future Is Bright for Sports Licensing

In summary, the multi-billion dollar sports licensing industry appears headed for continued expansion. While apparel maintains dominance, new categories and distribution channels create untapped potential. Strategic partnerships between sports organizations and licensees will unlock future growth, especially as international revenues represent a massive frontier. With the ability to capture global fan engagement and team passion through merchandise sales, sports licensing’s position as a revenue powerhouse looks assured. But only the innovators will fully seize the opportunities ahead.

Benefits of licensing deals for sports leagues and franchises

For major sports leagues and individual franchises, licensing represents a massive revenue opportunity. Strategic licensing programs and partnerships provide rights holders with a diversified income stream that leverages their powerful brands and intellectual property. Let’s examine why this matters and key benefits sports organizations realize from consumer product licensing.

Licensing Generates Billions with Minimal Risk

Unlike ticket sales or sponsorships, licensing requires minimal upfront investment from sports leagues and teams. Yet it can generate comparable revenues since all major sports organizations make hundreds of millions annually from licensing programs.

With licensing, sports brands simply provide access to intellectual property like trademarks, logos, and game footage to partners who handle product design, manufacturing, and sales. In exchange, they earn royalty payments on merchandise sold bearing their IP – typically 5-15% of wholesale prices.

This asset-light, high margin revenue stream diversifies income with little execution risk or overhead. Once deals are signed, leagues sit back and collect checks as partner sales ramp up. The lucrative returns and low risk make licensing an appealing business.

Taps into Fans’ Desire for Branded Merchandise

Licensing also succeeds because it directly taps into sports fans’ appetite for merchandise and apparel representing their favorite brands. Fans take pride in publicly displaying team logos, inspiring deep emotional connections with leagues and franchises.

This fuels massive consumer demand and sales volumes for branded products in categories like apparel, collectibles, toys, gifts, accessories, and home goods. Granting partners access to IP unleashes teams’ ability to monetize this demand.

The addressable market consists of entire fan bases worldwide, driving significant growth potential. leagues and teams would be unable to fully capitalize on this appetite without licensing programs.

Drives Global Brand Reach and Visibility for Sports

Effective licensing partnerships dramatically expand the global visibility and commercial reach of sports brands. When merchandise appears at retailers worldwide and ecommerce sites like Amazon, it provides constant brand impressions to new audiences.

Sports leagues counting on licensing for over $1 billion in annual revenue demand programs that make their brands ubiquitous. Strategic partnerships ensure merchandise distribution penetrates all major channels and regions. This provides strong consumer brand awareness lift that benefits sponsorship sales and broadcast rights negotiations.

Provides Full Control Over Brand Presentation

Unlike counterfeit black market merchandise, officially licensed products enable leagues to control brand presentation and quality. League policing minimizes inferior, unsafe products that could tarnish image.

With licensing, sports can required style guides, approve designs, set quality standards, and monitor manufacturing. Full control and oversight helps leagues carefully curate their brands to maximize appeal and value. After all, these billion-dollar brands represent irreplaceable assets.

Drives Incremental Revenue from New Categories

A benefit of effective licensing programs is the ability to expand into innovative new product categories that offer fresh merhandising and partnership opportunities.

For example, many leagues now participate in gaming licensing deals with sportsbooks, fantasy providers, and video game publishers. Access to real-time data and footage fuels growth of collectibles and trading cards for e-commerce sales. These emerging categories unlock incremental licensing income.

Ongoing category expansion keeps leagues at the forefront of consumer trends and allows them to continually create new revenue streams.

Licensing: An Indispensable Growth Engine

In summary, licensing provides indispensable benefits for professional sports leagues and franchises seeking diversified, global revenue streams. With careful management, licensing allows brands to maximize monetization of passionate, worldwide fan bases through merchandising partnerships.

Expect licensing to take on an even greater role in the future growth plans and revenues of leagues and teams. Whether revitalizing existing partnerships or launching innovative new programs, the potential remains massive.

Case studies of successful sports licensing deals (NFL, NBA, etc)

Sports licensing landscape is filled with both transformational partnerships and cautionary tales. Examining high-impact deals that shaped licensing can provide valuable lessons for rights holders seeking to maximize brand value. Here we analyze case studies from the NFL, NBA, MLB, NHL and colleges revealing keys to successful sports licensing programs.

NFL + Fanatics

The NFL’s landmark 10-year partnership with Fanatics to create online stores revolutionized league e-commerce. Fanatics gained rights to produce NFL-licensed merchandise and operate ecommerce flagships for all 32 teams. This provided a seamless destination meeting fans’ demand for licensed gear.

Rather than a basic royalty-based structure, the NFL took an equity stake in Fanatics to share in its growth. The league also granted Fanatics key category exclusivity, including an expanded trading cards deal in 2021.

This incentive-based deal made Fanatics a trusted steward of the NFL brand. With expertise in supply chain logistics and online retail, Fanatics has delivered massive merchandise sales volumes. Online now represents over 30% of NFL’s $1.5 billion in annual licensing revenue.

NBA + Nike

In 2017, Nike and the NBA signed an 8-year, $1 billion partnership making Nike the official on-court apparel provider. However, the deal’s real impact came from rights to produce NBA-branded merchandise.

The co-branded NBA/Nike merchandise could be sold across Nike’s vast distribution network and retail stores worldwide. Nike gained extensive access to NBA branding and personalities to integrate into marketing.

This catalyzed explosive growth in NBA licensed merchandise sales, from $400 million to over $1 billion annually after signing with Nike. The deal’s unique co-branding terms created a licensing home run.

MLB + New Era

In 1993, MLB signed an exclusive headwear partnership with New Era that has spanned almost 30 years. The deal provided New Era with rights to produce on-field caps for MLB teams and market co-branded fan gear.

While MLB could have shopped the rights annually, it chose to take a long-term view valuing loyalty. This incentivized New Era to heavily promote MLB branding and continually update cap designs.

Exclusivity in the headwear category helped turn New Era into a market leader while providing MLB with a staple merchandising stream and strong channel presence.

NHL + Adidas

When Adidas became the NHL’s official uniform and apparel partner in 2017, the goal was boosting the league’s merchandising revenue closer to the NBA and NFL’s levels.

Adidas gained broad rights to NHL IP and branding across all consumer products categories. With Adidas’ design capabilities and distribution scale, the partnership succeeded in significantly elevating NHL merchandise presence.

Within two years, annual NHL licensing revenue grew 25%, demonstrating how an endemic brand’s expertise can unlock value for a league’s IP.

Texas Longhorns + Nike

In 2000, the University of Texas partnered with Nike for a groundbreaking $150 million, 10-year deal that changed college licensing. While many colleges had shoe deals, this was the first all-encompassing brand partnership.

Nike gained access to UT logos and branding for apparel and merchandising, essentially becoming the university’s licensing division. The UT brand gained national exposure through Nike’s marketing.

Annual royalties jumped from $1.5 million to over $10 million for UT. Nike set the blueprint for college athletic licensing programs integrated with brand partners.

Key Takeaways

These case studies showcase partnerships taking sports licensing revenues to new heights. Some keys to their success include exclusive access, co-branding, long-term commitment, distribution scale, marketing integration, and incentive structures ensuring both parties win.

Rights holders and licensees seeking transformative deals should examine these examples. Strategic licensing partnerships remain vital for unlocking the full merchandising and brand-building potential for sports brands.

How to identify potential licensing partners

For sports leagues and teams, choosing the right licensing partners is crucial for building lucrative, long-term merchandise programs. With countless brands competing for deals across categories, determining which warrant consideration requires strategic analysis. Here are key factors rights holders should evaluate when identifying potential licensing partners:

Distribution Scale and Retail Presence

Ideal partners boast the manufacturing infrastructure and retail relationships to achieve massive distribution scale for licensed merchandise. Assessing a brand’s presence across key channels reveals its growth potential.

For example, licensees embedded in big box stores, sporting goods retailers, and major e-commerce marketplaces ensure access to mass-market consumer audiences. Significant retail distribution capabilities indicate a licensing partner capable of driving high sales volumes.

Financial Strength and Capability to Support Growth

Licensing deals often require sizeable upfront investments from licensees to design products, acquire inventory, and fund launch marketing. Potential partners should undergo financial vetting to evaluate their balance sheet strength.

Financially solid firms can better support ambitious growth plans and withstand downturns. Resources to invest in licensing success signals a partner positioned to maximize revenue for the rights holder.

Brand Equity and Market Positioning

Ideal licensing partners boast strong brand recognition among sports fans that will transfer to licensed merchandise. For example, market leaders like Nike and Adidas offer the halo effect of their powerful consumer brands.

Partners seen as authentic and aligned with a league or team’s positioning makes merchandising deals more impactful. The partner brand’s equity and goodwill provides lift to licensed products.

Design and Technical Capabilities

Top licensing partners possess strong technical and design expertise for developing attractive, compelling merchandise. This includes apparel fabrication, digital printing, and sourcing high-quality materials.

Partners with limited design experience or product development skills may struggle transitioning sports IP into appealing products. Internal capabilities to translate IP into products fans crave provides advantage.

Commitment to Innovation

Leagues should assess a potential partner’s roadmap for continuously innovating licensed merchandise and retail experiences. Is the company actively investing in areas like digital commerce, metaverse expansion, and sustainability?

Partners dedicated to pushing licensed merchandise into new frontiers can reveal untapped revenue potential. A demonstrated commitment to innovation ensures deals evolve along with fan demands and preferences.

Cultural Synergy with Sports Brand

The ideal licensing alliances align partner brands with the cultural ethos of a league or team. For instance, partners rooted in sports culture like Nike and Adidas reinforce authenticity.

Culturally “on-brand” partners who reflect the league’s values and resonate with fans make licensing deals more credible. This cultural fit ensures smooth collaboration.

Proven Track Record

Of course, past success predicts future performance. Potential partners with a portfolio of impactful licensing deals have already demonstrated executable strategies.

A proven ability to boost licensing revenues, expand retail distribution, pioneer new merchandise, and align with brand values provides rights holders valuable proof points.

Finding the Perfect Licensing Match

In summary, strategic analysis of potential partners across these factors allows leagues to determine deals offering the highest revenue and brand lift. The most lucrative alignments pair sports IP with companies capable of maximizing reach and leveraging brand strengths.

By fully assessing licensing hopefuls, rights holders give themselves the best chance of identifying partners that can propel merchandise sales to new heights.

Key factors to consider when evaluating licensing deals

Sports leagues and teams face high-stakes decisions when assessing licensing partnership opportunities. Properly evaluating deals requires weighing factors like revenue potential, brand impact, and resource trade-offs. Rights holders should analyze offers across these key dimensions:

Projected Royalty Rates and Guarantees

Of course, the partner’s proposed royalty rates and minimum guarantees deserve scrutiny. Higher royalties and guarantees offer more earnings upside.

However, rights holders must realistically assess the partner’s ability to deliver projected sales volumes required to achieve royalty targets. Securing too lofty rates on paper means little without executable sales plans.

Distribution Scale and Channel Access

Rights holders should examine where partners can distribute licensed merchandise and their retail relationships. Deals promising access to major channels like big box stores, specialty sporting goods retailers, and leading e-commerce platforms offer more revenue potential.

Significant distribution gaps, like an absence in general merchandise stores, may hinder sales reach. Assess how distribution plans align with fan shopping habits.

Product Development and Manufacturing Capabilities

Of course, deals hinge on a partner’s ability to translate IP into compelling merchandise fans wish to purchase. Evaluate their design talents, sourcing relationships, and manufacturing/printing capabilities for apparel, headwear, and hard goods.

Limitations around producing high-quality gear could inhibit sales. Ensure competencies align with product categories outlined in the licensing agreements.

Marketing Commitment and Brand Alignment

The degree of marketing support partners pledge reveals how much emphasis they will place on licensed products. Larger promotional budgets demonstrate commitment and innate motivation to drive sales volumes.

Also assess brand alignment. Partners with strong synergy are more apt to fully leverage league/team IP in advertising and positioning.

Exclusivity Clauses and Scope of Rights

Rights holders must carefully weigh any exclusivity rights granted, as they forfeit flexibility. Categorical exclusivity may maximize revenue for a key partner but limits future deals.

Also scrutinize IP access and usage rights included. Overly broad rights may lack justification or stray beyond the partner’s capabilities. Define IP usage clearly.

Contract Length and Termination Options

Longer-term deals provide partners security to invest in licensing strategies. But rights holders should ensure appropriate termination provisions if performance lags.

Deals spanning 5+ years with no exit opportunity lack flexibility should fan preferences or market dynamics shift. Build in proper cancellation clauses.

Ongoing Revenue Analysis and Reporting

Rights contracts should outline detailed sales tracking and reporting processes to govern the partnership. Receiving transparent royalty statements ensures accurate payouts.

Rights holders should demand robust data rights to frequently monitor revenue activity, analyze trends, and refine strategies. Data visibility protects the asset.

Making Licensing Partnerships Pay Off

Evaluating licensing deals across these factors allows rights holders to project potential upside, minimize risk, and negotiate optimal terms. The due diligence process must determine if partners’ strengths align with merchandise opportunities.

By approaching licensing conversations analytically, sports organizations put themselves in the best position to maximize both revenue generation and brand enhancement from partnerships.

Negotiating win-win licensing agreements

Crafting sports licensing deals where both parties benefit requires artful negotiation and compromise. Rights holders aiming for fruitful long-term partnerships must navigate conversations skillfully to find alignment on terms. Here are keys to negotiating licensing contracts where licensees and properties each feel like winners:

Lead With a Collaborative Mindset

Start by establishing a collaborative tone focused on mutual objectives like growing revenue, enhancing brands, and delighting fans. Framing licensing deals as true alliances rather than transactions can reveal creative solutions.

Partners may be more willing to creatively problem-solve if the relationship feels equitable from the outset. Developing trust and transparency around needs breeds goodwill.

Understand Motivations and Constraints

Rights holders should investigate partners’ goals, pressures, and pain points around licensing, while expressing their own. Grasping where each side has flexibility guides productive conversations.

For instance, licensees may prize exclusivity or multi-year deals to justify investment while rights holders value flexibility. Airing these motivations candidly promotes compromise.

Brainstorm Potential Benefit Exchanges

Explore trade-offs that allow each party to win. A rights holder may gain royalty rate upside in exchange for granting narrow exclusivity in a partner’s core channel. Or a licensee could obtain additional IP rights by guaranteeing higher minimum guarantees.

Both sides should brainstorm exchanges of value that leave each better off relative to standalone proposals. Identify where you can give to get.

Structure Agreements to Incentivize Success

Licensing contracts can feature performance bonuses, tiered royalties, and upside sharing that reward partners exceeding goals. The more both parties benefit from growth, the harder they’ll work to achieve it.

Rights holders could also offer royalty reductions on sales above certain thresholds to incentivize distribution expansion into untapped channels. Performance incentives spark motivation.

Outline Clear Expectations and Processes

Prevent future conflict by detailing required sales reports, marketing plans, branding guidelines, approvals processes, and other responsibilities in contracts. Ambiguity strains partnerships.

Transparency around expected time investments, decision makers, key dates, and contract clauses facilitates cooperation. Both parties should know exactly what they are committing to.

Maintain Ongoing Dialogue

Partners should establish consistent touchpoints to jointly review metrics, sales initiatives, fan feedback, and marketplace dynamics. This enables them to collaboratively refine strategies without waiting for formal contract renewals.

Staying aligned through continuous dialogue helps licensing deals evolve. Annual summits, quarterly calls, and frequent informal check-ins all promote collaboration.

The Win-Win Licensing Deal

In summary, thoughtful negotiation centered on creating shared value enables impactful licensing alliances. While rights holders and partners will disagree at times, maintaining a collaborative, inventive approach typically produces satisfactory compromises.

Deals succeeding over the long term balance both sides’ needs – the hallmark of a win-win partnership poised to maximize licensing’s revenue and brand potential.

Protecting your brand identity and intellectual property

For sports leagues and teams, intellectual property like trademarks, logos, and branding constitute invaluable assets. Licensing deals provide access to IP, so rights holders must take precautions to safeguard brand integrity and prevent misuse. Here are key strategies for protecting brand identity and IP when forming licensing partnerships:

Conduct Thorough Partner Due Diligence

Rights holders should deeply vet potential partners, analyzing their brand values, management, and supply chain oversight. Weeding out any partners presenting ethical issues or IP risks is crucial.

Reference checks, brand audits, and facility inspections provide assurance around responsible IP usage. Scrutinize partners thoroughly before any branding access.

Craft Precise IP Usage Rights and Style Guides

Licensing contracts must expressly define permitted uses of IP along with clear style guidelines. Be highly specific around approved logo applications, color usage, branding placement, language use cases, and imagery restrictions.

Any potential brand misuse scenarios should be addressed. Tightly controlling IP access limits chances of brand dilution or distortion. Legal terms must protect the asset.

Build In Brand Approvals Processes

Licensing deals should grant rights holders final sign-off over any merchandise or collateral featuring their IP before manufacturing and distribution.

Establish firm timelines for approving product designs, catalogs, packaging, advertising, and retail displays. This oversight right ensures brand-appropriate use.

Restrict Certain Sensitive Uses Like Alcohol

Leagues or teams may want certain brand associations avoided and should restrict IP usage accordingly. For example, many limit licensing for alcohol, tobacco, gambling, or dangerous products.

Barring usage in categories that may tarnish brand image protects integrity. Place clear boundaries around off-limits uses upfront.

Phase in Branding Access Gradually

Rather than immediately granting full IP usage rights, consider phasing in access as partners demonstrate brand stewardship. For instance, permit only limited logo usage initially, expanding as the relationship matures.

This incremental approach as trust builds minimizes early risks of brand mismanagement. It incentivizes respecting IP to gain more rights.

Audit Ongoing Advertising and Merchandise Sampling

While approvals processes govern pre-production, also periodically audit partners’ ongoing advertising, promotional materials, and manufactured samples featuring your IP.

Spot checks that branding complies with rules even after launch reduces chances of compliance drifting over time. Monitoring helps keep partners accountable.

Protect IP Assets Through Careful Licensing Oversight

For sports leagues and team, branding typically constitutes their most valuable asset. Licensing partnerships provide revenue potential, but strict usage governance is required to prevent brand dilution.

With careful controls, approvals processes, and partner oversight, rights holders can maintain brand integrity while still capitalizing on licensing opportunities. IP protection should remain central to any licensing strategy.

Monetizing licensed merchandise sales

The potential for sports licensing to drive significant revenue makes it an increasingly crucial component of leagues’ and teams’ business models. However, realizing this monetary value requires optimizing licensed merchandise programs for revenue generation. Here are key strategies rights holders should employ to maximize licensing income:

Secure Favorable Royalty Rates in Contracts

Rights contracts should outline base royalty rates around 5-15% of wholesale prices for licensees utilizing IP. Rates will vary by partner size, product categories, and projected volumes.

Locking in rates favoring the higher end of normal industry ranges provides more licensing income upside as partners hit sales targets.

Negotiate Minimum Guarantees

Minimum guarantees establish a floor for licensing revenues upfront regardless of sales. Rights holders should push partners for sizable guarantees that provide some income stability.

Realistic guarantees according to sincere sales projections indicate partners financially committed to driving licensing. Guarantees hedge risk.

Structure Tiered Royalties or Bonuses Around Goals

Consider graduated royalty rates increasing along sales volume tiers to incentivize growth. For example, 12% royalties on the first $10 million in sales, 15% on the next $15 million.

Alternatively, contractual bonuses for exceeding milestones motivate licensees while benefiting rights holders. Upside sharing fosters partnership.

Invest in Internal Licensing Management Resources

Rights holders should adequately staff internal licensing functions to actively manage partnerships and licensing growth. Licensing managers, financial analysts, and legal specialists allow proactive licensing strategies.

With investment in expertise, rights holders can pursue a pipeline of high-potential deals and product innovations expanding revenue.

Leverage Sales Trends and Data to Refine Licensing Approach

Analyze historical licensed merchandise sales data along with category and geographic trends to inform partnership strategies. Which products, retail channels, and international markets demonstrate untapped upside?

Data illuminates new licensing opportunities to pursue based on demand signals. Optimization relies on insights.

Pursue New Categories Like Gaming, Betting, and NFTs

Expand licensed merchandise into contemporary categories like sports betting, video games, digital collectibles, and metaverse products.

Emerging consumer trends translate into fresh licensing deal flow. Lean into new applications of sports IP benefitting from cultural momentum.

Execute Licensing Deals Strategically

In summary, fully monetizing licensing potential requires rights holders take an active stance. Implementing favorable contract terms, leveraging data, pursuing contemporary deal opportunities, and dedicating internal resources allows leagues and teams to maximize this revenue stream.

With sound licensing management and partnerships, merchandising programs can drive substantial value.

Leveraging licensing for brand awareness and reach

Beyond revenue generation, sports licensing also provides invaluable marketing benefits for leagues and teams. Distributing branded merchandise through vast retail and ecommerce networks greatly expands brand impression opportunities. Savvy rights holders utilize licensing to increase awareness and reach.

Engaging New Audiences

Licensed merchandise served as “walking billboards” exposes brands to new demographics. Casual apparel sold at big box stores, specialty retailers, or online marketplaces introduces properties to mainstream consumers.

This passive brand building occurs whenever a fan dons a hat or shirt outside sports contexts. Licensed products tap into lifestyle appeal.

Reinforcing Brand Identity

For existing fans, licensed merchandise allows demonstrating allegiance. Jersey sales around playoffs remind audiences of team identities and personalities.

By keeping brands visually present through ongoing merchandise engagement, licensing strengthens mindshare and loyalty. It cements emotional connections.

Expanding Geographic Reach

Partners with global retail distribution allow leagues to transcend home markets. When fans across Europe buy NBA merchandise, it drives awareness abroad.

Licensees entering new territories ultimately grow international fandom and broadcast/sponsorship revenue. Licensing is a global growth driver.

Digital Content and Social Amplification

Online marketing expands licensing’s benefits. Licensees promote products through digital and social content, enlisting influencers and hashtags to drive discoverability beyond physical retail.

This digital presence intersects with fans’ online habits, spreading brand impressions. It also provides content for leagues to amplify.

Leveraging Licensee Expertise

Partners like Nike and Adidas boast consumer marketing acumen leagues can leverage. Co-branded campaigns combining sports IP with licensees’ expertise create high-impact branding vehicles.

Letting experienced licensees take the lead in product messaging expands promotional capabilities.

Enhancing Marquee Events

Licensing adds branding power to tentpole events. All-Star merchandise, NBA Christmas uniforms, and NFL Draft caps increase excitement and visibility.

Fans don official apparel of marquee occasions, spreading its brand halo. Licensing boosts broadcast visibility.

Maximizing Licensing’s Brand Benefits

While licensing revenue remains vital, marketers must also strategize how to fully realize its brand-building potential. Leveraging partner scale and creativity through co-marketing offers advantages.

Ultimately, licensing represents perhaps the greatest asset diffusion mechanism for sports brands. With sound strategy, its awareness impact can equal its financial impact.

As the sports industry continues to grow and evolve, teams and leagues are looking for new ways to maximize revenue opportunities. One area that has seen enormous growth in recent years is sports licensing and strategic partnerships. Sports licensing refers to the process of granting the rights to use a sports brand name, logo, or other intellectual property. From jerseys and hats to video games and collectible items, the licensing of team and league intellectual property has become a multibillion dollar industry.

Strategic partnerships go hand-in-hand with licensing deals. These partnerships allow brands to affiliate themselves with teams and leagues to increase awareness and drive sales. The right partnership can be massively lucrative for both parties. However, choosing partnership opportunities wisely is critical to success.

Expanding into new product categories and demographics

In the past, sports licensing dealt mostly with apparel and merchandise directly targeted at avid fans. While this is still important, today’s licensing deals are expanding into whole new audiences and product categories.

For example, partnerships with consumer product brands allow team logos to appear on household items like kitchen appliances and tools, reaching casual fans in daily life. Deals with gaming brands bring team branding to video and mobile games, engaging younger tech-savvy audiences. Even licensing with adult beverage companies opens up new markets.

Expanding branding through thoughtful partnerships brings sports franchises into new demographics. Making smart choices about which products and brands to associate with is key to increasing revenue while maintaining a positive brand image.

Prioritizing personalization and customization

Today’s sports fans increasingly want options for customizing and personalizing branded merchandise. This presents an opportunity for leagues and teams, as personalized items sell for higher prices.

Strategic partnerships with companies at the forefront of customization technology allows franchises to offer personalized jerseys, hats, shoes, and more to their fanbase. Streamlining the ordering and manufacturing process for custom gear should be a top priority.

Partnerships with retail chains to offer customization in-store provides added value. Fans can get bespoke team gear right on the spot. This kind of individualized branded merchandise helps foster deeper fan loyalty and engagement.

Capitalizing on mobile app popularity

Mobile apps continue to grow dramatically in popularity across all demographics. Sports apps in particular draw in fans by providing up-to-the minute stats, scores, highlights and more.

Strategic partnerships with app developers can take team apps to the next level. Advanced features like AR/VR, integrated fantasy sports, exclusive content and gamification leverage the interactive potential. The right features make branded team apps “must-have” items for avid fans.

App partnerships also provide opportunities for highly targeted advertising. Because these apps contain so much personal user data, ads can be ultra-customized to each fan’s needs and wants. Such precision targeting typically commands premium ad rates.

The growth of esports

Competitive video gaming, also known as esports, has exploded into the mainstream in recent years. Top esports events are now selling out massive arenas and offering prize pools in the millions.

Many traditional sports franchises are getting involved in esports through partnerships and sponsorships. For example, several NBA teams have bought or launched esports teams to compete in pro gaming leagues.

This allows brands to tap into the young, digital-native esports audience. Esports licensing deals also provide expanded merchandise opportunities.

As esports continues its meteoric growth, partnerships in this space offer the potential for sports brands to reach entirely new markets.

Choosing win-win partnerships

At the end of the day, strategic partnerships only succeed if both parties benefit. Sports franchises should look for win-win opportunities that help partners increase awareness and sales, while expanding their own reach and revenue streams.

Companies on the cutting edge of technology and consumer trends make ideal partners. Their expertise and innovation can take sports licensing to bold new places. However, brands should also look to partner with established companies that offer scale and accessibility.

With careful analysis and planning, sports licensing and strategic partnerships present immense opportunities for growth. The future lies in using these partnerships to maximize the value of sports brands across new products, services, geographies and audiences.

The sports licensing industry has experienced tremendous growth in recent years. As teams and leagues look to maximize licensing revenue, optimizing royalty rates and contract terms is key.

Optimizing royalty rates and contract terms

At its core, sports licensing means granting rights to use intellectual property (like team names, logos, and imagery) in exchange for royalty payments. Negotiating favorable rates and contract terms is crucial.

Royalty rates are the percentage of wholesale or retail sales that licensees pay back to the IP owner. Rates often fall between 5-15%, but can sometimes be higher.

For especially hot brands or product categories, teams and leagues can push for higher rates. Rarely though, rates above 20% may decrease licensee participation. The goal is optimizing rates to maximize both revenue and sales volume.

Royalties are also structured as flat fee amounts per unit sold. This benefits licensees by capping costs, but limits licensor revenue potential. Flat fees work best for cheaper mass market items.

Guaranteed minimum royalties are amounts licensees commit to paying, regardless of actual sales. This benefits licensors by ensuring a revenue floor.

Tiered royalty rates are increasing rates based on sales volume. Typically, rates start around 5% for modest sales, but jump to 10-15% at higher volumes. Tiers incentivize licensees to grow sales.

Royalty-free “rent-a-brand” licensing

For some deals, brands opt for “rent-a-brand” fee-based contracts instead of royalties. With this model, licensees pay an upfront fee for usage rights over a defined period.

This benefits licensees by capping expenses, while benefiting licensors through guaranteed income. However, licensors lose out on upside revenue potential.

Common for sponsorships and promotions, rent-a-brand deals can work when licensed products are just part of a larger campaign. The predictable income helps offset licensing department costs.

Royalty holidays

Royalty holidays are periods where standard royalty rates are reduced or waived, often for new licensees entering a product category. This incentivizes licensee investment and risk-taking.

Holidays may last 6 months to a year. Licensors sacrifice short-term income, hoping to gain long-term licensee commitment and sales growth. If successful, future royalty income outpaces the holiday loss.

However, ill-conceived royalty holidays can train licensees to expect regular rate reductions. Smart contracts feature predefined renewal rates at full royalty after the holiday.

Royalty-free closeouts

Closeouts represent leftover inventory a licensee is unable to sell, usually due to changing trends or consumer preferences.

Licensors may allow limited closeout sales at zero royalty to quickly clear old inventory. This generates goodwill with the licensee, allowing them to move on. However, closeout allowances should be modest to avoid incentivizing overproduction.

Advertising and marketing fees

Licensors should push for contracts requiring cooperative advertising support from licensees. These marketing development funds ensure licensees are investing in brand promotion.

Typically, license contracts require ad funding equal to a percentage of sales, like 2-5%. Higher requirements, like 10%, help drive product visibility and sales.

For major product launches, temporary waivers of ad fees help limit licensee risks. However, established products should pay for brand visibility support.

Payment terms and audits

License contracts should outline detailed payment terms and sales reporting requirements. This ensures licensors receive timely and complete royalty payments.

Typical contracts require monthly or quarterly royalty payments, along with sales reports itemizing volumes by product/channel. Licensors should push for short payment terms, like 30 days.

Auditing rights are also critical, allowing licensors to review and verify licensee sales figures periodically. Contracts should allow surprise audits without advanced notice.

Strict payment terms and audit rights protect against underreporting. They ensure licensors capture all income rightly owed by the contract.

Exclusivity clauses

Exclusivity is another key contract consideration. Exclusive deals restrict licensors from partnering with additional brands in a product category.

This benefits licensees by blocking competition. In exchange, exclusivity usually commands higher royalty rates. Licensors must carefully weigh lost opportunity with increased rates.

Most deals are non-exclusive, allowing licensors to maximize partnerships. Exclusivity may be warranted for highly technical/expensive categories. But usually, non-exclusivity maximizes revenue across more licensees.

Properly structured licensing contracts optimize income while incentivizing licensee sales. As sports licensing expands, managing rates, terms and clauses is essential to success for both sides.

As sports leagues and teams increasingly rely on licensing for revenue, maintaining diligent oversight of product design and quality is imperative.

Maintaining control over product design and quality

In licensing deals, intellectual property owners grant partners the right to incorporate team and league brands into products. However, they must still control how marks are used.

Product design and quality oversight ensures licensees uphold brand standards. Licensing contracts stipulate approvals processes and requirements.

Initial design review and approvals

Licensors should require licensees to submit initial product designs, mockups and samples for review. This gives licensors clear veto rights early on.

Approvals at this stage prevent licensees from investing in designs or products that don’t meet standards. It avoids issues down the line.

Contracts should allow a reasonable window for licensors to approve or request modifications to submissions. Turnaround times of 5-15 days are typical.

Ongoing quality control

Beyond initial approvals, licensing contracts must give licensors ongoing oversight of in-market products through quality control clauses.

These allow licensors to request product samples at any point, even pulling items randomly off store shelves for inspection.

If quality issues arise, licensors can require fixes or even terminate agreement if licensees refuse to address problems.

Protecting brand integrity

The power to approve designs and control quality enables licensors to protect brand image and integrity.

This ensures licensees don’t take liberties with intellectual property that could diminish brand value. Failing to police usage can undermine reputation.

For example, licensors must guard against inappropriate designs that could offend fans and consumers.

Preventing brand dilution

Oversight also prevents brand dilution from low quality or excessive licensing. Uncontrolled licensing risks cheapening and weakening brand equity.

Licensors must be selective about suitable products and partners. Contracts should limit product categories and volumes.

Enforcing continual quality review protects premium brand positioning. It discourages licensees from cutting corners.

Using style guides

Comprehensive style guides and usage manuals are essential tools for license oversight.

These guides provide specific examples and parameters for how intellectual property can and can’t be incorporated into products. This includes logo dos and don’ts, color schemes, imagery guidelines, and more.

Detailed style guides empower licensors to enforce standards by giving clear policy basis to reject submissions or require modifications.

Licensee incentives for compliance

Beyond legal clauses in contracts, licensors should structure agreements to incentivize voluntary licensee compliance.

Offering multi-year deals contingent on meeting quality standards motivates better oversight. Licensees wishing to renew have added incentive to adhere to guidelines.

Royalty rebates for consistently high-quality products also help. Refunding a small percentage of royalties rewards and encourages licensees to uphold standards.

When to relax control

Licensors may strategically grant more creative license for certain products or partners where flexibility provides mutual benefits.

Allowing long-time or highly technical partners more leeway can enhance innovation that ultimately supports brand value.

However, oversight should only be relaxed thoughtfully and selectively based on demonstrated trust and alignment of incentives.

Proper control over design and quality enables licensors to maximize partnership opportunities while protecting brand integrity. However, care should be taken not to be overly restrictive toward mutually invested partners.

As sports licensing evolves into a major revenue stream, leagues and teams need tools to measure program effectiveness and return on investment.

Measuring performance and ROI of licensing programs

Licensing programs contain multi-variable moving parts across many partners and product categories. Quantifying program success requires monitoring a combination of performance metrics.

Royalty income

At the most basic level, licensing performance equates to royalty dollars earned. Tracking overall royalty income provides a snapshot of program reach.

Segmenting income by product category, licensee and geography provides greater insight into growth opportunities.

Benchmarking royalty ratios as a percentage of wholesale sales reveals category profitability. Higher ratios indicate more lucrative deals.

Sales and market share

Beyond income, sales volume and market share metrics demonstrate effectiveness in engaging customers.

Monitoring total licensed product sales shows how brands resonate with fans as buyers. Growth in market share indicates higher competitiveness.

Analytics should drill down into performance by product segment, licensee, retailer, and distribution channel.

Fan awareness and demand

Surveying fans provides qualitative data on awareness levels and demand dynamics that drive sales.

Are fans excited by available products? Which new products or untapped categories do they want? This intelligence guides licensing strategy.

Social listening also reveals real-time fan engagement and sentiment around licensed products.

Licensee network health

The number of active licensees, along with licensee satisfaction, shows the overall health of the licensing program.

More licensees indicate stronger demand to associate with the brand. Declining participation warns of issues.

Periodic surveys help assess licensee experiences and identify program improvement needs.

Operational metrics

Stats on operational efficiency also matter. This includes contract processing times, cost per contract, and licensee auditing success.

Faster contract turnarounds provide better licensee experiences. Higher costs and hours invested per contract reduce internal productivity.

Brand impact

The hardest metrics to quantify involve the influence licensing has on overall brand equity and revenues. But this relationship is key.

Surveys, market research, and financial modeling help estimate the halo effect of licensing on brand perception, partnerships, and merchandising.

Sophisticated attribution ties increased licensing royalties and sales to metrics like fan growth, engagement, media exposure, and marketability.

Digital analytics and business intelligence

Advanced analytics tools enable deeper understanding of licensing program dynamics. They unlock optimization opportunities.

Online sales tracking provides granular data on consumer behavior. Digital fan surveys and social listening offer real-time sentiment feedback.

Predictive modeling and data visualization software uncover hidden relationships and patterns. This powers smarter decisions.

Integrating diverse data streams into unified business intelligence presents a comprehensive view of program effectiveness. Key metrics can be monitored over time to fine tune strategy.

Balancing quantitative and qualitative inputs

Licensing leaders emphasize that measurement must balance quantitative metrics with qualitative insights.

Hard numbers don’t provide the complete picture. Subjective impressions of fans, partners and internal leaders also matter.

The most successful licensing programs combine statistical analysis with “gut feel” intuition. This holistic approach maximizes financial returns while advancing brand equity.

As the sports licensing industry matures, leagues, teams and partners must continually innovate to open new revenue streams and engage fans in new ways.

Future opportunities for innovation and growth in sports licensing

Sports licensing has already experienced tremendous growth, but many untapped opportunities remain through new technologies, products and business models.

Leveraging emerging technologies

Cutting edge technologies offer ways for brands to deliver more immersive and personalized fan experiences.

Augmented and virtual reality open new product and content formats. 3D printing enables customized merchandise made on demand. AI and machine learning optimize consumer connections.

Blockchain has potential to securely track licensed goods, reduce counterfeits and add collectible value. Smart partnerships will unlock new capabilities.

Direct-to-fan ecommerce

Owned ecommerce channels allow teams to sell specialized licensed merchandise directly to fans, increasing engagement.

Data-driven customization and personalization takes fan experiences to the next level. New D2C revenue outweighs any partner channel conflicts.

Turning physical venues into hybrid shopping/entertainment destinations supercharges on-site retail sales.

Digital licensing and NFTs

Digital licensing opens new merchandise possibilities through mobile apps, video games, digital collectibles and NFTs.

Virtual goods and NFTs require managing unique copyright, security and valuation factors. But successfully executed, huge fan engagement and revenue potential exists.

Unlocking digital experiences creates enduring digital connections with fans.

Micro licensing and influencer collaborations

Micro licensing partnerships with individual athletes, coaches, celebrities and influencers can resonate with niche fan bases.

Hyper-targeted collaborations with credible influencers personalize connections in their communities. Long-tail revenue potential is sizable.

Ensuring brand and campaign alignment is critical, but huge engagement upside exists.

International expansion

Leagues and teams still under-penetrate global licensing opportunities, especially in high-growth regions like Asia and South America.

Nuanced market understanding and localization is critical for overseas expansion. Collaboration with regional partners unlocks new demographics.

Thoughtful international growth diversifies revenue while expanding brand reach worldwide.

New distribution channels

Sports licensing is moving beyond just big box retailers into convenience, travel, restaurants, gyms, and company branding channels.

Putting brands in everyday contexts heightens awareness and adoption. But brand standards must be maintained across channels.

Exploring synergistic new sales outlets and branded environments boosts market penetration.

Innovative pop-up experiences

Short-term pop-up shops and experiences in high-traffic locations offer creative brand exposure.

They provide opportunities to highlighted limited products and make shopping into an exciting event.

Drawing in new audiences through buzzworthy activations seeds long-term licensing opportunities.

Equipment and training licensing

Applying intellectual property to equipment and sports training products represents an under-leveraged area.

Fans want to train like the pros through branded equipment. Partnerships with manufacturers open new categories.

Authentic, endorsed gear builds associations with sports performance and youth participation.

Focus on strategic value, not just revenue

Pursuing innovation for innovation’s sake is misguided. The goal should be leveraging new opportunities to strategically advance brand positioning.

This means licensing must deliver value beyond just revenue, including stronger emotional connections, international scope, digital reach, and future growth platforms.

With smart strategies, forward-thinking sports brands can unleash licensing innovation that fans love and sales reflect.