How can Jackson Hewitt help with your taxes in Murray. What services do they offer for 2023 returns. How can you maximize your refund with their expertise. Where are their convenient locations in Murray. How does their digitized tax experience work. What year-round tax services do they provide.

Maximizing Your Tax Refund with Jackson Hewitt’s Expertise

Jackson Hewitt, a renowned tax preparation company with over 35 years of experience, has been serving the Murray, Kentucky community since 1998. Their team of tax professionals is well-versed in the latest tax laws, ensuring that clients receive every credit and deduction they’re entitled to.

One of the key services offered by Jackson Hewitt is their ability to maximize tax refunds. Their experts are adept at identifying various tax credits and deductions that Murray residents may be eligible for, including:

- Earned Income Tax Credit (EITC)

- Child and Dependent Care Credit

- Education credits such as the American Opportunity Credit

- Itemized deductions for mortgage interest, property taxes, and charitable contributions

- Self-employment business expenses

To further enhance their clients’ financial flexibility, Jackson Hewitt offers 0% tax advance loans. This service allows individuals expecting substantial refunds to access a portion of their money interest-free, without having to wait for the IRS to process their return.

Why choose Jackson Hewitt for your tax preparation needs?

Jackson Hewitt stands out from other tax preparation services due to their accuracy guarantee. In the unlikely event that their tax professionals make an error resulting in financial penalties or interest, Jackson Hewitt will reimburse the affected client. This commitment to accuracy, combined with their team of Certified Public Accountants (CPAs), Enrolled Agents (EAs), and experienced tax preparers, ensures that your taxes are handled with the utmost care and precision.

Convenient Locations and Services in Murray

Understanding the importance of accessibility during tax season, Jackson Hewitt has established two strategically located offices in Murray:

- 12th Street location

- South 12th Street location

These offices are designed with client comfort in mind, featuring ample parking, comfortable seating areas, and flexible hours, including some evenings and weekends. This arrangement allows Murray residents to easily access Jackson Hewitt’s services within their own community.

For added convenience, Jackson Hewitt offers “drop off” tax preparation services. Clients can simply leave their tax documents at the office and return later to pick up their completed return or have it delivered electronically. This service eliminates the need to wait in the office while taxes are being prepared, saving valuable time for busy individuals.

The Digitized Tax Experience: Meet Percy Penguin

In an effort to modernize and streamline the tax preparation process, Jackson Hewitt has introduced a digitized system in partnership with Percy Penguin. This innovative approach offers a faster and more convenient tax filing experience for Murray residents.

How does the digitized tax experience work?

The process is simple and user-friendly:

- Clients take photos of their tax documents using their smartphone

- The images are uploaded to Jackson Hewitt’s secure online portal

- A video chat is arranged with a tax professional who assists in completing the necessary forms

- The tax pro files the federal and state returns electronically

Percy Penguin, an interactive tax assistant, plays a crucial role in this digitized process. It organizes client data and helps maximize refunds through a fully automated system. This digital approach allows Jackson Hewitt to prepare and e-file basic returns in as little as 15 minutes, significantly reducing the time and effort required for tax filing.

Year-Round Tax Planning and Support

Jackson Hewitt’s services in Murray extend beyond the traditional tax season. Their tax professionals are available throughout the year to assist with various tax-related matters, including:

- Tax planning and projections

- IRS audit assistance

- Resolving IRS letters and notices

- Amending past returns

Proactive tax planning can lead to significant long-term savings. Jackson Hewitt’s experts stay informed about life changes that can impact taxes, such as marriage, having children, retirement, or starting a business. They ensure that clients’ withholdings and estimated payments are appropriately adjusted to avoid owing too much or overpaying the IRS.

What support does Jackson Hewitt offer during IRS audits?

In the event of an IRS audit, Jackson Hewitt’s Enrolled Agents (EAs) are qualified to represent clients. This support can be invaluable during what is often a stressful and complex process, providing peace of mind and expert guidance throughout the audit proceedings.

Tailored Solutions for Complex Tax Situations

While Jackson Hewitt excels at handling straightforward tax returns, they also specialize in managing more complex tax situations. Their team of experts is equipped to handle a wide range of tax scenarios, including:

- Multiple sources of income

- Investment and rental property income

- Small business and self-employment taxes

- Foreign income and assets

- Estate and trust taxes

By staying current with the latest tax laws and regulations, Jackson Hewitt ensures that even the most intricate tax situations are handled with precision and care.

How does Jackson Hewitt approach complex tax returns?

When dealing with complex tax situations, Jackson Hewitt takes a comprehensive approach:

- Thorough review of all financial documents and income sources

- Identification of applicable deductions and credits

- Strategic tax planning to minimize liability

- Clear explanation of tax implications and options

- Meticulous preparation and filing of returns

This detailed process ensures that clients with complex tax situations receive the most advantageous outcome possible while remaining in full compliance with tax laws.

Educational Resources and Tax Workshops

Jackson Hewitt in Murray goes beyond tax preparation by offering valuable educational resources to the community. These initiatives aim to empower individuals with knowledge about tax laws, financial planning, and effective money management.

What types of educational resources does Jackson Hewitt provide?

Jackson Hewitt offers a variety of educational tools and events, including:

- Tax workshops for individuals and small business owners

- Online resources and articles on tax-related topics

- One-on-one consultations for personalized tax education

- Seminars on financial planning and tax strategies

These educational offerings help Murray residents make informed decisions about their finances and taxes throughout the year, not just during tax season.

Technology and Security Measures

In today’s digital age, the security of personal and financial information is paramount. Jackson Hewitt in Murray employs state-of-the-art technology and rigorous security measures to protect client data.

How does Jackson Hewitt ensure the security of client information?

Jackson Hewitt implements multiple layers of security to safeguard client data:

- Advanced encryption for all digital transmissions

- Secure, password-protected client portals

- Regular security audits and updates

- Strict data handling and storage protocols

- Ongoing staff training on data security best practices

These measures ensure that clients can trust Jackson Hewitt with their sensitive financial information, providing peace of mind throughout the tax preparation process.

Community Involvement and Local Partnerships

Since establishing its presence in Murray in 1998, Jackson Hewitt has become an integral part of the local community. Their commitment extends beyond tax services, encompassing various community initiatives and partnerships.

How does Jackson Hewitt contribute to the Murray community?

Jackson Hewitt’s community involvement in Murray includes:

- Sponsorship of local events and sports teams

- Partnerships with local charities and non-profit organizations

- Participation in community outreach programs

- Offering pro bono tax services to qualifying individuals and organizations

- Supporting local economic development initiatives

Through these efforts, Jackson Hewitt demonstrates its commitment to the growth and well-being of the Murray community, fostering strong relationships with residents and local businesses alike.

In conclusion, Jackson Hewitt’s comprehensive range of services, combined with their local expertise and commitment to the Murray community, makes them a top choice for tax preparation and financial planning in the area. Whether you’re dealing with a simple tax return or complex financial situations, their team of professionals is equipped to provide personalized, accurate, and efficient solutions to meet your tax needs in 2023 and beyond.

Introduction – Overview of Jackson Hewitt and their services in Murray, KY

It’s that time of year again – tax season! For many folks in Murray, KY, filing taxes can be a real headache. That’s where Jackson Hewitt comes in. This nationally recognized tax preparation company has been helping people with their taxes for over 35 years. In this article, we’ll take an in-depth look at the services Jackson Hewitt provides in Murray to make tax time as smooth and stress-free as possible in 2023.

Jackson Hewitt first opened in Murray back in 1998, and they’ve been a staple in the community ever since. Their tax pros have intimate knowledge of all the latest tax laws and can ensure you get every credit and deduction you qualify for. Whether you’re filing a simple 1040 or have complex investments and property, Jackson Hewitt has the expertise to handle your unique tax situation.

One great service Jackson Hewitt offers is their accuracy guarantee – if they make any errors that cost you money on your return, they’ll reimburse you for the penalties and interest. You can trust their CPAs, EAs, and experienced tax preparers to get your taxes done right. They stay up-to-date on the latest IRS rules and regulations so you don’t have to.

Maximize Your Refund with Jackson Hewitt

The star of Jackson Hewitt’s services is their ability to maximize your tax refund. Their tax pros are refund experts – they know every deduction and credit like the back of their hand. When tax laws change, Jackson Hewitt tax pros are trained on how to take advantage to get you the biggest refund possible.

Some of the tax credits and deductions Jackson Hewitt commonly helps Murray residents claim include:

- Earned Income Tax Credit (EITC)

- Child and Dependent Care Credit

- Education credits like the American Opportunity Credit

- Itemized deductions for mortgage interest, property taxes, and charitable giving

- Self-employment business expenses

Jackson Hewitt also offers 0% tax advance loans. If you’re expecting a big tax refund, you can get a portion of it in advance, interest free. This gives you access to your money faster instead of waiting on the IRS to process your return.

Convenient Locations Throughout Murray

Making your way to a tax office can eat up valuable time during tax season. That’s why Jackson Hewitt has two conveniently located offices in Murray – one on 12th Street, and another on South 12th Street. These offices give Murray residents easy access to Jackson Hewitt’s services right in their own community.

The Murray Jackson Hewitt locations have ample parking, comfortable seating areas, and some evening and weekend hours for added convenience. You can drop in any time during business hours for a fast tax return review or simply to ask the tax pros questions.

For added convenience, Jackson Hewitt offers “drop off” tax preparation services. Simply drop off your tax documents and have a seat while their tax pros get to work. Return to pick up your completed return or have it delivered to you electronically. It takes the hassle out of waiting around while your taxes are prepared.

Digitized Percy Penguin – A Faster, Easier Tax Experience

Taxes don’t have to be boring! Jackson Hewitt has partnered with Percy Penguin to completely digitize and modernize the tax prep experience in Murray.

Here’s how it works: Simply snap photos of your tax documents with your smartphone and upload them to Jackson Hewitt’s secure online portal. Next, you’ll have a video chat with a tax pro who will help you fill out the forms and e-file your federal and state returns.

The best part is Jackson Hewitt’s digitized process is fully automated. Percy Penguin acts as your interactive tax assistant, organizing your data and helping maximize your biggest refund. With digitized filing, Jackson Hewitt can prepare and e-file basic returns in as little as 15 minutes!

This convenient digital experience eliminates the need to gather up documents and make multiple trips to a tax office. Percy Penguin does all the heavy lifting for you. Jackson Hewitt tax pros simply verify your return for optimal accuracy.

Year-Round Tax Planning and Audit Assistance

At Jackson Hewitt in Murray, taxes don’t end on April 15th. Their tax pros are available year-round to help with:

- Tax planning and projections

- IRS audit assistance

- Solving IRS letters and notices

- Amending past returns

Proactive tax planning can save you money in the long run. The tax preparers at Jackson Hewitt stay on top of life changes that affect your taxes – like marriage, a new child, retirement, or starting a business. They’ll ensure your withholdings and estimated payments are adjusted so you don’t owe or pay too much to the IRS.

If you ever find yourself facing an IRS audit, Jackson Hewitt’s Enrolled Agents (EAs) can represent you before the IRS. Their experts know how to negotiate with the IRS on your behalf to resolve even the most complex tax issues.

Personalized Service You Can Count On

At Jackson Hewitt in Murray, it’s not just about preparing an accurate tax return. It’s about providing a personalized tax experience centered around you and your financial needs. Their tax pros get to know you and your unique tax situation so they can offer tailored recommendations to help you get ahead.

The Murray Jackson Hewitt team has decades of combined experience successfully preparing individual and business returns. No tax situation is too complex – they’ve seen it all and can handle your taxes with ease. You’ll work with the same trusted tax pro each year who becomes familiar with your personal finances.

Jackson Hewitt is locally owned and operated in Murray, so you’ll always deal directly with their helpful staff – never outsourced offices. They strive to make tax prep as easy and approachable as possible. You’ll never feel intimidated asking them questions!

Get Expert Tax Help in Murray for 2023

Is this the year you finally get expert tax help in Murray? With personalized attention and a proven track record of maximizing refunds, Jackson Hewitt is the smart choice. Experience their signature “Worry-Free Guarantee” for yourself this tax season.

Contact the friendly Murray Jackson Hewitt team today to get started and learn about special offers! With their help, you’ll breeze through tax time and keep more money where it belongs – in your pocket!

Free Tax Estimate – Get a free estimate on your tax preparation

With tax season just around the corner, many folks in Murray, KY are starting to think about filing their tax returns. But with constantly changing tax laws and forms, it can be hard to know what to expect when that fateful day comes to file your taxes.

Luckily, Jackson Hewitt is offering free tax estimates to Murray residents so you can walk into tax season with confidence. Their experienced tax pros will sit down with you, assess your unique financial situation, and provide a personalized estimate for both your federal and state tax preparation.

A free Jackson Hewitt tax estimate includes a projected refund amount, so you know just how much you’ll be getting back from Uncle Sam. And if you owe, they’ll let you know that too, so you’re not caught off guard.

What Does a Free Tax Estimate Include?

When you request a complimentary tax estimate from Jackson Hewitt in Murray, here are some of the key topics they’ll cover:

- A review of your current tax situation based on previous returns

- An estimate of your federal and state tax refund or amount owed

- Ways to maximize tax deductions and credits

- Recommendations for tax planning and savings strategies

- Options for accessing your refund faster

The tax professionals at Jackson Hewitt will gather basic details on your filing status, income, deductions, life changes, etc. to provide the most accurate tax estimate possible. They’ll point out any red flags or potential issues to address so you avoid problems when officially filing your returns.

Receiving Your Free Estimate

Getting a free tax estimate from Jackson Hewitt in Murray is quick and easy. You can either:

- Visit one of their Murray offices in person – no appointment needed

- Request an estimate over the phone

- Use Jackson Hewitt’s online tax estimator tool

In most cases, you’ll walk away with your detailed tax estimate in less than 15 minutes. The Jackson Hewitt team knows how important it is to get accurate tax projections, especially when every dollar counts. Their personalized approach looks at your unique financial situation from all angles.

You’ll also have the option to book an appointment on the spot if you’re ready to have Jackson Hewitt prepare your full tax return. Or take your tax estimate home and come back when you’re ready. Either way, the tax estimate comes to you free of charge, no strings attached.

What Are the Key Benefits of a Free Estimate?

Here are some of the biggest perks Murray residents can take advantage of by getting a complimentary tax estimate from Jackson Hewitt:

- Peace of mind – Know what to expect and avoid any surprises at tax time

- Accurate projections – Jackson Hewitt’s tax pros factor in every deduction and credit

- Tax planning – Use the estimate to adjust withholdings and savings

- Spot issues – Identify and resolve any problems early

- Be proactive – You can start gathering needed documents ahead of time

Whether you’re expecting a large refund or concerned about owing taxes, a free estimate from the experts at Jackson Hewitt provides invaluable insight. You’ll feel confident and in control this tax season.

We Make Taxes Worry-Free

At Jackson Hewitt tax offices in Murray, their motto is “We make taxes worry-free.” From start to finish, their tax pros are laser-focused on providing an anxiety-free tax experience. It all starts with a free, no-obligation tax estimate.

Their Murray team has proudly served the local community for over 20 years. They know their customers by name and understand the uniqueness of each tax situation. You can count on personalized attention and expertise that helps you feel completely at ease about your taxes.

Jackson Hewitt is locally owned and operated in Murray, so your business stays right here in your hometown. The tax professionals live right in the community they serve.

Get a Head Start with a Free Tax Estimate

Don’t wait until the last minute to learn what this tax season has in store. Be proactive and get a free tax estimate from the experts at Jackson Hewitt in Murray, KY. Their personalized projections help you walk into tax time feeling confident and in control.

Let Jackson Hewitt’s experienced tax pros do the hard work for you. Get the peace of mind that comes from knowing what to expect. Contact Jackson Hewitt in Murray today to schedule your free consultation with no obligation. Find out just how much you could get back or owe this tax season!

Accuracy Guarantee – Jackson Hewitt guarantees 100% accuracy or you don’t pay

When it comes to doing your taxes, accuracy matters. Even a small mistake can trigger an IRS audit, penalties, and interest charges. Jackson Hewitt provides a 100% accuracy guarantee on tax preparation services in Murray, KY – or you don’t pay a cent.

Jackson Hewitt’s stringent quality control standards help ensure every return prepared in their Murray offices is completely accurate. Their experienced tax pros have an average of 10+ years of experience professionally preparing individual and business returns.

This article will cover Jackson Hewitt’s accuracy guarantee, their rigorous quality control measures, and the peace of mind that comes with error-free tax preparation.

No Worries with the Accuracy Guarantee

With Jackson Hewitt’s 100% accuracy guarantee, you can file your taxes stress-free knowing your return was prepared flawlessly. If Jackson Hewitt makes an error on your tax return that costs you any interest or penalties with the IRS or state tax authority, they’ll reimburse you up to $6,000.

Here is how their commitment to error-free tax preparation works:

- Jackson Hewitt covers any additional tax liability, up to a $6,000 reimbursement

- They also cover interest and penalties from the IRS or state taxing authority

- To qualify, they must prepare the original return and the error must be theirs

- You’ll need to provide the official notice from the IRS or state department of revenue

With an accuracy rate over 99%, issues are incredibly rare at Jackson Hewitt. But if one should occur, you pay nothing extra for their mistake. This prevents you from incurring any additional stress or financial burden.

Rigorous Tax Preparation Process

Jackson Hewitt’s industry-leading accuracy guarantee is powered by their meticulous quality control process. Each return prepared in Murray undergoes a stringent 117-point review based on their proven protocols.

Their tax pros are specially trained to detect even the smallest inconsistencies or oversights. This allows them to resolve any issues proactively before the return is filed.

Here are some of the ways Jackson Hewitt ensures maximum accuracy:

- Tax preparers must pass background checks and extensive testing

- Ongoing technical training on the latest tax laws and IRS regulations

- Utilizing the latest e-filing software with built-in error detection

- Thorough review of prior returns to verify consistency

- Comparing taxpayer documents to entries on the return

By combining human expertise with the latest technology, Jackson Hewitt leaves no stone unturned when it comes to accuracy. You can trust your taxes are done right the first time.

No Sweat Tax Prep

In Murray, the Jackson Hewitt team treats customers like family. Their number one priority is providing an anxiety-free tax experience from start to finish. The accuracy guarantee is a reflection of their commitment to your peace of mind.

With guaranteed error-free preparation, you don’t have to stress about mistakes triggering an audit or costing you money later on. Jackson Hewitt handles everything meticulously so you can sit back and relax.

The Murray Jackson Hewitt tax office provides a comfortable, judgement-free environment. You’ll never feel intimidated asking them questions. Their tax pros are happy to walk you through the process and address any concerns.

We Stand Behind Our Work

At Jackson Hewitt, the saying goes “No one works harder for you than we do.” They stand behind that promise with their ironclad accuracy guarantee.

As locally owned and operated tax offices in Murray, they have a vested interest in safeguarding their reputation. Jackson Hewitt’s tax preparers are your neighbors, and they want to make sure your taxes are done right.

For over 20 years, Murray residents and businesses have trusted Jackson Hewitt to deliver error-free tax preparation. They’ve developed deep roots in the community through their customer-focused approach.

Experience Tax Prep You Can Trust

This tax season, why gamble on an unknown tax preparer or risking DIY mistakes? The tax experts at Jackson Hewitt eliminate the uncertainty with guaranteed accurate returns.

Let Jackson Hewitt give you the peace of mind that comes from taxes done right the first time. If you ever receive notice of an error on your return, they’ll make it right at no additional cost up to $6,000.

Contact Jackson Hewitt in Murray, KY today to learn more about their accuracy guarantee and get a head start on taxes. They’re standing by to answer all your questions and provide an estimate of your tax preparation costs.

Maximum Refund Guarantee – Get the max refund you deserve or your tax prep is free

It’s that time of year again – tax season is upon us! As residents of Murray, Kentucky prepare their tax returns, many may be wondering where to turn for reliable tax preparation services that will help them maximize their refund. Look no further than Jackson Hewitt Tax Service in Murray – they offer a maximum refund guarantee that ensures you’ll get the most money back, or your tax prep is free.

With dozens of locations across Kentucky, Jackson Hewitt has been a trusted name in tax preparation for over three decades. Their tax pros know all the latest tax laws and will meticulously examine your unique financial situation to uncover every deduction and credit you qualify for. This personalized attention to detail is how Jackson Hewitt makes good on their maximum refund guarantee.

Here’s how it works: when you get your taxes prepared at a participating Jackson Hewitt location, they guarantee you’ll receive the maximum tax refund you’re entitled to by law. If for any reason you don’t, they’ll redo your return for free. That takes the stress out of tax time and ensures you keep more of your hard-earned money.

Jackson Hewitt offers this iron-clad guarantee because their trained tax professionals take the time to understand your personal finances. They’ll ask strategic questions during an in-depth interview about your family, job, income, expenses, investments, retirement contributions, and more. Their expertise translates your financial life story into tax deductions and credits that lower your tax liability.

For example, they may discover you qualify for valuable tax breaks, such as:

- Earned Income Tax Credit

- Child and Dependent Care Credit

- Education credits like the American Opportunity Credit

- Deductions for mortgage interest, property taxes, and charitable donations

In addition to helping uncover tax deductions, Jackson Hewitt offers full service tax preparation. Their experts can e-file your federal and state tax returns for faster processing, ensure proper documentation of your deductions, double-check for errors that trigger audits, and guide you in setting up payment plans if needed. They’ll advise if an IRS audit assistance service is right for your situation in case you get audited.

Jackson Hewitt also provides Peace of Mind® reviews for an additional fee, where a second highly experienced tax pro checks over your return to catch any missed deductions or credits. This provides extra assurance you’re receiving every tax break possible. For Complex returns, they offer Platinum Tax Pro ReviewTM service.

Your personalized attention doesn’t end when you walk out their doors. Jackson Hewitt offers the following year-round services:

- Audit assistance from ex-IRS agents

- Help responding to IRS letters

- Guidance on filing amended returns

- Consultation on payment and repayment options

- Advice on retirement, investments, health savings accounts, and more

Jackson Hewitt makes the entire tax experience transparent and risk-free. There are never any hidden fees – you pay one upfront, flat fee and know exactly what you get. And they back it all up with their maximum refund guarantee, providing full confidence in their expert services.

This tax season, why risk missing out on deductions and credits and losing the maximum refund? The knowledgeable tax professionals at Jackson Hewitt Tax Service make it their mission to ensure you pay as little as legally required. Let them prepare, double-check, and file your taxes with total peace of mind and assurance of bigger returns.

Don’t leave money on the table – get the biggest possible refund you deserve. Visit or call your local Murray Jackson Hewitt office today and see what a difference their tax expertise makes. Rest assured with their no-risk Maximum Refund Guarantee!

Audit Assistance Guarantee – Free audit help from a Jackson Hewitt tax pro

Dealing with the IRS can be intimidating, especially if you get that dreaded letter saying you’re being audited. But tax experts at Jackson Hewitt in Murray, KY can help guide you through the process with their Audit Assistance Guarantee. This provides free audit help and support from a Jackson Hewitt tax pro, giving you peace of mind during a stressful time.

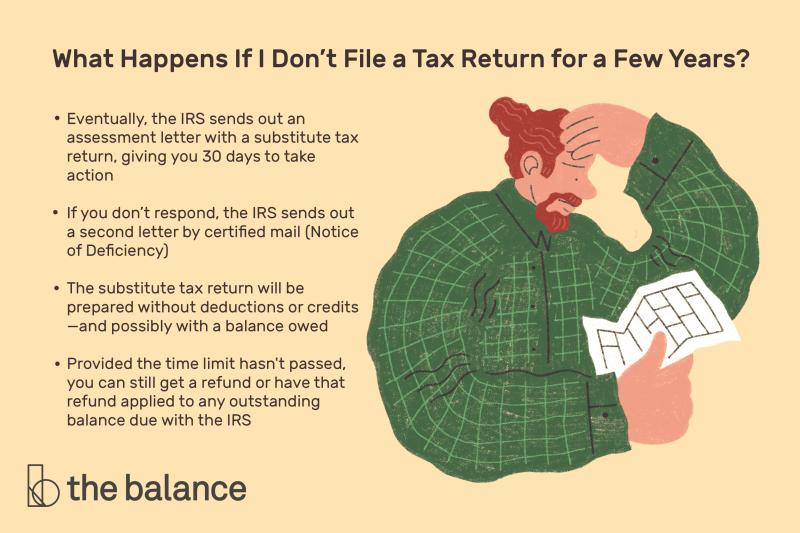

An IRS audit reviews your tax return in more detail to ensure no errors were made calculating credits and deductions. Getting audited does not necessarily mean you did something wrong, as returns are randomly selected for review. But it can be unnerving trying to gather documents or defend your filing yourself. This is where the Jackson Hewitt Audit Assistance Guarantee comes in.

With locations across Murray, Jackson Hewitt’s experienced tax pros are familiar with Kentucky state tax codes and deductions. They know how to accurately prepare returns to avoid triggering audits. But should you get an audit notice, they provide expert audit assistance at no additional cost beyond your tax prep fee. This gives you invaluable help from a tax pro who already knows the details of your return inside and out.

During an audit, you may need to:

- Locate documentation that supports your return numbers

- Respond to IRS inquiries and letters requesting more information

- Meet with an IRS agent to explain deductions, credits, or income

- Submit revised forms if errors are found

Having a Jackson Hewitt tax expert handle all audit-related tasks alleviates the pressure and anxiety. Their experienced team knows what receipts, forms, and evidence to supply. They can communicate with the IRS on your behalf and even accompany you to in-person audits for moral support.

The Jackson Hewitt tax pros preparing your return will also take proactive steps upfront to withstand an audit. For example, they may advise you to:

- Keep meticulous records of tax documents

- Avoid questionable deductions lacking evidence

- Seek tax help maximizing eligible deductions

- Get a Peace of Mind Review for double-checking

Should an audit occur, their experts walk you through each phase of the process:

- Audit Notification – They contact you ASAP if the IRS sends a notice to their office auditing your return.

- Information Gathering – They gather financial documents that substantiate your tax figures and deductions.

- Audit Preparation – They study your case and prepare responses to IRS questions and requests.

- Audit Support – They provide audit help by corresponding with the IRS on your behalf or attending in-person meetings.

- Result Review – If the IRS requests changes, they explain the outcome and revise your returns accordingly.

Having an experienced Jackson Hewitt tax pro in your corner removes the uncertainty of dealing with the IRS alone. TheirAUDIT ASSISTANCE GUARANTEEd audit support provides confidence during the process. In the unlikely event of additional tax owed, their tax experts explore payment plan or loan options to ease the burden.

Don’t stress over an IRS audit notice – let the tax experts at Jackson Hewitt handle it from start to finish! Their year-round audit assistance and support is there for you at any time. Get in touch with your local Murray Jackson Hewitt location and find out how the Audit Assistance Guarantee gives you invaluable peace of mind.

With over three decades of tax expertise, Jackson Hewitt has helped millions of Americans confidently file accurate returns. Their Audit Assistance Guarantee gives you a trusted tax pro by your side if the IRS comes knocking. Breathe easier knowing you have access to free audit help and support!

Student Tax Preparation – Special tax services for college students and families

College students in Murray have a reliable option for tax preparation – the student tax experts at Jackson Hewitt. They provide specialized tax services to help students and families maximize deductions and credits unique to their situation.

Jackson Hewitt has locations across Murray, KY and offers convenient tax help for the student community. Their trained tax pros understand the unique tax needs facing students, especially those working part-time jobs in addition to coursework.

Some key tax benefits college students may qualify for include:

- Higher standard deduction for dependents – $12,950 in 2022

- American Opportunity Tax Credit – Up to $2,500 per eligible student

- Lifetime Learning Credit – Up to $2,000 per tax return

- Student loan interest deduction – Up to $2,500

- Earned Income Tax Credit – For working students

Jackson Hewitt simplifies the tax preparation process for students. Their experts will conduct an in-depth interview to understand your academic status, income sources, tuition and fees paid, student loan details, and more. This determines optimal utilization of education credits, deductions, and income-based credits to minimize your tax liability.

For example, they determine scenarios where it may be advantageous to claim the student as a dependent on their parents’ return to reap larger credits as a family unit. Their experts ensure proper documentation is gathered to support claims to education benefits and credits on your taxes.

Jackson Hewitt also specializes in tax prep for graduate students working as teaching assistants or researchers. Their unique income situation of stipends and grants requires knowledge to classify properly and avoid overpayment. Jackson Hewitt has you covered.

International students face particular filing considerations as non-resident aliens. Jackson Hewitt helps ensure compliance with tax code through services like:

- Guidance on tax treaties between countries

- Exemption threshold knowledge for non-residents

- Specialized filing forms and procedures

- Assistance gathering proper student visa documentation

Student tax situation can change yearly with shifts in dependents, income, credits claimed, and more. Jackson Hewitt’s experts stay up-to-date on the latest tax laws and procedures affecting students and families. They can handle first-time filers, amended returns, and ongoing tax prep needs.

Jackson Hewitt also makes tax time easier for busy students and parents by offering:

- Flexible evening and weekend hours

- Filing an extension if needed

- Guidance on payment plan options

- Audit assistance if selected for review

- Response to IRS letters and notices

Getting taxes filed correctly and on time eliminates unnecessary stress during an already hectic semester. The tax pros at Jackson Hewitt give students comprehensive tax help filing individual or family returns. Multi-state tax preparation is also available for student moving between residences.

Don’t miss out on thousands in credits and deductions you’ve earned. This tax season, get expert tax preparation tailored to student needs. Visit a local Jackson Hewitt office in Murray or call to learn more about their specialized student tax services. Schedule an appointment today!

Jackson Hewitt is regarded as one of the top tax preparation providers in Murray, KY with an extensive track record helping students maximize their tax refunds. Trust your taxes to their knowledgeable experts and rest assured your unique tax situation is handled properly from filing to refund!

Small Business Services – Tax help for self-employed filers and small businesses

Running a small business involves handling many financial complexities, from payroll and expenses to quarterly taxes. This tax season, self-employed filers and small business owners in Murray can turn to the experts at Jackson Hewitt for simplified tax preparation and planning.

With locations across Murray, Jackson Hewitt provides full-service tax help catered to small businesses. Their tax pros have extensive expertise with Schedule C filings for sole proprietors and partnerships, payroll taxes, business deductions, depreciation, and more. They’ll ensure your business taxes are filed accurately and on time.

Jackson Hewitt begins by learning the ins and outs of your business. Expect questions on:

- Business structure – LLC, S-Corp, Partnership

- Number of employees

- Payroll details

- Income and expenses

- Assets and equipment

- Home office use

From there, their CPAs and enrolled agents can prepare your personal and business tax returns. This includes optimal use of business deductions, credits, and treatments to minimize your tax liability. Key services include:

- Income, payroll, and sales tax filings

- Business license and permit applications

- Bookkeeping and financial statements

- Sales tax exemption certificate

- New business registration and accounting setup

Jackson Hewitt’s experts stay up-to-date on the latest IRS rules and forms affecting small businesses. For example, they’ll ensure proper documentation when claiming:

- Home office deduction

- Business use of vehicle expenses

- Health insurance premium deductions

- Capital equipment first-year depreciations

They can also advise on business versus personal expenses, estimated quarterly payments, retirement plan options, payroll taxes, and much more. Their personalized guidance optimizes write-offs and tax savings for your business.

Jackson Hewitt makes tax preparation smooth and organized for busy owners. You can digitally send tax documents for review or mobile upload. Appointments accommodate your schedule, with weekend and after-hours times. Tax pros explain filings and planning in understandable terms – no complex accounting speak.

Their year-round services provide ongoing assistance beyond tax season, such as:

- IRS audit protection

- Responses to tax notices and letters

- Tax penalty abatement requests

- Payment plan coordination

- Bookkeeping and sales tax services

- Business tax planning and projections

Jackson Hewitt is trusted by small business owners across Murray for simplified tax prep. Customized attention from CPAs and EAs provides assurance your business taxes are done right. Experience fewer headaches this tax season and beyond with dedicated experts in your corner.

Don’t go it alone – tax laws for businesses change constantly. Leverage Jackson Hewitt’s expertise to maximize write-offs and deductions while staying IRS compliant. Call a Murray Jackson Hewitt location today to learn more about tax filing, planning, payroll, bookkeeping, and other services for your small business!

Year-Round Tax Planning – Proactive tax planning services to maximize deductions

The tax experts at Jackson Hewitt in Murray, KY know taxes are not just a once-a-year event. Proactive tax planning throughout the year is key to maximizing deductions, avoiding surprises, and keeping more of your hard-earned money. Their year-round tax planning services optimize your tax situation 365 days a year.

Jackson Hewitt locations across Murray provide ongoing tax advice to reduce your tax liability in the current and future years. Their tax pros become familiar with your personal finances in order to recommend strategic moves that align with your changing life priorities.

For example, getting married, having a child, retiring, or changing jobs can all impact your optimal tax strategy. Jackson Hewitt’s CPAs and enrolled agents offer guidance on life events such as:

- Getting married or divorced

- Having or adopting a child

- Paying educational expenses

- Buying or selling a home

- Taking distributions from retirement accounts

- Receiving an inheritance or large gift

- Changing jobs or salaries

They provide proactive tax advice on timing income and deductions around life events to maximize tax savings. Their tax planning assistance can include:

- Projecting taxable income and withholdings

- Coordinating retirement plan contributions

- Reviewing benefits selection for new jobs

- Establishing college savings accounts

- Advising when to sell investments at lower capital gains rates

Jackson Hewitt also keeps clients informed on the latest IRS rule changes that present planning opportunities, such as tax code changes for retirement and education benefits. Their tax experts know how to leverage these changes to legally minimize your tax responsibilities.

Ongoing guidance throughout the year allows for smoother tax preparation come filing season. Year-round services Jackson Hewitt provides includes:

- Tax projection and estimates

- Recordkeeping and document collection tips

- Retirement contribution planning

- Required minimum distribution (RMD) advice

- Tax-advantaged investment options

- Education credit and deduction optimization

- Small business expense planning

Planning early prevents last minute surpruses at tax time. It also avoids overpaying taxes unnecessarily. Jackson Hewitt makes tax prep easier by examining your unique situation early and often. Their CPAs and EAs become trusted advisors for maximizing deductions and savings year-round.

Don’t leave tax dollars on the table. Let the tax experts at Jackson Hewitt prepare for tax time now! Call your local Murray office today to schedule a personalized, proactive tax check-up and planning session.

With Jackson Hewitt’s year-round guidance, you can feel confident you’re optimizing tax savings based on your life circumstances. Their ongoing expertise means more money in your pocket over the short- and long-term!

Easy Financing Options – 0% interest loans to pay your tax prep fees over time

The start of a new year also means tax season is here. As people in Murray prepare their returns, tax preparation fees can be a financial burden. Thankfully Jackson Hewitt offers easy payment options to finance your tax prep with 0% interest.

Jackson Hewitt has multiple locations in Murray, KY and wants to make tax time worry-free. That’s why they offer no-interest financing so you can pay your tax prep fees over time. This avoids high upfront costs.

Jackson Hewitt gives you two flexible financing options:

- No-fee Refund Advance Loan – A 0% interest loan where tax prep costs come directly out of your refund when received.

- No-interest Financing – Pay for tax prep over 3 or 6 months with 0% interest.

The Refund Advance Loan deducts tax preparation fees from your total refund amount. This immediately finances your tax prep costs with no loan application needed. The remaining refund is paid to you by check or direct deposit.

For example, if your tax prep bill is $400 and refund $2000, you would receive $1600 immediately. The $400 tax prep fee is automatically paid from the refund once received from the IRS.

With Jackson Hewitt’s no-interest financing, you pay your tax prep fee evenly in 3 or 6 monthly payments. There is no loan application, interest, or hidden fees – just predictable monthly payments until the balance is paid.

Qualifying for these financing options is easy:

- No credit check required

- Payments are made automatically each month

- Works even for customers without a bank account

Jackson Hewitt’s upfront pricing ensures you know the cost before filing begins. Their experts then discuss with you the most affordable payment options. They also let you know upfront how much of a refund to expect so you can choose the best financing option.

Tax prep services that financing can cover include:

- Individual, family, business returns

- Itemized vs standard deduction selection

- Maximizing credits and deductions

- E-filing state and federal returns

- Audit assistance and representation

- Responses to IRS letters and notices

Jackson Hewitt’s goal is to match you with a personalized financing solution. This lets you get your taxes filed on time without breaking the bank. Options like the Refund Advance Loan allow you to put your tax refund to good use right away.

Financing also gives you time to properly gather documents for accurate filing. Jackson Hewitt takes the stress out of tax time by offering payment plans with no surprise costs or interest charges.

As tax specialists, Jackson Hewitt’s preparers ensure you maximize deductions to increase your tax refund – the ideal way to pay your tax prep costs! This tax season, skip financial worries and file with confidence by utilizing Jackson Hewitt’s financing programs.

Contact your local Murray Jackson Hewitt office today to learn more about easy 0% interest financing options. Their team will explain how you can afford expert tax preparation even on a budget!

Convenient Locations – Find a Jackson Hewitt office in Murray near you

Finding a reliable tax preparation service in Murray just got easier. Jackson Hewitt Tax Service has numerous office locations throughout the city, providing convenient options for expert tax help close to home or work.

With 75+ years of experience behind them, Jackson Hewitt is America’s tax experts. They operate over 55 offices across Kentucky, including multiple locations right here in Murray.

Some key areas where you can find a Jackson Hewitt tax office in Murray include:

- Murray Plaza – 414 N 12th St

- Southside Shopping Center – 817 S 12th St

- Chestnut Hills Shopping Center – 720 N 12th St

- Parkway Plaza – 1421 N 12th St

- Murray Business Center – 416 N 4th St

Jackson Hewitt provides expert tax preparation services for all tax situations. Their Murray tax pros have specific knowledge regarding Kentucky state tax laws and forms to ensure you maximize eligible deductions.

No tax situation is too complex for Jackson Hewitt. At any Murray location they can handle:

- Individual and joint married tax returns

- Small business, partnership, LLC taxes

- Tax preparation for military families

- First-time tax filer services

- Previous year and amended return filings

Jackson Hewitt also offers helpful services making the tax process smooth and transparent. These include:

- Upfront pricing

- Point-of-service payment options

- Digital upload of tax documents

- Tax refund advance loans

- Audit assistance and representation

All Murray Jackson Hewitt tax offices provide electronic filing to the IRS and state for faster processing and refunds. Trained preparers are available evenings and weekends by appointment to accommodate everyone’s schedule.

Jackson Hewitt locations make tax prep convenient with drive-up drop off service. No waiting around – simply drop off documents and an expert will contact you if any questions arise. They’ll inform you when the return is completed so you can promptly pick up and sign.

Murray residents also have the option of in-office tax preparation. Their offices provide comfortable seating with WiFi access while you wait. Some locations also offer snacks and refreshments.

With accurate filing and maximum refund guaranteed, Jackson Hewitt takes the tax season stress out of preparing Kentucky and Federal returns. Find a conveniently located tax office by visiting jacksonhewitt.com or calling 513-242-1200.

Appointments Available – Schedule your tax appointment online in minutes

Filing taxes can be time consuming, especially if you walk into a tax office and have to wait. At Jackson Hewitt in Murray, KY, you can conveniently schedule appointments online and skip the wait for expert tax preparation services.

Jackson Hewitt allows you to book appointments via their website with just a few clicks. Available times display for each Murray location based on preparer availability. You simply choose the date, time, office, and tax professional that works for you.

Some key benefits of online appointment scheduling include:

- Avoid waiting by showing up at your reserved time

- Pick your preferred location from multiple Murray offices

- Select the tax pro you want based on details like experience and languages spoken

- Reschedule or cancel appointments online as needed

You can schedule your Jackson Hewitt appointments on both desktop and mobile. This makes finding the right date, time, and location convenient whether at home or on-the-go.

When booking online, Jackson Hewitt allows you to specify the tax services needed, such as:

- Individual or joint married filing

- Home purchase deductions

- Investment income

- Rental property filing

- Small business taxes

Entering tax details ahead helps their preparers pull the right forms and review your situation thoroughly during the appointment. You also have the option to upload tax documents through their secure online portal for a more seamless filing process.

Jackson Hewitt offers flexible appointment times to fit everyone’s schedule:

- Weekday morning, afternoon, and evening hours

- Extended hours on weekends

- Virtual video conference appointments

Their Murray tax offices stay open late into tax season and weekends to accommodate last-minute filers. You’ll receive appointment reminders via email and text to confirm logistics leading up to your visit.

Jackson Hewitt guarantees maximum refund and 100% accuracy when you schedule ahead. Appointments allow their tax experts to dedicate the time needed to explore every tax deduction and credit unique to your situation. Walk-in filers may feel rushed during high season.

Online scheduling also makes tax prep easy if you move around during the year. Simply book appointments with different Jackson Hewitt locations based on convenience. For a stress-free tax experience, schedule at jacksonhewitt.com or on the Jackson Hewitt mobile app today.

Don’t leave your tax preparation to chance – set an appointment online with the Murray tax experts at Jackson Hewitt. Their personalized attention ensures you receive your biggest possible refund!

Bilingual Tax Pros – Get your taxes done in English or Spanish

Language barriers can make tax preparation difficult and stressful for non-native English speakers in Murray. Thankfully, Jackson Hewitt has bilingual tax pros at offices across the city to help you file your taxes with ease in English or Spanish.

Jackson Hewitt employs tax preparers fluent in multiple languages at their Murray locations. When booking appointments online or over the phone, you can request a tax pro who speaks your preferred language.

Their bilingual tax experts provide services in languages including:

- Spanish

- Chinese

- Korean

- Vietnamese

- Russian

This language versatility allows Jackson Hewitt to serve the diverse Murray community effectively. Getting your taxes filed can be complicated enough without a language barrier.

Jackson Hewitt makes the process smooth by matching you with a native speaking tax consultant. They feel confident explaining complex tax topics and forms in your spoken language.

The bilingual tax pros have extensive training in both English and their second language. Many are native speakers allowing for fluid conversation and precise details.

Key services Jackson Hewitt’s bilingual team provides include:

- Income tax preparation for individuals and families

- Small business return preparation

- Guidance on deductions and credits

- E-filing and direct deposit of refunds

- Audit assistance and correspondence

Getting personalized tax help in your native tongue removes uncertainties and errors. Jackson Hewitt’s CPAs and EAs take the time to clarify any confusing tax topics to ensure you understand.

Filing services are backed by guaranteed maximum refunds and 100% accuracy when using a bilingual tax pro. The ability to communicate details accurately results in optimal tax preparation.

Jackson Hewitt also provides tax documents and information in Spanish upon request. This further bridges comprehension gaps for faster filing. Other accommodations include:

- Over-the-phone interpreters

- Video conference appointments

- Translated website content

- Multilingual office signage

Don’t let language be a tax time barrier. Schedule an appointment with Jackson Hewitt’s bilingual tax experts today by phone or online.

Jackson Hewitt remains dedicated to making expert tax prep accessible to all citizens. By employing bilingual CPAs and EAs, they remove language obstacles for smooth filing in Murray’s diverse community.

Satisfaction Guarantee – Get your money back if you’re not 100% satisfied

Finding the right tax preparation service can make all the difference during tax season. You want accurate returns, maximum refunds, and an overall smooth and stress-free process. In Murray, many turn to the tax experts at Jackson Hewitt for just that. With knowledgeable staff, convenient locations, and a Satisfaction Guarantee, Jackson Hewitt aims to deliver exceptional service. As 2023 approaches, here’s a closer look at what this trusted tax chain offers locally.

The Benefits of Choosing Jackson Hewitt

With decades of experience under their belt, Jackson Hewitt has fine-tuned their approach to taxes. They provide a personalized experience and continually update their training to cover changing tax laws and forms. Some key advantages include:

- Accuracy guarantees – They’ll pay any penalty plus interest if they make an error on your return.

- Maximum refund guarantees – They’ll pay you $100 if another tax preparer gets you a bigger refund.

- Audit assistance – They’ll help you respond to any IRS or state tax notices.

- Year-round support – You can call them any time you have tax-related questions.

- Convenient locations – With 3 offices in the Murray area, you can usually find one close by.

Jackson Hewitt employs knowledgeable tax professionals who undergo rigorous training every year. This expertise allows them to find tax deductions and credits you may miss on your own. Their upfront, transparent pricing also means no surprises down the road. Overall, they aim to provide peace of mind during tax time.

A Look at Key Jackson Hewitt Services for 2023

From individual and business tax preparation to audit assistance, Jackson Hewitt offers a wide range of services. Here are some of their top offerings for the 2023 tax season:

- Individual income tax return preparation – Their tax pros will handle the entire return process for you, start to finish. They’ll walk through your unique tax situation, gather forms, review for deductions/credits, file the returns electronically, and more.

- Business tax services – No matter what type of business you own, they can prepare your business taxes. This includes partnerships, LLCs, S-corps and more.

- Second look review – Their pros will review your completed tax return to see if they can find any additional deductions or money-saving opportunities.

- Audit assistance – If you get an audit notice, they’ll help explain what it means and guide you through the entire audit process.

- Refund advance loans – You can get a portion of your refund in as little as 24 hours so you don’t have to wait weeks for your money.

Along with these services, they also offer tax debt relief, year-round tax planning, expat/international tax prep, and more. Their personalized approach looks at your unique financial situation to determine which tax-saving moves make sense for you.

Convenient Murray Locations

With three conveniently located offices in Murray, Jackson Hewitt makes it easy to get expert tax help close to home. Here is the contact information for each location:

- Murray #1 – 208 S 12th St, Murray, KY 42071 – (270) 753-5050

- Murray #2 – 813 N 12th St # A, Murray, KY 42071 – (270) 759-9379

- Murray #3 – 656 N 12th St, Murray, KY 42071 – (270) 753-0799

All locations are open extended hours during tax season. You can walk-in or make an appointment online or over the phone. Their friendly office staff will check you in and connect you with one of their highly qualified tax professionals.

Satisfaction Guarantee Offers Peace of Mind

Jackson Hewitt offers a first-of-its-kind Satisfaction Guarantee. If for any reason you aren’t 100% satisfied with their services, they’ll refund your tax preparation fees. This guarantee highlights their commitment to providing an exceptional experience and results you can feel good about.

As the 2023 tax season approaches, consider letting Jackson Hewitt handle the work for you. With tailored service, maximum refunds, and guarantees that protect you, they have the know-how to make tax time smoother. Contact one of their Murray offices today to learn more and get a head start on your taxes.

Experienced Tax Pros – CPAs, EAs and seasoned tax pros do your taxes

Doing your own taxes can be complicated and stressful. All those forms, calculations, and constantly changing tax laws – it’s a lot to keep up with. In Murray, many turn to the experienced tax professionals at Jackson Hewitt for help. With CPAs, enrolled agents (EAs), and seasoned tax preparers on staff, they have the expertise to get you maximum refunds. As tax time approaches, let’s take a closer look at their team of pros and services for 2023.

The Dedicated Pros Behind Jackson Hewitt

Jackson Hewitt employs a team of dedicated tax specialists to serve clients. Credentials held by their pros include:

- CPAs – Certified Public Accountants have passed rigorous licensing exams and meet ongoing education requirements.

- Enrolled agents – EAs are licensed by the IRS to represent taxpayers during audits, appeals, and collection disputes.

- AFSP credential holders – This Jackson Hewitt advanced credential requires passing 5 federal tax exams.

- Seasoned tax preparers – These pros have many years of real-world tax preparation experience.

Jackson Hewitt requires continuing education for all tax preparers. This ensures they’re up-to-date on the latest tax laws, forms, credits, deductions, etc. Their combination of specialized credentials and training enables them to handle complex tax situations with ease.

A Look at Key Jackson Hewitt Services for 2023

From simple individual returns to nuanced business taxes, Jackson Hewitt’s seasoned pros handle it all. Their personalized services for 2023 include:

- Individual tax return prep – Their CPAs, EAs, and tax pros will prep, review, file, and follow up on your personal income taxes.

- Business tax services – No matter your business structure, they’ll prepare your business returns accurately.

- Audit help – If you’re audited, they’ll clearly explain what’s needed and represent you to the IRS/state tax agency.

- Tax debt relief – They can help you understand payment plans, offers in compromise, innocent spouse relief, and more options.

- Year-round tax planning – Their guidance can help reduce your tax liability in the current and future years.

No tax situation is too complex for Jackson Hewitt’s knowledgeable pros. They stay up-to-date on all the intricacies of the tax code so you don’t have to.

Convenient Murray Locations

With three offices in Murray, Jackson Hewitt makes your taxes as painless as possible. Here is the contact information for each location:

- Murray #1 – 208 S 12th St, Murray, KY 42071 – (270) 753-5050

- Murray #2 – 813 N 12th St # A, Murray, KY 42071 – (270) 759-9379

- Murray #3 – 656 N 12th St, Murray, KY 42071 – (270) 753-0799

All locations have extended hours during tax season for your convenience. You can either walk-in or schedule an appointment online/by phone. When you arrive, you’ll be paired with the tax pro best suited for your needs.

Leave Your Taxes to the Experts

With all the complexities of the tax code, filing yourself and maximizing deductions is no easy task. At Jackson Hewitt, their pros have the tax know-how to ensure you get the biggest refund possible. You can rest assured your taxes are in good hands with their team of CPAs, EAs, credentialed preparers, and seasoned specialists. Contact a Murray Jackson Hewitt location today to learn more and get expert 2023 tax help.

Conclusion – Why choose Jackson Hewitt for your 2023 taxes in Murray, KY

Preparing and filing your taxes yourself can be challenging and leave you wondering if you got the maximum refund. In Murray, Kentucky, Jackson Hewitt provides professional tax help that takes the uncertainty and stress out of tax season. With expert tax pros, a satisfaction guarantee, and personalized service, they have many benefits that set them apart. As you look ahead to your 2023 taxes, here’s a recap of what makes Jackson Hewitt a top choice for tax preparation in Murray.

Dedicated Tax Experts Get You the Biggest Refund

Jackson Hewitt employs a team of trained tax specialists with credentials like CPAs, enrolled agents, and AFSP designees. These pros have deep tax knowledge and use it to find every deduction and credit available. The result? More money back in your pocket. Their expertise enables them to handle complex tax situations with ease.

Upfront Transparent Pricing – No Surprise Fees

Some tax preparers lure you in with low-ball pricing only to tack on lots of add-on fees at the end. Not Jackson Hewitt. Their no-surprises pricing is clearly outlined upfront before you start so you know exactly what to expect. This straightforward fee structure helps build trust.

Tax Audit Assistance Provides Peace of Mind

If the IRS or state taxing authority ever audits you, Jackson Hewitt has your back. Their pros are by your side explaining what’s needed and representing your case every step of the way. With their expertise in accounting and tax codes, they can make the audit process smooth and painless.

Convenient Locations Throughout Murray, KY

Jackson Hewitt offers three conveniently located offices in Murray at:

- 208 S 12th St

- 813 N 12th St # A

- 656 N 12th St

All locations are open extended hours during tax time for your scheduling flexibility. Whether you book an appointment online or just walk in, their friendly staff provides welcoming service.

Satisfaction Guarantee Protects You

Jackson Hewitt offers a Satisfaction Guarantee that no other major tax chain does. If for any reason you are dissatisfied with their tax preparation services, they will refund your money. This highlights their commitment to your complete satisfaction.

Tax Refund Loans Available

Through their Refund Advance program, Jackson Hewitt offers 0% interest loans based on your expected tax refunds. This provides access to your refund money in as little as 24 hours so you don’t have to wait weeks for the IRS to process.

As this overview illustrates, Jackson Hewitt offers many advantages for tax filers in Murray, KY. From tax pros who maximize deductions to service guarantees that protect you, they’ve got you covered for your 2023 taxes. Contact Jackson Hewitt today to learn more and schedule an appointment with their Murray tax experts.