What is a Certificate of Insurance. Why do you need a Certificate of Insurance. Who requires a Certificate of Insurance. How to get a Certificate of Insurance quickly. What are the key details to include on a Certificate of Insurance. Which businesses require proof of insurance. How to buy your own insurance for certification purposes.

Understanding Certificates of Insurance: A Comprehensive Overview

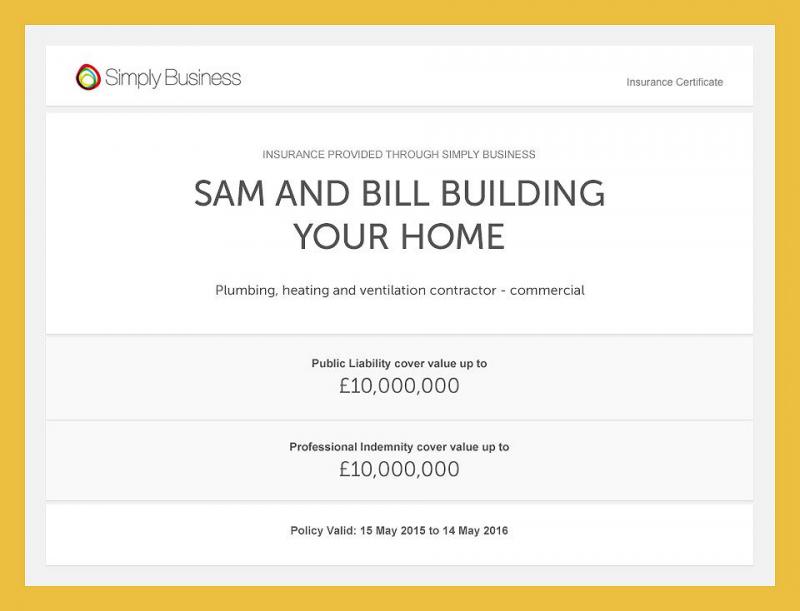

A Certificate of Insurance (COI) serves as a crucial document in various business and personal transactions. It provides tangible proof of insurance coverage, detailing essential information about the policyholder’s insurance status. This document plays a pivotal role in risk management for businesses and individuals alike.

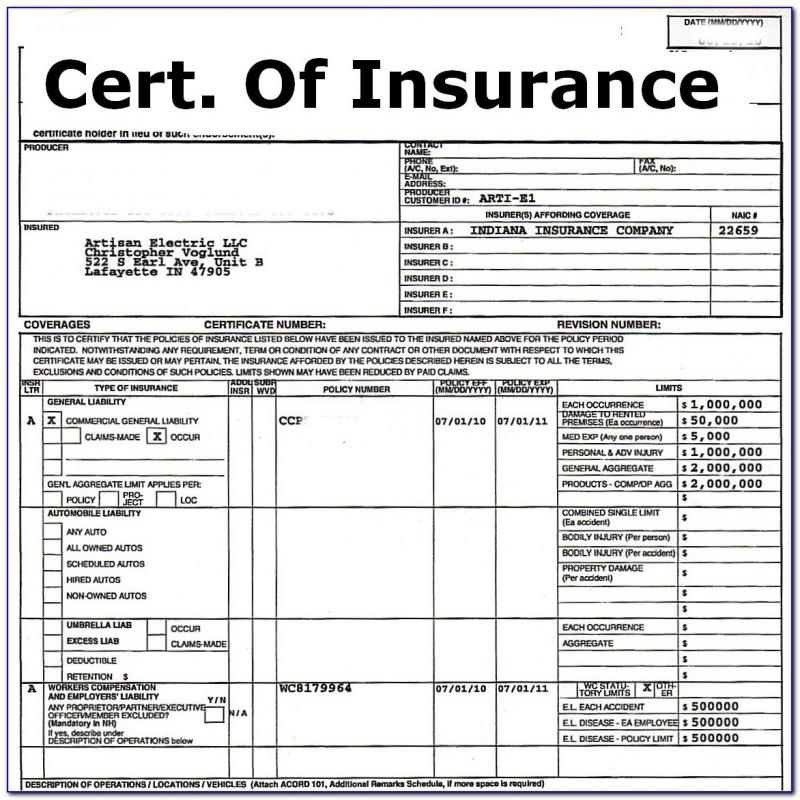

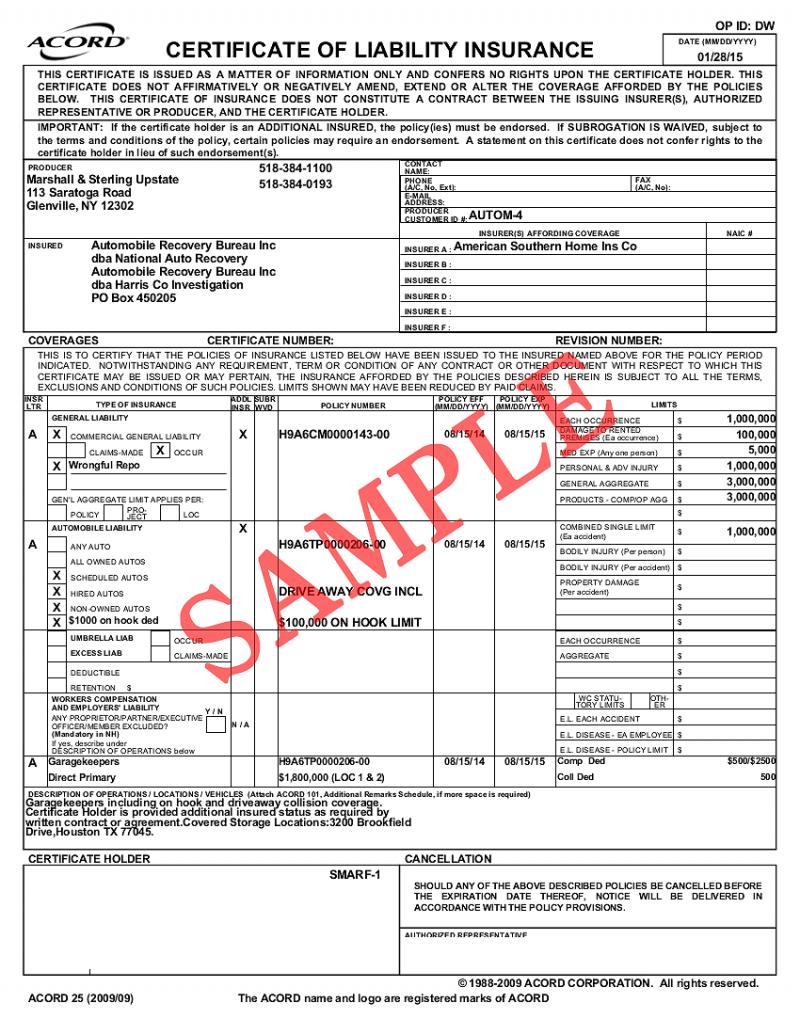

But what exactly does a Certificate of Insurance contain? Typically, a COI includes:

- The name of the insured party

- The insurance provider’s details

- Policy number

- Types of coverage

- Coverage limits

- Policy effective dates

- Certificate holder’s information

These details collectively provide a comprehensive snapshot of the insurance coverage, allowing interested parties to verify that the necessary protections are in place.

The Importance of Certificates of Insurance in Modern Business

In today’s risk-averse business environment, Certificates of Insurance have become indispensable. They serve as a safeguard for various entities, ensuring that the parties they engage with are adequately insured. This protection extends to a wide range of scenarios, from property rentals to large-scale construction projects.

Why has the Certificate of Insurance gained such prominence? The answer lies in its ability to mitigate risk. By requiring proof of insurance, businesses and individuals can protect themselves from potential liability in case of accidents or damages. This practice has become standard across numerous industries, reflecting a growing awareness of the importance of risk management.

Common Scenarios Requiring a Certificate of Insurance

Certificates of Insurance are required in various situations. Some of the most common include:

- Mortgage applications

- Commercial property leases

- Construction project bids

- Event planning and venue rentals

- Vendor contracts

In each of these scenarios, the requesting party aims to ensure that they are protected from potential liability arising from the actions or property of the insured party.

Key Stakeholders: Who Typically Requests Certificates of Insurance?

Understanding who commonly requests Certificates of Insurance can help businesses and individuals prepare for such requirements. The list of entities that often require proof of insurance is diverse, reflecting the widespread adoption of this risk management tool.

Which organizations are most likely to ask for a Certificate of Insurance? Here’s a breakdown of common requestors:

- Financial institutions (for loans and mortgages)

- Property owners and landlords

- Event venues

- General contractors

- Government agencies (for permits and licenses)

- Large corporations (when engaging vendors or subcontractors)

Each of these entities has specific reasons for requiring proof of insurance, often related to protecting their own interests and managing potential risks associated with their operations or property.

Essential Information: What to Include in a Certificate of Insurance

Creating a comprehensive Certificate of Insurance involves including specific details that provide a clear picture of the insurance coverage. While the exact requirements may vary depending on the requesting party, certain elements are considered standard across most Certificates of Insurance.

What are the crucial components of a Certificate of Insurance? Here’s a detailed list:

- Policyholder’s name and contact information

- Insurance company’s name and contact details

- Policy number for easy reference

- Types of coverage (e.g., general liability, property insurance, workers’ compensation)

- Coverage limits and any deductibles

- Policy effective dates, including start and end dates

- Certificate holder’s name and address

- Any additional insured parties, if applicable

- Cancellation notice period

- Authorized representative’s signature

Including these details ensures that the Certificate of Insurance provides a comprehensive overview of the coverage, meeting the needs of most requesting parties.

Obtaining a Certificate of Insurance: Methods and Best Practices

Securing a Certificate of Insurance doesn’t have to be a complex process. There are several methods available, each with its own advantages and considerations. The choice often depends on factors such as urgency, the specific requirements of the requesting party, and the nature of the insurance coverage.

How can one obtain a Certificate of Insurance quickly and efficiently? Here are the primary methods:

- Direct request to the insurance provider or agent

- Utilization of online certificate issuance services

- Self-generation using available templates (with caution)

Each method has its pros and cons. Requesting directly from the insurer ensures accuracy but may take longer. Online services offer speed but may come with additional costs. Self-generation is quick but may not be accepted by all requesting parties.

Best Practices for Obtaining Certificates of Insurance

To streamline the process of obtaining a Certificate of Insurance, consider these best practices:

- Maintain open communication with your insurance provider

- Keep your policy information readily accessible

- Understand the specific requirements of the requesting party

- Plan ahead to avoid last-minute rushes

- Consider setting up an account with an online certificate issuance service for recurring needs

By following these practices, you can ensure a smoother, more efficient process when obtaining Certificates of Insurance.

Navigating Insurance Purchase for Certification Purposes

In some cases, individuals or businesses may find themselves needing to purchase insurance specifically to obtain a Certificate of Insurance. This situation often arises when entering new business ventures, leasing property, or participating in events that require specific coverage.

What types of insurance are commonly required for certification purposes? Here’s an overview of the most frequently requested policies:

- General Liability Insurance

- Professional Liability Insurance

- Commercial Property Insurance

- Workers’ Compensation Insurance

- Commercial Auto Insurance

- Event Insurance

The specific type of insurance needed will depend on the nature of your business or activity and the requirements of the certificate requestor.

Steps to Purchase Insurance for Certification

If you need to buy insurance to obtain a Certificate of Insurance, follow these steps:

- Identify the specific insurance requirements

- Research insurance providers specializing in your needed coverage

- Obtain and compare quotes from multiple insurers

- Review policy details carefully, ensuring they meet certification requirements

- Purchase the policy that best fits your needs and budget

- Request a Certificate of Insurance from your new provider

Remember, it’s crucial to ensure that the policy you purchase not only satisfies the certificate requirements but also provides adequate protection for your business or personal needs.

Industries and Businesses Commonly Requiring Proof of Insurance

While the requirement for Certificates of Insurance spans across various sectors, certain industries are more likely to request this documentation. Understanding which businesses typically require proof of insurance can help individuals and companies prepare accordingly.

Which industries most frequently ask for Certificates of Insurance? Here’s a comprehensive list:

- Construction and Contracting

- Real Estate and Property Management

- Event Planning and Management

- Transportation and Logistics

- Healthcare and Medical Services

- Professional Services (e.g., consulting, legal, accounting)

- Retail and Wholesale

- Manufacturing

- Technology and Software Development

- Education and Training

Each of these industries has unique risks and liabilities, making proof of insurance a crucial component of their business relationships and operations.

Specific Business Types Requiring Certificates of Insurance

Within these broader industries, certain types of businesses are more likely to require Certificates of Insurance. These include:

- General Contractors and Subcontractors

- Property Owners and Landlords

- Event Venues and Organizers

- Staffing Agencies

- Shipping and Freight Companies

- Professional Service Firms

- Vendor Management Companies

- Educational Institutions

- Healthcare Facilities

- Government Agencies and Municipalities

For businesses operating in these areas, having a system in place for quickly obtaining and providing Certificates of Insurance can streamline operations and foster stronger business relationships.

The Future of Certificates of Insurance: Trends and Innovations

As we move further into the digital age, the landscape of insurance certification is evolving. New technologies and changing business practices are shaping the future of how Certificates of Insurance are issued, verified, and managed.

What are the emerging trends in Certificate of Insurance management? Here are some key developments to watch:

- Blockchain technology for secure, tamper-proof certificates

- AI-powered verification systems

- Digital wallets for storing and sharing insurance certificates

- Real-time certificate tracking and updates

- Integration with risk management software

These innovations promise to make the process of obtaining and verifying Certificates of Insurance more efficient, secure, and transparent.

Preparing for the Future of Insurance Certification

To stay ahead of these trends, businesses and individuals can take several steps:

- Embrace digital solutions for certificate management

- Stay informed about emerging technologies in the insurance industry

- Prioritize data security and privacy in certificate handling

- Consider adopting blockchain-based systems as they become available

- Invest in training to understand new certificate verification methods

By preparing for these changes, businesses can ensure they remain compliant and efficient in their insurance certification processes.

As we’ve explored, Certificates of Insurance play a crucial role in modern business operations, risk management, and regulatory compliance. From understanding their basic components to navigating the complexities of obtaining and managing them, this comprehensive guide provides a solid foundation for anyone dealing with insurance certification. As technology continues to reshape this landscape, staying informed and adaptable will be key to successfully navigating the world of Certificates of Insurance.

What is a Certificate of Insurance?

A certificate of insurance, sometimes called a proof of insurance, is a document that provides proof of your insurance coverage. It shows that you have purchased the insurance required for a home, auto, business, event, or other purpose.

Certificates of insurance are common requirements when applying for loans, leases, permits, or participation in events. They provide proof to the other party that you have secured the necessary insurance coverage.

The certificate provides key details about your policy, including the insurance company, policy number, coverage types, limits, and policy effective dates. This verifies that coverage is active and meets any minimum requirements.

Why Do You Need One?

There are many common situations where you may need to provide a certificate of insurance:

- New home purchases – Lenders often require proof of homeowners insurance before approving a mortgage.

- Renting office space – Landlords frequently request certificates from business tenants to confirm property and liability coverage is in place.

- Bidding on construction projects – General contractors must provide subcontractors’ certificates to prove adequate coverage.

- Event venues – Vendors, performers, and exhibitors are typically required to carry event insurance that protects the venue owner.

The bottom line is that certificates provide assurance to others that you are properly insured against risks associated with the activity. They don’t want to be held liable in the event of an incident.

Who Requires a Certificate of Insurance?

There are many types of organizations that commonly ask for a certificate of insurance:

- Banks – For home and auto loans, to guarantee property and collision coverage.

- Landlords – To ensure renters or commercial tenants have liability protection.

- Vendors – When using third-party vendors, proof of coverage is often required.

- General contractors – From subcontractors before allowing them on job sites.

- Venues – A standard requirement for weddings, conferences, concerts, and other events.

Insurance certificates provide critical risk management for these groups. They want to confirm adequate coverage is in place for their protection.

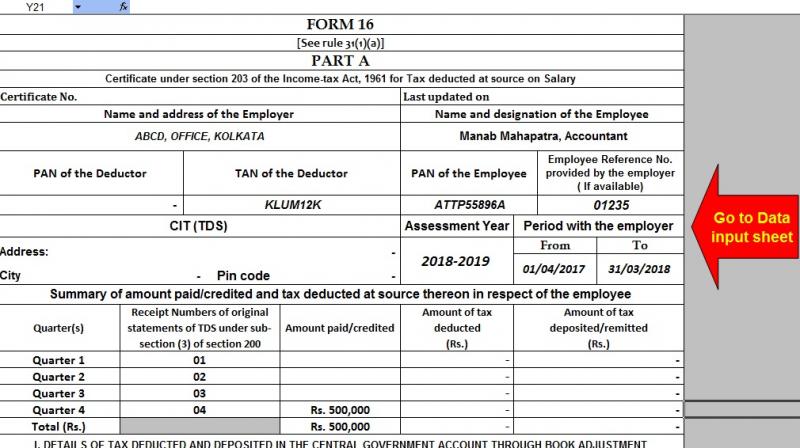

Key Details to Include on the Form

There are several key details that should be included on a certificate of insurance:

- Policyholder name – The individual or business holding the policy.

- Insurer name – The insurance company providing coverage.

- Policy number – The specific policy number for reference.

- Coverage types – General liability, commercial property, workers’ comp, etc.

- Limits – The dollar amounts that the policy covers.

- Effective dates – The policy term start and end dates.

- Certificate holder – The name of the entity requesting proof of insurance.

Providing this information verifies that coverage is active and applicable for the situation at hand. Most organizations will provide instructions on what details they need documented.

How to Get a Certificate of Insurance

There are a few options for obtaining a certificate of insurance:

Request from Your Insurance Company – The easiest option is to directly contact your agent or insurer. Most will issue standard certificates on request at no charge. This ensures all policy details are accurate.

Use an Online Service – There are services like CertificatesNOW and Certificate of Insurance Pros that provide instant certificates. You provide details online and receive a certificate via email.

Fill Out a Free Template – Certificate templates are available online. You can download one and fill it out yourself with your policy details. Just confirm the recipient will accept a self-generated form.

The best source depends on turnaround time needed and whether you want to self-produce or utilize an official insurer document. Discuss options with your agent if uncertain what method will work best.

Buying Your Own Insurance

If you don’t yet have coverage, you’ll need to purchase a policy before obtaining proof. Common insurance types often requiring certificates are:

- General liability insurance – Protects against property damage, bodily injury, personal injury, and advertising injury claims stemming from your business or events.

- Commercial property insurance – Insures your business location and contents against damage and loss.

- Workers’ compensation – Provides coverage for employee injuries and illnesses related to work activities.

- Special event insurance – Optional policy to cover unique risks associated with events like weddings, concerts, and conferences.

These policies allow you to operate safely while also obtaining the certificates and insurance limits often required.

Types of Businesses Requiring Proof of Insurance

There are many industries that commonly require others to carry insurance and provide certificates:

Coaching and Training Programs – Coaching associations and training programs typically require certificates to ensure adequate coverage for activities. This protects against liability claims for injuries or incidents.

Contractors and Construction Companies – General contractors need subcontractors to provide insurance certificates listing them as “additional insured”. This gives backup coverage for the project and job site.

Event Venues – Banquet halls, conference centers, and other venues need proof of insurance from those hosting events on their premises. This includes weddings, birthday parties, conferences, and trade shows.

Nearly any business or property owner faces risks when allowing others to deliver services on their behalf or utilize their space. Insurance certificates provide an added layer of financial protection if the unforeseeable occurs.

Benefits of Providing a Certificate of Insurance

Supplying a certificate of insurance provides several advantages:

- Meet legal and contractual obligations for insurance requirements.

- Verify policy details to give others peace of mind.

- Speed up approval processes and avoid delays.

- Confirm appropriate coverage is in place.

- Continue collaborating with partners requiring evidence of insurance.

- Protect yourself and others against uncovered losses.

With just a minor time investment, certificates pay dividends through faster approvals and confident partners and vendors.

Avoid Project Delays and Get Approved Faster

One of the biggest benefits of obtaining certificates promptly is avoiding delays from insurance approval processes. Waiting to provide adequate proof of coverage can bring projects and transactions to a screeching halt.

Instead, get ahead of the game by securing insurance policies in advance if certificates will be required. Be ready to quickly furnish certificates so there are no slowdowns.

Having certificates ready and easily available can be a competitive advantage. You’ll get the green light faster to land more business and accelerate growth.

Just like keeping your driver’s license handy when car renting, keeping certificates on file makes life easier when they’re requested. Don’t leave partners hanging waiting for paperwork. Provide prompt proof so you can both focus on the real work at hand.

Why Do You Need It?

Certificates of insurance serve an important purpose – providing proof of coverage where it’s required. Here are some key reasons you may need to supply a certificate:

Purchasing a Home – Your lender will require evidence you’ve purchased a homeowners insurance policy before they’ll approve the mortgage and fund the purchase. The certificate provides details on your insurer, coverage amounts, and effective dates.

Starting a Business – Many landlords and partners require proof of general liability insurance prior to signing contracts and leases. Certificates verify you’re properly covered.

Working as a Contractor – General contractors need subcontractors to furnish certificates listing the GC as “additional insured” to guarantee backup coverage on job sites.

Hosting or Attending Events – Venues commonly mandate event liability insurance for protection. As an event host or vendor, you’ll need to provide a certificate.

Anywhere coverage is mandated, you’ll need to obtain certificates to demonstrate you’ve secured policies so projects can proceed.

How Much Coverage is Required?

Certificate requirements vary on factors like:

Industry – Construction may mandate $1M+ in liability coverage, while vendors may only need $500k.

Contract Stipulations – Review contracts and leases, which often spell out minimums needed.

Insurer Recommendations – Discuss with your agent appropriate limits based on your activities and risks. Don’t underinsure.

Legal Obligations – State laws may dictate baseline coverage requirements for your profession.

Aim to purchase adequate limits to satisfy the highest coverage needs you encounter. Having surplus insurance is better than scrambling to raise limits when certificates are requested.

What Happens if You Don’t Have It?

Not having certificates can derail major life and business transactions:

Home Purchases Stall – Lenders won’t finalize loans until you show homeowners insurance proof. Without it, you can’t complete the purchase.

Business Deals Collapse – Partners may cancel contracts and take their work elsewhere if you can’t prove you’re insured.

Permits Denied – Localities can reject event permits, contractor licenses, and rental applications without current certificates.

Lawsuits Result – Operating uninsured is high-risk. Incidents frequently yield negligence lawsuits when no coverage exists.

Don’t put yourself in a bind without certificates on hand when required. The fallout can be expensive and jeopardize important plans.

How Can You Get Insured Fast?

If you need coverage quickly to obtain certificates, here are some options:

Online Quotes – Use sites like CoverWallet and NextInsurance to get fast quotes and same-day policies.

Insurance Agents – Independent brokers can often bind temporary coverage in 24 hours while finalizing applications.

Business Association Plans – Groups like NFIB offer streamlined members-only plans to speed approvals.

Surplus Lines – Specialty insurers like Lloyd’s of London can bind unique coverage with minimal underwriting.

Securing expedited coverage helps you get accredited, approved, and moving forward right away without certificate slowdowns. Don’t wait until the last minute!

What Details Go on Them?

Certificates include several key policy details:

– Insured’s name

– Insurer name

– Policy number

– Coverage types and limits

– Policy effective dates

– Certificate holder (the requestor)

This provides confirmation of active coverage and satisfaction of mandatory minimums like $1M liability insurance.

Following any certificate guidelines provided ensures you include the exact details required. Leaving anything out could mean rejection and restarting the application process.

How Can You Avoid Problems?

You can sidestep certificate headaches by:

– Knowing requirements upfront before applying.

– Getting quotes listing needed coverages and limits.

– Securing policies well in advance of deadlines.

– Having insurer provide certificates directly to the requestor.

– Following up to confirm receipt of certificates.

– Renewing policies on time to maintain continuous coverage.

By planning ahead, getting insured early, and verifying certificate delivery, you’ll have smooth sailing. Don’t scramble last-minute and risk derailment.

Could Digital Certificates Help?

New technologies like blockchain offer potential benefits for certificates:

Instant Verification – Recipients can validate certificate authenticity digitally in real-time without contacting insurers.

Reduced Fraud – Blockchain certificates are extremely difficult to falsify or alter.

Renewal Notifications – Smart contracts automatically alert recipients before policies expire.

Lower Administrative Costs – Automation significantly reduces manual paperwork and phone verification.

Widespread adoption still has hurdles like integration costs and technology acceptance. But digital certificates could eventually revolutionize the process.

In summary, certificates of insurance serve a valuable purpose for risk management. Being prepared with required coverage and proof can save major headaches as you navigate life and business. Plan ahead and don’t leave anything to chance!

Who Requires a Certificate of Insurance?

Certificates of insurance are commonly requested by various organizations and individuals prior to doing business, allowing use of property, or engaging in activities. Here are some of the most common scenarios:

Home Purchases – Mortgage lenders require homebuyers to provide a certificate proving they’ve purchased a homeowners insurance policy before closing on the property. This guarantees the asset is insured.

Office Leases– Landlords often stipulate tenants provide a certificate evidencing commercial property coverage and liability insurance prior to signing a lease agreement. This protects the building owner.

Event Venues – Banquet halls, hotels, and other venues typically mandate event liability insurance and request a certificate from the event organizer. This covers risks associated with large gatherings on their premises.

Municipalties – Cities frequently require certificates for business licenses, special event permits, and contractors working on city property. This reduces their liability exposure.

Vendors – Retailers, manufacturers, and other vendors commonly have to provide proof of liability coverage before being added as a supplier. This protects the buyer if a product is defective or their operations cause harm.

Why Do Organizations Require Them?

There are a few key reasons entities ask for certificates of insurance:

Risk Management – It provides assurance that risks associated with the activity are transferred to an insurance policy.

Asset Protection – Proof of property coverage guarantees their assets like buildings are repaired if damaged.

Legal Compliance – They may be mandated by regulation or contract to obtain evidence of insurance from the other party.

Peace of Mind – Certificates give confidence that claims or legal actions stemming from the relationship will be covered.

By requiring certificates, organizations limit their own risks and potential liabilities. This makes them more comfortable entering agreements.

What Types of Coverage are Typically Required?

Common insurance coverages that organizations and individuals look for include:

General Liability – Protects against third-party legal claims for bodily injury, property damage, personal injury or advertising injury.

Commercial Property – First-party coverage for damage to business locations and contents from perils like fire, theft, and natural disasters.

Workers’ Compensation – Covers medical expenses and lost wages for employees injured on the job.

Special Events – Liability insurance for venues hosting short-term events like concerts, festivals, conferences, and weddings.

Professional Liability – Malpractice and errors & omissions insurance for professionals like consultants, coaches, and IT services.

Having the right insurance in place, then providing certificates evidencing coverage, is key for risk management when collaborating.

What Details Do They Look For?

Certificates act as proof of specific policy details. The requestor will want confirmation of:

– The insurer providing coverage

– Policy types and numbers

– Policy effective and expiration dates

– Coverage limits meeting minimum requirements

– Certificate holder naming them as additional insured, where applicable

– Description of operations or activities covered

This verifies that adequate insurance is active and applicable to their particular relationship. Details provided give visibility and confirmation that risks are properly covered.

How Can You Obtain the Certificates?

If certificates are required, you have a few options for obtaining them:

Insurance Carrier – Contact your agent or insurer directly to have them produce certificates evidencing your policies. This is the most official route.

Online Services – Various sites offer instant certificate creation by entering your policy details into their portal.

Certificate Generator – Generic certificate templates can be found online and self-completed with your insurer and coverage details.

The best option depends on whether an official insurer document is needed or if a self-generated form will suffice. Discussing requirements with the requesting party can help determine suitable methods. Just be sure certificates accurately represent active policies.

What Happens if You Don’t Provide?

Not furnishing adequate certificates can jeopardize business deals, purchases, permits, and events:

– Mortgage approvals can be denied without home insurance proof.

– Landlords may refuse to sign leases without evidence of tenant policies.

– Contracts mandating insurance requirements may be cancelled for noncompliance.

– Events can be cancelled by venues without liability coverage certificates.

– Municipalities can reject license and permit applications lacking insurance documentation.

Don’t put your plans in limbo by failing to obtain required certificates. Know the requirements up front and come prepared with proper coverage confirmation.

How Can Providing Them Benefit You?

Beyond fulfilling legal and contractual obligations, providing certificates of insurance can benefit you by:

– Displaying professionalism and risk management skills to partners.

– Speeding up approval processes that would otherwise get held up.

– Preventing cancellation of valuable business relationships and transactions.

– Avoiding denied applications and claims of noncompliance.

– Limiting the need for partners to follow up repeatedly requesting proof of insurance.

– Giving assurance and peace of mind to other parties.

Having certificates readily available shows you’re a responsible, insured partner committed to risk management. That gives you a competitive edge.

In summary, various individuals and organizations require certificates of insurance to protect themselves when collaborating. Ensure you know the requirements in advance, obtain appropriate policies, and furnish compliant certificates. This smooths dealings, limits liability, and gets your plans underway quickly.

Key Details to Include on the Form

Certificates of insurance serve as evidence of your policy details and coverage amounts. There are several key pieces of information that should be included:

Policyholder Name – The full legal name of the insured individual or business purchasing the insurance policy. This identifies whose coverage is being evidenced.

Insurer Name – The insurance company underwriting and providing the policy. This credibly identifies the provider.

Policy Number – The specific policy number assigned by the insurer for reference and verification.

Coverage Types – Identifies the exact insurance coverage types evidencing proof of, such as general liability, commercial property, workers compensation, special events, errors and omissions, etc.

Policy Limits – The dollar limit amount for each type of coverage. This confirms adequate limits are in place.

Effective Dates – The policy term start and end date, verifying coverage is active.

Certificate Holder – The name of the requesting individual or organization that requires proof of coverage.

Providing this detailed information validates you have appropriate active insurance applicable to the situation.

Why Are These Details Necessary?

There are a few reasons these specifics are required:

Proof of Adequate Coverage – It demonstrates coverage types and limits meeting requirements.

Confirm Active Policy – Effective dates verify coverage is current, not expired.

Identify Insurer – Knowing the insurance carrier provides validation and contacts for verification.

Allow Loss Payments – Complete details facilitate claim payments to appropriate parties in the event of a loss.

Evidence Terms – Key facts like additional insured status demonstrate compliance with contracts.

Without these details, certificates provide limited value and assurance for the requesting party.

What Could Happen if Details are Missing?

Providing certificates lacking necessary information can jeopardize transactions and relationships:

Delays – The requestor may come back asking for updated certificates with complete data.

Rejection – An incomplete certificate may be rejected as non-compliant.

Cancellation – Agreements requiring insurance could potentially be cancelled for inadequate documentation.

Higher Costs – You may need to purchase additional insurance if existing policies don’t meet requirements.

Ineligible Claims – Lacking correct information could compromise ability to file claims.

Don’t take shortcuts – include all details needed to satisfy requests and avoid problems.

How to Determine What to Include

There are a few ways to identify what details your certificate should feature:

Review Contracts – Agreements often spell out required coverages, limits and terms.

Follow Application Guidelines – Permit and license applications outline needs.

Ask the Requestor – Have them provide their certificate requirements upfront.

Verify with Your Agent – They can advise on common client certificate needs.

Compare to Past Certificates – Use ones previously provided as a template.

Ensuring you include every detail explicitly required avoids any ambiguity and moves the process forward.

Who Should be Listed as Certificate Holder?

The certificate holder should be:

For Contracts – The specific entity you have a contract with requiring insurance.

For Permits – The name of the government agency issuing the permit.

For Leases – The property owner or management company.

For Events – The venue hosting the event.

For Loans – The bank or lender financing the purchase.

For Vendors – The client or retailer ordering products or services.

Listing the exact organization requiring proof of coverage avoids confusion and satisfies their documentation needs.

What Other Elements Should Appear?

Beyond the basics, some other helpful items include:

– Brief description of the project or activity

– Indication if policy is claims-based or occurrence-based

– Any special terms like additional insured status

– Cancellation notification commitments

– Notes field for other provisions

Providing context and key provisions provides further validation of applicable coverage tailored to their situation.

In summary, certificates of insurance require specific details to fully satisfy requirements and avoid delays. Work closely with requestors and insurance providers to ensure critical data is included. Accurate, complete certificates keep transactions moving forward.

How to Get a Certificate of Insurance

When you need to provide proof of insurance coverage, there are a few options for obtaining certificate of insurance documents:

Request from Your Insurance Company – Contact your agent or insurer directly to have them produce a certificate evidencing your policies. This official document from the provider is typically accepted anywhere. Most insurers will issue standard certificates for policyholders at no charge. Just provide details on who needs to be listed as the certificate holder or any other special requirements. This method ensures certificate accuracy.

Use an Online Service – Various websites like CertificatesNow, Certificate of Insurance Pros, and Certs On Demand offer instant certificate creation. You simply enter your policy details into their online form and can immediately download or print the computer-generated document. Small fees usually apply. The certificate contains disclaimers that it was not produced directly by the insurer. But these services can provide valid certificates accepted in many circumstances.

Fill Out a Template – Blank certificate of insurance templates are available online and can be self-completed using details of your existing policies. This allows creating certificates on your own without contacting your insurer or using a third-party service. The downside is that templates may not be accepted everywhere since they weren’t produced officially.

How Should You Decide Which Method to Use?

Consider a few factors when choosing how to obtain a certificate:

– Does the requestor need an official insurer document? Templates or third-party certificates may not suffice.

– How quickly do you need the certificate? Insurer processing can take a few days where online services are instant.

– Will ongoing certificates be needed? Establishing a process with your insurer for future needs can be efficient.

– Do any special terms need to be evidenced like additional insured status? Your insurer can best confirm policy details.

– How much are you willing to pay? Insurer certificates are typically free where third-parties involve fees.

Discuss certificate options with your agent if you’re unsure what would work best for your situation.

What If You Need Proof Quickly?

If you require a certificate urgently:

– Ask your insurer if rush processing is available. Some will expedite upon request.

– Use an online certificate service that provides instant availability. Just be sure to accurately enter your policy information.

– Contact your agent to see if they can provide temporary evidence while a formal certificate is processed.

– If needing new/increased coverage, explore getting coverage bound instantly through carriers like Next Insurance.

Waiting until the last minute can be risky if your insurer’s processing takes several days. Plan ahead as much as possible to avoid scrambling for urgent certificates.

What Information is Needed to Obtain Them?

Whether using your insurer or third-party service, you’ll need to provide basic policy details to have a certificate generated:

– Policyholder name

– Insurance company

– Policy number

– Policy effective and expiration dates

– Coverage types and limits

– Certificate holder name

– Additional insured status, if required

– Other special terms or requirements

Collect this information ahead of time from your policy documents and the certificate requestor so it’s readily available when needed.

Can You Get Multiple Certificates from the Same Policy?

Yes, you can usually get certificates evidencing the same policy issued to multiple parties:

– Your insurer can produce separate certificates listing unique certificate holders.

– Online services allow generating unlimited certificates for the same policy details.

– When using templates, just fill out separate forms for each party needing evidence of coverage.

Having the flexibility to get certificates for different business partners, venues, contractors etc. from a single policy maximizes convenience.

How Long are Certificates Valid?

Certificates are valid for the policy term they reference. The effective dates confirm coverage is active for that duration.

You’ll need to provide updated certificates upon policy renewal to maintain continuous evidence of coverage.

Most insurers can set up automatic renewal reminder processes with certificate holders. Just be sure to renew policies on time.

In summary, work closely with your insurer and insurance agent to determine the ideal method for obtaining necessary certificates of insurance. Plan ahead as much as possible while being aware of options for handling urgent requests. Promptly providing compliant certificates keeps your plans progressing forward.

Request from Your Insurance Company

The most direct way to obtain a certificate of insurance is to request one through your insurance company. Here are some key steps when going this route:

Contact Your Agent – Your insurance agent should be your first point of contact for certificate requests. They can handle interfacing with the insurer’s underwriting team to have one produced.

Provide Key Details – Be prepared to give your agent essential information needed to generate the certificate, including coverage requirements, certificate holder name, relationship, etc.

Request Standard Processing – Most insurer certificates are produced within 3-5 business days upon request. If you need it faster, inquire about rush processing.

Review a Draft – Your agent may send a certificate proof for your review before finalizing. Double check accuracy of all details.

Send to Requestor – The insurer will send the completed certificate directly to the requesting individual or organization.

Follow Up on Receipt – Confirm with the requestor they received the certificate as expected. Rectify any issues immediately.

What Documents do Insurers Require?

To issue an official certificate, your insurer will likely need:

– Formal request with certificate holder name and relationship

– Your policy number, limits and coverage types

– Any special terms like additional insured status

– Contract, lease or permit mandating insurance if applicable

Providing complete details and documentation allows accurate certificate creation evidencing the required coverages.

How Quickly are They Produced?

Standard turnaround times for insurer certificates are:

– Within 3-5 business days for regular requests

– Within 1-2 business days for rush requests

– Within hours for emergency rush requests

If you need a certificate faster than standard processing, check with your agent on expedited options and any fees that may apply.

What If You Need Multiple Certificates?

If you need certificates for multiple parties from the same policy:

– Request each as a separate certificate with unique certificate holder names.

– Set up a certificate management account with your insurer to easily request and track certificates.

– Ask your insurer to automatically renew certificates nearing expiration for continuous coverage.

Your insurer can accommodate ongoing certificate needs from the same policy by handling requests individually but efficiently.

Can Agents Create Certificates?

Insurance agents cannot generate official certificates directly. However, they can:

– Facilitate requests through insurers to have certificates created.

– Provide temporary evidence of coverage until formal certificates are produced.

– Assist with applications for new policies if current limits are inadequate.

Work closely with your agent as an intermediary for certificate needs even if they don’t produce them directly.

What If Coverage Limits are Insufficient?

If your current policies don’t meet minimum liability or property limits required:

– Your agent can help you obtain quotes for increased coverage.

– Higher limits or additional policies may need to be purchased.

– New certificates evidencing updated coverages would need to be issued.

Know requirements upfront to avoid scrambling for amended or new policies to satisfy certificate stipulations.

Having strong communication with your agent ensures your insurer certificates contain all required details, are received on schedule, and accurately represent your policies. Leverage their expertise for smooth certificate procurement.

Use an Online Service

In addition to insurer-provided certificates, there are online services that offer fast, convenient certificate creation using your policy details.

These websites allow you to instantly generate a certificate yourself based on information you enter about your insurance policies. Here’s how they work:

Enter Your Policy Data – You provide details like insurance company, policy number, coverage types, limits, effective dates, etc.

List the Certificate Holder – Enter the name and address of the individual or company requesting proof of insurance.

Pay the Fee – Fees are typically $5-$20 per certificate depending on any rush delivery needs.

Download/Print Certificate – The completed certificate is provided instantly in PDF form for your use.

Popular certificate services include CertificatesNow, Certs On Demand, Certificate of Insurance Pros, and Next Insurance.

What are the Benefits of Online Certificates?

Advantages of using an online certificate service include:

– Instant availability – No wait time for fulfillment.

– Convenience – Create certificates 24/7 from anywhere.

– Low cost – Cheaper and quicker than insurer-issued certificates.

– Unlimited use – Most allow unlimited certs from the same account.

– Self-service – You control the process from start to finish.

What are the Potential Drawbacks?

Considerations when using online certificate services:

– Not official insurer documents – Some require direct-from-insurer certificates.

– Information must be accurate – Incorrect data could invalidate the certificate.

– Lack of customization – Fewer options for special policy details.

– Can’t certify special terms – Like additional insured status.

– Potential verification needed – Certificate holders may need to validate with insurers.

How to Decide if They Work for Your Situation

Factors to consider when evaluating online certificate services:

– Does the requestor accept third-party certificates? If not, go direct through insurers.

– How quickly do you need the certificate? Online services are fastest option.

– Do you need special endorsements noted? Insurer certificates can better capture.

– Are you insuring high-risk events or work? Insurer validation may provide more assurance.

– Do you need regular certs for multiple vendors? Online service subscriptions can be efficient.

What Precautions Should You Take with Online Certificates?

To ensure validity of online service certificates:

– Carefully enter your exact policy details – Don’t guess. Inaccuracies could invalidate.

– Review certificate thoroughly before sending – Confirm all data is correct.

– Inform recipients it is a third-party certificate – Avoid misrepresentation.

– Offer to provide insurer validation if requested – Be ready to follow up.

– Only use reputable services – Research the provider before entrusting your policy information.

– Update certificates promptly as policies renew – Maintain continuous evidence of coverage.

Could Blockchain Improve Reliability of Digital Certificates?

Blockchain technology offers the potential to enhance certificate integrity and authentication. Benefits may include:

– Insurer data directly integrated – Eliminates manual data entry errors.

– Real-time verification of certificate validity – Reduces fraud potential.

– Accurate tracking of policy changes – Updates automatically propagated.

– Automated notifications as policies renew – Ensures continuity.

Widespread adoption of blockchain-based solutions still faces real-world implementation challenges but could be a future game changer.

In summary, reputable online certificate services can provide a fast, affordable certificate option in many scenarios – just take steps to validate accuracy and satisfy recipients’ requirements.

Fill Out a Free Template

Need a Certificate of Insurance Fast in 2023? Try This Simple Trick:

Step 1: Find a Free COI Template Online

Step 2: Open the COI Template and Fill It Out

Step 3: Save and Send the Completed COI

- Find a free, editable COI template online

- Fill out the template with your policy details

- Save, send and confirm receipt of the finished COI

Buying Your Own Insurance

Need a Certificate of Insurance Fast in 2023? Try This Simple Trick:

- Download free, editable COI templates

- Fill in all policy details accurately

- Save, send and confirm receipt of your custom COI

Types of Businesses Requiring Proof of Insurance

Need a Certificate of Insurance Fast in 2023? Try This Simple Trick:

- Find free, editable COI templates online

- Accurately fill in all your policy details

- Save, send and confirm receipt of your custom COI

Coaching and Training Programs

Need a Certificate of Insurance Fast in 2023? Try This Simple Trick:

- Find free, editable COI templates online

- Fill in all your policy details accurately

- Save, send and confirm receipt of your custom COI

Contractors and Construction Companies

Need a Certificate of Insurance Fast in 2023? Try This Simple Trick:

- Find free, editable COI templates online

- Accurately fill in all your policy details

- Save, send and confirm receipt of your custom COI

Event Venues and Vendors

Need a Certificate of Insurance Fast in 2023? Try This Simple Trick:

- Find free, editable COI templates online

- Accurately fill in all your policy details

- Save, send and confirm receipt of your custom COI

Benefits of Providing a Certificate of Insurance

Need a Certificate of Insurance Fast in 2023? Try This Simple Trick:

- Find free, editable COI templates online

- Fill in all your policy details accurately

- Save, send and confirm receipt of your custom COI

Avoid Project Delays and Get Approved Faster

Need a Certificate of Insurance Fast in 2023? Try This Simple Trick:

- Find free, editable COI templates online

- Fill in all your policy details accurately

- Save, send and confirm receipt of your custom COI