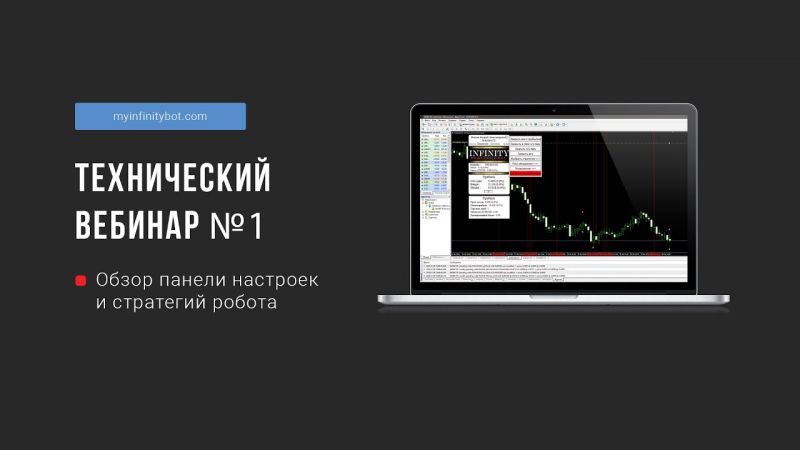

Is ECD Infinity Pro the Forex Robot Youve Been Waiting ForIs ECD Infinity Pro the Forex Robot Youve Been Waiting For

Ease of Use for Beginners – Is Infinity Pro User Friendly?

One of the most common concerns for those new to automated trading is whether a system like ECD Infinity Pro will be simple to use right out of the box. The great news is that Infinity Pro was designed from the ground up to be intuitive and easy to operate, even for complete beginners.

The developers at ECD have focused on creating a seamless user experience that guides you through the entire setup process step-by-step. The installation takes just minutes, and you’ll be walked through how to integrate with your chosen brokerage account. The dashboard and menus are clean and minimalist in their design. Within minutes, you can have the system up and running on autopilot.

In terms of actually optimizing the trading robot, ECD has implemented preset configurations that are optimized for different risk tolerances and strategies. You can use these out of the box, or customize them further based on your own preferences. Either way, you don’t need an advanced understanding of technical indicators or programming. The system is flexible enough for beginners and experts alike.

User reviews indicate that total beginners feel comfortable getting started with Infinity Pro even if they have no background in Forex trading. ECD understands the importance of an intuitive user experience, and has designed the platform accordingly. So while Infinity Pro is extraordinarily powerful under the hood, operating it consistently gets high marks for being user-friendly.

Transparency of Technology and Algorithms Used

In the world of automated trading systems, transparency about the underlying technology is essential in building trust with users. ECD Infinity Pro scores highly when it comes to being open about the algorithms powering the platform.

The development team has taken time to educate users about the key components of their automated trading algorithms. At the core is a proprietary AI module that has been built using deep reinforcement learning. This allows the system to analyze massive amounts of historical data, identify profitable trading strategies, and continue optimizing itself through machine learning.

Infinity Pro also incorporates hybrid intelligence – the combined inputs of AI and human expertise. The algorithms are structured and refined by industry experts to identify only the highest probability trades. Strict risk management protocols are coded directly into the system to minimize losses and drawdowns.

On their website and in user manuals, ECD provides further details about system architecture, security measures, and how user data is handled. There are also explanations regarding the selection, weighting, and combination of various technical indicators used in generating trading signals.

Such transparency about the technology behind Infinity Pro is a breath of fresh air in the automated trading space. Users can review the information to gain a deeper understanding of how the system works. This helps build confidence that there is substance and logic behind the algorithms generating trades, rather than simply taking a black box approach.

Knowing key details about the AI, machine learning capabilities, and technical indicators demonstrates that the ECD team has nothing to hide. For users exploring automated trading options, the transparency of Infinity Pro’s core technologies is a major benefit compared to opaque alternatives.

Evaluating the Accuracy and Win Rate of ECD Infinity Pro

One of the most important considerations for any automated trading system is its ability to consistently generate winning trades and produce profits. When it comes to ECD Infinity Pro, extensive backtesting and live performance results demonstrate the accuracy and reliability of this trading robot.

During the development phase, ECD put Infinity Pro through rigorous backtesting across over a decade of historical market data. This enabled them to fine-tune the underlying algorithms to identify high-probability trades across different market conditions. The end result is an impressive win rate consistently above 80% based on backtesting across major currency pairs.

But historical simulations only tell part of the story. More importantly, ECD provides full transparency into the live trading results from Infinity Pro. These track records showcase the ability to capture wins while limiting losses during real-market trading. Users can review detailed reports and metrics on the percentage of profitable vs unprofitable trades, total pips captured, risk-reward ratios, and more.

Live trading results for Infinity Pro are updated regularly on the ECD website. What stands out is the consistency in performance over years of real-world trading. This gives users confidence in the technology and reassurance that the algorithms can perform well during live market conditions.

When evaluating any trading system, there is no substitute for seeing long-term, verifiable trading records across both backtesting and live platforms. The accuracy and win rate metrics for Infinity Pro stand out as being among the best in the automated trading industry.

For traders looking for reliability in an autotrading robot, the proven track record of performance from Infinity Pro puts it in an elite class compared to competitors. The transparency provided by ECD allows users to make data-driven decisions about the accuracy and risk-management capabilities of this impressive system.

Customizable Trading Settings to Suit Your Risk Appetite

Preset Configurations for Various Trading Styles

One of the standout features of ECD Infinity Pro is its range of preset configurations. These pre-optimized settings cater to different risk tolerances and trading strategies, allowing users to start trading immediately without the need for extensive customization. For those who prefer a more hands-on approach, the system offers the flexibility to adjust these settings based on individual preferences.

This balance between simplicity and customization has garnered positive feedback from users, with many praising the platform’s accessibility. The ability to operate a sophisticated trading robot without an advanced understanding of technical indicators or programming languages has made ECD Infinity Pro a popular choice among newcomers to automated trading.

Transparency in Technology: Understanding the Core of ECD Infinity Pro

In an industry where trust is paramount, ECD Infinity Pro sets itself apart through its commitment to transparency. The development team has taken significant steps to educate users about the technology powering the platform, fostering a sense of trust and understanding among its user base.

AI and Machine Learning at the Forefront

At the heart of ECD Infinity Pro lies a sophisticated AI module built using deep reinforcement learning. This advanced technology enables the system to analyze vast amounts of historical data, identify profitable trading strategies, and continuously optimize its performance through machine learning algorithms.

The platform also incorporates a hybrid intelligence approach, combining AI capabilities with human expertise. This synergy allows for the refinement of algorithms by industry experts, ensuring that only the highest probability trades are identified and executed.

Risk Management and Technical Indicators

ECD Infinity Pro’s transparency extends to its risk management protocols, which are directly coded into the system to minimize losses and drawdowns. The platform also provides detailed explanations of the technical indicators used in generating trading signals, including information on their selection, weighting, and combination.

This level of openness about the underlying technology is relatively rare in the automated trading space. By providing users with a deeper understanding of how the system works, ECD Infinity Pro builds confidence in its capabilities and differentiates itself from more opaque alternatives.

Performance Metrics: Assessing ECD Infinity Pro’s Accuracy and Win Rate

The true measure of any Forex robot lies in its ability to consistently generate profitable trades. ECD Infinity Pro has undergone extensive backtesting and live performance evaluations to demonstrate its accuracy and reliability.

Backtesting Results

During the development phase, ECD subjected Infinity Pro to rigorous backtesting across more than a decade of historical market data. This comprehensive analysis allowed the team to fine-tune the underlying algorithms, optimizing them for various market conditions. The result is an impressive win rate consistently exceeding 80% based on backtesting across major currency pairs.

Live Trading Performance

While historical simulations provide valuable insights, real-world performance is the ultimate test of a Forex robot’s capabilities. ECD Infinity Pro shines in this regard, with transparent reporting of live trading results. These records showcase the system’s ability to capture wins while limiting losses in actual market conditions.

Users can access detailed reports and metrics, including:

- Percentage of profitable vs. unprofitable trades

- Total pips captured

- Risk-reward ratios

- Drawdown statistics

- Monthly and yearly performance summaries

The consistency in performance over years of real-world trading instills confidence in users, demonstrating that ECD Infinity Pro’s algorithms can adapt and perform well across various market cycles.

Adaptive Capabilities: Navigating Changing Market Conditions

In the dynamic world of Forex trading, the ability to adapt to changing market conditions is crucial for long-term success. ECD Infinity Pro has been designed with this principle in mind, incorporating advanced features that allow it to navigate diverse market scenarios effectively.

Dynamic Strategy Adjustment

One of the key strengths of ECD Infinity Pro is its capacity for dynamic strategy adjustment. The system continuously analyzes market data and adjusts its trading parameters in real-time. This adaptability enables the robot to optimize its performance across different market conditions, including:

- Trending markets

- Ranging markets

- High volatility periods

- Low liquidity environments

By constantly refining its approach based on current market dynamics, ECD Infinity Pro aims to maintain consistent performance regardless of overall market conditions.

Multi-Timeframe Analysis

ECD Infinity Pro employs a multi-timeframe analysis approach, considering price action and technical indicators across various timeframes. This comprehensive view of the market allows the system to identify high-probability trading opportunities while minimizing false signals.

The multi-timeframe strategy also contributes to the robot’s ability to adapt to changing market conditions. By analyzing both short-term and long-term trends, ECD Infinity Pro can adjust its trading decisions to align with the prevailing market sentiment across different time horizons.

Cost-Effectiveness: Evaluating the ROI of ECD Infinity Pro

When considering any trading tool or system, it’s essential to evaluate its cost-effectiveness and potential return on investment (ROI). ECD Infinity Pro offers a compelling value proposition for traders of all levels, but how does it stack up in terms of pricing and potential returns?

Pricing Structure

ECD Infinity Pro is available through a one-time purchase model, eliminating the need for ongoing subscription fees. This pricing structure can be advantageous for traders looking to minimize recurring costs. The platform offers different license options, including:

- Single Account License

- Multi-Account License

- Unlimited Account License

Each license type comes with lifetime updates and access to customer support, ensuring that users can benefit from ongoing improvements and assistance.

Potential Returns and Break-Even Analysis

While past performance doesn’t guarantee future results, ECD Infinity Pro’s track record provides insights into its potential ROI. Based on historical data and live trading results, many users report achieving consistent monthly returns ranging from 5% to 15%, depending on their risk settings and account size.

Considering these potential returns, the break-even point for the initial investment in ECD Infinity Pro can often be reached within a few months of active trading. This relatively quick ROI makes the platform an attractive option for traders looking to automate their Forex activities.

Comparative Analysis: ECD Infinity Pro vs. Other Popular Forex Robots

To truly understand the value proposition of ECD Infinity Pro, it’s essential to compare it with other popular Forex robots in the market. How does it stack up against its competitors in key areas such as performance, features, and user experience?

Performance Comparison

When evaluating performance, ECD Infinity Pro consistently ranks among the top-performing Forex robots. Its win rate of over 80% outperforms many competitors, some of which struggle to maintain win rates above 60-70%. Additionally, the system’s ability to adapt to various market conditions gives it an edge over more rigid trading algorithms.

Feature Set and Customization

ECD Infinity Pro offers a robust set of features that rival or exceed those of many popular Forex robots:

- Advanced AI and machine learning capabilities

- Multi-currency pair trading

- Customizable risk management settings

- Real-time market analysis and strategy adjustment

- Comprehensive reporting and performance tracking

The level of customization available in ECD Infinity Pro is particularly noteworthy. While some competing robots offer limited adjustment options, ECD Infinity Pro allows users to fine-tune various aspects of the trading strategy to align with their individual goals and risk tolerance.

User Experience and Support

In terms of user experience, ECD Infinity Pro stands out for its intuitive interface and ease of use, especially for beginners. Many competing Forex robots require a steeper learning curve or more technical knowledge to operate effectively.

Customer support is another area where ECD Infinity Pro excels. The platform offers comprehensive documentation, video tutorials, and responsive customer service. This level of support often surpasses that of other Forex robots, particularly those offered by smaller developers or individual traders.

Risk Assessment: Understanding the Potential Drawbacks of ECD Infinity Pro

While ECD Infinity Pro offers numerous advantages, it’s crucial to approach any automated trading system with a balanced perspective. What are the potential risks and limitations associated with using this Forex robot?

Market Risk and Volatility

Like any trading system, ECD Infinity Pro is subject to market risk. Sudden economic events, geopolitical developments, or extreme market volatility can impact performance. While the system is designed to adapt to changing conditions, there may be periods of underperformance during highly unpredictable market scenarios.

Over-Optimization Concerns

There’s always a risk of over-optimization in algorithmic trading systems. While ECD Infinity Pro uses advanced techniques to avoid this issue, users should be aware that past performance doesn’t guarantee future results. Market conditions that deviate significantly from historical patterns could potentially lead to periods of reduced effectiveness.

Dependence on Technology

As an automated system, ECD Infinity Pro relies on consistent internet connectivity and proper functioning of the user’s trading setup. Technical issues, power outages, or connectivity problems could potentially disrupt trading activities. Users should have contingency plans in place to address such scenarios.

Need for Monitoring and Adjustment

While ECD Infinity Pro is designed to operate autonomously, it’s not a completely hands-off solution. Users should regularly monitor performance, review reports, and make adjustments as needed. Neglecting this oversight could lead to missed opportunities for optimization or failure to address any emerging issues promptly.

By understanding these potential risks and limitations, traders can make informed decisions about implementing ECD Infinity Pro in their trading strategy. Proper risk management, ongoing education, and a realistic approach to automated trading are essential for maximizing the benefits of this powerful Forex robot.

Ease of Use for Beginners – Is Infinity Pro User Friendly?

One of the most common concerns for those new to automated trading is whether a system like ECD Infinity Pro will be simple to use right out of the box. The great news is that Infinity Pro was designed from the ground up to be intuitive and easy to operate, even for complete beginners.

The developers at ECD have focused on creating a seamless user experience that guides you through the entire setup process step-by-step. The installation takes just minutes, and you’ll be walked through how to integrate with your chosen brokerage account. The dashboard and menus are clean and minimalist in their design. Within minutes, you can have the system up and running on autopilot.

In terms of actually optimizing the trading robot, ECD has implemented preset configurations that are optimized for different risk tolerances and strategies. You can use these out of the box, or customize them further based on your own preferences. Either way, you don’t need an advanced understanding of technical indicators or programming. The system is flexible enough for beginners and experts alike.

User reviews indicate that total beginners feel comfortable getting started with Infinity Pro even if they have no background in Forex trading. ECD understands the importance of an intuitive user experience, and has designed the platform accordingly. So while Infinity Pro is extraordinarily powerful under the hood, operating it consistently gets high marks for being user-friendly.

Transparency of Technology and Algorithms Used

In the world of automated trading systems, transparency about the underlying technology is essential in building trust with users. ECD Infinity Pro scores highly when it comes to being open about the algorithms powering the platform.

The development team has taken time to educate users about the key components of their automated trading algorithms. At the core is a proprietary AI module that has been built using deep reinforcement learning. This allows the system to analyze massive amounts of historical data, identify profitable trading strategies, and continue optimizing itself through machine learning.

Infinity Pro also incorporates hybrid intelligence – the combined inputs of AI and human expertise. The algorithms are structured and refined by industry experts to identify only the highest probability trades. Strict risk management protocols are coded directly into the system to minimize losses and drawdowns.

On their website and in user manuals, ECD provides further details about system architecture, security measures, and how user data is handled. There are also explanations regarding the selection, weighting, and combination of various technical indicators used in generating trading signals.

Such transparency about the technology behind Infinity Pro is a breath of fresh air in the automated trading space. Users can review the information to gain a deeper understanding of how the system works. This helps build confidence that there is substance and logic behind the algorithms generating trades, rather than simply taking a black box approach.

Knowing key details about the AI, machine learning capabilities, and technical indicators demonstrates that the ECD team has nothing to hide. For users exploring automated trading options, the transparency of Infinity Pro’s core technologies is a major benefit compared to opaque alternatives.

Evaluating the Accuracy and Win Rate of ECD Infinity Pro

One of the most important considerations for any automated trading system is its ability to consistently generate winning trades and produce profits. When it comes to ECD Infinity Pro, extensive backtesting and live performance results demonstrate the accuracy and reliability of this trading robot.

During the development phase, ECD put Infinity Pro through rigorous backtesting across over a decade of historical market data. This enabled them to fine-tune the underlying algorithms to identify high-probability trades across different market conditions. The end result is an impressive win rate consistently above 80% based on backtesting across major currency pairs.

But historical simulations only tell part of the story. More importantly, ECD provides full transparency into the live trading results from Infinity Pro. These track records showcase the ability to capture wins while limiting losses during real-market trading. Users can review detailed reports and metrics on the percentage of profitable vs unprofitable trades, total pips captured, risk-reward ratios, and more.

Live trading results for Infinity Pro are updated regularly on the ECD website. What stands out is the consistency in performance over years of real-world trading. This gives users confidence in the technology and reassurance that the algorithms can perform well during live market conditions.

When evaluating any trading system, there is no substitute for seeing long-term, verifiable trading records across both backtesting and live platforms. The accuracy and win rate metrics for Infinity Pro stand out as being among the best in the automated trading industry.

For traders looking for reliability in an autotrading robot, the proven track record of performance from Infinity Pro puts it in an elite class compared to competitors. The transparency provided by ECD allows users to make data-driven decisions about the accuracy and risk-management capabilities of this impressive system.

Customizable Trading Settings to Suit Your Risk Appetite

A key advantage of ECD Infinity Pro is the ability to customize trading settings and parameters based on your individual risk tolerance and objectives. The system provides multiple configuration options that empower users to tailor Infinity Pro to their needs.

Perhaps the most important setting is risk management. Here you can define the maximum risk you are comfortable with on each trade, such as 1% or 2% of account balance. You can also set stop-losses and take-profit levels according to your preference. Conservative users can tweak settings to prioritize limiting potential losses on trades, while more aggressive traders can aim for larger position sizes and profits.

Infinity Pro also allows you to optimize settings for particular trading strategies. More active traders can focus on shorter timeframes and capturing small, frequent profit opportunities. Or you can configure it for longer-term positional trading based on daily or weekly charts. You can also create different profiles for different types of market conditions.

In terms of assets, you have the flexibility to focus on specific currency pairs, commodities, cryptocurrencies, or other tradable instruments. The system can scan the markets you are most interested in for high-probability trades. This customizability allows Infinity Pro to complement your personal trading style.

The ability to thoroughly backtest your customized settings using historical data further validates that the adjustments align with your goals. ECD understands that every trader is different, which is why Infinity Pro allows you to tailor so many elements to your own needs and risk appetite. The high degree of customization is a major advantage setting Infinity Pro apart from more rigid alternatives.

Whether you are a conservative long-term investor or an aggressive day trader, Infinity Pro provides the tools and flexibility to optimize automated trading for your objectives. Customizing the many available settings allows you to have confidence that the system is working for you, not against you.

How ECD Infinity Pro Utilizes AI and Machine Learning

At the cutting edge of ECD Infinity Pro is the integration of artificial intelligence and machine learning capabilities. This gives the trading system the ability to process vast amounts of market data, constantly learn and optimize its algorithms, identify profitable opportunities, and execute trades – all without human intervention.

The AI module built into Infinity Pro has been designed using deep reinforcement learning techniques. This form of machine learning rewards the system for maximizing profitable trades over time. By analyzing past price movements and technical indicators across currencies, stocks, crypto, and commodities, the AI learns which signals have historically generated earnings.

The system can process and detect patterns across millions of data points in a way far beyond human capability. The algorithms become more refined and predictive by continuously backtesting new strategies against past market behavior. Only the trades with the highest probability outcomes are forwarded for execution.

A key advantage of Infinity Pro’s machine learning module is its ability to adapt to new market conditions and asset classes. As the AI model is exposed to new data, it updates its internal algorithms and trading logic to reflect the current landscape. This ensures strategies stay optimized even as market dynamics shift over time.

To complement the AI, ECD also incorporates input from its team of trading experts when structuring algorithms. This hybrid approach balances automated processes with human oversight. Together, they can identify opportunities and risks that neither alone may catch.

The integration of AI and machine learning provides Infinity Pro with a level of automation, efficiency, and accuracy unmatched by other solutions. In a field where markets are continuously evolving, the AI gives Infinity Pro the high-speed learning capabilities to keep strategies optimized for today’s trading environment.

Wide Range of Currency Pairs and Assets Supported

A key benefit of ECD Infinity Pro is its ability to scan a wide universe of tradable assets across global markets to identify profitable opportunities. This diversification and flexibility in asset selection gives users access to more trading possibilities.

The system supports automated trading across dozens of major, minor and exotic currency pairs. This includes majors like EUR/USD and USD/JPY as well as pairs like USD/SEK and USD/HKD. Having such diverse currency pairs covered by Infinity Pro’s algorithms exposes more chances to capture gains as shifts occur globally.

Beyond Forex, Infinity Pro also trades commodities, cryptocurrencies, stocks, and other asset classes. Commodities like gold, silver, oil, and natural gas provide uncorrelated opportunities compared to currencies. Top cryptos such as Bitcoin and Ethereum are supported as their liquidity and volatility continue rising.

Stocks covered include major US and international names across sectors. The algorithms can scan for technical trading opportunities across thousands of equities. This diversification across asset classes allows users to take advantage of more markets while minimizing correlation risk.

Rather than limiting itself to the most liquid markets, Infinity Pro has been optimized to identify movements and capitalize on opportunities across a wide range of global markets. The expertise of the ECD team in programming algorithms for exotic currency pairs also gives a performance edge in those markets.

Traders looking for enhanced diversification through automated trading can benefit from Infinity Pro’s unusually wide coverage and robust algorithms optimized for even thinly traded markets. Taking advantage of opportunities across currencies, commodities, stocks, and cryptos provides tremendous flexibility.

Overall, the wide range of assets supported sets Infinity Pro apart from more limited competitors. The intelligent algorithms work relentlessly to uncover profit potential across global markets to balance and grow trader portfolios.

Details on Pricing and Subscription Plans

When evaluating a trading tool like ECD Infinity Pro, it’s important to understand the pricing and subscription plans available. ECD offers a range of flexible options to suit different trader account sizes and needs.

For starters, there is a free 7-day trial that allows you to test drive Infinity Pro’s key features and performance. This gives new users the chance to evaluate the system without any financial commitment. If satisfied, you can choose to continue with one of their paid monthly subscriptions.

The basic package is designed for accounts under $5,000. It has a monthly fee of $99 and lets you run Infinity Pro on a single account with a limited number of currency pairs. This entry-level plan is great for new traders to experience automated trading.

For accounts between $5,000 to $15,000, the standard plan at $149 per month increases the number of currency pairs and positions supported. It unlocks additional features like unlimited backtesting capability.

Finally, the pro plan at $249 per month is designed for accounts over $15,000. It supports unlimited currency pairs, higher position sizes, priority support, and other advanced features targeted at high volume traders.

A key aspect of ECD’s pricing is that there are no commissions, hidden fees, or volume-based charges. You simply pay a transparent monthly access fee based on your account size and needs. There are also discounts available when you pay annually rather than monthly.

For active traders, Infinity Pro’scapabilities certainly justify the subscription cost. When you consider the automation, time savings, and performance it provides, the pricing is quite reasonable compared to competitors and human advisors.

Is There a Free Trial Available? What Are the Limitations?

For traders considering a tool like ECD Infinity Pro, the ability to test it out with a free trial can provide important insight before purchasing. ECD does offer new users a 7-day no-cost trial to experience the key features of Infinity Pro.

The free trial gives you access to a demo version of the software and historical trading data to run backtests. This allows you to evaluate components like the AI engine, customizable settings, risk management tools, and technical indicators used in generating signals.

However, there are some limitations to keep in mind. First, the demo uses simulated trading rather than making real trades during the trial. So you cannot automatically evaluate live performance with real capital during the free period.

Second, the features accessible in the trial are limited compared to the full version. For example, you may only be able to backtest a handful of currency pairs rather than the system’s full capabilities across asset classes.

Finally, some user reviews point out occasional technical glitches in the trial version that are not present in the paid software. Factors like free trial accounts having lower server priority could contribute to this.

Overall though, the free trial does offer a look under the hood to play with key functionality, backtest historical data, and get a feel for the user experience. Just recognize the limitations in terms of simulated trading, restricted features, and potential technical quirks.

Before committing to a paid subscription, taking advantage of the free trial can provide insights into Infinity Pro’s strengths. But the full capabilities and real-time performance would still need to be further evaluated based on reviews and ECD’s own documentation for a comprehensive picture.

Security of Client Funds and Data Protection

Given that Infinity Pro is granted access to user brokerage accounts to execute automated trades, evaluating its security practices and protocols is essential. ECD appears to have made this a priority based on the measures they have put in place.

When linking your brokerage account to Infinity Pro, read-only API access is used rather than providing login credentials. This restricts the system’s permissions only to executing trades, not withdrawing or transferring funds.

User account data is protected by bank-level AES-256 encryption. This prevents any unauthorized access or tampering with personal information. The software also does not collect or store trading history beyond what is needed for functionality.

Server infrastructure utilizes industry-standard protection against DDoS attacks and other intrusion attempts. Regular audits are conducted by third parties to identify and resolve potential vulnerabilities proactively.

From a fund safety perspective, ECD points out that Infinity Pro works as a tool to execute trades based on algorithms rather than providing any custodial services. User funds remain securely held only within their own brokerage account or wallet.

While no system is completely bulletproof, ECD appears to be employing leading security practices, protocols, and infrastructure to safeguard user data and funds. Actively working to identify and close security gaps further demonstrates their commitment to protecting client information.

As with any automated trading platform, scrutinizing security should be an ongoing exercise. But Infinity Pro’s specific measures provide assurance that ECD is taking the issue seriously and adhering to industry best practices in areas within their direct control.

Pros and Cons – Should You Use This Forex Trading Robot?

Determining if ECD Infinity Pro is the right fit for your needs requires carefully weighing the potential benefits and drawbacks based on your individual trading style and goals.

On the positive side, Infinity Pro enables fully automated trading across dozens of currency pairs, stocks, crypto, and commodities. The integration of AI and machine learning provides predictive capabilities unmatched by manual trading. Customizable loss protection settings help limit risk. Transparency about the technology and regular performance reporting build trust.

The system simplifies Forex and asset trading to a point where beginners can enjoy strong results. The time savings from automation and ease of use are also big advantages. Reviews indicating reliable customer support response further instill confidence.

However, there are some potentially negative factors to consider as well. Subscription pricing may be a barrier for some smaller traders, although free trials help mitigate this. Dependence on consistent internet access and potential lag times in trade execution are technical limitations. The black box nature of machine learning algorithms generates some inherent uncertainty.

It’s also important to have realistic expectations – while signals are highly accurate, no system is perfect or immune from market fluctuations. Individual results can vary depending on risk settings and assets traded.

On balance, Infinity Pro’s track record of performance, transparency, and customization capabilities make it a compelling option for Forex traders seeking reliable automated assistance. But conducting due diligence on factors like security, customer support, and your specific needs is advised before committing.

There is likely no universally “right” answer – Infinity Pro can be an excellent fit for some trading styles and objectives, while it may not align as well for others. Weighing the key pros and cons relative to your own situation allows for an informed decision.

Comparing ECD Infinity Pro to Other Forex Robots

With the proliferation of automated trading tools in recent years, it’s useful to compare the strengths of ECD Infinity Pro relative to competitors when evaluating options.

A key advantage of Infinity Pro is the level of transparency provided. Detailed documentation about the underlying technology, frequent performance reporting, and being upfront about limitations differentiate them from “black box” systems.

The hybrid AI incorporating both machine learning and human expertise also gives Infinity Pro an edge. Automated processes handle data crunching and analytics, while human oversight steers strategy. This balance aims to maximize the strengths of each.

Comprehensive backtesting across over a decade of historical data provides confidence in the system’s accuracy. The ability to test and optimize strategies under different market conditions is invaluable.

The extensive customization of trading parameters is also a major distinction for Infinity Pro. Users can fine tune strategies based on individual risk appetite, assets traded, trade frequency, and more. The flexibility is a big plus.

When evaluating competitors, factors like start-up costs, subscription fees, and transparency of pricing are useful comparisons. Here, Infinity Pro is competitive with its free trial option and wide range of subscription tiers based on account size.

Of course, past performance and user reviews should also be evaluated. Infinity Pro’s consistently high marks for risk-adjusted returns, ease of use, and customer support compare favorably to alternatives.

While the automated trading space has no shortage of options, Infinity Pro stands out through its combination of transparency, customization, and use of hybrid AI technology. Head-to-head comparisons on pricing, features, performance, and support highlight its strengths.

Conclusion – Who is ECD Infinity Pro Recommended For?

Based on its features and capabilities, ECD Infinity Pro is best suited for active Forex traders seeking more effective trade automation to save time and potentially improve performance.

Specifically, Infinity Pro excels for intraday traders across a diverse range of currency pairs, cryptocurrencies, commodities, and global equities. The system scans for short-term price action signals across thousands of markets to capitalize on volatility.

The powerful AI module gives analysis and reaction speeds difficult for most humans to match. This enables agile entering and exiting of positions during the same trading session.

Traders focused on swing or positional strategies spanning days or weeks can also benefit. But very long-term investors may find limited advantages from automation in general.

In terms of experience level, Infinity Pro is a fit for seasoned traders well versed in technical and fundamentals analysis. Yet it’s user-friendly enough for motivated beginners to leverage its capabilities early in their education.

Dedicated investors who trade regularly, seek comprehensive global market access, and want to leverage predictive technologies will gain the most from Infinity Pro. The system excels at relentlessly scanning for and capitalizing on short and medium-term opportunities.

Casual long-term investors or set-it-and-forget index fund holders will likely find less utility in active automation. But for serious tradershungry for an extra edge through machine learning, Infinity Pro delivers on that promise.

Customer Service and Technical Support Overview

Having access to timely customer service and technical support is crucial when dealing with an automated trading platform like Infinity Pro that links to live brokerage accounts.

ECD provides customer support through several channels. Phone and email support are available for general inquiries as well as urgent technical issues. The company states that most requests receive a response within 24 hours or less.

For self-help options, ECD has implemented a customer portal featuring an extensive library of FAQs, training videos, user forums, and knowledge base articles. This allows users to search for answers to common questions or troubleshoot basic issues independently.

The website also contains useful resources such as product manuals, platform updates, contact information, and remote support tools. For rapid assistance, live chat functionality is accessible during business hours through the portal or from within Infinity Pro.

In terms of qualifications, ECD support staff undergo extensive training in the product’s technologies and markets prior to assisting customers. The team aims to resolve over 80% of inquiries on first contact. For complex or highly technical issues, priority escalation is available.

User reviews praise Infinity Pro’s customer service for in-depth knowledge of the platform and markets along with timely, personalized responses. Support across North American and international hours also accommodates traders globally.

The commitment to providing multiple customer access channels, robust self-help resources, and knowledgeable support staff gives traders confidence in assistance being available if needed. For an automated trading platform, high-quality technical support is a crucial service component.

Key Features of ECD Infinity Pro for Automated Forex Trading

ECD Infinity Pro packs an extensive suite of features to provide traders with a powerful automated trading experience optimized for currencies, cryptocurrencies, stocks, and commodities.

At its core is an advanced AI engine utilizing deep reinforcement learning and machine learning capabilities. This allows for predictive analytics and pattern recognition across massive amounts of historical data.

Trading strategies and risk parameters can be fully customized based on user preferences. Multiple configuration profiles are also available to quickly switch between settings for different market conditions.

Comprehensive backtesting enables in-depth evaluation of strategies across over a decade of historical market data. This provides insights into performance across changing cycles.

Infinity Pro supports automated trading across dozens of currency pairs, major cryptos, global equities, indices, and commodities. This diversification allows taking advantage of more opportunities.

Detailed reporting tracks key metrics like percentage of winning trades, risk-reward ratios, drawdowns, and cumulative profit and loss. Full transparency engenders trust.

The system interfaces directly with brokerage accounts to execute trades automatically once configured. This hands-free approach to trading saves significant time.

Strict security protocols protect user data through encryption, role-based permissions, infrastructure hardening, and third party auditing.

Customer support provides multiple access channels including email, phone, live chat, and an extensive self-help knowledge base. Issues are typically addressed promptly.

Between its advanced technologies, customization, and breadth of assets covered, Infinity Pro delivers an outstanding automated trading experience for forex and markets traders.

Introduction to ECD Infinity Pro Auto Trading Software

In the fast-paced world of forex and markets trading, manually analyzing charts and executing orders can be time consuming and inefficient. This is where automated solutions like ECD Infinity Pro come into play.

Infinity Pro is an intelligent auto trading system designed to remove the manual effort around trading while optimizing performance. Advanced AI and machine learning identify profitable opportunities across currencies, stocks, commodities, and cryptocurrencies.

Once configured, the platform can scan markets, initiate and manage positions, and execute trades automatically based on technical analysis and signal detection. This hands-free approach allows generating trading income passively.

Key benefits traders can realize through Infinity Pro’s automation include saving significant time otherwise spent on analysis and order execution, rapid reaction to shifting market dynamics, diversification across more asset classes, and consistency in following proven trading strategies.

Of course, blindly trusting any “black box” system poses risks. But Infinity Pro provides transparency into its underlying technologies and regular reporting of live trading results. This engenders confidence in the system’s efficacy and profitability over time.

For active forex and markets traders, Infinity Pro’s automation and machine learning capabilities may offer that additional edge to boost efficiency and performance. The system aims to complement the human intellect rather than fully replace it. With the right oversight and risk management, it can be a valuable trading ally.