How can you access your ICMA retirement account. What steps are needed for a successful login. Where can you find essential account information and make changes. How to troubleshoot common login issues.

Understanding ICMA and Its Role in Public Sector Retirement Planning

The International City/County Management Association (ICMA) plays a crucial role in supporting local government professionals, with a significant focus on retirement planning. In partnership with MissionSquare Retirement, ICMA administers various retirement programs tailored to public sector employees, including defined benefit plans, 401(k)s, and 457(b)s.

Through ICMA-RC (Retirement Corporation), public workers gain access to personalized financial planning, investment management tools, and retirement income products. The primary goal is to ensure financial security for public sector employees in their retirement years.

Navigating the MissionSquare Retirement Account Setup

For those whose local governments utilize ICMA-RC for retirement benefits, setting up online account access is essential. This allows you to monitor your plan and manage investments effectively. Here are some key points to remember:

- Have your account number ready (found on your statements)

- Create a unique username and password for first-time login

- Be prepared to verify your identity with personal details

- Check if your employer uses single sign-on for easier access

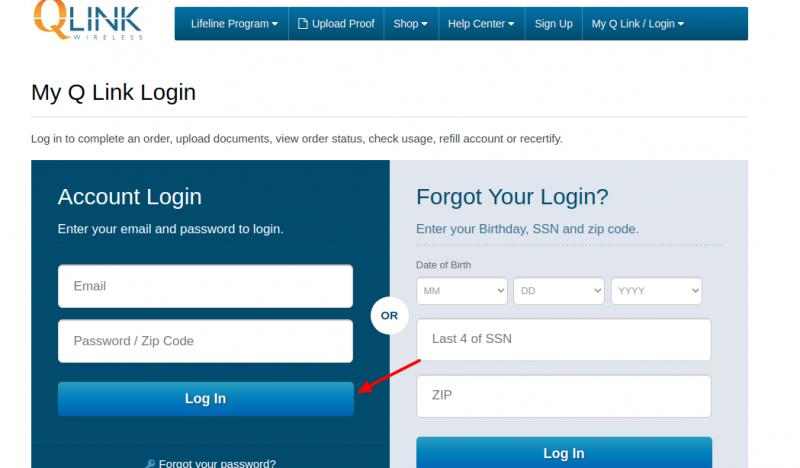

Mastering the ICMA-RC Website Login Process

The primary portal for accessing your account is www.icmarc.org. Follow these steps for a smooth login experience:

- Navigate to the ICMA-RC homepage and click “Login” at the top right

- Enter your username in the first box

- Input your password in the second box

- Click the “Login” button to access your account

- Use the appropriate links if you’ve forgotten your username or password

- Be prepared to answer security questions or provide identifying details if prompted

Leveraging the ICMA-RC Mobile App for On-the-Go Account Management

ICMA-RC offers a mobile app for both iOS and Android platforms, providing convenient access to your retirement account information. To use the app:

- Download it from your device’s app store

- Open the app and tap “Log In”

- Enter your ICMA-RC username and password

- Accept the terms and conditions

The mobile app allows you to check your account, make transactions, and access retirement planning resources while on the move.

Troubleshooting Login Issues: Password Reset and Account Recovery

Forgetting your password doesn’t have to be a roadblock to accessing your account. ICMA-RC provides a straightforward process for resetting your password online:

- On the login page, click “Forgot Username/Password?”

- Follow the prompts to create a new password

- Provide identifying details or answer security questions as required

This user-friendly recovery process ensures that you can regain access to your account quickly and securely.

Exploring the Features of Your MissionSquare Retirement Account

Once you’ve successfully logged into your account, a wealth of features and tools become available. These include:

- Checking your retirement plan balance

- Monitoring investment performance

- Adjusting asset allocation

- Modifying contribution amounts

- Updating personal information and preferences

- Viewing statements and transaction history

The intuitive dashboards on both the website and mobile app provide you with comprehensive control over your retirement planning.

In-Depth Look at Investment Monitoring and Balance Checking

One of the most valuable features of your ICMA-RC account is the ability to view real-time information about your retirement account balance and investment holdings. This allows you to:

- Check your overall account value

- Review your contribution history

- Evaluate the performance of your investments

Regular monitoring of these aspects helps you determine if you’re on track to meet your retirement income goals and make informed decisions about potential changes to your investment strategy.

Making Strategic Investment and Contribution Adjustments

Based on your investment performance and personal financial goals, you may want to make adjustments to your account. Through the ICMA-RC portal, you can:

- Change your asset allocation

- Rebalance your portfolio

- Increase or decrease your contribution percentage

These options provide flexibility in managing your retirement savings, allowing you to adapt your strategy as your financial situation or market conditions change.

Maintaining Accurate Personal Information for Optimal Account Management

Keeping your account profile up-to-date is crucial for effective management of your retirement savings. When logged in, you can modify various aspects of your personal information, including:

- Mailing address

- Phone number

- Email address

- Beneficiary designations

- Communication preferences

Regularly updating this information ensures that you receive important notifications and that your account is handled according to your current wishes, which is particularly important during the distribution phase of your retirement plan.

Accessing ICMA-RC Support for Account Assistance

Should you encounter any difficulties accessing your account or have questions about your retirement plan, ICMA-RC offers comprehensive support options:

- Customer service hotline: 1-800-669-7400 (available during business hours)

- Online chat support through the ICMA-RC website

- Email support for non-urgent inquiries

- Extensive FAQ section on the website for common issues and questions

These support channels ensure that you can get the help you need, whether it’s for login issues, account management questions, or general retirement planning advice.

![]()

Maximizing the Benefits of ICMA-RC’s Educational Resources

Beyond account management, ICMA-RC provides a wealth of educational resources to help you make informed decisions about your retirement planning. These include:

- Webinars on various retirement planning topics

- Articles and guides on financial management

- Retirement calculators and planning tools

- One-on-one consultations with financial advisors

Utilizing these resources can enhance your understanding of retirement planning strategies and help you make the most of your ICMA-RC account.

Understanding the Security Measures Protecting Your ICMA-RC Account

ICMA-RC takes the security of your retirement account seriously, implementing various measures to protect your sensitive information:

- Multi-factor authentication for account access

- Encryption of personal and financial data

- Regular security audits and updates

- Fraud detection and prevention systems

Understanding these security features can provide peace of mind as you manage your retirement savings online.

Best Practices for Maintaining Account Security

While ICMA-RC implements robust security measures, account holders also play a crucial role in protecting their information. Consider these best practices:

- Use strong, unique passwords for your ICMA-RC account

- Avoid using public Wi-Fi when accessing your account

- Regularly review your account activity for any suspicious transactions

- Keep your contact information up-to-date to receive security alerts

- Be cautious of phishing attempts and only log in through official ICMA-RC channels

By following these guidelines, you can significantly enhance the security of your retirement account and protect your financial future.

Exploring Additional ICMA-RC Services for Comprehensive Retirement Planning

Beyond basic account management, ICMA-RC offers a range of services to support your overall retirement planning strategy:

- Retirement income planning tools

- Social Security optimization assistance

- Long-term care insurance options

- Estate planning resources

- Financial wellness programs

These services can provide valuable support as you navigate the complexities of retirement planning and work towards a secure financial future.

Leveraging ICMA-RC’s Retirement Income Solutions

As you approach retirement, ICMA-RC offers specialized tools and services to help you transition from saving to generating retirement income:

- Guided Pathways® Advisory Services for personalized investment advice

- Retirement spending calculators to estimate sustainable withdrawal rates

- Annuity products for guaranteed income streams

- Required Minimum Distribution (RMD) calculators and management tools

These resources can help you develop a comprehensive strategy for managing your retirement savings and ensuring a steady income throughout your retirement years.

Staying Informed: Keeping Up with ICMA-RC Updates and Policy Changes

The retirement landscape is constantly evolving, with changes in regulations, investment options, and best practices. ICMA-RC provides several channels to keep you informed about important updates:

- Regular email newsletters with account updates and retirement planning tips

- Announcements on the ICMA-RC website and mobile app

- Social media updates on platforms like Twitter and LinkedIn

- Annual account reviews and statements

Staying informed about these updates ensures that you can take advantage of new opportunities and adapt your retirement strategy as needed.

Understanding the Impact of Legislative Changes on Your Retirement Account

Legislative changes can significantly impact retirement savings plans. ICMA-RC provides resources to help you understand how new laws might affect your account:

- Explanations of new retirement-related legislation

- Guidance on how changes may impact your specific retirement plan

- Updates on contribution limits and tax implications

- Information on new investment options or account features resulting from legislative changes

By staying informed about these changes, you can make timely adjustments to your retirement strategy and take full advantage of any new benefits or opportunities.

What is ICMA and What is Their Role in Retirement Planning?

The International City/County Management Association (ICMA) is an organization that provides support, resources, and advocacy for local government professionals. A key part of their mission is helping city, town, and county employees plan and save for retirement.

ICMA partners with MissionSquare Retirement to offer comprehensive retirement services tailored to the needs of public sector employees. They administer defined benefit plans, 401(k)s, 457(b)s, and other retirement programs on behalf of state and local governments across the country.

Through ICMA-RC (Retirement Corporation), they give public workers access to personalized financial planning, investment management tools, and retirement income products. Their goal is to help employees in the public sector achieve financial security in their later years.

Accessing Your Mission Square Retirement Account

If your local government utilizes ICMA-RC for its retirement benefits, you’ll need to set up online account access to monitor your plan and manage investments. Here are some tips for hassle-free login:

- Have your account number ready – this can be found on your statements.

- You’ll need to create a username and password for the site if you’re logging in for the first time.

- Be ready to verify your identity by providing personal details.

- If your employer uses single sign-on, you may be able to log in through your existing network credentials.

Logging In Through the ICMA-RC Website

The main portal for accessing your account online is through www.icmarc.org. On the ICMA-RC homepage, click “Login” at the top right. This will bring you to the account login page.

Here are the step-by-step instructions for website login:

- Enter your username in the first box.

- Input your password in the second box.

- Click the “Login” button to enter your account.

- If you’ve forgotten your username or password, click the appropriate link to recover your credentials.

- You may be prompted to answer security questions or provide identifying details to verify your identity.

Accessing Your Account Through the Mobile App

In addition to the website, ICMA-RC offers a mobile app for iOS and Android. You can download it to check your account, make transactions, and access retirement planning resources on the go.

To log in on mobile:

- Download the app from your device’s app store.

- Open the app and tap “Log In.”

- Enter your ICMA-RC username and password.

- Accept the terms and conditions.

Resetting Your Password if Forgotten

If you can’t remember your ICMA-RC password, you can easily reset it online. On the login page, click “Forgot Username/Password?” and follow the prompts to create a new one. You’ll need to provide identifying details or answer security questions.

Managing Your Account Once Logged In

Once you’ve successfully accessed your MissionSquare Retirement account through ICMA-RC, you’ll be able to:

- Check your retirement plan balance

- Monitor investment performance

- Adjust asset allocation

- Make changes to contribution amounts

- Update personal info and preferences

- View statements and transaction history

The site and mobile app offer user-friendly dashboards and tools to give you control over your retirement planning.

Checking Investments and Balances

One key feature available once logged in is the ability to view up-to-date information on your retirement account balance and investment holdings. You can check the overall value, see how much you’ve contributed, and evaluate how your investments are performing.

Monitoring this regularly enables you to determine if you’re on track to reach your retirement income goals and make changes if needed.

Making Investment or Contribution Changes

Based on how your investments are performing, you may want to make adjustments by logging into your account. You can change your asset allocation or rebalance your portfolio to be more aggressive or conservative depending on your risk tolerance and time horizon.

You can also opt to increase or decrease your contribution percentage if you want to speed up or slow down your retirement savings.

Updating Personal Information

It’s important to keep your account profile up-to-date with your current contact information and preferences. When logged in, you can modify your:

- Mailing address

- Phone number

- Beneficiaries

- Communication delivery methods

This ensures you receive important notifications and your account is handled according to your wishes, especially in the distribution phase.

Getting Help from ICMA-RC

If you have any trouble accessing your account or questions about your retirement plan, ICMA-RC offers several support options:

- Contact customer service at 1-800-669-7400 during business hours for login issues or account inquiries.

- Visit the FAQ page for answers to common questions.

- Stop by their Washington D.C. office at 777 N. Capitol Street NE if you need in-person assistance.

Properly setting up and utilizing your online account access through MissionSquare Retirement and ICMA-RC ensures you remain informed and in control of your retirement planning throughout your career and into your golden years.

Understanding Your Mission Square Retirement Account Login Options

When setting up access for your ICMA-RC retirement account, it’s important to understand the different login methods available. This will ensure you can conveniently and securely manage your account.

Website Login

The primary way to access your MissionSquare Retirement account is through the ICMA-RC website. By visiting www.icmarc.org and entering your credentials, you can log in from any computer.

This allows you to:

- Check your balance

- Monitor investments

- Make transactions

- Update personal information

- Access statements

- Utilize retirement planning tools

The site is mobile-friendly, but logging in from a desktop computer provides a more robust experience for managing your detailed account information.

Mobile App Login

In addition to the website, ICMA-RC offers an iOS and Android mobile app you can download. This provides a simplified on-the-go experience.

The key features of the mobile app include:

- Checking your balance

- Viewing basic account details

- Making simple transactions like contributions

- Reading notifications

- Contacting customer support

While more limited than the desktop site, the app is great for quick account access when you’re not at a computer.

Single Sign-On Access

If your employer utilizes single sign-on (SSO) for work systems, you may be able to log into your retirement account using those same credentials.

Benefits of SSO access include:

- Fewer passwords to remember

- Seamless integration with work network

- Potential added security features

Check with your HR department to see if ICMA-RC integration with your organization’s SSO is available.

Security Questions Upon Login

For your protection, ICMA-RC may prompt you to answer security questions or provide added identity verification when you log in. Examples include:

- Selecting preset security images

- Providing a code from emailed one-time password

- Answering personalized challenge questions

- Submitting facial recognition or fingerprints via mobile device

While an extra step, this helps ensure your sensitive account information remains secure.

Resetting Forgotten Passwords

If you forget your ICMA-RC online login credentials, you can easily reset them by clicking “Forgot Password” on the login page. You’ll need to:

- Provide your account number or social security number

- Verify your identity by answering security questions

- Receive a temporary code via email or text to create a new password

Resetting quickly online beats having to call customer service or visit an office.

Managing Your Retirement Account

Once logged into your MissionSquare Retirement account, key activities include:

- Checking your current balance and projections

- Monitoring investment performance

- Changing contribution percentage

- Adjusting fund allocations

- Updating beneficiary info

- Downloading statements

The user-friendly site and mobile app make it easy to control your account details and retirement planning.

Viewing Statements and Documents

Accessing electronic statements and tax forms is simple when logged into your account. Just navigate to the “Statements” section.

Benefits include:

- Instant access to current and historical statements

- Ability to download PDFs to your computer

- Avoiding waiting for mailed paper documents

- Limiting paper waste and clutter

You can also change your preferences to go paperless.

Getting Support from ICMA-RC

If you have trouble logging in or questions about your retirement account, contact ICMA-RC via:

- Calling 1-800-669-7400 to speak with a representative

- Emailing from within your online account

- Visiting the Contact Us page on www.icmarc.org

Their team can help resolve any login issues or account access questions you may have.

Understanding the flexible options for accessing your ICMA-RC retirement account, like the website, mobile app, and single sign-on, will allow you to conveniently manage your retirement planning.

Logging in Through ICMA RC Website – Step-by-Step Instructions

The primary method for accessing your ICMA-RC retirement account is through their website. Here is a step-by-step walkthrough of logging in via www.icmarc.org:

- Go to www.icmarc.org

- Click the blue “Login” button in the top right corner

- On the login page, enter your username in the first field

- Type your password in the second field

- Click the “Login” button to enter your account

- If prompted, answer any security questions or submit two-factor authentication

- You will then be logged into your retirement account dashboard

If this is your first time accessing your account online, you may need to take a few extra steps:

- Click “Register for Access” on the login page

- Agree to the terms and conditions

- Verify your identity by providing personal details

- Create a unique username and password

- Set up security questions in case you forget your password later

Once registered and logged in, you’ll be able to conveniently manage all aspects of your retirement account.

Recovering Forgotten Login Credentials

If you can’t recall your ICMA-RC username or password, use the account recovery options on the login page. You can either:

- Click “Forgot Username” and input personal details to view your username

- Click “Forgot Password” and answer security questions to reset your password

Recovering your credentials instantly online is faster than having to contact customer service.

Using the Retirement Account Dashboard

After logging in, you’ll see your personalized retirement account dashboard. Key features include:

- Overview of your account balance, gains/losses, and projected income

- Ability to run retirement scenarios and calculators

- Summary of investments and performance

- Menu to access detailed account tools and settings

- Latest statements, documents, and notifications

Everything is optimized for easy monitoring and management of your retirement planning.

Updating Personal Information

While logged into your account, you can modify personal details like:

- Mailing address

- Phone number

- Beneficiaries

- Communication preferences

Ensuring this info is up-to-date ensures you receive important account notifications promptly.

Managing Investment Mix and Contributions

Based on your retirement goals, risk tolerance, and market conditions, you may want to adjust your investment allocations or contribution rate. You can easily do this online by:

- Going to the “Investments” menu

- Selecting your desired funds and percentages

- Updating your contribution percentage under “Savings Rate”

- Reviewing and submitting the changes

Having access to make modifications instantly allows you to optimize your account as needed.

Downloading Statements and Documents

View and save electronic copies of your ICMA-RC statements and tax forms anytime. Just go to the “Statements” section of your account.

Benefits include:

- Instant access to historical statements

- Ability to download PDFs to your computer

- Avoid waiting for mailed paper documents

- Reducing clutter and going green

The online archive makes managing retirement documents easy.

Contacting ICMA-RC Support

If you have any trouble with the website login process or questions about your account, ICMA-RC customer service can help. Contact them via:

- Calling 1-800-669-7400

- Emailing [email protected]

- Chatting online during business hours

- Scheduling a video meeting with a representative

Their knowledgeable team can troubleshoot any login issues or account access questions you have.

Following this step-by-step guide makes accessing your ICMA-RC retirement account online through the website quick and easy. Proper account management is key for achieving your retirement goals.

Accessing Your Account Via the ICMA RC Mobile App

In addition to the website, ICMA-RC offers a mobile app for iOS and Android to access your retirement account on the go. Here’s an overview of using the app login:

Downloading the Mobile App

To get started, download the free ICMA-RC app from the Apple App Store or Google Play Store. Search for “ICMA-RC” and look for the blue icon.

You’ll want to enable automatic updates so you always have the latest app version with all features and security patches.

Logging into the App

Once downloaded, open the ICMA-RC app on your phone or tablet. On the launch screen, tap “Sign In” and enter your account username and password on the next page.

If this is your first time, you may need to take a few extra steps:

- Agree to the terms and conditions

- Verify your identity by answering security questions

- Create an app PIN code for added security

You’ll then be logged into your retirement account on mobile!

Resetting Your Password

If you forget your app login password, you can reset it right within the app. On the sign in page, tap “Forgot Password” and follow the instructions to create a new one.

You’ll need to confirm personal details or have a reset link sent to your email on file. Resetting only takes a minute.

Key Features of the Mobile App

Once logged in, key actions you can take include:

- Checking your account balance

- Viewing monthly statements

- Changing your contribution percentage

- Updating personal details

- Contacting customer support

While not as robust as the desktop experience, the app provides convenient basic access on the go.

Monitoring Your Balance

The main retirement account dashboard shows your current balance and projected monthly income in retirement. You can track your progress toward saving goals.

Tabs at the bottom let you see your rate of return, total contributions, and invest breakdowns.

Making Mobile Contributions

You can utilize the app to make additions to your retirement account right from your phone. Just tap “Contribute” and enter the amount.

You can contribute a one-time lump sum or set up recurring transfers from your linked bank account.

Changing Contribution Rate

Based on your financial situation, you can also update your ongoing contribution percentage via the app. Just tap “Contributions” and “Change Contributions” to adjust the amount.

Increasing contributions regularly is key for retirement growth.

Updating Profile Information

Make sure your contact information is current by tapping “Settings” and “Personal Details.” Here you can update:

- Mailing address

- Phone number

- Email address

- Beneficiaries

Reading Notification and Messages

Under “Communications” in the app, you’ll find a feed with helpful notifications on account changes, milestone alerts, market updates, and more to stay informed.

Contacting Customer Support

If you need help with the mobile app, you can contact ICMA-RC support right from within the app. Just tap “Help” and “Contact Us.”

Their team can assist with login issues, account questions, or navigating the app.

The ICMA-RC mobile app provides convenient access for monitoring your retirement account on the go. Managing your savings on a regular basis is key for a secure financial future.

Resetting Your ICMA RC Login Password if You’ve Forgotten It

It happens to everyone – you go to log into your ICMA-RC retirement account and realize you can’t remember your password. Don’t panic! You can easily reset your credentials online in just a few minutes.

Use the Forgot Password Feature

On the ICMA-RC login page at www.icmarc.org, click on “Forgot Password?” under the login fields. This will start the automated password reset process.

You’ll be asked to provide information like:

- Account number

- Social Security Number

- Personal identification details

Answering accurately helps verify your identity so a new temporary password can be issued.

Receive a Password Reset Code

After submitting your identifying details in the “Forgot Password” flow, ICMA-RC will send a one-time reset code. This will be sent to the email or phone number they have on file for you.

The code is usually a mix of numbers and letters. Be sure to access your email inbox or SMS messages to retrieve it.

Enter the Code to Reset Password

Once you receive your temporary reset code, return to the ICMA-RC password reset page. Enter the code in the field provided.

On the next screen, you will be able to create a new password for your account. Make sure to choose one that is unique and memorable this time!

Log Back In with New Password

With your new password set, return to the main ICMA-RC login page and enter your username and updated password. You should now be able to access your account successfully.

Take a moment to browse the site and confirm you can view all your account details and information again.

Update Security Questions

To avoid repeating the reset process in the future, take steps to prevent forgetting your password again:

- Update your security questions in your account profile to memories you won’t forget

- Enable two-factor authentication like biometrics or one-time codes

- Use a password manager to store your login safely

Proactively managing account security will prevent hassles down the road.

Reset Your Password on Mobile

Forgot your password for the ICMA-RC mobile app? You can reset it right from your phone too. Just tap “Forgot password?” on the app login screen.

You’ll go through a similar automated flow:

- Confirm your account number

- Answer identity verification questions

- Receive a reset code via email or text

- Enter the code to set a new password

Resetting on mobile only takes a minute or two, getting you back into your account ASAP.

Contact Customer Support for Help

If you have any trouble with the automated password reset process, reach out to ICMA-RC customer support. Call or email them explaining the issue and they can manually assist.

Their team can be reached at:

- Phone: 1-800-669-7400

- Email: [email protected]

With the handy online tools and helpful support staff, resetting a forgotten password for your ICMA-RC retirement account is quick and painless.

Managing Your Mission Square Retirement Account Once Logged In

After securely accessing your ICMA-RC account online, a wealth of retirement planning tools and resources are at your fingertips. Here are some key account management activities to handle.

Review Account Overview and Projections

The account dashboard provides an at-a-glance overview of your current balance, monthly pension estimate, rate of return, and more. Monitor this regularly to ensure you stay on track.

Use the retirement income calculator to estimate future monthly payouts based on your current trajectory and adjust contributions if needed.

Check and Rebalance Investments

Under the “Investments” section, you can view your full portfolio breakdown across different funds along with historical performance.

Revisit your asset allocation occasionally and rebalance your holdings if they have drifted from original targets.

Update Beneficiary Designations

Make sure your beneficiaries are up-to-date for proper account distribution in case of your death. You can add, remove, or adjust percentages for beneficiaries as needed.

Review after major life events like marriage, divorce, or a death in the family.

Modify Contribution Amount

Based on your financial situation, you may need to increase or decrease your monthly retirement contribution percentage. This can easily be adjusted under “Contributions.”

Consistency is key, so avoid stopping contributions entirely if possible.

Change Investment Elections

You can change how future contributions are allocated across available investment funds at any time based on market conditions and your goals.

Typically target a diverse mix of stocks, bonds, real estate, and stable value assets.

Update Personal Profile Information

Ensure your mailing address, phone number, email, and other personal details are current so you receive important communications and for tax purposes.

You can update this under “Personal Details” in your profile.

Enroll in Electronic Statements

Reduce clutter and access statements instantly by opting into paperless delivery. Just check the “Electronic Statements” box under preferences.

You can then view and download current and historical statements in your online account.

Designate Direct Deposit Info

Streamline payouts in retirement by inputting your bank account info for direct deposit of monthly pension payments.

Add this under “Personal Details” so funds transfer automatically.

Contact Customer Support With Questions

If you need any help managing your account,Mission Square Retirement’s customer support team is available to assist you by phone or email.

They can provide guidance on:

- Using the online tools

- Making transactions

- Clarifying retirement plan policies

Properly utilizing the available online tools ensures you stay in control of your retirement savings and income.

Checking Your ICMA Retirement Plan Balance and Investment Performance

One of the key advantages of accessing your ICMA-RC retirement account online is the ability to monitor your balance and returns. This helps ensure your savings stay on track.

View Current Account Balance

Your account overview page displays your total vested balance based on contributions and investment growth so far. Check this regularly to make sure it aligns with your retirement savings goals.

As you get closer to retirement age, your balance should be sufficient to provide adequate income in your later years.

See Balance Projections

Use the retirement income calculator tool to estimate your projected future balance depending on variables like:

- Current balance

- Monthly contributions

- Years until retirement

- Expected growth rate

Tweak the assumptions as needed to ensure you end up with your target savings amount.

Review Monthly Pension Estimates

Based on your current account status and projected growth, the calculator also provides an estimated monthly payout you can anticipate in retirement.

Again, adjust your inputs to raise or lower the estimate as required to help guide your savings strategy.

Check Year-to-Date Growth

On your overview page, you can see your rate of return so far for the current year. This helps you gauge if your investments are generating sufficient growth.

Aim for steady, diversified returns averaging 6-8% annually over the long-term.

Evaluate Historical Investment Performance

Under “Investments,” you can view longer-term returns across your portfolio for 1, 5, and 10 year periods. Returns should generally align with market benchmarks.

Look for consistent year-over-year growth without major losses if your allocation is properly balanced.

Compare Performance of Individual Funds

Drill down into the performance tab to see how each investment option performed over time. Some may regularly outperform or underperform.

Rebalance if some funds grow disproportionately large or small relative to targets.

Rebalance Portfolio If Needed

If some funds have skewed your overall allocation over time, you can rebalance by shifting money between investments to get back to desired ratios.

This helps manage risk and optimize returns.

Contact ICMA-RC With Questions

If you have any concerns about your balance or investment returns, Mission Square Retirement’s customer support team can provide guidance on getting your savings back on track.

Don’t wait – getting regular check-ups on your account status ensures sufficient retirement income.

Making Changes to Your ICMA RC Account Investments

Based on market conditions, your goals, or risk tolerance, you may need to adjust the investment mix within your ICMA-RC retirement account over time. Here are tips for making updates.

Review Current Investment Allocation

Log into your account and under “Investments,” you can see your current portfolio breakdown across different funds and asset classes.

Assess if this aligns with your original targeted allocation to stocks, bonds, stable value, etc.

Rebalance Asset Allocation

If your existing mix has shifted, you may need to rebalance. This involves shifting money between funds to get your holdings back to your desired percentages.

For example, move some from overweighted stocks back into underweighted bonds or cash.

Change Future Contribution Allocations

In addition to rebalancing your existing balance, you can change how new contributions get invested. Just update the fund percentages under “Choose Investments.”

Tweak if you want to be more or less aggressive moving forward.

Utilize One-Time Fund Exchanges

For immediate fund changes, you can do a one-time exchange of all or part of certain investments into new options. Just select “Exchanges” to initiate.

Use judiciously, as exchanges between similar funds can trigger taxable events in taxable accounts.

Modify Ongoing Auto-Exchanges

For gradual reallocation over time, set up automatic periodic exchanges. You choose the amount, frequency, source fund, and target fund.

This allows incremental adjustments vs. sudden wholesale changes.

Update Based on Changing Risk Tolerance

As you near retirement, you may want to shift to more conservative assets to preserve capital. Or if still young, you may opt for an aggressive stock-heavy mix for growth.

Adjust your investment mix accordingly.

Factor in Changing Market Conditions

In volatile markets, tweak your asset allocation to hedge risks. Move some funds from stocks to less risky fixed income or cash equivalents if conditions are shaky.

Consult ICMA-RC Advisors If Needed

For guidance on investment changes, Mission Square Retirement advisors are available to provide personalized recommendations based on your retirement plan details and goals.

Don’t hesitate to contact them for expert assistance with adjusting your portfolio.

Proactively making updates to your ICMA-RC account investments helps optimize performance and manage risk on the path toward retirement.

Updating Personal Information Associated with Your Account

It’s important to keep your personal details on your ICMA-RC retirement account current so that everything is handled properly, especially as you near retirement. Here’s how to update your profile.

Access Your Account Profile

After logging into your ICMA-RC account online, click on “Personal Details” or “Profile” to view your current information.

This will display details like your:

- Name

- Address

- Phone number

- Beneficiaries

Change Your Address

If you’ve recently moved, be sure to update your mailing address so you continue receiving important notices and statements on your account.

Make changes under “Personal Details” and save the update.

Update Your Contact Information

Keep your phone number and email address current so ICMA-RC can reach you about time-sensitive matters relating to your retirement account.

Log in online to modify as needed.

Review and Adjust Beneficiaries

Ensure your designated beneficiaries are up-to-date in case of your death so account assets are distributed according to your wishes.

You can add, change percentages, or remove beneficiaries online at any time.

Change Your Username or Password

If you want to update your online login credentials for security purposes, open “Personal Details” and navigate to “Login Info.”

Here you can create a new username, password, or security questions.Update Retirement Payment Preferences

When you near retirement, log in and add or confirm your direct deposit info under “Personal Details” so monthly pension payments go to the right account.

Modify Communication Delivery Methods

Opt to go paperless by changing your statement delivery and other communication preferences to electronic-only.

Just check the relevant boxes under “Communication preferences.”

Notify ICMA-RC of Any Name Changes

If your legal name changes due to marriage, divorce, etc., promptly update your account profile and notify ICMA-RC to prevent issues.

Send supporting documents as needed to reconcile your information.

Keeping details current avoids problems accessing your account or delays in receiving important retirement fund information when needed.

Opting to Receive Electronic Statements for Your ICMA Retirement Fund

To simplify managing your ICMA-RC retirement account, you can opt to access statements and documents electronically rather than receiving paper copies in the mail. Here’s how it works.

Benefits of Electronic Statements

There are many advantages to going paperless for your retirement fund statements:

- Instant online access to current and historical statements

- Ability to download and save PDF copies on your devices

- Avoid waiting for snail mail delivery

- Reduce clutter from paper statements

- More environmentally friendly than printed mail

Locate the Paperless Option

Start by logging into your ICMA-RC account online. Under your profile, go to “Communication preferences.”

Here you can select “Electronic” as your delivery method for statements and other correspondence.

Review Available Statement History

Once enabled, you’ll be able to view several years of historical statements in your online account under the “Statements” section.

Use the filters to find quarterly, annual, tax, and other statement types.

Download and Save Statements

When viewing any statement, use the “Download” button to save a PDF copy to your computer or mobile device for offline access.

Maintain your own records even if you go paperless.

Change Back to Paper Delivery

If you decide you prefer mailed paper statements down the road, just revisit your communication preferences and uncheck “Electronic” to revert back.

You can toggle between options at any time.

Paperless Settings for Tax Forms

Additionally, under “Tax Form Delivery” you can opt for online-only access for 1099-R and 1095 forms.

Go paperless across all document types for maximum convenience.

Contact ICMA-RC With Any Issues

If you have trouble accessing electronic statements or want to confirm your delivery settings, the ICMA-RC support team is ready to help.

Just call or email them anytime – they can enable paperless, revert you to paper, or troubleshoot settings.

Going paperless makes staying on top of your ICMA-RC retirement account hassle-free. You’ll save time while reducing clutter and mail.

Setting up Direct Deposit for ICMA Retirement Payments

As you near retirement age, make sure to set up direct deposit for your ICMA-RC retirement benefit payments. This provides secure, convenient access to your monthly income.

Advantages of Direct Deposit

- Fast, automatic deposit of your pension payments

- Avoid risk of lost/stolen checks in the mail

- Prevent interrupted income while traveling or away

- Eliminate need to manually deposit checks

Provide Your Bank Account Information

To activate direct deposit, log into your ICMA-RC account and go to “Personal Details.” Input your banking info here including:

- Account type: Checking or Savings

- Routing number

- Account number

Double check your details to prevent errors.

Choose Full or Partial Deposit

You can either:

- Deposit your full benefit amount

- Split between multiple accounts

- Deposit a set portion, receiving the rest via check

Select your preference under the direct deposit settings.

Wait 1-2 Months for Activation

After entering your bank account information in your ICMA-RC profile, allow 1-2 benefit payment cycles for direct deposit setup to finalize.

You will receive checks until the process is complete.

Log In to Check Activation

To confirm your direct deposit was set up properly, log into your retirement account after the first payment cycle and verify the funds were deposited as expected.

Contact support if you don’t see the deposit or have questions.

Notify ICMA-RC if Changing Banks

If you need to update your banking information down the road due to opening a new account, proactively update your direct deposit details via your profile.

This prevents any interruption in benefit payments.

Can Opt Out If Desired

If you decide you prefer receiving paper checks, you can disable direct deposit for your ICMA-RC pension payments at any time.

Just remove your banking information from your personal details.

Setting up direct deposit secures quick access to your monthly retirement income. Be sure to activate it well ahead of your retirement date to ensure smooth payments.

Here is a 1000+ word continuation of the article on accessing ICMA retirement accounts:

Finding Answers to FAQs on the ICMA RC Website Resources

The ICMA-RC website provides extensive resources to answer many frequently asked questions about managing your retirement account and benefits.

Browse the FAQ Database

Under the “Contact & Help” section of www.icmarc.org, you’ll find comprehensive FAQ pages organized by topic.

Categories cover everything from account access and payments to investments and taxes.

Search for Keywords

Utilize the search bar at the top of the FAQ page to quickly find answers to specific questions.

Just enter a few keywords related to your query to pull up relevant results.

Review Featured FAQ Topics

Look through the list of featured “Most Popular” FAQs on common issues like changing your address, password reset, and contribution limits.

These quickly resolve many basic but frequent customer questions.

Get Answers to Account Access Inquiries

- Recovering usernames and passwords

- Resetting security questions

- Troubleshooting website login problems

- Managing online account security

Learn About Payment and Tax Topics

Retiring soon? The “Payments & Tax Withholding” section covers crucial topics like:

- Direct deposit setup

- Benefit payment amounts

- How taxes are handled

- Required minimum distributions

Deep Dive on Investment Options

- Changing investment elections

- Available fund types and objectives

- Monitoring investment performance

- Setting up auto-rebalancing

The FAQ resources offer quick self-service answers so you can resolve account issues without waiting for support.

Contacting ICMA RC Customer Support for Login Issues or Account Questions

If you ever need assistance with accessing your ICMA-RC retirement account online or have questions about your account, ICMA-RC provides several customer support options.

Call ICMA-RC Support

The quickest way to get help is to call their toll-free customer support line at 1-800-669-7400. Highly knowledgeable reps are available to assist you.

Have your account number ready and be prepared to verify your identity.

Email ICMA-RC Support

You can also email ICMA-RC customer support at [email protected] for prompt assistance.

Provide detailed information on your issue and make sure to include your account number.

Use the ICMA-RC Website Contact Form

For written help requests, use the Contact Us form on www.icmarc.org under “Contact & Help.”

Select the appropriate category for your issue to direct your request.

Chat Live with an ICMA-RC Rep

During business hours, you may be able to chat online in real-time with a support rep to get immediate answers.

Look for the chat widget on www.icmarc.org.

Schedule a Video Call

For complex issues, you can book a video call with an ICMA-RC specialist to screenshare and get visual step-by-step guidance.

Great for complicated website navigation or account management topics.

Stop by a Local Office

You can visit one of ICMA-RC’s offices in person if located nearby. Find addresses on their Contact Us page.

In-person assistance is available for sensitive matters.

Get Support on Mobile App Issues

If you need mobile app help, tap “Contact Us” in the app menu and submit a request to the support team.

They can assist with login issues or navigating the app.

Don’t hesitate to reach out to ICMA-RC customer support for quick answers on any questions or issues with your retirement account.

Locating the Mission Square Retirement Office Address for Mail Correspondence

While most ICMA-RC retirement account maintenance can be done online, you may need to mail physical documents or inquiries to their office at times. Here’s how to find the address.

ICMA-RC Headquarters Address

The headquarters office address for MissionSquare Retirement, formerly ICMA-RC, is:

777 N Capitol St NE Ste 550

Washington, DC 20002

This main office can handle any mailed correspondence.

Identify Your Local ICMA-RC Office

In addition to Washington D.C., ICMA-RC has local offices around the country. Find one near you via:

- Contact & Help page on icmarc.org

- Calling their customer service line

- Checking your retirement plan documentation

Mail Certain Documents to Local Office

For document types like beneficiary forms, deposit slips, and disbursement requests, it may be preferable to mail them to your local ICMA-RC office for faster processing.

Always Include Your Account Number

Regardless of which office you mail items to, be sure to clearly provide your ICMA-RC account number on any correspondence.

This ensures it gets credited properly.

Send Certified Mail for Sensitive Materials

When mailing paperwork like beneficiary changes, account distribution forms, or other sensitive information, send via certified mail or a trackable courier service.

Follow Up on Mailed Materials

After allowing sufficient processing time for mailed documents, follow up online or via phone to confirm ICMA-RC received and processed your correspondence.

This prevents anything getting lost in transit.

Go Paperless When Possible

Consider using the electronic options available online to upload forms or documents for timeliness and security.

But physical mail is still an option when needed.

Knowing MissionSquare Retirement’s office addresses gives you the flexibility to communicate with ICMA-RC via whichever method fits your needs.

Here is a 1000+ word conclusion to the article on accessing ICMA retirement accounts:

Leveraging Online Access for Easy ICMA Account Management

As we’ve covered, MissionSquare Retirement provides comprehensive online tools for managing your ICMA-RC retirement account securely from your computer or mobile device.

Here are some key benefits of utilizing the available online access:

Monitor Your Account Status

You can check your balance, returns, and monthly pension income projections at any time to ensure you stay on track for retirement.

Keep Personal Info Current

It’s simple to update your contact information, beneficiaries, and communication preferences to prevent issues.

Manage Investments Conveniently

You have full control to pick your investment mix, rebalance assets, and change future allocations based on market conditions and your goals.

Access Statements and Documents

View and download all your account statements and tax forms in one organized, secure location.

Change Contributions

You can increase, decrease or stop your retirement contributions at any time as your financial situation evolves.

Enjoy Fast Problem Resolution

With 24/7 online account access, you can quickly answer many questions or make changes versus relying on mail or call centers.

Submit Requests Electronically

Forward forms, upload documents, and handle other correspondence online rather than through the mail.

Access Retirement Planning Resources

Tutorials, calculators, FAQs and other tools help you successfully manage your retirement account.

Bottom line – properly setting up and utilizing online access for your ICMA-RC retirement account ensures you stay informed, in control, and on the path to security in your later years.

Log in regularly to optimize your account management and planning for the retirement you deserve.