How Epochs New Dragonfly Feature Boosts ID Protection and Credit Card SecurityHow Epochs New Dragonfly Feature Boosts ID Protection and Credit Card Security

Dragonfly’s biometric identity confirmation

Epoch’s game-changing Dragonfly feature utilizes facial recognition and fingerprint scanning – known as biometrics – to confirm users’ identities. This biometric identity confirmation adds an extra layer of security beyond old-fashioned passwords which can be guessed or stolen. By requiring a scan of the user’s unique facial features or fingerprints, Dragonfly ensures accounts are only accessed by verified individuals. This prevents fraudsters from gaining entry, even if login credentials are compromised.

Preventing credit card fraud with AI monitoring

Dragonfly deploys artificial intelligence to monitor all credit card transactions in real-time. This AI system is on the lookout for any suspicious or anomalous purchases that may indicate fraud. For example, if a credit card registered in New York is suddenly used to buy electronics in Russia, Dragonfly will instantly flag this as potentially fraudulent. By using predictive analytics, Dragonfly can identify fraud patterns and stop thieves in their tracks before financial damage is done.

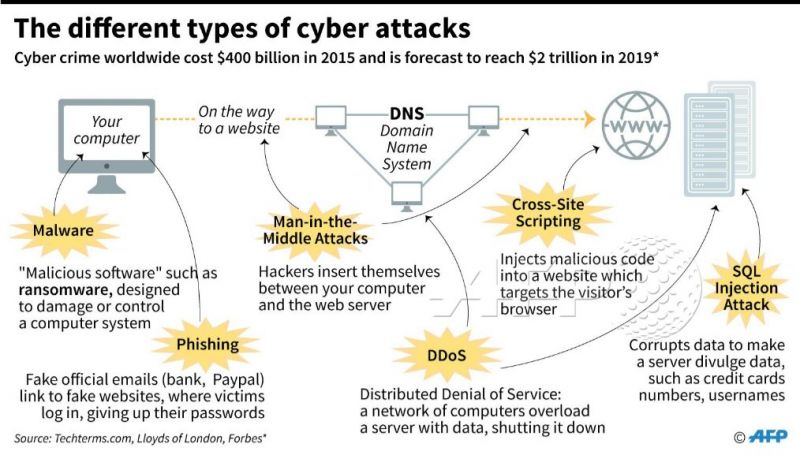

Safeguarding data from cyberattacks

We all know data breaches are a growing threat, with hackers constantly developing new ways to infiltrate systems and steal personal information. Dragonfly leverages the highest levels of encryption and cybersecurity to create an impenetrable barrier around users’ financial data. Even if malicious actors manage to breach Dragonfly’s outer defenses, all sensitive information remains securely encrypted and indecipherable. Customers can rest assured knowing their data is safe from even the most sophisticated cyberattacks.

Blocking suspicious purchases

When Dragonfly detects a suspicious purchase with your credit card, it can instantly block the transaction before it’s approved. This prevents thieves from racking up fraudulent charges to your account. Dragonfly is constantly analyzing your regular spending patterns, so it can tell when an anomalous purchase pops up that doesn’t fit your profile. With Dragonfly, you don’t have to worry about discovering fraudulent charges after the fact – they are proactively denied at the point of sale.

Alert system for unauthorized charges

In the event an illegitimate charge does slip past Dragonfly’s sensors, you’ll receive an immediate SMS and email alert about the unauthorized transaction. This allows you to take swift action, such as contacting your credit card company to report the fraud or freezing your account if needed. Dragonfly’s real-time monitoring and instant notifications enable customers to respond rapidly to any potential credit card fraud.

Preventing credit card fraud with AI monitoring

Dragonfly’s cutting-edge artificial intelligence system acts as a vigilant watchdog, keeping an unblinking eye out for suspicious credit card activity. This AI fraud fighter utilizes advanced machine learning algorithms to analyze millions of transactions and detect patterns that may indicate fraud. For instance, if a purchase pops up that is inconsistent with your regular shopping habits – like a big-screen TV when you’ve never bought electronics before – the AI will flag this as potentially fraudulent. Or if your card associated with your hometown is suddenly being used overseas, Dragonfly’s AI will recognize this anomaly. By continually monitoring all credit card use and adapting to new fraud tactics, Dragonfly’s AI guardian can identify and deny illegitimate charges in real-time. Customers can sleep soundly knowing Dragonfly’s artificial brain has their back.

Safeguarding data from cyberattacks

In our digitally connected world, data breaches and cyberattacks are an ever-present threat. Hackers are constantly evolving new methods to infiltrate systems and steal sensitive personal and financial information. Dragonfly combats this through multilayered cybersecurity defenses and advanced encryption. Dragonfly utilizes cutting-edge firewalls, intrusion prevention systems, and network monitoring to guard the perimeter. Even if these outer levels are penetrated, customer data remains protected by military-grade 256-bit AES encryption. This cryptographic encoding scrambles data into an indecipherable random string of characters. Only with the encryption key can the data be unlocked and read. So even if hackers access the encrypted data, it remains securely scrambled and useless. Dragonfly’s impenetrable encryption fortress keeps customer information safe, even in the event of a breach.

Blocking suspicious purchases

Dragonfly acts as your personal bouncer, blocking shady transactions before they happen. The system uses predictive analytics to analyze your normal spending patterns – the locations you shop, types of merchants, and average purchase amount. Armed with this baseline, Dragonfly can instantly spot anomalous transactions that seem suspicious and don’t fit your profile. For example, if your card is normally only used around your hometown, then a purchase pops up from an electronics store overseas, Dragonfly will deem this highly irregular and deny the transaction. By stepping in to stop sketchy purchases in real-time that appear to be fraudulent, Dragonfly prevents thieves from ever charging your account in the first place.

Encrypting financial information

Dragonfly leverages robust encryption to scramble and secure all your sensitive financial data. Whenever you input or access any payment info through Dragonfly, it is immediately encrypted using a complex cryptographic algorithm known as AES-256 bit. This converts the data into a completely random string of characters that is impossible to decipher without the encryption key. The encrypted data remains unintelligible and useless to hackers or anyone without authorization. Even if they managed to steal the encrypted data, it would appear as gibberish code. Dragonfly’s encryption occurs on-device so payment information is converted before it is even transmitted or stored in the cloud. By encrypting all financial data end-to-end, Dragonfly ensures prying eyes can never view your sensitive information.

Facial recognition login

Dragonfly takes identity verification to the next level by using facial recognition for secure account access. Instead of relying on passwords that can be compromised, Dragonfly has you snap a quick selfie to log in. Advanced AI analyzes the unique facial map based on your bone structure, distances between features, and other distinctive attributes. This creates a 3D model of your face that is far more secure than passwords or security questions. Once your facial biometrics are registered, you can instantly log in just by looking at your camera. Facial recognition also ensures it’s actually you accessing your account, not some fraudster. By tying access directly to your face, Dragonfly provides air-tight identity confirmation and prevents account takeovers.

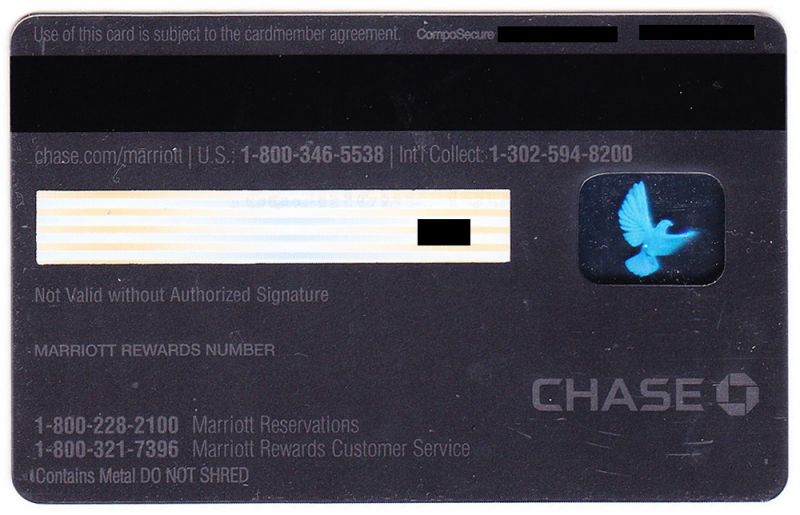

Anonymizing payment details

Dragonfly helps keep your payment information private through tokenized card data. Whenever you input a new credit card, Dragonfly uses tokenization to replace sensitive card details with a unique digital identifier. This token acts as a stand-in, so your actual card number is never stored or transmitted. Even Epoch only receives the anonymous token rather than raw card data. Tokenization renders payment details meaningless to hackers, even if they managed to access the tokens. And if a merchant experiences a breach, your real card number remains protected. Dragonfly’s anonymized payment network keeps financial information confidential while still allowing transactions to process. Customers enjoy privacy and security.

Virtual card numbers add security layer

For online purchases, Dragonfly offers an added layer of security through virtual card numbers. With this feature, Dragonfly generates a unique, one-time-use card number to represent your account for each transaction. Even if this virtual card data is compromised, it can’t be reused or lead back to your real account number. After the single transaction is processed, the virtual card number is immediately invalidated. This isolates your actual credit card from exposure during online shopping. By only sharing transaction-specific virtual numbers rather than primary account data, Dragonfly helps shield your identity and prevent account takeovers or fraudulent use. You can shop virtually anywhere online without worrying about your real card information being stolen or misused.

Tracking credit activity and scores

Dragonfly helps you monitor your financial health by providing a comprehensive credit tracking dashboard. It aggregates data from all your accounts and cards to give you a holistic view of credit utilization, payments, balances, and other activity. Dragonfly also monitors your credit reports and scores across all three bureaus – Equifax, TransUnion, and Experian. You can observe your credit scores from each bureau, see which factors are impacting them, and take steps to improve them over time. With all this financial data in one place, Dragonfly lets you keep your finger on the pulse of your credit profile. Usage trends, past payments, inquiries, and other critical info is tracked to optimize your credit standing.

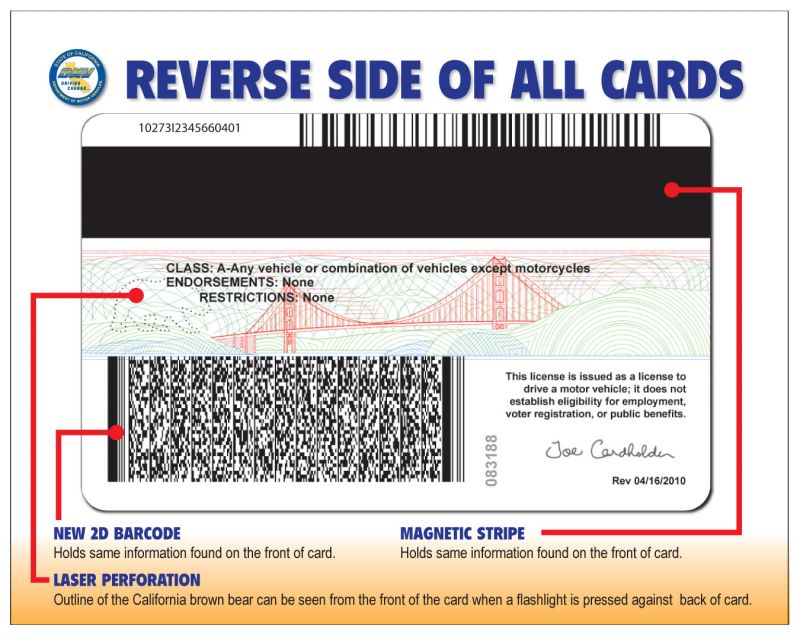

Securing accounts from data breaches

Even giants like Equifax and Capital One have experienced massive data breaches. To protect customers from potential account takeovers if their data is exposed, Dragonfly utilizes robust multi-factor authentication. This requires an additional step beyond passwords when logging in, like a unique code sent to your phone or a fingerprint scan. That way, even if hackers steal passwords from a breach, they can’t access accounts without the extra verification. Dragonfly also provides real-time breach alerts, so if your info appears on the dark web you can take swift action to freeze accounts and change passwords. Combined with constant AI monitoring for suspicious activity, Dragonfly keeps your accounts ultra-secure against any potential threats related to data breaches.

Integrating with banks and lenders

Dragonfly seamlessly syncs with your existing financial accounts for a unified view of your digital financial life. By securely connecting with your banks, credit cards, investment accounts and more, Dragonfly aggregates all your account data into a single dashboard. This gives you a comprehensive snapshot of balances, transactions, credit details, budgets, cash flow and net worth across institutions. Dragonfly even integrates with lenders to make applying for loans and monitoring rates quick and easy. With robust open banking APIs and money management tools, Dragonfly serves as a hub for managing finances, leveraging integrations to automate workflows. Less manual tracking means more time focusing on financial goals.

Easy identity verification for purchases

Dragonfly simplifies identity confirmation when making purchases by integrating with your device’s biometrics. To verify a transaction, Dragonfly uses your fingerprint or face recognition from your smartphone rather than requiring cumbersome two-factor authentication. Once your biometrics are enrolled, you can validate your identity in seconds for seamless payments. This biometric verification ensures merchants know exactly who is making the purchase, preventing fraudsters from using your accounts while allowing you to buy online or in stores effortlessly. No more fumbling for devices or entering codes. With Dragonfly, a quick fingerprint or selfie is all you need to confirm you’re the genuine cardholder. Frictionless and secure.