How Can You Capitalize on Opportunity Zones in Wisconsin and Mississippi This YearHow Can You Capitalize on Opportunity Zones in Wisconsin and Mississippi This Year

What Are Opportunity Zones and How Do They Work?

Opportunity zones are designated census tracts in certain communities that allow for valuable tax incentives on capital gains when investing in these areas. The Tax Cuts and Jobs Act of 2017 established opportunity zones to spur economic development and job creation by encouraging long-term investments in low-income communities nationwide.

So how do these opportunity zones work exactly? Investors can defer paying taxes on capital gains by investing those gains into qualified opportunity funds within 180 days. These funds then invest at least 90% of their assets into opportunity zone businesses and real estate. By investing in an opportunity zone for 5-7 years, investors can exclude 10-15% of their original capital gain from taxes. If they hold the investment for at least 10 years, they can exclude any additional capital gains on the opportunity zone investment itself from taxes. That’s a pretty sweet deal!

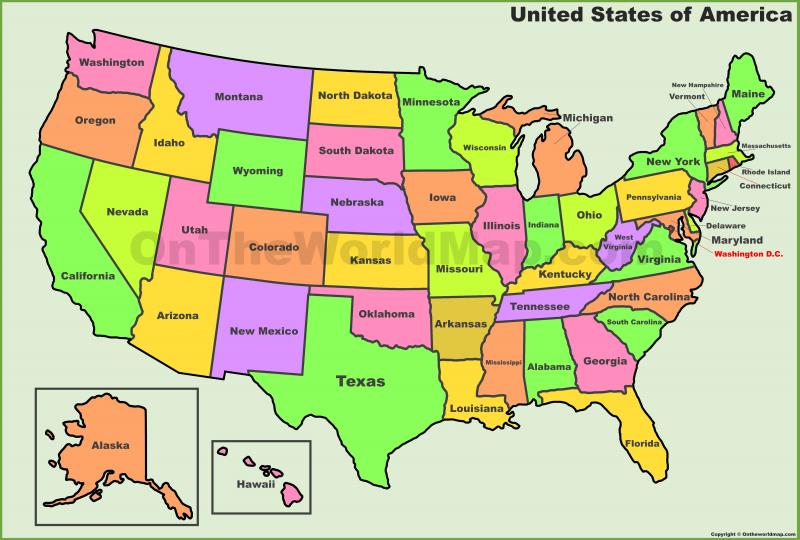

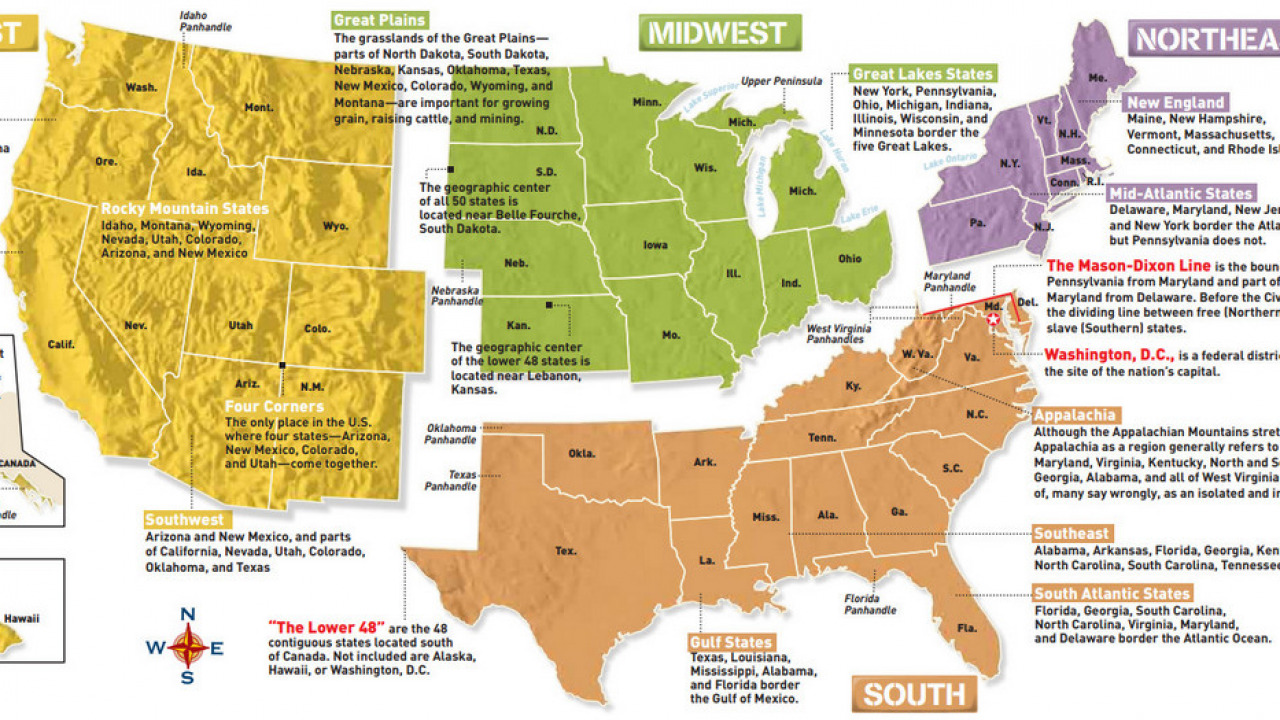

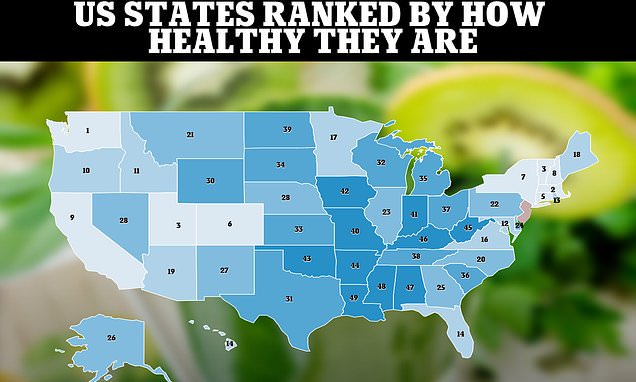

Reviewing Opportunity Zone Maps for WI and MS

When considering opportunity zone investments, it helps to review maps of designated tracts. Wisconsin and Mississippi have interactive maps available online that allow you to zoom in on counties and cities to see which ones have certified opportunity zones.

For example, areas around Lacrosse, WI and Gulfport, MS have federally designated opportunity zones that present exciting investment prospects. You can look up specific addresses to see if they fall within opportunity zone boundaries too.

Looking Up Addresses to Find Qualified Zones

Wondering if that great real estate deal is located within an opportunity zone? Rather than studying detailed maps, you can simply input property addresses on online lookup tools.

For instance, the Enterprise Airport in Lacrosse, WI falls within a qualified opportunity zone tract. Knowing the tract number can help you easily verify if investment properties qualify for tax incentives.

Opportunity Zone Homes For Sale in Popular Areas

From fixer-uppers to luxury homes, you can find affordable real estate located in opportunity zones. Investing in residential properties in improving areas can really pay off down the road.

For example, there are beautiful homes for sale near the oceanfront in Gulfport that fall within qualified tracts. Purchasing these homes could make for lucrative long-term investments.

Using Installment Sales for Opportunity Zone Investments

One savvy way to invest capital gains into opportunity zones is through installment sales. This involves selling an appreciated asset and reporting the capital gain over multiple years.

As long as you invest the proceeds into a qualified opportunity fund within 180 days, you can defer tax on the gains over time while reaping the zone’s benefits.

Creating an Effective Opportunity Zone Presentation

Educating prospective investors on opportunity zones through presentations can be highly effective. Discuss capital gains tax incentives, investment options, and potential community impacts.

Sharing zone maps, real estate listings, and qualification criteria visually engages audiences. Conclude by outlining next steps to get involved.

Understanding Economic Development Through Opportunity Zones

The tax benefits are tiered based on the investment duration:

- 5-7 year investment: 10-15% of the original capital gain is excluded from taxes

- 10+ year investment: Any additional capital gains on the opportunity zone investment itself are tax-free

This structure incentivizes long-term investments in areas that have historically struggled to attract capital, creating a win-win scenario for both investors and communities.

Navigating Opportunity Zone Maps in Wisconsin and Mississippi

For investors looking to capitalize on opportunity zones in Wisconsin and Mississippi, the first step is to familiarize yourself with the designated areas. Both states offer interactive online maps that allow users to explore certified opportunity zones at the county and city level.

Notable areas with promising investment potential include:

- La Crosse, Wisconsin

- Gulfport, Mississippi

These maps serve as invaluable tools for investors, providing a visual representation of where tax-incentivized investments can be made. They allow for a granular view of opportunity zones, helping investors identify specific neighborhoods or districts that align with their investment strategies.

Verifying Opportunity Zone Eligibility

Are you considering a specific property investment but unsure if it falls within an opportunity zone? Online lookup tools simplify this process by allowing you to input property addresses directly. This feature eliminates the need to pore over detailed maps, streamlining the verification process for potential investments.

For instance, the Enterprise Airport in La Crosse, Wisconsin, is situated within a qualified opportunity zone tract. By knowing the tract number, investors can quickly confirm whether potential properties qualify for the associated tax incentives.

Real Estate Opportunities in Qualified Zones

The real estate market within opportunity zones offers a diverse range of investment options, from affordable fixer-uppers to high-end luxury homes. These areas present unique possibilities for long-term value appreciation, especially in regions showing signs of economic improvement.

Gulfport, Mississippi, for example, boasts attractive oceanfront properties within qualified tracts. Investing in these homes could yield significant returns over time, combining the natural appeal of coastal living with the financial benefits of opportunity zone investments.

Leveraging Installment Sales for Opportunity Zone Investments

Installment sales represent a strategic approach to investing capital gains in opportunity zones. This method involves selling an appreciated asset and reporting the capital gain over multiple years, providing investors with additional flexibility in their tax planning.

How does this benefit opportunity zone investors? As long as the proceeds are invested in a qualified opportunity fund within 180 days of each installment payment, investors can defer taxes on the gains while still taking advantage of the zone’s benefits. This approach allows for a more gradual transition of capital into opportunity zone investments, potentially aligning better with an investor’s overall financial strategy.

Crafting an Effective Opportunity Zone Investment Presentation

For those looking to attract investors or educate stakeholders about opportunity zones, creating a compelling presentation is crucial. An effective presentation should cover several key areas:

- Overview of capital gains tax incentives

- Exploration of various investment options

- Analysis of potential community impacts

- Visual aids including zone maps and real estate listings

- Clear explanation of qualification criteria

- Outline of next steps for interested parties

By incorporating these elements, presenters can provide a comprehensive understanding of opportunity zone investments, addressing both the financial benefits and the broader economic impact on communities.

Economic Development Through Opportunity Zones: A Closer Look

Opportunity zones are more than just tax incentives; they represent a concerted effort to revitalize underserved neighborhoods and spur economic growth. But what tangible impacts can these zones have on local communities?

The potential benefits are multifaceted:

- Job creation through new businesses and expanded operations

- Infrastructure improvements funded by increased investment

- Development of affordable housing options

- Attraction of new businesses to the area

- Overall increase in community prosperity

For example, the Enterprise Zone in La Crosse, Wisconsin, supports business investments and developments that have far-reaching benefits for the entire community. This holistic approach to economic development aims to create sustainable growth that extends beyond the initial investment period.

Maximizing Tax Benefits: Wisconsin’s Capital Gains Incentives

Wisconsin offers additional tax benefits for opportunity zone investments, enhancing the already attractive federal incentives. How do these state-specific benefits work?

Investors in Wisconsin can:

- Defer state taxes on capital gains invested for 5-7 years

- Permanently exclude gains on zone investments held for 10+ years

Understanding Wisconsin’s capital gains tax structure is crucial for investors looking to maximize both federal and state incentives. This dual-layer of tax benefits can significantly enhance the overall return on investment for opportunity zone projects in the state.

Identifying Specific Opportunity Zone Addresses in Wisconsin

For investors focused on Wisconsin, pinpointing eligible investments within opportunity zones is a critical step. Online mapping tools have simplified this process, allowing users to enter specific addresses to verify their inclusion within zone boundaries.

This functionality enables investors to quickly assess potential properties or business locations, streamlining the due diligence process and helping to identify promising investment opportunities more efficiently.

Beyond Opportunity Zones: Enterprise Zones and Development Areas

While federal opportunity zones offer significant benefits, some cities have taken additional steps to encourage investment through the creation of enterprise zones and special development areas. These locally-designated areas often provide complementary incentives to federal programs, creating even more attractive investment opportunities.

La Crosse, Wisconsin, for instance, has established an Airport Development Zone around the Enterprise Airport. This designation aims to stimulate business growth and development in the area, potentially offering additional benefits to investors beyond those available through the federal opportunity zone program.

Exploring Real Estate Prospects in Wisconsin and Mississippi Zones

The real estate market within opportunity zones in Wisconsin and Mississippi offers a diverse range of investment possibilities. From residential properties to commercial developments, these areas present unique opportunities for investors looking to capitalize on the tax benefits while contributing to community revitalization.

What types of properties can investors find in these zones?

- Residential homes in various price ranges

- Undeveloped land for new construction projects

- Commercial properties for business development

- Mixed-use developments combining residential and commercial spaces

By exploring listings within qualified opportunity zones, investors can identify properties that not only offer potential for appreciation but also align with the broader goals of economic development and community improvement.

The Role of Opportunity Funds in Zone Investments

Opportunity funds play a crucial role in facilitating investments in qualified opportunity zones. These investment vehicles are specifically designed to pool capital from multiple investors and deploy it into eligible projects within designated zones.

How do opportunity funds benefit investors?

- Provide access to diversified investments across multiple opportunity zones

- Offer professional management of zone investments

- Ensure compliance with regulatory requirements

- Allow for potentially larger-scale projects than individual investments

For investors looking to capitalize on opportunity zones without directly managing properties or businesses, opportunity funds offer a streamlined approach to accessing the tax benefits while contributing to community development.

Community Impact: Measuring the Success of Opportunity Zones

As opportunity zones continue to attract investment, assessing their impact on local communities becomes increasingly important. How can we measure the success of these initiatives beyond simple financial returns?

Key indicators of opportunity zone success include:

- Job creation and unemployment rate reduction

- Increase in median household income

- Growth in new business formations

- Improvements in local infrastructure and public services

- Expansion of affordable housing options

By tracking these metrics over time, investors and community leaders can gauge the real-world impact of opportunity zone investments, ensuring that the program achieves its intended goal of fostering sustainable economic growth in underserved areas.

Navigating Regulatory Compliance in Opportunity Zone Investments

While opportunity zones offer attractive benefits, investors must navigate a complex regulatory landscape to ensure compliance and maximize their returns. Understanding the rules and requirements is crucial for successful investment in these zones.

What are some key compliance considerations for opportunity zone investors?

- Meeting the 180-day investment window for capital gains

- Ensuring that at least 90% of fund assets are invested in qualified opportunity zone property

- Adhering to the “substantial improvement” requirement for existing properties

- Maintaining proper documentation for tax reporting purposes

Investors should consider working with legal and financial professionals experienced in opportunity zone regulations to ensure full compliance and to optimize their investment strategies within the program’s guidelines.

Future Outlook: The Evolution of Opportunity Zones

As the opportunity zone program matures, it’s natural to consider its future trajectory and potential evolution. How might these zones develop in the coming years, and what changes could we see in the program?

Potential developments in the opportunity zone landscape include:

- Refinement of regulations based on early program outcomes

- Expansion or modification of qualified census tracts

- Introduction of additional state-level incentives to complement federal benefits

- Increased focus on measuring and reporting community impact

- Integration with other economic development initiatives

Staying informed about these potential changes will be crucial for investors looking to capitalize on opportunity zones in Wisconsin, Mississippi, and beyond. As the program evolves, it may present new opportunities for investment and community development.

Leveraging Technology in Opportunity Zone Investments

In the digital age, technology plays an increasingly important role in identifying, analyzing, and managing opportunity zone investments. How can investors leverage technological tools to enhance their opportunity zone strategies?

Innovative tech applications in opportunity zone investing include:

- AI-powered analytics for market trend prediction

- Virtual reality tours of potential investment properties

- Blockchain-based platforms for transparent fund management

- GIS mapping tools for detailed zone analysis

- Mobile apps for real-time investment tracking and reporting

By embracing these technological advancements, investors can make more informed decisions, streamline their investment processes, and potentially identify opportunities that might otherwise be overlooked.

Building Partnerships: Collaboration in Opportunity Zone Development

Successful opportunity zone investments often involve collaboration between various stakeholders. How can investors, local governments, and community organizations work together to maximize the impact of these investments?

Effective partnership strategies in opportunity zone development include:

- Public-private partnerships for large-scale projects

- Collaboration with local nonprofits to address community needs

- Engagement with educational institutions for workforce development

- Coordination with city planners to align investments with broader development goals

- Joint ventures between investors to pool resources and expertise

By fostering these collaborative relationships, investors can not only enhance the potential returns on their investments but also contribute more meaningfully to the long-term revitalization of opportunity zone communities in Wisconsin and Mississippi.

What Are Opportunity Zones and How Do They Work?

Opportunity zones are designated census tracts in certain communities that allow for valuable tax incentives on capital gains when investing in these areas. The Tax Cuts and Jobs Act of 2017 established opportunity zones to spur economic development and job creation by encouraging long-term investments in low-income communities nationwide.

So how do these opportunity zones work exactly? Investors can defer paying taxes on capital gains by investing those gains into qualified opportunity funds within 180 days. These funds then invest at least 90% of their assets into opportunity zone businesses and real estate. By investing in an opportunity zone for 5-7 years, investors can exclude 10-15% of their original capital gain from taxes. If they hold the investment for at least 10 years, they can exclude any additional capital gains on the opportunity zone investment itself from taxes. That’s a pretty sweet deal!

Reviewing Opportunity Zone Maps for WI and MS

When considering opportunity zone investments, it helps to review maps of designated tracts. Wisconsin and Mississippi have interactive maps available online that allow you to zoom in on counties and cities to see which ones have certified opportunity zones.

For example, areas around Lacrosse, WI and Gulfport, MS have federally designated opportunity zones that present exciting investment prospects. You can look up specific addresses to see if they fall within opportunity zone boundaries too.

Looking Up Addresses to Find Qualified Zones

Wondering if that great real estate deal is located within an opportunity zone? Rather than studying detailed maps, you can simply input property addresses on online lookup tools.

For instance, the Enterprise Airport in Lacrosse, WI falls within a qualified opportunity zone tract. Knowing the tract number can help you easily verify if investment properties qualify for tax incentives.

Opportunity Zone Homes For Sale in Popular Areas

From fixer-uppers to luxury homes, you can find affordable real estate located in opportunity zones. Investing in residential properties in improving areas can really pay off down the road.

For example, there are beautiful homes for sale near the oceanfront in Gulfport that fall within qualified tracts. Purchasing these homes could make for lucrative long-term investments.

Using Installment Sales for Opportunity Zone Investments

One savvy way to invest capital gains into opportunity zones is through installment sales. This involves selling an appreciated asset and reporting the capital gain over multiple years.

As long as you invest the proceeds into a qualified opportunity fund within 180 days, you can defer tax on the gains over time while reaping the zone’s benefits.

Creating an Effective Opportunity Zone Presentation

Educating prospective investors on opportunity zones through presentations can be highly effective. Discuss capital gains tax incentives, investment options, and potential community impacts.

Sharing zone maps, real estate listings, and qualification criteria visually engages audiences. Conclude by outlining next steps to get involved.

Understanding Economic Development Through Opportunity Zones

These designated areas aim to spur economic growth and community revitalization in underserved neighborhoods. Zone investments facilitate job creation, infrastructure improvements, affordable housing, new businesses, and overall prosperity.

For example, the Enterprise Zone in Lacrosse supports business investments and developments that benefit the whole community.

Reviewing Capital Gains Tax Incentives in WI

Wisconsin offers some enticing tax benefits for investing capital gains in opportunity zones. You can defer state taxes on gains invested for 5-7 years and permanently exclude gains on zone investments held for 10+ years.

Reviewing Wisconsin’s capital gains tax structure helps you maximize federal and state incentives when investing.

Finding Specific Opportunity Zone Addresses

Want to pinpoint eligible investments in Wisconsin opportunity zones? Start by identifying specific addresses located within zone tracts.

Online mapping tools allow you to easily enter addresses like 123 Main Street, Lacrosse, WI to see if they fall within boundaries.

Locating Enterprise Zones and Development Areas

In addition to federal opportunity zones, some cities have created special enterprise zones and development areas. These also offer incentives for community investments.

For example, Lacrosse has an Airport Development Zone to encourage business growth around the Enterprise Airport.

Reviewing Homes and Developments For Sale

Looking for real estate prospects in Wisconsin or Mississippi zones? You can find listings for homes, land, and commercial developments located within opportunity zone tracts.

Evaluate options like vacant land for new housing near Lacrosse or waterfront condos in Gulfport before deciding where to invest.

Hopefully this overview gives you a great starters guide for tapping into the potential of opportunity zones! Let me know if you need any clarification or have additional questions.

Reviewing Opportunity Zone Maps for WI and MS

When researching opportunity zone investments, it’s essential to examine zone maps for the areas you’re considering. Interactive online maps for Wisconsin and Mississippi allow investors to zoom in and view designated tracts across counties and cities. Pinpointing qualified zones on these maps can help target your search for real estate deals and business ventures.

For instance, say you’re interested in the Lacrosse, Wisconsin area. Their opportunity zone map shows a tract encompassing downtown and the riverfront. Cross-referencing with a map of current developments, you find there are vacant lots near the river primed for commercial real estate projects or new housing. This knowledge helps you narrow your focus when reviewing investments.

Likewise, exploring Mississippi’s opportunity zone map leads you to certified tracts along the gorgeous Gulf Coast beaches in Gulfport. Noticing promising zone locations on the map provides direction for seeking out potential investment properties in those communities.

Looking Up Specific Addresses in Online Tools

Rather than studying detailed maps, you can also input property addresses directly into online lookup tools. These interfaces allow you to instantly check whether a specific address falls within designated opportunity zone boundaries.

For example, say you come across a great warehouse facility for sale near the airport in Lacrosse. You can take its address and plug it into the address lookup on the Wisconsin opportunity zone website. If it shows that the property lies within a certified tract, you know it qualifies for the zone’s capital gains tax incentives.

Finding Local Real Estate Listings in the Zones

Once you’ve identified promising zones in your locations of interest, the next step is finding investment-worthy real estate listings within those tracts. The zone boundaries encompass a diverse range of properties – from affordable single family homes to land for commercial developments.

Based on the Mississippi zone maps, you may search for charming beach cottages for sale in Long Beach or Bay St. Louis that fall within the zones. If purchasing as rentals or renovating, they could deliver substantial long-term gains.

Presenting the Benefits to Potential Investors

Educating prospective investors on opportunity zones through presentations is key for raising capital. You should highlight the appealing capital gains tax breaks, risk/return profiles, and community impact of projects within the zones.

Displaying zone maps and property listings helps audiences visualize the possibilities. Use real-world examples like a boutique hotel development in an abandoned Lacrosse warehouse that will create jobs and drive tourism.

Researching State Capital Gains Tax Laws

While federal opportunity zone incentives are standardized across states, it helps to examine state capital gains tax structures too. Some states like Wisconsin also offer capital gains relief for zone investments, further enhancing returns.

You don’t necessarily have to be a Wisconsin resident to benefit, but knowing the nuances can help you maximize both federal and state tax savings.

Understanding Economic Development Goals

At their core, opportunity zones aim to uplift communities through business growth, job creation, and infrastructure improvement. zones target areas with potential but insufficient investment.

For example, Lacrosse’s Downtown Riverfront Zone seeks transit-oriented developments to drive foot traffic and commerce in the area. Your projects should align with these broader economic goals.

In summary, analyzing zone maps, property listings, and tax policies equips you to capitalize on these incentives. Let me know if any aspect needs more explanation! There’s lots of potential in Wisconsin and Mississippi zones.

Looking Up Addresses to Find Qualified Zones

With thousands of opportunity zones spanning the country, how can you easily determine if a potential investment property falls within a qualified tract? Rather than pouring over detailed zone maps, there is an easier way – simply look up the property’s address!

Online tools allow you to input any street address to instantly check if it is located within an officially designated opportunity zone. This streamlines the process of validating if your real estate prospects or business locations qualify for the capital gains tax incentives.

Validating Property Addresses

For example, let’s say you come across a promising multifamily home for sale in La Crosse, Wisconsin near the airport. But is it actually within one of La Crosse County’s opportunity zone tracts?

Rather than cross-referencing with zone boundary maps, you can take the address – 123 Main St., La Crosse, WI – and plug it into the address lookup tool on the Wisconsin opportunity zone website. Within seconds, it will confirm that yes, indeed, that address falls within a qualified opportunity zone!

Finding Qualified Business Locations

Address lookups aren’t just for real estate – they can also help determine if potential business properties or development sites meet opportunity zone criteria.

For instance, you could use the online lookup tools to verify if that vacant lot on Ocean Ave in Gulfport, Mississippi lies within a certified tract before moving forward with plans for a new retail space.

Simplifying Property Research

Trying to identify qualified opportunity zone properties on your own can be tremendously time consuming. You’d have to pore over detailed maps, cross-checking boundaries for each individual address.

With online address lookup tools, you skip this manual research entirely. Just plug in the address and instantly receive a definitive yes or no if it’s located within a zone. This makes the overall process much more efficient.

Accelerating Real Estate Investment Decisions

When you come across a promising real estate listing, being able to rapidly validate if it’s in an opportunity zone helps accelerate the decision process. If the address isn’t qualified, you can immediately eliminate it and move on.

Likewise, if the lookup confirms it is within a designated tract, you can proceed with confidence that you’ll be able to realize the tax benefits.

Ensuring Compliance for Investments

Verifying property or business addresses is an important compliance step before investing in an opportunity zone. You need to officially confirm the location is within a qualified tract to receive the tax incentives.

Relying on address lookups provides documentation straight from the government opportunity zone sites that you’ve done your due diligence.

In summary, address lookups are an invaluable, time-saving tool for opportunity zone investing. Give it a try next time you evaluate a property and see how easy address validation can be!

Opportunity Zone Homes For Sale in Popular Areas

One of the most appealing real estate investments in opportunity zones can be homes for sale located in desirable and up-and-coming neighborhoods. Purchasing residential properties in areas seeing improvement can really pay off in the long run.

For instance, the chance to buy homes near the oceanfront in an area like Gulfport, Mississippi may not come along often. But some beautiful listings there fall within opportunity zone tracts, making them even more enticing prospects.

Finding Affordable Properties

Don’t think opportunity zone home investments are only for luxury properties. You can also find more affordable single family houses, condos, and townhomes located within the designated tracts.

For example, there are often reasonably priced fixer-upper type homes intermixed with higher end listings in zones encompassing downtown La Crosse, Wisconsin.

Researching Appreciation Potential

It’s not just about buying homes in an opportunity zone – it’s about purchasing in areas poised for appreciation. Factors like new developments, infrastructure improvements, and population growth indicate rising property values.

Ocean Springs, Mississippi has seen a revitalization in recent years, so homes for sale there could gain substantial value over the 10+ year opportunity zone investment time horizon.

Leveraging Rental Income Potential

Within opportunity zones, there are often popular areas near universities or hospitals where rents are in high demand. Homes in these locations can potentially generate significant rental income in addition to long-term capital gains.

For instance, homes near UW-La Crosse could make sound rental investments for both consistent cash flow and tax-advantaged gains.

Reviewing Future Development Plans

When evaluating residential opportunity zone investments, research what new developments or infrastructure upgrades are planned nearby. These projects can dramatically increase property values.

If the city has plans to build a new park or transit station near oceanfront homes in Gulfport, for example, those properties become even more appealing.

Leveraging Local Knowledge

Work with real estate professionals familiar with the area to identify opportunity zone homes with the most upside potential. Local expertise helps spot neighborhoods and listings poised to thrive.

Consult experienced Realtors in La Crosse or Gulfport to pinpoint homes in improving areas before they gain widespread interest.

With sound research and local insights, homes in high-potential opportunity zones can deliver impressive gains. Just be strategic in choosing locations and properties wisely!

Using Installment Sales for Opportunity Zone Investments

One savvy way to invest capital gains into opportunity zones is through installment sales. This strategic approach allows you to sell an appreciated asset and realize the gains over time rather than all at once.

As long as you reinvest the proceeds from the installment sale into a qualified opportunity fund within 180 days, you can take advantage of tax deferral on the capital gains.

Deferring Taxes on Capital Gains

Here’s a simplified example of how installment sales work with opportunity zone investing:

Let’s say you sell some stock for a $100,000 capital gain. Rather than paying taxes on the full $100k gain right away, you could structure it as an installment sale to be paid over 5 years at $20k per year.

As long as you invest that $20k/year into an opportunity fund within 180 days, you can defer taxes on that portion of the gain annually. This spreads your tax liability over time.

Accelerating Timelines for Tax Benefits

Another major advantage of using installment sales for opportunity zone investing is accelerating the timeline for maximum tax savings.

Remember, you need to hold an opportunity zone investment for at least 10 years to eliminate taxes on any appreciation. With an installment sale, you start the 10-year clock annually as new gains are realized. This allows you to reach the full tax exemption faster.

Multi-Year Investment Strategy

Installment sales also lend themselves well to a patient, long-term opportunity zone investment strategy.

Rather than investing a lump sum all at once, you can steadily build a diversified portfolio year-after-year as new gains are realized. Taking an incremental approach helps balance risk across multiple projects and asset classes.

Consulting Tax Experts

While installment sales offer enticing benefits, the rules around structuring them correctly for opportunity zone investing can be complex.

To ensure you realize the full tax advantages, it’s wise to consult qualified tax attorneys or CPAs who understand these nuances completely.

Weighing Different Scenarios

It’s also important to crunch the numbers and model out different timelines and approaches when considering installment sales.

For some gains, it may make more sense to invest the full amount upfront. Having flexibility is key.

With sound tax planning, installment sales can be a strategic way to systematically build an opportunity zone portfolio over time. But professional guidance is a must to maximize benefits.

Creating an Effective Opportunity Zone Presentation

Putting together a compelling presentation is crucial for educating potential investors about opportunity zone projects. An impactful deck should highlight the tax benefits, investment upside, and community impacts of investing in qualified opportunity zones.

When creating presentations, focus on communicating the most important details clearly and visually. You want to grab audiences’ interest and have them ready to get involved.

Explaining the Tax Incentives

A key section of any opportunity zone presentation should outline the capital gains tax incentives these investments provide. Explain how investors can defer and reduce taxes on existing capital gains by reinvesting into opportunity funds and projects.

Use diagrams and charts to visually demonstrate the potential tax savings at years 5, 7, and 10+ of an opportunity zone investment. These benefits are what pique investor interest initially.

Presenting the Investment Thesis

Beyond taxes, you need to lay out the compelling investment thesis for specific projects or real estate developments you’re pitching. Provide details on target returns, time horizons, upside potential, and risks involved.

For example, highlight the market demand supporting plans for a new boutique retail development in downtown La Crosse. Outline projected occupancy rates and stabilized yields.

Showcasing Real-World Examples

Bring the opportunity zone concept to life by showcasing real-world projects that delivered strong returns. Before and after photos of redevelopment projects help audiences visualize success stories.

For instance, an adaptive reuse apartment project transformed an abandoned warehouse in Gulfport into popular new downtown housing. Share these case studies.

Underscoring Community Impact

Importantly, discuss how opportunity zone investments support job creation, infrastructure, and economic growth in underserved areas. This mission-driven aspect is key to the program’s appeal.

Show how a business incubator facility in La Crosse could nurture entrepreneurs and diversify the local economy. Investors want to back projects that do good.

An effective opportunity zone presentation covers all the bases. Distilling this complex program into an engaging discussion is vital to spurring investment.

Understanding Economic Development Through Opportunity Zones

More than just providing tax incentives, opportunity zones aim to spur economic growth and revitalization in underserved communities nationwide. The program targets census tracts in need of investment to create jobs, improve infrastructure, and support new businesses.

Understanding these broader economic goals is key when evaluating potential real estate or business investments within designated opportunity zones.

Encouraging Private Investment

Opportunity zones help drive private capital into communities where lack of investment has stalled economic mobility. The tax benefits incentivize investors to support transformative projects.

For example, a new grocery store development in an outdated downtown area brings access to fresh food while creating local construction and grocery jobs.

Supporting Community Assets

Another priority is uplifting community anchors like affordable housing, hospitals, schools, and cultural institutions. These assets may lack investment on their own.

Opportunity zone funding could help rehabilitate an arts center in a neglected neighborhood that provides programs for local youth year-round.

Infrastructure Upgrades

From broadband internet to public transit, infrastructure upgrades lay the groundwork for economic growth. Opportunity zone capital can back major projects municipalities struggle to fund.

For instance, a new community health clinic providing primary care services represents critical infrastructure improving quality of life.

Diversifying Local Economies

Attracting new industries diversifies economies in underserved zones reliant on just one or two sectors. Business incubators, labs, and shared workspaces help nurture startups.

An opportunity zone coworking campus catering to tech founders could bring innovative jobs to downtown Gulfport, for example.

Aligning with Community Needs

Zone investors should meet with local leaders to understand where new development would have the biggest impact. The best projects address clearly identified needs.

Perhaps workforce training facilities would bolster employment opportunities for the area’s low-income residents based on feedback.

Researching the community context is crucial when honing in on opportunity zone projects that drive economic progress.

Reviewing Capital Gains Tax Incentives in WI

While federal opportunity zone tax incentives are standardized across the country, it’s important to also understand state-level capital gains tax policies when investing in Wisconsin. The state offers some appealing incentives that can further enhance returns on top of the federal benefits.

Even if you aren’t a Wisconsin resident, reviewing the state’s capital gains tax structure helps ensure you maximize your overall tax advantage when deploying opportunity zone capital in the state.

Wisconsin’s Long-Term Capital Gains Tax

Currently, Wisconsin taxes long-term capital gains on assets held over one year at rates ranging from 3.54% to 7.65%, depending on the taxpayer’s total income. Gains on assets held under one year are taxed as ordinary income.

For opportunity zone investments, Wisconsin allows investors to defer paying state tax on capital gains reinvested for 5-7 years, mirroring the federal incentives. This provides upfront state tax savings.

Exclusion on Opportunity Zone Gains

After holding an opportunity zone investment in Wisconsin for over 10 years, state capital gains taxes can be completely avoided on any appreciation gains from the sale of that investment, just like with federal taxes.

This exclusion of state capital gains tax on the back end after 10+ years aligns perfectly with the federal tax benefits to maximize incentives for long-term opportunity zone investors.

Modeling Overall Tax Savings

When assessing potential opportunity zone projects in Wisconsin, be sure to model out your estimated federal and state tax savings over the 5, 7, and 10+ year holding periods to quantify the combined benefits.

Work closely with a tax advisor familiar with both federal opportunity zone rules and Wisconsin capital gains taxes to ensure your analysis captures total potential savings accurately.

Reviewing Other State Tax Considerations

Beyond capital gains, also assess how Wisconsin taxes opportunity zone funds and business income generated from zone properties. Some states offer additional local tax credits or incentives you may be able to leverage.

Consult experienced advisors to determine if other Wisconsin tax policies could enhance overall returns on proposed opportunity zone developments.

While federal incentives take center stage, don’t leave potential Wisconsin capital gains tax savings on the table. Understanding state and local policies brings clarity when making strategic opportunity zone investments.

Finding Specific Opportunity Zone Addresses

With thousands of opportunity zones spanning states and counties nationwide, how can investors identify specific properties or sites located within the boundaries? Let’s explore some strategies for pinpointing eligible addresses.

Opportunity zone investing often starts with finding attractive real estate listings or development sites already located within designated tracts. But tracking down these qualified addresses takes research.

Studying Zone Maps

Many state and local opportunity zone websites provide detailed interactive maps showing tract boundaries. Studying these maps helps narrow down target neighborhoods.

For example, maps may show tracts encompassing downtown Gulfport. You could then search for specific addresses within that area to pursue.

Address Lookups

Some zones also provide online tools for instantly looking up if a property address falls within a qualified tract. This makes verification quick and easy.

Simply enter an address like “125 Ocean Ave, Gulfport, MS” to immediately see if it is opportunity zone eligible or not.

Local Business Directories

Search business directories covering cities with opportunity zones to find addresses of existing establishments located within the tracts.

For example, a restaurant listing showing a La Crosse address could represent a promising acquisition target if the address falls within a zone.

Consulting Local Brokers

Real estate brokers working in opportunity zone areas often have listingsbank of properties located within designated tracts. They can provide qualified addresses.

A broker covering Gulfport listings may share promising oceanfront condos or vacant lots that fall within the zones.

City Development Offices

Municipal economic development offices track opportunities for growth in zones including available sites for new construction or redevelopment.

The city of La Crosse for instance could point you to tract addresses suited for new mixed-use housing.

On-the-Ground Research

Once you identify districts within zones, explore them in person to spot “For Sale” signs and other promising listings to note addresses.

Walking through downtown tracts in La Crosse provides visibility into investment options.

With some targeted research, finding eligible addresses within opportunity zone tracts becomes very feasible.

Locating Enterprise Zones and Development Areas

In addition to federally-designated opportunity zones, some cities and states have created special enterprise zones, innovation districts, and other development areas with investment incentives. Understanding where these intersect with opportunity zones can further inform your investment strategy.

Enterprise zones and development areas also aim to spur economic growth through public-private partnerships and tax benefits. Layering state/local incentives on top of federal opportunity zone gains maximizes returns.

Researching Enterprise Zone Boundaries

Many major metros like Chicago, Los Angeles, and Houston have established enterprise zones in certain districts. Look up enterprise zone maps to see if they overlap with opportunity zone tracts.

For example, Milwaukee’s Century City zone overlaps substantially with federal zones eligible for added incentives.

Comparing Incentives

Each enterprise zone offers unique packages of tax credits, grants, fee waivers etc. Compare these to federal opportunity zone incentives to understand total benefits.

For properties within both, certain enterprise zone credits may be able to be layered on top of opportunity zone capital gains reductions for major tax savings.

Researching City Development Areas

Cities also create designated development areas or districts to encourage growth in certain neighborhoods through planning and resources.

For example, La Crosse established an Airport Development Zone with additional incentives around the municipal airport.

Connecting with Local Agencies

Economic development agencies manage enterprise zones and development areas. Connect with them early to learn about resources and requirements for projects seeking overlapping incentives.

They want to collaborate with investors pursuing developments that create jobs and drive economic growth within the zones.

Assessing Feasibility

Not all combinations of state/local zone incentives stacked onto federal opportunity zones will pencil out. Conduct detailed pro formas on project costs vs. incentives.

Also research potential timing gaps between realizing different benefits at the local, state, and federal level.

At their best, enterprise zone incentives enhance already attractive opportunity zone returns. But comprehensive diligence is required to leverage them.

Reviewing Homes and Developments For Sale

Once you’ve identified promising opportunity zones to invest in, the next step is researching real estate listings and developments located within those tracts. Comparing options on the market helps narrow your focus.

Homes, land, and commercial developments positioned to appreciate make ideal opportunity zone investments. But finding the right prospects takes an in-depth review.

Evaluating Residential Listings

Certain neighborhoods within opportunity zone tracts often have appealing homes for sale. Look for renovated properties or fixer-uppers with upside potential.

A historic Mississippi home near downtown Gulfport could be acquired and refreshed into a showpiece yielding large gains long-term.

Vacant Land Prospects

Empty lots zoned for multifamily or commercial development also provide blank slate opportunities within zones. Visionary projects can be built from the ground up.

A vacant parcel in La Crosse’s Downtown Riverfront tract could support a new mixed-use apartment complex overlooking the river.

Existing Commercial Properties

Some tracts have existing stabilized commercial buildings that could be acquired and improved. Others have distressed assets with turnaround potential.

An outdated downtown Gulfport office building could be purchased and renovated into creative loft apartments at an attractive cost basis.

Planned Developments

Research planned projects that have not broken ground yet, like permitted sites for new shopping centers or apartment communities that require financing.

Providing capital to get these shovel-ready projects underway could be a lucrative opportunity zone play.

Comparing Opportunities

Weigh factors like asset class, purchase price, projected returns, execution risks, and time horizon when comparing for-sale properties.

Focus on assets aligned with your investment goals and expertise to maximize upside.

With so many possibilities within opportunity zones, targeting the most promising prospects is crucial.

Capital Gains Tax Incentives in Wisconsin

A Brief Overview of Opportunity Zones

Opportunity Zones in Wisconsin

Opportunity Zones in Mississippi

How to Invest in Opportunity Zones

Act Now to Maximize Opportunity Zone Benefits

This overview of capital gains tax incentives through Wisconsin and Mississippi opportunity zone investments demonstrates the win-win potential of this community development program prior to its expiration in 2028. With substantial tax benefits and the ability to transform overlooked neighborhoods, opportunity zones are an innovative tool for investors and communities alike. Exploring zones in Wisconsin, Mississippi, and across the U.S. can lead to new possibilities in your portfolio and local communities.

Identifying Qualified Opportunity Zone Tract Numbers

How Can You Capitalize on Opportunity Zones in Wisconsin and Mississippi This Year?

So in summary:

- Use Wisconsin and Mississippi’s interactive maps and lists to find Opportunity Zone tract numbers

- Lookup addresses in the U.S. Treasury tool to verify tract eligibility

- Consult the tract ID when making Qualified Opportunity Fund investments

- Act fast to maximize tax advantages before 2026 deadline

With smart planning and research, you can take advantage of the generous Opportunity Zone tax incentives in Wisconsin, Mississippi, and states across the country to fuel economic growth while saving on your capital gains tax obligations.