How can you simplify bill payments with a free service. What are pay service networks and how do they work. Why should you consider going paperless for utility bills. How can bill pay apps streamline your financial management. Is it possible to pay bills without an account number. What steps are involved in registering for a bill payment service. Can you safely pay bills using credit cards through these services.

Understanding Pay Service Networks: Your One-Stop Bill Payment Solution

Managing multiple bills each month can be overwhelming. From utilities to cable, cell phone plans to streaming services, keeping track of due dates and ensuring timely payments can be a time-consuming task. This is where pay service networks come into play, offering a convenient solution to simplify your bill payment process.

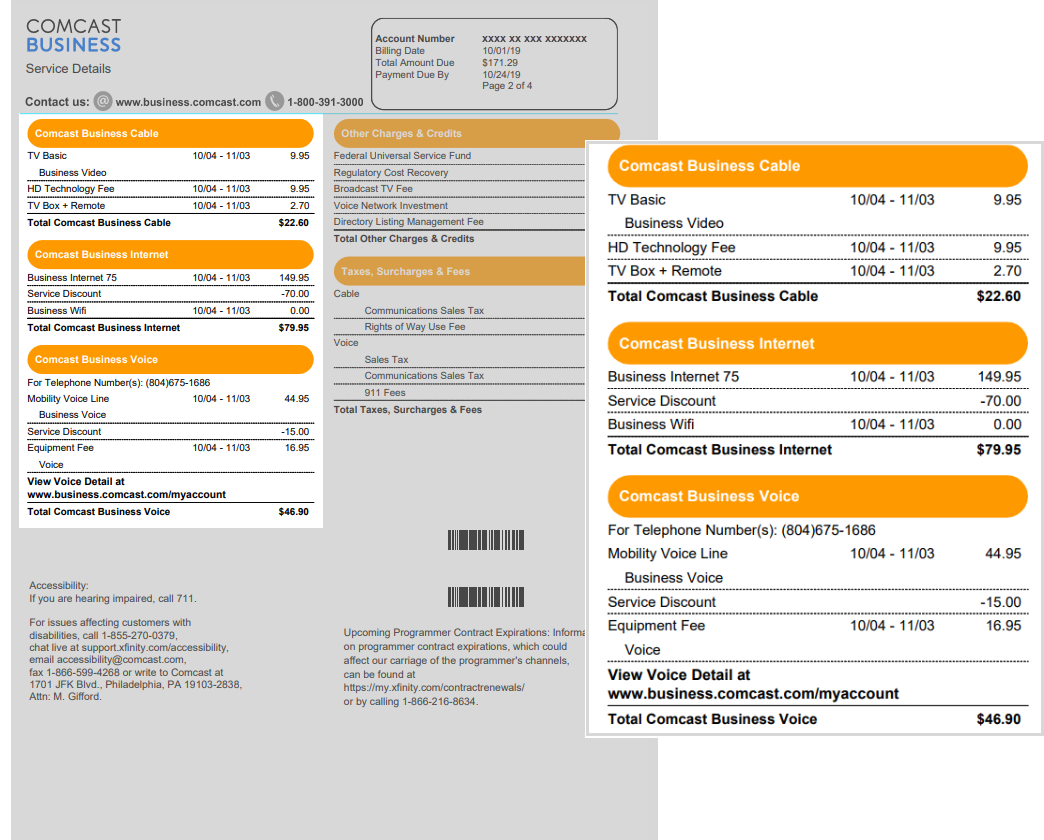

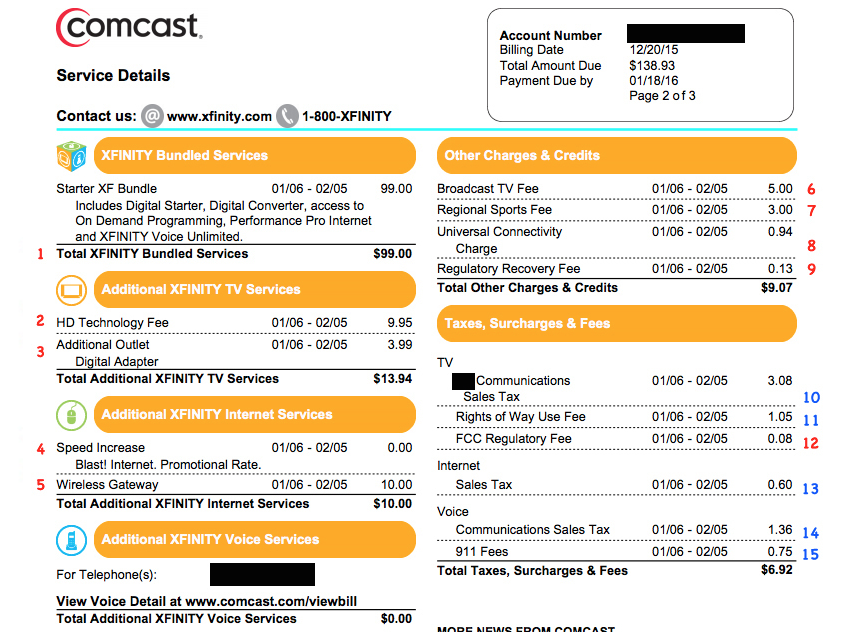

Pay service networks are online platforms that allow you to view, pay, and manage all your bills in one centralized location. Popular services like PSN, PayMyUtilityBill, and BillPayNetwork consolidate your regular bills onto a single website or mobile app, eliminating the need to visit multiple websites or write numerous checks.

Key Features of Pay Service Networks

- Bill consolidation in one platform

- Direct connections with hundreds of billing companies

- Email or push notifications for bill due dates

- Autopay setup for recurring bills

- Payment history and statement viewing

- Multiple payment method management

- One-time bill payment options

By utilizing these services, you gain control, convenience, and clarity over your household expenses. The ability to manage all your bills from a single platform not only saves time but also reduces the risk of missed payments and late fees.

Embracing Paperless Billing: The First Step Towards Simplified Payments

To fully leverage the benefits of pay service networks, it’s essential to set up online accounts with your regular utility and service providers. Most major companies now offer digital account management options, allowing you to access statements and make payments online.

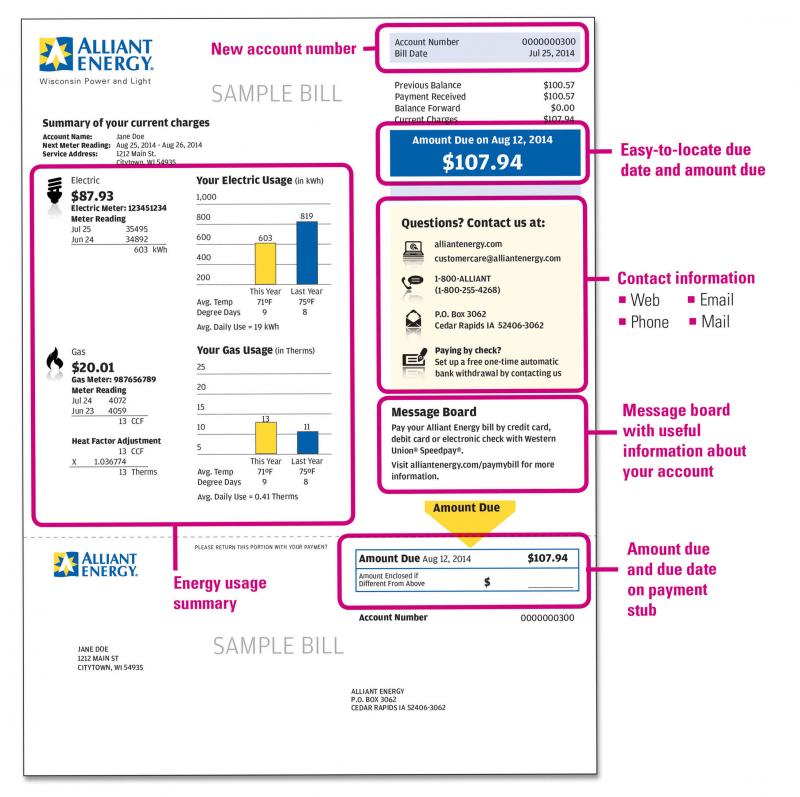

To set up online accounts, visit your providers’ websites and look for options like “Pay My Bill Online” or “Manage My Account.” You’ll typically need to provide personal information such as your account number, name, and address to verify your identity and create an account.

Benefits of Going Paperless

- Instant access to bills and statements

- Reduced paper waste and environmental impact

- Decreased risk of lost or stolen bills

- Easy integration with pay service networks

- Real-time account balance and payment history access

Once your online accounts are set up, you can opt for paperless billing, contributing to a greener environment while streamlining your bill management process. This digital approach allows pay service networks to securely connect to your accounts, displaying and facilitating payments for your bills efficiently.

Leveraging Bill Pay Apps for Seamless Account Management

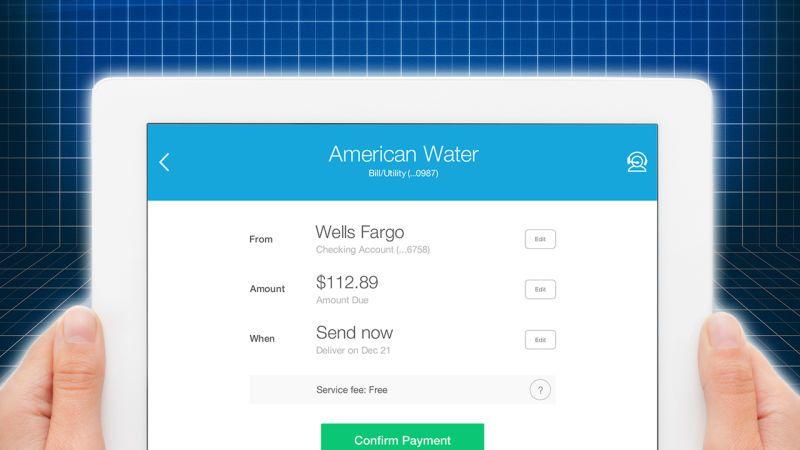

Bill pay apps such as PSN, PayMyBill, and Doxo offer user-friendly interfaces to connect and manage all your service providers in one convenient location. These apps use secure technology to store your login credentials, allowing for easy linking of accounts from major billers.

For instance, the PSN app, available for both Android and iPhone, provides a range of features to simplify your bill management:

- Synchronization of utility accounts (cable, electric, water, etc.)

- Bill due date reminders

- One-time bill payments via photo capture or manual entry

- Future payment scheduling

- Multiple payment method storage

- Mobile bill payment capabilities

These apps save you valuable time by eliminating the need to visit individual websites for each bill. They employ bank-level security measures and encryption to protect your data, ensuring safe credential storage and facilitating payments to thousands of billers and service providers.

Hassle-Free Payments: Paying Bills Without an Account Number

One of the most convenient features of pay service networks is the ability to make payments even when you don’t have your account number at hand. This functionality is particularly useful for infrequent expenses like medical bills, utilities at a new address, or other one-time payments.

Many pay service networks allow you to search for billers using alternative information such as the company name, ZIP code, or phone number. This flexibility ensures that you can still make timely payments without the stress of locating specific account details.

Steps to Pay a Bill Without an Account Number

- Open your preferred pay service network app or website

- Search for the biller using available information (name, ZIP code, phone number)

- Verify the company name and service address

- Enter the amount due

- Provide payment details and submit

The payment network will process your payment correctly, even without the account number, making it easier than ever to manage irregular or new bills efficiently.

Getting Started: Registering for a Pay Service Network Account

To begin enjoying the benefits of simplified bill management through pay service networks, you’ll need to register for an account. The process is straightforward and typically takes just a few minutes to complete.

When registering on platforms like PSN, you’ll generally need to provide the following information:

- Your full name

- Address

- Email address

- Phone number

- A secure password

After completing the registration process, you’ll have immediate access to the platform’s features. You can download the mobile app, sync your existing accounts, and start paying bills right away. Don’t forget to add your preferred payment methods, such as credit cards, debit cards, or bank accounts, to streamline future transactions.

While some platforms offer guest checkout options without registration, creating an account unlocks additional features like biller synchronization, payment history viewing, reminders, scheduled payments, and other convenient tools to enhance your bill management experience.

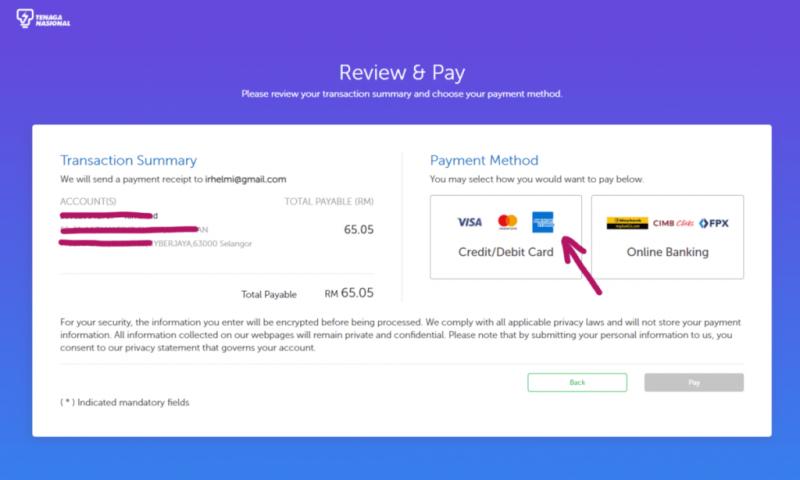

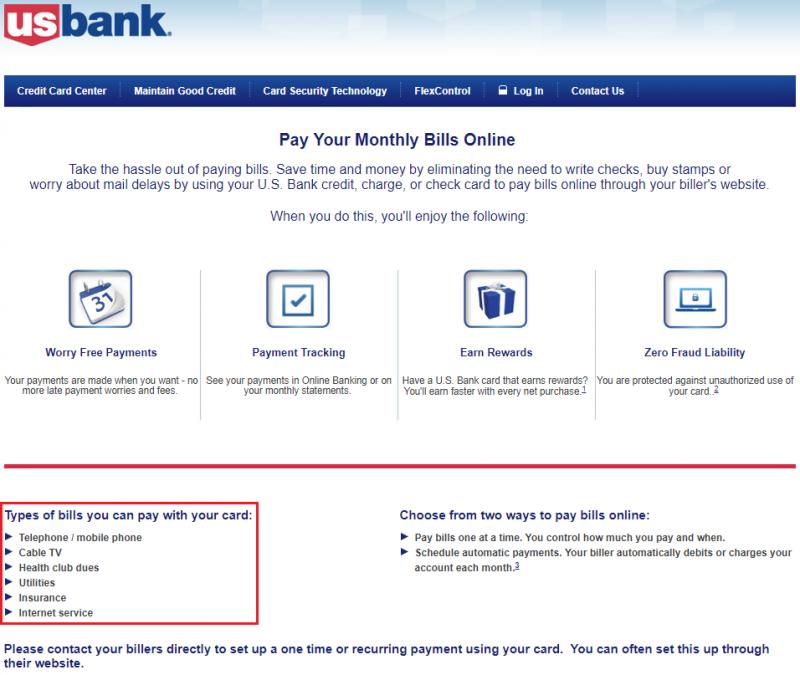

Secure Bill Payments: Using Credit Cards Through Pay Service Networks

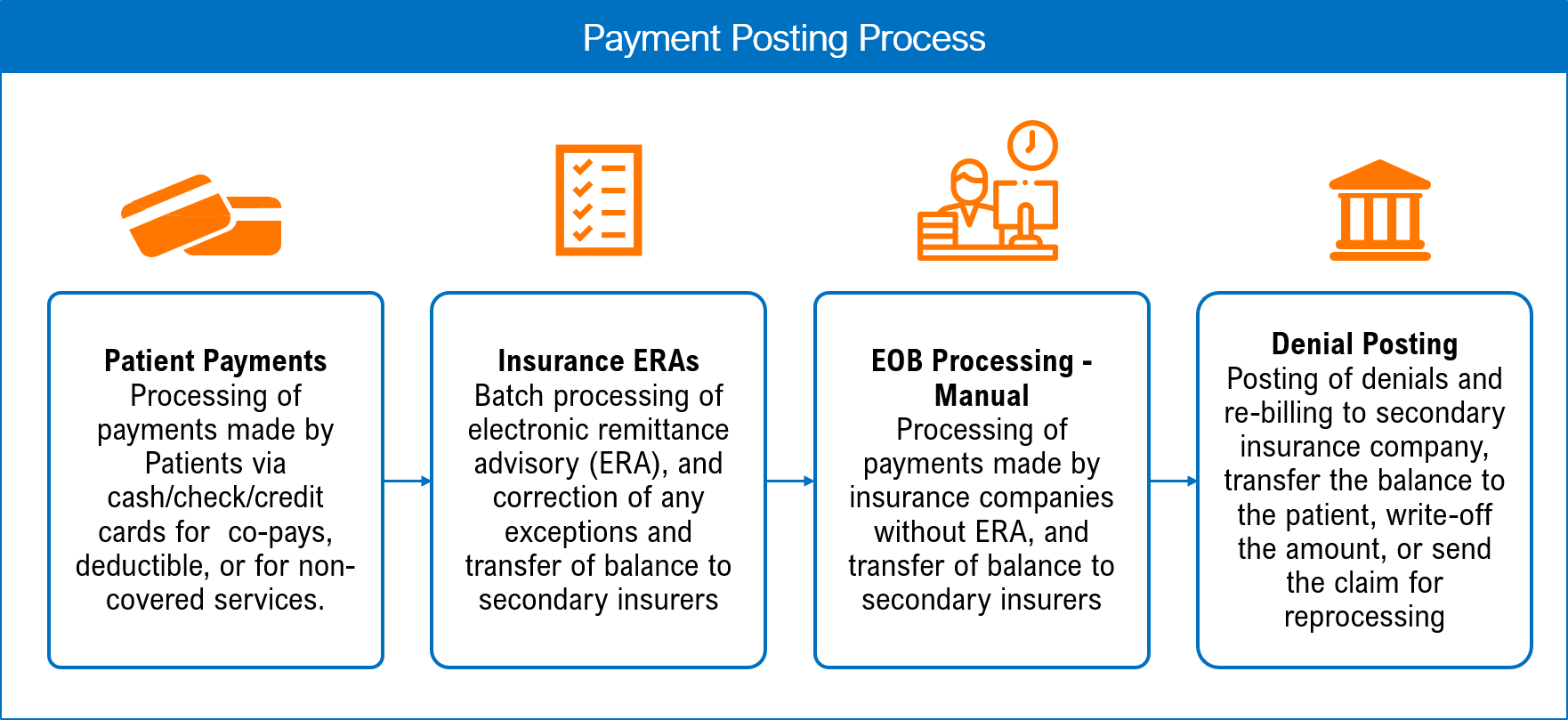

Many consumers prefer using credit cards for bill payments due to the potential rewards, improved tracking capabilities, and added layer of security they provide. Pay service networks understand this preference and typically offer the option to pay bills using credit cards safely and conveniently.

Advantages of Paying Bills with Credit Cards

- Potential to earn rewards or cashback on payments

- Extended grace period for payments

- Improved expense tracking and budgeting

- Additional fraud protection offered by credit card companies

- Ability to dispute charges if necessary

When using a credit card through a pay service network, your card information is securely stored and encrypted. This means you don’t need to re-enter your card details for each payment, further streamlining the bill payment process.

It’s important to note that some billers may charge a convenience fee for credit card payments. Always check the terms and conditions or fee structure before proceeding with a credit card payment to avoid unexpected charges.

Maximizing Efficiency: Advanced Features of Pay Service Networks

As you become more familiar with pay service networks, you’ll discover advanced features that can further enhance your bill management experience. These tools are designed to save you time, reduce errors, and provide a comprehensive overview of your financial obligations.

Automation and Scheduling

Many pay service networks offer automation features that allow you to set up recurring payments for regular bills. This “set it and forget it” approach ensures that your bills are paid on time, every time, without requiring manual intervention.

You can typically schedule payments in advance, allowing you to align bill payments with your pay schedule or preferred payment dates. This feature helps in maintaining a consistent cash flow and avoiding late fees.

Bill Splitting and Roommate Management

Some platforms provide tools for splitting bills among roommates or family members. These features can automatically calculate each person’s share of shared expenses and facilitate individual payments, reducing potential conflicts and ensuring fair distribution of costs.

Budget Tracking and Spending Insights

Advanced pay service networks often include budgeting tools that provide insights into your spending patterns. By categorizing your bills and expenses, these platforms can generate reports and visualizations that help you understand where your money is going and identify areas for potential savings.

Integration with Financial Management Software

For those who use personal finance software, many pay service networks offer integration capabilities. This allows for seamless data transfer between platforms, ensuring that your financial records are always up-to-date and accurate across all your tools.

By taking advantage of these advanced features, you can transform your bill payment process from a tedious chore into a streamlined, efficient system that supports your overall financial health.

Ensuring Security: Protecting Your Financial Information Online

While pay service networks offer numerous benefits, it’s natural to have concerns about the security of your financial information when using these platforms. Reputable pay service networks employ multiple layers of security to protect your sensitive data and ensure safe transactions.

Key Security Measures in Pay Service Networks

- Encryption: All data transmitted between your device and the service is encrypted, making it unreadable to potential interceptors.

- Two-Factor Authentication: Many platforms offer this additional layer of security, requiring a second form of verification beyond your password.

- Tokenization: Your actual account numbers are replaced with unique identifiers, reducing the risk of exposure in case of a data breach.

- Regular Security Audits: Reputable services undergo frequent security assessments to identify and address potential vulnerabilities.

- Fraud Monitoring: Advanced systems are in place to detect and prevent unauthorized access or suspicious activities.

When choosing a pay service network, look for platforms that are transparent about their security measures and comply with industry standards such as PCI DSS (Payment Card Industry Data Security Standard).

Best Practices for User Security

While service providers implement robust security measures, users also play a crucial role in maintaining the security of their accounts. Here are some best practices to follow:

- Use strong, unique passwords for your pay service network account

- Enable two-factor authentication whenever possible

- Regularly monitor your account for any unauthorized activity

- Avoid accessing your account on public Wi-Fi networks

- Keep your devices and apps updated to ensure you have the latest security patches

By combining the security measures implemented by pay service networks with your own vigilant practices, you can enjoy the convenience of simplified bill payments while maintaining the highest level of protection for your financial information.

Introduce pay service networks and their convenience

Juggling multiple bills every month can be a hassle. Between utility bills, cable bills, cell phone bills, and more, keeping track of due dates and ensuring on-time payment takes time and effort. This is where pay service networks come in handy! These convenient online platforms allow you to view, pay, and manage all your bills in one place.

Pay service networks like PSN, PayMyUtilityBill, and BillPayNetwork consolidate all your regular bills onto a single site or app. Rather than visiting multiple websites or writing multiple checks, you can pay all your bills with just a few clicks. These payment services connect directly with hundreds of billing companies, so you can quickly set up and access accounts without having to manually enter account numbers or payment info each time.

The benefits don’t stop there! Most pay service networks also allow you to:

– Receive email or push notifications when bills are ready to pay

– Set up autopay for recurring bills so you never miss a payment

– View payment history and statements

– Manage multiple payment methods like bank accounts, credit cards, and debit cards

– Pay one-time bills like medical bills or infrequent utilities

With pay service networks, you gain control, convenience, and clarity over all your household bills and expenses. Keep reading to learn more about how these services can simplify your bill payments!

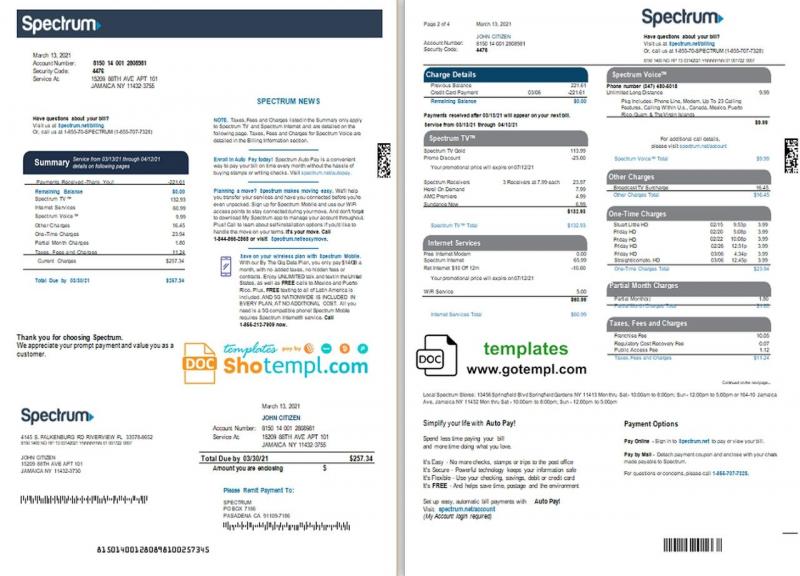

Go paperless by setting up online utility accounts

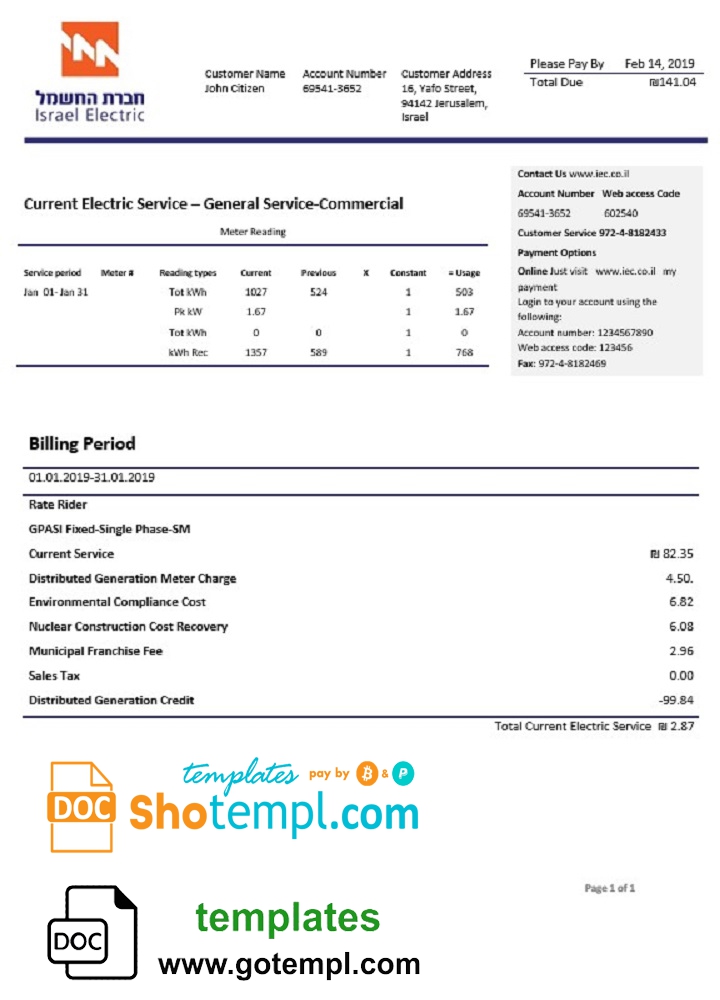

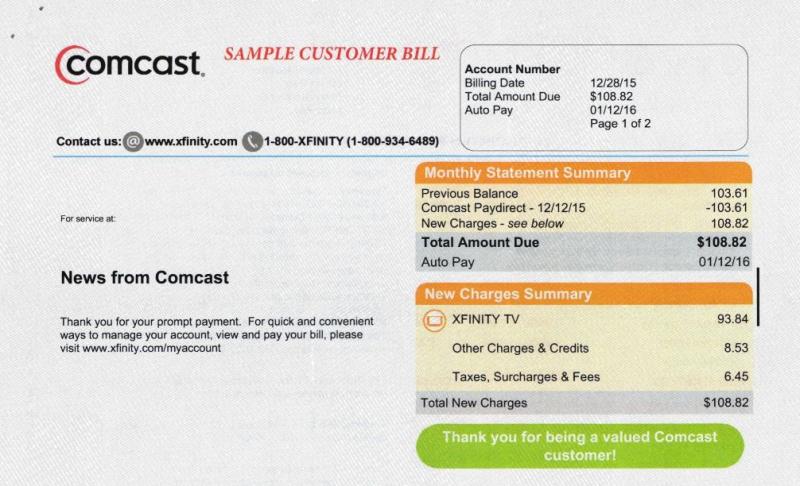

To get started with pay service networks, first set up online accounts with your regular utility and service providers. Most major companies like cable, gas, electric, water, and waste management providers allow you to create accounts on their websites to access statements and make payments.

Visit your providers’ websites and look for options like “Pay My Bill Online” or “Manage My Account.” You’ll need to enter some personal information like your account number, name, and address to match their records. After your account is created, you can opt for paperless billing and go green!

Once your accounts are set up online, the pay service network can securely connect to them to display and pay your bills. With online access, you can check balances, view PDF statements, check payment history, and receive notifications without waiting for the mail.

Link accounts seamlessly with top bill pay apps

Bill pay apps like PSN, PayMyBill, and Doxo make it easy to connect and manage all your providers in one convenient spot. These apps securely store your login credentials to link accounts from major billers.

For example, the PSN app for Android and iPhone allows you to:

– Sync utility accounts like cable, electric, water, etc.

– Receive reminders when bills are due

– Pay one-time bills by snapping a photo or entering details

– Schedule future dated payments

– Store multiple credit cards or bank accounts

– Pay bills on the go with their mobile app

You’ll save time not having to visit individual websites since everything is in one place. Bill pay apps use bank-level security and encryption to keep your data safe. You can trust them to safely store credentials and make payments to thousands of billers and service providers.

Pay without hassle even without an account number

Don’t worry if you need to pay a bill but don’t have your account number handy. Many pay service networks allow you to search for billers by company name, ZIP code, or phone number. This is handy for paying infrequent medical bills, utilities at a new address, or other one-time expenses.

For example, to pay a water bill without an account number using PSN:

1. Open the PSN app or website and search for your water company by name, ZIP code, or phone number

2. Confirm the company name and service address

3. Enter the amount due without needing your account number

4. Enter payment details and submit

The payment network will process the payment properly even without the account number. This quick pay feature makes managing irregular or new bills a breeze.

Register an account to start simplified bill management

Ready to start enjoying the perks of pay service networks? Registering for an account is easy and just takes a few minutes.

On platforms like PSN, you’ll need to:

1. Enter your name, address, email, and phone number

2. Create a secure password

3. Agree to terms of use

After registering, you can download the mobile app, sync your existing accounts, and start paying bills immediately. Don’t forget to add your credit cards, debit cards, or bank account as payment methods.

Many platforms offer guest checkout without registration. But creating an account allows you to sync billers, view history, set reminders, schedule payments, and take advantage of other convenient features. Consolidate your bills and say goodbye to hassle!

Safely pay bills with credit cards

Wondering if you can pay bills with your credit card through pay networks? The answer is yes! Platforms like PSN allow you to securely store Visa, Mastercard, American Express, or Discover cards to pay bills.

Credit cards offer advantages like:

– Earning rewards points or cashback on purchases

– Building your credit history

– Increased fraud protection

– Ability to dispute charges

Just keep in mind that some billers charge convenience fees for credit card payments, usually around 2-3%. Be sure to check for any fees before submitting payments. But overall, credit cards are a convenient option for paying bills through all-in-one pay networks.

Manage waste and recycling bills with ease

Don’t haul out that heavy recycling bin without paying your waste management bill! Garbage and recycling companies can easily be synced to your pay service account.

Popular waste management providers like Waste Industries, Republic Services, and Waste Management all allow online payments through bill pay platforms.

To add your waste/recycling account:

– Locate your provider and verify account details

– Sync logins to permit viewing statements

– Set up autopay or one-time payments

Through pay networks, you can schedule additional pickups, get reminders about holiday schedules, receive recycling tips, and more. Paying your waste bills is one less chore thanks to consolidated bill pay platforms.

Click and pay securely with Click2Pay

For one-time or infrequent bills, Click2Pay services make payment a cinch. Rather than setting up an entire account, you can quickly pay bills as needed.

Here’s how Click2Pay works:

1. Select the Click2Pay option on your pay service network

2. Search for the company name or account details

3. Enter the payee name and payment amount

4. Submit payment with your credit/debit card or bank account

The biller receives an electronic payment without you needing to set up an account or enter extensive details. It’s great for medical bills, utilities at old addresses, appliance repairs, and anything else that crops up. Add the convenience of Click2Pay to your bill payment toolkit.

Manage payments and personalize notifications

The ability to personalize notifications and manage payments from one dashboard is a gamechanger. With your pay service network account, you can:

– Schedule future dated payments in advance

– Set payment reminders via email, text, or push notification

– Update payment methods or account details

– View annual summaries or export reports

– Receive paperless statements to track usage

– Update preferences like auto-pay rules and reminders

By customizing notifications and controlling payments, you stay effortlessly on top of bills. Pay service networks put you in the driver’s seat of hassle-free bill management.

New users can easily register for services

If you’re intrigued by the conveniences pay networks offer, signing up is simple. The registration process only takes a few minutes.

On platforms like PSN, provide details like:

– Full name

– Physical address

– Contact email and phone number

– Secure password

After creating your profile, read and accept the terms of use. Download the mobile app and you can immediately link existing accounts, make quick payments, and organize bills.

Pay networks store credentials securely using encryption. Your information is never sold or shared. Don’t hesitate to take advantage of simplified bill pay and register today!

Convenience and security with payment apps

Bill payment apps allow you to view, track, and pay all your household bills in one convenient spot. But are they secure?

The short answer is yes. Reputable platforms like PSN use industry-leading technology like:

– 256-bit SSL encryption for data transfer

– Secure credential storage

– Multi-factor authentication options

– No storage of full credit card numbers

– Regular third-party auditing

Your personal information is safer than if you entered it on individual biller websites each month. Bill pay apps undergo rigorous testing and adhere to financial industry security standards.

The convenience doesn’t compromise your security. Pay bills confidently knowing your data is safe.

Explain how to create a utility bill payment account online

Tired of shuffling through papers and mailing checks to pay utility bills? Creating an online payment account with your providers is a convenient alternative. Here’s a step-by-step guide to securely setting up online access:

First, collect your recent utility bill or locate your account number. You’ll need this handy along with basic personal information to verify your identity. Visit your utility company’s website and look for options like “Pay Online” or “Account Login.”

You’ll be prompted to either log-in to an existing account or create a new one. If it’s your first time, choose to set up a new account and enter the required details like:

– Account number

– Name on the account

– Service address

– Phone number

– Email address

– Last payment amount

Double check that all details match your utility company’s records. Accurate information ensures quick validation and account activation.

Next, you’ll create your secure log-in credentials. Be sure to choose a strong password you don’t use on other websites. This protects your account security.

Accept the terms and conditions to finish activating your online access. Depending on the provider, you may need to wait 1-2 days for confirmation. But soon you’ll receive a welcome email confirming your online account is ready to go!

Once your access is enabled, you can take advantage of convenient features like:

– View and download PDF statements

– Monitor usage and charges

– Make one-time payments

– Set up recurring auto-pay

– Report outages or service issues

– Update account preferences and contact info

With an online utility account, you have 24/7 access and can skip the paperwork. Now your electric, gas, water, and other bills can be handled completely online. It only takes a few minutes to start reaping the conveniences!

Connect accounts to bill pay apps for easy access

After setting up your online utility accounts, connect them to a bill pay app for super simple access. Apps like PSN synch securely with thousands of providers nationwide.

Linking your account is a snap:

1. Download the bill pay app and register your details

2. Search for your utility company like “Duke Energy”

3. Enter your account login credentials when prompted

4. Confirm the account and address details to link it

5. You can immediately view bills and make payments!

The app stores your login information, so you won’t have to manually enter it again. With a few taps you can log-in, view statements, manage payments, and more.

Bill pay apps are extremely convenient for accessing all your vital accounts in one spot. And you’ll receive alerts whenever a new bill is ready for review. Say bye to logging into multiple websites!

Consolidate bills and ditch the paperwork

Tired of that ever growing stack of bills and statements? Go paperless! An online utility account lets you access PDF statements securely on any device.

When you sign up for e-bills, you reduce clutter and help the environment by saving paper. Plus, there are lots of practical benefits:

– Receive statements instantly instead of waiting for snail mail

– View or download statements anytime from your bill pay app

– Never misplace important bills again

– Add due date reminders for easy organization

– Simplify tax prep by accessing old statements digitally

Most providers allow you to revert back to paper statements if needed. But once you make the switch to e-bills, you likely won’t look back!

Ditch the paper clutter by transitioning utility and credit card accounts to online statements. Combine with a bill pay app to conveniently manage payments in one place. Go green and declutter your life!

New renters can easily set up utility accounts

Moved into your first apartment and need to set up utilities? The process is quick when you do it online. As a new renter, here are some tips for establishing services:

– Contact the utility companies servicing the area to open accounts. Having the address handy speeds the process.

– Choose a billing date that coincides with when you get paid. This avoids late fees.

– Provide contact and employment details even without an established credit history. This helps verify identity.

– See if any deposits are required and what payment methods are accepted.

– Set up autopay or paperless billing to simplify managing your account.

– Download bill pay apps to conveniently monitor usage and payments.

Many providers waive deposits or fees for new digital accounts. Starting services online takes less than 15 minutes. Enjoy the convenience of managing utilities completely digitally as a new renter.

One account dashboard makes bill management easy

Between the electric bill, internet bill, rent check, and more, keeping track of household expenses is a chore. The solution? A bill pay app to conveniently manage everything in one place!

Bill management apps like PSN let you:

– Link all accounts to a secure digital wallet

– Receive bill notifications from all providers

– Review due dates, balances, and statements

– Make one-time or auto payments

– Store payment methods for checkout

– Set up alerts and notifications

Why juggle multiple websites or statements? A unified account dashboard gives you command over bills. Monitor expenses, schedule recurring payments, and simplify finances from your smartphone. Regain control with an all-in-one bill pay solution.

Digital access empowers users to save money

Did you know online utility accounts can also help you save? With detailed tracking and reporting, you gain insights to make your home more efficient.

Modern account dashboards allow you to:

– View usage trends over time

– See how weather impacts energy use

– Track the impact of new appliances

– Set energy savings goals like 5% lower next month

– Receive conservation tips relevant to your home

Online access provides data needed to optimize utility use. Keeping tabs on your home’s energy and water habits can ultimately save significant money.

Go green and maximize savings with digital tools. Online utility accounts offer knowledge and control over your environmental impact and monthly bills.

Online utility accounts simplifiy how you manage and pay monthly bills. But bill pay apps take it a step further by allowing you to orchestrate everything from one hub. Skip the paperwork and make bill pay painless by leveraging the digital conveniences available today!

Discuss the benefits of consolidated bill payment services

Juggling due dates, websites, and payment methods for all your monthly bills is tedious. Wouldn’t it be nice to view, track, and pay all your bills from one convenient place? That’s exactly what consolidated bill pay services provide. Here are some of the great benefits these platforms offer:

Reduced Clutter

By going paperless and accessing statements digitally through your bill pay service, you’ll cut down on bill clutter and hassle. No more shuffling through a pile of papers to find the water bill!

Easy Account Management

You can sync all your existing accounts to the bill pay platform and manage everything from one login. Avoid visiting multiple websites to check balances and make payments.

Single Payment Hub

Consolidated bill pay means making payments for all providers from a single site or app. Rather than separate transactions, pay all bills with one click.

Payment Reminders

Never miss a payment again! Bill pay services let you set custom reminders via email, text, app notifications, and more. Auto-pay is also available.

Enhanced Security

Bill pay platforms use bank-level encryption, multi-factor authentication, and other security measures to keep data safe. All information is stored securely in the digital wallet.

Budgeting Insights

By reviewing past statements and activity, consolidated bill pay makes it easy to analyze spending. Spot wasted money and make appropriate budget adjustments.

Expanded Payment Options

Bill pay platforms allow all kinds of payment methods like bank account, multiple credit cards, Apple/Google Pay, and more. Pick what works for your financial situation.

Bill Tracking

See all your bills in a unified dashboard to better understand monthly cash flow. Identify seasonality, track annual costs, and catch dubious charges.

Convenience On The Go

Bill pay platforms have great mobile apps that allow you to monitor and pay bills from anywhere. Check due dates during your commute or make a payment at the coffee shop.

Customer Service Support

Reputable bill pay providers have dedicated customer service teams ready to answer questions and provide support via phone, email or chat.

Bill pay services offer a host of features that save time, reduce stress, and help organize your financial life. The convenience of having everything in one place is invaluable!

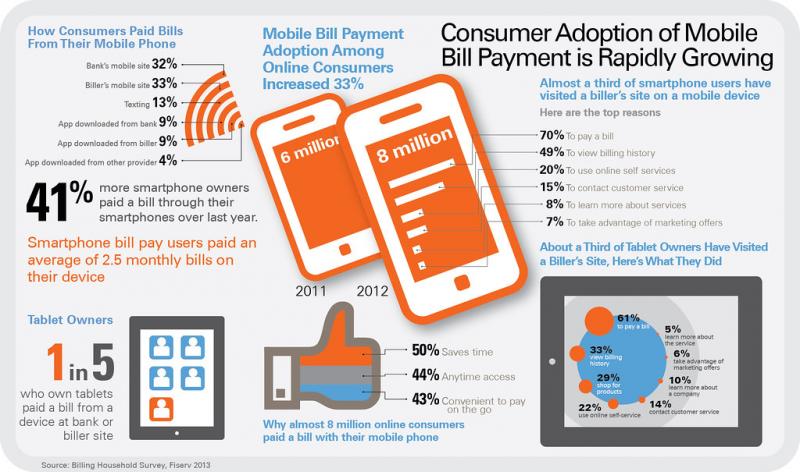

Apps allow easy bill access from your smartphone

Managing bills and payments has never been easier thanks to bill pay apps. These powerful mobile apps allow you to take control of finances on the go.

Top features of bill pay apps include:

– Dashboard showing account balances, due dates, and recent activity

– Push notifications when new bills arrive

– PDF access to digital statements

– Secure login using fingerprint or facial recognition

– Make one-time payments or set up auto-pay

– Attach photos of bills to submit for payment

– Sync accounts from major billers nationwide

– Customer support contact options

You’ll be amazed how easy it is to monitor and manage bills straight from your smartphone! Ditch the laptop and paperwork by embracing the convenience of bill pay apps. They put financial control right in your pocket.

Auto-pay saves effort and prevents missed payments

Don’t waste time manually paying bills every month. Set it and forget it with auto-pay! Most bill pay services give you the option to automate payments for regular monthly bills.

When you activate auto-pay, bills are paid automatically on the due date so you can cross that chore off your list. Auto-pay offers advantages such as:

– Avoid late fees caused by forgetting a bill

– Saves time not having to manually make each payment

– Gives peace of mind knowing bills are handled

– Prevents disruption of vital utilities or services

– Schedule payments to align with your paycheck deposit schedule

Just be sure the payment method you select for auto-pay has sufficient funds when the payment date arrives. Auto-pay simplifies bill management and keeps your accounts in good standing.

Features help optimize personal finances

In addition to convenience, consolidated bill pay services provide useful tools to optimize your finances and save money.

Money management features include:

– Spending summary reports to analyze expenses

– Bill splitting to divide shared bills with roommates

– Payment reminders aligned with your paycheck deposit

– Recurring payment scheduling to match due dates

– Account transfer to easily change payment method

– Savings goal trackers for bills like utilities and cell phone

– Spending forecasts using past statements

Take advantage of these smart features to better understand your cash flow. Identify waste, adjust spending habits, save for big purchases, and reach financial goals faster. Bill pay services aren’t just about convenience – they help you master personal finances!

Ensure on-time HOA and rent payments

Never stress about paying HOA fees, rent, or mortgage again! Bill pay services make it easy to schedule recurring housing payments so they’re never late.

Simply set up automatic payments from your linked bank account to pay:

– Monthly HOA (homeowners association) fees

– Rent for your apartment

– Mortgage payment

– Any recurring housing bills

Most platforms allow you to pick the exact payment date that coincides with your paycheck deposit schedule. You’ll avoid late fees and free up mental bandwidth not having to manually handle these payments.

Your landlord or property manager will appreciate timely funds delivery as well. Consolidated bill pay takes the hassle out of fixed housing expenses.

In today’s digital age, consolidating all your bills into one place is a no-brainer. Bill pay services reduce friction, provide insights, and give control over finances. Simplify bill management once and for all!

List popular bill pay apps and their features

Bill pay apps make managing monthly bills incredibly easy. Rather than visiting multiple websites, you can view, track, and pay all your bills from an intuitive mobile app. Here are some top-rated options with useful features:

PSN

The PSN app allows you to sync accounts, set reminders, pay bills, and more. Great features include:

– Pay bills from thousands of providers

– Sync accounts by snapping a photo

– Receive notifications when bills are ready

– Pay easily with Apple Pay, credit/debit cards

– Securely store payment information

– Download PDF statements

PayMyBill

PayMyBill helps you organize finances and make quick payments. Notable features:

– Pay bills with various payment methods

– Set up automatic recurring payments

– Split shared bills with roommates

– Scan documents using mobile camera

– Annually compiles payment data for taxes

– 24/7 live chat support

Doxo

Doxo makes it simple to pay bills and manage documents. App perks:

– Organizes bills into folders

– Syncs accounts from major providers

– Imports documents from email and drive

– Creates customized calendars and reminders

– Secures documents and payments

– Available on iOS, Android, web

Prism

Prism aims to help users achieve financial goals. Key features:

– Analyze spending habits with AI

– Set bill due date reminders

– Pay bills and send money to others

– Split expenses with groups

– Access budgeting and financial wellness content

– Secured with bank-grade encryption

These user-friendly apps simplify managing finances! Find one aligned with your needs and say goodbye to bill payment hassle.

Mobile apps ensure payments on the go

Bill pay apps make it easy to manage your finances on the go. Their well-designed mobile apps allow you to:

– Review account balances and upcoming due dates

– Receive notifications when bills become available

– Make payments with a few taps

– Securely store payment information like bank accounts or credit cards

– Split cost of bills with roommates or partners

– Add due date reminders directly in your calendar

– Contact customer support to get questions answered

– Review statements and payment history

You no longer need to wait until you’re at your desktop to pay bills or manage accounts. Bill pay apps put control over finances right in your pocket!

Next time you’re waiting in line for coffee, riding the subway, or sitting on the couch, open your bill pay app and get your finances in order. Mobile convenience makes tasks like paying bills completely painless.

Apps sync securely with major providers

Tired of visiting multiple websites to access all your accounts? Bill pay apps offer a better solution by syncing directly with major providers to unify access.

Apps securely connect to top companies like:

– Internet and cable: Spectrum, Xfinity, Cox

– Electric: Duke Energy, ConEd, PG&E

– Gas: National Grid, Atmos Energy

– Water: American Water, Aquarion

– Mortgage and rent: Chase, Wells Fargo

– Insurance: State Farm, Liberty Mutual

– Credit cards: Citi, Chase, Capital One

The app stores your login credentials and links the accounts for streamlined access. You no longer have to visit each individual website to log in and manage payments.

Syncing accounts provides a single hub for convenient digital asset management. Streamline finances with unified tools.

Improved money management and savings

Savvy bill pay apps do more than just make payments easy. They provide insights and tools to optimize your finances and savings too!

Money management features include:

– Visual dashboard to view net worth over time

– Spending analysis and income/expense tracking

– Bill splitting to divvy up shared payments

– Budget creation with spending goal setting

– Reminders aligned with paycheck deposit dates

– Paperless billing to reduce clutter

Take advantage of robust features to gain visibility into cash flow. Identifying waste and adjusting spending habits results in real savings.

Don’t just make payments conveniently – use bill pay apps to actively improve financial wellness!

Bill pay apps make financial management a breeze with useful tools right at your fingertips. Take control of your money by downloading a highly rated app that meets your needs today!

Compare bill payment apps for Android and iOS

Bill pay apps available for Android and iOS devices share the same goal: making bill management easy. But they differ slightly in their approach. Here’s an overview of key differences between platforms:

Syncing Accounts

The iOS version of apps like PSN and Prism take advantage of iCloud to instantly sync accounts you set up. Android apps may require manually entering credentials to link accounts.

Biometric Login

Android apps allow login via fingerprint or facial recognition thanks to features like Fingerprint API. Apple restricts biometric logins to Apple Pay for additional security.

Design Paradigm

Following Google’s guidance, Android apps emphasize using the hamburger menu for navigation. Apple apps adhere to iOS design standards like static tab bars for quick access.

Pre-installed Apps

Google Pay comes preloaded on Android devices while Apple produces Apple Pay for iOS. This influences the default payment method options.

Sharing Files and Data

Android apps more seamlessly integrate with Google Suite to share documents via Gmail or Google Drive. Apple apps focus sharing through iCloud.

Together Functionality

Apple apps permit shared family calendars, locations, and payment methods via Apple’s Together mode. This is not mirrored in Android.

Onboarding Experience

iOS apps generally feature more interactive tutorials and onboarding walks through key features. Android apps use more succinct tooltips.

While core features are consistent, design paradigm and device integration vary slightly. Evaluate your priorities to choose the right platform for your bill pay needs.

Apple excels at biometric security features

Apple offers industry-leading biometric security features leveraging Face ID and Touch ID that Android has been slower to adopt.

For example, with iPhone bill pay apps you can:

– Use Face ID to authenticate payments

– Secure app login with Touch ID fingerprint

– Disable screenshots to protect sensitive information

– Self-destructing messages provide additional confidentiality

Apple also gives users robust control over app permissions and data sharing. You can easily revoke access when desired for privacy.

Android apps are catching up with enhanced fingerprint authentication and facial recognition. But Apple still leads in leveraging biometrics for financial apps.

Google provides seamless account syncing

Android devices excel at instantly connecting new apps to your Google profile and services. If you use Gmail, Google Pay, Drive, and more – Android bill pay apps leverage them.

Benefits include:

– Apps autofill personal details like address and name

– Saved payment methods populate automatically

– Upload documents directly to Google Drive

– Receiving notifications via Gmail account

– Shared contacts and calendars reduce data entry

Rather than starting from scratch, new Android apps build on your existing Google ecosystem. Seamless integration with services you already use makes account setup a breeze.

Both platforms allow quick payments on the go

Whether you prefer iOS or Android, bill pay apps on both platforms excel at convenient payments on the go.

Handy features like:

– Push notifications when bills are ready

– Saved payment methods for one-click pay

– Snap a photo of a bill to submit payment

– Recurring autopay set-up

– Calendar reminders for upcoming dues

– Secure storage of credit cards and bank accounts

– PDF access to paperless statements

You no longer need a laptop to manage finances. Robust bill pay apps on mobile keep your accounts organized and bills paid from anywhere.

Convenience and simplicity unite iOS and Android bill payment solutions.

While some differences exist between platforms, the top bill pay apps provide user-friendly tools for easy money management. Focus on core features that solve your pain points when choosing the best solution for your needs and budget.