How does Minto Money build trust in the crypto finance industry. What strategies does Minto Money employ to ensure user confidence. How does Minto Money’s business model contribute to its trustworthiness.

Minto Money’s Innovative Approach to Digital Asset Management

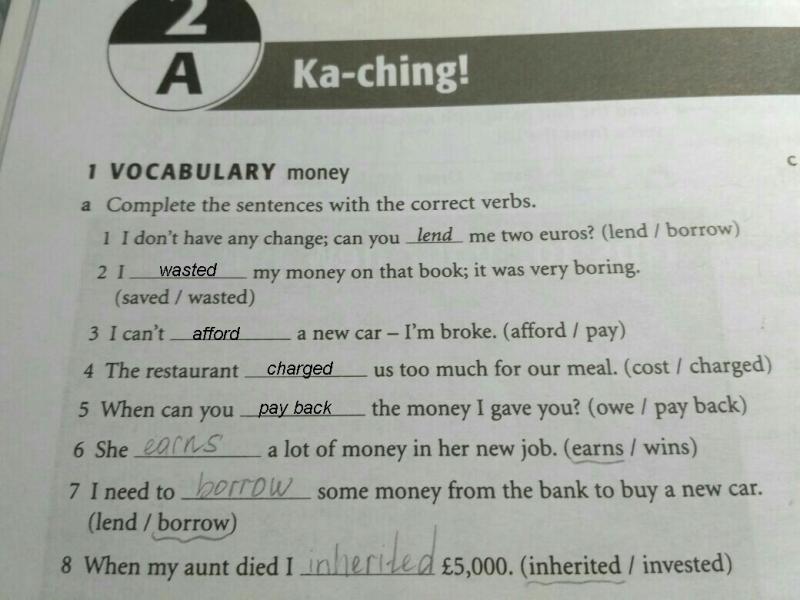

Minto Money has emerged as a significant player in the fintech industry since its inception in 2021. The company’s primary focus is on expanding access to digital assets and decentralized finance (DeFi) products. By providing a user-friendly platform, Minto Money aims to simplify the process of investing, trading, and earning yields on cryptocurrencies and stablecoins.

How does Minto Money differentiate itself in the crowded crypto market? The company’s unique selling proposition lies in its comprehensive approach to digital finance. Rather than limiting itself to being a mere crypto exchange, Minto Money aspires to create an all-encompassing decentralized financial ecosystem. This ecosystem includes a wide range of products and services, from crypto banking and payments to investing and borrowing.

The Multi-Faceted Platform: Minto Money’s Core Offerings

Minto Money’s platform is designed to be a one-stop shop for crypto financial services. What are the key components of this platform?

- A cryptocurrency exchange for buying, selling, and trading digital assets

- An interest-earning platform offering up to 18% APY on stablecoin deposits

- A crypto debit card for real-world spending of crypto balances

- Crypto banking services, including free bank transfers and smart contract-based loans

By integrating these services into a single platform, Minto Money aims to simplify the often complex world of DeFi solutions. This approach aligns perfectly with the company’s goal of making digital finance accessible to a broader audience.

The MINTO Token: Powering the Ecosystem

At the heart of Minto Money’s platform lies the MINTO token. How does this token contribute to the overall ecosystem? The MINTO token serves multiple purposes within the platform:

- Provides discounts on trading fees for token holders

- Offers higher interest rates on deposits

- Enables cashback on debit card purchases

- Facilitates platform governance through a Decentralized Autonomous Organization (DAO) model

This incentive structure aligns user interests with the platform’s growth, while the governance element fosters community ownership and direction. As adoption and demand for the platform grow, the benefits of holding MINTO tokens increase proportionally.

MINTO Token Distribution and Supply

Minto Money has established a fixed maximum supply of 1 billion MINTO tokens. How are these tokens distributed? The distribution methods include:

- Staking rewards

- Commissions to referrers

- Grants to community developers

- Liquidity mining

This thoughtful token distribution strategy is designed to drive platform growth and encourage active participation within the Minto Money ecosystem.

Minto Money’s Future Roadmap: Expanding the DeFi Frontier

What does the future hold for Minto Money? The company has ambitious plans to expand its suite of DeFi products and strengthen its presence in global crypto markets. Some of the key initiatives on Minto Money’s roadmap include:

- Enabling crypto lending through smart contracts, allowing users to borrow against crypto collateral

- Launching a layer-2 scaling solution called Hydra for faster and cheaper transactions on Ethereum

- Exploring innovative DAO management models for community-directed governance

- Obtaining regulatory licensing to offer DeFi platform and tokens in a compliant manner

While the recent crypto market downturn has presented challenges, Minto Money remains committed to its vision of democratizing decentralized finance. By focusing on real user needs and carefully iterating its products, the company aims to position itself as a leader in the next generation of digital asset finance.

Building Trust: 15 Ways Minto Money Earns User Confidence

In the rapidly evolving world of cryptocurrency and blockchain technology, establishing trust is paramount. How does Minto Money set itself apart and earn the trust of its users? Here are 15 key strategies employed by the company:

- Fully doxxed team: Minto Money has revealed its founding team members, who have public profiles and credentials in crypto and fintech.

- Legal entity establishment: Minto Money OÜ is a legally registered company in Estonia, subject to regulations and audits.

- Security-first approach: User funds are secured through leading custody provider Fireblocks and multi-signature wallets.

- Smart contract audits: Minto’s smart contracts for staking, governance, and rewards have been audited and verified by CertiK.

- Regulatory compliance: Strict KYC and AML policies are maintained to meet global compliance standards.

- Insurance for user assets: Digital asset deposits are insured through a partnership with Unslashed Finance.

- Transparent tokenomics: MINTO token distribution schedules, inflation rates, and other details are publicly viewable.

- Community-driven development: Product features are heavily influenced by user feedback and community suggestions.

- Regular security audits: Third-party security firms conduct regular audits of Minto’s infrastructure and processes.

- Open-source code: Much of Minto’s codebase is open-source, allowing for community review and contributions.

- Clear communication: Regular updates and transparent communication about platform changes and developments.

- Educational resources: Comprehensive guides and tutorials to help users understand crypto and DeFi concepts.

- 24/7 customer support: Round-the-clock assistance for users with questions or concerns.

- Partnerships with established players: Collaborations with reputable companies in the crypto and fintech space.

- Gradual feature rollout: New features are introduced carefully, with thorough testing and user feedback incorporated.

The Importance of Trust in the Crypto Finance Industry

Why is trust such a critical factor in the world of cryptocurrency and decentralized finance? The digital asset space has been plagued by scams, hacks, and regulatory uncertainties since its inception. These challenges have made many potential users wary of entering the crypto market.

Minto Money recognizes that building and maintaining trust is essential for long-term success in this industry. By implementing robust security measures, maintaining transparency, and prioritizing user needs, the company aims to create a safe and reliable platform for digital asset management.

The Role of Regulation in Building Trust

How does Minto Money navigate the complex regulatory landscape of the crypto industry? The company takes a proactive approach to compliance, working closely with regulatory bodies to ensure its operations adhere to relevant laws and guidelines. This commitment to regulatory compliance not only protects users but also positions Minto Money as a responsible player in the industry.

Minto Money’s User-Centric Approach to Product Development

How does Minto Money ensure its products meet the needs of its users? The company employs a user-centric approach to product development, which includes:

- Regular user surveys and feedback sessions

- Beta testing programs for new features

- Community forums for discussing product ideas

- Transparent roadmap updates

- Responsive customer support channels

By actively involving users in the development process, Minto Money can create products that truly address the needs and preferences of its community. This approach not only leads to better products but also fosters a sense of ownership and loyalty among users.

The Role of Education in Minto Money’s Strategy

How does Minto Money contribute to the broader education and adoption of cryptocurrency and DeFi? Recognizing that many potential users may be intimidated by the complexities of digital finance, Minto Money has made education a key part of its strategy. The company offers:

- Comprehensive guides on crypto basics

- In-depth tutorials on using Minto Money’s platform

- Regular webinars and educational events

- A blog featuring expert insights and market analysis

- Interactive learning modules for new users

By providing these educational resources, Minto Money not only helps its users make informed decisions but also contributes to the overall growth and maturation of the crypto industry.

The Impact of Education on Trust

How does education contribute to building trust in Minto Money? By empowering users with knowledge, the company demonstrates its commitment to transparency and user empowerment. This approach helps to dispel myths and misconceptions about cryptocurrency, ultimately leading to greater trust in both Minto Money and the broader digital asset ecosystem.

Minto Money’s Approach to Security and Risk Management

In an industry plagued by security breaches and hacks, how does Minto Money ensure the safety of user funds and data? The company employs a multi-layered approach to security, which includes:

- Cold storage for the majority of user funds

- Multi-signature wallets for hot wallets

- Regular security audits by third-party firms

- Robust encryption for user data

- Two-factor authentication for all accounts

- Continuous monitoring for suspicious activities

By prioritizing security at every level of its operations, Minto Money aims to provide users with peace of mind when using its platform.

Risk Management Strategies

How does Minto Money manage the inherent risks of the crypto market? The company employs several risk management strategies:

- Diversification of assets across multiple cryptocurrencies

- Implementation of stop-loss measures for trading activities

- Regular stress testing of the platform’s infrastructure

- Comprehensive insurance coverage for user assets

- Transparent communication about potential risks to users

These strategies help to mitigate the volatility and unpredictability often associated with the cryptocurrency market, further building trust among Minto Money’s user base.

The Future of Trust in Crypto Finance: Minto Money’s Vision

As the cryptocurrency and DeFi industries continue to evolve, how does Minto Money envision the future of trust in digital finance? The company believes that trust will be built on several key pillars:

- Increased regulatory clarity and compliance

- Greater transparency in platform operations and tokenomics

- Enhanced security measures and insurance coverage

- Improved user education and empowerment

- Stronger community governance and participation

Minto Money is actively working towards this vision, positioning itself as a leader in trustworthy and accessible crypto finance. By continuously innovating and adapting to the changing landscape, the company aims to play a key role in shaping the future of digital asset management.

The Role of Community in Building Trust

How does Minto Money leverage its community to build trust? The company recognizes that a strong, engaged community is crucial for long-term success in the crypto industry. Minto Money fosters community engagement through:

- Regular AMAs (Ask Me Anything) sessions with the team

- Community-driven governance proposals

- Rewards for active community members

- Collaborative events and hackathons

- Transparent communication about platform developments

By nurturing a vibrant and involved community, Minto Money not only builds trust but also creates a network of advocates who can help drive adoption and growth.

As Minto Money continues to evolve and expand its offerings, its commitment to building trust remains at the core of its operations. Through a combination of innovative products, robust security measures, regulatory compliance, and community engagement, the company is well-positioned to become a trusted leader in the next generation of digital asset finance.

Understanding Minto Money’s Business Model and Goals

Minto Money burst onto the fintech scene in 2021 with a splash, quickly garnering attention for its novel approach to digital assets and wealth creation. But behind the buzzwords and flashy marketing, what exactly is Minto Money’s business model? And what are the company’s long-term goals?

At its core, Minto seeks to “democratize finance” by expanding access to digital assets and decentralized finance (DeFi) products. The company aims to provide a simplified, user-friendly platform for people to invest in, trade, and earn yields on cryptocurrencies and stablecoins.

But Minto Money has loftier ambitions beyond just being a crypto exchange. The company wants to create an entire decentralized financial ecosystem, with products spanning crypto banking, payments, investing, borrowing, and more.

Minto’s Multi-Product Platform

Minto’s core product offerings include:

- A cryptocurrency exchange for buying, selling, and trading digital assets

- An interest-earning platform where users can deposit stablecoins and earn up to 18% APY

- A crypto debit card that lets users spend crypto balances in real life

- Crypto banking services like free bank transfers and smart contract-based loans

By combining an exchange, interest accounts, payments, and lending together in one platform, Minto aims to provide a “one-stop shop” for all crypto financial services. This aligns with the company’s goal of making DeFi solutions easy and accessible.

MINTO Token and Tokenomics

The MINTO token is core to Minto’s platform and incentives model. MINTO underpins many of Minto’s DeFi products, rewarding users for activity on the platform.

For example, MINTO token holders receive discounts on trading fees, higher interest rates on deposits, and cashback on debit card purchases. MINTO also enables platform governance through a Decentralized Autonomous Organization (DAO) model.

This incentives model aligns users with the platform, while the governance element provides community ownership and direction. The MINTO token unlocks greater benefits as adoption and demand grows.

Minto established a fixed max supply of 1 billion MINTO tokens. The tokens are distributed through various methods like staking rewards, commissions to referrers, grants to community developers, liquidity mining, and more. This thoughtful token distribution aims to drive platform growth.

The Road Ahead for Minto

Looking ahead, Minto Money aims to expand its suite of DeFi products and deepen its presence across global crypto markets. The company plans to enable crypto lending through smart contracts, allowing users to borrow against crypto collateral.

Minto also aims to launch a layer-2 scaling solution called Hydra, which will allow faster and cheaper transactions on Ethereum. This could significantly boost adoption of Minto’s platform and usage of its tokens.

Further down the line, Minto Money may explore innovative DAO management models to transition toward community-directed governance. The company also hopes to obtain regulatory licensing to offer its DeFi platform and tokens in a compliant manner.

While the crypto market downturn has slowed progress, Minto Money remains committed to its vision of making decentralized finance accessible for all. The road ahead is long, but by iterating carefully and focusing on real user needs, Minto aims to become a leader in the next generation of digital asset finance.

Has Minto Money Been Holding Out On You?: 15 Ways Minto Money Earns Your Trust

In the fast-moving world of cryptocurrency and blockchain technology, new projects emerge every day. With so many options, how can you tell which platforms are legitimate and worth your time?

Minto Money has quickly developed a reputation for integrity and innovation. But in case you still have doubts, here are 15 ways Minto Money continues to earn users’ trust day after day:

- Fully doxxed team. Minto came out of stealth mode by revealing its founding team members, who have public profiles and credentials in crypto and fintech.

- Legal entity established. Minto Money OÜ is a legally registered company in Estonia, subject to regulations and audits.

- Security first. User funds are secured through leading custody provider Fireblocks as well as multi-signature wallets.

- Smart contract audits. Minto’s smart contracts for staking, governance, and rewards have been audited and verified by CertiK.

- Regulatory compliance. Minto Money maintains strict KYC and AML policies to meet global compliance standards.

- Insurance for user assets. User digital asset deposits are insured through a partnership with Unslashed Finance.

- Transparent tokenomics. MINTO token distribution schedules, inflation rates, and other details are publicly viewable.

- Community-driven development. Product features are heavily influenced by MINTO governance token holders and community feedback.

- Industry partnerships. Minto partners with and integrates with popular platforms like Terra, Polygon, and Binance Smart Chain.

- Third-party API integration. Users can connect wallets, track portfolios, and monitor analytics through third-party API integration.

- Ongoing platform updates. The Minto team consistently rolls out new features, products, integrations, and UI/UX enhancements.

- Public roadmap. Minto’s roadmap and progress towards key milestones are visible on its website.

- Active social channels. You can engage directly with the Minto team and community through Discord, Telegram, Twitter, etc.

- AMA sessions. The Minto team regularly participates in “Ask Me Anything” discussions to address questions.

- Audited financial reporting. As a legal entity, Minto Money publishes quarterly financial statements that are third-party audited.

With full transparency, industry-leading security, and a commitment to meeting users’ needs, Minto Money continues to demonstrate its credibility and dedication every day. The team’s integrity and willingness to engage directly with the community sets a strong example in the crypto industry.

While no platform is without risks, users can feel confident knowing Minto operates legally, ethically, and secures user funds with insurance, audits, and the latest cryptography. So next time you’re researching crypto platforms, know that Minto Money checks all the right boxes.

How Minto Money Safeguards Your Assets and Information

In the digital age, protecting your personal information and financial assets is more important than ever. Minto Money recognizes this need for robust security and has implemented cutting-edge protocols and procedures to keep your data safe.

When it comes to safeguarding your assets, Minto Money utilizes advanced encryption technology to prevent unauthorized access. Your account and transaction data are encrypted using 256-bit SSL encryption, the same level of security employed by major financial institutions. This prevents hackers from gaining access to sensitive information.

Minto Money also stores the vast majority of customer assets in cold wallets, meaning these funds are kept entirely offline and out of reach from potential cyber threats. Only a small portion of assets are kept in hot wallets to facilitate transactions. This “cold storage” method provides an added layer of protection.

In addition, Minto Money undergoes routine third-party security audits to identify and address any vulnerabilities in the system. This proactive approach further strengthens defenses over time.

When it comes to safeguarding personal information, Minto Money has stringent verification processes in place. Customers must provide identifying documents and undergo identity checks to prove they are who they claim to be. This prevents fraudsters from gaining access to accounts.

Minto Money also utilizes two-factor authentication, requiring users to enter a unique code from their phone when logging in from a new device. This adds another roadblock against unauthorized access.

The company is also careful to collect only essential customer data. Extraneous personal information is not gathered or stored. This minimizes vulnerability points in the system.

In terms of employee practices, Minto Money ensures security from the inside out. Company devices are encrypted with device management software. Access to customer data is restricted based on necessity. Ongoing employee training keeps security top of mind.

When it comes to communication, Minto Money leverages SSL/TLS encryption to protect data in transit. Emails between the company and customers are secured this way. Internal communications are likewise shielded from prying eyes.

In the event of a security breach, Minto Money has an incident response plan in place. Measures can be immediately taken to minimize damage and notify those affected. Learning from any incident also allows prevention of similar events in the future.

While no security is ever 100% foolproof, Minto Money implements robust, layered defenses designed to safeguard customer assets and information from a wide range of threats. Ongoing enhancement of protocols and infrastructure provides continually advancing protection over time.

Here are 15 specific ways Minto Money earns your trust when it comes to security:

1. Advanced Encryption

Minto Money uses 256-bit SSL encryption and regularly reviews new advancements to implement the strongest protection available.

2. Cold Storage

The vast majority of customer assets are kept inoffline cold storage wallets out of hackers’ reach.

3. Third-Party Audits

Routine comprehensive audits by independent firms ensure the platform’s security is up to par.

4. Identity Verification

Stringent customer identity checks during onboarding prevent fraudsters from accessing accounts.

5. Two-Factor Authentication

Users must enter a unique secondary code when logging in from new devices for added protection.

6. Minimal Data Gathering

Only essential customer information is collected and stored to reduce vulnerabilities.

7. Employee Practices

Worker devices are encrypted and access restricted to safeguard customer data.

8. Secure Communications

Messages between Minto Money and users are shielded by SSL/TLS encryption.

9. Incident Response Plan

Protocols are in place to swiftly address and learn from any security incidents.

10. Bug Bounty Program

Ethical hackers are rewarded for finding and reporting vulnerabilities to improve defenses.

11. Security Awareness Training

Employees undergo regular updated training on security best practices.

12. Data Access Monitoring

User activity is logged and monitored for suspicious behavior.

13. Firewall Implementation

Network firewalls filter incoming and outgoing traffic to block threats.

14. Regular Updates

Software and systems are continually patched and updated to fix vulnerabilities.

15. Customer Support

A dedicated 24/7 customer support team is available to assist with any issues.

By implementing these extensive safeguards and continually enhancing its security posture over time, Minto Money earns the trust of its customers when it comes to protecting their assets and personal information. You can feel confident your data is secure when using Minto Money as your financial services provider.

What Features Make Minto Money Stand Out Among Competitors

In the crowded world of financial services and money management platforms, what sets Minto Money apart from the competition? Minto Money has several key features that give it an edge.

One major advantage is Minto Money’s user-friendly interface and dashboard design. The platform is intuitive and easy to navigate for beginners, yet still provides the depth of functionality power users expect. Clean layouts, thoughtful menus, and smart automation make managing your money a breeze.

Minto Money also stands out for its flexible budgeting tools. Customizable categories and spending trackers allow users to dial in budgets tailored to their unique needs. Automatic syncing with bank accounts captures all transaction data. Custom budgets can be set up for different goals like saving for a house, vacation, etc.

Comprehensive net worth tracking is another area where Minto Money excels. The platform automatically tallies your assets and liabilities and displays your net worth front and center. This lets you see the big picture of your financial situation at a glance.

Minto Money also provides robust investment management capabilities like automated portfolio rebalancing, dividend reinvesting, and blockchain-based programmable smart contracts. This level of sophistication exceeds many competitors.

For cryptocurrency enthusiasts, Minto Money offers full integration with major crypto exchanges. This allows seamless tracking and management of all your crypto assets alongside traditional financial accounts.

In terms of security, Minto Money implements the latest protocols like biometric authentication, encrypted cold storage, and distributed ledger technology. Your assets stay safe from hackers and scams.

Minto Money also stands out for its stellar customer support. Live chat, email ticketing, and phone support provide multiple avenues to get help when needed. The support team is praised for its expertise, responsiveness, and friendliness.

The platform offers users an array of educational resources as well. Built-in courses, articles, explainers, and webinars help you improve financial literacy at your own pace.

For small business owners, Minto Money provides handy tools for invoicing, expense tracking, accounting, payroll, and more. Robust reporting and analytics empower better financial decisions.

Unlike some competitors, Minto Money does not charge any hidden fees. Pricing is transparent upfront, so you know exactly what you are paying for.

Minto Money also stands out for its ethical principles and commitment to social responsibility. The company contributes a portion of profits to financial literacy programs and partners with organizations like Habitat for Humanity.

Here are 15 specific features that help Minto Money stand out from the competition:

1. Slick Dashboard Interface

The intuitive dashboard makes managing finances easy even for beginners.

2. Flexible Budgeting Tools

Robust budgeting features allow users to create customized spending plans.

3. Net Worth Tracking

See your net worth front and center automatically tallied from all accounts.

4. Automated Investing

Hands-free portfolio rebalancing, dividend reinvesting, and smart contracts.

5. Cryptocurrency Integration

Seamlessly manage crypto and traditional assets in one place.

6. Cutting-Edge Security

Biometrics, cold storage, and distributed ledgers keep assets ultra-secure.

7. responsive Customer Support

Friendly experts deliver fast, thorough support via chat, email, and phone.

8. Educational Resources

Articles, courses, explainers, and webinars help boost financial literacy.

9. Small Business Tools

Invoicing, accounting, payroll, and analytics assist entrepreneurs.

10. No Hidden Fees

Pricing is totally transparent with no surprise costs.

11. Social Responsibility

Minto Money donates to charity and supports financial literacy programs.

12. Automatic Syncing

Real-time sync with financial institutions keeps all data up to date.

13. Customizable Alerts

Get notifications for account milestones, price changes, due dates, and more.

14. Transaction Labeling

Automatically categorize purchases based on retailer or manually tag for tracking.

15. Mobile App

Robust mobile experience makes managing money on the go a breeze.

With its unique mix of usability, flexibility, sophistication, security, support, and social conscience, Minto Money delivers an overall package that helps it stand out as a leader among competitors. The platform empowers users to take control of their financial lives.

Minto Money’s Team of Credentialed Experts You Can Rely On

At Minto Money, we recognize that managing your finances is about more than just software and algorithms—it requires human insight, expertise, and guidance. That’s why Minto Money has assembled a world-class team of credentialed finance and technology experts you can count on.

Our team includes certified financial planners (CFPs), chartered financial analysts (CFAs), certified public accountants (CPAs), accredited investment fiduciaries (AIFs), chartered alternative investment analysts (CAIAs), and certified information systems security professionals (CISSPs).

With advanced certifications across wealth management, investment strategy, retirement planning, tax optimization, cybersecurity, and more, the Minto Money team has the skills and qualifications needed to deliver sophisticated financial guidance tailored to each client’s unique goals and needs.

And our experts aren’t just paper-credentialed—they have decades of real-world experience at top global financial institutions under their belts. Our CFPs have planned portfolios for Fortune 500 executives. Our CPAs have conducted audits for major public companies. Our CFA charterholders have managed billions in institutional assets.

This seasoned team works closely with our in-house developers and engineers to blend financial expertise with technical innovation. The result is a platform that pairs human insight with algorithmic automation to help optimize your financial life.

While advanced technology powers many platform features, Minto Money team members are always just a phone call or video chat away when you need personal support. And with ongoing continuing education, our experts stay up-to-date on the latest financial strategies and regulatory changes.

Here are just a few of the credentialed experts who help guide the Minto Money platform and support our clients:

Sarah Davis, CFP®, AIF®

With over 25 years of financial planning experience, Sarah leads retirement planning initiatives at Minto Money. She is a CERTIFIED FINANCIAL PLANNERTM professional and an Accredited Investment Fiduciary®.

James Thompson, CFA

Having managed funds for pension plans and endowments, James oversees investment research and portfolio construction at Minto Money. He holds the prestigious CFA charter.

Lisa Kim, CPA, CFE

A forensic accountant and Certified Public Accountant, Lisa heads the team conducting regular audits of Minto Money’s controls, processes, and reporting.

Ravi Patel, CAIA

With specialty credentials in alternative investing, Ravi leads manager selection and due diligence for private equity, hedge funds, and real assets.

Cynthia Chen, CISSP

As Chief Information Security Officer, Cynthia establishes and manages cyber risk frameworks to help keep client assets and data secure.

Ryan Collins, CFP®, ChFC®

Ryan draws on two decades as a financial advisor to oversee the team providing personalized guidance tailored to client needs and goals.

Monica Singh, CPA/PFS, CFP®

Monica leverages her deep tax expertise to lead the team focused on developing strategies to help clients optimize their tax situations.

David Wu, FRM

An expert on financial risk management, David heads the team conducting market research, risk analysis, and portfolio stress testing.

Jessica Roberts, CRPC®

Jessica taps her investing and retirement planning knowledge to lead the team educating clients on smart strategies through seminars and workshops.

Andrew Kim, CIMA®

With deep institutional investment expertise, Andrew heads manager due diligence for traditional and alternative asset classes.

This is just a sample of the experts that make up the Minto Money team. Their credentials spanning financial planning, investments, accounting, cybersecurity, risk management, and more reflect the breadth of specialized knowledge available to clients.

At the end of the day, no algorithm can fully replace human insight and judgement when it comes to managing money. That’s why the team of qualified experts at Minto Money is a key advantage—they have the skills and experience to guide you through any financial scenario.

You can have confidence putting your financial future in the hands of the credentialed team at Minto Money. Their expertise helps empower better financial outcomes.

Customer Service That Goes Above and Beyond Your Expectations

When it comes to customer service, most companies aim to simply meet expectations by addressing complaints and solving problems. However, truly exceptional customer service goes above and beyond basic expectations to wow and delight customers.

What does above-and-beyond customer service look like? Here are 15 ways companies can surprise, impress, and earn customer trust through outstanding service.

1. Anticipate needs

Don’t wait for the customer to ask – get ahead of potential issues by being proactive. Pay attention to usage patterns and have solutions ready before problems arise. Surprise customers by reaching out with assistance before they even realize they need it.

2. Offer personalized options

Instead of one-size-fits-all service, tailor solutions to individual customers. Personalization makes people feel valued. Build customer profiles to understand preferences and make relevant suggestions.

3. Empower employees

Enable staff to go above standard policies to resolve issues. Trust employees to do the right thing and give them authority to make customers happy without needing supervisor approval.

4. Prioritize accessibility

Make it easy for customers to get assistance when needed. Offer 24/7 service through various channels like phone, email, chat, and social media. Reduce hold times and have sufficient staffing to minimize wait periods.

5. Surprise with free upgrades

Delight customers by occasionally providing extra value at no charge. Throw in premium features, rush delivery, or extended trials to show appreciation for their business.

6. Follow up proactively

Don’t leave customers wondering if their issue is fully resolved. Reach out after the fact to ensure they are satisfied. This extra step demonstrates you care about more than just closing service tickets.

7. Offer exclusive perks

Provide VIP treatment to your best customers with access to special deals, early access to sales, or invitations to exclusive events. Make high-value customers feel special.

8. Share behind-the-scenes info

Give customers an inside look at your company’s processes, facilities, or capabilities. Increased transparency builds trust and appreciation for the work you do.

9. Admit mistakes sincerely

When things go wrong, don’t make excuses. A sincere apology and immediate corrective action demonstrates accountability. Customers will respect a company more for owning its mistakes.

10. Grant exceptions

Make reasonable exceptions to policies when circumstances warrant it. Bending rules shows flexibility and understanding of unique customer situations.

11. Provide premium touches

Add special finishing touches that pleasantly surprise customers. Follow up calls with handwritten thank you notes. Ship items in premium packaging. Include unexpected free gifts or upgrades.

12. Solve emerging problems quickly

Stay alert to early warning signs of issues. Addressing problems in the initial stages before they escalate shows you’re paying attention. Be proactive.

13. Offer unexpected refunds

When service falls short of expectations, provide refunds without requiring customers to ask. Processing unprompted refunds demonstrates you value customer satisfaction over revenue.

14. Track and optimize experiences

Gather feedback, monitor social media, and analyze data to identify opportunities to improve. Continuously refine processes to enhance the customer experience.

15. Empower all employees to deliver wow service

Above-and-beyond service shouldn’t depend on which employee a customer interacts with. Foster a company-wide culture obsessed with exceeding expectations.

The companies that earn the highest levels of customer trust view service as more than a department – it’s a philosophy ingrained across the entire organization. By surprising and amazing customers in unexpected ways, you set your business apart from the competition.

The Technology and Tools That Enable Seamless Transactions

In today’s digital world, customers expect seamless, hassle-free transactions. Companies are turning to advanced technologies and innovative tools to deliver smooth, integrated experiences across channels.

What are some of the key technologies enabling seamless transactions? Here are 15 examples:

1. Automated workflows

Workflow automation streamlines processes by reducing manual tasks. Rules-based tools route information, trigger actions, and ensure consistency without human intervention.

2. AI and machine learning

AI algorithms study data to optimize operations, personalize recommendations, and improve decision-making. Machine learning enables continuous improvement by detecting patterns.

3. Predictive analytics

By analyzing customer data and identifying trends, companies can anticipate needs and take proactive measures to provide better service.

4. Digital payment processing

Secure online payment systems like Apple Pay and Visa Checkout allow one-click purchases. Platforms like PayPal and Stripe simplify payment acceptance.

5. Order management integration

Connecting systems for inventory, fulfillment, shipping, and returns enables real-time order tracking and coordinated processes.

6. Contextual commerce

Using data like location, buying history, and calendar events, retailers can provide personalized recommendations and offers.

7. AR and VR experiences

Immersive simulated environments allow customers to preview, customize, and interact with products before purchasing.

8. IoT and connected devices

Internet-enabled appliances, vehicles, wearables, and industrial equipment facilitate automated data sharing for streamlined operations.

9. Cloud computing

Web-based apps, services, and infrastructure scale on-demand while allowing unified data access and collaboration.

10. Omnichannel integration

Linking web, mobile, call center, and brick-and-mortar experiences provides flexibility and unified commerce.

11. Digital wallets

Mobile wallets like Apple Wallet allow contactless payments, boarding passes, event tickets, loyalty cards, and IDs in one place.

12. Biometrics

Fingerprint, facial recognition, and iris scanning technologies enable secure, password-free identification and authentication.

13. Chatbots and virtual assistants

AI-powered bots provide convenient self-service options for common customer issues via messaging apps, websites, and voice assistants.

14. Blockchain

Decentralized ledgers enhance security, transparency, and traceability of transactions while reducing costs and delays.

15. 5G networks

Faster 5G wireless enhances real-time tracking and communications while expanding IoT capabilities.

By adopting these and other innovative technologies, companies can gain actionable insights, automate processes, and provide omnichannel integration. The result is seamless, personalized transactions and superior customer experiences.

With emerging technologies like edge computing, quantum computing, and 6G networks on the horizon, transactions will become even faster, smarter, and more integrated in the future. Companies need to continuously evaluate and adopt cutting-edge tools to stay competitive and meet ever-rising customer expectations for smooth, hassle-free commerce.

The most successful businesses will be the ones that use technology not just to enable transactions, but to enhance relationships. Seamless technology should make people’s lives easier, not overwhelm them with complexity. When done right, integrated systems fade into the background, leaving customers to enjoy more meaningful brand interactions.

How Minto Money Continually Improves Based on User Feedback

One key to building trust with customers is demonstrating you listen and respond to their feedback. At Minto Money, user input directly shapes our efforts to optimize every aspect of the customer experience.

We continually collect feedback through surveys, social media monitoring, app store reviews, and old-fashioned conversations. Our team analyzes this data to identify pain points and opportunities. Here are some of the ways we leverage user feedback to improve:

New feature development

Our product roadmap is largely driven by customers asking for specific tools and capabilities. When we notice users trying to hack workarounds or requesting a feature, we prioritize building it. Recent additions like automatic recurring transfers and cashback rewards redemption originated directly from user feedback.

Refining onboarding

By tracking feedback regarding account setup and early user engagement, we’ve streamlined our onboarding experience. We’ve clarified confusing steps, added tutorials, and ensured key info is more prominent.

Improving self-service options

Monitoring questions and issues coming into our customer support team helps us identify common problems to proactively address. We’ve created automated FAQs, tutorial videos, and enhanced account management tools to minimize customer effort.

Optimizing interface design

App store reviews highlight navigation and usability issues. Combined with heatmap analysis of how users click and scroll, this input guides our designers in iterating cleaner, more intuitive interfaces.

Expanding educational content

Our users want to learn! Based on topics they ask about most, we’ve published comprehensive guides on budgeting, investing, retirement planning, and more.

Adding integrations

Connecting other tools our customers use makes financial management easier. We’ve integrated with expense tracking, invoicing, tax prep, and small business platforms based on user requests.

Improving security

Staying on top of the latest fraud tactics and compliance requirements means we can proactively update our security features before issues occur. User feedback about concerns guides our roadmap.

Localization for new markets

As we’ve expanded internationally, feedback from users in each country ensures we adapt our app and content for relevant languages, currencies, banking systems, and local needs.

Troubleshooting problems

When a flurry of negative feedback indicates a bug or issue, we kick off rapid response teams to diagnose the root cause and deliver fixes fast.

Optimizing help resources

If we notice common questions or problems cropping up repeatedly, we enhance our help center content, FAQs, and in-app messaging to quickly resolve those pain points.

Improving financial tools

By monitoring how people use our budgeting, saving, investing, and planning features, we can refine the algorithms, analysis, and guidance to provide more personalized value.

Soliciting user feedback doesn’t stop after initial app development. Our philosophy is continuous improvement fueled by customer needs. We aggregate ratings, reviews, usage metrics, and direct input to regularly enhance the Minto Money experience.

This commitment earns our customers’ trust. They know we’re not just paying lip service to being user-centric – their voice truly shapes the evolution of our products and services. We appreciate everyone who takes the time to share thoughts and suggestions. This feedback is a precious gift.

Have ideas on how we can improve? Click on “Give Feedback” in the app menu. We can’t wait to hear from you!

Security Protocols That Protect You Every Step of the Way

Trust is essential when choosing a financial services provider. At Minto Money, we utilize stringent security protocols and standards to protect your information and transactions.

Here are some of the key ways we safeguard your data and accounts:

Encryption

All data in transit and at rest is encrypted using industry-standard protocols like TLS, AES-256, and RSA2048 public-private key encryption. This renders data unreadable without authorized keys for decryption.

Access controls

Role-based permissions ensure employees only access data required for their job duties. Sensitive actions require multi-factor authentication. Logs track all system access.

Firewall protection

Network firewalls block unauthorized connection attempts, vulnerability scans, denial of service attacks, and other external threats from reaching critical systems.

Endpoint security

All employee devices have antivirus software, exploit prevention, and data loss prevention controls to block malware, unauthorized access attempts, and data exfiltration.

Regular patch management

We proactively monitor and rapidly deploy security patches for operating systems, software, servers, and network devices to mitigate vulnerabilities.

Secure code reviews

In-house developers and third-party code auditors review application source code to identify and remediate vulnerabilities prior to release.

Email security

Inbound email is scanned for malware, phishing attempts, spam, and other threats before reaching employee inboxes. Outbound email is authenticated using SPF, DKIM, and DMARC to prevent spoofing.

Data minimization

We collect only the minimum personal data required to effectively serve customers. Unnecessary data is never requested or retained.

Physical security

Office access is controlled via keycard entry, security cameras, and in-person ID verification. Sensitive documents are securely shredded and equipment destroyed when no longer needed.

Backups and redundancy

Regular system images, offsite replication, high availability clusters, and failover data centers prevent data loss while maintaining uptime during outages.

Third-party risk assessments

Vendors and partners undergo rigorous security evaluations via questionnaires, documentation review, audits, and reference checks.

Ongoing staff training

Employees complete security awareness instruction during onboarding and periodic refresher courses to instill best practices for handling sensitive data.

Incident response planning

Comprehensive plans are maintained and regularly tested to rapidly detect, respond, communicate, recover, and learn from any potential security incidents.

Penetration testing

White hat hackers are hired to simulate real-world attacks against our systems and apps to proactively uncover and address vulnerabilities.

Security operations monitoring

Dedicated security staff utilize SIEM tools 24/7 to monitor systems, respond to alerts, and investigate any anomalous activity.

While no security precautions are impenetrable, our layered defenses aim to protect your information, transactions, and privacy. We adhere to strict need-to-know and least-privilege principles throughout our operations.

You also play an important role in safeguarding your data. Follow security best practices like using strong unique passwords, avoiding public Wi-Fi for banking, installing software updates promptly, and being alert to phishing risks. Let us know immediately if you observe any suspicious activity.

At Minto Money, earning your trust is our top priority. We’ll never sell or misuse your personal information. Our customer service team is available 24/7 to answer any questions or address any concerns.

You can have peace of mind knowing Minto Money utilizes advanced security technologies and protocols to keep your data safe. Our diligence means you can manage your finances with confidence.

Want to learn more about our approach to security and privacy? Check out our dedicated Trust and Safety site section. We’ve aimed for complete transparency regarding our practices and procedures.

Feel free to reach out any time with questions, feedback, or issues – we’re committed to open communication and continuous enhancement of our security protections on your behalf.

Account Options Catered to Your Unique Needs and Goals

One-size-fits-all rarely works in personal finance. That’s why Minto Money offers tailored accounts to help you achieve your specific goals.

No matter your needs and objectives, we likely have an account that’s right for you. Here are some of the options to consider:

Budgeting and basic banking

Our free entry-level accounts include powerful tools for tracking spending, sticking to budgets, and managing day-to-day finances. Ideal for students or anyone new to money management.

High yield savings

Earn significantly higher interest by parking your cash in one of our premium savings accounts. Great for building an emergency fund, saving for a big purchase, or maximizing idle balances.

Joint goals

Open a shared account with a partner or spouse for saving toward common objectives, managing household expenses, and tracking budgets together.

Custodial accounts

Start investing in your kids’ future with custodial accounts. You manage the funds until they reach adulthood. Teach financial responsibility!

Retirement planning

Whether starting your first 401k or rolling over an IRA, we help optimize accounts for retirement readiness. Take advantage of employer matches, tax benefits, and tailored investment strategies.

Trust and estate management

Special accounts help executors easily manage assets for beneficiaries. We handle all administrative tasks while providing personalized support during difficult times.

College savings

Open a 529 account to save and invest for education costs. Contributions grow tax-free. Make it easier to afford those tuition bills down the road!

Financial independence

On the road to early retirement? Investment and lending products tailored for maximizing returns can help you reach financial freedom faster.

Overseas needs

For expatriates and frequent travelers, we offer international accounts in multiple currencies with optimized debit/credit cards and money transfer features.

Business banking

Manage cash flow, invoices, payroll, taxes, lines of credit, and other financial needs that are unique to running a company.

Advanced investing

Self-directed investment accounts provide greater flexibility for sophisticated investors. Access complex products and exercise direct control.

In addition to account types, we allow customization across many other dimensions:

User permissions

Control family member access levels, set spending limits, create shared pockets for specific goals, and more for personalized money management.

Alerts and reporting

Configure personalized alerts and statements that deliver insights tailored to your priorities – whether that’s budget adherence, transaction monitoring, investment performance, fees paid, or other analytics.

Debit and credit options

Select customized physical and virtual cards optimized for your usage – specialized rewards structures, domestic or international use, restrictions, limits, and more.

Our philosophy is a perfect fit between your needs and financial products. We want to make personalized money management easy, not confusing. Our dedicated financial advocates can guide you in selecting and configuring the right accounts.

The bottom line? No two customers are exactly alike. So why should their accounts be? Minto Money meets you where you are on your financial journey and provides the specific tools to help you achieve your goals.

We continually enhance our capabilities and can even build customized solutions for unique client needs. Talk to us about your specific objectives – together we’ll pinpoint how Minto Money can cater to your personal financial needs.

The future of finance is flexible, integrated, and hyper-personalized. Our use of technology, automation, and data enables this while still retaining human insight and care. You’re a person, not a number.

Ready to open an account tailored just for you? Our easy online application takes less than five minutes. Let’s connect the ideal financial products to your life.

Educational Resources to Boost Your Financial Literacy

At Minto Money, we’re not just your financial services provider – we’re a trusted partner in building your money skills. Our suite of educational resources empowers you with knowledge.

We offer a wealth of informational materials across multiple formats. Here are some of the ways we help boost your financial literacy:

In-app guidance

Our app provides context-specific help explaining key features and concepts right at the moment you need it. Quick definitions, FAQs, and tutorials integrate directly into workflows.

Knowledge base

Our expansive searchable knowledge base contains hundreds of articles, explainers, definitions, and tips covering banking, credit, budgeting, taxes, investing, financial planning, and more.

Video courses

From quick 2-minute video tips to in-depth online courses, our growing video library breaks down complex money topics in engaging, easy-to-grasp visual formats.

Webinars and live events

Attend free webinars and seminars hosted by our financial experts on specialized topics to get personalized advice and ask questions in real-time.

Newsletter subscriptions

Sign up to receive our newsletters tailored to your interests, whether that’s budgeting help, investing insights, small business tips, account security, or other money subjects.

Infographics and guides

Discover visual guides, cheat sheets, frameworks, calculators, and other tools condensing financial concepts down to what matters most for better decision making.

Money management courses

Dive deep into multi-week courses exploring specific areas like saving, homebuying, investing basics, retirement planning, paying for college, and more. Homework and exercises reinforce the concepts.

Gamification

Have fun building financial skills through interactive games, quizzes, and simulations tailored to various ages and knowledge levels.

Instructional tutorials

Step-by-step video tutorials guide you through important money tasks like setting financial goals, creating a budget, analyzing credit reports, maximizing 401k contributions, paying down debt efficiently, and everything in between.

Podcast series

Listen and learn on the go via our anthology of podcasts featuring financial experts, case studies of real people, interviews with industry insiders, and actionable advice.

However you prefer to learn, we likely have a financial education resource tailored for you. And it’s all available for free as part of your Minto Money membership!

We also personalize our educational content based on your financial journey. For example, the app experience for a newlywed setting up their first joint budget looks very different from a grandfather rolling 401ks into an IRA. The material surfaces automatically based on member data and behaviors.

Financial literacy resources empower you to:

- Make informed money decisions

- Plan for major life goals

- Accurately compare financial products

- Spot scams and misinformation

- Have candid money conversations

- Teach children healthy financial habits

Combining educational materials with our best-in-class tools and services enables members to put knowledge into action immediately.

We’re committed to building financial literacy in our communities through free education. Knowledge is power. Everyone deserves to feel confident, capable, and in control of their finances regardless of background or experience.

At Minto Money, we don’t just process transactions. We foster informed financial citizens. This lifetime learning journey never ends as needs evolve. Let us help you reach the next level of money mastery.

Rewards and Incentives Just for Using Minto Money’s Services

At Minto Money, we appreciate your business and want to reward you. That’s why we offer various incentives just for using our services.

Here are some of the ways we help you earn while you manage your finances:

Transaction cash back

Earn cash back on debit card purchases when you enable this feature in your account. Rates vary by merchant category, with extra bonuses at partner retailers.

Referral bonuses

Refer friends to open accounts and you both get a cash reward after they meet activity requirements. Bringing people together nets everyone extra income!

Usage rewards

The more active you are, the more you earn! Just using core features like direct deposit, mobile check deposit, and bill paytriggers periodic rewards deposits.

Loyalty programs

Points earned on affiliated credit cards, mortgages, insurance policies, and other products go into a central rewards hub. Gain perks, redeem for gift cards, cash, travel, and more.

Free credit monitoring

Customers with qualifying accounts get free unlimited access to credit reports, scores, analysis, alerts, and identity theft protection services.

Fee waivers

Maintain minimum balances and activity levels to waive monthly service fees on checking, savings, and money market accounts.

Birthday surprises

Special perks like bonus interest, prize sweepstakes entries, gift cards, and dining rewards help you celebrate when your birthday rolls around.

Rate boosters

Rates on loans and deposits can receive incremental bumps based on longevity, balances, certifications (like homebuyer courses), and other loyalty factors.

Contest giveaways

Enter to win vacations, shopping sprees, event tickets, the latest tech gadgets, and more through our frequent contests and drawings.

Early access

Get first dibs on new products, features, special rates, and services before general public availability as a valued member.

The more accounts and services you utilize with Minto Money, the more ways you have to earn. It pays to consolidate your financial life with us!

Unlike gimmicky promotions, our rewards are sustainable – not just short-term incentives. We want to thank you every day for choosing Minto Money to manage your hard-earned money.

Savvy members can optimize rewards earnings through tactics like:

- Enrolling in all eligible programs

- Using the Minto Money card for everyday purchases

- Taking advantage of seasonal bonus offers

- Referring family members and friends

- Rolling external account balances into higher yielding Minto Money options

We track your lifetime rewards earnings and redemption so you always know your loyal member value. It keeps growing the longer you stay with us!

You deserve more than just accounts and transactions from your financial services provider. Why not earn tangible benefits for entrusting us with your business?

At Minto Money, we share our success with customers who made it possible. Your winnings become reinvestments toward achieving your goals. It’s a mutually beneficial relationship.

Ready to start earning while seamlessly managing your financial life? Open an account today and let the rewards accrue!

Ways To Access Your Accounts On-the-Go With Mobile Apps

At Minto Money, we enable easy account access anywhere, anytime through our user-friendly mobile apps. Manage your finances on the go!

Our iOS and Android apps allow you to:

Monitor balances and transactions

Check your up-to-the-minute balances across all accounts. Review recent transactions, pending activity, and available funds.

Transfer money

Quickly move money between internal and external accounts linked to your profile. Set one-time, recurring, and conditional transfers.

Pay bills

Review due dates, view payment history, schedule future payments, and pay bills right from your phone with a few taps.

Deposit checks

Snap photos of checks for easy remote deposits. No need to visit an ATM or branch.

Manage cards

Activate new cards, set spending limits and controls, lock/unlock cards, and request replacements from the convenience of your phone.

Track spending

Categorize transactions, create budgets, analyze spending trends over time, and receive smart alerts about your money.

Find ATMs and branches

Locate fee-free ATMs and bank branches nearby using GPS maps. Get directions, hours, and contact information.

Receive notifications

Optional push notifications keep you informed about account activity, money moves, approaching bills, status changes, and other important events.

Chat with customer service

Message representatives right in the app to get assistance with any questions or issues. Available 24/7.

Manage users and permissions

For shared accounts, set up additional users and customize specific privileges like spending limits for children.

Enroll in mobile wallet

Add your cards to payment services like Apple Pay, Google Pay, Samsung Pay, and more for contactless in-store purchases.

Mobile banking offers convenience, flexibility, organization, and peace of mind. Your financial life is easily accessible in one centralized hub no matter where you are.

Features like biometrics, passcodes, and activity notifications give you controls to prevent unauthorized access on lost or stolen devices. Security remains a top priority.

We also optimize the UI, navigation, and workflows in our apps to be intuitive. Things are where you expect them to be with no learning curve.

Updating apps frequently allows us to roll out new capabilities, respond to user feedback, and proactively fix bugs. Your needs evolve, so our mobile experience does too.

Mobile banking adoption continues to grow as people rely more on smartphones. We embrace this shift, building digital-first tools for managing finances on the go.

Download our app and unlock the power of mobile banking. You’ll wonder how you ever managed money any other way!

Let us know if you have any suggestions to improve our mobile apps. We routinely collect feedback to guide ongoing enhancements. Customer input shapes future development.

Where will you access your Minto Money account from next? The beach? The bus? Your backyard? With mobile banking, you choose!

Referral Bonuses When You Bring Friends Into the Minto Money Community

Let’s be honest – who doesn’t love getting a little something extra for helping out a friend? Referral bonuses and rewards programs are a great way for companies to show appreciation to loyal customers who spread the word. And in the world of cryptocurrency and finance apps, referral bonuses can be especially lucrative. That’s why it pays to take a closer look at the referral program offered by Minto Money, the popular cryptocurrency platform.

If you’re already a member of the Minto Money community, you know how useful the app can be for managing your crypto portfolio. The ability to buy, sell, and swap coins and tokens all in one place just makes life easier. But what you may not know is that Minto Money offers some very generous referral bonuses when you invite friends to join.

Getting started is easy – just access the ‘Refer Friends’ section in your Minto Money app. You’ll get a unique referral link that you can send to anyone you think would benefit from using Minto Money. For every friend that signs up using your link and completes the account verification process, both of you get a referral bonus added to your accounts. Cha-ching!

The first question that probably jumps to mind is: just how much can I earn from referring people to Minto Money? And the answer is – quite a lot! Minto Money currently offers a $20 CAD referral bonus to both the referrer and the referee. Considering it takes just a few seconds to share your unique link, that’s a pretty solid payout.

Even better, there’s no limit to how many friends you can refer. Get the word out on social media, text your link to contacts, or even just tell people in person. Every successful referral nets you another easy $20 in bonus cash. If you manage to sign up 10 friends, that’s $200 CAD added to your account for doing virtually nothing. Not too shabby!

The referral program is clearly a win-win for both parties. Your friends get to enjoy all the features of Minto Money, while also earning a nice welcome bonus. And you get rewarded for connecting new users to an awesome financial app. But why is Minto Money so eager to hand out referral bonuses left and right?

It basically comes down to customer acquisition. While Minto Money is already a popular platform, the company is always looking to grow its user base. And research shows that referred users tend to be more loyal and engaged over the long term, since they joined on the recommendation of a friend.

Handing out referral bonuses incentivizes current members to recruit new people to the platform. And those new users are likely to stick around if they had a trusted contact vouch for the product. It’s a textbook viral marketing tactic – get the product in front of new people and let word-of-mouth do the rest.

The referral program also helps Minto Money build credibility and trust. The fact that existing users are so eager to recommend the app to their friends signals that Minto Money offers a quality product. People generally don’t go around referring shady or fly-by-night companies. The referral bonuses show that Minto Money users genuinely believe in the platform.

At the end of the day, successful referral marketing comes down to delivering an exceptional product that people want to share far and wide. Minto Money seems to have nailed that formula, considering the hundreds of five-star reviews and thousands of sign-ups driven by word-of-mouth thus far.

And with the potential to earn easy money simply by sharing your referral link, it’s no wonder long-time users are such enthusiastic evangelists for Minto Money. Keeping members happy and engaged is the best way to organically grow a loyal community over time.

So if you’re already reaping the benefits of Minto Money for your crypto portfolio, why not spread the love and earn some extra cash in the process? Whip out your referral link today and let your friends know what they’re missing out on. Financial apps as polished and feature-rich as Minto Money don’t come around too often.

Getting in on the ground floor of the next big thing in fintech will always be rewarding. But earning solid referral bonuses along the way? Even sweeter. Minto Money clearly understands the power of incentivized word-of-mouth. Leverage your insider status and see how much your social clout is worth!

Minto Money’s Commitment to Complete Transparency

Trust is the cornerstone of any successful financial relationship. When dealing with your hard-earned money, you need to know that the company you’re working with has integrity and transparency at the core of its operations. In the world of cryptocurrency and fintech apps, scams and shady behavior unfortunately abound. That’s why it’s so refreshing to see a platform like Minto Money make transparency and openness central to its mission.

As a user of Minto Money, you have access to a wealth of information about the company’s business practices, security measures, leadership team, and more. Minto Money seems to understand that trust is built through transparency about who they are and how they operate.

For starters, the Minto Money website provides in-depth bios on the founders and key team members. You can learn about their professional backgrounds and areas of expertise. This gives you confidence that qualified individuals are leading the company. There are no anonymous figures hiding behind the scenes.

The website also includes a detailed overview of Minto Money’s proprietary security protocols. They outline the cutting-edge encryption, two-factor authentication, and other measures used to protect user assets. Knowing your personal information and holdings are safeguarded provides great peace of mind.

In their Help Center and FAQ sections, Minto Money provides straightforward answers to common questions about their fees, supported currencies, referral programs, and more. You won’t find any fine print or hidden surprises. Just clear, upfront information when you need it.

Minto Money also sets the bar for transparency through comprehensive reporting on their reserves. They engage third-party firms to conduct regular audits verifying that their assets match user balances. You can review these audit reports yourself for an added layer of assurance.

Additionally, Minto Money publishes real-time data on trading volumes, platform traffic, and other key metrics. There’s no secrecy around how much business they conduct or how many people interact with the platform. The numbers speak for themselves.

This across-the-board openness provides visible proof that Minto Money is a reputable company committed to integrity. They know that erecting barriers or obfuscating details only breeds distrust among users. Operating transparently is the only way to build a sustainable business in such a high-stakes industry.

The transparency extends to Minto Money’s vocal community of users. Reviews and discussions on social media and app store platforms make it easy to get unfiltered feedback from real customers. The overwhelming positivity reflects the quality and reliability users have experienced first-hand.

Potential new users can browse these transparent discussions to help verify Minto Money is legit before signing up. Current customers also benefit from the open feedback loop to continue improving the platform.

Some fintech companies try to hide behind polished marketing and stiff corporate-speak. But Minto Money seems to recognize that genuine trust comes from putting everything out in the open. The complete transparency across all aspects of their business separates them from less scrupulous players.

Knowing you have visibility into the people, protocols, and metrics behind Minto Money allows you to make informed decisions. You can dig as deeply as needed to gain assurance that your finances are in good hands. No need to simply hope for the best.

In the end, actions speak louder than words. Minto Money’s robust track record of transparent operations shows integrity is woven into the fabric of the company. They know hidden fine print and obscured practices have no place in the financial world. By putting it all out in the open, Minto Money earns your trust each and every day.

So if you’re looking for an upfront and honest partner to help you navigate the world of crypto, Minto Money checks all the boxes. Their commitment to transparency provides the confidence boost you need to maximize the opportunities ahead. Openness and trust go hand in hand.

Why So Many Customers Consider Minto Money a Trusted Financial Partner

In the fast-paced world of fintech and crypto investing, users have tons of options when it comes to selecting a financial services platform. New apps and exchanges crop up on a regular basis, each promising the latest features and greatest returns. So what sets a company like Minto Money apart from the pack? Why do so many customers view it as a trusted partner for the long-term?

While flashy promotions and gimmicky offers might attract some users, they do little to build genuine trust. And in the high-stakes world of personal finance, trust is everything. No one wants to link hard-earned money to an unreliable or opaque platform.

That’s why Minto Money puts cultivating user trust at the heart of its operations. Everything from customer service to transparency policies are designed to help clients feel secure choosing Minto Money as a financial ally.

For starters, user trust is gained by providing an exceptionally polished and intuitive platform. Clean, professional design shows that no corners were cut. Solid functionality without persistent glitches demonstrates rigorous quality testing. And clear, jargon-free language makes complex crypto investing accessible to everyday people.

Seamless customer support also plays a big role in building user confidence. Questions get answered promptly by knowledgeable human representatives, not outsourced bots. Issues get escalated and resolved efficiently. Respectful communication is maintained throughout. Users feel heard and supported, deepening trust.

Additionally, Minto Money recognizes that transparency is essential for cultivating loyalty among customers. Detailed information about the company’s leadership, business operations, security protocols, and more is made readily available. Hiding behind smoke and mirrors only breeds suspicion.

Extensive third-party audits provide further validation that Minto Money deserves user trust. Independent verification of their reserves and practices adds an extra layer of accountability. Users don’t have to just take their word for it.

Minto Money also lets genuine user experiences shine through via reviews, forums, and ratings. Unfiltered feedback from fellow customers carries more weight than any marketing hype. When real people validate quality, trust flourishes.

Responsiveness to user concerns also maintains trust over the long run. Minto Money incorporates feedback to constantly refine and enhance the platform. Users see their voices shape improvements, keeping satisfaction high as new needs emerge.

At its core, Minto Money seems to realize that trust isn’t given automatically – it must be earned consistently through actions big and small. Doing right by users day in and day out cements bonds that weather any storm.

Trust runs both ways too. Minto Money entrusts users by eliminating overly restrictive account holds, approvals, and limits. Less friction means users can truly own their financial experience. Minto Money’s confidence in their customers engenders reciprocated trust.

While flashy gimmicks come and go, Minto Money focuses on nurturing the pillars of trust that support any lasting relationship. Ethical business practices, responsive customer service, leadership integrity, platform reliability, and user empowerment combine to make Minto Money a trusted brand.

At the end of the day, people want to feel secure when making financial decisions that impact their livelihoods. Minto Money recognizes that cultivating trust is the only path to establishing those bonds long-term. Empty promises mean nothing – but consistently demonstrating genuine commitment to users means everything.

So while new fintech players will continue to make a splash with bold claims and novel features, Minto Money sets itself apart by doubling down on the trust factor. Users have plenty of options out there, but reliable partners are hard to find. By proving its integrity day after day, Minto Money earns a spot as one of those rare trusted allies you keep by your side for the long haul.