How did Phil Knight build Nike from scratch. What key innovations did Mark Parker bring to Nike. Why is the Jordan Brand so crucial for Nike’s success. How has Nike’s advertising strategy evolved under different leadership. What challenges does Nike face in its supply chain management. How might ousting the current CEO impact Nike’s future.

The Battle for Nike’s Throne: Legendary Founder vs Modern Visionary

In a scenario set in 2025, Nike’s boardroom is heating up with a potential power struggle between its iconic founder, Phil Knight, and the current CEO, Mark Parker. This clash of titans represents more than just a typical founder-successor dispute; it’s a collision of eras, philosophies, and visions for one of the world’s most recognizable brands.

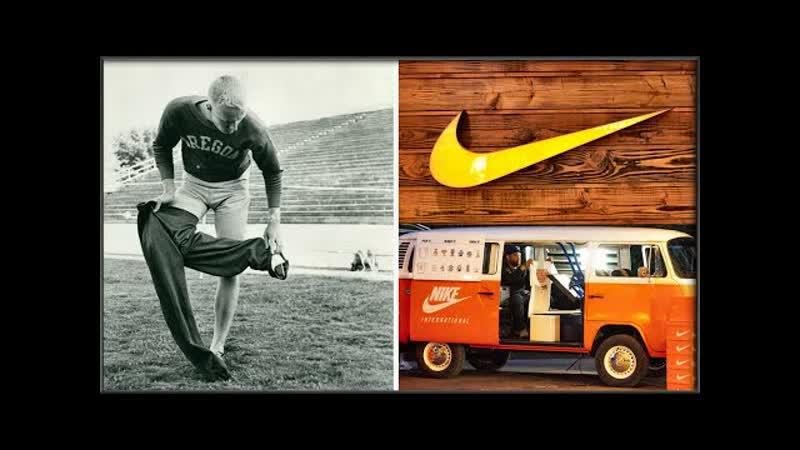

Phil Knight: The Architect of the Swoosh

Phil Knight, with a staggering net worth of approximately $50 billion, stands as a colossus in the business world. His journey from selling shoes out of his car to building Nike into a global powerhouse is the stuff of entrepreneurial legend. Knight’s vision and determination in Nike’s formative years have earned him unparalleled respect and influence within the company, even years into his retirement.

Mark Parker: The Modernizer

Under Mark Parker’s leadership, Nike has undergone a dramatic transformation. No longer just a sneaker company, Nike has diversified into athletic apparel, sports equipment, and digital health tracking. Parker’s tenure has seen Nike generate over $10 billion annually from non-sneaker divisions, a testament to his strategic vision and ability to adapt to changing market dynamics.

Clashing Ideologies: Old School Performance vs New Age Disruption

The core of this potential conflict lies in the contrasting approaches of Knight and Parker. Knight, often viewed as old school, emphasizes performance sneakers and high-profile advertising campaigns. This time-tested formula has served Nike well for decades. Parker, on the other hand, represents a new direction, focusing on diversification and industry disruption.

Is Nike’s future in staying true to its roots or embracing radical change? This fundamental question underlies the tension between these two visionaries.

The Enduring Magic of Jordan Brand

Despite Parker’s success in expanding Nike’s portfolio, the Jordan Brand remains the company’s crown jewel. The synergy between Michael Jordan and Nike, nurtured by Phil Knight from its inception, has created a brand identity that transcends sport. This enduring legacy gives Knight a powerful advantage in any potential power struggle.

Digital Revolution: Parker’s Ace in the Hole

Mark Parker has been instrumental in catapulting Nike into the digital age. His initiatives, including Nike+ running sensors and the SNKRS app, have leveraged cutting-edge technology to engage consumers in novel ways. Parker’s expansion of e-commerce and digital marketing teams globally has positioned Nike to dominate in an increasingly online retail landscape.

How significant is Nike’s digital transformation in securing its future? Parker’s focus on digital innovation has equipped Nike with tools to personalize customer experiences and streamline online sales, a stark contrast to Knight’s more traditional approach.

Supply Chain Woes: A Chink in Parker’s Armor

Despite Parker’s digital prowess, Nike has faced persistent supply chain challenges under his leadership. Product shortages, shipping delays, and inventory management issues have plagued the company, raising questions about Parker’s ability to manage Nike’s global operations effectively. In contrast, Knight’s legacy includes building a robust operational infrastructure, potentially giving him an edge in this crucial aspect of the business.

Advertising Evolution: From Aspirational to Controversial

Phil Knight has publicly criticized Nike’s recent advertising as “lazy,” highlighting another point of contention with Parker. While Knight favors big branding campaigns featuring star athletes, Parker has approved more edgy and experimental marketing strategies.

The “Dream Crazy” campaign featuring Colin Kaepernick exemplifies this shift. While celebrated by many, it also sparked controversy and boycotts. Parker’s willingness to take political stands in Nike’s branding represents a significant departure from Knight’s more universally appealing approach.

Can Nike maintain its broad appeal while taking stands on divisive issues? This question encapsulates a key strategic difference between Knight and Parker.

Strategic Maneuvers: The Chess Game for Nike’s Future

Both Knight and Parker appear to be making calculated moves to strengthen their positions. Knight has reclaimed his status as board chairman and acquired a stake in Nike competitor Peloton. Meanwhile, Parker continues to push forward with innovations like FlyEase hands-free shoes and ventures into metaverse apparel.

These strategic maneuvers reflect the high stakes involved in controlling Nike’s future direction. Each move seems designed to demonstrate vision and reinforce influence within the company.

The Risks of Radical Change

Any drastic action to remove Parker from his position could have far-reaching consequences for Nike. It might damage recently improved executive and board relationships, cause employee unrest, and potentially tarnish the brand’s image during an uncertain economic period.

Given these risks, could a partnership between Knight and Parker be the optimal solution for Nike’s future?

The Synergy of Experience and Innovation

While tensions between Knight and Parker are evident, their complementary strengths suggest that collaboration might be more beneficial than conflict. Knight’s unparalleled experience and brand legacy, combined with Parker’s innovative approach and digital acumen, could create a powerful leadership dynamic.

How might Nike benefit from harnessing both Knight’s foundational wisdom and Parker’s forward-thinking strategies? This collaboration could potentially drive Nike to new heights, blending respect for its heritage with a bold vision for the future.

Nike’s Global Impact: Beyond Business

The outcome of this leadership tussle has implications far beyond Nike’s bottom line. As one of the world’s most recognizable brands, Nike’s decisions influence global trends in sports, fashion, and even social issues.

Corporate Responsibility and Sustainability

Under Parker’s leadership, Nike has made significant strides in corporate responsibility and sustainability. The company has set ambitious targets for reducing its environmental impact and has been at the forefront of developing sustainable materials for its products.

How would a potential leadership change affect Nike’s commitment to sustainability? This question is crucial not only for Nike’s brand image but also for its long-term viability in an increasingly environmentally conscious market.

Innovation in Sports Technology

Nike’s influence extends into the realm of sports technology and performance enhancement. From the controversial Vaporfly running shoes to the development of advanced materials for athletic wear, Nike’s innovations have sometimes blurred the lines between competitive advantage and unfair edge in sports.

Will Nike continue to push the boundaries of sports technology, potentially influencing the very nature of athletic competition? The answer to this question could depend on whether Knight’s performance-focused approach or Parker’s broader technological vision prevails.

The Global Economic Impact of Nike’s Leadership

As one of the largest sportswear companies in the world, Nike’s business decisions have far-reaching economic implications. The company’s supply chain spans the globe, providing employment and driving economic activity in numerous countries.

Manufacturing and Labor Practices

Nike’s approach to manufacturing and labor practices has evolved significantly since the controversies of the 1990s. Under Parker’s leadership, the company has made efforts to improve working conditions and increase transparency in its supply chain.

How might a change in leadership affect Nike’s stance on labor practices and manufacturing strategies? This question is crucial not only for Nike’s reputation but also for the livelihoods of thousands of workers in its global supply chain.

Market Influence and Competition

Nike’s market position gives it significant influence over trends in the sportswear industry. The company’s strategies often set the pace for competitors and shape consumer expectations.

Will Nike maintain its market-leading position, or could internal conflicts provide opportunities for competitors? The outcome of the Knight-Parker dynamic could have ripple effects throughout the entire sportswear industry.

The Future of Athlete Sponsorships and Marketing

Nike’s approach to athlete sponsorships and marketing has been a cornerstone of its brand identity. From Michael Jordan to Serena Williams, Nike’s partnerships with elite athletes have defined eras in sports and popular culture.

Evolving Athlete-Brand Relationships

Under Parker’s leadership, Nike has expanded its definition of an athlete, partnering with a more diverse range of individuals and causes. This shift reflects changing societal values and a broader interpretation of sports and athleticism.

How will Nike’s athlete partnerships evolve in the future? The answer could depend on whether the company adheres more closely to Knight’s traditional star-athlete model or continues to expand its definition of athletic endorsement.

Digital Marketing and Social Media Engagement

Parker’s tenure has seen a significant shift towards digital marketing and social media engagement. Nike has leveraged platforms like Instagram and TikTok to connect with younger audiences and create viral marketing moments.

Will Nike continue to lead in digital marketing innovation, or will it return to more traditional advertising methods? The resolution of the Knight-Parker dynamic could significantly influence Nike’s marketing strategies in the coming years.

Nike’s Role in Shaping Athletic Culture

Beyond its products and marketing, Nike plays a significant role in shaping athletic culture worldwide. The company’s initiatives in grassroots sports, urban athletics, and fitness trends have far-reaching impacts on how people engage with physical activity and sports.

Promoting Inclusivity in Sports

Under Parker’s leadership, Nike has made efforts to promote inclusivity in sports, developing products like the Pro Hijab and expanding its range of adaptive sportswear. These initiatives reflect a commitment to making sports accessible to a wider range of people.

How will Nike’s approach to inclusivity in sports evolve? The answer to this question could have significant implications for athletic participation and representation globally.

The Future of Fitness and Wellness

Nike’s influence extends beyond traditional sports into the broader realms of fitness and wellness. The company’s digital platforms and wearable technologies have positioned it as a player in the health and wellness industry.

Will Nike continue to expand its presence in the fitness and wellness space, or will it refocus on its core sportswear business? This decision could shape not only Nike’s future but also trends in how people approach personal fitness and health monitoring.

As the potential showdown between Phil Knight and Mark Parker unfolds, the implications stretch far beyond a simple leadership change. The outcome of this clash of titans could reshape not only Nike’s future but also influence global trends in sports, fashion, technology, and corporate responsibility. Whether through conflict or collaboration, the interplay between Knight’s foundational vision and Parker’s innovative drive will undoubtedly leave an indelible mark on one of the world’s most iconic brands.

Introduction: The Legendary Founder vs the Modern Visionary

The year is 2025 and tensions are reaching a boiling point in Beaverton. Nike’s legendary founder, Phil Knight, has returned from retirement and is making power moves to oust current CEO Mark Parker. On the surface, it appears to be a classic founder vs successor showdown. But a deeper look reveals key differences that could decide who ultimately prevails in this battle for the sneaker throne.

Phil Knight’s Net Worth Provides Massive Influence

With a net worth hovering around $50 billion, Phil Knight has immense wealth and influence. He built Nike from scratch into one of the most recognizable brands on the planet. Many insiders believe the swoosh would not exist today if not for Knight’s vision and determination in the early days. This gives the founder huge sway behind the scenes, even in retirement. But does this translate to support in a head-to-head faceoff versus the current CEO?

Mark Parker Moved Nike Beyond Sneakers

While Knight founded Nike, Mark Parker is credited with evolving it into a diverse, tech-focused giant. Under Parker, Nike has aggressively expanded into new product categories like athletic apparel, sports equipment, and digital health tracking. The brand also now generates over $10 billion annually from non-sneaker divisions. Parker drove these initiatives by investing heavily in digital, sustainability, and key acquisitions like Converse.

The Founder’s Old School Ways vs The CEO’s New Thinking

Herein lies the core tension. Phil Knight is seen as old school – focused on performance sneakers and big ad campaigns. He brings a time-tested formula, but some feel it’s outdated. Parker represents a new direction, diversifying Nike and disrupting the industry. However, detractors argue he’s straying too far from the brand’s heritage. How this ideological clash plays out could tilt the scales in this CEO faceoff.

But Knight’s Jordan Brand Magic Endures

While Parker expanded Nike, the Jordan brand remains its crown jewel. Many view Michael Jordan and Nike as identical. Parker has managed Jordan well, but Phil Knight nurtured that relationship and magic from the start. In a winner-take-all duel for control, Knight’s Jordan ties and mystique give him a potent trump card.

Parker’s Digital Innovation Goes Global

Mark Parker turbocharged Nike’s digital transformation. Initiatives like Nike+ running sensors and SNKRS app tap the latest tech to engage consumers. He also expanded e-commerce and digital marketing teams globally. As buying shifts online, Parker has equipped Nike to dominate digital sales and personalization. Knight’s analog approach now seems dated versus Parker’s digital prowess.

But Clouds loom Over Parker’s Supply Chain

For all of Parker’s digital savvy, supply chain woes have soured his legacy. Constant product shortages, shipping delays and bloated inventories have plagued Nike. While macro forces are partly to blame, many question Parker’s global supply chain leadership. Knight built an operations empire, giving him an advantage on this critical dimension of the business.

Knight Criticizes Parker’s ‘Lazy’ Advertising

In another dig, Phil Knight criticized Nike’s recent advertising as “lazy.” This ramps up tension with Mark Parker, who approved Nike’s edgier ads. Knight feels Parker has strayed too far from Nike’s aspirational roots. The founder still craves big branding campaigns with star athletes, while Parker favors experimental and social media-led marketing.

But Parker’s Politics May Alienate Some

Unlike Knight, Parker has not shied away from taking political stands in Nike’s branding. The “Dream Crazy” Kaepernick ad was celebrated by many but spurred controversy and boycotts. As society grows more divided, Parker’s willingness to pick sides in cultural battles may undermine staff and consumer unity. Knight was careful to keep Nike universal.

The Billionaire Founder Plays Chess, The CEO Sticks to His Vision

Like grandmasters, Knight and Parker seem to be strategically maneuvering for advantage. Knight recently reclaimed board chairman status and bought a stake in Nike competitor Peloton. Parker continues pushing his FlyEase hands-free shoes and metaverse apparel initiatives. They appear locked in a high stakes chess match for control of Nike’s future.

But Would Ousting Parker Cause Brand Chaos?

For all the maneuvering, Knight must hesitate before making any drastic move against the CEO. Removing Parker could damage recently-repaired executive and board relations. It may also cause employee upheaval and tarnish the swoosh during a tricky economic environment. After weighing these risks, Knight may conclude the better play is partnering with Parker.

The Verdict: Knight and Parker Need Each Other

While tensions run high, my take is Phil Knight and Mark Parker need each other. Knight’s founder story and Jordan brand power balances Parker’s digital innovation and expansion beyond sneakers. Together, they represent Nike’s past, present and future. Rather than a messy overthrow, Knight should leverage his influence to align Parker with Nike’s core strengths. Their dynamic rivalry can lift Nike to new heights – if egos don’t get in the way.

Phil Knight’s Net Worth and Influence Over Nike

Phil Knight’s staggering $50 billion personal net worth gives him immense power and sway. He owns over 10% of Nike stock, valued at over $30 billion. This makes Knight the second largest individual shareholder after members of the family of company co-founder Bill Bowerman. Unlike typical corporate founders, Knight has held onto his Nike stake for decades. This stock position ensures the Nike board and leadership team can’t easily ignore his opinions or demands.

Beyond the numbers, Knight’s legacy as the creator of Nike gives him an almost mythical status within the company. Thousands of current employees joined after Knight stepped down as CEO in 2006. But they still know the stories – starting Nike with one employee and a trunk full of shoes, mortgaging his house multiple times in the early cash-strapped days, and conquering shoe giants with groundbreaking marketing. Parker may be CEO, but he can’t match Knight’s larger-than-life founder mystique.

The Swoosh Empire Owes Knight Everything

When Phil Knight first sold shoes out of his car at local track meets, Nike didn’t officially exist. The company rose from humble origins due entirely to Knight’s relentless will and vision. In the 1960s, established footwear players like Puma and Adidas dominated the market. Through innovation and grit, Knight took Nike from startup to global titan. Employees today realize the swoosh likely wouldn’t be here if not for Knight’s tenacity in those early years.

Knight Immersed Himself in the Shoe Wars From Day One

Phil Knight has shoes in his veins. From his college track days as a Nike prototype shoe tester to leveraging the waffle iron inspiration behind Nike’s first soles, Knight has always immersed himself in the details. Even as CEO, he would personally test shoe innovations. This intimate knowledge of Nike’s heritage gives Knight authority with footwear designers that Parker can’t match. When Knight speaks on performance sneakers, few would think to question him.

The Air Jordan Legacy Is Knight’s Trump Card

Knight’s most valuable influence source is his ties to Nike’s Jordan Brand. It was Knight who originally pursued the rookie Michael Jordan, sensing his marketing potential. Knight nurtured Jordan’s rise from the start, investing in him as the face of Nike despite early doubts within the company. Even today, insiders view the Air Jordan dynasty as synonymous with Phil Knight. This gives Knight unmatched credibility with Nike’s most devoted fans worldwide.

Current Leadership Came of Age Under Knight

Today’s Nike executives grew up professionally under Phil Knight’s leadership. Parker became Nike’s president of global footwear in 1993 while Knight was CEO. Even younger rising stars within the company joined during the Knight era. So while Knight has been out of the CEO role since 2006, today’s leadership learned management directly from him. They understand Knight’s high standards and strategic philosophy on a visceral level.

The Founder Wields Power Through Legacy and Lore

Unlike most executives, Knight derives power not from his current title, but from his legacy. As founder, mentor and coach to many current leaders, vast shareholder wealth, Jordan brand magic, and reputation as the creator of Nike itself, Knight has influence that transcends normal corporate hierarchy. While Parker is theoretically in charge, Knight has many ways to wield power through sheer force of reputation and history.

The dynamics between Phil Knight and today’s Nike leadership team are complex. But make no mistake – his legacy and vast resources give the founder cards to play in any battle for Nike’s future direction. With Knight now stepping back up as board chairman, his influence at Nike is undiminished.

Mark Parker’s Innovations and Brand Expansion

When Mark Parker took over as Nike’s CEO in 2006, the brand relied heavily on footwear sales. Parker diversified Nike’s product mix by aggressively growing apparel, equipment, and accessories. He also accelerated Nike’s digital transformation through acquisitions, partnerships, and internal product development.

Apparel Became a $10 Billion Business Under Parker

Recognizing shifting consumer trends, Parker rapidly scaled Nike’s apparel division. He invested in performance fabrics like Dri-FIT to make Nike shirts and pants a must-have for athletes. Parker also expanded lifestyle apparel via hot collaborations with celebrities like Michael Jordan. Today, Nike tops $10 billion in annual apparel sales, almost matching footwear.

Women’s Business Got Needed Focus

Parker prioritized Nike’s historically underserved women’s market. He grew women’s-specific apparel lines and funded a women’s initiative called Nike Goddess. Nike is now the top women’s athletic brand. Female consumers have become a key growth engine under Parker’s leadership.

Equipment Like Bags and Headphones Took Off

Leveraging Nike’s brand power, Parker entered new equipment categories like athletic bags, headphones, and sunglasses. This expanded Nike’s share of wallet beyond shoes and clothing. Accessories now make up over 10% of Nike’s sales, adding revenue diversity.

Health Tech Investments Tap New Markets

Parker made Nike a player in digital health tracking through partnerships with Apple and acquisitions like Fitsense. Owning health data makes Nike more embedded in athletic lifestyles. Under Armour’s struggles with tech wearables highlight the wisdom of Parker’s investments.

Acquisitions Like Converse Maintained Momentum

To inject new brands and capabilities into Nike, Parker engineered acquisitions like Converse, Hurley International, and Nike Bauer Hockey. This avoided overreliance on Nike’s namesake brand. Converse in particular soared under Nike’s ownership to over $2 billion in sales.

Nike Became a Global Digital Retail Powerhouse

Parker supercharged Nike’s e-commerce infrastructure, now generating over 30% of sales online. He also built digital experiences like Nike apps, SNKRS for limited releases, and Nike Fit to scan feet and recommend shoes. This digital focus will enable Nike to thrive long after physical retail declines.

Sustainability Initiatives Aimed to Protect the Planet

Under Parker, Nike implemented major sustainability programs to minimize environmental impact. These span recycled materials, renewable energy, and waste reduction. While not affecting the bottom line yet, Parker’s sustainability push helped counter activist pressure and burnished Nike’s social image.

Parker Took Decisive Action, But Also Big Risks

Mark Parker moved aggressively on many fronts to evolve Nike beyond Phil Knight’s performance shoe roots. This rapid transformation involved risk, including distracting Nike from core strengths. But while ambitious, Parker’s big bets on digital, women’s, apparel, sustainability and global direct sales changed Nike’s trajectory in positive ways.

Mark Parker’s tenure has seen successes, but also strategic questions as Nike stretched beyond its heritage. But few would deny Parker took bold action to ready Nike for the future. What comes next will determine his ultimate legacy.

CEO Battle Royal: Could Phil Knight Take Down Mark Parker in an Epic Nike Faceoff?

Key Differences in Leadership Style and Vision

A potential battle for control of Nike between founder Phil Knight and current CEO Mark Parker has intrigued industry watchers. Knight, now 84, served as CEO of Nike from 1968 to 2004, overseeing the company’s rise from a scrappy startup to a global sportswear powerhouse. Parker, 65, took over in 2006 and is credited with accelerating Nike’s digital transformation and focus on innovation. But now, rumors swirl that Knight is making moves to oust Parker and reassert control. What could spark such an epic faceoff? Most point to key differences between the two leaders’ styles and visions for Nike’s future.

Centralized vs. Decentralized Leadership

As CEO, Knight ran Nike with an iron fist. He made virtually all major decisions and controlled operations with a centralized authority. Parker took a different approach, empowering teams and managers. He gave Nike’s divisions more autonomy to operate independently. While Knight’s centralized style allowed him to directly shape Nike’s path, Parker’s decentralized approach is credited with driving creativity and experimentation across the company.

Product Design vs. Brand Building

Knight was obsessively focused on product design and performance. He believed superior products were key to outcompeting rivals like Reebok and Adidas. Parker shared Knight’s product passion initially, having himself designed early Nike Air sneakers as a young designer at the company. But as CEO, Parker pivoted to emphasize brand building, marketing and connecting with youth culture. For instance, he championed Nike’s viral hit ad campaign with NBA superstar LeBron James, “What Should I Do?”.

Innovation vs. Operational Excellence

As CEO, Knight stressed operational excellence and lean efficiency. He streamlined production and strictly controlled costs. Parker aimed to make Nike a perpetual innovation machine. He launched Nike Digital Sport to pioneer wearable tech. He formed partnerships with tech firms like Apple to integrate Nike services into their devices. Parker also opened Nike innovation incubators globally to tap local ideas and made sustainability a key goal, seeing it as an innovation opportunity.

Athletic Performance vs. Lifestyle Branding

While Knight focused Nike firmly on performance footwear and apparel for serious athletes, Parker expanded Nike’s appeal as a lifestyle brand. He drove Nike’s segmentation strategy targeting casual wearers and fashion-forward urban youth. Parker increased Nike’s style offerings and struck collaborations with celebrities and designers to develop must-have lifestyle sneakers and athleisure apparel. This expanded Nike’s reach and sales beyond hardcore sports fans.

Behind-the-Scenes vs. Outspoken Advocate

As CEO, Knight shunned the spotlight and let Nike’s edgy marketing speak for itself. Parker adopted a much higher profile, regularly speaking out on social causes relevant to Nike’s customer base. For example, he has been outspoken on sustainability, racial justice, and equal rights – aligning Nike with the values of socially-conscious young consumers. While controversial at times, Parker’s outspokenness has built Nike’s brand as a company that takes stands on issues that matter to its community.

In the end, Parker’s more decentralized, innovative and lifestyle-focused approach has proven hugely successful, with Nike excelling financially under his leadership. But Knight’s return would likely see a reversion to centralized control, operational discipline, and hardcore performance branding. This stark contrast shows why the two leaders’ visions for Nike’s future may no longer align – setting the stage for a historic CEO faceoff at the swoosh.

But will Knight’s legend and founder status be enough for him to wrest control from the well-entrenched Parker? Could Parker’s digital savvy and close ties to Nike’s now-diverse customer base give him an edge in a power struggle? The synergy between the two leaders did wonders for Nike in the past. But if their relationship turns combative, it could destabilize the sportswear icon. There’s much at stake for Nike’s culture and direction in what would surely be an epic battle of the sneaker titans.

CEO Battle Royal: Could Phil Knight Take Down Mark Parker in an Epic Nike Faceoff?

Knight’s Old School Approach vs Parker’s Tech Focus

The potential power struggle at Nike between founder Phil Knight and CEO Mark Parker stems largely from their contrasting leadership styles and visions. Knight, who drove Nike’s early success, is an old school, performance-obsessed sneakerhead. Parker, who has led Nike to new heights this century, is a tech-savvy innovator. This culture clash could spark an epic battle for control of the swoosh.

As CEO from 1968-2004, Knight ingrained his intense focus on product performance and no-nonsense attitude into Nike’s DNA. He pored over shoe designs, insisting materials and construction support athletic prowess. Marketing simply amplified those product benefits. Knight also ran Nike top-down, keeping decision-making centralized and costs tightly controlled.

Parker brought a distinctly different vision to the CEO role since taking over in 2006. He embraces innovation, collaboration and leveraging technology to energize Nike. Parker gave product teams more freedom to experiment. He connected Nike’s gear to digital services and wearable tech. Sustainability became a priority under his watch. Parker also rebranded Nike beyond hardcore sports to tap lifestyle markets.

Old School Shoedog vs Tech Visionary

To Knight, products were Nike’s sole focus – building better shoes was the key to beating Adidas and Reebok. He left no stone unturned in improving performance and quality. Parker certainly appreciated those fundamentals initially. But as CEO, he’s more excited by the possibilities of digital integration and tech innovation. He aims to keep Nike at the forefront of what’s next.

Command-and-Control vs Loose-Rein Leadership

Knight maintained authoritarian control over all major decisions as CEO. His word was law. Parker took the opposite approach, giving teams more latitude to operate independently. He believes empowering divisions spurs creativity. Knight ensured tight operational discipline. Parker sees room for loose-rein experimentation.

Athletic Excellence vs Lifestyle Branding

Knight steered Nike squarely toward performance products for serious athletes. That was the company’s sole focus and core competency under his watch. Parker seized upon athleisure trends and the sneakerhead subculture to expand Nike’s appeal as a lifestyle brand. He drove the segmentation necessary to make Nike equally relevant to urban fashionistas.

Just Do It vs Take a Stand

Knight was notorious for avoiding the spotlight and letting Nike’s edgy marketing do the talking. But Parker recognizes today’s consumers expect brands to engage on social issues. He regularly speaks out on causes important to Nike’s diverse customer base – like racial justice, climate action and LGBTQ rights.

In many ways, Parker’s innovative and socially-conscious vision for Nike aligns well with today’s market realities. But Knight’s singular focus on world-class athletic performance remains deeply ingrained in Nike’s DNA. This culture clash helps explain why Nike’s legendary leaders may be on a collision course. Can the two sneaker titans smooth over their stylistic differences? Or will Nike’s future be defined by an earth-shaking founder vs CEO showdown?

Perhaps each leader’s strengths can balance the other’s weaknesses if an all-out power struggle is averted. Parker’s tech savvy and marketing flair could reinvigorate performance innovation. Knight’s voice could refocus operations and margins. But a complete Knight takeover to restore top-down control risks losing the cultural progress Nike has made under Parker. The inverse is also true if Parker consolidates power. Ultimately, compromise may be critical. Each titan must allow the other just enough sway over Nike’s direction to feel invested and satisfied. An epic CEO battle royal could bring Nike to its knees if neither giant prevails definitively. Like yin and yang, their contrasting but complementary styles may be key to Nike’s continued success.

CEO Battle Royal: Could Phil Knight Take Down Mark Parker in an Epic Nike Faceoff?

The Success of Nike Air Jordan Under Knight

Phil Knight’s relentless focus on performance and excellence during his tenure as Nike CEO helped birth one of the company’s most iconic and lucrative franchises – Air Jordan. This case study in founder-driven innovation highlights why Knight may now be gunning to reassert control and bring back Nike’s old school product focus under current CEO Mark Parker.

In 1984, a then-rookie Michael Jordan was seeking a sneaker deal. Major brands showed little interest, but Knight saw tremendous marketing potential. He signed Jordan, launching the Air Jordan line with the now-legendary Air Jordan 1. Knight drove the shoe’s performance design himself, demanding excellence. But his real genius was branding Jordan’s emerging superstar talent as the face of Nike.

The Air Jordan line allowed Knight to blend his two great passions – engineering top-flight sportswear and amplifying its appeal through marketing.Knight refined each new Air Jordan model to push performance boundaries. He also gave Jordan unprecedented creative input on design to ensure authenticity. And Knight built Jordan’s persona into a dynamic and edgy marketing campaign that made Air Jordan the pinnacle of athletic cool.

Performance and Passion

Knight’s zeal for outstanding design and materials made Air Jordan a performance standout from the start. The banned Air Jordan 1 set new standards for support and responsiveness on the court. Knight consistently improved cushioning, fit and durability with each iteration, often incorporating new technologies like Nike Air. He spared no expense perfecting Air Jordan to meet Jordan’s exacting standards.

Cultural Icon

Knight knew marketing would make Air Jordan as much a cultural force as sportswear achievement. His campaigns with Spike Lee immortalized Jordan’s athletic brilliance while cementing his persona as a consummate trash-talking winner. Air Jordan became the must-have status sneaker for urban trendsetters and an icon of hip hop and youth culture – thanks to Knight’s marketing mastery.

Legacy

Under Knight’s close guidance, Air Jordan became far more than a sports shoe. It morphed into a juggernaut lifestyle brand that came to embody achievement, greatness and swaggering attitude. At Nike, the Air Jordan dynasty encompasses 28 core models that have spawned thousands of colorways and spinoff products. Sales topped $3.6 billion in 2020. Knight showed vision in signing Jordan when others balked. But it was his product passion and marketing moxie that built the undisputed king of sneakers.

Air Jordan’s phenomenal rise illuminates Knight’s greatest strengths as a founder-leader. His intense focus on excellence and leveraging personality to sell product may explain why Knight now seeks fuller control. In his eyes, reigniting Nike likely requires tapping the formula that fueled Air Jordan’s success. For CEO Mark Parker, the challenge is blending Knight’s old school product zeal with modern digital savvy and a lifestyle focus to keep Nike dominant. If not artfully balanced, the two titans’ dueling philosophies could derail Nike’s future.

Ultimately, Knight and Parker both want Nike to win. Knight built the swoosh into a global powerhouse before passing the reins. Parker then catalyzed Nike’s digital transformation and cultural resonance. Avoiding a disruptive CEO battle royal may come down to each leader recognizing the other’s vital contributions. Knight’s singular product focus and Parker’s tech-driven innovation and branding have proven a winning blend. Together, these complementary geniuses may take Nike even higher. But divided by a bitter power struggle, their opposing philosophies could undermine Nike’s hard-won leadership.

CEO Battle Royal: Could Phil Knight Take Down Mark Parker in an Epic Nike Faceoff?

Parker’s Push Into Digital and Sustainability

Current Nike CEO Mark Parker charted a distinct course for Nike after taking over from founder Phil Knight in 2006. He accelerated Nike’s digital transformation and sustainability efforts. But now, rumblings suggest Knight seeks to retake control from Parker. Does the founder want to roll back Parker’s tech and eco priorities to refocus Nike on old school performance and marketing?

As CEO, Parker doubled down on leveraging digital to energize Nike. He established Nike Digital Sport to pioneer wearable tech and connected fitness. Partnerships with Apple and Strava integrated Nike services into top devices and platforms. Acquisitions of startups like Virgin Mega expanded Nike’s digital capabilities. And Parker opened Nike innovation hubs globally to tap new tech and design ideas.

Sustainability became another signature priority under Parker. He set bold targets to minimize waste, use more sustainable materials, and reduce carbon emissions across Nike’s vast supply chain. Parker added 100% renewable energy at Nike facilities, recycled over 1 billion plastic bottles into gear, and boosted training for contract factories. He aims to cut Nike’s carbon footprint 30% by 2030.

Wearables and Workouts

Parker saw digital integration as crucial to keeping Nike relevant. Nike+ Run Club and Training Club apps built communities around tracking workouts and performance. Connected shoes like the Adapt BB link to smartphones to dial in fit. And collaborations produced Nike wearables from Apple Watches to Xbox Kinect gaming. Parker is staking Nike’s future on fusing digital services, tech and gear.

Materials Innovation

Making products more sustainably motivated key materials advances under Parker like Flyknit knitted uppers. This technology generates far less waste than cut-and-sew production while enhancing fit. Parker also drove use of recycled polyester, organic cotton and bio-based materials like Nike Grind rubber. He believes sustainability will unleash creativity.

Culture Change

Embedding sustainability into design principles, operations and corporate culture was crucial to Parker. He tied executive pay to ESG goals and invested in employee training and accountability across Nike’s vast supply network. The aim is making sustainability a lens for business decisions at every level.

Parker’s digital and sustainability push kept Nike on the cutting edge of industry trends. But founder Knight’s mooted return suggests a clash over priorities. Knight may see Parker’s focus as distracting from product design excellence and marketing fundamentals. However, Parker would likely argue Nike must harness digital and sustainability or risk irrelevance. Blending the best of both leaders’ philosophies could power Nike’s continued success.

Ultimately, each titan has spearheaded crucial phases in Nike’s evolution. Founder Knight drove performance innovation and brand aura. Parker intelligently bridged Nike into the digital age and sustainability economy. Rather than battle for control, both leaders must find the wisdom to hear each other. Knight’s voice compels focus on what makes Nike unmatched – product and marketing. Parker provides vision to keep Nike leading through tech and responsibility. Together, their strengths combine into an unstoppable force. But divided, Nike risks faltering as disruptive rivals rise. The sneaker giant’s future may hinge on Parker and Knight remembering what made them great partners, not adversaries.

Reports of tensions brewing behind the scenes at Nike headquarters have fueled speculation of a potential coup, with company co-founder Phil Knight maneuvering to overthrow current CEO Mark Parker. While succession plans had seemed straightforward, rumblings of boardroom discontent hint at a brewing CEO Battle Royal.

Speculation of Power Struggle and Infighting

On the surface, the transition had appeared settled. Mark Parker was set to step down in January 2023, handing the reins to next Nike CEO John Donahoe after 13 years running the sporting goods giant. However, recent events indicate the changing of the guard may not go smoothly.

While no open warfare has broken out yet, there are signs Parker’s grip on power may be loosening. Theories abound that Knight, who built Nike from scratch with co-founder Bill Bowerman in 1964 and served as CEO until 2004, is plotting to overthrow Parker and install his own pick for chief executive.

The speculation stems from what some view as Parker’s mishandling of various issues and PR crises during his tenure, and Knight’s diminished influence on Nike’s direction in recent years. Insiders whisper about Parker’s “authoritarian style” ruffling feathers among executives and straining his relationship with Knight, who still holds sway as Nike’s largest individual shareholder.

Knight has publicly voiced disappointment over scandals during Parker’s reign, such as ill-conceived ad campaigns and the doping controversy surrounding Nike’s Oregon Project. Some believe Knight blames Parker for these missteps and see his perceived errors as an opening to reassert control.

Rumored frustration over stock performance may also factor in. Nike shares have lagged rivals like Adidas and Lululemon in recent years. While the stock has still offered steady gains under Parker, it’s possible Knight feels more could be done to boost shareholder value and the Nike brand.

Making matters worse, Knight appears to have been somewhat sidelined in key moves such as the recruitment of next CEO John Donahoe. Knight may view the succession plan as orchestrated without his input, further straining the relationship between the current and former CEOs.

The internal drama seems poised to reach a boiling point as Parker’s tenure winds down. With Parker refusing to relinquish power early, Knights’ camp is rumored to be “sharpening their knives” for a potential coup d’état. The balance of power may well hang in the absence of a peaceful transfer.

A Legendary Rivalry Takes Shape

In many ways, the building tension seems fated. Parker and Knight are both athletic apparel legends with an intense competitive drive. Parker, a long-time Nike designer and innovator, assumed the throne from Knight in 2006. He helped shepherd Nike’s growth to over $30 billion in annual sales.

Yet Knight, the elder statesman and company patriarch, likely cannot resist exerting influence. Since officially stepping down as chairman in 2016, he has remained a Nike board member and its largest shareholder. While taking a less active role, Knight still owns more than 10% of Nike stock, valued at over $14 billion. For a man not used to idleness, the temptation to retake the reins may be overwhelming.

From Parker’s standpoint, he may see Knight as an obstacle to running Nike his way. Parker has never been one to shy away from bold design risks, evidenced by controversial rolls outs of apparel like the Olympic snowboarding uniforms that seemed more fitting for a rave. He also approved Nike’s edgy “Dream Crazy” ad campaign featuring Colin Kaepernick.

For Parker to execute his vision without interference, he may feel the need to consolidate power and remove meddling influences like Knight. Yet pushing back directly on a living legend like Knight would pose serious risks.

In this brewing battle of new Nike vs. old, there may be room for only one CEO. The next few months will illuminate whether Knight can pull off the executive coup, or if Parker can defend his throne and resist the founder’s challenge.

Fallout From a Nike Civil War

If Parker hangs on through January, crisis seems averted and a smooth transition to Donahoe follows. But if Knight makes a successful power play, it could get ugly. The ensuing fallout and instability could impact Nike’s business for years.

A sudden overthrow of Parker could spur an exodus of executives loyal to the current CEO. Key personnel could flee to rivals like Adidas, taking talent and intellectual property with them.

Alternatively, Knight could find himself without seasoned operations veterans needed to guide the massive Nike empire. Disruption in Nike’s senior ranks could leave the company directionless and unable to compete with rising industry powers.

There are also big questions around how Nike’s brand image withstands internal turbulence. Consumers may see leadership chaos as a sign of corporate dysfunction and turn away from the swoosh. Given Nike’s deep consumer connections, any disruption to brand loyalty could have far reaching impacts.

And while Knight asserts control, the coordination with Donahoe’s incoming regime could suffer, leaving Nike without clear leadership as 2023 approaches. The hazardous power vacuum could capsize Nike’s ship.

Of course, the saga could conclude with an amicable passing of the torch. But if Parker digs in his heels and Knight schemes an insurgency, the Nike civil war could get ugly fast. Let’s hope any boardroom backstabbing ends quickly, for Nike’s sake.

As rumors swirl of Phil Knight plotting to overthrow Nike’s CEO Mark Parker, much intrigue centers around Knight’s apparent frustrations with Nike’s recent advertising strategies under Parker’s watch.

Knight’s Criticism of Nike’s Advertising Strategy

A key factor fueling speculation of Knight’s brewing coup is his vocal critique of Nike’s edgy marketing campaigns in recent years. While Parker has pushed creative boundaries, Knight has made his displeasure known.

Most notably, Knight condemned Nike’s 2018 “Dream Crazy” ad campaign featuring former NFL quarterback Colin Kaepernick. The bold ads supported Kaepernick’s protests against racial injustice, sparking praise but also controversy. While aligning with Nike’s values, Knight felt the campaign needlessly polarized consumers and tarnished the brand.

Insiders say Knight lobbied hard behind the scenes to block the Kaepernick ads, indicating a schism between the Nike bosses. With Parker disregarding his wishes, frustration apparently grew. Knight may see Parker’s marketing moves as jeopardizing Nike’s mainstream appeal.

Other ads during Parker’s tenure have also drawn Knight’s ire. A 2019 campaign targeting women in Japan and Korea was pulled after outcry over racial insensitivity. Knight purportedly blamed Parker for greenlighting marketing missteps in important Asian markets.

There’s also said to be disagreement over Nike’s approach to key demographics. Parker has focused on young urban audiences, whereas Knight wants broader outreach to maintain dominance. The rumored rift represents a classic generational divide on Nike’s future direction.

Adding fuel to the fire, Nike brand favorability has slipped under Parker. Surveys show growing consumer wariness, especially among older shoppers. If Knight points to Parker’s edgy ads as alienating customers, it could undermine support within Nike’s boardroom.

The Art of Nike’s Audacious Advertising

While Knight appears unimpressed, Parker sees bold marketing as critical to Nike’s success. His appetite for audacious ads and provocative campaigns has defined his tenure.

Back in 2012, risqué ads featuring Olympic athletes caught heat for sexualizing women. But Parker doubled down, seeing attention as positive for the Nike brand. The approach paid dividends, with Nike’s market share steadily climbing since.

Parker also views marketing as a key way for Nike to lead on social issues. The Kaepernick ad was controversial, but drove conversation around racial justice. In Parker’s view, Nike’s advocacy helps build loyalty among socially conscious customers.

Insiders say Parker strongly believes Nike must take risks to stay culturally relevant. In his eyes, playing it safe could allow Adidas and Under Armour to siphon away younger fans. Knight’s wariness of envelope-pushing marketing seemingly frustrates Parker.

At the same time, Parker recognizes the need for balance. While granting edgy campaigns, he’s canned concepts deemed too inflammatory. Still, Knight likely sees Parker as pushing marketing further than necessary just to make a splash.

For Parker, advertising drives energy around the Nike brand. But Knight seems more concerned with avoiding missteps. With control of the CEO seat at stake, their advertising feud could reach a reckoning.

Battle Lines Over Nike’s Ad Strategy

As the power struggle plays out, Nike’s ad strategy seems destined for overhaul under new leadership. But which vision ultimately prevails remains uncertain.

If Knight regains influence through a palace coup, expect a return to safer, mainstream campaigns. The days of provocative ads could be over. Knight may feel a back-to-basics approach is needed to turn around brand favorability.

But if Parker holds sway, bold marketing would continue. Status quo with edgy, progressive ads targeted at urban communities seems the likely path. Parker has staked much on Nike’s ability to push boundaries and court controversy.

A compromise path could see Nike walk back certain daring efforts while still championing social issues. But in a civil war, a moderate path may not be possible. The battle lines are seemingly drawn between two stark advertising philosophies.

For an iconic brand like Nike, advertising strategy carries high stakes. If Parker clings to power, his appetite for audacious marketing will shape Nike’s future. But if Knight seizes control, expect a stern correction to Nike’s recent brand image gambles.

As Phil Knight allegedly marshals forces to overthrow Mark Parker, scrutiny centers on Parker’s moves to expand Nike globally and overhaul its supply chain model, which some view as sources of internal dissent.

Parker’s Global Expansion and Supply Chain Moves

Since becoming CEO in 2006, Mark Parker has aggressively expanded Nike’s global footprint, especially in China. He also enacted sweeping supply chain changes aimed at speeding production.

But not all are cheering Parker’s bold expansionist moves and supply chain shake-ups. Insiders say co-founder Phil Knight has voiced concerns, and that rifts over Parker’s global vision have widened.

Under Parker, Nike has aggressively built out China operations, now comprising over 15% of total revenue. But rapid China growth has created reliance on a potentially unstable market. If Chinese sales growth stalls, Parker’s expansionist bets could backfire.

There are also rumblings over supply issues and sales volatility in Europe under Parker’s watch. Knight may see missteps abroad as justification to install new leadership.

Additionally, Parker ruffled feathers with supply chain reforms that upended long-time manufacturing partnerships. His vision of a nimble supply network clashed with old-school views, wearing thin the patience of execs like Knight.

Nike’s Lightning-Fast Supply Chain

For Parker, fast product turnaround is fundamental to Nike’s edge. He’s touted supply chain speed as critical to beating Adidas and Under Armour.

Under his watch, Nike pivoted to lean manufacturing techniques like 3D prototyping. Lead times for new designs plummeted from years to months or even weeks. The responsive supply web lets Nike capitalize on trends faster.

Parker also brought manufacturing closer to target markets. Nike now ships over 40% of shoes from factories within the country of sale. This localization further shrinks lead times and cuts costs.

Critics argue Parker moved too fast. The manufacturing shake-up unsettled long-time suppliers, some going bankrupt. But Parker likely sees the pain as necessary change.

For Parker, outrunning the competition requires a radically nimble supply chain. Whether his urgency breeds resentment among old guard execs like Knight remains to be seen.

Global Turmoil Threatens Nike’s China Market

As Parker focused on speed, China became vital to Nike’s growth story. Greater China revenue now surpasses $6 billion annually across over 7,000 stores.

But as Parker expanded in China, risks mounted. Nike faced backlash last year over statements on forced labor in Xinjiang, leading to boycotts. Sales took a hit, spooking some execs.

Tensions over Taiwan and Hong Kong also jeopardize China sales. And COVID shutdowns continue rattling operations and inventory flow in China’s vast Nike manufacturing base.

For Parker, the China market remains key to Nike’s aims of reaching $50 billion in sales by 2025. But if volatility persists, his China bet could go bust.

At 78, Knight likely urges more caution on China, leery of volatility and human rights headaches. His wariness of Parker’s bold China vision may be a wedge dividing the executives.

A Global Proxy War for Nike’s Soul

As Parker and Knight clash, Nike’s future global orientation hangs in the balance. Whoever wins the brewing executive war will steer Nike’s course through an uncertain world.

If Parker prevails, expect continued expansion abroad, especially in China. Nike will push the boundaries to grow sales worldwide and dominate markets like running shoes. Risks of overexposure abroad would be damned.

But if Knight regains control, he could pull back overseas as controversies mount. Growth would lean more on core U.S. strength. And supply chain speed may lose priority over stability.

For now, Parker’s vision still reigns. But with proxy skirmishes underway, his global expansion agenda faces threats both outside and within. How the power struggle resolves will decide whether Nike continues its world march. The battle is just getting started.

As the rumored Nike executive battle heats up, scrutiny has fallen on how Phil Knight and Mark Parker compare in compensation and perks as CEO. The dramatic differences highlight a source of alleged tension fueling Knight’s power move.

How the Two CEOs Compare on Compensation and Perks

Mark Parker has enjoyed lavish compensation as Nike CEO, earning over $200 million total since 2006. Phil Knight took a more modest package back in the day. The gap has reportedly been a sore spot for Knight.

Last year, Parker made $19 million, over 300x the average Nike employee salary. Knight never cracked $3 million, keeping pay below 20x average workers during his tenure.

Parker also travels by private jet, costing Nike over $400,000 annually. Knight flew commercial when CEO. For Parker, the Gulfstream perk lets him zip between Nike outposts and manufacturing hubs worldwide.

Adding fuel to the fire, Parker got a huge $525 million stock award in 2015 to dissuade him from joining another brand. Knight, known for thrift, is said to see Parker’s lavish compensation as excessive and vain.

The High Cost of Innovation

In fairness to Parker, Nike sales ballooned from $15 billion to over $30 billion during his reign. He also spearheaded Nike’s digital revolution, justifying his rich rewards.

Parker took risks that paid off big, like acquiring hot brands Converse and Hurley. Knight likely couldn’t imagine making such bold bets back in his CEO days.

And since Parker receives most pay in stock, his fortune depends on Nike’s performance. Share prices are up over 400% during his tenure, suggesting his lavish compensation aligns with shareholders’ interests.

Those close to Parker argue he earned every penny, given Nike’s growth under his watch. In their view, Knight is just jealous and past his prime.

A Testament to Knight’s Frugality

But Knight’s supporters counter he took a prudent approach to compensation that today’s Nike execs should emulate. His CEO pay never strayed far from average employee levels.

Knight flew coach and drove modest cars like a Toyota Avalon. And he owned the same Palm Pilot for 15 years. Those expecting Parker’s globetrotting, private jet-setting lifestyle may be let down post-coup.

However, the cronies backing Knight’s power play are unlikely motivated by righteousness alone. As architects of Nike’s early success, they probably covet the lavish perks Parker enjoys.

For Knight, deposing Parker may be personal, not just business. Reclaiming the reins would restore the era of thrift and humility he feels defines the Nike brand.

A Crossroads for the Swoosh

As Parker and Knight face off, the future culture of extravagance or modesty at Nike hangs in the balance. Whether Parker’s luxurious compensation continues may well determine who wins the battle for control.

If Knight prevails, expect a return to conservative pay andpaired-back perks. But if Parker holds sway, Nike’s new Gilded Age will endure, for better or worse.

Ironically, defeat for Parker may prove most lucrative. His lifetime Nike earnings guarantee he won’t exactly suffer, regardless of any lost power. But for Knight, reclaiming dominance may be priceless.

As Phil Knight allegedly schemes to overthrow Mark Parker, theories swirl over how Knight could wield his power as Nike board member to install new leadership. Parker may face an ambush if Knight makes a bold boardroom power play.

Might Knight Make a Board Power Play?

Even in semi-retirement, Phil Knight holds strong sway at Nike through his board seat and 31% ownership stake. Speculation mounts over whether he could use that clout to spark a palace coup against Parker’s regime.

As board member and biggest shareholder, Knight remains influential among fellow directors. He also has allies in Nike’s executive ranks that provide insider intel and could coordinate sabotage efforts.

If Parker’s support fractures, Knight may see an opening to stoke director dissatisfaction. By rallying the board against Parker’s leadership missteps, Knight could potentially force his ouster.

However, mounting an outright board revolt has risks. It could damage Nike’s reputation if power struggles spill into public view. But as a master tactician, Knight may have subtler maneuvers in mind.

Phil Knight’s Legacy Ties

While no longer chairman, Knight derives power through his towering legacy at Nike and ties to long-time directors. Having appointed many current board members himself earlier as CEO, his influence runs deep.

Directors like Alan Graf, John Donahoe, and Cathleen Benko have long-standing connections to Knight. If he signals discontent with Parker, they may be compelled to act, putting their jobs on the line.

Knight is also close with Nike brand heads who command loyalty among the rank and file. By turning top executives against Parker, mass defections could follow, sinking Parker’s standing.

Given his prestige, Knight needs only a few key defections to put Parker’s rule in jeopardy. His reputation in Nike’s halls confers immense power.

Mark Parker’s Early Missteps

For now, Parker retains broad board support after delivering steady growth and strong shareholder returns. But it only takes one stumble to provide an opening.

If growth stalls, or hot rival brands steal market share, directors might waver. And perceived marketing missteps under Parker already have Knight upset. Further brand-damaging scandals could convince the board it’s time for change.

Parker also ruffled feathers with corporate staff by consolidating power. Directors may balk at his “imperial CEO” style if business hits snags. And more alleged affairs after his divorce could bring allegations of moral failure.

In short, Parker has limited margin for error. One slip-up could turn the board against him and make Knight’s behind-the-scenes war path decisive.

A Brewing Boardroom Showdown

If Parker catches wind of Knight’s scheming, he may try preemptive strikes like replacing key lieutenants with loyalists. Or Parker could seek out a White Knight investor to bolster his standing.

But with Knight’s power and history, Parker faces disadvantages in any boardroom game of thrones. His best hope may be continued business success and exuding total command.

For now, Nike directors likely hesitate to backstab the sitting CEO. But if Parker shows weakness, all bets are off. The possibility of a stealth board coup underscores his precarious position.

As tensions build, will Knight ultimately make a bold board power play? All eyes turn to Nike’s next shareholder meeting, where the brewing civil war could spill into open revolt. Mark Parker better watch his back.

As theories swirl of Phil Knight plotting a coup, speculation turns to whether he could recruit influential allies amongst Nike’s executives and board members to help overthrow Mark Parker.

Could Knight Recruit Allies to Oust Parker?

Phil Knight retains trusted lieutenants across Nike’s senior ranks that may aid his power move against Parker. By convincing key executives to withdraw support, Knight could isolate Parker and make his ousting inevitable.

As Nike’s founder, Knight enjoys residual loyalty, especially among long-timers.If he signals intentions to reclaim power, many would likely back him over Parker.

Knight also has strong sway with Nike’s board. By turning crucial directors against Parker, he could make Parker’s position untenable. Knight may know exactly how to foment a palace revolt.

However, Parker has cultivated his own network of devotees. Wresting control may require Knight picking off Parker’s core backers to sow dissension in the ranks. The game of executive thrones could get intense.

Knight’s web of Influence

Even in retirement, Knight has disciples throughout Nike owing career success to his mentorship. This network provides insider intelligence and potential turncoats.

Long-time Nike executives like Trevor Edwards, Elliott Hill and Michael Spillane are especially loyal to Knight. As ambitious veterans, they may relish opportunity to boost power in a Knight regime.

Knight also enjoys strong rapport with directors like Cathleen Benko and Elizabeth Comstock. If he stokes board worry over Parker’s scandals, a unified ouster push could gain steam.

By calling in favors, Knight could assemble a powerful coalition. If key executives and directors coordinate, checkmate may come swiftly for Parker.

Parker’s Devoted Inner Circle

However, recruiting allies has risks, as Parker will fight to keep loyalists in his corner. As sitting CEO, his authority to retaliate still carries weight.

Parker relies on close confidantes like Heidi O’Neill and Andy Campion to enforce his will internally. If they stand firm, mass defections may not materialize despite Knight’s power.Parker also has support from influential directors like John Donahoe and Mark Thibault who backed his succession plan. Turning Parker’s inner circle against him will be key for Knight.

A stealth offensive risks putting Knight’s top collaborators in peril. Parker would likely sack disloyal execs if a coup fails, limiting Knight’s options.

An Executive Civil War

With intrigue building, a complex web of loyalties across Nike’s power structure will determine if Knight can recruit enough conspirators. Parker retains strong cards to play.

For now, most Nike executives likely wait for definitive signs of Knight’s intent before committing treason. They know failed betrayals often end careers.

Similarly, directors hesitant to spark infighting may only turn on Parker if Knight demonstrates superior force. But if persuasion fails, Knight has darker arts like blackmail in reserve.Befitting great dramas, the final act of this brewing executive civil war remains highly uncertain. Sudden betrayals could turn the tide for or against Knight’s brewing insurgency at any moment. The battle lines are forming, but conclusions are far from foregone.

What Would a Battle For Control Mean for Nike?

A legendary showdown for the ages could be brewing behind closed doors at Nike headquarters. Rumors have swirled for years about friction between longtime CEO and chairman Phil Knight and current CEO Mark Parker. Knight stepped back from day-to-day management in 2006, handing the reins to Parker. But the two titans have clashed over Nike’s direction. Now, sources say Knight aims to reassert control and depose Parker in an epic faceoff for the soul of the Swoosh.

Such a battle would rock the sports apparel and footwear empire to its core. What would a coup d’etat mean for Nike? And how bloody could the fight get? Let’s break it down.

A Clash of Egos and Visions

Knight looms large as a mythic figure and founder-hero at Nike, while Parker represents a new generation of technocratic leadership. The two strong personalities have butted heads as Knight seeks to protect his legacy and Parker wants creative freedom. According to insiders, Parker chafed under Knight’s oversight for years. He finally saw his chance to grab power when Knight stepped aside in 2006.

Since then, Parker has taken Nike in new directions, accelerating digital transformation and leading acquisitions. For instance, Nike’s $1 billion purchase of activity tracker Fitbit reflected Parker’s push into wearable tech. But Knight seemingly stews as Parker strays from his preferences. Meanwhile, Parker likely aims to escape Knight’s long shadow and fully claim the throne. Egos and diverging visions could fuel an epic fallout.

Proxy War and Power Politics

Rumored factions have formed behind each leader vying for supremacy. Knight may rally old-guard allies in Oregon and lean on his gigantic stake of Class A shares granting extra voting power. Parker could counter by wooing Nike’s board and executives in Beaverton. The fight could get ugly with whisper campaigns, strategic leaks and boardroom politicking.

In corporate power politics, shareholders usually win. Knight owns or controls around 25% of total shares. But he’d likely need over 50% voting power to oust Parker. He could persuade other investors or trigger a call for an emergency shareholder vote. However, Parker retains significant sway with institutional investors after leading Nike to huge gains.

Proxy wars often end in truce. Knight and Parker may compromise to avoid mutually assured destruction. For instance, Parker could stay as CEO but cede some authority back to Knight. Yet their rift runs deep, making a lasting peace uncertain.

Upheaval in Nike’s Management

A Parker resignation or firing could cause turmoil atop Nike. Some execs remain loyal to him while others align with Knight. Mass departures could follow Parker’s ouster. Nike could also split internally between the two camps even if Parker clings to power. Dysfunction and paralysis would likely result, hampering decision-making.

Knight would face backlash over heavy-handed meddling if he forces out Parker. But he may install a new CEO who pledges fealty, reversing Parker’s more independent course. His likely play: elevating protege and Nike president Eric Sprunk or COO Andy Campion to the helm. However, talent flight and internecine conflict would plague any new regime.

Product and Stock Impacts

The core business could flounder amid distractions from a civil war. Product pipelines could clog as managers halt and reverse decisions to avoid angering either side. Innovation may slow given uncertainty over Nike’s direction. Declining morale could also hurt output from designers and developers. These disruptions could manifest in two or three years if untested products face delays today.

Wall Street hates uncertainty. Expect Nike’s stock to drop 10-20% if a battle royal breaks out as investors fret over chaos. But shares could rebound if one side achieves decisive victory and charts a clear path forward. Ultimately, Nike’s fundamentals remain strong despite any C-suite drama.

Final Implications

While messy in the moment, a Parker-Knight showdown could bring needed clarity on who sits atop Nike’s throne. The winner can reshape the company to align with their priorities. But the combatants must beware mutually destructive tactics that could cripple Nike. With wisdom and restraint, one legend could pass the baton to the other without burning down all they’ve built.

But irrational brinksmanship remains a risk with so much power at stake. Egos have clouded judgment before at giants like Apple and Disney. While unlikely, Nike’s game of thrones could turn into a catastrophic scenario where everyone loses big. Let’s hope cooler heads prevail in Beaverton for the good of the Swoosh.

The Verdict: Could Knight Actually Topple Parker?

The prospect of Phil Knight launching a coup against Mark Parker makes for juicy headlines. But could Knight actually pull it off in reality? He faces obstacles in wresting back control, even with his status. Let’s game out the endgame scenarios.

Knight’s Path to Victory

To kick out Parker, Knight needs to rally big supporters. He’d likely start by lobbying Nike’s board. Convincing more than half of directors to back him could force Parker’s ouster. Alternatively, Knight could try to spark an emergency shareholder vote. He’d need strong turnout from typically passive institutional investors.

Either path requires hardball tactics. Knight might trash Parker’s record and leadership in public. Or he could work behind the scenes to undermine support for Parker. He may threaten to sell his stake if directors don’t comply. Knight has enough power and history to make even this bold play conceivable.

Parker’s Survival Instincts

But Parker boasts significant advantages as the sitting CEO. He likely retains loyalty among many executives he’s promoted. Key directors also back Parker’s strategy given Nike’s hot financial performance. He’s charted a strong enough course to keep top talent on his side.

To keep power, Parker needs to isolate Knight as a meddling emeritus. He could argue Knight’s actions damage Nike. Securing unequivocal board support would bolster Parker against challenges. Unifying executives behind him also limits Knight’s options. Parker may already be shoring up his alliances in case tensions escalate.

Most Likely Outcome

Parker sits in the driver’s seat for now. The board seems reluctant to rock the boat while Nike clicks on all cylinders. Investors also appreciate Parker’s success. Unless Knight can flip power centers against Parker, he may not have enough leverage. If Parker stays disciplined and keeps performing, he may retain his perch.

This suggests the stability quo could prevail, at least for today. But Parker must still placate Knight somewhat. Giving him back some authority could be the path of least resistance. Knight could get a louder voice on strategy while Parker remains CEO. This type of compromise could work if both protect egos and understand their shared interests.

Wildcards and What-Ifs

Predicting Nike’s shadow conflict requires game theory. Each side must anticipate countermoves. Random events also introduce uncertainty. For instance, an economic downturn could suddenly weaken Parker’s standing if Nike stumbles.

There are also human elements like emotion in play. Pride or spite could override rational calculations. Dramatic escalations can’t be ruled out. But ultimately, Parker and Knight must know a civil war harms Nike most of all. This shared context likely restrains either from pulling the trigger on scorched earth tactics, even if a simmering cold war persists.

In the end, no one can foresee every twist and turn. We’ll have to wait and see how the next chapter in Nike’s history reads.

The Corporate King Staying Supreme?

Parker emerging victorious seems the probable finale given the circumstances. But Knight still has moves to make this a clash for the ages. The legendary founder probably can’t reclaim his throne outright. However, his legacy remains woven into Nike’s fabric.

And even if Parker fends off direct control, Knight’s presence behind the scenes can’t be ignored. The final lesson may be that at Nike, there can only be one king – the Swoosh itself. Leaders come and go, but Nike’s brand reigns supreme forevermore.