How do capital budgeting apps streamline financial processes. What key features should you look for in budgeting software. Why is integration with accounting systems crucial for effective capital management. How can financial modeling capabilities enhance your budgeting strategy.

Understanding Capital Budgeting: A Cornerstone of Financial Management

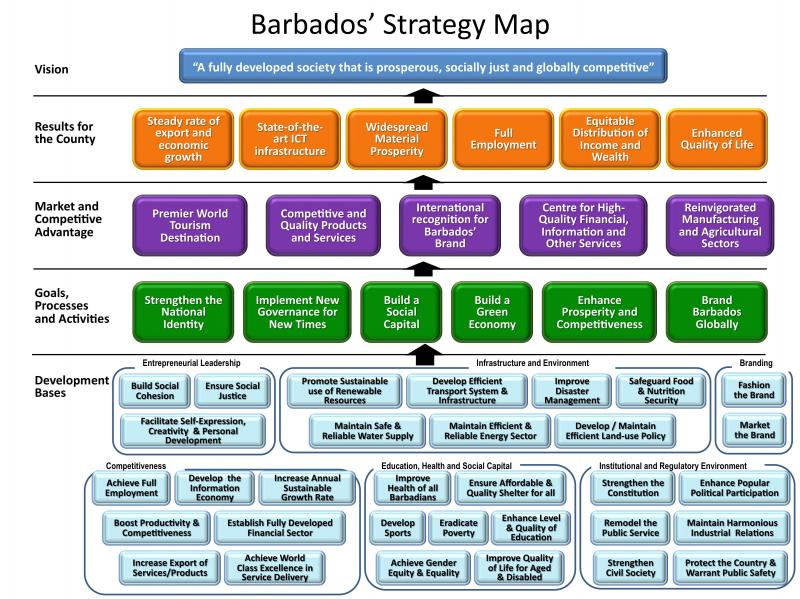

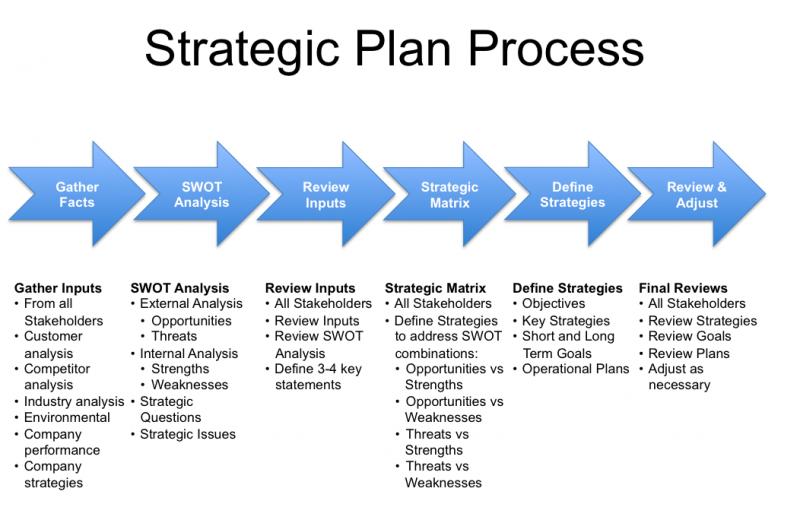

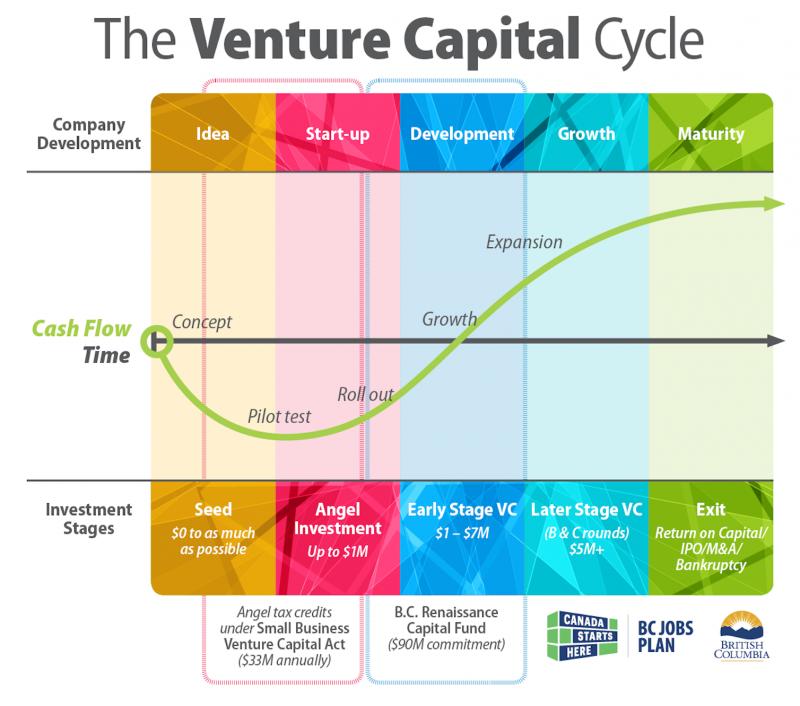

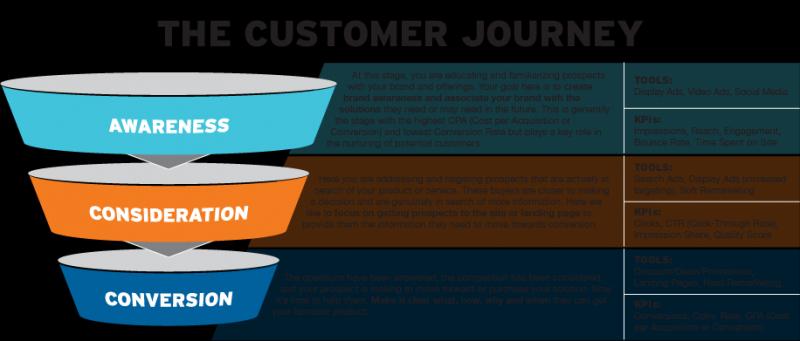

Capital budgeting forms the backbone of strategic financial planning for businesses of all sizes. This critical process involves the meticulous planning, allocation, and control of expenditures on long-term assets and projects. These investments typically include equipment, machinery, IT systems, and other resources that require significant upfront capital but yield value over an extended period.

The importance of capital budgeting cannot be overstated. It serves as a compass, guiding organizations through the complex landscape of financial decision-making. By employing various analytical techniques, businesses can evaluate potential returns, assess risks, and prioritize investments that align with their strategic objectives.

Key Components of Capital Budgeting

- Net Present Value (NPV) analysis

- Internal Rate of Return (IRR) calculations

- Payback period assessments

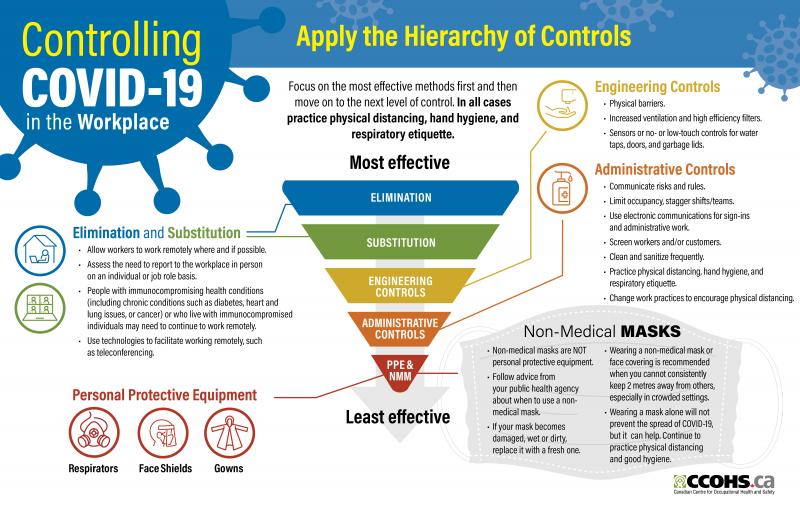

- Risk evaluation and mitigation strategies

- Project prioritization and resource allocation

How does effective capital budgeting impact business performance. By implementing robust capital budgeting practices, companies can significantly enhance their operational efficiency, minimize costs, and drive strategic growth. This process acts as a safeguard against ill-informed investments, ensuring that resources are channeled into ventures with the highest potential for success.

The Evolution of Capital Budgeting: From Spreadsheets to Sophisticated Apps

The landscape of capital budgeting has undergone a dramatic transformation in recent years. Traditional methods involving complex spreadsheets and manual calculations are rapidly giving way to sophisticated software solutions designed to streamline and enhance the budgeting process.

Capital budgeting apps represent a quantum leap in financial management technology. These powerful tools automate many of the time-consuming tasks associated with budgeting, allowing finance professionals to focus on strategic analysis and decision-making rather than getting bogged down in data entry and formula management.

Benefits of Capital Budgeting Software

- Increased accuracy and reduced human error

- Real-time data updates and dynamic forecasting

- Enhanced collaboration across departments

- Improved visibility into financial performance

- Streamlined approval processes and workflow management

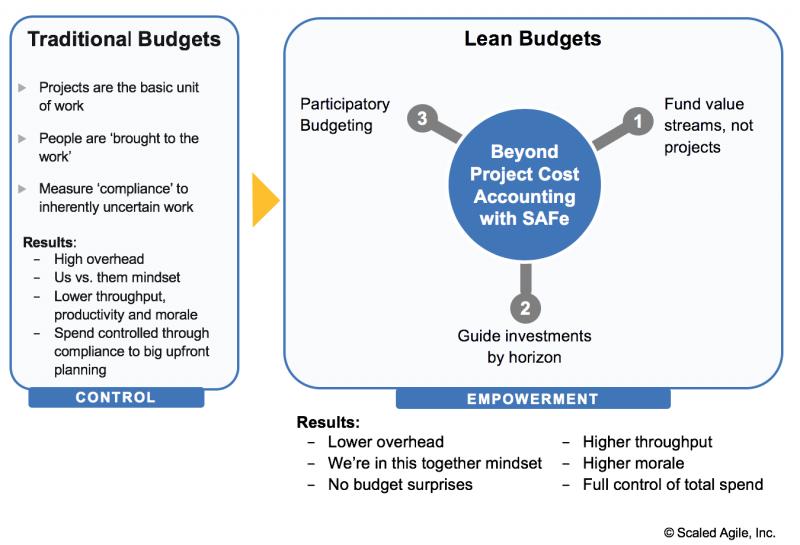

How do capital budgeting apps contribute to improved financial decision-making. By providing a centralized platform for data analysis, scenario modeling, and performance tracking, these applications empower organizations to make more informed and timely investment decisions. The result is a more agile and responsive approach to capital management that can adapt to changing market conditions and business needs.

Essential Features of Top-Tier Capital Budgeting Applications

When evaluating capital budgeting software, it’s crucial to identify the features that will provide the most value to your organization. While specific needs may vary depending on the size and nature of your business, certain core functionalities are essential for effective capital management.

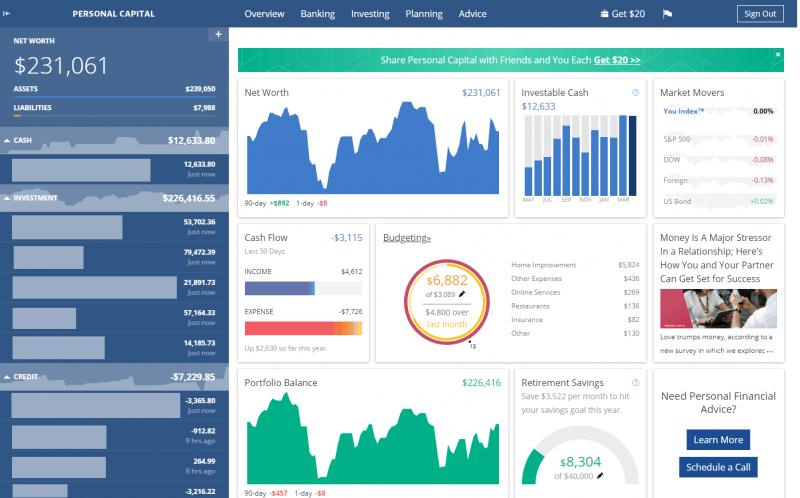

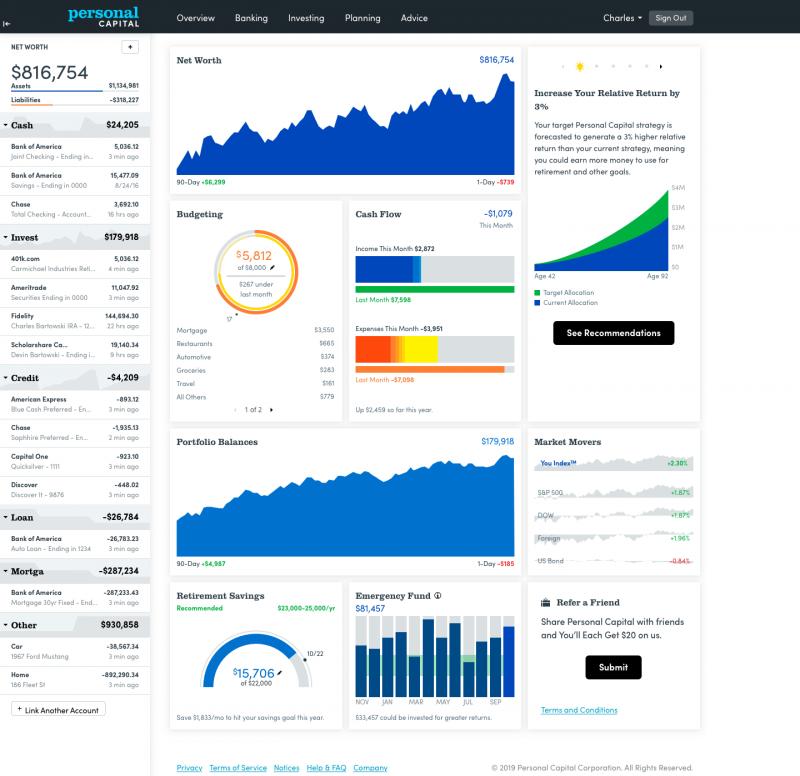

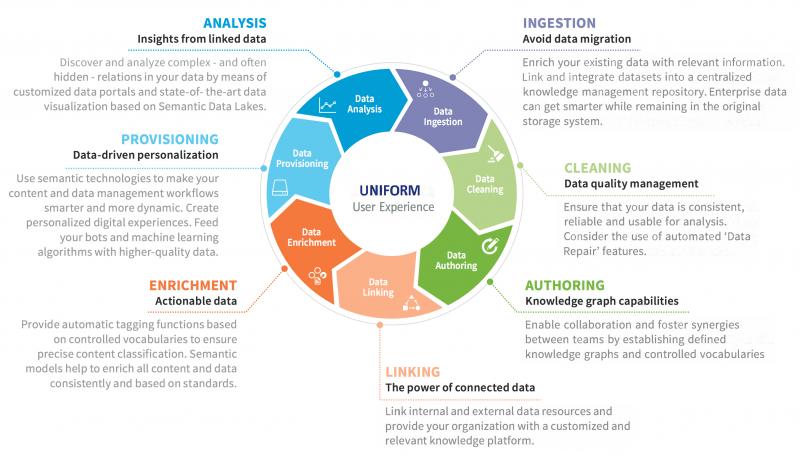

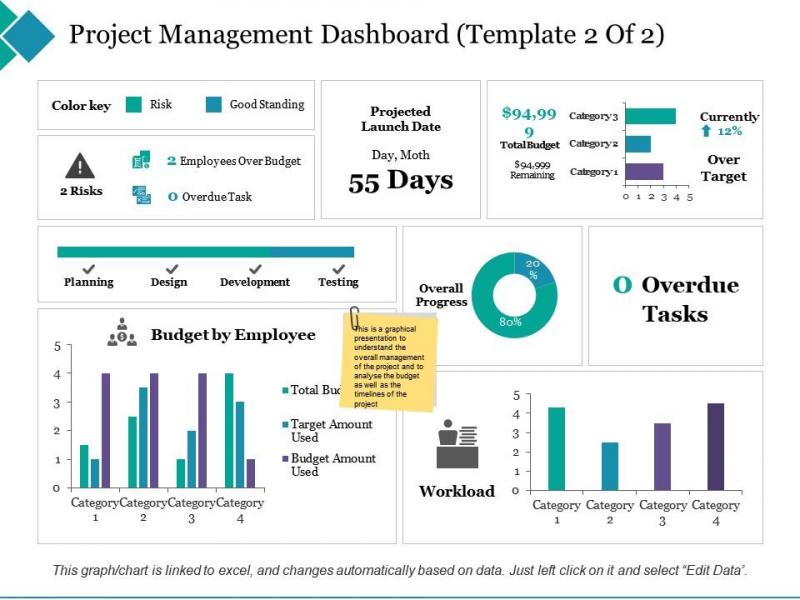

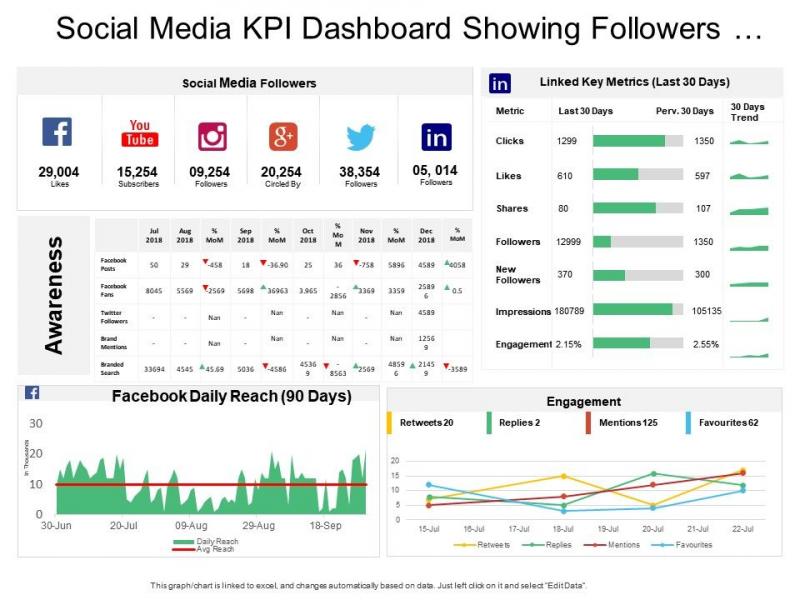

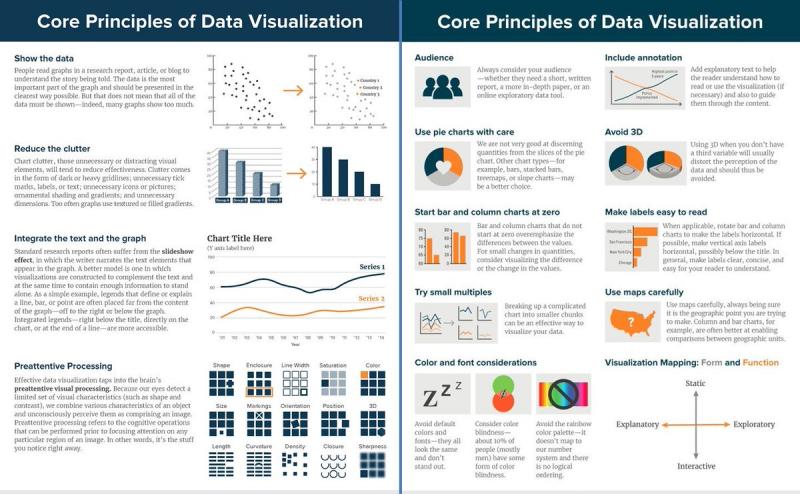

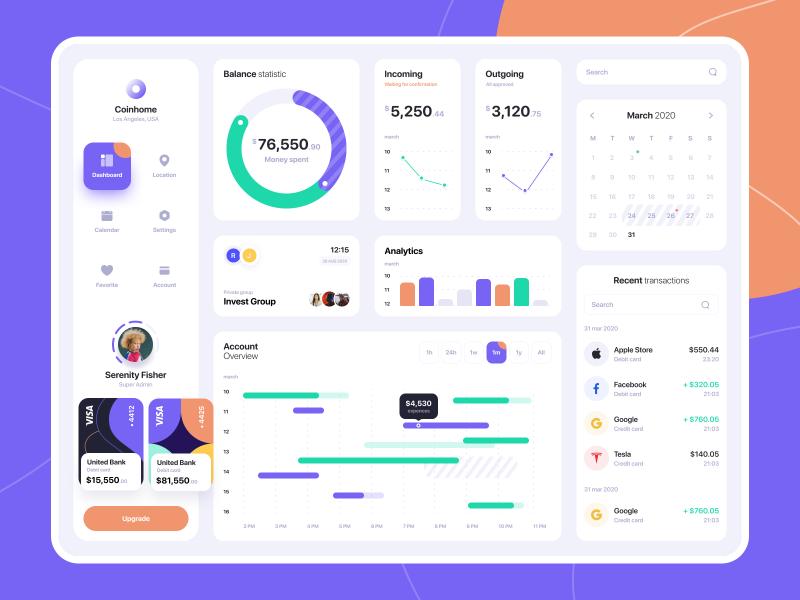

Comprehensive Reporting and Analytics

Advanced reporting capabilities are the lifeblood of effective capital budgeting. Look for software that offers customizable dashboards, interactive visualizations, and the ability to generate detailed reports on demand. These features enable stakeholders to gain deep insights into financial performance and make data-driven decisions with confidence.

Scenario Modeling and What-If Analysis

The ability to model different scenarios and perform what-if analysis is crucial for navigating uncertainty in the business environment. Top-tier capital budgeting apps allow users to create multiple scenarios, adjust variables, and instantly see the impact on projected outcomes. This flexibility enables organizations to prepare for various contingencies and optimize their investment strategies.

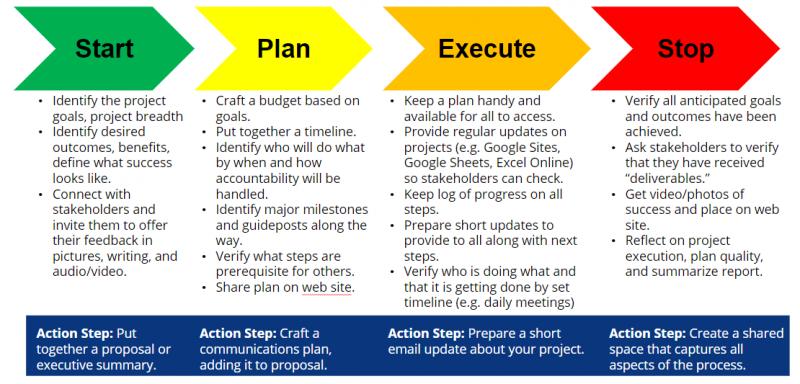

Approval and Compliance Management

Efficient workflow management is essential for ensuring that capital budgeting processes adhere to organizational policies and regulatory requirements. Look for software that includes built-in approval workflows, audit trails, and compliance tracking features. These tools help streamline decision-making processes and maintain transparency throughout the budgeting cycle.

How can robust approval and compliance features enhance organizational governance. By automating approval processes and maintaining comprehensive audit trails, capital budgeting apps help organizations enforce financial controls, reduce the risk of fraud, and ensure compliance with regulatory standards. This not only improves operational efficiency but also enhances stakeholder confidence in the company’s financial management practices.

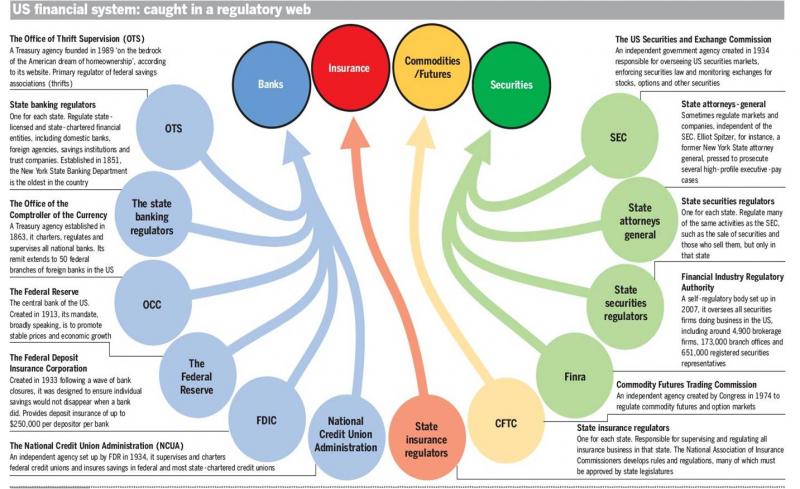

Integrating Capital Budgeting Apps with Existing Financial Systems

The true power of capital budgeting software is unleashed when it’s seamlessly integrated with other financial systems within the organization. Integration capabilities allow for the smooth flow of data between different platforms, creating a unified ecosystem for financial management.

Key Integration Points

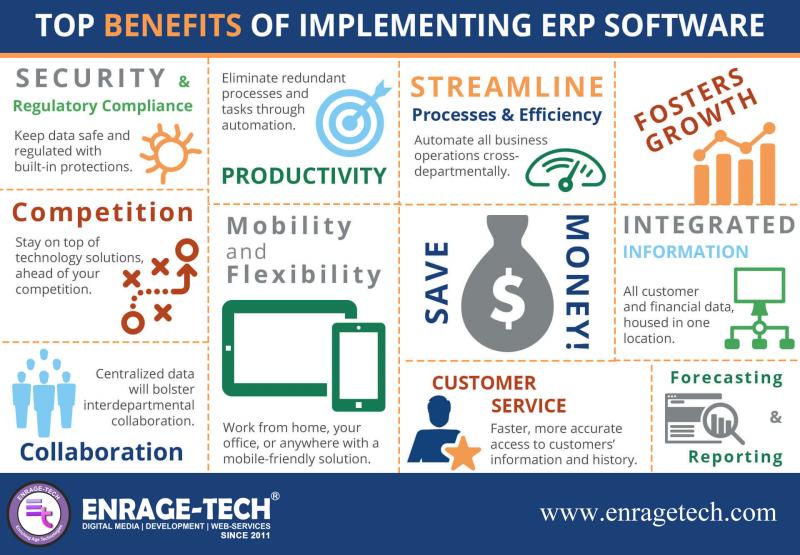

- Enterprise Resource Planning (ERP) systems

- Accounting software

- Customer Relationship Management (CRM) platforms

- Project management tools

- Business intelligence solutions

Why is system integration critical for effective capital budgeting. By connecting capital budgeting apps with other financial systems, organizations can eliminate data silos, reduce manual data entry, and ensure that all stakeholders are working with the most up-to-date information. This level of integration facilitates more accurate forecasting, improves decision-making speed, and enhances overall financial visibility across the organization.

Benefits of Integrated Capital Budgeting Solutions

- Real-time data synchronization across platforms

- Elimination of duplicate data entry and associated errors

- Improved collaboration between finance and other departments

- Enhanced ability to track project performance against budgets

- More accurate and timely financial reporting

How does system integration impact the accuracy of financial forecasts. By pulling data from multiple sources in real-time, integrated capital budgeting apps can generate more precise and reliable forecasts. This holistic view of financial data enables organizations to identify trends, anticipate challenges, and make proactive adjustments to their investment strategies.

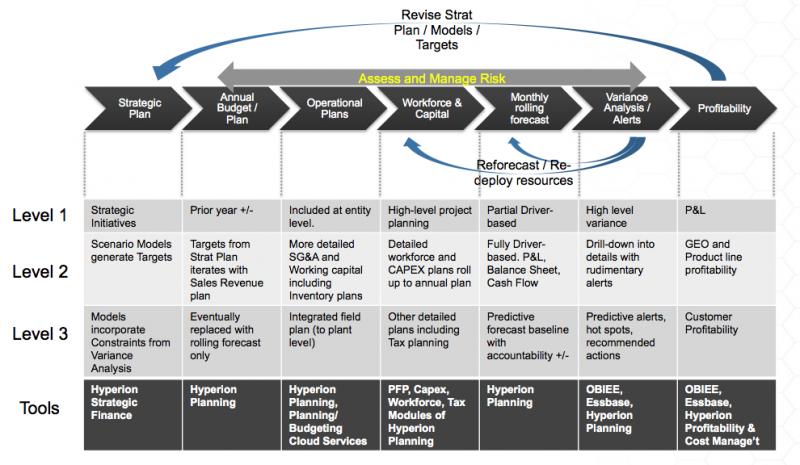

Leveraging Advanced Financial Modeling Capabilities

At the heart of every powerful capital budgeting application lies a sophisticated financial modeling engine. These advanced tools enable organizations to create complex, multi-dimensional models that account for a wide range of variables and scenarios.

Key Financial Modeling Features

- Dynamic cash flow projections

- Sensitivity analysis tools

- Monte Carlo simulations

- Risk assessment models

- Multi-currency and multi-entity support

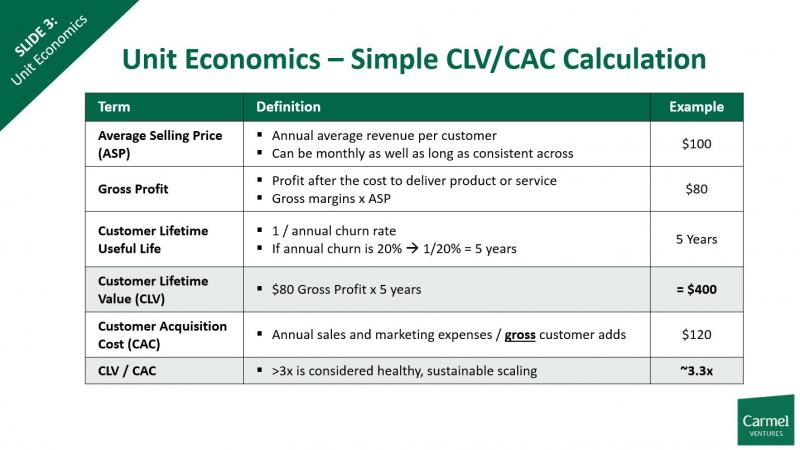

How do advanced financial modeling capabilities enhance strategic planning. By leveraging these sophisticated tools, organizations can develop more nuanced and accurate projections of future financial performance. This level of insight allows for better-informed investment decisions, more effective risk management, and improved long-term financial stability.

The Power of Predictive Analytics in Capital Budgeting

Many cutting-edge capital budgeting apps now incorporate predictive analytics capabilities, leveraging machine learning and artificial intelligence to identify patterns and forecast future trends. These advanced features can provide invaluable insights into market dynamics, customer behavior, and economic factors that may impact investment decisions.

How can predictive analytics improve capital allocation strategies. By analyzing historical data and external factors, predictive analytics can help organizations anticipate future capital needs, identify potential risks, and optimize resource allocation. This proactive approach to capital budgeting can lead to more efficient use of resources and improved return on investment over time.

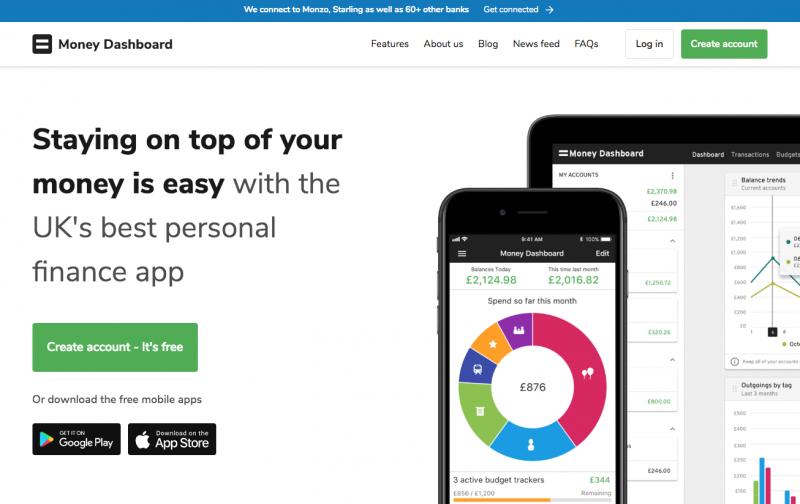

Enhancing Collaboration and Decision-Making with Cloud-Based Solutions

The shift towards cloud-based capital budgeting applications has revolutionized the way organizations approach financial planning and decision-making. These solutions offer unprecedented levels of accessibility, collaboration, and scalability, making them an increasingly popular choice for businesses of all sizes.

Advantages of Cloud-Based Capital Budgeting Apps

- Anytime, anywhere access to financial data

- Real-time collaboration among team members

- Automatic software updates and security patches

- Scalable infrastructure to accommodate growth

- Reduced IT overhead and maintenance costs

How do cloud-based solutions facilitate better decision-making in capital budgeting. By providing a centralized platform accessible to all stakeholders, cloud-based apps enable faster information sharing, more efficient approval processes, and improved visibility into the overall financial picture. This collaborative environment fosters better communication and alignment among different departments, leading to more informed and consensus-driven investment decisions.

Addressing Security Concerns in Cloud-Based Financial Applications

While the benefits of cloud-based capital budgeting solutions are clear, some organizations may have concerns about the security of their financial data in the cloud. It’s essential to choose a reputable provider that employs robust security measures, including:

- End-to-end encryption of data in transit and at rest

- Multi-factor authentication and role-based access controls

- Regular security audits and compliance certifications

- Data backup and disaster recovery protocols

- Transparency in data handling and storage practices

How can organizations ensure the security of their financial data in cloud-based capital budgeting apps. By carefully vetting potential providers, implementing strong internal security policies, and staying informed about best practices in cloud security, organizations can confidently leverage the benefits of cloud-based solutions while minimizing potential risks to their sensitive financial information.

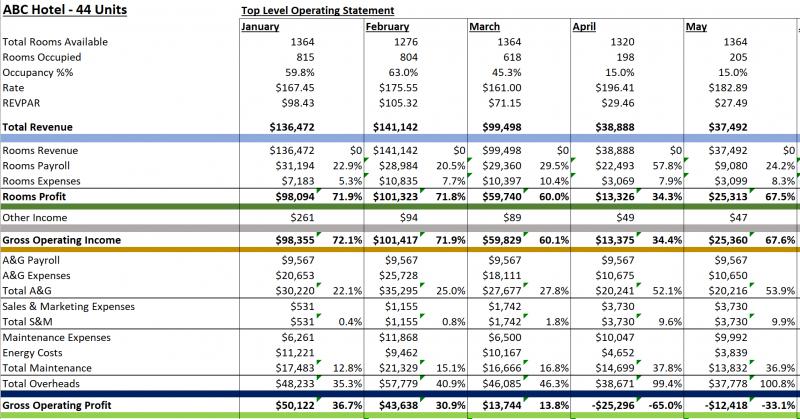

Measuring ROI: The Impact of Capital Budgeting Apps on Financial Performance

Implementing a capital budgeting application represents a significant investment for many organizations. As such, it’s crucial to measure the return on investment (ROI) and quantify the impact of these tools on overall financial performance.

Key Performance Indicators for Evaluating Capital Budgeting Apps

- Time saved in budgeting and forecasting processes

- Reduction in manual errors and data discrepancies

- Improved accuracy of financial projections

- Faster decision-making and approval cycles

- Enhanced visibility into project performance and ROI

How can organizations quantify the benefits of capital budgeting software. By tracking these key performance indicators before and after implementation, businesses can gain a clear picture of the value delivered by their capital budgeting application. This data-driven approach to evaluating ROI can help justify the investment and identify areas for further optimization.

Long-Term Financial Benefits of Effective Capital Budgeting

Beyond the immediate operational improvements, the strategic benefits of implementing a robust capital budgeting solution can have far-reaching effects on an organization’s financial health. These long-term advantages may include:

- Improved capital allocation efficiency

- Enhanced ability to identify and pursue high-value investment opportunities

- Better alignment of capital expenditures with strategic objectives

- Increased stakeholder confidence in financial management practices

- Greater agility in responding to market changes and economic fluctuations

How does improved capital budgeting contribute to long-term financial stability. By enabling more informed and strategic investment decisions, effective capital budgeting practices can lead to improved cash flow management, reduced financial risk, and enhanced overall profitability. This, in turn, can contribute to stronger financial performance and increased competitiveness in the marketplace.

Let’s dive right in and get the lowdown on capital budgeting, shall we? It’s the process of planning, allocating, and controlling expenditures on long-term assets and projects. We’re talking equipment, machinery, IT systems – anything that requires a chunk of change upfront but provides value over time. Sound familiar? It should, because every business under the sun needs solid capital budgeting to make sound investments.

Introduction to Capital Budgeting

But capital budgeting isn’t just estimating costs and picking projects. There’s a whole methodology behind analyzing potential returns, risks, timing, and prioritization. You’ve got your net present value, internal rate of return, payback period – financial models galore! Let’s not forget the critical ‘what-if’ scenarios either. Point is, capital budgeting is a complex balancing act with a lot at stake. Choose well, and you fuel growth. Choose poorly, and you sink resources into money-losing ventures. Yikes!

The Importance of Capital Budgeting for Businesses

Now we know capital budgeting ain’t no walk in the park. But taking the time and effort to get it right? It pays dividends, friends. Proper capital budgeting improves efficiency, minimizes costs, and drives strategy. It prevents organizations from flying blind with their investments. And in our disruptive modern economy, planning for the future has never been more crucial. Companies that fail to actively manage their capital budgets? Let’s just say they won’t be around for long.

Key Elements of a Capital Budget

Building an effective capital budget takes careful consideration. You need robust models to assess potential ROI. It requires identifying must-fund projects versus nice-to-haves. Prioritizing investments that align with company objectives is critical too. Don’t forget thoroughly vetting risks like changes in the market or regulations. And once the budget is set, monitoring progress to tweak as needed is vital. It’s a balancing act, but sticking to best practices makes it manageable.

Capital Budgeting Techniques and Methods

Let’s dig into the techniques that turn capital budgeting from intimidating to approachable. Net present value (NPV) models project cash flows over time to determine value. Internal rate of return (IRR) estimates expected returns as a percentage. Payback period shows when initial investment will be recouped. Then you’ve got scoring models, optimization methods, Monte Carlo simulations, real options – the list goes on. Point is, with the right approach for your needs, capital budgeting doesn’t have to make your head spin!

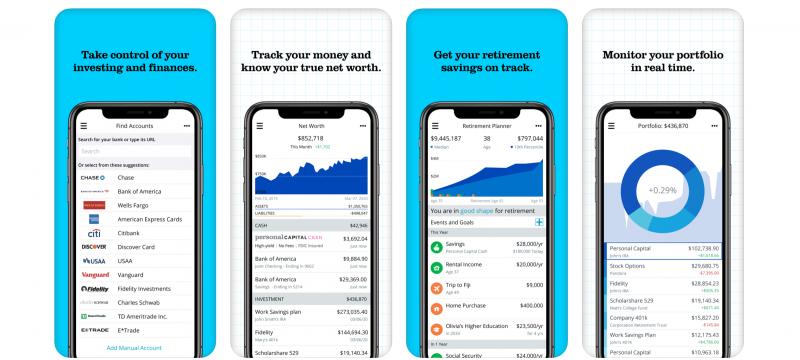

Advantages of Using Capital Budgeting Software

Now that we’ve got the basics down, where can technology come in to make the process smoother? Well, doing capital budgeting with spreadsheets is old news. Purpose-built software takes it to the next level with automated workflows, real-time data, and built-in best practices. That means creating models and forecasts with lightning speed and total accuracy. Collaborating across teams and locations in one shared system. And gaining 360-degree visibility into spending and performance. Capital budgeting software brings ease, efficiency, and confidence. Talk about a winning combo!

Top Features to Look for in Capital Budgeting Apps

So what functionality should be on your capital budgeting software wish list? Comprehensive reporting and analytics is key for data-driven decisions. Scenario modeling and ‘what-if’ analysis offer crucial insights. Tools to manage approvals, compliance, and audits are essential too. And don’t forget about forecasting capabilities and pipeline management to see the full picture. Of course, ease of use is key so staff actually use the tools. With the right feature set, capital budgeting apps offer immense strategic value far beyond spreadsheets.

Integrations with Accounting and ERP Systems

Integration capabilities also allow capital budgeting apps to take things up a notch. Tying into accounting, ERP, CRM, and other systems provides a single source of truth. That means no more manually exporting data or reconciling discrepancies. Updates surface in real-time across all connected platforms. And automated syncing means your capital budget is always using the latest and greatest data. Seamless integrations give you finger-on-the-pulse visibility to base decisions on.

Financial Modeling and Forecasting Capabilities

Let’s not forget the dynamic modeling engine that makes capital budgeting software tick. Built-in financial intelligence allows flexible assumptions and dynamic projections. Capital funding models, project proposals, milestone planning – it handles them all with ease. And forecasting tools help anticipate future capital demands based on pipeline analysis, capacity plans, and strategic priorities. With nimble modeling and forecasting, you can shift gears as business needs change. Now that’s strategic value!

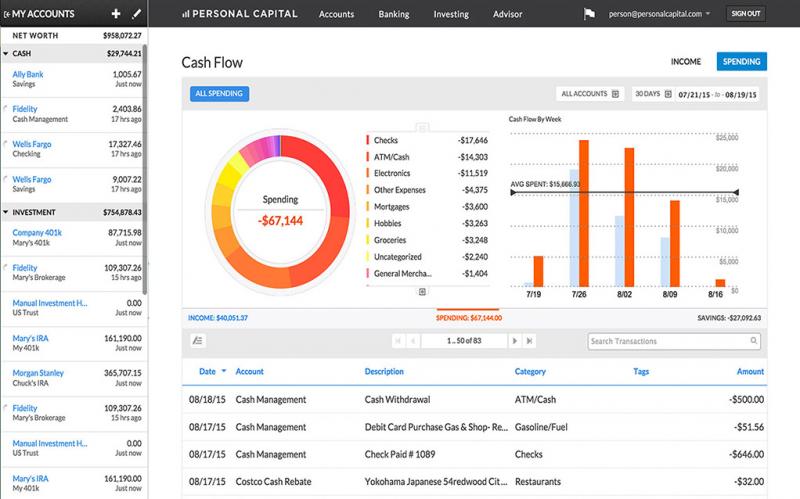

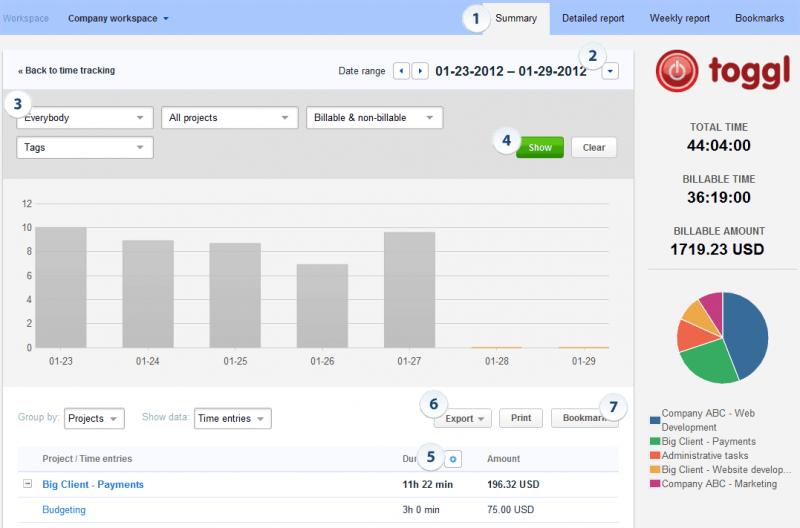

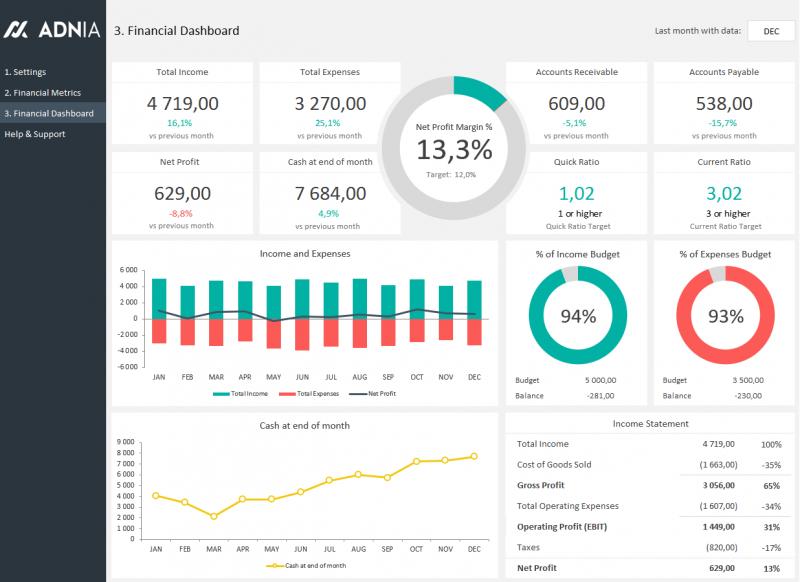

Data Visualization and Reporting

Of course, world-class technology means nothing without visibility into the data and insights. Capital budgeting apps empower users with real-time dashboards, KPIs, and drill-down reports. Interactive charts allow you to spot trends and outliers at a glance. Custom views ensure teams see the most relevant information. And automated reports free up time spent cranking out updates. With robust reporting, you get 24/7 transparency into spending and performance to drive decisions. Now that’s what we call winning!

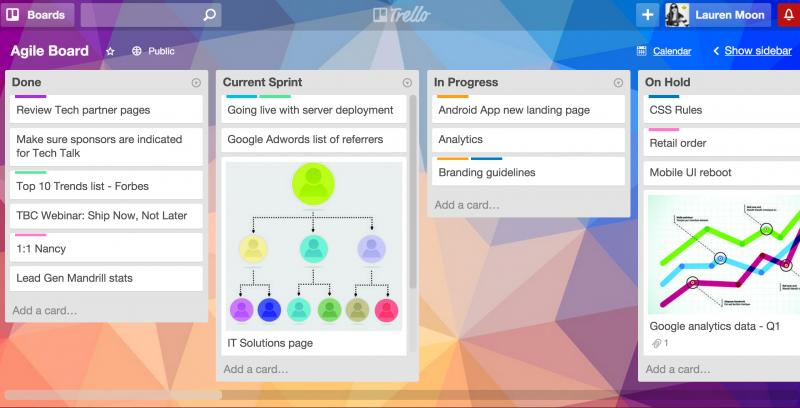

Collaboration and File Sharing Functionalities

Don’t forget collaborative features to get everyone on the same page! Commenting and activity feeds foster organization-wide engagement. Workflow automation, task management, and alerts align cross-functional teams. And secure portals with role-based access permissions control information sharing. Combine it all with version control and document storage for centralized access. With seamless collaboration, capital budgeting connects departments and locations driving strategic unity.

Accessibility and Mobile App Options

Mobility and convenience are at the forefront of technology, and capital budgeting apps follow suit. Cloud-based platforms allow anytime, anywhere access from any device. That means teams are never constrained to physical locations or desktop computers. And native mobile apps put insights and management right in your pocket on smartphones and tablets. With on-the-go accessibility, you can stay on top of capital spending from home, on vacation, or during your commute. Talk about effective time management!

Security, Privacy, and Compliance Standards

With powerful software comes great responsibility around security, privacy, and compliance. Advanced encryption and role-based access keep sensitive financial data under lock and key. Audit logs provide transparency into system activity. Leading providers meet extensive regulations and certifications like SOC2, ISO 27001, GDPR, and more. And rigorous security practices prohibit unauthorized access. With air-tight protection of your capital budget details, you can rest assured your data is safe and sound.

Implementation and Adoption Strategies

Transitioning to new technology? Change management is critical for user adoption. Gradual rollouts with training get everyone up to speed. Starting with a pilot group helps optimize configurations and processes. And proactive support smooths out the learning curve. With the right preparation, capital budgeting software can achieve rapid ROI. And drive lasting value as users master and maximize its potential.

Choosing the Right Capital Budgeting App Provider

Selecting the perfect capital budgeting software takes diligent decision-making. Prioritize an intuitive platform that empowers users at any technical skill level. Look for robust modeling capabilities to handle your unique needs. Data integrations are key for a unified view across systems. Ongoing support and training add immense value too. By aligning features to requirements, capital budgeting apps become a strategic asset. For long-term growth and productivity gains, choose your technology partner wisely!

So there you have it, friends! Capital budgeting apps help optimize investment decisions, strategy, and efficiency. With streamlined financial management, dynamic modeling, and 360-degree visibility, they provide immense strategic value. So don’t settle for spreadsheets. Join the future with capital budgeting software and watch productivity soar. The growth gains will speak for themselves. It’s time to level up, tackle capital spending like a pro, and boost your bottom line. Let’s get down to business!

Let’s get down to the nitty gritty on capital budgeting, shall we? It’s the crucial process of planning, budgeting, and managing expenditures for long-term investments. We’re talking equipment, facilities, IT systems – any major asset that costs a pretty penny upfront but delivers value over time. Sound critical? You bet it is, because every business under the sun requires air-tight capital budgeting to make prudent decisions.

Introduction to Capital Budgeting

But capital budgeting is more than just estimating costs. It’s a meticulous methodology of analyzing potential returns, risks, timing, and prioritizing investments. You need robust financial models to assess net present value, internal rate of return, payback period – the works! Don’t forget thorough ‘what-if’ scenario planning either. In short, capital budgeting is a high-stakes balancing act. Choose wisely, and you fuel growth. Choose poorly, and you hemorrhage resources into sinking ships. The stakes don’t get much higher than that!

The Importance of Capital Budgeting for Businesses

Now we appreciate capital budgeting is no cakewalk. But taking the time to perfect it? Pure gold, my friends. Proper capital budgeting boosts efficiency, controls costs, and drives strategy. It prevents blind investing and wasted resources. In today’s breakneck marketplace, actively managing capital budgets is mission critical. Companies that neglect them? Let’s just say they won’t be around for long.

Like a compass guiding your ship through rocky waters, solid capital budgeting steers organizations to prosperity. It aligns investments with overarching objectives. We’re talking expanding facilities to increase manufacturing capacity or upgrading technology to improve product quality. Every project ties back to strategic goals, generating value and growth. That’s why finely tuned capital budgeting is indispensable for enduring success.

Key Elements of a Capital Budget

Now let’s dive into crafting a stellar capital budget. It takes meticulous planning and consideration. You need robust models to calculate potential returns on investment down to the decimal. Identifying must-fund necessities versus nice-to-have pet projects is imperative. Prioritizing investments that align with company goals and strategy is key too. And don’t forget thoroughly assessing risks like market changes that could derail projections. Once the budget is set, closely monitoring progress allows fluid adjustments as needed. It’s an art and a science, but sticking to proven best practices makes it doable.

Capital Budgeting Techniques and Methods

Let’s explore the techniques that make capital budgeting manageable. Net present value (NPV) projects future cash flows to gauge investment value. Internal rate of return (IRR) estimates expected returns as a percentage. Payback period shows when the initial outlay will be recovered. Then you’ve got scoring models, optimization algorithms, Monte Carlo simulations, real options theory – the list goes on. The point is, the right approach makes capital budgeting smooth sailing.

Advantages of Using Capital Budgeting Software

Now that we’ve got the fundamentals down pat, how can technology take capital budgeting to the next level? Spreadsheets are yesterday’s news. Purpose-built software brings workflow automation, real-time data, and built-in best practices to the table. That means building models and forecasts at lightning speed with total accuracy. Enabling company-wide collaboration in one system. And gaining 24/7 visibility into spending and performance. Capital budgeting software brings ease, efficiency, and confidence. Talk about a winning trifecta!

Top Features to Look for in Capital Budgeting Apps

So what functionality should be on your capital budgeting software wish list? Robust reporting and analytics are clutch for data-backed decisions. Scenario modeling and ‘what-if’ analysis provide game-changing insights. Tools to manage approvals, compliance, and auditing are essential too. And forecasting and pipeline tracking offer the full view. Of course, ease of use ensures adoption and ROI. With the right features, capital budgeting apps offer immense strategic benefits far beyond spreadsheets.

Integrations with Accounting and ERP Systems

Integration capabilities also give capital budgeting software an edge. Tying into accounting, ERP, CRM, and other systems creates a single source of truth. That means no more manually exporting data or reconciling discrepancies. Changes surface in real-time across platforms. And automated syncing leverages the latest data. With seamless integrations, you gain finger-on-the-pulse visibility to drive decisions.

Financial Modeling and Forecasting Capabilities

Let’s not overlook the dynamic modeling engine powering capital budgeting apps. Built-in financial intelligence enables flexible assumptions and projections. Capital funding models, project proposals, milestone roadmaps – it handles them with finesse. And forecasting tools predict future capital needs based on pipeline analysis, capacity plans, and strategic priorities. With agile modeling and forecasting, you can pivot on a dime when business needs shift. Now that’s strategic value!

Data Visualization and Reporting

Of course, world-class technology is worthless without visibility into the data and insights. Capital budgeting apps empower users with real-time dashboards, KPIs, and drill-down reports. Interactive charts allow you to spot trends and outliers at a glance. Custom views showcase the most relevant information for each team. And scheduled reports free up resources spent cranking them out manually. With robust reporting, you gain 24/7 transparency into spending and performance to drive decisions. Now that’s what we call a strategic advantage!

Collaboration and File Sharing Functionalities

Don’t overlook collaborative features to align everyone! Commenting and activity feeds drive company-wide engagement. Workflow automation, task management, and alerts get cross-functional teams on the same page. Secure portals with role-based access permissions control information sharing on a need-to-know basis. Version control and document storage enable centralized access and up-to-date data. With seamless collaboration, capital budgeting connects departments and locations driving strategic unity.

Accessibility and Mobile App Options

Mobility and flexibility are non-negotiable today, and capital budgeting apps deliver. Cloud-based platforms enable anytime, anywhere access on any device. Teams are no longer tethered to desktop computers in the office. And native mobile apps put data and management right in your pocket via smartphones and tablets. With on-the-go access, you stay connected to capital spending around the clock. Now that’s effective time management!

Security, Privacy, and Compliance Standards

Advanced technology requires stringent security, privacy, and compliance. Robust encryption and role-based access keep sensitive financial data secure. Extensive audit logs provide transparency. Leading providers meet regulations like SOC2, ISO 27001, GDPR, and more. And rigorous best practices prohibit unauthorized access. With ironclad protection of your capital budget details, you can rest easy knowing your data is safe and sound.

Implementation and Adoption Strategies

Transitioning to new systems? Change management is key for user adoption. Gradual rollouts with extensive training help teams get up to speed. Pilot groups enable optimizing configurations and processes before wide deployment. And responsive support smooths out the learning curve. With the right preparation, capital budgeting software can achieve rapid ROI. And continue driving value as users master its potential.

Choosing the Right Capital Budgeting App Provider

Selecting the perfect capital budgeting software takes due diligence. Prioritize an intuitive platform that empowers users at all skill levels. Look for robust modeling capabilities that fit your needs like a glove. Integration capabilities are crucial for a unified view across systems. Ongoing support and training provide immense value too. By matching features to requirements, capital budgeting apps become an invaluable strategic asset. For long-term growth and productivity gains, choose your technology partner wisely!

There you have it, folks! Capital budgeting apps optimize investment decisions, strategy, and efficiency. With streamlined financial management, dynamic modeling, and 360-degree visibility, they deliver immense strategic benefits. Don’t settle for spreadsheets. Embrace the future with purpose-built software and watch productivity skyrocket. The growth dividends will speak for themselves. It’s time to step up your capital budgeting game, make prudent moves, and boost your bottom line. Let’s do this!

Key Elements of a Capital Budget

Developing a capital budget is a crucial process for any business looking to make significant investments in long-term assets. Unlike an operating budget that covers routine expenses, a capital budget focuses on expenditures for fixed assets like equipment, facilities, and technology. Creating an effective capital budget requires careful analysis of potential costs and benefits to ensure the investments align with the company’s strategic goals and provide an acceptable return. Here are some key elements to include in a capital budget:

Identification of Capital Investments

The first step is to identify potential capital projects, equipment purchases, facility expansions, or technology upgrades under consideration for the upcoming fiscal year. This could come from various departments proposing investments or an annual strategic planning process. Every potential capital expenditure, large and small, should be included on a master list for further evaluation.

Cost Analysis

For each proposed capital project, detailed cost estimates should be developed. This includes not only the direct purchase price or construction costs, but also ancillary expenses like shipping and installation, needed infrastructure upgrades, ongoing maintenance expenses, as well as any costs related to the disposal of current assets being replaced. Cost overruns are common on major capital projects, so it’s wise to pad estimates with a contingency fund.

Benefits Analysis

The benefits of capital investments can be more difficult to quantify, but are vital to analyze. Some projects like new equipment may have easily projected gains in productivity or capacity. Others like brand new facilities have benefits that are indirect, like improving employee satisfaction and retention. Consider both short and long-term benefits as well as how they align with strategic business objectives.

Time Frame

Capital budgets should have an annual time horizon like fiscal or calendar years. But many capital investments may take months or years to implement fully. Creating a projected schedule for each capital project ensures the costs and benefits are properly spread over time. This helps prevent pouring too much capital into projects all at once.

Return on Investment

Using the cost and benefit projections, an ROI analysis should be conducted on each proposed capital expenditure. Comparing different investment options using ROI and other financial metrics like payback period helps determine priorities. Threshold ROI rates can be established to only pursue projects expected to yield sufficient long-term returns.

Authorization Process

Capital budgets require board approval at most organizations. The authorization process, thresholds, and decision criteria should be defined. This ensures only projects that align strategically and financially move forward. Many boards also require progress reports on approved capital projects to monitor against the budget.

Financing Options

Finally, capital budgets must look at how proposed investments will be financed. Common options are accumulating reserves, debt financing like loans and bonds, or equity financing like selling stock shares. The availability, costs, and risks of various financing options should be weighed.

Developing a thoughtful capital budget aligned with these key elements allows organizations to optimize their capital investments and avoid missteps that could waste funds or jeopardize long-term success.

Boost Productivity: How Can Capital Budgeting Apps Streamline Your Finances?

For many businesses, developing and managing capital budgets is a cumbersome process reliant on spreadsheets and manual processes. It takes significant time and effort to accurately project costs and benefits, model cash flows, calculate metrics, and update constantly changing plans. However, new capital budgeting apps can dramatically improve productivity by streamlining the entire process digitally.

Centralize Capital Investment Data

Capital budgeting apps provide a central database to store and organize information on all proposed capital projects, equipment purchases, facility improvements, and other investments. Details like cost estimates, timelines, approvals, and more can be entered and tracked in one integrated system accessible to stakeholders company-wide. This eliminates duplicative data entry, ensures consistency, and saves huge amounts of time over managing separate spreadsheets.

Automate Financial Modeling

The most powerful capital budgeting apps automate the financial calculations needed for ROI analysis, cash flow projections, and investment comparisons. Rather than manual computations using calculators or complex spreadsheets formulas, the software does the number crunching for you instantly as data is input. Automation reduces errors and allows rapid what-if scenario modeling.

Provide Real-Time Reporting

Monitoring the status of capital projects against the approved budget is easier with real-time digital dashboards. Capital budgeting apps centralize status updates from departments and project managers, providing instant access to the latest timelines, costs, risks, and ROI projections. Push notifications can alert stakeholders when critical changes occur, enabling quick responses.

Enhance Collaboration

Cloud-based capital budgeting apps allow teams to collaborate across multiple locations and departments. Comments can be added to discuss investments under consideration. Approval workflows ensure proper sign-offs at every stage. Tasks can be assigned to specific individuals with tracking. This level of collaboration saves trips to meetings and email chains.

Integrate With Accounting Systems

Rather than transferring data manually, many capital budgeting apps offer seamless integration with popular accounting platforms like Quickbooks and Oracle NetSuite. This allows approved capital budgets to flow directly into financial reports and simplifies asset tracking. Integrations also synchronize historical spending data to inform future budgets.

Provide Oversight for Compliance

Capital budgets require oversight and approval controls to stay compliant. Digital apps enable user permissions to be set by role, protecting sensitive financial data. Approval workflows can route proposed budgets through proper authority channels. Audit trail tracking provides detailed reporting on any changes for transparency.

Improve Forecasting Accuracy

Advanced analytics and machine learning capabilities in some capital budgeting apps help uncover insights to improve forecasting and cost benefit analysis. By examining past spending trends and project performance, predictions can be fine-tuned over time.

Streamlining capital budget management digitally enables finance leaders to complete the once painstaking process faster and more strategically. Teams spend less time crunching numbers in spreadsheets and more time evaluating investments to drive business growth. With real-time data visibility and collaboration across the organization, capital budgets become a value-driver rather than a burden.

Capital Budgeting Techniques and Methods

Making major capital investments is a crucial process for businesses. Capital budgeting refers to the formal evaluation and approval procedures for long-term expenditures on fixed assets. There are various capital budgeting techniques and methods that provide the analytical framework for comparing investment options and deciding where to allocate capital. Choosing the right techniques is key to maximizing returns.

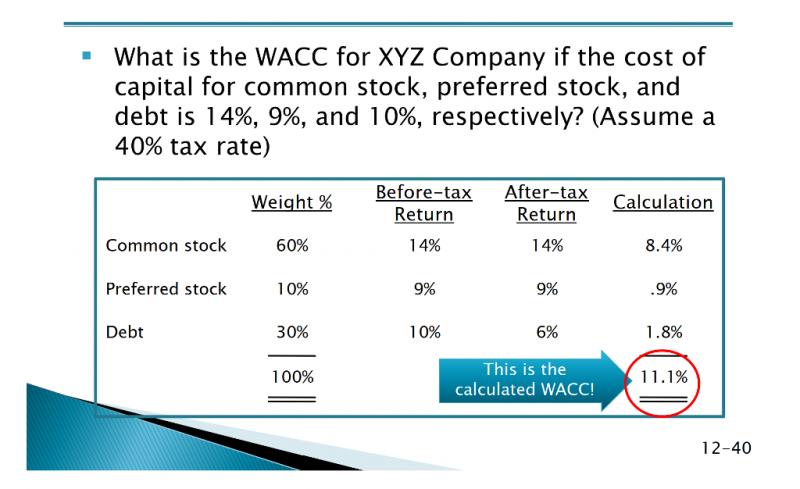

Net Present Value (NPV)

The net present value method is one of the most common and useful capital budgeting techniques. NPV analysis projects the expected cash inflows and outflows from an investment over time. These cash flows are discounted to adjust for the time value of money using the company’s cost of capital as the discount rate. If the NPV is positive, the investment is financially worthwhile.

Internal Rate of Return (IRR)

While NPV focuses on total value, IRR calculates the expected rate of return from an investment. It’s the discount rate that would result in an NPV of zero. Companies often have target IRR thresholds that proposed capital projects must meet for approval. The higher the IRR, the more desirable the investment.

Payback Period

The capital budgeting payback period method calculates how long it will take to recoup the initial investment from project cash flows. Faster payback periods mean less financial risk. But this technique does not account for cash flows beyond the breakeven point, which is a limitation.

Discounted Payback Period

The discounted payback period method improves upon simple payback analysis by factoring in the time value of money. It measures how long until an investment’s NPV becomes positive based on discounted cash flows. While better, this still ignores post-payback period returns.

ROI Analysis

Return on investment (ROI) metrics can also be applied to capital budgeting. ROI measures accounting income expected from an investment divided by the cost. This technique is easy to calculate but ignores the timing of cash flows and time value of money.

Profitability Index

The profitability index method divides an investment’s NPV by its initial cost. Any project with a profitability index greater than 1.0 has a positive NPV and is considered an economically viable option. This helps rank competing projects by profitability.

Capital Asset Pricing Model

The capital asset pricing model (CAPM) aims to quantify the investment risk associated with a capital project. By incorporating the cost of equity capital, CAPM helps determine hurdle rates of return needed to justify approving risky investments.

Scenario Analysis

Conducting scenario analysis when evaluating capital investments analyzes how changes to key assumptions, like sales projections or construction costs, would impact financial returns. This provides insights into the riskiness of the investment.

Decision Tree Analysis

Decision trees map out various paths a capital investment proposal could take based on different conditions and probabilities. This technique quantifies the overall chances of achieving target financial returns given all the uncertainties.

Using capital budgeting methods like NPV, IRR, and ROI provides data-driven guidance rather than gut instinct alone. The right analytical approach depends on the investment type and where it falls in the company’s strategic roadmap. Taking the time to crunch the numbers ultimately pays dividends.

Boost Productivity: How Can Capital Budgeting Apps Streamline Your Finances?

For many businesses, developing and managing capital budgets is a cumbersome process reliant on spreadsheets and manual processes. It takes significant time and effort to accurately project costs and benefits, model cash flows, calculate metrics, and update constantly changing plans. However, new capital budgeting apps can dramatically improve productivity by streamlining the entire process digitally.

Centralize Capital Investment Data

Capital budgeting apps provide a central database to store and organize information on all proposed capital projects, equipment purchases, facility improvements, and other investments. Details like cost estimates, timelines, approvals, and more can be entered and tracked in one integrated system accessible to stakeholders company-wide. This eliminates duplicative data entry, ensures consistency, and saves huge amounts of time over managing separate spreadsheets.

Automate Financial Modeling

The most powerful capital budgeting apps automate the financial calculations needed for ROI analysis, cash flow projections, and investment comparisons. Rather than manual computations using calculators or complex spreadsheets formulas, the software does the number crunching for you instantly as data is input. Automation reduces errors and allows rapid what-if scenario modeling.

Provide Real-Time Reporting

Monitoring the status of capital projects against the approved budget is easier with real-time digital dashboards. Capital budgeting apps centralize status updates from departments and project managers, providing instant access to the latest timelines, costs, risks, and ROI projections. Push notifications can alert stakeholders when critical changes occur, enabling quick responses.

Enhance Collaboration

Cloud-based capital budgeting apps allow teams to collaborate across multiple locations and departments. Comments can be added to discuss investments under consideration. Approval workflows ensure proper sign-offs at every stage. Tasks can be assigned to specific individuals with tracking. This level of collaboration saves trips to meetings and email chains.

Integrate With Accounting Systems

Rather than transferring data manually, many capital budgeting apps offer seamless integration with popular accounting platforms like Quickbooks and Oracle NetSuite. This allows approved capital budgets to flow directly into financial reports and simplifies asset tracking. Integrations also synchronize historical spending data to inform future budgets.

Provide Oversight for Compliance

Capital budgets require oversight and approval controls to stay compliant. Digital apps enable user permissions to be set by role, protecting sensitive financial data. Approval workflows can route proposed budgets through proper authority channels. Audit trail tracking provides detailed reporting on any changes for transparency.

Improve Forecasting Accuracy

Advanced analytics and machine learning capabilities in some capital budgeting apps help uncover insights to improve forecasting and cost benefit analysis. By examining past spending trends and project performance, predictions can be fine-tuned over time.

Streamlining capital budget management digitally enables finance leaders to complete the once painstaking process faster and more strategically. Teams spend less time crunching numbers in spreadsheets and more time evaluating investments to drive business growth. With real-time data visibility and collaboration across the organization, capital budgets become a value-driver rather than a burden.

Advantages of Using Capital Budgeting Software

Developing an effective annual capital budget is a complex, data-intensive process for most organizations. Historically, finance teams have relied on spreadsheets, calculators, and manual processes to evaluate potential investments and build capital budgets. However, modern capital budgeting software provides significant advantages over old-school methods:

Streamlined Workflow

Capital budgeting software centralizes the entire budget development workflow in a single, collaborative platform. Departments can submit investment proposals, finance can analyze options, and leadership can review and approve requests. Configurable forms and automated routing eliminate paperwork and email chains.

Data Integration

Manually consolidating data from disparate sources into spreadsheets is eliminated by software integration. Capital requests, accounting data, resource allocations, and project plans can be automatically synced. This provides real-time visibility and cuts data entry time.

Financial Modeling

Spreadsheet financial models are error-prone and time-consuming to update. Capital budgeting systems automate cash flow projections, NPV and IRR calculations, scenario analysis, and other complex modeling for faster, more accurate analysis.

Custom Reporting

Monitoring and reporting on capital budgets during implementation is easier with software dashboards versus static spreadsheets. Real-time reports display custom views of spending, project status, resources, and KPIs.

Enhanced Collaboration

Cloud-based capital budgeting platforms allow teams to collaborate across multiple locations. Comments, file sharing, task management, and approvals can happen in the software rather than email.

Secure Access Control

System user permissions provide secure access appropriate to each user’s budget responsibilities. Granular settings control who can view, edit, approve, and submit budget data.

Audit Trails

Capital budgeting software logs all system activity for complete audit trails. This simplifies compliance and provides oversight of changes to the capital budget for transparency.

Version Control

Managing budget revisions with spreadsheets leads toConfusion over which version is current. Capital software maintains each iteration with timestamped audit trails of all changes.

Change Management

Updating spreadsheets is risky and can overwrite data. Capital budgeting tools use controls like forms and workflows to manage changes, ensuring no accidental overrides.

Scalability

Spreadsheets bog down with too much data or too many users. Web-based capital budgeting software easily scales to accommodate large budgets, global teams, and complex data.

Risk Analysis

Leading capital budgeting platforms quantify risk through Monte Carlo simulations, sensitivity analysis, probability distributions, and other advanced methods difficult in spreadsheets.

Capital budgeting software saves finance teams time while also improving data accuracy, collaboration, compliance, and risk management. The advantages over spreadsheets are abundantly clear for organizations managing substantial capital investments.

Boost Productivity: How Can Capital Budgeting Apps Streamline Your Finances?

For many businesses, developing and managing capital budgets is a cumbersome process reliant on spreadsheets and manual processes. It takes significant time and effort to accurately project costs and benefits, model cash flows, calculate metrics, and update constantly changing plans. However, new capital budgeting apps can dramatically improve productivity by streamlining the entire process digitally.

Centralize Capital Investment Data

Capital budgeting apps provide a central database to store and organize information on all proposed capital projects, equipment purchases, facility improvements, and other investments. Details like cost estimates, timelines, approvals, and more can be entered and tracked in one integrated system accessible to stakeholders company-wide. This eliminates duplicative data entry, ensures consistency, and saves huge amounts of time over managing separate spreadsheets.

Automate Financial Modeling

The most powerful capital budgeting apps automate the financial calculations needed for ROI analysis, cash flow projections, and investment comparisons. Rather than manual computations using calculators or complex spreadsheets formulas, the software does the number crunching for you instantly as data is input. Automation reduces errors and allows rapid what-if scenario modeling.

Provide Real-Time Reporting

Monitoring the status of capital projects against the approved budget is easier with real-time digital dashboards. Capital budgeting apps centralize status updates from departments and project managers, providing instant access to the latest timelines, costs, risks, and ROI projections. Push notifications can alert stakeholders when critical changes occur, enabling quick responses.

Enhance Collaboration

Cloud-based capital budgeting apps allow teams to collaborate across multiple locations and departments. Comments can be added to discuss investments under consideration. Approval workflows ensure proper sign-offs at every stage. Tasks can be assigned to specific individuals with tracking. This level of collaboration saves trips to meetings and email chains.

Integrate With Accounting Systems

Rather than transferring data manually, many capital budgeting apps offer seamless integration with popular accounting platforms like Quickbooks and Oracle NetSuite. This allows approved capital budgets to flow directly into financial reports and simplifies asset tracking. Integrations also synchronize historical spending data to inform future budgets.

Provide Oversight for Compliance

Capital budgets require oversight and approval controls to stay compliant. Digital apps enable user permissions to be set by role, protecting sensitive financial data. Approval workflows can route proposed budgets through proper authority channels. Audit trail tracking provides detailed reporting on any changes for transparency.

Improve Forecasting Accuracy

Advanced analytics and machine learning capabilities in some capital budgeting apps help uncover insights to improve forecasting and cost benefit analysis. By examining past spending trends and project performance, predictions can be fine-tuned over time.

Streamlining capital budget management digitally enables finance leaders to complete the once painstaking process faster and more strategically. Teams spend less time crunching numbers in spreadsheets and more time evaluating investments to drive business growth. With real-time data visibility and collaboration across the organization, capital budgets become a value-driver rather than a burden.

Top Features to Look for in Capital Budgeting Apps

Automating the capital budgeting process with dedicated software provides enormous efficiency gains over spreadsheets and manual methods. But not all capital budgeting apps are created equal when it comes to features and functionality. Here are some of the most important capabilities to look for when evaluating capital budgeting solutions:

Customizable Requests and Forms

The system should provide forms for capital project requests, equipment purchases, and other investment proposals that are tailored to your organization’s specific process and data needs. Forms that are configurable without IT help streamline data collection.

Built-In Financial Calculators

Powerful capital budgeting software includes sophisticated financial modeling capabilities to automatically calculate NPV, IRR, discounted cash flows, depreciation, and key return metrics as data is input into request forms.

Flexible Reporting and Dashboards

Real-time reporting through interactive dashboards provides insights into capital spending vs. budgets, project pipelines, cost/benefit forecasts, and other KPIs. Customizable reports are essential for stakeholders.

Collaboration Tools

Centralized communication around capital projects eliminates silos. Collaboration features like commenting, file sharing, task management, and notifications enable team-based budgeting.

Role-Based Permissions

Managing user access with permissions provides security and separation of duties. View, edit, approval, and submission permissions should be role-based.

Configurable Workflows

The software should route capital requests and budgets through custom approval chains, allowing you to define sign-off roles. Automated workflows reduce delays and errors.

Integration Capabilities

APIs and connectors to import data from ERP systems, project plans, accounting software, and other sources eliminate duplicate data entry. Two-way integrations also push approved budgets back to financial systems.

Audit Trail Tracking

Detailed activity logs and audit trails provide transparency into the capital budgeting process. Traceability simplifies compliance and change control.

Access Control

Granular access settings give finance full control while allowing wider team access to relevant data. Multi-factor authentication adds security around financial data.

Real-Time Budget vs. Actuals

The best apps compare real-time spending vs. capital budgets to provide alerts on misalignments from planned investments. Real-time data aids decision-making.

Portfolio Analysis

Dashboard analysis of the overall capital investment portfolio – including costs, returns, risks, and alignment to goals – provides insights unavailable in spreadsheets.

Today’s most advanced capital budgeting apps leverage the cloud, automation, and real-time data to transform a painful manual process into a strategic asset. Prioritize must-have features during your software selection process.

Boost Productivity: How Can Capital Budgeting Apps Streamline Your Finances?

For many businesses, developing and managing capital budgets is a cumbersome process reliant on spreadsheets and manual processes. It takes significant time and effort to accurately project costs and benefits, model cash flows, calculate metrics, and update constantly changing plans. However, new capital budgeting apps can dramatically improve productivity by streamlining the entire process digitally.

Centralize Capital Investment Data

Capital budgeting apps provide a central database to store and organize information on all proposed capital projects, equipment purchases, facility improvements, and other investments. Details like cost estimates, timelines, approvals, and more can be entered and tracked in one integrated system accessible to stakeholders company-wide. This eliminates duplicative data entry, ensures consistency, and saves huge amounts of time over managing separate spreadsheets.

Automate Financial Modeling

The most powerful capital budgeting apps automate the financial calculations needed for ROI analysis, cash flow projections, and investment comparisons. Rather than manual computations using calculators or complex spreadsheets formulas, the software does the number crunching for you instantly as data is input. Automation reduces errors and allows rapid what-if scenario modeling.

Provide Real-Time Reporting

Monitoring the status of capital projects against the approved budget is easier with real-time digital dashboards. Capital budgeting apps centralize status updates from departments and project managers, providing instant access to the latest timelines, costs, risks, and ROI projections. Push notifications can alert stakeholders when critical changes occur, enabling quick responses.

Enhance Collaboration

Cloud-based capital budgeting apps allow teams to collaborate across multiple locations and departments. Comments can be added to discuss investments under consideration. Approval workflows ensure proper sign-offs at every stage. Tasks can be assigned to specific individuals with tracking. This level of collaboration saves trips to meetings and email chains.

Integrate With Accounting Systems

Rather than transferring data manually, many capital budgeting apps offer seamless integration with popular accounting platforms like Quickbooks and Oracle NetSuite. This allows approved capital budgets to flow directly into financial reports and simplifies asset tracking. Integrations also synchronize historical spending data to inform future budgets.

Provide Oversight for Compliance

Capital budgets require oversight and approval controls to stay compliant. Digital apps enable user permissions to be set by role, protecting sensitive financial data. Approval workflows can route proposed budgets through proper authority channels. Audit trail tracking provides detailed reporting on any changes for transparency.

Improve Forecasting Accuracy

Advanced analytics and machine learning capabilities in some capital budgeting apps help uncover insights to improve forecasting and cost benefit analysis. By examining past spending trends and project performance, predictions can be fine-tuned over time.

Streamlining capital budget management digitally enables finance leaders to complete the once painstaking process faster and more strategically. Teams spend less time crunching numbers in spreadsheets and more time evaluating investments to drive business growth. With real-time data visibility and collaboration across the organization, capital budgets become a value-driver rather than a burden.

Integrations with Accounting and ERP Systems

To maximize the value of capital budgeting software, seamless integrations with existing accounting and ERP systems are essential. Rather than managing financial data in silos, automation and APIs enable system connectivity. This brings substantial productivity benefits for finance teams by eliminating manual workarounds.

The Challenges of Disparate Systems

Without integrations, capital budgeting apps operate independently from the accounting and financial data in ERP platforms. Teams must manually extract data from one system and re-enter it into another. Syncing transactions and reconciling accounts becomes tedious and duplicative.

Benefits of Integrated Systems

Integrations between capital budgeting software and core financial systems provide a “single source of truth” for data. Investments, expenses, assets, and other financial information flows seamlessly between systems. This automation delivers numerous benefits:

- Reduced manual data entry and re-entry

- Fewer errors from duplicate data

- Real-time visibility into budgets vs. actuals

- Streamlined asset tracking and depreciation

- Synchronized changes and updates across systems

- Elimination of version control issues

- Accelerated financial reporting cycles

Popular Accounting Integrations

Leading capital budgeting apps offer pre-built integrations with major accounting and ERP platforms like:

- QuickBooks

- Oracle NetSuite

- SAP

- Microsoft Dynamics

- Sage Intacct

- Multiview

- Acumatica

These integrations synchronize general ledger accounts, project/department codes, vendor and customer data, capital/operational expenses, assets, and other financial information.

How Bidirectional Integration Works

The most seamless connections use bidirectional data flows between capital budgeting apps and accounting/ERP systems. Key processes include:

- Investment proposals initiated in the budgeting app sync to financial systems

- Accounting data feeds into financial models and calculations

- Approved budgets flow back into financial reports

- Actual spend is tracked against capital budgets

- Asset depreciation schedules remain aligned

With real-time data flowing both ways, finance teams have a unified view of capital spending and finances.

Leveraging APIs for Flexibility

Application programming interfaces (APIs) allow capital budgeting platforms to integrate with virtually any accounting or ERP solution, beyond just pre-built connectors. APIs enable custom integrations when needed.

Deep integrations between systems eliminate siloed financial data and wasted manual efforts. This allows finance leaders to focus on high-value analysis and decision-making rather than data consolidation.

Boost Productivity: How Can Capital Budgeting Apps Streamline Your Finances?

For many businesses, developing and managing capital budgets is a cumbersome process reliant on spreadsheets and manual processes. It takes significant time and effort to accurately project costs and benefits, model cash flows, calculate metrics, and update constantly changing plans. However, new capital budgeting apps can dramatically improve productivity by streamlining the entire process digitally.

Centralize Capital Investment Data

Capital budgeting apps provide a central database to store and organize information on all proposed capital projects, equipment purchases, facility improvements, and other investments. Details like cost estimates, timelines, approvals, and more can be entered and tracked in one integrated system accessible to stakeholders company-wide. This eliminates duplicative data entry, ensures consistency, and saves huge amounts of time over managing separate spreadsheets.

Automate Financial Modeling

The most powerful capital budgeting apps automate the financial calculations needed for ROI analysis, cash flow projections, and investment comparisons. Rather than manual computations using calculators or complex spreadsheets formulas, the software does the number crunching for you instantly as data is input. Automation reduces errors and allows rapid what-if scenario modeling.

Provide Real-Time Reporting

Monitoring the status of capital projects against the approved budget is easier with real-time digital dashboards. Capital budgeting apps centralize status updates from departments and project managers, providing instant access to the latest timelines, costs, risks, and ROI projections. Push notifications can alert stakeholders when critical changes occur, enabling quick responses.

Enhance Collaboration

Cloud-based capital budgeting apps allow teams to collaborate across multiple locations and departments. Comments can be added to discuss investments under consideration. Approval workflows ensure proper sign-offs at every stage. Tasks can be assigned to specific individuals with tracking. This level of collaboration saves trips to meetings and email chains.

Integrate With Accounting Systems

Rather than transferring data manually, many capital budgeting apps offer seamless integration with popular accounting platforms like Quickbooks and Oracle NetSuite. This allows approved capital budgets to flow directly into financial reports and simplifies asset tracking. Integrations also synchronize historical spending data to inform future budgets.

Provide Oversight for Compliance

Capital budgets require oversight and approval controls to stay compliant. Digital apps enable user permissions to be set by role, protecting sensitive financial data. Approval workflows can route proposed budgets through proper authority channels. Audit trail tracking provides detailed reporting on any changes for transparency.

Improve Forecasting Accuracy

Advanced analytics and machine learning capabilities in some capital budgeting apps help uncover insights to improve forecasting and cost benefit analysis. By examining past spending trends and project performance, predictions can be fine-tuned over time.

Streamlining capital budget management digitally enables finance leaders to complete the once painstaking process faster and more strategically. Teams spend less time crunching numbers in spreadsheets and more time evaluating investments to drive business growth. With real-time data visibility and collaboration across the organization, capital budgets become a value-driver rather than a burden.

Financial Modeling and Forecasting Capabilities

One of the core functionalities capital budgeting software must provide is robust financial modeling and forecasting tools. Rather than relying on error-prone spreadsheets, the best solutions automate projections, scenarios, and data analysis to streamline planning.

Cash Flow Projections

Building multi-year cash flow models is simplified with software automation. Timeseries forecasts can be configured to calculate periodic cash inflows and outflows from capital investments based on scheduled in-service dates, estimated useful life, tax and interest implications, and other variables.

NPV and IRR

Net present value (NPV) and internal rate of return (IRR) metrics are automatically computed using discounted cash flow analysis as data is input. This provides rapid insight into return potential versus opportunity cost.

Payback Period

Payback periods are generated to determine the breakeven point for capital expenditures. Shorter payback periods reduce risk. Software simplifies multiple payback period versions like discounted and dynamic.

Scenario Analysis

Building different what-if scenarios allows testing of assumptions like cost fluctuations, changes in revenue forecasts, delays, etc. Capital budgeting software makes scenario modeling quick and easy versus spreadsheets.

Sensitivity Analysis

Understanding which variables have the greatest impact on investment returns helps assess risk. Software can instantly run sensitivity analysis by changing assumptions to see their effect.

Monte Carlo Simulation

This technique runs thousands of randomized iterations to forecast probabilities of achieving target returns or costs. It provides deep statistical insights difficult to replicate manually.

Reports and Charts

Financial analysis is clearer when presented visually. Capital budgeting tools include libraries of charts, graphs, and reports to communicate forecasts, returns, risks, and insights.

Portfolio Optimization

Viewing capital requests as an investment portfolio enables analysis of overall risk-return balance. Software can recommend ideal project mix based on constraints.

Real-Time Updates

As projects progress, financial models stay up-to-date via automatic data connectivity. This allows actuals vs forecasting and rerunning projections.

Version Control

Every funding iteration and scenario is tracked and stored. This allows easy retrieval and comparison to see how analysis has evolved.

Purpose-built financial modeling tools within capital budgeting software save huge time over spreadsheet models, while providing advanced analytics not possible manually. This enables data-driven funding decisions.

Boost Productivity: How Can Capital Budgeting Apps Streamline Your Finances?

For many businesses, developing and managing capital budgets is a cumbersome process reliant on spreadsheets and manual processes. It takes significant time and effort to accurately project costs and benefits, model cash flows, calculate metrics, and update constantly changing plans. However, new capital budgeting apps can dramatically improve productivity by streamlining the entire process digitally.

Centralize Capital Investment Data

Capital budgeting apps provide a central database to store and organize information on all proposed capital projects, equipment purchases, facility improvements, and other investments. Details like cost estimates, timelines, approvals, and more can be entered and tracked in one integrated system accessible to stakeholders company-wide. This eliminates duplicative data entry, ensures consistency, and saves huge amounts of time over managing separate spreadsheets.

Automate Financial Modeling

The most powerful capital budgeting apps automate the financial calculations needed for ROI analysis, cash flow projections, and investment comparisons. Rather than manual computations using calculators or complex spreadsheets formulas, the software does the number crunching for you instantly as data is input. Automation reduces errors and allows rapid what-if scenario modeling.

Provide Real-Time Reporting

Monitoring the status of capital projects against the approved budget is easier with real-time digital dashboards. Capital budgeting apps centralize status updates from departments and project managers, providing instant access to the latest timelines, costs, risks, and ROI projections. Push notifications can alert stakeholders when critical changes occur, enabling quick responses.

Enhance Collaboration

Cloud-based capital budgeting apps allow teams to collaborate across multiple locations and departments. Comments can be added to discuss investments under consideration. Approval workflows ensure proper sign-offs at every stage. Tasks can be assigned to specific individuals with tracking. This level of collaboration saves trips to meetings and email chains.

Integrate With Accounting Systems

Rather than transferring data manually, many capital budgeting apps offer seamless integration with popular accounting platforms like Quickbooks and Oracle NetSuite. This allows approved capital budgets to flow directly into financial reports and simplifies asset tracking. Integrations also synchronize historical spending data to inform future budgets.

Provide Oversight for Compliance

Capital budgets require oversight and approval controls to stay compliant. Digital apps enable user permissions to be set by role, protecting sensitive financial data. Approval workflows can route proposed budgets through proper authority channels. Audit trail tracking provides detailed reporting on any changes for transparency.

Improve Forecasting Accuracy

Advanced analytics and machine learning capabilities in some capital budgeting apps help uncover insights to improve forecasting and cost benefit analysis. By examining past spending trends and project performance, predictions can be fine-tuned over time.

Streamlining capital budget management digitally enables finance leaders to complete the once painstaking process faster and more strategically. Teams spend less time crunching numbers in spreadsheets and more time evaluating investments to drive business growth. With real-time data visibility and collaboration across the organization, capital budgets become a value-driver rather than a burden.

Data Visualization and Reporting

Transforming capital budget data into actionable business insights requires robust visualization and reporting capabilities. Rather than static spreadsheets, today’s software solutions include interactive dashboards, custom reports, and graphical analytics.

Real-Time Dashboards

Consolidated views of capital spending, project financials, ROI forecasts, and other key performance indicators via dashboards enable rapid data analysis. Drill-down abilities provide details.

Custom Reporting

User-defined reports tailored to specific roles, departments, and information needs drive better decision making. Reporting parameters like time periods and data sets add flexibility.

Charts and Graphs

Visually comparing budget vs. actuals, project timelines, investment returns, and resource allocations through charts provides quick insights not apparent in tables alone.

Interactive Data Exploration

Modern business intelligence functionality allows users to dynamically filter, sort, analyze, and visualize data relationships. This facilitates discoveries.

Ad Hoc Reporting

Generating reports on the fly based on any parameters enables faster answers to financial questions as they arise. The best tools require no IT help.

Scheduled Report Delivery

Automating report generation and distribution via email or portal download eliminates manual efforts. Scheduled visibility into capital spending metrics aids oversight.

Project Portfolio Views

Cross-project visibility surfaces insights into the total capital portfolio. Charts, graphs, and reports roll up to program-level analytics.

Visual Alerts and Flags

Dashboards feature visual alerts when KPIs exceed defined limits or require attention. Red/yellow/green color coding quickly highlights issues.

Mapping and Geospatial Analysis

For capital projects involving sites and locations, mapping tools and geospatial analysis displays spending, progress, and results visually on interactive maps.

Robust reporting and data visualization transforms raw capital budget data into strategic insights for improved planning, transparency, and outcomes.

Boost Productivity: How Can Capital Budgeting Apps Streamline Your Finances?

For many businesses, developing and managing capital budgets is a cumbersome process reliant on spreadsheets and manual processes. It takes significant time and effort to accurately project costs and benefits, model cash flows, calculate metrics, and update constantly changing plans. However, new capital budgeting apps can dramatically improve productivity by streamlining the entire process digitally.

Centralize Capital Investment Data

Capital budgeting apps provide a central database to store and organize information on all proposed capital projects, equipment purchases, facility improvements, and other investments. Details like cost estimates, timelines, approvals, and more can be entered and tracked in one integrated system accessible to stakeholders company-wide. This eliminates duplicative data entry, ensures consistency, and saves huge amounts of time over managing separate spreadsheets.

Automate Financial Modeling

The most powerful capital budgeting apps automate the financial calculations needed for ROI analysis, cash flow projections, and investment comparisons. Rather than manual computations using calculators or complex spreadsheets formulas, the software does the number crunching for you instantly as data is input. Automation reduces errors and allows rapid what-if scenario modeling.

Provide Real-Time Reporting

Monitoring the status of capital projects against the approved budget is easier with real-time digital dashboards. Capital budgeting apps centralize status updates from departments and project managers, providing instant access to the latest timelines, costs, risks, and ROI projections. Push notifications can alert stakeholders when critical changes occur, enabling quick responses.

Enhance Collaboration

Cloud-based capital budgeting apps allow teams to collaborate across multiple locations and departments. Comments can be added to discuss investments under consideration. Approval workflows ensure proper sign-offs at every stage. Tasks can be assigned to specific individuals with tracking. This level of collaboration saves trips to meetings and email chains.

Integrate With Accounting Systems

Rather than transferring data manually, many capital budgeting apps offer seamless integration with popular accounting platforms like Quickbooks and Oracle NetSuite. This allows approved capital budgets to flow directly into financial reports and simplifies asset tracking. Integrations also synchronize historical spending data to inform future budgets.

Provide Oversight for Compliance

Capital budgets require oversight and approval controls to stay compliant. Digital apps enable user permissions to be set by role, protecting sensitive financial data. Approval workflows can route proposed budgets through proper authority channels. Audit trail tracking provides detailed reporting on any changes for transparency.

Improve Forecasting Accuracy

Advanced analytics and machine learning capabilities in some capital budgeting apps help uncover insights to improve forecasting and cost benefit analysis. By examining past spending trends and project performance, predictions can be fine-tuned over time.

Streamlining capital budget management digitally enables finance leaders to complete the once painstaking process faster and more strategically. Teams spend less time crunching numbers in spreadsheets and more time evaluating investments to drive business growth. With real-time data visibility and collaboration across the organization, capital budgets become a value-driver rather than a burden.

Collaboration and File Sharing Functionalities

Developing capital budgets requires input and coordination across multiple departments and stakeholders. Leading software solutions include built-in collaboration and file sharing capabilities to streamline team-based planning.

User Comments and Activity Feeds

Enabling comments on proposed projects, budget requests, and other items allows discussion in context. Activity feeds provide visibility into conversations and changes.

Attachments and File Storage

Uploading documents like RFPs, vendor quotes, project plans, and supporting analysis directly into the capital budgeting system centralizes information access.

Version Control

Maintaining proper version control for budget drafts, proposals, documents, and models prevents confusion around which is most current.

Document Markup and Annotation

Users can highlight, comment on, and annotate documents online in real time, replacing emailed feedback and attachments.

Task Management

The ability to create task lists with assignments, due dates, reminders, and tracking streamlines project management integrated with budgets.

Notifications and Alerts

Email or in-app notifications on activity like new comments, completed approvals, or deadline reminders keeps stakeholders engaged.