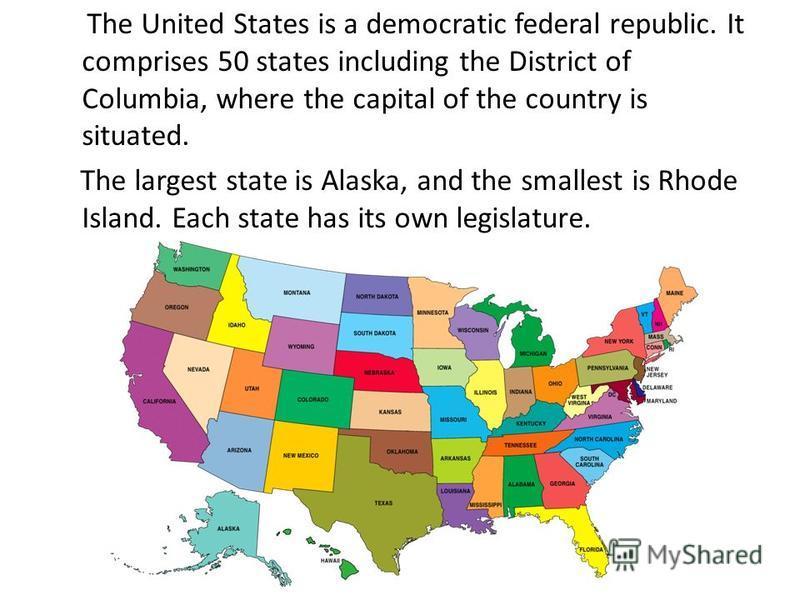

How are famous USA sporting goods stores adapting to survive in the digital age. What strategies are they employing to remain competitive against online retailers. Why are some brick-and-mortar sporting goods stores thriving while others have failed. How is the sporting goods retail landscape evolving in response to changing consumer preferences.

The Transformation of Brick-and-Mortar Sporting Goods Retail

The sporting goods retail landscape in the United States has undergone a significant transformation in recent years. While many once-prominent chains like Sports Authority and Modell’s succumbed to bankruptcy, others have found innovative ways to adapt and thrive in the face of fierce online competition. This resurgence demonstrates the enduring value of physical retail spaces when combined with modern strategies and technologies.

Has the demise of major sporting goods chains spelled doom for the entire brick-and-mortar sector? Contrary to expectations, the answer is a resounding no. In fact, the closure of giants like Sports Authority has created opportunities for both established players and newcomers to reimagine the in-store shopping experience.

Dick’s Sporting Goods: A Case Study in Retail Revival

Dick’s Sporting Goods stands out as a prime example of a traditional retailer that has successfully navigated the challenges posed by e-commerce. How did Dick’s manage to turn its fortunes around? The company implemented a multi-faceted strategy focused on enhancing the in-store experience and leveraging its physical presence to complement online offerings.

Key Elements of Dick’s Sporting Goods’ Revival Strategy:

- Investment in high-quality, knowledgeable staff

- Integration of cutting-edge in-store technologies

- Creation of experiential displays and interactive areas

- Strong omnichannel integration

- Curated online order pickup services

By offering unique experiences like simulated golf swings and shooting ranges alongside convenient online order pickups, Dick’s has successfully differentiated itself from pure e-commerce competitors. The retailer has effectively leveraged its physical scale and hands-on expertise to provide value that online-only stores simply cannot match.

The Rise of Specialty Sporting Goods Retailers

While large chains like Dick’s Sporting Goods have found success through reinvention, smaller specialty retailers have carved out their own niches in the market. How are these specialty stores competing against big-box retailers and e-commerce giants? The key lies in their ability to forge strong community connections and offer personalized services.

Play It Again Sports exemplifies this approach by focusing on buying, selling, and trading gently used sports equipment. This business model not only meets local demand but also aligns with growing consumer interest in sustainability and circular economy principles. The intimate customer interactions fostered in these specialty stores build loyalty that can withstand digital disruption.

Advantages of Specialty Sporting Goods Retailers:

- Deep understanding of local market needs

- Personalized customer service

- Unique product offerings tailored to community interests

- Ability to quickly adapt to changing local trends

- Strong community relationships and brand loyalty

Revitalizing Malls with Innovative Sporting Experiences

The decline of traditional anchor stores has forced shopping malls to reimagine their spaces. How are malls adapting to attract foot traffic in the age of online shopping? Many are turning to experiential sporting goods retailers to fill vacant spaces and create new attractions.

Round1 Bowling & Amusement serves as an excellent example of this trend. By transforming empty department store spaces into entertainment hubs featuring bowling, karaoke, arcade games, and sports simulators, Round1 provides experiences that cannot be replicated online. These innovative retail concepts are breathing new life into struggling malls and giving customers compelling reasons to visit physical retail spaces.

The Power of Omnichannel Retail in Sporting Goods

Successful sporting goods retailers have recognized that the future of retail lies in seamlessly blending physical and digital shopping experiences. What strategies are they employing to achieve this integration? Leading companies are implementing comprehensive omnichannel initiatives that offer customers the best of both worlds.

Key Components of Omnichannel Sporting Goods Retail:

- Buy Online, Pick Up In Store (BOPIS) options

- Curbside pickup services

- In-store returns for online purchases

- Integrated customer data across all channels

- Consistent pricing and promotions across online and offline platforms

These omnichannel strategies not only provide convenience to customers but also help retailers protect their brick-and-mortar operations from e-commerce cannibalization. By leveraging physical stores as fulfillment centers and showrooms, sporting goods retailers can offer a level of service and immediacy that pure e-commerce players struggle to match.

Filling the Void: The Aftermath of Sports Authority’s Demise

The bankruptcy and closure of Sports Authority in 2016 sent shockwaves through the sporting goods retail industry. How did competitors respond to fill the gap left by this retail giant? The aftermath of Sports Authority’s demise provides a fascinating case study in market adaptation and opportunity.

Smaller chains like Dunham’s Sports, Olympia Sports, and Big 5 Sporting Goods seized the opportunity to expand into former Sports Authority locations. Simultaneously, internet-first companies such as Fanatics and Moosejaw made bold moves into the brick-and-mortar space, recognizing the enduring value of physical retail presence.

Strategies Employed to Fill the Sports Authority Void:

- Expansion of existing regional chains into new markets

- Entry of online-first retailers into physical retail spaces

- Increased focus on specialized, community-oriented stores

- Enhanced sporting goods offerings from big-box general merchandisers

- Growth in secondhand and consignment sporting goods sales

The Growing Importance of Secondhand Sporting Goods

The closure of major sporting goods chains has contributed to a surge in the secondhand sports equipment market. Why are consumers increasingly turning to pre-owned sporting goods? This trend is driven by a combination of economic factors and growing environmental consciousness among consumers.

Platforms like Poshmark, Mercari, and eBay have seen a significant increase in listings for used sports equipment, apparel, and accessories. This shift not only provides budget-conscious consumers with affordable options but also aligns with the values of environmentally-aware customers who appreciate the sustainability aspects of purchasing pre-owned items.

Benefits of the Secondhand Sporting Goods Market:

- Affordability for budget-conscious consumers

- Reduction in environmental impact through product reuse

- Opportunity for consumers to try high-end equipment at lower costs

- Additional revenue stream for retailers through trade-in programs

- Community-building through local buying and selling networks

Leveraging Technology to Enhance In-Store Experiences

How are sporting goods retailers using technology to create compelling in-store experiences? The integration of cutting-edge technologies has become a key differentiator for brick-and-mortar sporting goods stores seeking to compete with online retailers.

Many retailers are investing in interactive displays, virtual reality (VR) experiences, and augmented reality (AR) applications to engage customers and provide unique value propositions. For example, some stores now offer VR golf simulators that allow customers to test clubs before purchasing, while others use AR technology to help shoppers visualize how equipment or apparel will look and perform in real-world settings.

Innovative Technologies in Sporting Goods Retail:

- Virtual reality product testing environments

- Augmented reality fitting rooms and product visualization

- Interactive digital signage and product information kiosks

- Mobile apps for in-store navigation and personalized recommendations

- RFID technology for inventory management and customer insights

By leveraging these technologies, brick-and-mortar sporting goods retailers can offer immersive, informative, and entertaining experiences that go far beyond what is possible in traditional online shopping environments.

The Role of Community Engagement in Sporting Goods Retail

How are successful sporting goods retailers fostering community connections to drive customer loyalty? Many brick-and-mortar stores have recognized the importance of becoming more than just places to buy products; they are positioning themselves as community hubs for sports enthusiasts.

Retailers are organizing events, sponsoring local teams, and creating spaces for community members to gather and share their passion for sports. This approach not only drives foot traffic but also builds emotional connections with customers that can’t be easily replicated by online competitors.

Community Engagement Strategies in Sporting Goods Retail:

- Hosting clinics and workshops led by local athletes or experts

- Sponsoring youth sports leagues and school athletic programs

- Creating in-store spaces for club meetings and team gatherings

- Organizing charity events and fundraisers for sports-related causes

- Offering personalized team apparel and equipment services

By becoming integral parts of their local sports communities, brick-and-mortar sporting goods stores can create lasting relationships with customers that extend far beyond individual transactions.

Adapting to Changing Consumer Preferences in Sporting Goods

How are sporting goods retailers responding to evolving consumer preferences and lifestyle trends? The sporting goods industry is closely tied to broader shifts in health, wellness, and leisure activities. Successful retailers are those that can anticipate and quickly adapt to these changing preferences.

For instance, the rise of athleisure wear has blurred the lines between performance sportswear and everyday clothing. Many sporting goods retailers have expanded their apparel offerings to cater to this trend, creating dedicated sections for lifestyle-oriented athletic wear. Similarly, the growing interest in outdoor activities and adventure sports has led to an increased focus on camping, hiking, and other outdoor gear.

Key Trends Influencing Sporting Goods Retail:

- Growth of athleisure and performance lifestyle apparel

- Increased interest in outdoor recreation and adventure sports

- Rise of technology-enabled fitness and wellness products

- Growing demand for sustainable and eco-friendly sporting goods

- Shift towards personalized and customized sports equipment

By staying attuned to these trends and adapting their product offerings accordingly, brick-and-mortar sporting goods retailers can remain relevant and attractive to modern consumers.

The Future of Brick-and-Mortar Sporting Goods Retail

What does the future hold for physical sporting goods stores in an increasingly digital world? While challenges remain, the resilience and adaptability demonstrated by successful retailers suggest a promising outlook for brick-and-mortar sporting goods retail.

The future of sporting goods retail will likely be characterized by a seamless integration of physical and digital experiences, with stores evolving into multifaceted destinations that offer more than just products. Successful retailers will continue to leverage their physical presence to provide hands-on experiences, expert advice, and community engagement that complement and enhance their online offerings.

Key Elements of Future Sporting Goods Retail:

- Hyper-personalized shopping experiences powered by data analytics

- Increased focus on experiential retail and interactive product testing

- Seamless integration of online and offline channels

- Emphasis on sustainability and circular economy principles

- Continued evolution of stores as community hubs and brand showcases

As the sporting goods retail landscape continues to evolve, brick-and-mortar stores that can adapt to changing consumer preferences, leverage technology effectively, and create meaningful community connections will be well-positioned to thrive in the years to come.

Brick and mortar sporting goods stores in the USA once seemed destined for extinction, with major chains like Sports Authority and Modell’s declaring bankruptcy in the 2010s. However, some stalwarts like Dicks Sporting Goods have engineered an unlikely resurgence through reinventing the in-store shopping experience. While online retailers pose a constant threat, specialty retailers in local communities are also finding ways to thrive.

Dicks Sporting Goods once struggling, now thriving with new strategies

Dicks Sporting Goods, one of the largest sporting goods retailers in America, faced steep declines in the early 2010s as customers flocked to e-commerce sites. Foot traffic slowed, sales stagnated, and many locations were shuttered. However, Dicks has since turned things around by focusing on high-quality staff, in-store technologies, experiential displays, and strong omnichannel integration. Customers now enjoy simulated golf swings and shooting ranges alongside curated online order pickups. Dicks learned to leverage its physical scale and hands-on expertise to complement online convenience.

Speciality retailers differentiate from big-box competition

While massive chains like Dicks can use scale, smaller specialty retailers find success through community connections. For example, Play It Again Sports focuses on buying, selling, and trading gently used sports equipment. By tapping into secondhand demand, they meet local needs and sustainability values. Intimate customer interactions in these specialty stores build loyalty despite digital disruption.

Innovative retail spaces bring energy to declining malls

As anchor stores disappear, malls are getting creative by bringing in new experiential sporting goods retailers. For example, Round1 Bowling & Amusement transforms vacant department store spaces into entertainment attractions with bowling, karaoke, arcade games, and sports simulators. Customers come to malls specifically for these engaging sporting experiences you can’t get online.

Omnichannel retail integrates the best of physical and digital

Leading sporting goods retailers combine physical and online shopping through omnichannel initiatives. Features like buy online pickup in store (BOPIS), curbside pickup, and in-store returns of online orders provide flexibility to customers. Retailers gain data on browsing habits across channels. Omnichannel retail protects brick and mortar from e-commerce cannibalization.

While Amazon and other online retailers continue to dominate market share, many sporting goods customers still crave tangible in-person interactions. Physical retailers like Dicks Sporting Goods have adapted to this new reality, finding ways to leverage their stores as assets rather than liabilities. The future is omnichannel, with room for both digital convenience and real-world experience.

When Sports Authority filed for bankruptcy in 2016 and closed all of its stores, it left a huge void in the sporting goods retail landscape. Sports Authority had been one of the largest sporting goods chains in America with nearly 500 locations at its peak. However, competitors both new and old have stepped up to fill this void in creative ways.

Sports Authority bankrupt in 2016, but competitors fill the void

The demise of the once dominant Sports Authority enabled smaller competitors to gain market share. Chains like Dunham’s Sports, Olympia Sports, and Big 5 Sporting Goods expanded into former Sports Authority venues. Meanwhile, internet-first companies like Fanatics and Moosejaw opened dozens of physical stores. Rather than just ceding ground to Amazon, these retailers found new life in the brick-and-mortar space.

Niche local sporting goods stores thrive

Smaller, more specialized local sporting goods stores also benefited from Sports Authority’s closure. These niche retailers could focus on specific community needs and local team apparel better than a national chain. For example, Harman’s Sports & Outdoor Store in Virginia relies on hands-on customer service and inventory tailored for hunting, fishing, and hiking in the region.

Big box retailers reinforce sporting goods offerings

Mass merchandisers stepped up their sporting goods selections to fill the void left by Sports Authority. Chains like Walmart, Target, and Dick’s Sporting Goods expanded floor space dedicated to athletic apparel, outdoor recreation gear, and sports equipment. Customers could conveniently purchase these items while shopping for other general merchandise.

Secondhand sporting goods gain popularity

The Sports Authority closure also drove growth in secondhand sporting goods sales. Sites like Poshmark, Mercari, and eBay saw increased listings for used sports equipment, apparel, and accessories. Environmentally-conscious customers appreciated giving quality pre-owned gear a second life.

Despite Sports Authority’s demise, plenty of sporting goods retailers eagerly absorbed its lost market share. Nimble small businesses, expanding big box stores, niche startups, and the secondhand market all stepped up. This diversity of competition ultimately benefited customers with better selection, convenience, and bargains across sporting goods retail.

When Modell’s Sporting Goods filed for bankruptcy and liquidated in 2020 after over 100 years in business, it was another blow to brick-and-mortar sporting goods retailers. With 156 stores on the East Coast, Modell’s had been a staple for local team apparel and equipment. However, smaller specialty retailers have emerged to fill this niche in local communities.

Modell’s Sporting Goods bankrupt in 2020, but niche retailers emerge

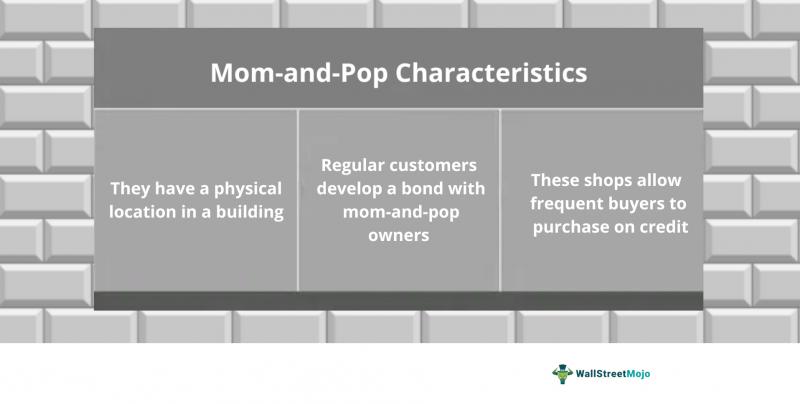

After Modell’s closed all its locations, specialty mom-and-pop sporting goods shops saw an opportunity to cater to customers who missed the neighborhood feel and team focus. These retailers intentionally created a distinctive experience not found in big box stores. For example, Family First Sports in New Jersey sponsors local teams and hosts events to foster community connections. Their tight customer relationships confer an advantage over larger impersonal competitors.

Local sporting goods retailers focus on personal service

Small specialty sporting goods stores make customer service a priority to stand out from corporate chains. At retailers like Kelly’s Sports in Pennsylvania, owners and staff provide personalized recommendations tailored to each shopper. This hands-on approach inspires loyalty even when selection is smaller than massive national retailers.

Used sporting goods fill inventory gaps

Some local shops are offsetting more limited new inventory by selling quality used sporting goods. For example, Play It Again Sports franchises carry large selections of gently used team equipment and apparel. Customers appreciate the savings and sustainability of giving pre-owned gear “another life.”

Nostalgia and team pride drive local connections

Smaller sporting goods retailers lean into nostalgia and team affiliations to drive business. Stores like Beach Ball Sports in New Jersey thrive on long-time customer relationships and multi-generational shopping trips. Carrying hard-to-find vintage apparel and equipment taps into this emotional appeal.

Modell’s left big shoes to fill, but specialized local sporting goods retailers are proving community roots still matter. Customized service and connections to local teams give these niche stores an edge where the national chains faltered.

The rise of e-commerce giants like Amazon seemed to spell doom for physical sporting goods stores. Online shopping offers unbeatable selection and convenience. However, many customers still seek in-store experiences, and foot traffic is rebounding as retailers adapt.

Online retailers like Amazon threaten physical stores, but foot traffic rebounds

Sporting goods e-commerce sales continue to grow, led by Amazon. Shopping online provides customers access to endless inventory and the ease of home delivery. Pure play online retailers like Fanatics and Moosejaw also thrive. However, after a pandemic dip, foot traffic has resumed at physical sporting goods stores as they leverage strengths online can’t match.

In-store expertise retains sporting goods customers

Despite convenience of online, many customers still value hands-on expertise when purchasing sporting goods. Small specialty retailers like Play It Again Sports thrive on guiding customers to the right equipment. Even big box stores like Dick’s Sporting Goods highlight sales staff knowledge.

Experiential retail enhances the in-store sporting goods experience

To combat online-only advantages, sporting goods stores are embracing experiences customers can’t get online. Retailers like L.L. Bean use simulations to showcase products. Stores also host events and classes related to their gear.

Omnichannel retail integrates physical and digital

Leading sporting goods retailers combine brick-and-mortar and online shopping via omnichannel initiatives. Curbside pickup, in-store returns of online orders, and ship-to-store provide flexibility to customers. This strategy keeps physical stores relevant.

Pure e-commerce retailers hold clear digital advantages, but physical sporting goods stores retain loyal customers through experiences, expertise, and omnichannel convenience. Stores enduring the online threat found ways to play to their strengths.

Online sporting goods retailers tout convenience and selection, but many customers still prefer the hands-on expertise and experiences of physical store locations. In-store services retain sporting goods customers despite the rise of e-commerce.

In-store experiences and expertise retain customers despite convenience of online

Sporting goods e-tailers like Amazon and Moosejaw offer unrivaled access to gear. However, specialty retailers like L.L. Bean and REI rely on knowledgeable sales staff to guide customers. Trying out products in-store provides tangible value beyond digital transactions. Face-to-face interactions build loyalty.

Product simulations enhance the in-store sporting goods experience

To combat the convenience of online shopping, sporting goods stores create immersive experiences. Retailers like Bass Pro Shops incorporate shooting ranges and fishing ponds. Stores use virtual reality to let customers simulate activities. This interactivity engages customers in ways websites can’t.

Specialty retailers build community with classes and events

Local sporting goods shops foster brand loyalty through classes and community events related to their products. For example, independent bike shops host group rides and maintenance clinics. Yoga apparel stores provide free workshops. These hands-on experiences drive repeat business.

Expert guidance streamlines purchasing decisions

For complex sporting goods like fitness trackers or ski gear, many customers value on-site product expertise to find the right items. Smaller specialty retailers emphasize deep category knowledge. Even big box store associates receive training to aid customers more effectively.

Purely transactional e-commerce can’t always replicate the helpfulness of in-person interactions with knowledgeable sporting goods retailers. The tactile instore experience retains devoted customers despite online’s advantages.

While massive national sporting goods chains struggle, local specialty retailers are filling unique community niches. Hands-on customer service and hyper-focused inventory build loyalty despite competition from big box stores.

Specialty local stores differentiate from big-box companies to drive community engagement

Independent sporting goods shops thrive by tailoring specialty inventory and services to their region. For example, local bike shops curate selections for area trails and provide maintenance classes. Smaller retailers connect through hosting teams and leagues. Customized community focus provides an edge.

Niche product expertise caters to local sporting goods customers

Local specialty shops invest in deep knowledge of their niche to best serve customers. A golf pro shop staffed by experts provides custom club fitting. Fly fishing shops carefully select gear ideal for nearby rivers. This specialization builds trust despite smaller inventory.

Hands-on customer service fosters sporting goods community

Smaller specialty retailers rely on attentive customer service to stand out from impersonal big box stores. Taking time to fit running shoes and offer training advice builds loyal followings. This personal touch keeps customers coming back despite added convenience of national chains.

Local team partnerships connect sporting goods stores to communities

Independent sporting goods shops sponsor area high school and youth league teams. Displaying these team names and logos in-store boosts community appeal. Customers feel their purchases directly support hometown sports.

While scale has advantages, smaller specialty sporting goods retailers stay relevant through targeted regional inventory, service, and partnerships. Their community roots run deeper than national chains ever could.

As traditional department stores falter, malls are getting creative by bringing in experiential sporting goods retailers to fill vacant anchor spaces. Pop-up shops and innovative retail concepts draw customers seeking engaging in-store experiences.

Pop-up shops and innovative retail spaces bring energy to flagging malls and shopping centers

With major chains like Macy’s and JC Penney closing stores, malls have abundant empty square footage to fill. Temporary and experiential sporting goods retailers are moving into these vacant spaces, hoping to re-energize flagging malls.

Sporting goods pop-up shops provide flexibility to malls

Sporting goods pop-ups allow malls to quickly bring in new tenants for short-term leases. Brands test new markets and products via temporary physical retail. The short pop-up terms give malls flexibility while generating foot traffic.

Innovative sporting goods stores focus on experience

Permanent experiential sporting goods stores also drive mall engagement through activities beyond just transactions. For example, Round1 Bowling & Amusement mixes retail with bowling, karaoke, and arcade games. Customers come for the experience.

Demo areas showcase sporting goods products

Other innovative sporting goods stores convert empty mall spaces into hands-on product demo areas. Customers can try out treadmills, golf clubs, baseball bats, and more before purchase. This interactivity was missing from old-school department stores.

As online shopping accelerates, malls and sporting goods retailers must provide value beyond convenience and price. Pop-up shops and experiential stores offer just that – an engaging in-person experience customers can’t replicate online.

Omnichannel sporting goods retailers are integrating physical and digital shopping experiences. Features like buy online, pickup in-store (BOPIS), curbside pickup, and in-store returns of online orders provide flexibility and convenience to customers.

Curbside pickup and BOPIS allow integration of physical and digital retail

Leading sporting goods stores are leveraging their brick-and-mortar footprint to enhance online convenience. Curbside pickup saves customers a trip inside. BOPIS provides instant gratification after online ordering. These options bridge the gap between physical and digital.

BOPIS offers sporting goods customers best of both worlds

The ability to buy items online and pick them up in-store merges the upside of both channels. Customers can browse endless inventory online but still get products same-day without shipping fees. For retailers, BOPIS drives in-store foot traffic.

Curbside pickup adds convenience to the sporting goods shopping experience

Clicking online and grabbing items curbside appeals to customers seeking convenience. Retailers bring orders right to the customer’s car. This low-contact process provides ease and speed when shopping in person isn’t desired.

In-store returns of online orders encourage cross-channel sporting goods shopping

As omnichannel retailers, Dicks Sporting Goods and others allow customers to return online purchases at any physical location. This flexibility provides assurance during the online buying process. Cross-channel return policies link the digital and physical experience.

Omnichannel initiatives allow sporting goods customers to seamlessly combine the strengths of online and brick-and-mortar shopping. Retailers meet demand for integrated physical-digital convenience and choice.

Leading omnichannel sporting goods retailers are integrating the best aspects of brick-and-mortar and online shopping into a seamless experience. This omnichannel approach provides customers flexibility and convenience.

Omnichannel approach unites the best of online and offline shopping

Sporting goods customers increasingly expect flexibility in how they shop across channels. Savvy retailers are responding with omnichannel initiatives that bridge online and physical stores.

Omnichannel retail captures expanded sporting goods data

Shared inventory and customer databases across channels give omnichannel sporting goods retailers enhanced data. Online browsing informs in-store recommendations. In-store purchases drive online marketing. Retailers optimize experiences with cross-channel insights.

Flexible fulfillment options serve sporting goods omnichannel customers

Leading retailers fulfill purchases where it suits customers best. Buy online, pick up in-store. Ship to store for free returns. Curbside for convenience. Customers can shop anytime, anywhere and get gear how they want.

Omnichannel approach maximizes convenience for sporting goods shoppers

An integrated experience allows customers to research products online, test in-store, purchase for in-store pickup and return via any channel. The omnichannel sporting goods retailer meets their needs at every touchpoint.

Rather than competing, physical and digital shopping reinforcement each other in an omnichannel model. Customers enjoy expanded options while retailers see bigger baskets and improved conversion.

Brick-and-mortar sporting goods retailers are creating immersive in-store experiences through interactive displays and simulations. This experiential retail showcases products and engages customers in ways e-commerce can’t.

Experiential retail with simulations and displays enhances the in-store experience

To combat the convenience of online shopping, sporting goods stores are investing in experiences that bring products to life. Creative retail spaces allow customers to test gear and envision use cases.

In-store sporting goods simulations demonstrate products interactively

Retailers like Bass Pro Shops incorporate shooting ranges, golf simulators, and fishing ponds to let customers try products first-hand. Virtual reality also enables simulation of activities. This interactivity builds engagement and confidence in purchasing.

Sporting goods displays connect products to real-world use

In-store presentations recreate context for how sporting goods are used. Climbing walls, campsite mock-ups, and bike trails illustrate natural applications. Customers gain tangible understanding beyond just viewing items on shelves.

Experiential in-store events build community around sporting goods

Retailers host classes and events like yoga sessions, craft workshops, and guest athlete appearances to build community. In-store experiences position sporting goods stores as lifestyle hubs, not just transaction points.

Creative experiential retail transforms sporting goods stores from showrooms to activity centers. Customers engage with products on deeper levels while building connections with brands, staff, and fellow customers.

To attract diverse customers, sporting goods retailers are expanding beyond traditional categories. Products like lifestyle apparel, outdoor furniture, and fitness tech meet wider interests beyond just sports fans.

Retailers diversify product selection to serve wider customer demographics

Sporting goods stores were once male-dominated showrooms for team sports equipment. But today women make up 45% of sporting goods shoppers. Retailers now cater to broader audiences with expanded products.

Activewear and athleisure serve the growing women’s sporting goods market

Female shoppers drive demand for versatile activewear that transitions from workouts to daily wear. Brands like Lululemon and Athleta pioneer stylish workout clothing for women. Even sports generalists like Dick’s expand yoga and running apparel selections.

Outdoor living products broaden sporting goods stores’ appeal

Retailers carry outdoor furniture, grills, and fire pits to become lifestyle hubs, not just sports stores. Products tied to cooking, Entertaining, and backyard living activities attract whole families.

Wearable tech and fitness trackers expand sporting goods gadgets

Devices like Fitbits, Apple Watches, and Bluetooth headphones enable retailers to tap the tech and fitness tracking trends. These lifestyle devices with sport applications draw interest beyond traditional sports categories.

The sporting goods customer no longer fits one profile. Retailers meet exploding diversity across gender, age, and interests with ever-wider product offerings.

Vintage sporting goods let retailers tap into nostalgic trends while clearing inventory of unused older gear. Customers appreciate these throwback items along with the sustainability of giving pre-owned products “another life.”

Vintage apparel and gear tap into fashion trends and customer nostalgia

Retro sports uniforms, equipment, and memorabilia are increasingly popular among sporting goods shoppers. Millennials enjoy the ironic vintage aesthetic. Older customers feel nostalgia for gear from their youth.

Secondhand sports merchandise sustains inventory of vintage goods

Retailers source vintage apparel and equipment from used gear trade-ins and resell platforms. These pre-owned goods offer novelty without the costs of new production. Renewed demand gives used sporting merchandise another cycle.

Vintage sporting goods capture style trends

Throwback team apparel and athletic wear tap into streetwear and athleisure fashion. Sports fans and non-fans alike incorporate retro jerseys and sweats into everyday outfits. Vintage cool helps drive sporting goods sales.

Nostalgia fuels interest in classic sporting goods

Long-time fans feel deep connections to beloved old sports gear. Items like leather football helmets and wooden tennis rackets transport customers back to fond memories of youth. Vintage items evoke emotion beyond just their utility.

Sporting goods retailers leverage used vintage merchandise to delight customers through fashion, nostalgia, and sustainability. Pre-owned gear gets reinvented with newfound cultural cachet.