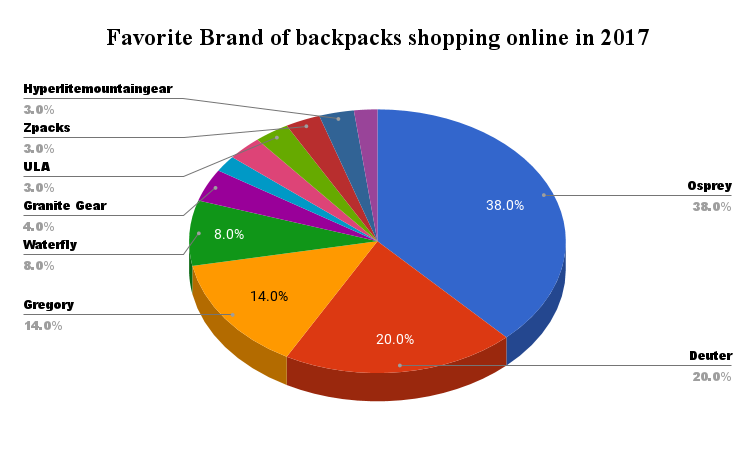

Which brands have captured the hearts of American consumers. How do companies like USPS, Google, and Amazon rank in terms of favorability and trust. What factors contribute to a brand’s popularity and success in the US market.

The Top 10 Most Loved Brands in America: An In-Depth Look

In the ever-evolving landscape of consumer preferences, certain brands have managed to secure a special place in the hearts of Americans. The Brand Love Index, which considers factors such as favorability, trust, community impact, and net promoter score, provides valuable insights into the most beloved brands across the nation. Let’s explore the top 10 brands that have won over American consumers:

- USPS (Score: 264.8)

- Google (Score: 258.6)

- UPS (Score: 257.5)

- Amazon (Score: 256.0)

- Netflix (Score: 253.7)

- Clorox (Score: 246.4)

- Amazon Prime (Score: 245.7)

- M&M’s (Score: 244.1)

- Home Depot (Score: 241.8)

- YouTube (Score: 241.7)

The United States Postal Service (USPS) leads the pack with an impressive score of 264.8, highlighting the enduring trust and reliance Americans place in this long-standing institution. Tech giants Google and Amazon also feature prominently, showcasing the increasing importance of digital services in our daily lives.

The Power of Convenience: How Delivery and E-commerce Brands Dominate

A notable trend in the top rankings is the prevalence of delivery and e-commerce brands. USPS, UPS, Amazon, and Amazon Prime all feature in the top 10, underscoring the value Americans place on convenience and efficient service. This trend has likely been accelerated by the COVID-19 pandemic, which has led to an increased reliance on delivery services and online shopping.

Why have these brands become so essential to American consumers? The answer lies in their ability to simplify daily life, save time, and provide reliable services. As our lives become increasingly fast-paced, brands that can offer convenience and dependability are naturally rising to the top of consumer preferences.

The Amazon Effect: A Closer Look

Amazon’s presence in the top 10 twice (as Amazon and Amazon Prime) is particularly noteworthy. This dual appearance highlights the company’s success in creating a comprehensive ecosystem that caters to various consumer needs. From e-commerce to streaming services, Amazon has woven itself into the fabric of American life, earning high scores in favorability and trust.

Entertainment Giants: Netflix and YouTube’s Rise to Prominence

The presence of Netflix (5th) and YouTube (10th) in the top 10 reflects the growing importance of digital entertainment in American households. These platforms have revolutionized how we consume media, offering on-demand content that caters to diverse tastes and preferences.

How have these entertainment brands captured the hearts of American consumers? By providing:

- Vast libraries of content

- Personalized recommendations

- User-friendly interfaces

- Affordable pricing models

- Original, high-quality productions

The success of Netflix and YouTube also points to a broader trend of cord-cutting, with many Americans moving away from traditional cable TV in favor of more flexible, personalized streaming options.

Traditional Retail Holds Strong: Home Depot’s Continued Appeal

While digital brands dominate much of the top 10, Home Depot’s presence at number 9 demonstrates that brick-and-mortar retail still has a place in the hearts of American consumers. As the only traditional retailer in the top 10, Home Depot’s success is particularly impressive.

What factors contribute to Home Depot’s enduring popularity? Several key elements set this home improvement giant apart:

- Extensive product range

- Knowledgeable staff

- DIY workshops and resources

- Competitive pricing

- Robust online presence complementing physical stores

Home Depot’s ability to balance traditional retail strengths with modern conveniences like online ordering and curbside pickup has helped it maintain its position as a beloved brand among American consumers.

The Sweet Spot: M&M’s and America’s Love for Iconic Snacks

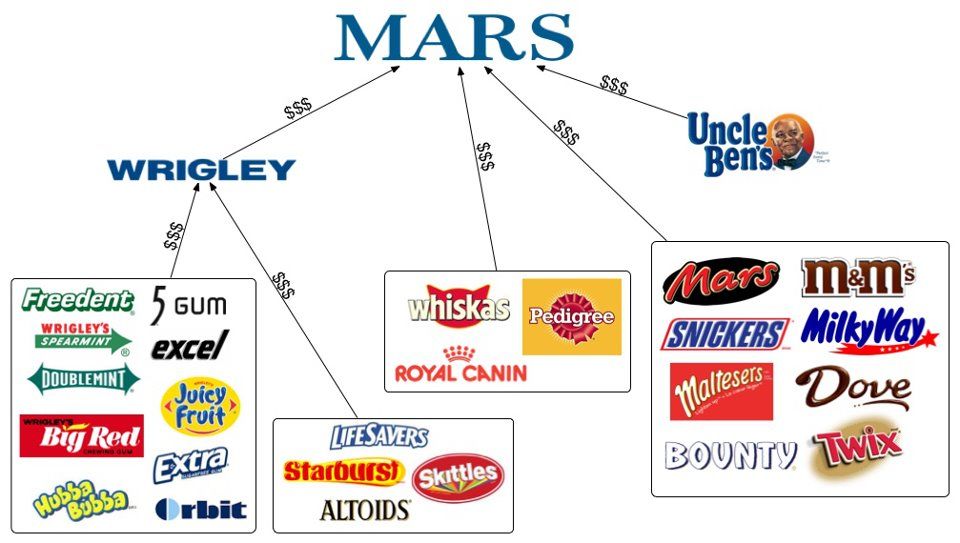

M&M’s appearance at number 8 in the rankings highlights America’s enduring affection for iconic snack brands. As the only food product in the top 10, M&M’s represents a broader category of beloved American snacks that have stood the test of time.

Why do brands like M&M’s continue to resonate with consumers? Several factors contribute to their lasting appeal:

- Nostalgia and emotional connections

- Consistent quality and taste

- Innovative marketing campaigns

- Product diversification (e.g., new flavors and variations)

- Cultural significance and brand recognition

The success of M&M’s also points to the importance of brand personality and storytelling in creating lasting connections with consumers. The anthropomorphized M&M characters have become cultural icons in their own right, contributing to the brand’s strong emotional appeal.

Tech Titans: Google’s Dominance in the Digital Age

Google’s position at number 2 in the rankings underscores the central role that technology plays in modern American life. As a brand that has become synonymous with internet search and a wide array of digital services, Google has successfully embedded itself into the daily routines of millions of Americans.

How has Google achieved such high levels of trust and favorability? Key factors include:

- Ubiquity and reliability of its search engine

- Diverse ecosystem of useful products (Gmail, Google Maps, Google Drive, etc.)

- Commitment to innovation and cutting-edge technology

- User-friendly interfaces and seamless integration between services

- Strong brand identity and corporate culture

Google’s success also highlights the importance of data-driven personalization in modern brand strategies. By leveraging user data to provide tailored experiences, Google has created a sense of indispensability among its users.

Cleaning Up: Clorox’s Surge in Popularity

Clorox’s appearance at number 6 in the rankings is particularly noteworthy, likely reflecting the increased focus on cleanliness and hygiene during the COVID-19 pandemic. As consumers became more conscious of disinfecting surfaces and maintaining a clean environment, Clorox emerged as a trusted brand in the fight against germs.

What factors have contributed to Clorox’s rise in consumer esteem?

- Perceived effectiveness in killing germs and viruses

- Long-standing reputation for quality

- Increased visibility and relevance during the pandemic

- Diverse product range catering to various cleaning needs

- Corporate social responsibility initiatives

Clorox’s success demonstrates how external factors, such as global health crises, can significantly impact brand perceptions and consumer priorities. It also highlights the importance of brand trust and reliability, particularly in categories related to health and safety.

Brand Adaptability in Times of Crisis

The COVID-19 pandemic has served as a litmus test for brand adaptability. Companies that were able to quickly pivot their operations, messaging, and product offerings to meet changing consumer needs have generally fared better in terms of brand perception. Clorox’s strong showing in the rankings is a testament to its ability to meet increased demand and maintain consumer trust during a challenging period.

Beyond the Top 10: Emerging Trends and Notable Brands

While the top 10 brands offer valuable insights into consumer preferences, examining the broader list reveals additional trends and noteworthy performances. Let’s explore some of the patterns and standout brands beyond the top 10:

The Rise of Discount Retailers

Dollar Tree’s appearance at number 17 (Score: 235.0) highlights the growing appeal of discount retailers. In an era of economic uncertainty and budget-consciousness, brands that offer value for money are increasingly resonating with American consumers. This trend is further supported by the presence of Walmart at number 23 (Score: 232.5) and Costco at number 42 (Score: 224.1).

Food and Beverage Brands: A Mixed Bag

While M&M’s is the only food brand in the top 10, several other food and beverage companies feature prominently in the extended list:

- Cheerios (11th, Score: 240.4)

- Kellogg’s (16th, Score: 235.2)

- Oreo’s (20th, Score: 233.3)

- The Hershey Company (22nd, Score: 232.8)

- Reese’s (24th, Score: 232.3)

- Heinz Ketchup (25th, Score: 231.9)

The strong showing of these brands underscores the emotional connections many Americans have with familiar food products. It also highlights the importance of brand heritage and nostalgia in shaping consumer preferences.

Fast Food and Restaurant Chains

Several fast food and restaurant chains make appearances in the rankings, reflecting America’s ongoing love affair with convenient dining options:

- Dairy Queen (27th, Score: 230.7)

- Dunkin’ (32nd, Score: 226.9)

- Chick-fil-A (33rd, Score: 226.7)

- Subway (41st, Score: 224.1)

The presence of these brands highlights the importance of factors such as consistency, convenience, and brand personality in the highly competitive fast food sector.

Tech and Digital Services

Beyond Google, Amazon, Netflix, and YouTube, several other tech and digital service providers feature in the rankings:

- PayPal (28th, Score: 230.2)

- Samsung (36th, Score: 225.1)

- Weather Channel (40th, Score: 224.2)

- Visa (44th, Score: 222.8)

The strong showing of these brands underscores the increasing integration of technology and digital services into everyday life. It also highlights the importance of reliability, user experience, and innovation in building brand loyalty in the tech sector.

Factors Driving Brand Love: Key Takeaways for Businesses

Analyzing the Most Loved Brands of 2020 reveals several key factors that contribute to strong brand affinity among American consumers. Businesses looking to improve their brand perception can learn from these successful companies by focusing on:

1. Trust and Reliability

Brands that consistently deliver on their promises and maintain high standards of quality tend to earn consumer trust. This is evident in the strong performances of institutions like USPS and companies like Google and Amazon.

2. Convenience and Accessibility

In today’s fast-paced world, brands that make life easier for consumers are highly valued. This is reflected in the success of delivery services, e-commerce platforms, and digital entertainment providers.

3. Innovation and Adaptability

Companies that continuously innovate and adapt to changing consumer needs tend to maintain strong brand loyalty. Google’s diverse ecosystem of products and Amazon’s expansion into various services exemplify this approach.

4. Emotional Connections and Nostalgia

Brands that evoke positive emotions or nostalgic feelings often enjoy strong consumer affinity. This is particularly evident in the food and beverage category, with brands like M&M’s, Cheerios, and Oreo’s performing well.

5. Corporate Social Responsibility

Increasingly, consumers are drawn to brands that demonstrate a commitment to social and environmental causes. While not explicitly measured in the Brand Love Index, this factor likely contributes to the overall perception of many top-ranking brands.

6. Personalization and Customer Experience

Brands that offer personalized experiences and prioritize customer satisfaction tend to build stronger connections with consumers. Netflix’s recommendation algorithm and Amazon’s customer-centric approach are prime examples of this strategy.

7. Value for Money

The strong performance of discount retailers and value-oriented brands highlights the importance of offering perceived value to consumers, especially in uncertain economic times.

By focusing on these key areas, businesses can work towards improving their brand perception and fostering stronger connections with American consumers. The Most Loved Brands of 2020 serve as valuable case studies in effective brand building and management strategies.

The Future of Brand Love: Emerging Trends and Predictions

As consumer preferences continue to evolve and new technologies emerge, the landscape of brand affinity is likely to shift. Based on current trends and the performance of top brands, we can make some predictions about the future of brand love in America:

1. Increased Emphasis on Digital Integration

As more aspects of daily life become digitized, brands that successfully integrate digital solutions into their offerings are likely to gain favor. This could lead to the rise of new tech-focused brands and the continued success of adaptable traditional companies.

2. Growing Importance of Sustainability

With increasing awareness of environmental issues, brands that demonstrate a genuine commitment to sustainability are likely to see growth in consumer affinity. This could lead to the emergence of new eco-friendly brands in the top rankings.

3. Personalization at Scale

As data analytics and AI technologies advance, brands that can offer highly personalized experiences while maintaining privacy and security are likely to thrive. This could give rise to new personalization-focused brands across various sectors.

4. Health and Wellness Focus

The COVID-19 pandemic has heightened awareness of health and wellness. Brands that cater to these concerns, whether through products, services, or corporate policies, may see increased consumer affinity.

5. Authenticity and Transparency

In an era of misinformation and “fake news,” brands that prioritize authenticity and transparency in their communications and operations are likely to build stronger connections with consumers.

6. Ethical AI and Data Usage

As AI becomes more prevalent, brands that demonstrate ethical use of AI and responsible data management are likely to gain consumer trust and affinity.

By staying attuned to these emerging trends and continuing to prioritize the factors that drive brand love, companies can work towards building and maintaining strong emotional connections with American consumers in the years to come.

The Most Loved Brands of 2020 provide valuable insights into the current state of consumer preferences in America. From the dominance of convenience-oriented services to the enduring appeal of nostalgic food brands, the rankings offer a snapshot of what matters most to American consumers. As the business landscape continues to evolve, brands that can adapt to changing needs while maintaining trust, reliability, and emotional connections are likely to thrive in the hearts and minds of consumers.

Most Loved Brands 2020 – Morning Consult

These brands are ranked by their Brand Love Index score, which is based on performance across four metrics: favorability, trust, community impact, and net promoter score. More information on the index is available at the bottom of the page.

1

USPS

Score: 264.8

2

258.6

3

UPS

257.5

4

Amazon

256.0

5

Netflix

253.7

6

Clorox

246.4

7

Amazon Prime

245. 7

7

8

M&M’s

244.1

9

Home Depot

241.8

10

YouTube

241.7

11

Cheerios

240.4

12

FedEx

239.5

13

Target

236.7

14

Ziploc

236.2

15

Dove

235.2

16

Kellogg’s

235. 2

2

17

Dollar Tree

235.0

18

Tide

234.1

19

Colgate

233.6

20

Oreo’s

233.3

21

Lowe’s

233.0

22

The Hershey Company

232.8

23

Walmart

232.5

24

Reese’s

232.3

25

Heinz Ketchup

231. 9

9

26

Walgreens

230.9

27

DQ

230.7

28

PayPal

230.2

29

Doritos

229.8

30

Snickers

229.7

31

CVS Pharmacy

227.1

32

Dunkin’

226.9

33

Chick-fil-A

226.7

34

Kit Kat

226. 3

3

35

Disney

225.5

36

Samsung

225.1

37

Coca-Cola

224.8

38

Crest

224.5

39

Tylenol

224.3

40

Weather Channel

224.2

41

Subway

224.1

42

Costco

224.1

43

Scotch

223. 2

2

44

Visa

222.8

45

Kraft

222.1

46

Ritz

222.1

47

Lay’s

220.7

48

Febreze

220.6

49

Charmin

220.0

50

Microsoft

219.7

See All

Special Report: Gen Z’s Most Loved Brands of 2020

COVID-19 has drastically impacted spending behavior, shopping habits and even selection criteria for all consumers – but Generation Z (born 1997-2012), and its decidedly different priorities, sense of purpose, and brand expectations creates unique challenges for today’s companies striving for both short-term survival and long-term growth. `

`

The Biggest Gainers

The biggest gainers in Brand Love since the onset of coronavirus speak to the profound shifts that consumers have experienced and the brands that were there for them amid this new reality, whether by delivering connectivity and accessibility, entertainment and inspiration, or self-care.

The Biggest Gainers improved most on their Brand Love Index score between March 1 and the end of July 2020. The full report “What Drives Brand Love” explores brands that have gained most in this era across a range of metrics. Download it below.

1

Zoom

Score: 159.77

Change:

+84.5

2

SpaceX

107. 45

45

+34

3

TikTok

102.55

+22.9

4

Instacart

102.28

+21.5

5

Headspace

47.87

+19.8

Watch Now: The Most Loved Brands Webinar

Morning Consult hosted a webinar to dive deep into this year’s Most Loved Brands data and provide actionable insights into what brands can do to improve their relationship with consumers in these trying times. Watch On-Demand Webinar Now.

Download the Report

Download the companion report to this year’s rankings to get exclusive insights into what brands can do today to build long-lasting relationships that extend far past the pandemic.

All fields are required

Methodology

About the ranking

To determine this year’s rankings, Morning Consult analyzed over 150,000 Morning Consult Brand Intelligence interviews with U.S. adults to measure consumer perceptions across four key metrics: favorability, trust, community impact, and Net Promoter Score.

The final rankings were determined using surveys conducted online among a national sample of adults. Between 3,700 and 8,300 adults rated each of the over 1,900 companies from June through July 2020. The average company was surveyed over 6,000 times. The maximum margin of error for a given brand is plus or minus 3%.

The Brand Love Index Score

The Most Loved Brands Index is based on four metrics, added together for an index score:

Favorability Score: The percentage of consumers with a favorable opinion of the brand.

Trust Score: The percentage of consumers who trust the brand to do the right thing.

Community Impact Score: The percentage of consumers who say the brand has a positive impact on their local community.

Net Promoter Score: Consumers are asked on a scale of 1-10 how likely they would be to promote a given brand. NPS is determined by subtracting the percentage who say 0-6 from the percentage who say 9 or 10.

About Brand Intelligence

Brand Intelligence is the most powerful brand management solution available today. Communications, marketing and insights professionals rely on our state-of-the-art brand research and analysis technology to deliver intelligent data on the most important brand metrics to drive strategic decisions. We survey tens of thousands of people across the globe every day to provide real-time insights on what consumers think about thousands of brands and products.

Learn more

Best Global Brands – The 100 Most Valuable Global Brands

For the first time ever in 2022, the average brand value of a Best Global Brand has reached over US$3 trillion. The overall value of the Top 100 brands has reached US$3,088,930m, a 16% rise from 2021 (US$2,667,524m). This year sees the fastest rate of brand value growth ever recorded, demonstrating the growing contribution a company’s brand has in driving its economic success. While financial markets have shown significant swings over the last few years, the value of the world’s strongest brands have steadily increased driving customer choice, loyalty and margins.

The overall value of the Top 100 brands has reached US$3,088,930m, a 16% rise from 2021 (US$2,667,524m). This year sees the fastest rate of brand value growth ever recorded, demonstrating the growing contribution a company’s brand has in driving its economic success. While financial markets have shown significant swings over the last few years, the value of the world’s strongest brands have steadily increased driving customer choice, loyalty and margins.

In the top ten brands we see exponential growth and the emergence of a ‘super league’. Built on a foundation of exceptional experiences and strong integrity, these companies can move in multiple directions, growing their share of customers’ lives, along with their brand value and market cap.

Its increasingly difficult to fit the Top Ten into categories (what do Apple and Google do?), but things become much clearer when taking the perspective of customer jobs to be done (what aspects of consumers lives they address). Apple helps us Connect, Do, Belong, Play, Pay and – more recently – Thrive. Rumour has it that soon it may help us Move, too. Google helps us get many jobs done, like Learn, Connect, Move – and even Dwell. Nike – not a FAANG – helps us Thrive and Express ourselves. We can think along the same lines for the likes of Microsoft or Disney.

Apple helps us Connect, Do, Belong, Play, Pay and – more recently – Thrive. Rumour has it that soon it may help us Move, too. Google helps us get many jobs done, like Learn, Connect, Move – and even Dwell. Nike – not a FAANG – helps us Thrive and Express ourselves. We can think along the same lines for the likes of Microsoft or Disney.

Ultimately, these organisations are building businesses around their brand (in contrast to the traditional approach of building brand around a product) – and it’s setting them apart from the rest of the pack.

Interbrand’s leaders were at the “biggest tech event in the world” to present our 2022 Best Global Brands report and spark conversations about the importance of sports brands, ethical leadership and more.

Web Summit 2022: Launching Interbrand’s Best Global Brands 2022

Web Summit 2022: Meet the 2022 Best Global Brands

Web Summit 2022: Ethical brand leadership for a better world

Web Summit 2022: Welcome to the future of sports and entertainment

Web Summit 2022: Creating a sports super brand

Top 5 brands in Russia

- Andrey Zlobin

Editorial Forbes

The list of the best brands, which was compiled for the first time for Russia by the research company Gfk, includes two Russian and three foreign companies

by GfK for the first time. Among them were two Russian and three foreign brands that won first places in five categories: Best Product Brand, Best Growing Product Brand, Best Foreign Corporate Brand, Best Russian Corporate Brand and Best Russian Product Brand. .

During the study, GfK took into account not only the market performance of the brand, but also its emotional perception by the consumer. “This is not an expert assessment, but a representative study that takes into account both the commercial success of brands and the opinion of consumers,” Natalia Ignatieva, Director of Marketing and Communications at GfK Rus, explained to Forbes.

“This is not an expert assessment, but a representative study that takes into account both the commercial success of brands and the opinion of consumers,” Natalia Ignatieva, Director of Marketing and Communications at GfK Rus, explained to Forbes.

As a result, Apple, the leader of the Forbes ranking of the most valuable brands in the world, was only fifth in the Best Foreign Corporate Brand category, missing Google in first place. “It turned out that people in Russia are much more emotionally involved with Google,” says Ignatieva. And the German Bosch won in the main nomination – “Best Product Brand”. In terms of “market share” in the total calculation, it was significantly behind five competitors at once, but it turned out to be far ahead in terms of “soul share”, which GfK understands as the psychological attractiveness of the brand for Russians.

When determining the “strength of a brand”, its market achievements were taken into account (determined based on open information and GfK panel data) and the psychological attractiveness of the brand, assessed based on the results of a survey of 7,250 people in Russia (for more information about the rating methodology, click here).

The organizer of the Best Brands award, Serviceplan Group, announced its winners at a ceremony in Moscow on April 9, 2019.

Best Food Brand

Bosch

German Bosch competed with Alpen Gold, Bonduelle, Canon, Lay’s, Nescafe, Samsung, Tefal, Tikkurila and FrutoNyanya in the Best Food Brand nomination. In terms of commercial success, the German brand was not among the leaders, losing to Nescafe, Tikkurila, Samsung, Bonduelle and Tefal. But it overtook its competitors due to a significant gap in psychological attractiveness for Russian consumers. The top three in terms of total indicators also included Samsung and Bonduelle.

“German brands traditionally have a good image for quality and innovation among Russians,” says Ignatieva. At Bosch itself, consumer attitudes towards a brand are associated with ongoing marketing campaigns and the emotional involvement of the audience. “For many years in a row, we have been actively supporting creative initiatives within the framework of such public events as, for example, Afisha Picnic, the purpose of which is to involve young people and reveal their creative potential,” says Andrey Krivosheev, Regional Director for Sales of Power Tools at Robert Bosch LLC . “Another example is the support of the activities of the Galchonok charitable foundation aimed at developing creative opportunities and integrating children with disabilities.”

At Bosch itself, consumer attitudes towards a brand are associated with ongoing marketing campaigns and the emotional involvement of the audience. “For many years in a row, we have been actively supporting creative initiatives within the framework of such public events as, for example, Afisha Picnic, the purpose of which is to involve young people and reveal their creative potential,” says Andrey Krivosheev, Regional Director for Sales of Power Tools at Robert Bosch LLC . “Another example is the support of the activities of the Galchonok charitable foundation aimed at developing creative opportunities and integrating children with disabilities.”

Methodology. “Best Product Brand” is determined by two indicators. First, the commercial success of a brand is assessed, which is determined by its market share, customer preference (first choice) and price premium (the percentage by which the sale price of a product exceeds the reference price). Secondly, the attractiveness of the brand for consumers is taken into account. To do this, 5,750 people are surveyed, they are asked to rate the brand’s popularity and experience of interacting with it.

Secondly, the attractiveness of the brand for consumers is taken into account. To do this, 5,750 people are surveyed, they are asked to rate the brand’s popularity and experience of interacting with it.

Best Growing Product Brand

Xiaomi

The main competitors of the Chinese giant in the Best Growing Product Brand category in Russia were Alpen Gold, Bosch, Huawei, Lay’s, Makita, Mr. Ricco, Nutrilon, Panasonic and Sony. Xiaomi became the first by a wide margin due to a significant increase in the company’s share in the Russian market. Behind him in this category are Panasonic and Alpen Gold.

In terms of emotional perception among Russian buyers, the Chinese brand turned out to be an obvious outsider, losing to the other nine nominees, but surpassing rivals in terms of growth rates of its market share in Russia.

Methodology . In the Best Growth Brand category, growth dynamics is a priority.

The best Russian food brand

FrutoNyanya

The baby food brand outperformed such rivals as Greenfield, Babaevsky, Goryachaya Shtushka, Dobry, Makfa, “Maheev”, “Prostokvashino”, “Russia” and “Sloboda”. In terms of financial performance, FrutoNyanya was inferior to its main competitors, Prostokvashino and Sloboda, but outperformed them in terms of the “share of the soul” (emotional and rational perception on the part of consumers). In addition, the brand’s ability to translate its power into other categories also played a role (consumer surveys asked about the willingness to buy a brand in other product segments). FrutoNyanya was favored by the assessment of the quality of its products, the brand’s ability to cause joy, its adaptation to the needs of consumers, and a good price-quality ratio. According to the totality of these criteria, FrutoNyanya won.

According to the totality of these criteria, FrutoNyanya won.

Marketing Director of JSC “Progress” (manufacture products under the brand “FrutoNyanya”) Anna Ivanova explains the success of the company’s ability to predict the mood and needs of the consumer. In particular, the brand began to build its positioning not only on the opportunity to help mothers, but also fathers (“today, a man in the baby food department no longer surprises anyone”). An illustrative example of strengthening the position of the FrutoNyanya brand in the children’s juice market, Ivanova called the refusal in 2017 of “cunning stories and legends” in advertising.

Best Russian Corporate Brand

Yandex

In the competition for the title of Best Russian Corporate Brand, the company created by Arkady Volozh and Ilya Segalovich overtook Mail. Ru Group, Aeroflot, VTB, Gazprom, Lukoil, MTS, Rosneft, Russian Railways and Sberbank. Yandex, Sberbank and Aeroflot have similar rational indicators. Slightly higher emotional preferences of consumers allowed Yandex to become the first. It is followed by Sberbank and Aeroflot.

Ru Group, Aeroflot, VTB, Gazprom, Lukoil, MTS, Rosneft, Russian Railways and Sberbank. Yandex, Sberbank and Aeroflot have similar rational indicators. Slightly higher emotional preferences of consumers allowed Yandex to become the first. It is followed by Sberbank and Aeroflot.

The brands of Rosneft, VTB, MTS and Mail.Ru Group were at the bottom of the list of 10 nominees. In terms of emotional perception by respondents, the brands of VTB and Rosneft took the last lines. According to rational perception, VTB and MTS were at the end of the list.

Methodology. When determining the nominees in the Best Russian Corporate Brand category, open data on the commercial success of companies operating in Russia were taken into account. Brand strength was calculated from the results of an online survey of 1,500 respondents and reflects their emotional and rational perception of these companies.

The best foreign corporate brand

In terms of emotional and rational perception, the image of Google turned out to be higher than that of competitors, among which were Apple, Danone, LG Electronics, Mercedes-Benz, Nestle, Pepsico, Procter and Gamble, Samsung Electronics and Toyota Motor. But the victory for the American brand was due to the greatest contribution of rational perception, stressed at GfK.

Samsung, Mercedes-Benz and Toyota are a little behind Google. The American Apple was in the top three in terms of rational brand perception in Russia (we are talking about reputation, international recognition and development), but it turned out to be only sixth in terms of emotions that the brand awakens among buyers (sympathy, identification, uniqueness).

Google outperformed the competition on emotional characteristics, especially on likeability, attractiveness, and identification. “People, as the study shows, feel somewhat more close to Google, which is logical, since the company’s products are used in everyday life and this does not require a high level of income,” Ignatieva explained.

The Google press service called the launch of an assistant in Russian, the You Tube Music streaming service, the Business Class program and Google Reading “From small to large” the brand’s most striking marketing campaigns in 2018.

Top 45 brands in Russia

- org/ListItem”>

Business

- Andrey Zlobin

Editorial Forbes

20 Russian and 25 international brands were included in the list of the best brands compiled by GfK for the Best Brands award. Founded in Germany in 2004, the award will be presented in Russia for the first time this year.

As part of the study, GfK studied more than 300 leading brands in the Russian market. The researchers assessed their strength not only by objective market indicators, but also in terms of the psychological attractiveness of the brand for consumers. The brands were divided into five groups: Best Product Brand, Best Growing Product Brand, Best Foreign Corporate Brand, Best Russian Corporate Brand, and Best Russian Product Brand. The best product brands were identified based on Gfk panel data and a survey of 5,750 people, while the best corporate brands were determined based on open data on the commercial success of brands and a survey of 1,500 people (more on the ranking methodology here). According to the results of the study, 10 leaders were named in each nomination and a total of 45 brands were selected (one brand can be represented in several categories). From this list 9April Gfk will select five winners of the Best Brands award (the award is organized by Serviceplan Group). The slideshow shows the brands in alphabetical order.

According to the results of the study, 10 leaders were named in each nomination and a total of 45 brands were selected (one brand can be represented in several categories). From this list 9April Gfk will select five winners of the Best Brands award (the award is organized by Serviceplan Group). The slideshow shows the brands in alphabetical order.

Best Product Brand

Top 10: Alpen Gold, Bonduelle, Bosch, Canon, Lay’s, Nescafe, Samsung, Tefal, Tikkurila and Frutonyanya.

The categories of consumer goods (FMCG) and durable goods (durables) were considered in determining the best product brand. In each category, 15 brands were selected, which, according to Gfk, are leading the market. The Automotive category used data from the Association of European Businesses (AEB). Tobacco products, alcoholic beverages and pharmaceuticals were excluded from the study.

Top Growing Product Brand

Top 10: Alpen Gold, Bosch, Huawei, Lay’s, Makita, Mr. Ricco, Nutrilon, Panasonic, Sony and Xiaomi.

The list of brands in the category “Best Growing Product Brand” included the same categories and brands as in the category “Best Food Brand”. But such an additional indicator as the increase in the market share of each brand over the past year was also taken into account. The survey on the change in brand attractiveness used in compiling the Best Brand rating abroad was not conducted in Russia in 2018, since the award winners are determined in the country for the first time.

Best Russian food brand

Top 10: Greenfield, Babaevsky, Hot Stuff, Dobry, Makfa, Maheev, Prostokvashino, Rossiya, Sloboda and Frutonyanya.

The top ten best Russian food brands were determined using the same methodology as the best food brands. But when compiling the list, only brands created in Russia were taken into account.

Best Russian corporate brand

Top 10: Mail.Ru Group, Aeroflot, VTB, Gazprom, Lukoil, MTS, Rosneft, Russian Railways, Sberbank of Russia and Yandex.

When determining companies in the Best Russian Corporate Brand nomination, data on companies operating in Russia were taken into account from open sources, including the RBC 500 rating (tobacco products, alcoholic beverages and pharmaceuticals were not included in the rating). The top three companies in each consumer sector industry were selected for inclusion in the survey by revenue. The strength of the brand in this category was calculated based on the data of an online survey of 1,500 respondents and reflects their emotional and rational perception of these companies.