What are Creative Commons licenses and how do they work. How can you use CC-licensed content legally. What are the different types of CC licenses available. How does CC0 differ from other licenses. Why do organizations use Creative Commons licenses.

What Are Creative Commons Licenses?

Creative Commons (CC) licenses are public copyright licenses that allow creators to grant certain permissions for their work to be used by others. These licenses provide a standardized way for content creators to give the public permission to share and use their creative work, on conditions of their choice.

CC licenses are designed to work alongside traditional copyright laws, giving creators more flexibility in how their work can be used while still maintaining some rights. They allow for a middle ground between full copyright protection (“all rights reserved”) and the public domain (“no rights reserved”).

Key Features of Creative Commons Licenses

- Free to use and legally valid worldwide

- Allow creators to retain copyright while permitting others to copy, distribute, and make some uses of their work

- Ensure creators get credit for their work

- Can be applied to almost any type of work, from music and art to educational materials and scientific research

How Do Creative Commons Licenses Work?

When a creator applies a CC license to their work, they are granting the public permission to use the work under certain conditions. These conditions are specified by the type of CC license chosen.

To use CC-licensed material, you must follow the license terms. This typically involves providing attribution to the original creator and following any other specified conditions, such as non-commercial use or share-alike requirements.

Steps to Use CC-Licensed Content

- Check the type of CC license applied to the work

- Review the license terms and conditions

- Provide proper attribution to the original creator

- Comply with any additional requirements (e.g., non-commercial use, no derivatives)

- If creating a derivative work, apply the appropriate license to your new creation

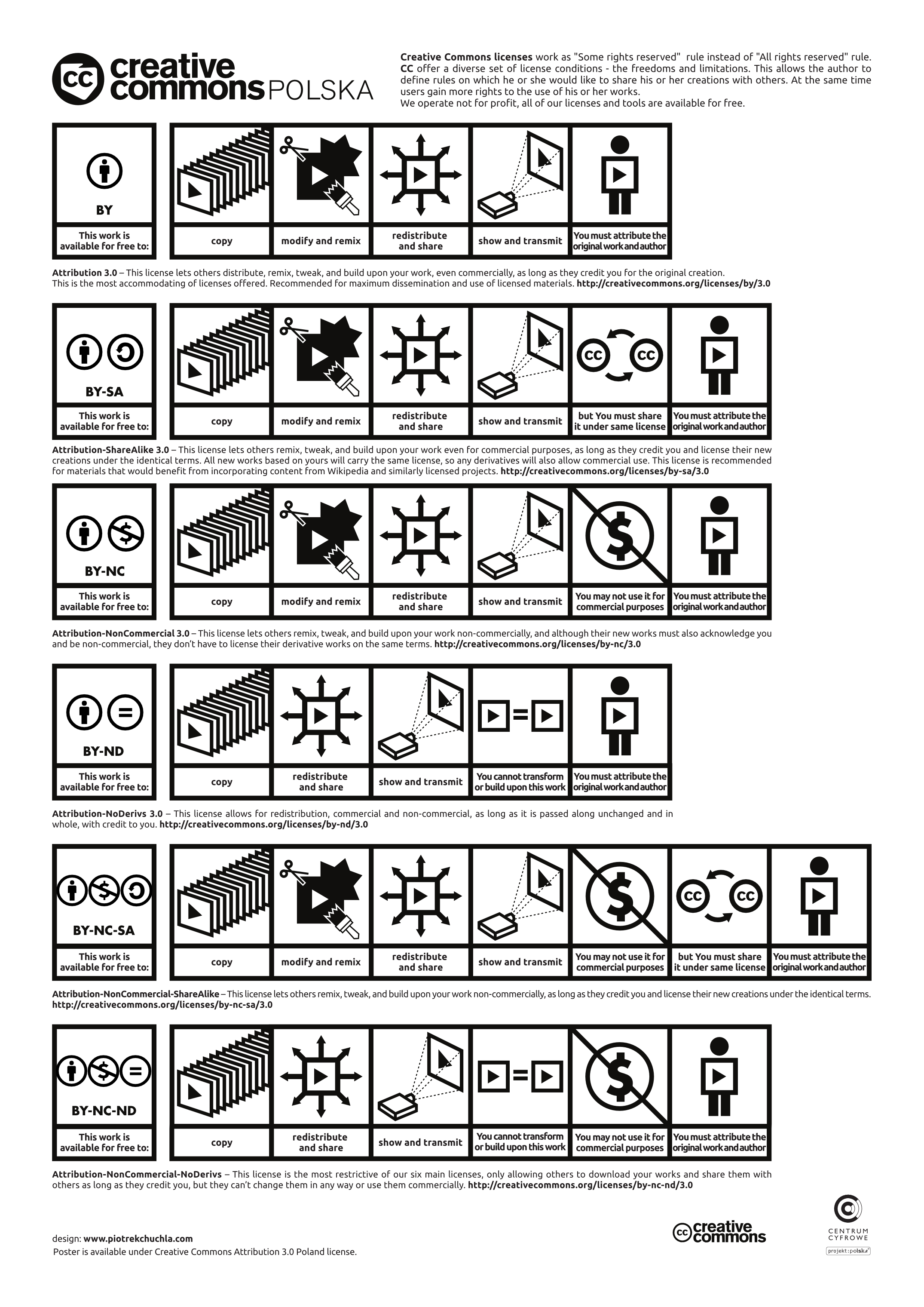

Types of Creative Commons Licenses

Creative Commons offers six main licenses, each with different levels of permissions and restrictions. Understanding these licenses is crucial for both creators and users of CC-licensed content.

CC BY (Attribution)

This is the most permissive CC license. It allows others to distribute, remix, adapt, and build upon the work, even commercially, as long as they credit the original creator.

CC BY-SA (Attribution-ShareAlike)

This license allows for commercial and non-commercial redistribution, as long as it is passed along unchanged and in whole, with credit to the creator.

CC BY-ND (Attribution-NoDerivs)

This license allows for redistribution, commercial and non-commercial, as long as it is passed along unchanged and in whole, with credit to the creator.

CC BY-NC (Attribution-NonCommercial)

This license lets others remix, tweak, and build upon the work non-commercially. While new works must acknowledge the original creator and be non-commercial, they don’t have to license their derivative works on the same terms.

CC BY-NC-SA (Attribution-NonCommercial-ShareAlike)

This license allows others to remix, tweak, and build upon the work non-commercially, as long as they credit the original creator and license their new creations under identical terms.

CC BY-NC-ND (Attribution-NonCommercial-NoDerivs)

This is the most restrictive of the six main licenses. It only allows others to download the works and share them with others as long as they credit the creator, but they can’t change them in any way or use them commercially.

CC0 and Public Domain Dedication

In addition to the six main licenses, Creative Commons offers CC0, a public domain dedication tool. CC0 allows creators to waive all their copyright and related rights in their works to the fullest extent allowed by law.

How Does CC0 Differ from Other CC Licenses?

- CC0 is not a license, but a waiver of rights

- It places the work as close to the public domain as legally possible

- No attribution is required for CC0 works

- CC0 works can be used for any purpose, including commercial use

CC0 is particularly useful for databases and datasets, where attribution requirements can become burdensome in large-scale projects.

Benefits of Using Creative Commons Licenses

Creative Commons licenses offer numerous advantages for both content creators and users. They promote the sharing and reuse of creative works while still protecting the rights of creators.

For Creators

- Retain copyright while allowing others to use and share the work

- Increase visibility and impact of creative works

- Contribute to the growth of shared cultural and intellectual resources

- Choose the level of permissions that best suits their needs

For Users

- Access a wide range of content for use in various projects

- Clear understanding of how the content can be used

- Reduced legal uncertainty and transaction costs

- Ability to build upon and remix existing works (depending on the license)

Creative Commons Licenses in Practice

Many organizations and platforms use Creative Commons licenses to share their content. Understanding how these licenses are applied in real-world scenarios can help both creators and users navigate the CC ecosystem more effectively.

![]()

Wikipedia and CC BY-SA

Wikipedia uses the CC BY-SA license for all its content. This allows for the free dissemination of knowledge while ensuring that any derivatives also remain freely accessible.

Open Educational Resources (OER)

Many educational institutions and organizations use CC licenses to create and share open educational resources. This promotes access to education and allows for the adaptation of materials to suit different contexts.

Government and Public Sector Information

Some government agencies use CC licenses to make public sector information more accessible and reusable. This can include datasets, reports, and other official documents.

Limitations and Considerations of Creative Commons Licenses

While Creative Commons licenses offer many benefits, it’s important to understand their limitations and consider certain factors before applying or using a CC license.

Irrevocability

Once a CC license is applied to a work, it cannot be revoked. The creator can stop distributing the work under the CC license, but this won’t affect any copies already in circulation.

Compatibility Issues

Not all CC licenses are compatible with each other. For example, content under a CC BY-SA license cannot be combined with content under a CC BY-NC license in a new work.

Limited Application

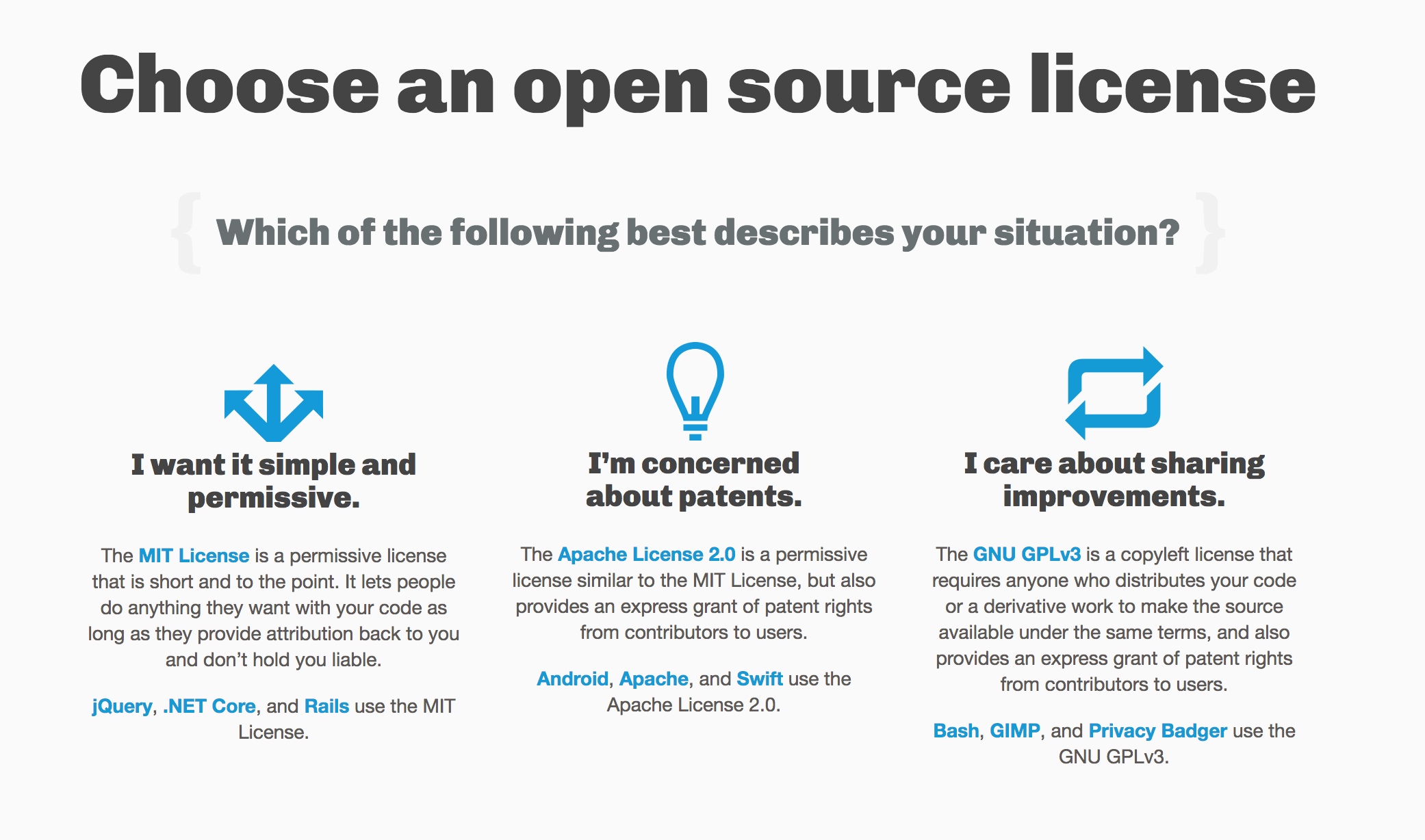

CC licenses only apply to works protected by copyright and similar rights. They cannot be used for trademarks or patents.

Potential Misuse

While CC licenses are designed to protect creators’ rights, there’s always a risk of misuse or misinterpretation of the license terms.

The Future of Creative Commons

As the digital landscape continues to evolve, Creative Commons is adapting to meet new challenges and opportunities in the realm of intellectual property and content sharing.

Emerging Technologies

Creative Commons is exploring how its licenses can be applied to new technologies such as artificial intelligence, blockchain, and the Internet of Things.

Global Expansion

The organization is working to increase adoption of CC licenses worldwide, particularly in developing countries and underrepresented communities.

Policy Advocacy

Creative Commons continues to advocate for policies that support open access to knowledge and culture, including copyright reform and open education initiatives.

As we move further into the digital age, Creative Commons licenses will likely play an increasingly important role in shaping how we share and access information and creative works. By providing a flexible framework for content sharing, these licenses help foster innovation, creativity, and the free exchange of ideas in our interconnected world.

Creative Commons Licenses – Creative Commons

Creative Commons Licenses

Creative Commons licenses are public licenses. A public license permits certain uses of copyrighted materials by the public at large. If a work you wish to use has been released under a public license, you do not have to seek additional permission from the rightsholder in order to do the things authorized by the license. However, you do still need to follow the license terms. For example, the license may require attribution to the original author or it may forbid commercial uses. Other public licenses include the licenses on the lists of free software licenses maintained by the Free Software Foundation and the licenses approved by the Open Source Initiative.

The following descriptions of the Creative Commons licenses come from About the Licenses by Creative Commons and are licensed under a Creative Commons Attribution 4.0 International license.

Attribution: CC BY

- This license lets others distribute, remix, tweak, and build upon your work, even commercially, as long as they credit you for the original creation.

This is the most accommodating of licenses offered. Recommended for maximum dissemination and use of licensed materials.

This is the most accommodating of licenses offered. Recommended for maximum dissemination and use of licensed materials. - CC BY License Deed

- CC BY Legal Code

Attribution-ShareAlike: CC BY-SA

- This license lets others remix, tweak, and build upon your work even for commercial purposes, as long as they credit you and license their new creations under the identical terms. This license is often compared to “copyleft” free and open source software licenses. All new works based on yours will carry the same license, so any derivatives will also allow commercial use. This is the license used by Wikipedia, and is recommended for materials that would benefit from incorporating content from Wikipedia and similarly licensed projects.

- CC BY-SA License Deed

- CC BY-SA Legal Code

Attribution-NoDerivs: CC BY-ND

- This license allows for redistribution, commercial and non-commercial, as long as it is passed along unchanged and in whole, with credit to you.

- CC BY-ND License Deed

- CC BY-ND Legal Code

Attribution-NonCommercial: CC BY-NC

- This license lets others remix, tweak, and build upon your work non-commercially, and although their new works must also acknowledge you and be non-commercial, they don’t have to license their derivative works on the same terms.

- CC BY-NC License Deed

- CC BY-NC Legal Code

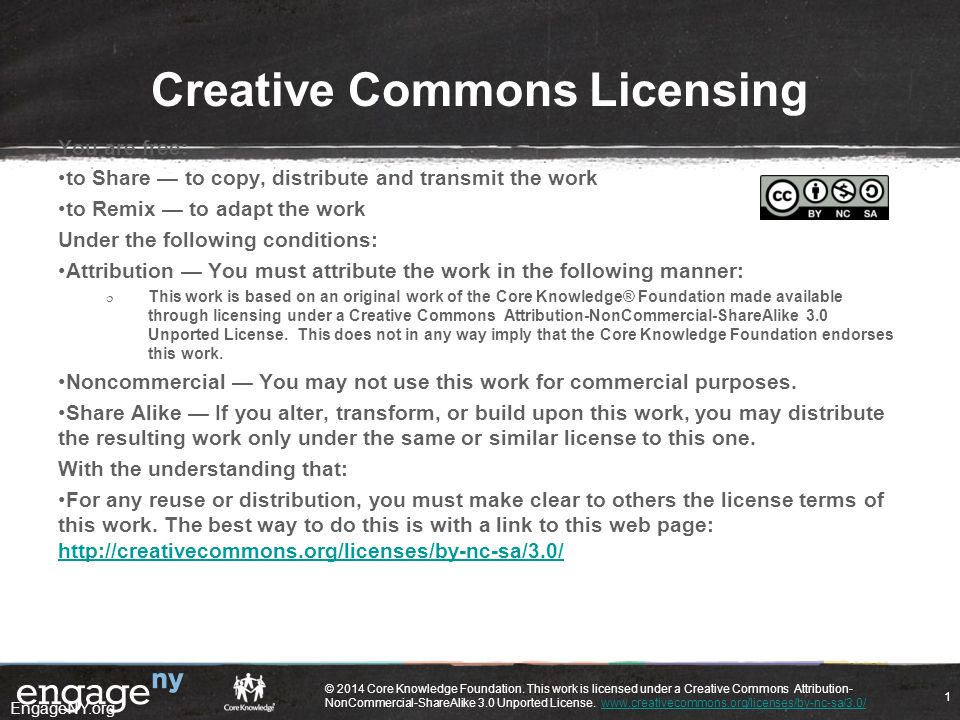

Attribution-NonCommercial-ShareAlike: CC BY-NC-SA

- This license lets others remix, tweak, and build upon your work non-commercially, as long as they credit you and license their new creations under the identical terms.

- CC BY-NC-SA License Deed

- CC BY-NC-SA Legal Code

Attribution-NonCommercial-NoDerivs: CC BY-NC-ND

- This license is the most restrictive of our six main licenses, only allowing others to download your works and share them with others as long as they credit you, but they can’t change them in any way or use them commercially.

- CC BY-NC-ND License Deed

- CC BY-NC-ND Legal Code

Creative Commons Public Domain Dedication

Creative Commons also offers a Public Domain Dedication, known as CC0. You can use CC0 to waive your copyright in a work. For more information about CC0, consult Creative Commons’s CC0 FAQ.

Get Creative!

This 2002 video from Creative Commons explains why Creative Commons was founded and what it does.

Get Creative! by Creative Commons is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 1.0 Generic License.

Copyright and permissions | British Museum

Copyright and permissions

What does the Creative Commons licence apply to?

The Creative Commons licence does not apply to everything on our website. Content that is published under the Creative Commons licence will be marked with the following logo:

Content that is published under the Creative Commons licence will be marked with the following logo:

Why is everything on the website not published under a Creative Commons licence?

All the content on our website is protected by internationally recognised laws of copyright and intellectual property. The British Museum can decide under what terms to release the content for which we own the copyright.

However, not all the content on our website is owned exclusively by the British Museum. Some of it may have third-party intellectual property or image rights that the Museum doesn’t own. While we have made all reasonable efforts to obtain permission from the owners of such content to post it on our website, we cannot allow any additional uses ourselves.

Additionally, there may be content we can’t share under a Creative Commons licence due to cultural sensitivities, or if doing so would be against any existing Museum policies (such as our human remains policy).

How can I use the content published under a Creative Commons licence?

The British Museum publishes some of the content on our website under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0) licence.

This licence allows you to:

BY (Attribution): Copy, distribute, display and perform our copyrighted work – and derivative works based upon it – but only if you give us credit in the way we request:

© The Trustees of the British Museum.

NC (NonCommercial): Copy, distribute, display, and perform our work – and derivative works based upon it – but for non-commercial purposes only.

SA (ShareAlike): Distribute derivative works only under a licence identical to the licence that governs our work.

Creative Commons defines commercial use as ‘reproducing a work in any manner that is primarily intended for or directed toward commercial advantage or monetary compensation’.

For the avoidance of doubt, the British Museum considers the following to be commercial activities (this list is not exhaustive):

- Anything that is in itself charged for, including textbooks and academic books or journals

- An individual’s website or blog that is used as a platform to promote or conduct commercial activities (for example, to sell products created by or services provided by such an individual)

- A commercial organization’s website or blog, including trading arms of charities

- freely distributed leaflets or merchandise that promote goods or services

- Corporate stationery or any business communications such as annual reviews

- Free-entry events, presentations or lectures promoting a product or a service

- Displays in public places offering or promoting a product or service, such as use in a shop, restaurant, hotel, public bar or property showroom

The British Museum considers the following to be non-commercial activities (this list is not exhaustive):

- Use in free-entry, educational lectures (or in activities promoting free-entry lectures)

- Promotion of any non-commercial activity, such as a poster advertising a bursary

- One-off classroom use

- Reproduction within a thesis document submitted by a student at an educational establishment (an electronic version of the thesis may be stored online by the educational establishment as long as it is made available at no cost to the end user)

- Use in websites as long as they are informational, academic or research-oriented and not linked to any commercial activity

- Display within a free-entry public space (including museums and galleries), as long as the use is not promoting a product or a service

- Educational and classroom use within an educational establishment or in the course of formal instruction

How can I use the content that is not published under a Creative Commons licence?

Please note: the British Museum can’t guarantee that your use of any content found on our website will not infringe any third-party copyright or other intellectual property rights. It is your responsibility to judge whether any of the content may need additional clearances for your intended use and to obtain them.

It is your responsibility to judge whether any of the content may need additional clearances for your intended use and to obtain them.

Re-use of images

Unless stated otherwise, the copyright for the majority of images on the British Museum website belongs to The Trustees of the British Museum. However, please note that the copyright for certain images is held by third-parties.

To re-use any of the website images, the type of license you may need depends on your intended use. Determine whether it is for non-commercial or commercial use, by referring to the lists of activities above.

Find out where and how to source and download images, plus further licensing and copyright information, on our Images and photography page.

FAQs

Yes, you may use British Museum content at no charge in your thesis (including images from Collections online and content from our website) as long as:

- We’ve made the content available under a Creative Commons licence

- You attribute us with the appropriate credit line

- If published, the thesis is made available for free and, if placed in electronic deposit, the electronic copy is also available for free

- You or your academic institution further distributes our content by applying the same conditions under which we gave it to you

If your thesis is published, whether as an article or a book and whether in print or electronic format, you need to contact us to request permission. You may do so by emailing [email protected] or, in the case of photographs, [email protected].

You may do so by emailing [email protected] or, in the case of photographs, [email protected].

You may use British Museum content that has been made available under Creative Commons on social media sites, so long as the page doesn’t advertise or isn’t connected to commercial activity or commercial services of any kind.

Please note: we distribute our content under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0) licence, which does not allow use of our content for commercial purposes.

Some social media sites distribute content under a Creative Commons Attribution/ShareAlike licence, which does allow the content posted on their site to be further used commercially. In other cases, by uploading content to the social media site, the user is granting the host of the site permission to further use the content commercially.

In those cases, posting British Museum content to those sites would not be allowed.

It depends. One of the conditions of the Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0) licence is that the content be further shared under the same conditions we shared it with you.

If the journal where you’d like to publish our content is published under a licence that is less restrictive than ours (for example, CC BY-SA, which allows commercial uses) or more restrictive than ours (for example, CC BY-NC-ND, which doesn’t allow the creation of derivative works) you may not use our content without asking us for permission first.

If, on the other hand, the journal is published under a licence that wouldn’t limit or expand the rights we grant you (that is, a CC BY-NC-SA licence) you may use the content we have published under a Creative Commons licence without needing further permission.

If you’re unsure under which licence the journal is being published, you should ask your editor for clarification.

Again, it depends. Some charitable uses could be made within the Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0) licence. However, Creative Commons differentiates between uses, rather than between users, for its definitions of commercial and non-commercial uses. This means, for example, that:

Some charitable uses could be made within the Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0) licence. However, Creative Commons differentiates between uses, rather than between users, for its definitions of commercial and non-commercial uses. This means, for example, that:

- If a charity or not-for-profit society sells products in order to carry out or support itself, the activity is commercial because the sales (as opposed to free distribution) of the products are ‘primarily intended or directed toward a commercial advantage’, even if the commercial advantage is in the public interest of supporting the charity.

- On the other hand, if a commercial entity, such as a private university, holds a series of free-entry educational lectures, the activity may be non-commercial (provided it’s not a form of marketing) even though the institution may normally charge commercial rates for all other courses and events.

The British Museum is starting to explore the possibilities of 3D imaging. We make 3D photographs of our objects (both the images and the data files) available via our website and external sites dedicated to 3D imaging under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0) licence, which allows use of the 3D photographs for non-commercial purposes only (as explained in more detail above).

As for printing out the 3D objects, you may do so for personal, non-commercial uses only. Under no circumstance may you sell, lease, rent or otherwise commercially distribute 3D printouts of our objects.

Where the British Museum permits the photography or scanning of objects in its collection that are culturally sensitive or have continuing religious meaning in their cultures of origin you are asked to be mindful and respectful of such cultural sensitivities when taking and using films, photographs, scans and printouts for your own purposes.

Should you wish to use the scans or printouts commercially, you may contact [email protected] to obtain the appropriate licence.

Chamber of tax consultants. Official website

September 27 Tax Congress “Tax and Legal Reality – 2023: Autumn Session”

will open the events of the Russian tax week

September 27 – October 6

Registration

Advanced Tax Advisor Training Program

All innovations of the tax legislation. Undergraduate practice in tax consulting in the Union “PNK”

More

Independent assessment of the qualification “Consultant on taxes and fees”

individual form of professional activity

More

Anniversary promotion

Simplified restoration of qualification certificates “Consultant on taxes and fees”

Promotion period:

until December 31, 2023

More

- New events

- Specialized advanced training course

- Russian tax week

July 27, 2023

Safonova Tatyana Yurievna

Bashkatov Maxim

Leoshko Sergey

Sign up

Read more

July 28, 2023

Dmitry Knizhentsev

Evgeny Kuznetsov

Sign up

Read more

September 07-28, 2023

Leading speaker:

Burdina Anna Anatolyevna

member of the Scientific and Expert Council of the Union “PNC”, Doctor of Economics, professor, practicing tax and financial consultant, leading author specialized advanced training course for tax consultants “Business purpose, due diligence through financial analysis tools”

Make an appointment

More details

September 11-13, 2023

Klimova Marina Arkadievna

Borisova Vera Semyonovna

Vov chenko Oksana Vladimirovna

Sign up

Read more

September 18, 2023

Lead speaker:

Zagorulko Irina Petrovna

Head of the Tax Bureau of the PNK Union, member of the Scientific and Expert Council of the PNK Union, member of the Educational and Methodological Council Union “PNK”, lawyer, practicing tax consultant

Make an appointment

Read more

27 September 2023

Enroll

Read more

All events

Registration for event

Mandatory field

Mandatory field

Mandatory field

Mandatory field

I consent to the processing of my personal data by the Chamber of Tax Advisers

and hereby

I confirm that I have read and agree to the terms of the privacy policy

Thank you for registering for the event..jpg)

We will contact you shortly to clarify the information.

Send error, please try sending again

Open meeting of the Scientific and Expert Council of the PNK Union “Digital ruble: issue procedure, turnover and tax regime”

Date: July 27, 2023

Time: 15:00 – 18:00 Moscow time

In person, for NEC members and speakers : Moscow, O2 Consulting office, Presnenskaya embankment, d 12, West Federation Tower, floor 43

Online: for members of the PNK Union (ZOOM platform)

All members of the PNK Union are invited to the meeting

Representatives of the Ministry of Finance are invited to the discussion and Russia, Federal Tax Service of Russia, Central Bank of the Russian Federation

Applications for speaking are accepted by email: [email protected], Elena Gerchikova

REGISTER

Business breakfast with tax consultant training partners – educational organizations

Date: August 3, 2023

Time: 11:00 Moscow time

Format: in person / online (zoom platform)

In person at the address: office of the Chamber of Tax Consultants, Moscow, st. Zemlyanoy Val, 4, building 1

Zemlyanoy Val, 4, building 1

Applications for participation – until July 26 by email: [email protected], [email protected]

Details

Meeting of the Educational and Methodological Direction of the Scientific and Expert Council of the PNK Union

Date: August 2, 2023

Time: 11:00

Format: in person at Zemlyanoy Val, house 4, building 1, 2nd floor

Meeting of the Board of the Union “PNK”

Date: August 3, 2023

Time: 16:00 Moscow time

Format: in person and remotely

9000 3 More

Meeting of the Accreditation Commission

Date: August 30, 2023

Time: 11:00 Moscow time

Format: in person and remotely

All news and events

HOTLINE +7 495 380-06-06 +7 962 944-50-05

Restoration of the qualification certificate “Consultant on taxes and fees”

Simplified Form

Unified register of certified tax consultants, members of the PNK Union

Job search

Pay membership dues

Partners – educational organizations throughout Russia

>21000

tax

consultants

Select an area on the map

Here you can find:

Educational

organizationsTax

consultantsTax Bureau

Educational organizations

Tax consultants

Tax Bureaus

Elena Shmykova

Member of the PNK Union since 2021

I completed the advanced training form “Tax practice: professional and psychological tools”, and received from the process itself more understanding of myself, which is the driving force behind my desire and aspiration to be . ..

..

Natalia Lyamina

member of the PNK Union since 2021

In 2021, I completed the Written Consultation tax practice and I am very impressed by this event. Tax practice has shown once again that not everyone can communicate with a client in such a way that he will receive …

Ekaterina Chumakova

member of the PNK Union since 2020

Having completed the tax practice “Oral Consultation”, I am happy that I attended the training “Psychological Tools in the Work of a Tax Consultant”. I have become more attentive, patient and listen to my clients. …

Anna Stroganova

member of the PNK Union since 2020

I completed a new form of advanced training “Tax practice: professional and psychological tools” 72 ac. h., and the profession of a tax consultant was revealed to me in a completely different format. Thanks…

h., and the profession of a tax consultant was revealed to me in a completely different format. Thanks…

Andrey Pankov

Member of the PNK Union in 2010, Head of the Legal Department

After obtaining the status of a consultant on taxes and fees, the nature of my work has changed towards increasing external consulting, professional confidence has strengthened, more targeted contacts, clients have appeared….

Anna Rodionova

member of the PNK Union since 2019, head of a consulting…

The Chamber of Tax Consultants is a powerful resource for professional growth. It provides an opportunity to communicate with experienced colleagues – consultants. During the internship at the Hotline, I had a chance to talk to…

Ivan Pokrasenko

member of the PNK Union since 2017, head of the economic service . ..

..

For me, the Chamber of Tax Advisers is at the same time a place where I get the most up-to-date knowledge from recognized authorities in the field of taxation and protection of the rights of taxpayers, as well as a discussion platform for…

Egor Kryuchkov

Member of the PNK Union since 2013, Deputy Director of the Legal…

I studied at the certified training center of the Chamber of Tax Advisers in 2012/2013.

I went to the Chamber purposefully, because by that time, as a lawyer’s assistant, I had accumulated experience in…

Elena Ovchinnikova

member of the PNK Union since 2017

The internship was very interesting and useful for me, but not easy.

There were situations when, as it seemed to me, the answer was already ready, but at that moment I suddenly suddenly realized that I was mistaken and had to . ..

..

Andrey Zuykov

member of the PNK Union since 2002, managing partner of a legal…

The Tax Consulting program proved to be a life-changing one in my career. Back in 2002, and at that time I worked as the head of a legal department in a trading and manufacturing company, innate inquisitiveness and various …

All reviews

If you want to leave feedback about the work of the Chamber, you can send it to pr@ palata-nk.ru

Order of the Federal Tax Service of Russia dated September 27, 2017 N SA-7-3 / 765@

“On approval of the form and format for submitting a tax declaration for indirect taxes (value added tax and excises) when importing goods into the territory of the Russian Federation from the territory of the member states of the Eurasian Economic Union in electronic form and the procedure for filling it out”

(Registered with the Ministry of Justice of Russia on October 19, 2017 N 48616)

- Home

- Documents

- Order

- Appendix N 1.

Tax declaration on indirect taxes (value added tax and excises) when importing goods into the territory of the Russian Federation from the territory of the states – members of the Eurasian Economic Union (Form on KND 1151088)

Tax declaration on indirect taxes (value added tax and excises) when importing goods into the territory of the Russian Federation from the territory of the states – members of the Eurasian Economic Union (Form on KND 1151088) - Section 1. The amount of value added tax

- Section 2. Amount of excise payable to the budget in respect of excisable goods imported into the Russian Federation from the territory of the Eurasian Economic Union member states economic union, with the exception of ethyl alcohol from all types of raw materials (including denatured ethyl alcohol, raw alcohol, wine, grape, fruit, cognac, calvados, whiskey distillates)

- Calculation of the amount of excise tax on types of excisable goods imported into the territory of the Russian Federation from the territory of the member states of the Eurasian Economic Union, with the exception of ethyl alcohol from all types of raw materials (including denatured ethyl alcohol, raw alcohol, distillates of wine, grape distillates , fruit, cognac, calvados, whiskey)

- Section 3.

The amount of excise calculated to be paid to the budget when importing ethyl alcohol from all types of raw materials (including denatured ethyl alcohol, raw alcohol, distillates of wine, grape, fruit, cognac, calvados, whiskey), to the territory of the Russian Federation from the territory of the member states of the Eurasian Economic Union

The amount of excise calculated to be paid to the budget when importing ethyl alcohol from all types of raw materials (including denatured ethyl alcohol, raw alcohol, distillates of wine, grape, fruit, cognac, calvados, whiskey), to the territory of the Russian Federation from the territory of the member states of the Eurasian Economic Union - Appendix No. 2. Procedure for filling out a tax declaration for indirect taxes (value added tax and excises) when importing goods into the Russian Federation from the territory of the member states of the Eurasian Economic Union

- I. General provisions

- II. General requirements for filling out the declaration

- III. Procedure for filling out the Title Page of the Declaration

- IV. The procedure for filling out section 1 of the declaration “The amount of value added tax payable to the budget in respect of goods imported into the territory of the Russian Federation from the territory of the member states of the Eurasian Economic Union”

- V.

The procedure for filling out section 2 of the declaration “The amount of excise tax payable to the budget in respect of excisable goods imported into the territory of the Russian Federation from the territory of the member states of the Eurasian Economic Union, with the exception of ethyl alcohol from all types of raw materials (including denatured ethyl alcohol, raw alcohol, wine, grape, fruit, cognac, calvados, whiskey distillates)”

The procedure for filling out section 2 of the declaration “The amount of excise tax payable to the budget in respect of excisable goods imported into the territory of the Russian Federation from the territory of the member states of the Eurasian Economic Union, with the exception of ethyl alcohol from all types of raw materials (including denatured ethyl alcohol, raw alcohol, wine, grape, fruit, cognac, calvados, whiskey distillates)” - VI. The procedure for filling out section 3 of the declaration “The amount of excise calculated for payment to the budget when importing ethyl alcohol from all types of raw materials (including denatured ethyl alcohol, raw alcohol, wine, grape, fruit, cognac, calvados, whiskey distillates) into the territory Russian Federation from the territory of the member states of the Eurasian Economic Union”

- Appendix No. 1. Codes defining the tax period

- Appendix No. 2. Codes for submitting to the tax authority a tax declaration on indirect taxes (value added tax and excises) when importing goods into the territory of the Russian Federation from the territory of the member states of the Eurasian Economic Union

- Appendix N 3.

Codes of forms of reorganization and code of liquidation of the organization – members of the Eurasian Economic Union

Codes of forms of reorganization and code of liquidation of the organization – members of the Eurasian Economic Union - Appendix No. 5. Codes of types of excisable goods

- Ethyl alcohol from all types of raw materials

- Alcoholic products (except for beer and beer-based drinks produced without the addition of ethyl alcohol) and alcohol-containing products

- Beer, as well as beer-based beverages produced without the addition of ethyl alcohol

- Tobacco products

- Cars and motorcycles

- Petroleum products

- Appendix N 6. Codes for the sign of applying the excise rate in accordance with Article 193 of the Code for ethyl alcohol from all types of raw materials (including raw ethyl alcohol from all types of raw materials, wine, grape, fruit, cognac, calvados, whiskey distillates ) imported into the territory of the Russian Federation from the territory of the member states of the Eurasian Economic Union

- Appendix N 3.

Tax declaration on indirect taxes (value added tax and excises) when importing goods into the territory of the Russian Federation from the territory of the states – members of the Eurasian Economic Union (Form on KND 1151088)

Tax declaration on indirect taxes (value added tax and excises) when importing goods into the territory of the Russian Federation from the territory of the states – members of the Eurasian Economic Union (Form on KND 1151088) The amount of excise calculated to be paid to the budget when importing ethyl alcohol from all types of raw materials (including denatured ethyl alcohol, raw alcohol, distillates of wine, grape, fruit, cognac, calvados, whiskey), to the territory of the Russian Federation from the territory of the member states of the Eurasian Economic Union

The amount of excise calculated to be paid to the budget when importing ethyl alcohol from all types of raw materials (including denatured ethyl alcohol, raw alcohol, distillates of wine, grape, fruit, cognac, calvados, whiskey), to the territory of the Russian Federation from the territory of the member states of the Eurasian Economic Union The procedure for filling out section 2 of the declaration “The amount of excise tax payable to the budget in respect of excisable goods imported into the territory of the Russian Federation from the territory of the member states of the Eurasian Economic Union, with the exception of ethyl alcohol from all types of raw materials (including denatured ethyl alcohol, raw alcohol, wine, grape, fruit, cognac, calvados, whiskey distillates)”

The procedure for filling out section 2 of the declaration “The amount of excise tax payable to the budget in respect of excisable goods imported into the territory of the Russian Federation from the territory of the member states of the Eurasian Economic Union, with the exception of ethyl alcohol from all types of raw materials (including denatured ethyl alcohol, raw alcohol, wine, grape, fruit, cognac, calvados, whiskey distillates)” Codes of forms of reorganization and code of liquidation of the organization – members of the Eurasian Economic Union

Codes of forms of reorganization and code of liquidation of the organization – members of the Eurasian Economic Union