How does Limestone University’s financial aid office support students. What federal grants and loans are available for Limestone University students. How can students apply for financial aid at Limestone University. What work-study opportunities exist at Limestone University.

Federal Grants Available at Limestone University

Limestone University offers several federal grant options to help students finance their education. These grants are typically awarded based on financial need and do not require repayment.

Federal Pell Grant

The Federal Pell Grant is a need-based award for undergraduate students who have not yet earned a bachelor’s degree. Eligibility is determined by factors such as:

- Expected Family Contribution (EFC)

- Cost of attendance

- Enrollment status

To be considered for a Pell Grant, students must complete the Free Application for Federal Student Aid (FAFSA).

Federal Supplemental Educational Opportunity Grant (FSEOG)

The FSEOG is awarded to students demonstrating exceptional financial need. Priority is given to students with the lowest EFC as determined by the FAFSA. Availability is limited, so early application is recommended.

Federal Work-Study Program at Limestone University

The Federal Work-Study program provides part-time employment opportunities for students with financial need. This program allows students to earn money to help cover educational expenses while gaining valuable work experience.

Key aspects of the Federal Work-Study program at Limestone University include:

- Supervised work assignments across campus

- Regular pay periods based on hours worked

- Available only to Traditional Day Students

- Awarded on a first-come, first-served basis

How does the Federal Work-Study program benefit students? It provides a structured way to earn money for college expenses while developing professional skills and building a resume.

Federal Loan Options for Limestone University Students

Limestone University participates in the William D. Ford Federal Direct Loan Program, offering various loan options to help students and their families meet college costs.

Direct Subsidized Stafford Loans

These loans are available to undergraduate students who demonstrate financial need. The government pays the interest on these loans while the student is in school at least half-time.

Direct Unsubsidized Stafford Loans

Unsubsidized loans are available to undergraduate, graduate, and professional students regardless of financial need. Interest accrues on these loans from the time of disbursement.

What are the borrowing limits for Direct Stafford Loans? The annual limits range from $5,500 to $12,500 for undergraduates, depending on the student’s year in school and dependency status. Graduate students can borrow up to $20,500 per year in Direct Unsubsidized Loans.

Federal Direct PLUS Loans

PLUS loans are available to parents of dependent undergraduate students and to graduate or professional students. These loans can cover educational expenses not met by other forms of financial aid.

Key features of PLUS loans include:

- Credit check required

- No financial need requirement

- Can cover up to the full cost of attendance minus other aid received

Loan Entrance Counseling and Master Promissory Note Requirements

Before receiving federal student loans, borrowers must complete two important steps: Entrance Counseling and signing a Master Promissory Note (MPN).

Entrance Counseling

Entrance Counseling ensures that borrowers understand their responsibilities and obligations when taking out federal student loans. The process can be completed online at studentaid.gov and includes information on:

- Loan terms and conditions

- Borrower rights and responsibilities

- Repayment options

- Consequences of default

Master Promissory Note (MPN)

The MPN is a legal document in which the borrower agrees to repay their federal student loans, including accrued interest and fees. It outlines the terms and conditions of the loan.

How often must students complete the MPN? For most federal student loans, the MPN remains valid for ten years, allowing students to receive multiple loans under a single MPN.

Applying for Financial Aid at Limestone University

The cornerstone of applying for financial aid at Limestone University is completing the Free Application for Federal Student Aid (FAFSA). This form is used to determine eligibility for federal, state, and some institutional aid programs.

Steps to apply for financial aid at Limestone University:

- Create a Federal Student Aid (FSA) ID at fsaid.ed.gov

- Complete the FAFSA at fafsa.gov, using Limestone University’s school code

- Review your Student Aid Report (SAR) for accuracy

- Submit any additional documentation requested by the Financial Aid Office

- Accept or decline your awarded aid through the Limestone University student portal

When should students submit their FAFSA? The FAFSA becomes available on October 1st each year, and students are encouraged to submit it as early as possible to maximize their aid opportunities.

Maintaining Financial Aid Eligibility at Limestone University

To continue receiving financial aid, students must meet certain academic and enrollment requirements. These typically include:

- Maintaining satisfactory academic progress (SAP)

- Enrolling in the required number of credit hours

- Completing the FAFSA annually

- Meeting any specific requirements of individual aid programs

How often do students need to reapply for financial aid? Students must complete the FAFSA each academic year to be considered for federal and many forms of institutional aid.

Additional Financial Aid Resources at Limestone University

Beyond federal aid programs, Limestone University offers various institutional scholarships and grants to help students finance their education. These may include:

- Merit-based scholarships

- Athletic scholarships

- Talent-based awards

- Need-based institutional grants

Students are encouraged to explore all available options and consult with the Financial Aid Office for guidance on additional funding sources.

State and Private Aid Programs

In addition to federal and institutional aid, students may be eligible for state grants or scholarships, as well as private scholarships from external organizations. The Financial Aid Office can provide information on state-specific programs and resources for finding private scholarships.

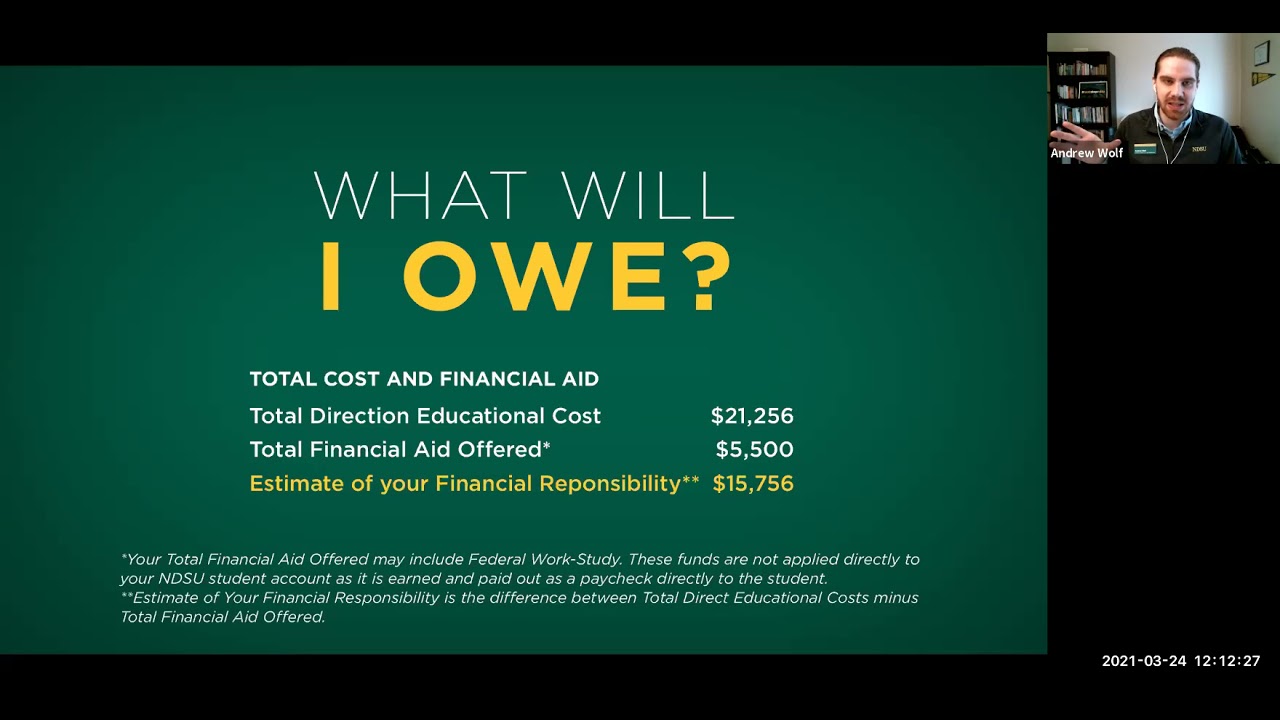

Understanding the Cost of Attendance at Limestone University

The cost of attendance (COA) is an estimate of the total expenses a student may incur during an academic year. This figure is used to determine financial aid eligibility and includes:

- Tuition and fees

- Room and board

- Books and supplies

- Transportation

- Personal expenses

How does the cost of attendance affect financial aid awards? The COA serves as a cap on the total amount of financial aid a student can receive from all sources combined.

Net Price Calculator

Limestone University provides a Net Price Calculator on its website to help prospective students estimate their out-of-pocket costs after factoring in potential financial aid. This tool can be valuable for financial planning and comparing costs across different institutions.

Financial Literacy and Counseling Services

Limestone University’s Financial Aid Office is committed to helping students make informed decisions about financing their education. The office provides various resources and services to promote financial literacy, including:

- One-on-one counseling sessions

- Workshops on budgeting and money management

- Information on student loan repayment options

- Guidance on understanding financial aid award letters

Why is financial literacy important for college students? Developing strong financial management skills can help students minimize debt, make informed borrowing decisions, and set themselves up for long-term financial success.

Exit Counseling for Student Loan Borrowers

Students who have received federal student loans are required to complete exit counseling when they graduate, leave school, or drop below half-time enrollment. This session provides important information on loan repayment, including:

- Repayment plan options

- Loan servicer contact information

- Consequences of default

- Deferment and forbearance options

Appeals and Special Circumstances

Limestone University recognizes that a family’s financial situation may change after filing the FAFSA. The Financial Aid Office has processes in place to review special circumstances that may affect a student’s ability to pay for college.

Examples of special circumstances that may warrant an appeal include:

- Loss of employment

- Significant medical expenses not covered by insurance

- Death of a parent or spouse

- Divorce or separation

How can students appeal their financial aid award? Students should contact the Financial Aid Office to discuss their situation and learn about the appeal process, which typically involves submitting documentation of the special circumstances.

Professional Judgment

Financial aid administrators have the authority to use professional judgment to adjust a student’s financial aid eligibility based on unique circumstances not reflected in the FAFSA. This process allows for a more accurate representation of a family’s ability to contribute to educational expenses.

Technology and Financial Aid at Limestone University

Limestone University leverages technology to streamline the financial aid process and improve communication with students. Some technological features include:

- Online student portal for viewing and accepting financial aid awards

- Electronic notification of missing documents or requirements

- Secure document upload system for submitting sensitive information

- Text message alerts for important deadlines and updates

How does technology enhance the financial aid experience for students? By providing 24/7 access to information and streamlining processes, technology helps students stay informed and manage their financial aid more effectively.

Virtual Appointments and Webinars

To accommodate diverse student needs, the Financial Aid Office offers virtual appointments and webinars on various financial aid topics. These online options provide flexibility for students who may not be able to visit the office in person.

Preparing for Life After Limestone: Financial Aid and Career Services Collaboration

Limestone University’s Financial Aid Office works closely with the Career Services department to help students understand the connection between their educational investment and future career prospects. This collaboration includes:

- Workshops on managing student loan debt after graduation

- Information on loan forgiveness programs for certain career paths

- Guidance on evaluating job offers in relation to student loan repayment obligations

- Resources for understanding the return on investment of various degree programs

Why is it important to consider career prospects when making financial aid decisions? Understanding potential earnings and job market demand can help students make informed choices about borrowing and career planning.

Alumni Support and Networking

Limestone University’s commitment to student success extends beyond graduation. The institution offers various resources to alumni, including:

- Ongoing career counseling and job search assistance

- Networking events with potential employers

- Access to job boards and career development resources

- Opportunities to connect with fellow alumni for mentorship and career advice

These resources can be valuable for recent graduates navigating student loan repayment and career advancement.

Staying Informed: Financial Aid Updates and Policy Changes

The landscape of financial aid is continually evolving, with changes to federal programs, institutional policies, and economic factors affecting aid availability and eligibility. Limestone University’s Financial Aid Office is committed to keeping students informed about important updates that may impact their aid packages.

Ways the Financial Aid Office communicates updates:

- Regular email newsletters

- Social media announcements

- Updates to the financial aid website

- Information sessions during orientation and throughout the academic year

Why is it crucial for students to stay informed about financial aid changes? Keeping up-to-date with policy changes and new opportunities can help students maximize their aid and make informed decisions about financing their education.

Advocacy and Student Representation

Limestone University actively participates in state and national associations focused on student financial aid. This involvement allows the institution to advocate for student interests and stay at the forefront of best practices in financial aid administration.

Students are encouraged to voice their concerns and suggestions regarding financial aid policies and procedures, fostering a collaborative approach to improving the financial aid experience at Limestone University.

Federal Aid | Limestone University

-

Federal Grants

Federal Pell Grant

Federal Pell Grant is awarded to undergraduate students who are enrolled in an eligible program, have not received a bachelor’s degree, and who demonstrate financial need. Eligibility is determined based on the expected family contribution (EFC) as a result of completing the Free Application for Federal Student Aid (FAFSA), the cost of attendance, and enrollment status.

Federal Supplemental Educational Opportunity Grant

Federal Supplemental Educational Opportunity Grant is awarded to students demonstrating exceptional financial need and determined based on the results of the FAFSA (EFC). Students showing exceptional need will be given first consideration for these grants as long as funds are available.

Federal Work Study

Federal Work Study allows the students to meet a portion of their financial need by working at assigned tasks supervised by faculty, staff, or administrative personnel.

Students will be paid each pay period for hours worked and approved by their supervisor. Time sheets must be turned in on time. Late time sheets will be audited for payment in the next payment period. The work-study Programs are only offered to Traditional Day Students. The Federal College Work-Study Program is for students demonstrating financial need. Students must perform work to earn this aid. Federal Work-Study is need based and awarded on a first-come, first-serve basis.

Students will be paid each pay period for hours worked and approved by their supervisor. Time sheets must be turned in on time. Late time sheets will be audited for payment in the next payment period. The work-study Programs are only offered to Traditional Day Students. The Federal College Work-Study Program is for students demonstrating financial need. Students must perform work to earn this aid. Federal Work-Study is need based and awarded on a first-come, first-serve basis. -

Federal Loans

To receive loans, a student must be enrolled at least half-time per semester (typically two courses). All new borrowers are required to complete Entrance Counseling and complete a signed Master Promissory Note (MPN). Repayment and deferment guidelines are included in the required Loan Entrance Counseling Session. Students must complete the FAFSA form each year. Additional information can be found at https://studentaid.gov or by contacting the Financial Aid Office.

- William D. Ford Federal Direct Loan Program is designed to help students and their families meet college costs.

-

Federal Direct Stafford Loans are student loans with repayment deferred until the student separates college or drops below half time status.

- Direct Subsidized Stafford Loans- loans made to eligible undergraduate students who demonstrate financial need to help cover the costs of higher education.

- Direct Unsubidized Stafford Loans- loans made to eligible undergraduate, graduate, and professional students, but eligibility is not based on financial need.

- The maximum amount an undergraduate student can borrow each year in Direct Subsidized Loans and Direct Unsubsidized Loans ranges from $5,500 to $12,500 per year, depending on your year in school and your dependency status.

- If you are a graduate or professional student, you can borrow up to the annual cost of attendance for your program, not to exceed $20,500 each year in Direct Unsubsidized Loans.

-

Federal Direct Plus Loans are loans made to parents of dependent undergraduate students and graduate or professional students to help pay for education expenses not covered by other financial aid. Eligibility is not based on financial need, but a credit check is required. Borrowers who have an adverse credit history must meet additional requirements to qualify.

- If you are a parent of a dependent undergraduate student, you can receive a Direct PLUS Loan for the remainder of your child’s college costs not covered by other financial aid.

- If you are a graduate or professional student, Direct PLUS Loans can also be used for the remainder of your college costs not covered by other financial aid, if you have exhausted your Federal Direct Unsubidized loan eligibility.

-

- Entrance Counseling is required for all new Direct Loan borrowers to ensure that you understand the responsibilities and obligations you are assuming.

- Instructions for Completing Loan Entrance Counseling

- You can complete the requirement by visiting: https://studentaid.gov.

- Click on ‘Complete Aid Processes’, then select ‘Complete Entrance Counseling’

- Click the Blue “Login” Button.

- Enter your Federal Student Aid (FSA) login information.

- Click the first Blue “Start” button under“Entrance Counseling”

- Select “Limestone University” from the drop down menu on the left side and select the “Undergraduate”option for Student Type. Click “Continue.”

- Answer all questions in the green “Check Your Knowledge” boxes.

- Limestone University will receive an electronic confirmation once completed.

- Instructions for Completing Loan Entrance Counseling

Direct Loan Master Promissory Note (MPN) a legal document in which you promise to repay your loan(s) and any accrued interest and fees to the U.S. Department of Education. It also explains the terms and conditions of your loan(s).

A Master Promissory Notes must be completed for all new Direct Loan borrowers.

A Master Promissory Notes must be completed for all new Direct Loan borrowers.- Completing the Master Promissory Note (MPN)

- You can complete the MPN requirement by visiting https://studentaid.gov.

- Click on ‘Complete Aid Processes’, then select ‘Complete Master Promissory Note’

- Click the Blue “Login” Button, if necessary.

- Enter your Federal Student Aid (FSA) login information

- Click the first blue “Start” button beside the MPN you need to complete “MPN for Subsidized/Unsubsidized Loans”

- Enter all of your (student) information and Select “Limestone University” from the drop down menu. Click “Continue”.

- List two persons with different U.S. addresses who have known you for at least three years.

- The first reference should be a parent or legal guardian.

- References must have different addresses and telephone numbers.

- Limestone University will receive an electronic confirmation once completed.

- Completing the Master Promissory Note (MPN)

- William D. Ford Federal Direct Loan Program is designed to help students and their families meet college costs.

Indicates Day Program students eligible

Indicates Online Program students eligible

Indicates Graduate students eligible

Limestone College Tuition, Financial Aid, and Scholarships

| Aid Type | ||

|---|---|---|

| Grant or scholarship aid | 99% | $11,050 |

| Federal Grants | 56% | $4,873 |

| Pell grants | 56% | $3,753 |

| Other federal grants | 26% | $916 |

| State/local goverment grant or scholarships | 53% | $5,178 |

| Institutional grants or scholarships | 95% | $12,711 |

| Student loan aid | 86% | $12,167 |

| Federal student loans | 85% | $10,218 |

| Other student loans | 14% | $13,873 |

| 90 | Up to $2,500 |

| 195 | Up to $3,000 |

| 206 | Up to $3,000 |

| 198 | Up to $6,000 |

| 141 | Up to $12,000 |

| 138 | Up to $2,100 |

| 99 | Up to $1,500 |

| 201 | Up to $500 |

| 132 | Up to $5,000 |

*GPA and other eligibility restrictions may apply

Ready to start the application process for Limestone College?

Apply Here

Student Population

| Campus Life | |

|---|---|

| Total undergraduates | 1818 |

| Living on campus | |

| Transfer Students | 7% |

| Under Age 25 | |

Student Diversity

Limestone College, Gaffney: UniPage Tuition Fees

Gaffney, USA

www. limestone.edu

limestone.edu

Learn all about Limestone College admissions and available programs in our article.

Are you a representative of this university?

The information is for informational purposes only. Check the prices and requirements on the official website of the educational institution.

University

Limestone College is a private non-profit educational institution. Limestone College is located in Gaffney, USA. Limestone College has membership in the Council of Independent Colleges (CIC). Sport affiliations and memberships: National Collegiate Athletic Association (NCAA).

Limestone College is open to new students. A list of available programs can be found on the university website.

Need help applying?

Get adviceAbout Services

Limestone College Tuition Fees

The academic calendar at Limestone College is divided into semesters, like in many other US universities. But for convenience, the cost of training is calculated per year. Both local residents and foreign students pay the same tuition fees at Limestone College – from 19,995 USD per year. The university provides tuition assistance to some students through financial aid programs. They are available to both locals and foreigners. The exact cost of programs and information on the availability of scholarships can be found on the website of the university.

Both local residents and foreign students pay the same tuition fees at Limestone College – from 19,995 USD per year. The university provides tuition assistance to some students through financial aid programs. They are available to both locals and foreigners. The exact cost of programs and information on the availability of scholarships can be found on the website of the university.

Also be prepared for additional expenses: hostel rent, transportation, study materials, meals and personal expenses.

Limestone College Campus

The campus of the educational institution is located in the suburbs. It combines the features of a rural and urban campus. Students live quite apart and create a close-knit community. At the same time, they are not very far from the city and have access not only to urban entertainment, such as cinemas and restaurants, but also to outdoor entertainment. During the period of study at the university, students can use the university library, where they can do homework and write scientific papers.

We can help you get in

Free consultationAbout services

What to do after Limestone College

Students are allowed to stay in the country for one year after graduation. To do this, you need to extend your student visa or apply for a visa to look for work. For other options for immigration, you can find in our article.

Thank you, your reply has been sent!

Universities in the USA

Entries 1-5 of 6 955

Advanced search

- from7 918USD

- from58 224USD

- from57 678USD

- from48 098USD

- from55 995USD

Who are metallurgists? – AKOTB

- Reception: +7(39151)7-13-04

- E-mail: This email address is being protected from spambots. You must have JavaScript enabled to view.

- 662161, Krasnoyarsk Territory, Achinsk, st. Gagarina, 27

Search. ..

..

Visually impaired version

Are you applying?

“Who are metallurgists?” – we addressed this question to the students of the city secondary school No. 4 before the start of professional trials. Everyone answered in their own way, but the meaning of the answers boiled down to the fact that metallurgists are people who mine metal, and that this profession is not easy and very necessary.

Schoolchildren get acquainted with the specialty “Non-ferrous metallurgy” in the laboratory of chemical and physico-chemical methods of analysis, equipped with the financial support of RUSAL Achinsk JSC. Teachers tell the children about the specialty “Non-Ferrous Metallurgy” and what you need to know and be able to become metallurgists. A separate question is about employment prospects, for example, at the city-forming enterprise JSC RUSAL Achinsk.

Schoolchildren explore the collection of minerals and ores, learn a lot of new information about each mineral. The children are offered to hold in their hands malachite, magnetic and brown iron ore, quartzite, ferrosilicon and even ore interspersed with gold. They will see crushed bauxite, nepheline-limestone cake and AGC products – alumina and soda ash. Together with teachers, schoolchildren conduct an experiment demonstrating the spectacular combustion reaction of two-chromium ammonium ((Nh5)2Cr2O7).

Then the students get acquainted with the equipment of the laboratory: they inspect the muffle furnace, photoelectric calorimeter, desiccator, laboratory water bath, laboratory scales of various degrees of accuracy. They learn the principle of operation of a magnetic stirrer, a vibration drive and other equipment, try using crucible tongs to install porcelain crucibles in a muffle furnace.

The children are interested in whether a magnetic stirrer can mix tea with sugar, why the vibrator remains stable while sifting samples, and why laboratory scales change readings due to slight fluctuations in air.

Students will be paid each pay period for hours worked and approved by their supervisor. Time sheets must be turned in on time. Late time sheets will be audited for payment in the next payment period. The work-study Programs are only offered to Traditional Day Students. The Federal College Work-Study Program is for students demonstrating financial need. Students must perform work to earn this aid. Federal Work-Study is need based and awarded on a first-come, first-serve basis.

Students will be paid each pay period for hours worked and approved by their supervisor. Time sheets must be turned in on time. Late time sheets will be audited for payment in the next payment period. The work-study Programs are only offered to Traditional Day Students. The Federal College Work-Study Program is for students demonstrating financial need. Students must perform work to earn this aid. Federal Work-Study is need based and awarded on a first-come, first-serve basis.

A Master Promissory Notes must be completed for all new Direct Loan borrowers.

A Master Promissory Notes must be completed for all new Direct Loan borrowers.