Where can you find ICE Currency Services USA locations at LAX. How to get the best exchange rates at Los Angeles International Airport. What are the pros and cons of airport currency exchange services.

ICE Currency Services USA: Locations at Major US Airports

ICE Currency Services USA offers extensive currency exchange options across several major US airports. Their presence is particularly notable at key international gateways, providing travelers with convenient access to foreign currency exchange services. Let’s explore their locations in detail:

Honolulu International Airport

- International Arrivals (Groups, Main, and Outside)

- International Departures (Gates 12 and 25, Main Lobby)

Houston Airports

- Houston International Airport (Terminals C, D, and E)

- William P. Hobby International Airport

Los Angeles International Airport (LAX)

- Terminals 2-7 (Various locations in Arrivals and Departures)

- Tom Bradley International Terminal (Arrivals and Departures)

Miami International Airport

- Concourses D, E, F, G, H, and J (Multiple locations)

New York John F. Kennedy International Airport (JFK)

- Terminal 1 (International Arrivals and Departures)

Orlando-Sanford International Airport

- Terminal B

Washington DC Area Airports

- Washington Dulles International Airport (Multiple locations)

- Seattle-Tacoma International Airport (Various points)

This extensive network of locations ensures that travelers have access to currency exchange services at crucial points throughout their journey, from arrival to departure.

Navigating Currency Exchange at LAX

Los Angeles International Airport (LAX) stands out with its comprehensive coverage of ICE Currency Services USA locations. Travelers can find exchange booths in nearly every terminal, catering to both arriving and departing passengers. This widespread availability raises an important question: Is exchanging currency at the airport the best option for travelers?

Advantages of Airport Currency Exchange

- Convenience: Easy access before or after flights

- Immediate availability: Get local currency as soon as you land

- Multiple locations: Options in both arrivals and departures areas

- Extended hours: Often open late to accommodate various flight schedules

Potential Drawbacks

- Higher exchange rates: Airport locations often have less favorable rates

- Limited currency options: May not carry all foreign currencies

- Possible queues: Can be busy during peak travel times

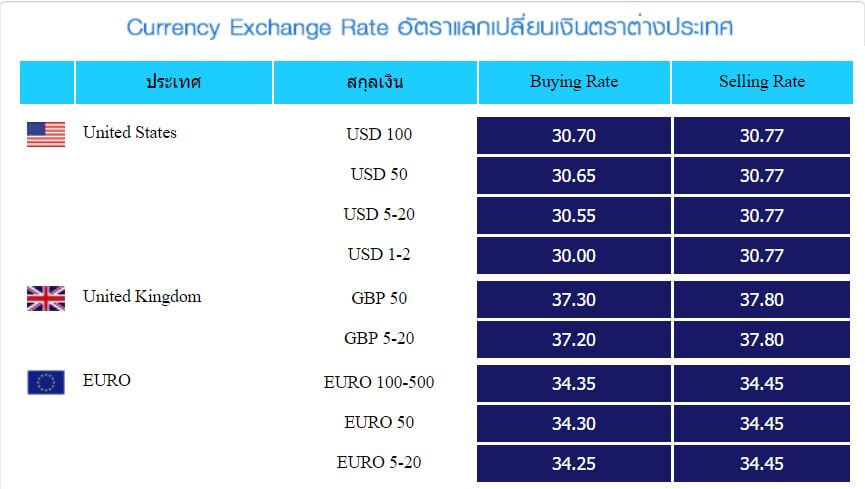

Are airport exchange rates always higher than other options. While airport currency exchange services offer unmatched convenience, they often come with a premium. Rates at airport kiosks can be 5-15% less favorable than those found at banks or specialized currency exchange offices in the city.

Alternatives to Airport Currency Exchange in Los Angeles

For travelers seeking better exchange rates, Los Angeles offers several alternatives to airport currency services. Consider these options for potentially more favorable rates:

- Banks: Major banks in downtown LA often offer competitive rates

- Specialized exchange offices: Dedicated currency exchange businesses may provide better deals

- ATMs: Withdrawing cash from ATMs can sometimes offer near-market exchange rates

- Credit cards: Using credit cards for purchases can often result in good exchange rates

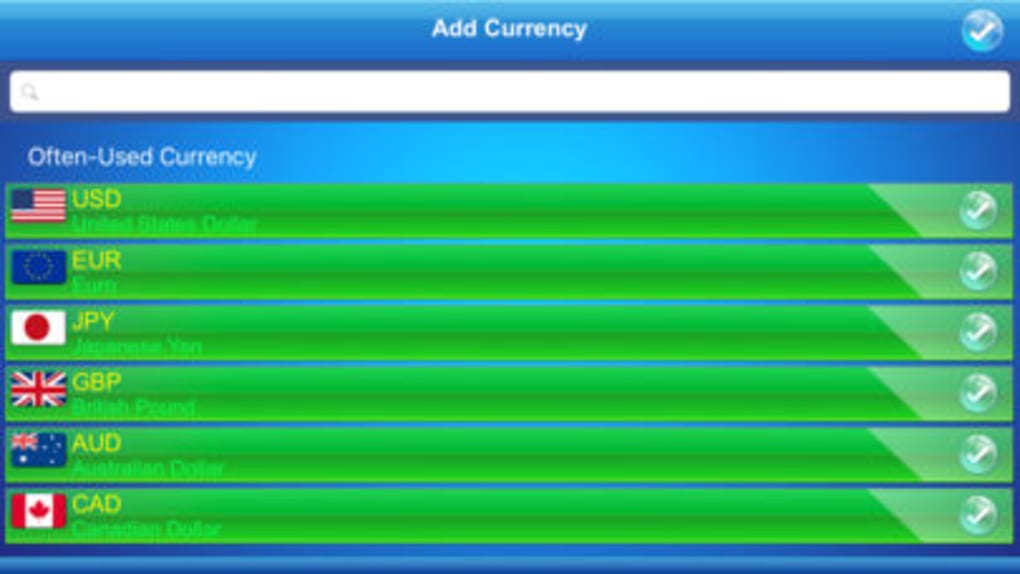

How can you find the best exchange rates in Los Angeles. Research and compare rates from multiple sources before your trip. Online currency conversion tools and apps can help you track real-time exchange rates and find the best deals available in the city.

Understanding the US Dollar and Exchange Rates

The US Dollar’s status as a global reserve currency significantly impacts exchange rates and availability. Its widespread use in international transactions makes it a highly sought-after currency for travelers and investors alike.

Factors Affecting Dollar Exchange Rates

- Economic indicators: GDP growth, employment rates, inflation

- Political stability: Both domestic and international factors

- Interest rates: Federal Reserve decisions on interest rates

- Global economic conditions: Trade balances, geopolitical events

Why does the dollar’s value fluctuate. The dollar’s value is determined by a complex interplay of economic, political, and market factors. Its status as a reserve currency means that global events, not just domestic ones, can significantly impact its value.

Strategies for Getting the Best Exchange Rates

To maximize your currency exchange in Los Angeles or any other destination, consider implementing these strategies:

- Monitor exchange rates: Track rates for several weeks before your trip

- Use rate alerts: Sign up for notifications when rates become favorable

- Avoid airport exchanges if possible: Use them only for small amounts or emergencies

- Combine methods: Use a mix of cash exchange, ATM withdrawals, and credit card purchases

- Consider timing: Exchange when the dollar is weaker for better rates

How much should you exchange before your trip. A good rule of thumb is to exchange enough for immediate needs (transportation, meals for the first day) and rely on ATMs or credit cards for the rest. This approach balances convenience with getting better rates.

The Role of Technology in Currency Exchange

Modern technology has revolutionized the way travelers handle currency exchange. Several digital tools and services can help you make informed decisions:

- Currency conversion apps: Real-time rate information and calculators

- Online comparison tools: Compare rates from various providers

- Digital wallets: Some offer competitive exchange rates for international transactions

- Fintech services: Specialized apps for international money transfers and exchanges

Can digital solutions completely replace traditional currency exchange. While digital options offer convenience and often better rates, having some local currency on hand is still advisable for small purchases and emergencies, especially in less digitally-oriented destinations.

Safety Considerations for Currency Exchange

When dealing with currency exchange, especially in a bustling city like Los Angeles, safety should be a top priority. Keep these tips in mind:

- Use reputable exchange services: Stick to well-known providers or banks

- Be discreet: Avoid displaying large amounts of cash in public

- Secure storage: Use hotel safes or secure pockets for carrying currency

- Be aware of surroundings: Exercise caution when using ATMs or exchange offices

- Verify transactions: Always count your money and check receipts before leaving

What should you do if you suspect fraudulent activity during a currency exchange. Immediately report any suspicions to local authorities and your bank. Keep all receipts and documentation to support your claim.

Planning Your Los Angeles Trip: Currency Considerations

As you plan your visit to Los Angeles, incorporating currency exchange into your itinerary can save time and potentially money. Consider these factors:

- Estimate your cash needs: Plan for daily expenses and emergency funds

- Research exchange options: Look into banks, exchange offices, and ATM locations near your accommodations

- Check your bank’s international partners: Some banks have agreements for reduced ATM fees abroad

- Notify your bank of travel plans: Prevent your cards from being blocked for suspicious activity

- Consider a mix of payment methods: Bring some cash, credit cards, and perhaps a prepaid travel card

How can you protect yourself from exchange rate fluctuations. Consider exchanging a portion of your travel budget before the trip if rates are favorable. For larger amounts, you might explore options like forward contracts or travel-specific financial products that lock in rates.

Los Angeles, as a global city, offers numerous options for currency exchange. While ICE Currency Services USA provides convenient locations throughout LAX and other major airports, savvy travelers should consider all available options to get the best value for their money. By understanding the factors that influence exchange rates and utilizing a combination of methods—including airport services, local banks, and digital tools—you can ensure a smooth financial experience during your visit to the City of Angels.

Remember, the key to successful currency exchange lies in preparation and informed decision-making. Whether you’re visiting Hollywood, exploring world-class museums, or enjoying the beautiful beaches, having a solid currency strategy will allow you to focus on what really matters—experiencing all that Los Angeles has to offer.

| Honolulu Intl Airport – Intl Arrivals Groups |

| Honolulu Intl Airport – Intl Arrivals Main |

| Honolulu Intl Airport – Intl Arrivals Outside |

| Honolulu Intl Airport – Intl Departures Gate 12 |

| Honolulu Intl Airport – Intl Departures Gate 25 |

| Honolulu Intl Airport – Intl Departures Main Lobby |

| Houston Intl Airport – Terminal C |

| Houston Intl Airport – Terminal D |

| Houston Intl Airport – Terminal E |

| Houston William P. Hobby Intl Airport |

| Los Angeles, LAX Intl Airport – Terminal 2 Arrivals |

| Los Angeles, LAX Intl Airport – Terminal 2 Departures |

| Los Angeles, LAX Intl Airport – Terminal 3 Departures |

| Los Angeles, LAX Intl Airport – Terminal 4 Departures |

| Los Angeles, LAX Intl Airport – Terminal 5 Arrivals |

| Los Angeles, LAX Intl Airport – Terminal 5 Departures |

| Los Angeles, LAX Intl Airport – Terminal 6 Arrivals |

| Los Angeles, LAX Intl Airport – Terminal 6 Departures |

| Los Angeles, LAX Intl Airport – Terminal 7 Departures |

| Los Angeles, LAX Intl Airport – Tom Bradley Intl Arrivals |

Los Angeles, LAX Intl Airport – Tom Bradley Intl Dept. Hall Hall |

| Los Angeles, LAX Intl Airport – Tom Bradley Intl Dept. North |

| Los Angeles, LAX Intl Airport – Tom Bradley Intl Dept. South |

| Miami Intl Airport – D 1st Level Intl Arrivals Pre-Security |

| Miami Intl Airport – D 2nd Level Dept. Pre-Security |

| Miami Intl Airport – D Airside Post-Security (ARM) |

| Miami Intl Airport – D Gate D19 Dept. Post-Security |

| Miami Intl Airport – D Gate D29 2nd Level Dept. Post-Security |

| Miami Intl Airport – E 2nd Level Dept. Pre-Security |

| Miami Intl Airport – F 2nd Level Dept. Pre-Security |

| Miami Intl Airport – G 2nd Level Dept. Pre-Security |

| Miami Intl Airport – H 2nd Level Dept. Pre-Security |

| Miami Intl Airport – H/J Connecting Hall Post-Security |

Miami Intl Airport – J 2nd Level Dept. Post-Security Post-Security |

| Miami Intl Airport – J 3rd Level Arrv. Pre-Security |

| New York, JFK Intl Airport – T-1 Intl Arrivals Pre-Security |

| New York, JFK Intl Airport – T-1 Intl Dept. Post-Security |

| Orlando, Orlando – Sanford Intl Airport Terminal B |

| Washington DC Intl Airport – C Gate C12 2nd Level Post-Security |

| Washington DC Intl Airport – AB Connecting Hall 2 Lvl Post-Security |

| Washington DC Intl Airport – C Gate C8 2nd Level Post-Security |

| Washington DC Intl Airport – D Gate D15 2nd Level Post-Security |

| Washington DC Intl Airport – Intl Arrv Main Terminal Post-Security |

| Washington DC Intl Airport – Main Terminal East End Pre-Security |

| Washington DC Intl Airport – Main Terminal West End Pre-Security |

| Washington, Seattle-Tacoma Intl Airport – Intl Arrivals |

| Washington, Seattle-Tacoma Intl Airport – Kiosk |

| Washington, Seattle-Tacoma Intl Airport – South Esplanade |

| Washington, Seattle-Tacoma Intl Airport – South Satellite |

Best places to exchange currency in Los Angeles

As an internationally well known city and the world’s entertainment capital, Los Angeles is as vast as it’s iconic.

There are incredible museums, world class shopping and some of the best-known attractions anywhere. In fact, you could probably spend years in LA without ever doing the same thing twice.

Or course, all of this costs money; so you’ll need a fair amount of US Currency to make the most of your trip. Read this guide to see how you can get the best deal possible when exchanged your money in Los Angeles.

Things to know before exchanging your money

Before you rush to the the nearest place to exchange your currency to USD, first take some time to learn about this process. Here are few helpful facts that will better prepare you.

About the US Dollar

The Dollar is widely used in international transactions and it’s the world’s main reserve currency.

But while the Dollar is often very much in demand, it’s value does fluctuate regularly. It’s a good idea to monitor its performance for a few weeks before your trip. Then you can try to make your exchange when its value is lower than usual. By buying when USD is weaker, you’ll be able to buy more dollars with the same amount of money. You can sign up for exchange rate alerts to receive notifications when the exchange rate changes.

By buying when USD is weaker, you’ll be able to buy more dollars with the same amount of money. You can sign up for exchange rate alerts to receive notifications when the exchange rate changes.

Know the actual exchange rate

As a floating currency, the Dollar’s value can go up or down every day, or even every few hours.

The exchange rate to keep in mind is the mid-market rate. This is considered the real exchange rate, and the fairest one possible. You can use this rate as a benchmark to compare how fair offered tourist rates are. Check the live rate using the Wise currency converter.

Avoid airport and hotel currency exchanges

If you’re looking for the best deal possible on foreign exchange, you’re probably better off avoiding the airport. The same logic applies for exchange services offered in hotels. The fees will usually be higher and the exchanges rates poorer.

If you only want a small amount to get you started, though, the convenience of using the airport might be worth the less favourable rate.

LAX, Los Angeles’s main international airport, has a total of nine foreign exchange kiosks which are all operated by ICE Currency Exchange. You can find their locations and information about their opening hours here.

ATM withdrawals

Bank of America, which is part of the Global ATM Alliance, has several ATM machines in and around Los Angeles that are fee-free for customers of other alliance banks.

Citibank, which offers its customers fee-free withdrawals from all its ATMs worldwide, also has several ATM locations around the city.

Either way, you may still want to check with your home bank before you leave as they may have a special arrangement with a US bank. This could mean special offers on foreign ATM withdrawals.

But while withdrawing dollars from an ATM can be a cheap way to exchange currency, if an ATM asks you to choose whether to be charged in dollars or in your home currency, you should always choose dollars. Otherwise, you’ll be facing a very unfavourable exchange rate.

Spend all your money

Most foreign exchange companies charge you one rate when they sell you a currency and a different rate when they buy it back from you. This means that selling back any leftover dollars you may have is rarely a good idea, as you’ll probably lose out on the transaction.

Some companies do offer buy-back guarantees where they offer to buy back your leftover currency at the same rate you bought it. However, these usually come at an additional fee and have lots of terms and conditions. So as illogical as it may sound, you’ll probably get a better deal if you just spend all your money during your trip.

Where to exchange money in Los Angeles

There are several foreign exchange bureaus in and around Los Angeles. They will all charge fees whether advertised upfront or hidden in the exchange rate they offer. To pick the fairest of the lot, compare their offered rate against the live mid-market rate.

Foreign exchange companies that tend to have a good reputation include Foreign Currency Express, Currency Exchange International, Bretton Woods and LA Currency. The details of these services are listed in the table below.

The details of these services are listed in the table below.

| Currency Bureau | Address | Contact Information |

|---|---|---|

| Foreign Currency Express | 350 S Figueroa St Ste 134, Los Angeles | 1-213-624-3693 |

| Currency Exchange International | Currency Exchange International has five branches in the Los Angeles area. You can find the one closest to you here. | Varies by outlet. You can find the phone number for the branch closest to you here. |

| Bretton Woods | Bretton Woods is located in the Brentwood area, at 11659 San Vicente Boulevard. You can view it on the map here. | 1-800-439-2426 |

| LA Currency | LA Currency has branches in Downtown Los Angeles, Van Nuys and Hollywood. You can find them on the map here. | 1-213-228-0000 – Downtown; 1-323-878-0555 – Hollywood; 1-818-785-0999 – Van Nuys |

The bottom line

While buying money at the airport is really convenient, it’s rarely a good deal. Your best bet is to use an ATM or shop around at a reputable foreign exchange bureau. Be sure to check the rate offered against the live mid-market rate, and take into account any upfront fees applied.

Your best bet is to use an ATM or shop around at a reputable foreign exchange bureau. Be sure to check the rate offered against the live mid-market rate, and take into account any upfront fees applied.

Or, even better, if either you or a friend has access to a USD account in Los Angeles, use Wise and make the transfer ahead of time. Not only does Wise use the real mid-market exchange rate to convert your money (which almost always beat the banks), your money will also be sent and received using local banks, bypassing those nasty international banking fees.

Should you use currency conversion at the airport?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

You’ve just walked off the airplane after a 12-hour flight, and you cannot wait to pick up your bags and get as far away from the airport as possible. After all, you’re about to start your vacation!

There’s just one thing you need to take care of — exchanging some of your money into the local currency. You remember reading somewhere that using currency conversion at the airport is a terrible deal, but at this point, maybe you shouldn’t worry about it.

You remember reading somewhere that using currency conversion at the airport is a terrible deal, but at this point, maybe you shouldn’t worry about it.

This is a scenario to which many of us can relate. But just how bad is the exchange rate when you convert currency at the airport? And what other options do you have?

Airport exchange rate compared to other alternatives

The good news is, there are a lot of alternatives that are better than carrying around a large sum of cash while you travel or paying hefty currency exchange rates, including:

- Exchange currency at your local bank before your trip – One of the best ways to manage your money is to prepare in advance. Determine how much cash you might need for your trip and visit the local branch of your bank. They will typically have common foreign currency on hand, and the fees you’ll pay will be much less than those charged by airport currency exchange outfits.

- Use your debit card to access cash from the airport ATM – A no brainer, right!? Find an ATM at the airport and withdraw cash this way.

You’ll receive the bank’s exchange rate instead of the airport’s extra fees.

You’ll receive the bank’s exchange rate instead of the airport’s extra fees. - Use your credit card as much as possible – In addition to earning points for the money that you spend on your international vacation, many travel credit cards offer the benefit of no foreign transaction fees. That’s a double win for you.

Pro tip: To avoid paying currency exchange fees on your way home, consider if you will be back in this country in the near future. It might be worth holding on to that cash for your next trip. Or, check with friends and family to see if they’d like to purchase it from you for their upcoming travels.

Airport currency exchange

The rumors are true, exchanging cash at the airport is expensive. In fact, an MMS team member once paid nearly 27% more for their money to exchange currency at a Travelex booth at the airport.

You might be wondering: Why, exactly, is it so expensive?

To start, the exchange rate at the airport currency exchange kiosks is significantly lower than you’d get by simply pulling money out of the ATM in a different county.

For example, you might see an exchange rate as low as 65% when converting USD to Euros. Considering that the current exchange rate for the Euro is around 85%, that is a huge difference. If you’re converting $100 to Euros, for example, you’ll only get 65 Euros from the currency exchange kiosk, whereas you’d get 85 Euros from an ATM.

On top of these crazy exchange rates, there is typically a service fee added when you exchange money at an airport kiosk. Let’s assume that you’re exchanging $100 with a rate of 65% and a $10 service fee. You would walk away with just 55 Euros. That is a lot of money lost for simply exchanging cash at the airport.

The fact of the matter is, a terrible conversion rate can impact your budget for your trip before you even leave the airport.

Best way to manage currency exchange when you land

Let’s say you’re reading this article mid-flight, thinking to yourself, “Agh! If I’d only known about my other options ahead of time!” Don’t worry, let’s work with what we have.

If you haven’t exchanged currency ahead of your trip, no problem. The goal here is to come up with a plan for how you’ll manage to exchange currency once you arrive at your destination.

Maybe you have some cash on hand and were planning to convert this to the local currency at the airport. That is still an option, but try to minimize the amount of money you exchange. You can do so by determining how much cash you might need for the next 24 hours. Ask yourself these questions to figure out the right amount:

- Will you be taking a taxi that requires cash?

- Can you purchase a public transportation ticket and pay with your credit card?

- Are you comfortable spending a few extra minutes looking around the airport for an ATM, or are you in a rush?

- Do you mind planning to go to a local bank the following day to exchange your cash for a better currency conversion rate?

By knowing how much you’ll need for your first few hours on the ground, you’ll be able to exchange just enough and avoid excessive fees.

The airport currency conversion kiosks are banking on two things:

- Travelers don’t feel comfortable exchanging their money outside of the airport.

- Travelers feel like they need local currency before they leave the airport and don’t know their options.

Don’t fall into the terrible-currency-conversion-rate trap. Be smarter and save money for something more exciting, like that pitcher of sangria you and your friends have been talking about for the last five months.

Bottom line

Converting your money at the airport can be expensive and should be considered a last resort. There are plenty of other ways to obtain foreign currency without paying exorbitant exchange fees.

Plan ahead by getting foreign currency from your local bank before you set off on your adventure. Or, use the currency conversion services at the airport to exchange small amounts of cash until you can get to an ATM.

And, as always, plan to use your travel credit card as much as you can to avoid foreign transaction fees. As a bonus, you’ll continue racking up those travel rewards so you can start planning your next trip as soon as you return home.

As a bonus, you’ll continue racking up those travel rewards so you can start planning your next trip as soon as you return home.

Featured image by Peter Voronov/Shutterstock.

Chase Sapphire Preferred® Card

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 when you redeem through Chase Ultimate Rewards®.

Enjoy new benefits such as a $50 annual Ultimate Rewards Hotel Credit, 5X points on travel purchased through Chase Ultimate Rewards®, 3X points on dining and 2X points on all other travel purchases, plus more.

Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Ultimate Rewards®. For example, 60,000 points are worth $750 toward travel.

With Pay Yourself Back℠, your points are worth 25% more during the current offer when you redeem them for statement credits against existing purchases in select, rotating categories.

Get unlimited deliveries with a $0 delivery fee and reduced service fees on eligible orders over $12 for a minimum of one year with DashPass, DoorDash’s subscription service. Activate by 12/31/21.

Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

Get up to $60 back on an eligible Peloton Digital or All-Access Membership through 12/31/2021, and get full access to their workout library through the Peloton app, including cardio, running, strength, yoga, and more. Take classes using a phone, tablet, or TV. No fitness equipment is required.

Intro APR on purchases

N/A

Regular APR

15.99%-22.99% Variable

Balance Transfer Fee

Either $5 or 5% of the amount of each transfer, whichever is greater.

Rates & Fees

Annual Fee $95

Other

Credit Needed Excellent

/

Good

Issuer Chase

Card Type Visa

Editorial Note: We’re the Million Mile Secrets team. And we’re proud of our content, opinions and analysis, and of our reader’s comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! 🙂

And we’re proud of our content, opinions and analysis, and of our reader’s comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! 🙂

Where to Exchange Currency—and How to Be Smart About It

Exchanging your money at the airport is kind of like buying a beer at a baseball game: Even though $10 seems like way too much to pay for it, if you walk by and the line is short, you might just do it anyway. Much like knowing stadiums overcharge for beers, it’s no secret that airport exchanges are an expensive option for trading in money. Most charge a fee or service charge of anywhere from $5 to $15, and the exchange rate you get can be seven to 15 percent worse than the standard bank rate.

Though better options exist, many international travelers simply don’t know what they are and end up trading money at the airport for the sake of simplicity. But look a little further, and you’ll find there are much better ways of exchanging money when you travel.

Use your credit or debit card

Using only plastic is a popular method of overseas spending, since banks use the current exchange rate and many waive foreign currency and transaction fees. If you’re curious which cards have the best offers, Bankrate has a nice breakdown of who charges fees, and who waives them. Picking up a debit card with no foreign transaction fee and no ATM fees, and a credit card with no foreign transaction fees, can save you upwards of five percent.

The inherent downside in using only cards is that many countries, especially less developed ones, still use cash for everything. Some of those countries accept U.S. Dollars, but most do not, and when your rickshaw driver looks at you like you’re handing him a jar of magic beans when you pull out your AmEx, things can get dicey.

Also, be wary of businesses that ring up your credit/debit transactions with an option to pay in dollars. It might make the math a little easier, but that price includes a few-percentage-points markup that serves as their transaction fee. Always opt to pay in the local currency; your card’s fees—if it even has them—will likely be cheaper.

Always opt to pay in the local currency; your card’s fees—if it even has them—will likely be cheaper.

Withdraw from a local ATM

Like credit cards, ATMs use the current bank rate and give you the best deal. Many U.S. banks have global ATM networks, offering cards with no foreign debit or ATM fees. However, much like stateside, foreign machines can have ATM fees that range anywhere from $2 to $5, and that’s in addition to any fees your bank might already charge.

Paying fees is almost inevitable when exchanging money overseas, but minimizing your trips to the ATM by taking out larger sums of money at once can cut down on how much you’re paying in fees. Just make sure you guard that cash carefully.

Exchange with your bank before you go

It’s unlikely your bank will have an abundance of Peruvian sol on hand the day before your big trip to Lima, so walking in at the last minute and expecting to trade in your dollars for sol—or any other currency—isn’t realistic. Instead, call ahead and order foreign currency from your bank, which is usually available to pick up within a couple of days. They’ll even deliver it to you, and though you might still pay a fee, the exchange rate will be much better than at the airport.

Instead, call ahead and order foreign currency from your bank, which is usually available to pick up within a couple of days. They’ll even deliver it to you, and though you might still pay a fee, the exchange rate will be much better than at the airport.

Exchange money at your destination

Most cities have currency houses where you can exchange money, as does your hotel and most train or bus stations. Though these spots are fairly convenient, they all offer different exchange rates, and you may find yourself shopping around the entire city to save two percent on a transaction. This is akin to driving ten miles to save a nickel on a gallon of gas. Unless you enjoy spending your vacation at financial institutions, you’re better off either exchanging before you go, or hitting an ATM on the ground. Because just like the airport kiosk and the ATM, these currency houses charge fees.

Alternatively, opt for a pre-paid travel card, which allows you to load foreign currency onto what’s essentially a traveling gift card, though those typically carry an annual fee, and a fee to purchase.

No matter how you opt to change money overseas, fees are almost inevitable; the key is keeping them to a minimum. Whatever method you choose, nearly everything will be cheaper than the airport kiosk. Now if only they’d have these kinds of options at baseball games.

Lax exchange rate fee vsmxp

26 Jun 2019 Some also provide exchange rates online or by phone so you can compare At LAX, there are ICE Currency Exchange kiosks at gate level

LAX Official Website | Live flight times and updates, arrivals and departures, news, advice, maps, traffic and parking | Los Angeles International Airport. English; Login × Departures Arrivals Parking at LAX LAX Terminal Maps Find My Way in LAX Guides, Tips & Amenities Ask LAX. Lost and Found Airline List Airport Conditions Customs and Enter page description here – around 150 words. Exchange rates displayed below are indicative. Rates correct as at 3/16/2020 (mm/dd/yyyy) at 10:09 AM local time We guarantee the best foreign currency exchange rates in Los Angeles. It was much more convenient, rates were the same if not better! Probably took less than 5mins and no exchange fee. Also, you can call ahead and they will reserve your foreign currency for you too. Useful Funny Cool. Joyce N. Los Angeles, CA. 157 friends. 271 reviews. 924 Join over 100,000 monthly users saving thousands by finding and comparing exchange rates and fees for their next international transfers. All it takes is a few taps or clicks to compare and select the lowest fees and rates available. Treasury Reporting Rates of Exchange. A program of the Bureau of the Fiscal Service Yearly average currency exchange rates. For additional exchange rates not listed below, refer to the governmental and external resources listed on the Foreign Currency and Currency Exchange Rates page or any other posted exchange rate (that is used consistently). *Travelex’s ‘Best Rates’ are determined by averaging our standard Travelex Retail Exchange Rates, including promotional rates, over the past year. Travelex Retail Exchange Rate is determined daily by Travelex in its sole discretion. Check your nearest Travelex retail store for current in store promotional rates. Online and in store rates differ.

12 Mar 2020 Check real time exchange rates for over 80 currencies from Travelex. Order online for pick up in-store or get your money delivered to your

Exchange rate margins are the most common way currency vendors make their income but fees are also not unheard of. While Travelex does not charge you any fees, ICE is known to charge a $3-5 delivery fee and a 2% fee if you pay by card. Plus, your credit card issuer may also charge you when using your card to purchase currency. Actual LAX Los Angeles Airport exchange rates will vary due to local market demand for currencies being exchanged, if the exchange is made with cash or travellers cheques, and local competition. For actual exchange rates and fees, please visit or contact any Los Angeles Airport currency exchange. At LA Currency Inc., we take pride in providing our community with the best foreign currency exchange rates in Los Angeles! We actively monitor the international market and adjust our real-time foreign currency exchange rates to offer the most competitive prices. Answer 1 of 27: I’ll be flying out of LAX in 2 weeks, to China. Do the currency exchange kiosks and/or banks at LAX hit travelers with a commission or fee for changing their dollars into CYN, or do they just exchange the currencies for a little less than the

Whether you’re going from LAX to Hollywood or the beach, count on Uber to get you Flat rates and minimum fees may apply. Currency exchange at LAX.

At LA Currency Inc., we take pride in providing our community with the best foreign currency exchange rates in Los Angeles! We actively monitor the international market and adjust our real-time foreign currency exchange rates to offer the most competitive prices. Answer 1 of 27: I’ll be flying out of LAX in 2 weeks, to China. Do the currency exchange kiosks and/or banks at LAX hit travelers with a commission or fee for changing their dollars into CYN, or do they just exchange the currencies for a little less than the Best Foreign Currency Exchange Rates Guaranteed in Los Angeles. No Fees, No Hidden Charges for Foreign Currency Exchanges. Real time Currency Exchange Rates Exchange Rates. Click & Collect. Branch. Location Honolulu Intl Airport – Intl Arrivals Groups: Honolulu Intl Airport – Intl Arrivals Main: Honolulu Intl Airport – Intl Arrivals Outside: Honolulu Intl Airport – Intl Departures Gate 12 Los Angeles, LAX Intl Airport – Tom Bradley Intl Dept. North: Los Angeles, LAX Intl Airport – Tom Bradley Best Places To Exchange Currency In Los Angeles . You won’t get the best exchange rates at LAX–or any other airport, for that matter. However, if you only need a small amount of cash in

About Us · Locations · Exchange Rates · Click & Collect Los Angeles, LAX Intl Airport – Terminal 2 Departures. Los Angeles, LAX Intl Airport – Terminal 3

My bank will sell me Chinese currency at the official rate, but charge a $10 fee. Just wondering if LAX places do likewise. Report inappropriate content. 8 Feb 2020 You won’t get the best exchange rates at LAX–or any other airport, for that matter. However, if you only need a small amount of cash in your 26 Jun 2019 Some also provide exchange rates online or by phone so you can compare At LAX, there are ICE Currency Exchange kiosks at gate level BOOK YOUR FOREIGN CURRENCY ONLINE Book Now The best rates you can now pre-order your travel money online hassle free; and for peace of mind, About Us · Locations · Exchange Rates · Click & Collect Los Angeles, LAX Intl Airport – Terminal 2 Departures. Los Angeles, LAX Intl Airport – Terminal 3 10 Apr 2017 LAX, Los Angeles’s main international airport, has a total of nine Most foreign exchange companies charge you one rate when they sell you a We guarantee the best foreign currency exchange rates in Los Angeles. Real- Time Foreign Currency Exchange Rates. CODE CURRENCY FLAG WE BUY WE

Foreign Currency Exchange: For current rates call 310-649-0553. Exchange booths are available in all terminals at their departure halls; and are also available at

My bank will sell me Chinese currency at the official rate, but charge a $10 fee. Just wondering if LAX places do likewise. Report inappropriate content. 8 Feb 2020 You won’t get the best exchange rates at LAX–or any other airport, for that matter. However, if you only need a small amount of cash in your 26 Jun 2019 Some also provide exchange rates online or by phone so you can compare At LAX, there are ICE Currency Exchange kiosks at gate level

Exchange Rates. Click & Collect. Branch. Location Honolulu Intl Airport – Intl Arrivals Groups: Honolulu Intl Airport – Intl Arrivals Main: Honolulu Intl Airport – Intl Arrivals Outside: Honolulu Intl Airport – Intl Departures Gate 12 Los Angeles, LAX Intl Airport – Tom Bradley Intl Dept. North: Los Angeles, LAX Intl Airport – Tom Bradley

Is A Lax Virtual Currency Compliance Program Putting Your Business At Risk?

Shoring up your virtual compliance program is crucial to staying on the right side of law … [+] enforcement and regulators.

getty

Convertible Virtual Currencies (“CVCs” or “virtual currencies”), which include digital currencies like Bitcoin, continue to pose emerging money laundering and sanctions compliance risks. CVCs are non-fiat currencies with real-world value that are secured and transmitted electronically. Many virtual currencies utilize cryptography to validate and secure transactions that are digitally recorded on a distributed ledger – hence the nomenclature “cryptocurrency.”

Law enforcement agencies are concerned with virtual currencies because CVCs have been used to facilitate financial crimes ranging from fraud and ransomware campaigns to exploiting underage persons, sanctions evasion, and terrorist financing. Regulatory bodies are also troubled about the financial institutions they regulate and whether those institutions have sufficiently mitigated financial crime risks associated with virtual currencies. While the amount of illicit activity cannot be definitively identified, the Financial Crimes Enforcement Network within the U.S. Department of Treasury (“FinCEN”) estimates that illicit activities account for 10% of all CVC transactions – a draconian (and likely) overestimate. Conversely, the blockchain analytics company Chainalysis estimates that approximately $11 billion in CVC transactions, or only 1% of all cryptocurrency transactions in 2019, supported illicit activities.

Of course, not all transactions present the same level of sanctions and money laundering risk. For example, funds gained from “mining” currency by providing the computing power to encrypt blockchains are often viewed as more benign. In many instances, it can be demonstrated that the gain was from lawful activities. Alternately, foreign terrorist organizations may solicit funds anonymously using virtual currencies, domestic terrorists may use virtual currencies to raise money for their activities, or virtual currency exchanges may assist Iranians in moving funds from Iran elsewhere to pay for goods and services – actions generally prohibited by U.S. sanctions.

Government Taking Action on Mixers

Three recent enforcement actions highlight the U.S. government’s increased interest in pursuing virtual currency businesses that violate money laundering and terrorism criminal laws, as well as applicable anti-money laundering (“AML”) and sanctions regulations. These cases also define how regulators and law enforcement authorities are developing a better knowledge of the industry, as well as the tactics and technology to successfully pursue CVC-related enforcement actions.

In February 2020, the U.S. Department of Justice (“DOJ”) indicted Larry Harmon and his company, Helix. Helix was a “mixer” that allowed customers to send virtual currency to another party anonymously by “mixing” the original customer’s bitcoins – in the case of Helix, those involving illicit narcotics proceeds and other criminal profits – with ones that appear clean and have never been traded with accounts associated with the darknet or other criminal activities.

As a mixer, Helix operated in two different ways. First, a user could send bitcoin to a wallet held by the darknet site Grams, which was used by actors to search darknet markets for illicit goods and services. Helix would then send clean bitcoins to the user from a different wallet – essentially layering virtual currency funds. Alternately, the user could simply send the funds to a wallet designated by Helix, and then Helix sent the clean funds to the user.

This is a complex investigation. Not only does it reaffirm the DOJ’s commitment to combat the illicit use of virtual currencies, but it also demonstrates that the U.S. government has improved its tools to track and account for the trade-in cryptocurrencies.

Several lessons can be drawn from this indictment and the accompanying FinCEN penalty:

· Money transmitters, such as cryptocurrency exchanges and persons accepting and transmitting virtual currency, are required to maintain an AML compliance program under the Bank Secrecy Act (“BSA”). So not only was Harmon criminally indicted, but he was also assessed a $60M penalty by FinCEN for failing to register Helix as a money services business (“MSB”) and failing to report on suspicious transactions through the filing of suspicious activity reports when it had an obligation to do so. While Harmon’s conduct was egregious enough to warrant indictment, this case should also serve as a warning that FinCEN has the tools and willpower to fine persons and companies who do not comply with their regulations.

· Although mixers can be utilized for privacy or legitimate reasons, law enforcement agencies often view them as tools designed to assist in money laundering or anonymous access to illicit markets. In the Helix announcement, the DOJ almost went as far as to call CVC mixing a crime. As such, persons providing virtual currency-related services, such as exchanges, should always factor in the use of a mixer into the risk associated with a particular customer, including establishing a trigger for the performance of Enhanced Due Diligence;

· Money transmitters should develop transaction monitoring practices that identify mixer-related transactions and should use the presence of mixers as possible indicia of suspicion when considering whether to file a SAR;

· The U.S. government has demonstrated the ability to track several thousand transactions conducted by Helix, including identifying the darknet markets for which the bitcoin were used. This extra detail suggests that DOJ and FinCEN are employing specialized tools to analyze the Bitcoin ledger and will likely use these tools in future cases. This differs from previous cases, where indictments relied on public information such as published ransomware addresses, the DOJ, and FinCEN’s indictment and penalty against BTC-e.

Virtual Currency Services in the Crosshairs

Next, the Office of Foreign Assets Control (“OFAC”) ended 2020 with its first ever enforcement action relating to virtual currency services. The agency penalized BitGo, a provider of virtual currency wallet technology, leading BitGo to pay a settlement fine of $98,830 for processing 183 transactions on behalf of parties in Iran, Syria, Sudan (within the statute of limitations), Cuba, and the Crimean region of Ukraine. These countries and regions were subject to comprehensive sanctions at the time of the transactions.

This settlement, while small in value for OFAC, signals the agency’s interest in proceeding with enforcement actions against virtual currency-related businesses when they violate U.S. sanctions regulations. OFAC uses penalties to signal its interests in an industry, as well as the agency’s compliance expectations. Reviewing this penalty provides a roadmap of OFAC’s interpretations and focus.

First, OFAC emphasized that a firm does not need to maintain custody of virtual currencies to incur sanctions-related liability. Unlike BSA/AML regulations, which apply to financial institutions and money transmitters, sanctions regulations apply to all U.S. persons including persons who provide services like BitGo that simply facilitate transactions on behalf of non-custodial wallets. These organizations should therefore maintain adequate sanctions compliance programs.

OFAC also highlighted the importance of being able to screen IP addresses for references to sanctioned countries. This also underscores the fact that financial crime compliance departments should be able to coordinate with other parts of the compliance and security departments. In this case, the same cybersecurity tools which monitor against IP addresses can be used to blacklist and report on ISPs and CIDRs located in a sanctioned country.

Following the BitGo announcement, OFAC announced a settlement with another digital currency firm called BitPay, Inc. on February 18, 2021. BitPay is a payment processing company that offers its solution to merchants for purposes of accepting digital currency as payment for goods and services. Like BitGo, BitPay’s settlement related to BitPay allowing persons located in Cuba, North Korea, Iran, and other sanctioned countries or regions to transact with merchants in the United States between 2013 and 2018. Further, OFAC states that BitPay had actually obtained certain location information—including but not limited to IP addresses—for those persons prior to effecting the transaction but failed to analyze and screen this information. Unlike the BitGo case, BitPay had a much higher number of violations (over 2,000 versus less than 200) and a higher civil penalty (over $500,000 versus less than $100,000).

The actions taken against BitGo and BitPay demonstrate that OFAC is likely to increase its enforcement activities going forward. OFAC investigated BitGo and BitPay using methods with which the agency is comfortable. More specifically, OFAC has previously focused on – both publicly and privately – actors who access goods or services using IP addresses in sanctioned countries.

OFAC is also likely already improving its methodology with respect to virtual currency actions. As we saw with the DOJ investigation of Helix, the U.S. government is growing more sophisticated in tracing the direction and use of virtual currencies. OFAC’s investigations are usually the culmination of years of work and litigation, so we may expect to see more virtual currency cases pop up that evidence new techniques.

What’s Next for Enforcement?

What does this mean for participants in the virtual currency market? Law enforcement and regulatory agencies are likely to only increase their focus around virtual currencies in the coming months and years. At least with respect to pursuing enforcement actions and criminal prosecutions, there is a concerted investment in and reliance on technology used to analyze the blockchain. Regulatory compliance expectations, such as those around tracking IP addresses associated with customers or the triggers for having to seek an MSB license, will also continue to coalesce through the issuance of FAQs, final rules, and assessed penalties. To avoid being targeted as part of the increased enforcement, it is important to devote a critical eye to the review of compliance policies, the manner in which a risk assessment is conducted, and the steps taken to mitigate identified risks. Testing the implementation of AML and sanctions controls may save your business from serious monetary and reputational harm.

Currency in Los Angeles, California

ATMs are available in many parts of Los Angeles – ensure you inform your bank before travelling abroad, and be aware you may be charged for cash withdrawals. It is advisable to exchange some cash before arriving in Los Angeles.

Visit the other Los Angeles city guide sections to get more detailed travel advice, and information on the best Los Angeles attractions and sightseeing activities, recommended shops and restaurants, as well as the best Los Angeles hotels.

Los Angeles – Notes and Coins

Visitors from foreign countries should plan on exchanging their money before they come to Los Angeles. LA’s currency is the American Dollar, which comes in notes of $1, $5, $10, $20, $50, and $100. Larger denominations are used very rarely, as is the $2 bill. The penny (one cent), nickel (five cents), dime (ten cents), and quarter (25 cents) are also used regularly, with 100 cents equaling one dollar. Rarely, you will see fifty cent or dollar coins. Changing money in LA can be difficult, so exchanging money or purchasing travelers checks in your home country will save a great deal of trouble. LAX offers money changing services as well.

For those who do not want to carry large amounts of case, there are conveniently located ATMs throughout Los Angeles. These can be found in banks, airports, stores, tourist attractions, hotels, restaurants, and more. In addition, major credit cards are accepted at most locations. Visa, MasterCard (EuroCard) are almost universally accepted.

Typical Los Angeles banks are open Monday through Friday from 9:00 am to 6:00 pm and Saturday from 9:00 am to 2:00 pm. Banks are closed on Sundays, as well as on state and federal holidays. ATMs are easy to locate in Los Angeles, as most blocks have several from which to choose. When determining which ATM to use, look at the back of your bank card. It will probably have either the Cirrus or the PLUS network logo. This means that your card will be accepted at ATMs in that network, and since they are global, this is not a problem. You can check online for Los Angeles ATM locations in your network.

Be aware that your bank may charge a fee if you withdraw money from a different bank and that the bank you take money from may also charge a fee. Domestic transactions are typically $1.50 – $2.00. Foreign transactions may have a fee of $5 or more attached. You can use a number of different web-based services to compare fees. If you don’t want to incur a fee of $5 when taking out small amounts, use a store that offers cash back. Ask if the store accepts ATM cards (most accept Visa and MasterCard debit cards) and offer no-fee cash back with purchases. This way, you can buy some groceries or sunscreen, get your cash, and be on your way without an ATM fee.

Bank of the West – (213) 625-2628 – 333 S Alameda St, Los Angeles, CA

Bank of America – (213) 312-9000 – 590 S Central Ave, Los Angeles, CA

Bank of America – (323) 730-9140 – 1127 S Hill St, Los Angeles, CA

State Bank of India California – (213) 896-0287 – 707 Wilshire Blvd, #1995, Los Angeles, CA

Mizuho Corporate Bank of CA – (213) 243-4505 – 350 S Grand Ave, Ste 1500, Los Angeles, CA

First Bank – (213) 625-1888 – 711 W College St, Los Angeles, CA

Cit National Bank – Pershing Square – (213) 347-2200 – 606 S Olive St, Los Angeles, CA

Manufacturers Bank – (213) 489-6400 – 200 S San Pedro St, Los Angeles, CA

Bank of the West – (213) 972-0200 – 300 S Grand Ave, Los Angeles, CA

90,000 discussion and comments in Tinkoff Pulse

?? # Closing of the Russian market

Good evening, dear friends! Let’s sum up the results of the current day on the Russian market.

? It is already customary to see the Russian market fall on Friday. In conditions of high uncertainty, some market participants hesitate to leave open positions for the weekend – you never know what will happen in 2 non-trading days. #Brent $ BRX1 crude oil demonstrates moderate growth. Market participants continue to assess the economic impact of the omicron strain.At the same time, the reports of scientists that the symptoms of the new variant are weaker than the previously identified strains, bring a share of optimism to the mood in the market. Claims by pharmaceutical companies about the efficacy of their omicron-strain vaccines also contribute to the positive trend. At the same time, pressure on oil quotes continues to exert fears about the state of the Chinese economy in connection with the default of the country’s largest developers. The ruble $ USDRUB is strengthening against the dollar on the back of rising oil prices.Besides, the Russian currency was supported by the inflation data published yesterday. According to Rosstat data, in annual terms, inflation accelerated to 8.4%, which is the maximum over the past five years. After the publication of the data, the head of the Central Bank of the Russian Federation Elvira Nabiullina said that at the next meeting the Central Bank is likely to raise the key rate.

? Index of the Moscow Exchange IMOEX -1.4% Consumer prices in the United States in November increased by 6.8% in annual terms, the highest rate since 1982.The Russian stock market by Friday evening remains under selling pressure after the release in the US of statistics on the acceleration of consumer inflation in November, which strengthens expectations of an imminent tightening of the US Federal Reserve’s monetary policy?

? $ TRNFP Transneft + 5.3% The Board of Directors of PJSC Transneft confirmed plans to split the company’s shares in 2022 and supported the proposal to switch to the payment of dividends twice a year?

? $ ALRS Alrosa -3.7% ALROSA’s total diamond sales in November amounted to $ 334 million, the company said.This is 8% more than in October, although 14% less than in November last year. The fall intensified after the publication of data on inflation in the United States?

? $ POLY Polymetal + 0.3% $ PLZL Polyus gold -0.8% Gold miners turned around after gold, which began to rise after the publication of inflation data in the US. Gold rose to $ 1,788 per troy ounce?

? $ MTSS MTS + 0.3% Better than the market. Inessa Galaktionova, Vice President for Telecommunications Business of MTS: – “In general, we expect that in the next three years the volume of our online sales will reach 10% or more” ?

? $ GCHE Cherkizovo -3.1% Cherkizovo in November 2021 reduced pork production by 29% compared to November 2020, to 19.55 thousand tons (in live weight). Poultry meat sales fell 7% to 56.65 thousand tonnes, the company said. Cherkizovo will buy from the Spanish Grupo Fuertes 50% in the Tambov Turkey company, will pay with new shares?

? $ AKRN Acron -7% Yesterday rose without news, but corrected today?♂️

Source: https://smart-lab.ru/ 90,000 The EAEU and China are preparing to abandon the dollar

Payments between the Eurasian Economic Union (EAEU) and China using the dollar and the euro lead to losses for both business and the budget of these countries …To avoid losses associated with exchange rate volatility and not to depend on international sanctions, the EAEU and China must carry out settlements either in national currencies or in their own supranational currency. This is the conclusion reached by the participants of the forum “Conjugation of the Eurasian Economic Union and the Chinese initiative“ One Belt, One Road ”.

“It’s not about separating politically from the US and the EU,” said Sergei Glazyev, Member of the Board (Minister) for Integration and Macroeconomics of the EEC.“It’s just that the current state of monetary and financial relations in the international market does not meet the interests of many countries.” Now, according to him, there are signs of manipulation of currency quotes in the international financial market, which negatively affect the economies of the EAEU countries. Additional problems are created by unequal monetary and economic exchange, which is associated with different prices for money in different markets and concerns capital flows and pricing. “The fact that we trade at prices that we do not determine ourselves brings considerable losses to our companies,” noted Glazyev.“There are also significant losses due to the offshorization of our economy.”

The head of the Association for Electronic Money and Money Transfers, Viktor Dostov, gave an illustrative example of the additional costs arising. “Now, if I want to transfer money from Russia to Kazakhstan, the payment is made through the dollar: first, the bank or payment system converts my rubles into dollars, and then from dollars converts them into tenge. There is a double conversion with high interest rates. In addition, one should take into account currency risks and the vagueness of responsibility – when the transfer is carried out by two countries, it is not known who is responsible for the safety of money, ”he said.

Head of the Monetary Policy Analysis Department of the Center for Macroeconomic Analysis and Short-Term Forecasting, Oleg Solntsev, points out that in the current situation the problem of stability comes to the fore, since the process of de-globalization and disintegration is taking place all over the world. “In many countries, state debts are growing, geopolitical problems are aggravated. Against this background, the main agenda for the EAEU and China is to ensure macroeconomic stability, the economist emphasized.”And this, in turn, brings to the fore the issue of creating a technological and legal basis for servicing commodity and financial flows, bypassing the jurisdictions of other countries.”

According to Glazyev, despite the fact that Russia has already created an infrastructure for international ruble settlements, its business is not yet striving to use it. “Today, only half of settlements in the EAEU take place in national currencies, with China the share of settlements in rubles and yuan is even less – 15%,” he said, explaining that the main reason that businesses prefer to trade in dollars and euros is high volatility ruble.“Until now, the authorities have followed the assumption that for this it is enough to ensure the free convertibility of the ruble, and then the market will itself ensure that it is given the status of a reserve currency. However, the crisis has shown that this is not the case. Sharp and unexpected ruble devaluations undermine confidence in it and make it impossible to use it not only as a reserve currency, but also as a tool for pricing, payments and settlements in medium and long-term projects, ”Glazyev emphasized.

Another reason for the weak interest in using the Russian currency in international settlements is the lack of financial support.For sellers and buyers to want to trade in rubles, they need help: to provide profitable loans (at a rate of 1-2% per annum) for international trade and investments. “Then it will be unprofitable for buyers and sellers to convert money and pay in another currency,” Glazyev said.

Senior Researcher at the Institute of Economics of the Russian Academy of Sciences Violetta Arkhipova noted that there is no universal recipe for currency integration in the world. “China is promoting the yuan gradually, relentlessly and aggressively if necessary, with an emphasis on its stability,” she says.”And the US was more aggressive in advancing the dollar: the Fed created markets focused on the dollar and provided a long-term unrivaled currency space for the dollar around the world.”

According to the director of the department of macroeconomic research at the People’s University of China, Liu Yu Shu, settlements in digital national currencies are the most promising way to save on transactions and mitigate various risks. However, so far this topic is being discussed on its own, without involvement in specific economic tasks.“We need to get together and understand what political and economic tasks we will solve by switching to settlements in national digital currencies, assemble a joint committee to assess such a transition and then establish coordination between the central banks of the trading partner countries to create a digital currency in which settlements will be carried out, ”said Liu Yu Shu.

Glazyev noted that he is in favor of creating his own Eurasian monetary and financial system, “which would be reliable, efficient and transparent.”But for this, first of all, it is necessary to stabilize the exchange rates of the national currencies of the EAEU countries, eliminating their volatility. “It seems to me that the issue of signing an agreement between our EAEU states to ensure the stabilization of exchange rates and the creation of a“ currency snake ”similar to the one that worked in the EU countries before the introduction of the euro is ripe. And on the basis of the CIS Interstate Bank, it would be possible to create a certain mechanism for mutual stabilization of exchange rates, ”he suggested.

Questions and Answers | Bank of Russia

The exchange rate can affect the economy through various channels.

First, the exchange rate directly affects domestic prices through the prices of imported goods. At the same time, the weakening of the ruble may have a stimulating effect on domestic production associated with the switching of demand from imported goods and services that have risen in price to domestic ones (the effect of import substitution). The magnitude of this effect depends on the availability of domestic goods that can replace imports, the availability of unused production factors to expand output, and the sensitivity of demand for imported products to changes in their prices.At the same time, a decrease in the real incomes of economic entities associated with an increase in prices due to the rise in prices for imported products may weaken the demand for both imports and domestic products.

Second, if imported goods are used as intermediate products in the production process, then the rise in the cost of imports can increase the price of the final product. The rise in prices for imported investment products may negatively affect the investment programs of enterprises.

Third, a change in the exchange rate can affect the price competitiveness of domestic goods in international commodity markets. Thus, the cheapening of the national currency increases their competitiveness, creating the preconditions for the growth of their exports.

Fourth, the dynamics of the exchange rate affects the balance sheets of banks, households, companies – there is a revaluation of their foreign currency assets and liabilities. The impact of the weakening of the national currency on the financial aspects of organizations’ activities (increase in the debt burden, increase in investment returns) depends on the currency structure of their assets and liabilities.

Fifth, a change in the exchange rate can affect moods and expectations: the behavior of financial market participants, inflationary expectations, propensity to save.

The change in the exchange rate also affects the state of public finances. For example, a weakening of the national currency can lead to an increase in income from foreign economic activity, in particular, export customs duties on oil and gas products, as well as to an increase in VAT and excise tax revenues on imported goods.At the same time, budget expenditures on servicing the external public debt may increase. As a result, a change in the size of the budget deficit is possible.

The final impact of the exchange rate dynamics on economic development depends on the structure of production and demand, the sensitivity of exports and imports to changes in the exchange rate, the degree of impact on price increases and, consequently, on the real incomes of economic entities.

90,000 Between devaluation and pandemic: what will happen to the American currency under the new president

On November 9, Joe Biden’s headquarters sent a request to the US General Services Administration to recognize him as the country’s elected president.Although the election results have not yet been officially announced, the leaders of many countries have already congratulated Biden on his victory in the presidential election. And analysts have made forecasts, including the devaluation of the dollar.

Reasons for the devaluation

The Joe Biden administration may be associated with a weaker dollar and higher investment flows to emerging markets, Sophia Donets, economist at Renaissance Capital for Russia and the CIS, wrote on October 4 in the review “US Elections and Sanctions Scenarios for Russia” …If in the scenario, in the event of Donald Trump’s victory, the investment bank’s forecast was $ 1-1.1 per euro, then for Biden it is $ 1.2-1.3 per euro.

There are three main factors in favor of a weakening dollar, says Forbes Donets. Under the Trump administration, there were tax breaks that encouraged doing business domestically. Biden is focused on raising taxes. Then the outflow of foreign investments from the United States is possible, as a result of which the dollar will weaken, Donets explains. Charles Robertson, chief economist at Renaissance Capital, said the pandemic could help reverse an eight-year bearish trend for emerging market currencies.He believes that from 2021, the net inflow of foreign direct investment in the United States will stop, and from 2022 it will be “redirected to other parts of the world.”

Advertising on Forbes

Bidenomics: what the economy will be like under the new US president

The second point is trade wars with China. Donets believes that it would be wrong to assume that Biden will end this conflict, but there will be more predictability and less escalation risks. This can be a plus for the currencies of developing countries and a “pressure” factor for the dollar.

The third argument is the possible strengthening of the euro against the dollar, Donets continues. Biden intends to improve relations with the European Union, which will contribute to this trend. Dmitry Polevoy, Investment Director of LOCKO-Invest, shares the position that the dollar as a safe haven will be less interesting than the currencies of developing countries due to the reduced risks of trade wars.

A weakening of the dollar is also predicted by Aton, but lists several other factors. The first is the growth of the M2 money supply in the United States (cash + demand deposits + time deposits).This figure from April to October 2020 added $ 3.3 trillion and amounted to $ 6.7 trillion. The second factor is the change in the Fed’s monetary policy and the likely period of low rates for more than three years. Third, due to the conflict with the United States, China may begin to get rid of dollar assets.

There are concerns about the devaluation of the dollar, since it was from the Democratic Party in Congress during the presidency of Donald Trump that great incentives were initiated, agrees Alexey Tretyakov, head of the management company Arikapital.Democrats pushed a $ 2.5 trillion stimulus bill. This package of measures includes additional unemployment benefits, assistance to small and medium-sized businesses, and so on.

The end of the Trump era: how America and the world will change under a Democratic president

Even without additional incentives next year, the budget deficit in the United States could be 7-8% of GDP, Tretyakov notes. If the need to finance support measures is added to it, then the budget deficit may approach the astronomical amount of 20% of GDP, says Tretyakov.

“If the bill is passed in the form [in which the Democrats are proposing], then this is a signal that the United States will abandon its conservative policy for the long term and begin to engage in unlimited printing of money. In this case, the dollar may devalue against the euro by 10% within a year, ”Tretyakov expects.

But if the Republicans win the Senate, it is highly likely that the stimulus package will be $ 0.5-1 trillion. This will be comparable to the support measures that are being introduced in the European Union and the UK, so the devaluation will not be as strong, he concludes.

“The double deficit of the budget and the current account in the United States at zero rates for the coming years is an additional fundamental factor against the dollar,” Polevoy agrees.

The fate of the dollar: will the predictions of the collapse of the American currency come true

Arguments for a strong dollar

Head of operations in the currency and money market of Metallinvestbank Sergey Romanchuk does not believe that the dollar is doomed to weakening for a long time.After it became clear that Biden won the election, there was a slight weakening of the dollar, but it did not fall below its values in September-October this year, he notes. “We do not see that this movement has become a defining trend,” says Romanchuk.

The scale and inevitability of changes associated with trade wars and an increase in the attractiveness of assets in developing countries remains in question, says Romanchuk. In his opinion, the fate of the dollar, the attractiveness of risky assets rather depend on the development of the pandemic than on the personality of the US president.

Investment manager of Otkritie Broker Timur Nigmatullin believes that the situation with forecasts for the dollar’s weakening against the basket of world currencies should be analyzed by components. For example, to ask the question, is the increase in the money supply in the United States a trigger that can lead to inflationary consequences? Over the past 12 months, dollar inflation has been 1.4%, which is very low – even below the long-term target of the US Federal Reserve, which is 2%, says Nigmatullin.And disinflationary trends have persisted for decades, he adds.

“Danger Grossly Overestimated”: What Joe Biden’s victory could mean for investors

Advertising on Forbes

In the United States, as in many other developing countries, there is a stable long-term trend towards a decrease in the speed of circulation of money in the economy, says Nigmatullin. According to him, the speed of their circulation in the economy is also important to maintain inflation at a low level.And the US FRS rationally compensates for the decrease in the velocity of money circulation by increasing the money supply. Therefore, apocalyptic statements about a weakening dollar are a rather gross strategic investment mistake, says Nigmatullin.

“There are now expectations on the market that an increase in the dollar money supply will lead to hyperinflation, and if investors start shifting assets into the same gold, this rate is likely to lead to losses again,” warns Nigmatullin.

He recalls that the risks of inflation in the dollar after the 2008 crisis did not materialize, and the bet on the assets that will protect – gold – turned out to be wrong, he recalls.Gold in 2011, after speculative irrational growth, fell in price and further decreased for a long time, until it fell in price by 2 times.

Invisible sanctions: how the revenues of the largest American companies in Russia have changed under Trump

10 photo

90,000 There will be no strong dollar | Economy in Germany and the World: News and Analytics | DW

At a meeting in Boca Raton, the G7 finance ministers, without mentioning the US dollar, called strong fluctuations in currency rates undesirable.The final statement states: “Extremely sharp fluctuations in currencies are negatively affecting economic growth.” The exchange rates, according to the ministers, should reflect the main economic indicators of the countries. As the Minister of Finance of the Federal Republic of Germany Hans Eichel (Hans Eichel), this statement does not need any additional explanation. The very fact that the finance ministers have come to a consensus is, according to Eichel, an important signal for the financial markets.

The statement did not make an impression

The joint statement of finance ministers at the G7 meeting did not have the expected effect.On Monday, on the stock exchanges of the Far East countries, the US dollar against the euro fell again. In early trading, the dollar rallied slightly, but soon after, it fell to its lowest level in the past two weeks and amounted to 1.2727 per euro. Exchange experts doubt that the statement should be regarded as a signal aimed at strengthening the dollar.

No specific measures foreseen

Europeans insisted on more specific wording of the final statement, who fear that a weak dollar will harm export-oriented industries in European countries.Over the past two years, the dollar has lost 29 percent of its value. US Treasury Secretary Jon Snow tried not to attach much importance to the topic of currency exchange. A weak dollar plays into the hands of American firms and the US government as the country’s election campaign begins. The Europeans were unable to convince their American counterparts of the need for concrete measures aimed at curbing the further fall in the dollar exchange rate.

US Treasury Secretary John Snow has once again made a statement on the policy of a strong dollar, which has not been taken seriously in financial markets for a long time.Snow also added that exchange rates are best shaped in freely competing markets. Snow presented the US government’s plan to cut the US government deficit, now $ 521 billion, or 4.5 percent of GDP, by half over the next five years.

Strong euro – for the benefit of financial policy

President of the Federal Bank of Germany Ernst Welteke (Ernst Welteke) believes that the final statement will have a calming effect on financial markets.According to him, the sharp fluctuations in exchange rates do not allow enterprises and consumers to make long-term planning of their activities and harms economic growth even more than the high rate of the euro. A strong euro benefits financial policy in the eurozone. A strong currency is helping to keep inflation low. Welteke said that if the euro is high, interest rates can be kept low for a longer period. (s)

AUD Australian Dollar | 1.6566 | 1.5206 |

GBP British Pound Sterling | 0.8659 | 0.8401 |

BGN Bulgarian lev | 2.0145 | 1.8678 |

BRL Brazilian Real | 8.5749 | 5.7137 |

HUF Hungarian Forint | 387.92 | 343.57 |

VND Vietnamese Dong | 28134.00 | 23479.00 |

HKD Hong Kong Dollar | 10.5916 | 8.2029 |

GEL Georgian Lari | 3.8005 | 3.1999 |

DKK Danish Krone | 7.7338 | 7.2571 |

AED UAE Dirham | 4.2606 | 4.0461 |

USD US Dollar | 1.1575 | 1.1187 |

DOP Dominican Peso | 73.8575 | 58.9403 |

EGP Egyptian Pound | 18.5729 | 14.9943 |

IDR Indonesian Rupiah | 19518.00 | 14629.00 |

ISK Icelandic krone | 138.60 | |

CAD Canadian Dollar | 1.5119 | 1.4178 |

KES Kenyan Shilling | 138.07 | 116.73 |

CNY Chinese Yuan | 8.0745 | 7.0737 |

LVL Latvian lats | 0.9136 | 0.7028 |

LTL Lithuanian litas | 4.4888 | 3.4527 |

MUR Mauritian rupee | 54.516 | 45.264 |

MKD Macedonian Dinar | 66.6144 | 57.2415 |

MYR Malaysian Ringgit | 5.7232 | 4.5238 |

MXN Mexican Peso | 25.5329 | 21.9419 |

BYN New Belarusian ruble | 3.6968 | 2.4893 |

NOK Norwegian krone | 10.5104 | 10.0139 |

PLN Polish Zloty | 4.7395 | 4.4214 |

RUB Russian ruble | 85.2494 | 81.5882 |

RON Romanian Leu | 5.3731 | 4.6751 |

RSD Serbian Dinar | 127.03 | 110.43 |

SGD Singapore Dollar | 1.6685 | 1.4971 |

THB Thai Baht | 41.1037 | 35.7097 |

TRY Turkish Lira | 16.4938 | 14.284 |

UAH Ukrainian hryvnia | 32.9034 | 28.5689 |

HRK Croatian Kuna | 7.7518 | 6.9569 |

CZK Czech Koruna | 25.7881 | 24.8507 |

SEK Swedish Krona | 10.3825 | 9.9989 |

CHF Swiss Franc | 1.0843 | 1.0265 |

SBP Scottish Pound | 0.9213 | 0.8478 |

EEK Estonian kroon | 16.13 | 11.7288 |

KRW South Korean Won | 1603.66 | 1242.17 |

ZAR South African Rand | 19.5394 | 17.3902 |

JPY Japanese Yen | 138.61 | 124.07 |

SBER Pro | Media

This information is brought to your attention for informational purposes only, and no part of it, including the description of financial instruments, products and services, is not considered and should not be considered as a recommendation or an offer to make any transaction, including a purchase or sale any financial instruments, products or services.

Nothing in this material is and should not be considered as individual investment recommendations and / or the intention of Sberbank PJSC (hereinafter – Sberbank) to provide investment advisor services. Sberbank cannot guarantee that investing in any financial instruments described in this material is suitable for persons who have become familiar with it. Sberbank is not responsible for financial or other consequences that may arise as a result of your decisions regarding financial instruments, products and services presented in the information materials.